In the fast-moving world of cryptocurrency futures trading, price charts tell only part of the story. Skilled traders go beyond patterns and candlesticks to understand market sentiment, the collective positioning of thousands of futures traders worldwide.

One often-overlooked tool for this is the long/short ratio. It won’t predict the exact next move, but it can reveal whether the market is leaning heavily bullish, bracing for a sell-off, or balanced on a knife’s edge. Used correctly, it helps anticipate price movements, prepare for volatility, and avoid getting caught on the wrong side of a sudden reversal.

In this guide, we’ll explore what the long/short ratio is, what it reveals about bullish and bearish sentiment, how to interpret it in real trading scenarios, and how

BingX futures traders can combine it with other metrics like open interest and funding rates to refine their trading strategies and risk management.

What is the Long/Short Ratio?

At its core, the long/short ratio measures how many traders in the futures market expect an asset’s price to rise compared to how many expect it to fall. It’s calculated by dividing the total number of open long positions (bets on a price increase) by the total number of open short positions (bets on a price drop).

In cryptocurrency futures, the asset in question, known as the underlying asset, could be Bitcoin (BTC), Ethereum (ETH), or any other traded digital asset. These positions are held in futures contracts, agreements to buy or sell the asset at a set strike price on a future expiry date.

The total number of contracts that remain active and unsettled is called open interest, which often provides useful context alongside the ratio.

A value above 1.0 means there are more longs than shorts, signaling that traders are leaning bullish. A value below 1.0 indicates more shorts than longs, often suggesting bearish sentiment.

How Long/Short Ratio is Calculated

The long/short ratio is typically calculated as:

Long/Short Ratio = Total Open Long Positions ÷ Total Open Short Positions

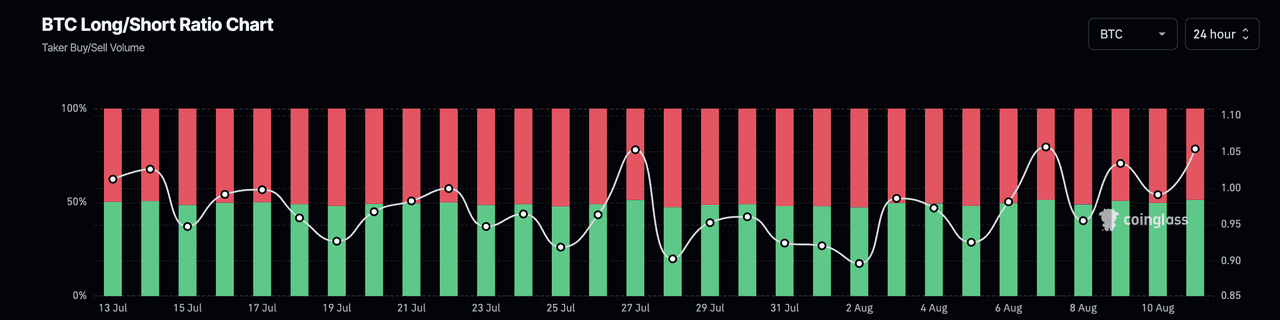

Long/short ratio - Source: Coingass.com

A value above 1.0 means there are more open long positions than shorts; a value below 1.0 means more shorts than longs.

On

Coinglass, traders can view the long/short ratio for major cryptocurrencies in real time, alongside other sentiment metrics like open interest, funding rates, and trading volume.

What the Long/Short Ratio Conveys

Once you know how it’s calculated, the next step is interpreting what the ratio says about market sentiment:

• Bullish Bias: A sustained rise in the ratio can indicate strong buying interest and confidence in higher prices.

• Bearish Bias: A sustained drop suggests growing selling pressure and expectations of lower prices.

• Extreme Readings: Very high ratios can warn of an overcrowded long trade, increasing the risk of sharp pullbacks; very low ratios can signal an overcrowded short trade, setting up conditions for a short squeeze.

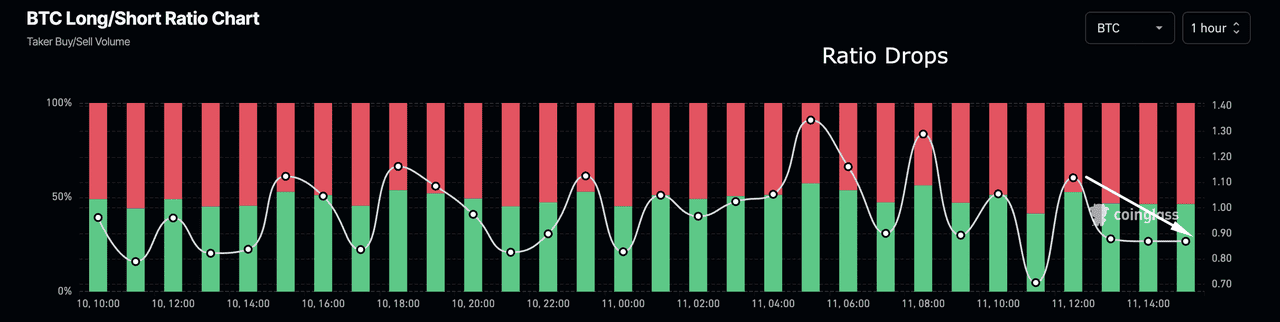

• Shifts in Momentum: Rapid changes in the ratio, for example, a sudden jump from balanced levels to heavily long or short, can precede breakouts or reversals.

How to Use Long/Short Ratio in Your Crypto Futures Trading

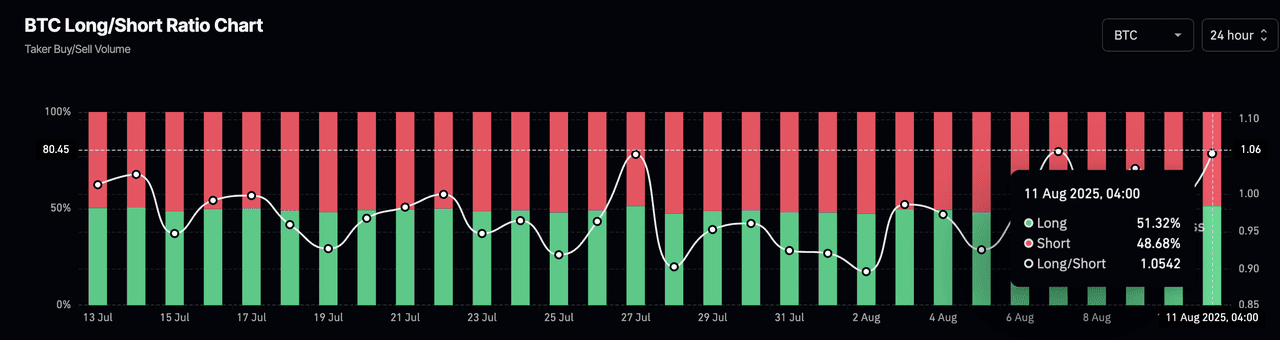

On 11 August 2025 at 04:00 UTC, Coinglass data showed Bitcoin’s long positions at 51.32% and shorts at 48.68%, giving a ratio of 1.0542. This nearly even split suggested no clear directional bias — conditions that can shift quickly if a major catalyst emerges.

Long/short ratio - Source: Coingass.com

By tracking these shifts and comparing them with indicators like open interest and funding rates, BingX futures traders can better gauge when a move is gaining strength or losing momentum

Combining the Long/Short Ratio with Other Indicators

The long/short ratio is most reliable when interpreted alongside other market metrics. Moving from raw sentiment to actionable insights often means confirming what the ratio suggests with technical and market data.

I. Trend Confirmation

A steady rise in the ratio with increasing open interest can reinforce an uptrend, while a decline with negative funding rates can support a downtrend.

II. Using Long/Short Ratio in Crypto Arbitrage

Differences in the ratio between exchanges can point to sentiment gaps that create price variations. Traders can go long where exposure is lower and short where it is higher, including in cross-exchange futures setups to capture pricing differences while keeping risk controlled.

III. Optimizing Risk Management in Futures Positions

The ratio can refine stop-loss and take-profit placement by showing when sentiment is leaning heavily in one direction. It can also guide position sizing, helping traders reduce leverage when the market is imbalanced to limit the impact of sudden reversals or squeezes.

Interpreting the Ratio and Applying It in Strategy

For instance,

Bitcoin is trading around $120,000 after consolidating for several sessions near a key resistance zone. On Coinglass, you notice the long/short ratio has moved from 1.05 to 1.42 in less than a day.

At face value, this points to an increase in bullish sentiment, but as a strategic futures trader, you check supporting metrics:

• Open Interest: Rising alongside the ratio, suggesting new positions are being opened.

• Funding Rates: Turning positive, meaning longs are paying shorts, often a sign of market overextension.

• Price Action: BTC has tested the $121,000–$121,500 resistance area twice without a breakout.

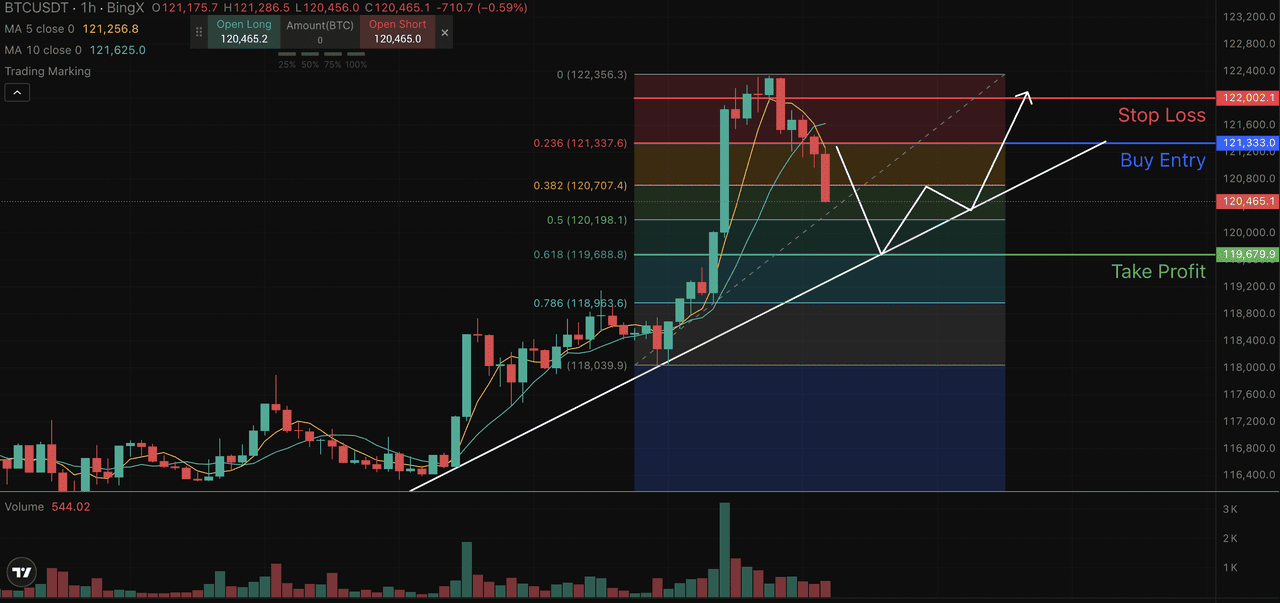

Scenario 1: Long Opportunity (Breakout Confirmation)

You decide to look for a long setup if the ratio continues to rise and price action confirms bullish momentum:

• Entry Trigger: BTC breaks and closes above $120,000 with strong volume.

• Stop-Loss: Just below $119,500 to limit downside risk in case of a false breakout.

• Target: First target at $122,000, with a possible extension to $125,000 if momentum holds.

A rising long/short ratio with increasing open interest and a breakout above resistance suggests that bullish sentiment is translating into actual buying pressure.

Scenario 2: Short Opportunity (Overextension Reversal)

If bullish sentiment fades without breaking through resistance, the setup shifts toward a short trade.

Long/short ratio - Source: Coingass.com

• Entry Trigger: BTC fails to reclaim $121,333, and the long/short ratio drops below 1.0, confirming reduced long positioning.

• Stop-Loss: Above $122,002 to protect against an unexpected breakout.

• Target: First target at $119,679 (near the 0.618 Fibonacci level), with a possible extension to $118,963 if selling pressure accelerates.

This structure combines sentiment data and technical levels. A declining ratio signals weakening bullish conviction, while repeated rejection from resistance increases the likelihood of a move lower.

Still, the long/short ratio should be used alongside price structure, open interest, and funding rates for a complete view before committing to a position.

Avoiding Common Pitfalls

The long/short ratio should never be used in isolation. Incorporating open interest, funding rates, and technical analysis creates a fuller picture. Market sentiment can shift quickly due to news, liquidity changes, or broader market conditions, so decisions should account for these factors to remain adaptable.

Conclusion

The long/short ratio is a valuable tool for futures traders to optimize their trading strategies and positions in the dynamic crypto market. However, it isn’t a magic predictor; when paired with strong analysis, it can reveal how the futures market is positioned and where sentiment may shift next. For BingX traders, combining this metric with technical, fundamental, and risk management tools can turn raw data into actionable insights, helping you trade with greater precision and confidence.

Related Articles

Frequently Asked Questions (FAQ)

1. What is the long/short ratio in cryptocurrency futures?

The long/short ratio compares the number of open long positions to open short positions in the futures market. It helps gauge market sentiment, whether traders are leaning bullish or bearish.

2. What does a low long/short ratio indicate?

A low ratio means more traders are holding short positions, indicating bearish sentiment. If the ratio is extremely low, it can set the stage for a short squeeze if prices rise unexpectedly.

3. How often should traders check the long/short ratio?

Active futures traders often monitor the ratio in real time, especially near key support or resistance levels, or before major news events.

4. Where can I find the long/short ratio for cryptocurrencies?

Websites like Coinglass provide real-time long/short ratio data for major cryptocurrencies. BingX traders can use this data alongside BingX’s market tools to plan and execute futures trading strategies.