Sei Network apare ca cel mai rapid blockchain

Layer 1 paralel, cu scopul de a transforma tranzacționarea,

DeFi și aplicațiile în timp real. Combină compatibilitatea

EVM, execuția paralelă și finalitatea sub-secundă, făcându-l o alternativă puternică la blockchain-urile existente.

În 2025, Sei a explodat în lumina reflectoarelor. Token-ul SEI a crescut cu peste 80% într-o săptămână pe măsură ce utilizarea DeFi a crescut masiv și TVL a atins aproape 1,1 miliarde de dolari. Încrederea instituțională a urmat: Sei a fost preselectat de Wyoming ca blockchain candidat pentru programul pilot de stablecoin emis de stat. Activitatea majoră pe

DEX, utilizarea în

gaming și volumele săptămânale au stabilit recorduri noi.

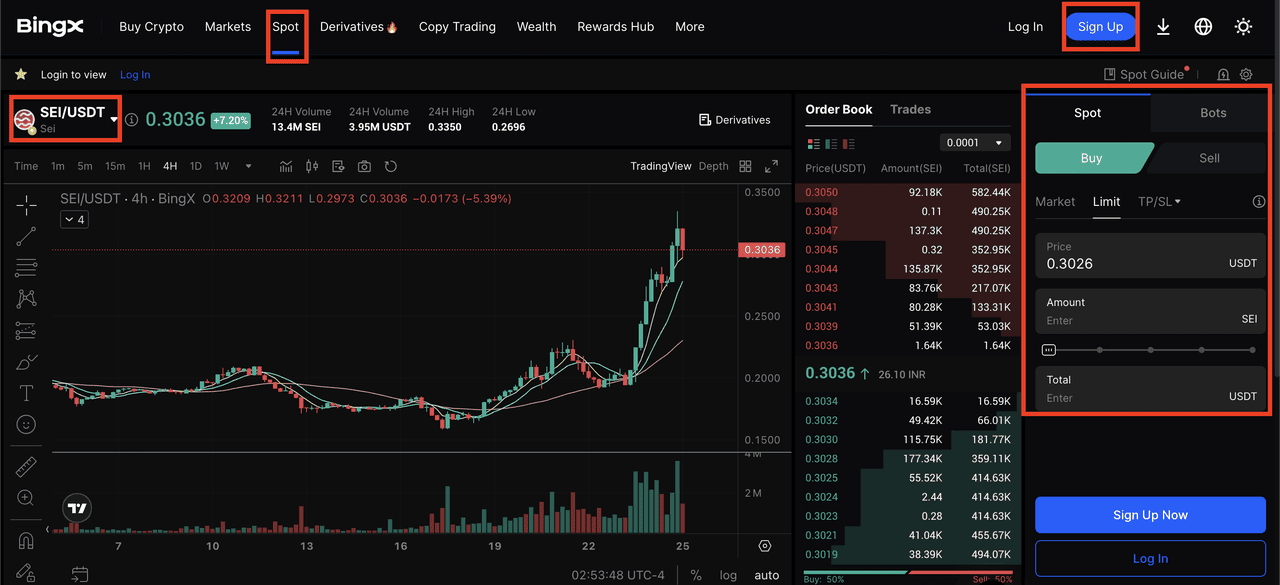

Creșterea prețului SEI | Sursă: BingX

Curios să aflii ce face Sei să funcționeze și de ce atrage atenția în 2025? Continuă să citești pentru a explora tehnologia unică a blockchain-ului Sei, ecosistemul în creștere și ce înseamnă această inovație pentru utilizatori și investitori.

Ce Este Sei Network?

Sei Network este un blockchain Layer 1 de mare viteză, open-source, construit special pentru tranzacționare, DeFi,

NFT-uri și gaming

Web3. Spre deosebire de blockchain-urile cu scop general precum

Ethereum sau

Solana, Sei se concentrează pe viteză, latență redusă și scalabilitate, oferind performanțe în timp real pentru aplicații de înaltă frecvență.

În centrul arhitecturii Sei se află execuția paralelă a tranzacțiilor și un motor de potrivire a ordinelor integrat. Aceasta permite schimburilor descentralizate (DEX) să potrivească și să lichideze tranzacții cu finalitate sub-secundă, ceva ce majoritatea blockchain-urilor nu pot realiza.

Sei suportă Ethereum Virtual Machine (EVM), astfel încât dezvoltatorii pot implementa

contracte inteligente Solidity folosind instrumente familiare precum

MetaMask, Remix și Hardhat. Este de asemenea construit pe

Cosmos SDK, permițând transferuri inter-blockchain prin IBC (Inter-Blockchain Communication).

Pentru a atinge viteza sa, Sei folosește Twin-Turbo Consensus:

• Propagarea Inteligentă a Blocurilor accelerează comunicarea

validatorilor.

• Procesarea Optimistă a Blocurilor reduce latența prin omiterea pașilor redundanți.

Cu o finalitate de aproximativ 400 de milisecunde, Sei oferă performanțe mai rapide decât Ethereum și mai multă flexibilitate decât Solana, făcându-l ideal pentru orice

dApp care necesită execuție în timp real.

Proiectul este susținut de investitori de top precum Multicoin Capital, Coinbase Ventures și Jump Crypto, cu peste 35 milioane de dolari în finanțare și un fond de ecosistem de 120 milioane de dolari pentru a susține dezvoltatorii,

lichiditatea și adoptarea de către utilizatori.

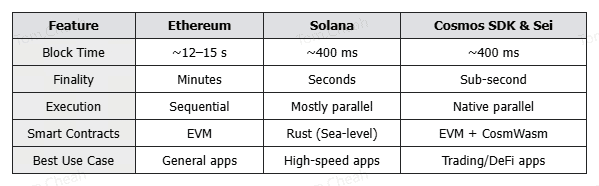

Sei vs. Ethereum vs. Solana: O Comparație

Lumea blockchain este plină de rețele Layer 1, dar puține sunt construite cu tranzacționarea și aplicațiile de mare viteză în minte. Iată cum se compară Sei cu doi dintre cei mai cunoscuți actori: Ethereum și Solana.

• Ethereum este cea mai utilizată platformă de contracte inteligente, cunoscută pentru instrumentele de dezvoltare, ecosistemul dApp și securitatea puternică. Dar vine cu compromisuri, cum ar fi viteza lentă a tranzacțiilor (12–15 secunde), taxe

gas mari și congestie de rețea în timpul activității de vârf. Este excelent pentru aplicații cu scop general, dar nu ideal pentru tranzacționarea rapidă.

• Solana oferă throughput mare și costuri reduse, folosind o arhitectură unică care permite

blocuri rapide. Cu toate acestea, s-a confruntat cu probleme de downtime, preocupări legate de centralizarea validatorilor și instrumente de dezvoltare complexe. Este mai rapid decât Ethereum, dar încă se luptă să echilibreze scalabilitatea cu descentralizarea.

• Sei Network adoptă o abordare diferită. Combină finalitatea sub-secundă (~400ms), execuția paralelă și compatibilitatea EVM pentru a oferi o experiență mai fluidă și mai rapidă atât pentru utilizatori, cât și pentru dezvoltatori. Prin utilizarea Cosmos SDK, Sei suportă de asemenea tranzacții inter-blockchain prin IBC, oferindu-i mai multă flexibilitate decât Solana.

Ceea ce îl diferențiază cu adevărat pe Sei este Twin-Turbo Consensus, un sistem cu două părți care include Propagarea Inteligentă a Blocurilor și Procesarea Optimistă a Blocurilor. Aceasta accelerează finalitatea tranzacțiilor menținând în același timp rețeaua sigură și eficientă.

În plus, Sei include un motor nativ de potrivire a ordinelor on-chain, ceva ce Ethereum și Solana nu oferă la nivelul de bază. Aceasta face din Sei fundația ideală pentru schimburi descentralizate, tranzacționare de înaltă frecvență și orice aplicație care se bazează pe lichidare rapidă, corectă și transparentă.

De Ce Sei Atrage Atenția în 2025?

Sei Network atrage privirile în 2025, și din motive întemeiate. Nu este doar tehnologia care este impresionantă. Proiectul face mișcări importante pe piață, câștigă susținere instituțională și crește rapid în DeFi.

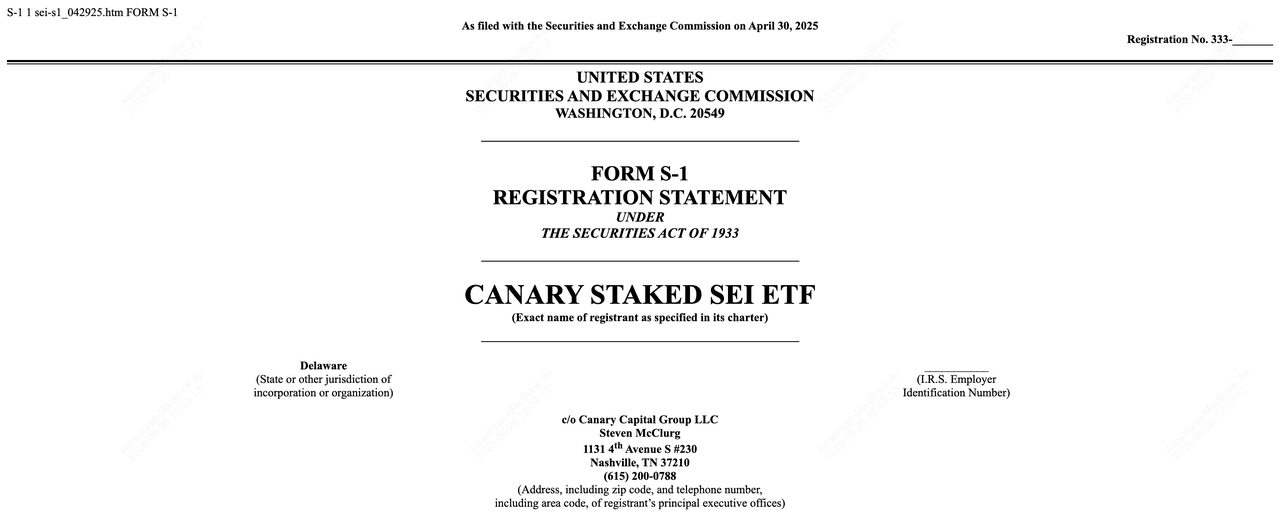

La începutul anului 2025, Wyoming a selectat Sei ca blockchain potențial pentru viitorul său pilot de

stablecoin susținut de stat (WYST). Aceasta plasează Sei alături de actori majori precum Ethereum, Solana și

Avalanche. În același timp, Canary Capital a depus pentru primul ETF SEI, cu o componentă de staking. Dacă este aprobat, aceasta ar oferi investitorilor instituționali acces reglementat la SEI, sporind în același timp credibilitatea și vizibilitatea token-ului.

Token-ul SEI și Activitatea On-Chain se Întăresc

Prețul SEI a crescut cu peste 80% în săptămâna trecută. Analiștii leagă această creștere atât de interesul speculativ, cât și de creșterea reală. Pe măsură ce mai multe protocoale DeFi se lansează pe Sei și cererea utilizatorilor crește, dinamismul continuă să se construiască.

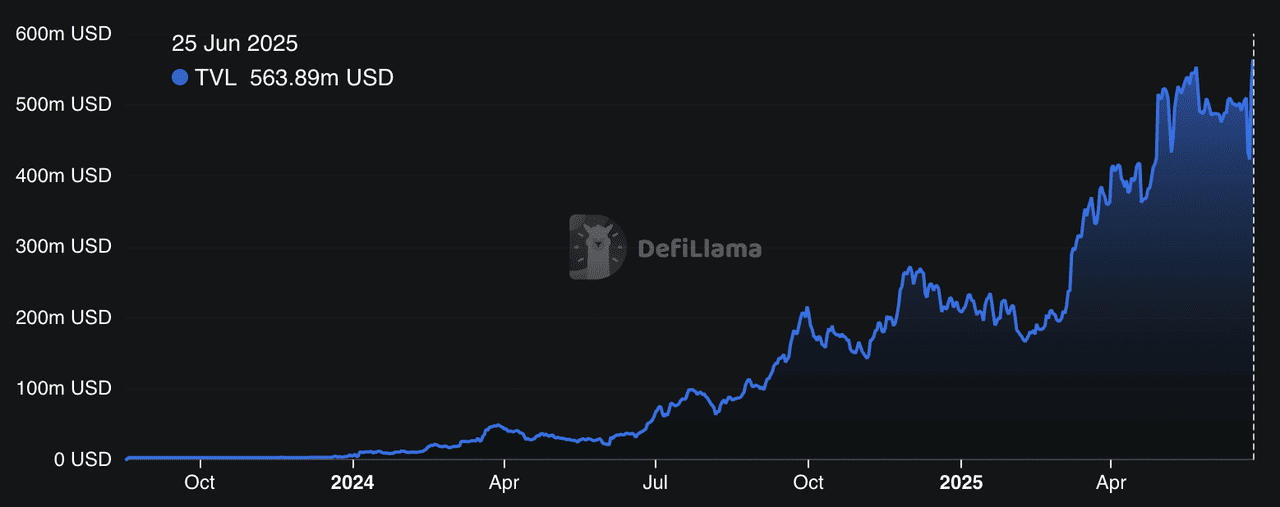

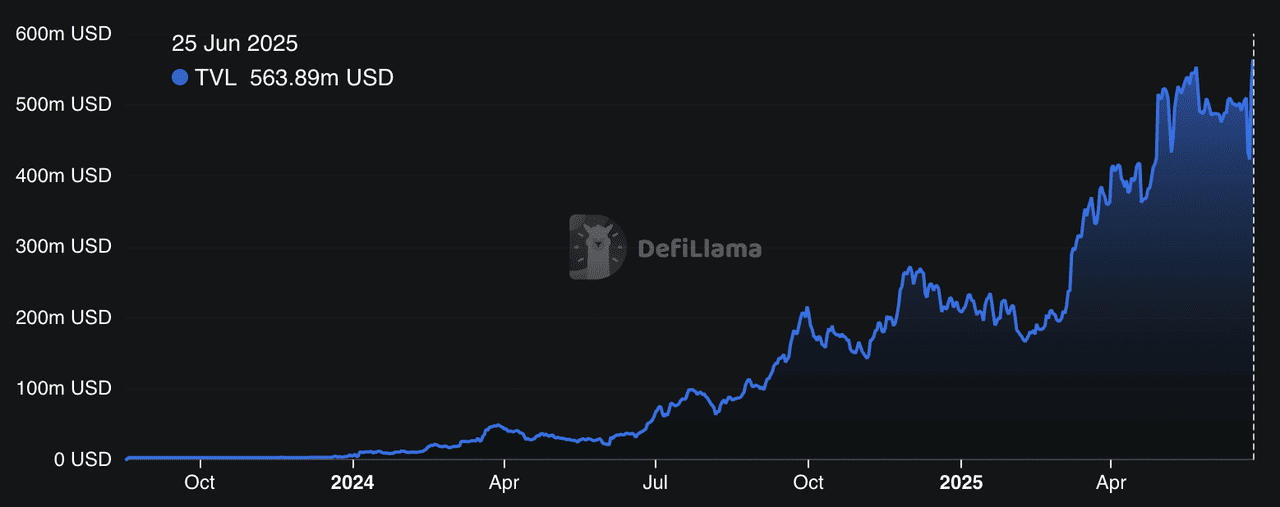

TVL DeFi Sei | Sursă: DefiLlama

În spatele acțiunii prețului se află o activitate on-chain serioasă. Sei are acum peste 28 de milioane de adrese active și o Valoare Totală Blocată (TVL) care depășește 1 miliard de dolari până în iunie 2025. Platforme precum Yei Finance și DragonSwap conduc această creștere, în timp ce aplicațiile mai noi în NFT-uri, GameFi și

staking își extind amprenta Sei. TVL-ul DeFi singur al rețelei Sei depășește 560 de milioane de dolari la momentul scrierii.

Integrarea AI a Sei prin MCP

Un alt motiv pentru care Sei atrage atenția? Săritura sa îndrăzneață în integrarea AI prin

Protocolul Model Context (MCP). Această nouă caracteristică permite

agenților AI, precum ChatGPT sau Claude, să interacționeze direct cu blockchain-ul Sei. Folosind limbajul natural, dezvoltatorii pot verifica soldurile, citi contracte inteligente, transfera token-uri și multe altele. MCP face legătura între

AI și infrastructura Web3, făcând instrumentele blockchain mai accesibile și mai prietenoase pentru dezvoltatori. Pe măsură ce cererea pentru automatizarea condusă de AI în crypto crește, Sei se poziționează ca unul dintre primele Layer 1-uri care oferă interacțiune

AI-to-blockchain fără întreruperi.

O Privire asupra Ecosistemului Sei

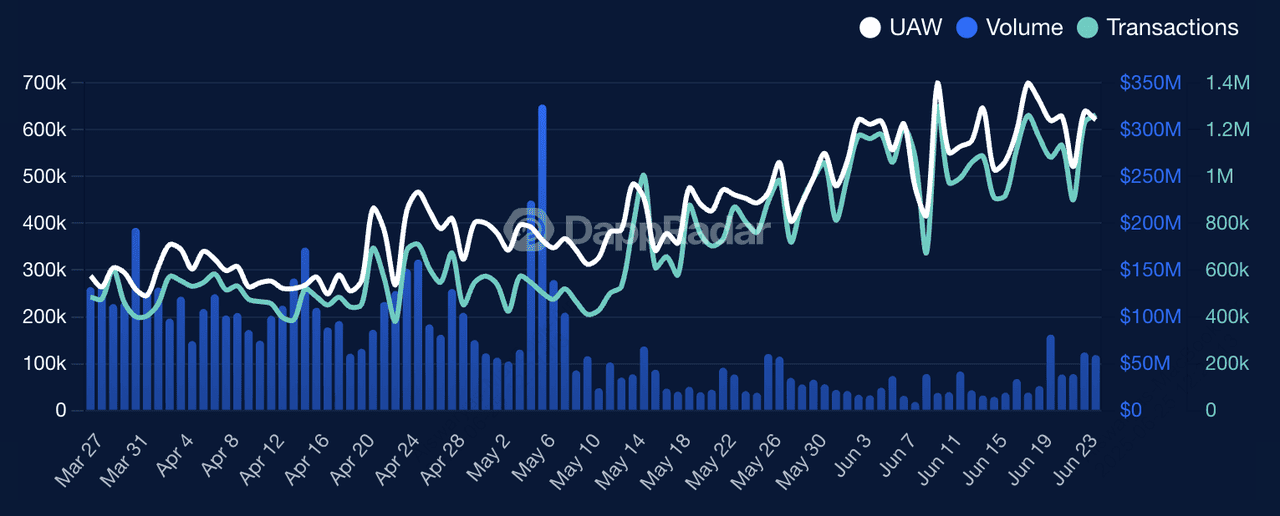

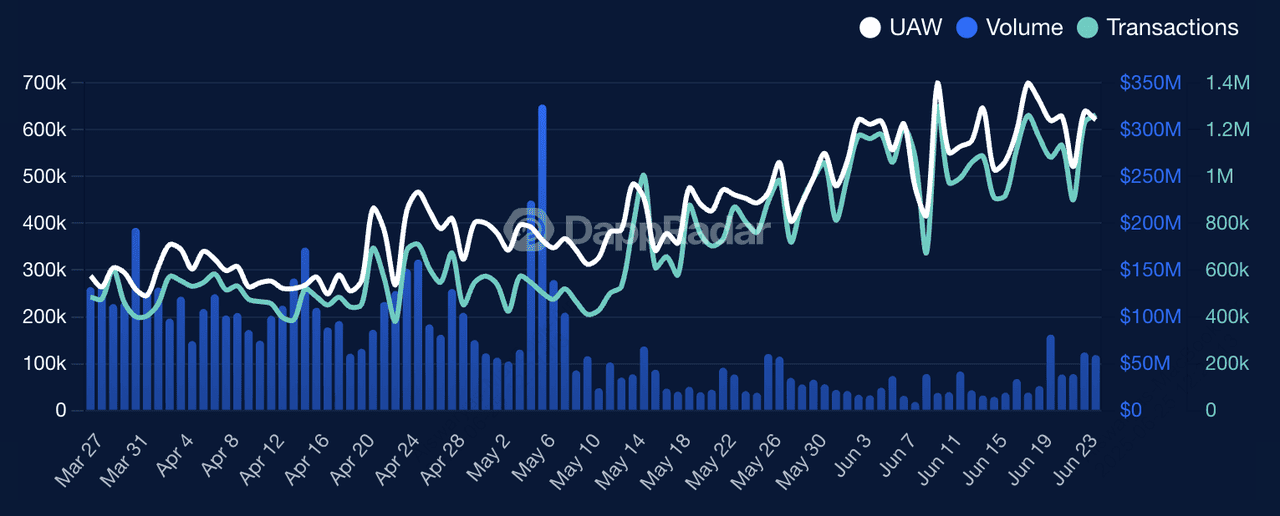

Activitatea dApp Sei | Sursă: DappRadar

Ecosistemul Sei se extinde rapid în 2025, cu o creștere puternică în DeFi, NFT-uri, gaming și infrastructura inter-blockchain.

În DeFi, Sei găzduiește protocoale majore precum DragonSwap, primul DEX compatibil EVM din rețea, și Sailor, un schimb

orderbook nativ Cosmos. Platforme de împrumuturi precum Yei Finance, care deține peste 60% din TVL-ul DeFi al Sei, și Takara Lend oferă oportunități de împrumuturi și randament similare cu

Aave. Mulțumită motorului nativ de potrivire a ordinelor al Sei și finalității sub-secundă, aceste aplicații oferă taxe mici, lichiditate adâncă și funcții avansate de tranzacționare ideale atât pentru utilizatorii instituționali, cât și pentru cei retail.

Sei este de asemenea optimizat pentru tranzacționarea de înaltă frecvență (HFT). Cu finalitatea blocurilor de 400ms, licitații în loturi și rezistența integrată la frontrunning, permite execuția precisă și corectă a ordinelor on-chain.

Pe partea NFT, platforme precum Pallet Exchange oferă creatorilor creare și tranzacționare rapidă și accesibilă. Taxele mici și lichidarea instantanee îmbunătățesc experiența utilizatorului atât pentru colecționari, cât și pentru marketplace-uri.

În gaming, Sei suportă proiecte care cer gameplay rapid și responsiv. Titluri precum World of Dypians, Archer Hunter și Enchanted Isles câștigă tracțiune, contribuind la o creștere de 79% a activității de gaming în Q1 2025. Aceste jocuri combină proprietatea NFT, interacțiunea în timp real și mecanica DeFi, arătând potențialul Sei în spațiul de divertisment Web3.

Sei este de asemenea un hub pentru interoperabilitate. Construit pe Cosmos SDK, suportă nativ IBC (Inter-Blockchain Communication), permițând transferuri fără întreruperi de active cu blockchain-uri precum Osmosis, Injective și Secret Network. Punți precum

Axelar,

Wormhole și Skip Protocol permit utilizatorilor să mute active precum

USDC,

ETH și wBTC din Ethereum și alte ecosisteme majore, făcând din Sei un actor cheie în peisajul DeFi multi-blockchain.

Utilitatea Token-ului SEI și Tokenomics

Token-ul SEI este criptomoneda nativă a Sei Network. Alimentează funcțiile principale ale blockchain-ului și joacă un rol cheie în menținerea rețelei sigure, descentralizate și prietenoase cu utilizatorii.

Pentru Ce Este Folosit Token-ul SEI?

SEI are mai multe utilități cheie în ecosistem:

1. Taxe de Tranzacție: Plătești taxe gas în SEI când faci schimburi, creezi NFT-uri sau interacționezi cu contracte inteligente. Structura sa de taxe mici ajută la menținerea aplicațiilor accesibile și eficiente.

2. Staking: Sei folosește un sistem delegated proof-of-stake (dPoS). Poți face stake SEI pentru a deveni validator sau să îți delegi token-urile altora și să câștigi recompense de staking. Staking-ul ajută de asemenea să securizeze rețeaua și să îmbunătățească descentralizarea.

3. Guvernare: Deținătorii SEI pot vota asupra actualizărilor majore de protocol și propunerilor de guvernare. Aceasta include decizii despre parametrii rețelei, utilizarea trezoreriei și dezvoltarea ecosistemului.

4. Utilizare DeFi & Colaterală: SEI este de asemenea utilizat pe scară largă în aplicațiile DeFi din rețea. Îl poți folosi ca garanție în protocoalele de împrumuturi, furniza lichiditate în DEX-uri sau câștiga recompense prin farming și campanii de stimulente.

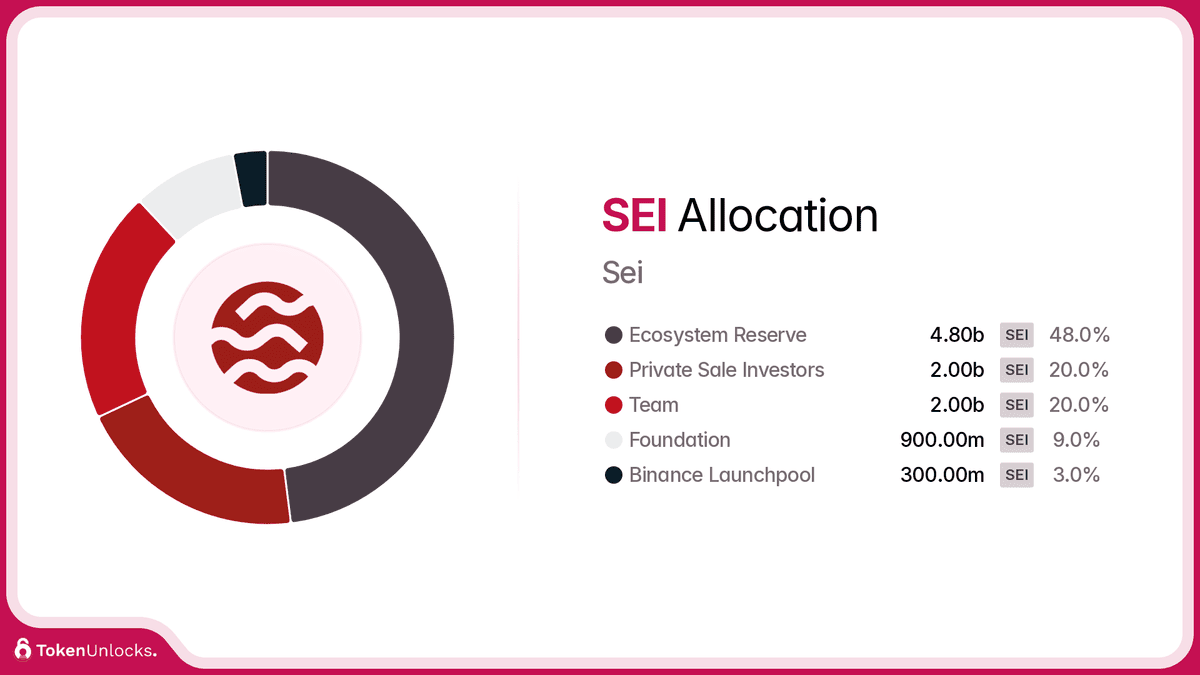

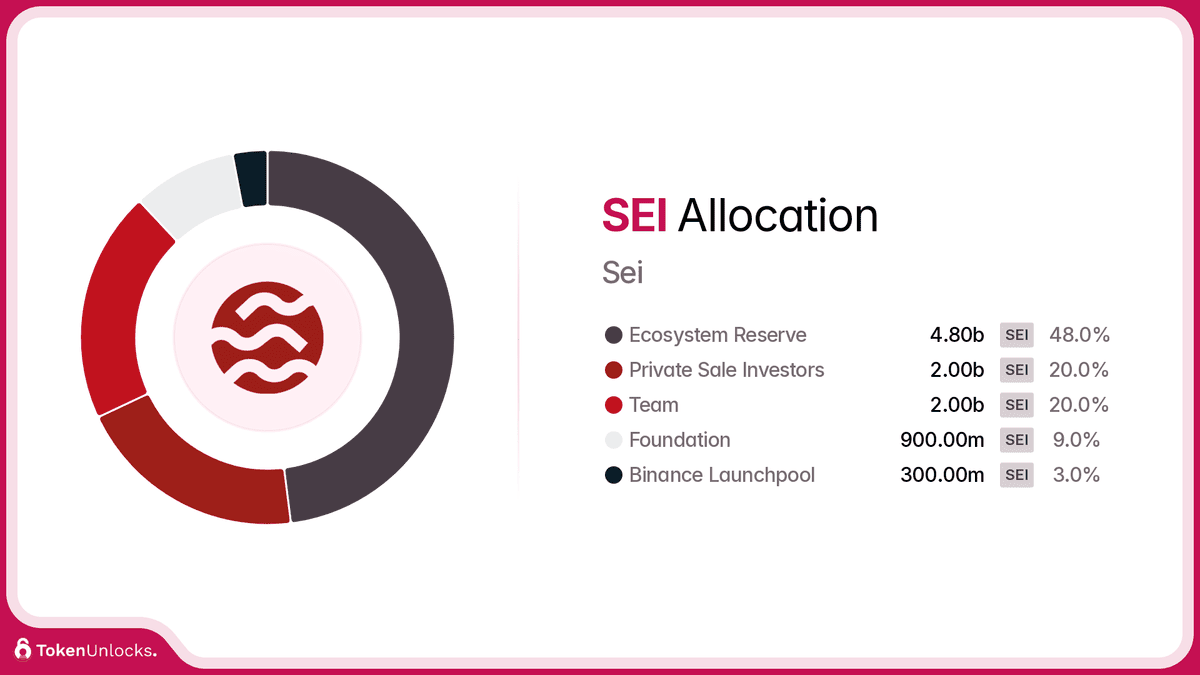

Defalcarea Alocării Token-ului SEI

Distribuția token-ului SEI | Sursă: TokenUnlocks

SEI are o ofertă totală fixă de 10 miliarde de token-uri, concepută pentru sustenabilitate pe termen lung și participarea comunității. Iată o defalcare generală:

• Dezvoltarea Ecosistemului – ~48%: Suportă creșterea DeFi, stimulentele dApp și expansiunea rețelei

• Echipa Principală & Contribuitorii – ~20%: Recompensează constructorii și contribuitorii timpurii cu vesting pe termen lung

• Investitori – ~20%: Alocat susținătorilor strategici și firmelor de capital de risc

• Rezerva Fundației – ~9%: Folosită pentru granturi, parteneriate și sustenabilitate pe termen lung

• Comunitate & Airdrop-uri – ~3%: Distribuit utilizatorilor timpurii și membrilor comunității pentru a încuraja adoptarea

Notă: Unele dintre aceste alocări sunt supuse unor perioade de vesting pentru a promova eliberarea responsabilă a token-urilor și a evita impacturile bruște asupra pieței.

Cum să Tranzacționezi SEI pe BingX: Un Ghid Pas cu Pas

Gata să tranzacționezi SEI? Iată cum să faci acest lucru ușor pe BingX:

1. Înscrie-te sau conectează-te la contul tău BingX și completează

KYC-ul.

2. Depune fonduri prin transfer bancar, card de credit/debit sau P2P.

4. Sub interfața de tranzacționare, alege tipul de ordin:

• Ordin Limit: Se execută când SEI atinge prețul țintă.

5. Introdu suma de SEI sau

USDT, apoi apasă Cumpără sau Vinde pentru a finaliza.

• Monitorizează pozițiile deschise și revizuiește ordinele executate în istoricul ordinelor.

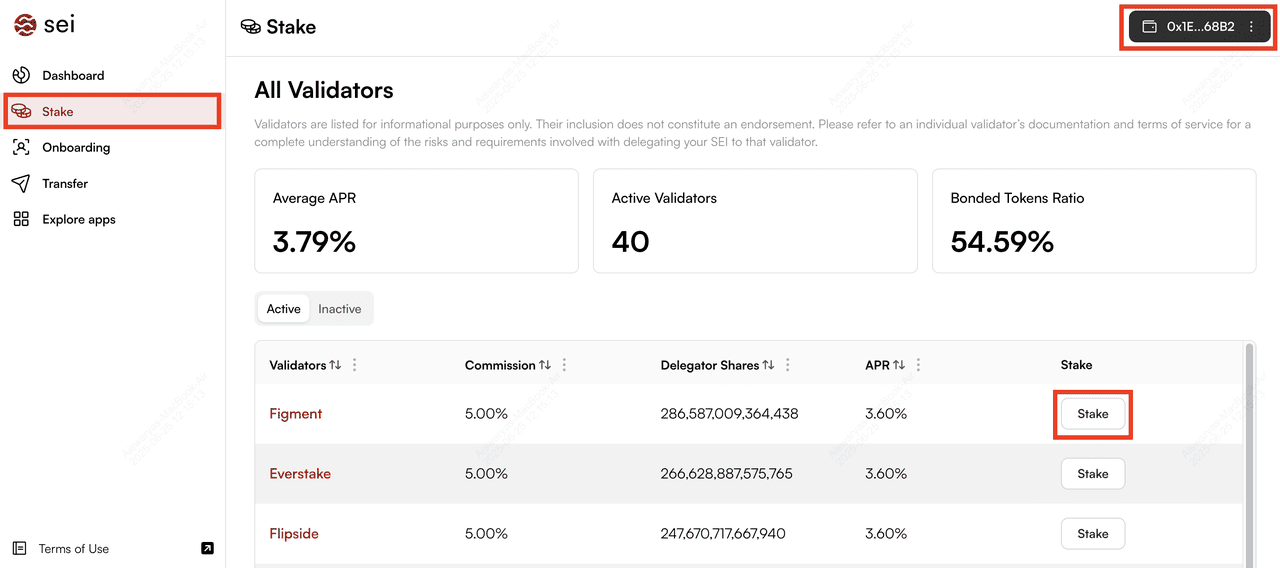

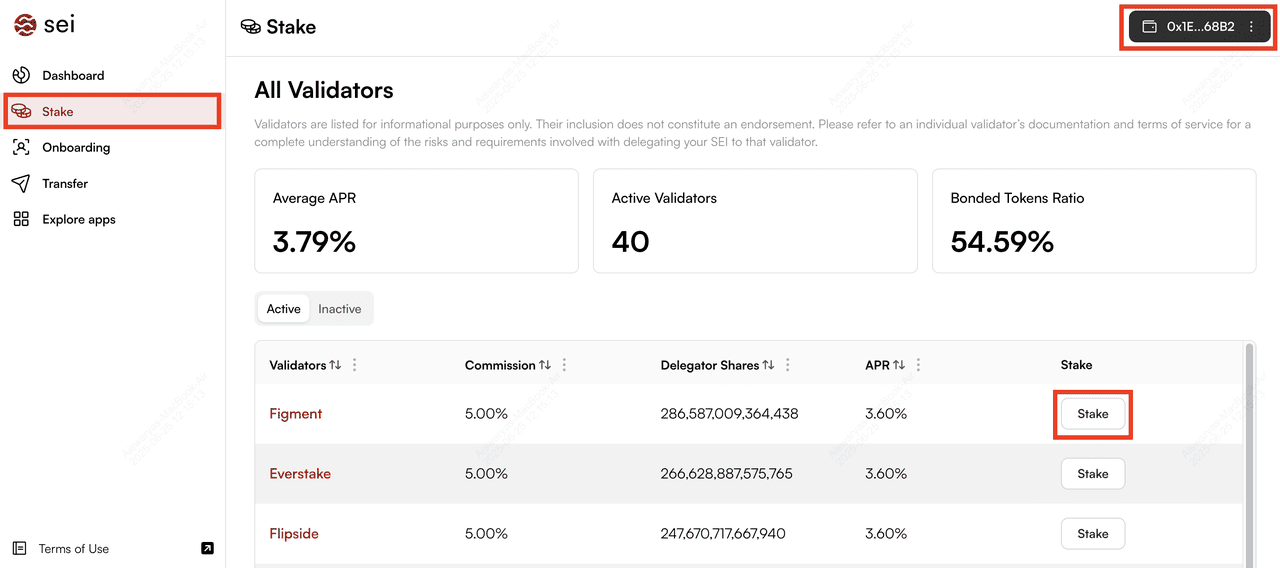

Cum să Faci Stake SEI pe Rețeaua Sei

Staking token-uri SEI | Sursă: Aplicația Sei

Fă stake cu SEI-ul tău pentru a câștiga recompense pasive și pentru a ajuta să securizezi rețeaua. Iată cum:

1. Alege un portofel: Folosește

MetaMask, Keplr, Gem sau Compass/Everstake.

3. Trimite token-uri SEI în portofelul tău (min. ~1 SEI pentru a acoperi taxele).

4. Deschide tab-ul Staking sau Earn al portofelului și selectează SEI.

5. Alege un validator de încredere (ex. Figment, Everstake).

6. Introdu suma pentru stake și confirmă tranzacția.

7. Token-urile tale sunt blocate și câștigă recompense. Monitorizează recompensele în panoul de staking.

Pentru a opri staking-ul, navighează la Unstake, apoi așteaptă perioada de unbonding de 21 de zile.

Concluzie

Sei Network se evidențiază în 2025 ca cel mai rapid blockchain Layer 1 paralel. Combină finalitatea sub-secundă, compatibilitatea EVM și interoperabilitatea Cosmos, toate alimentate de Twin‑Turbo Consensus și un motor nativ de potrivire a ordinelor. Cu o creștere puternică în DeFi, gaming și cross-chain, și un interes instituțional în creștere, Sei oferă o propunere unică pe piața crypto.

Dar amintește-ți: aceasta este încă tehnologie în stadiu incipient. Păstrează-ți riscul sub control,

fă-ți propria cercetare și investește doar ceea ce îți poți permite să pierzi. Rămâi informat despre actualizările protocolului și tendințele pieței pe măsură ce explorezi viteza și inovația pe care le oferă Sei.

Lecturi Conexe

Creșterea prețului SEI | Sursă: BingX

Creșterea prețului SEI | Sursă: BingX

TVL DeFi Sei | Sursă: DefiLlama

TVL DeFi Sei | Sursă: DefiLlama Activitatea dApp Sei | Sursă: DappRadar

Activitatea dApp Sei | Sursă: DappRadar Distribuția token-ului SEI | Sursă: TokenUnlocks

Distribuția token-ului SEI | Sursă: TokenUnlocks

Staking token-uri SEI | Sursă: Aplicația Sei

Staking token-uri SEI | Sursă: Aplicația Sei