On July 17, 2025, the U.S. House of Representatives passed the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act), sending it to President Donald Trump for signature. The bill had previously cleared the Senate on June 18, 2025, and Trump is expected to sign it into law during a signing ceremony on July 18, 2025.

The GENIUS Act creates a comprehensive federal framework for the issuance and regulation of stablecoins—digital tokens pegged to assets like the U.S. dollar or short-term Treasury bills. Once enacted, the law will take effect 18 months after signing, or 120 days after U.S. regulators issue final implementation rules.

Key provisions include:

• Full 1:1 reserve backing: Issuers must hold liquid assets such as U.S. dollars and Treasury bills equal to their outstanding stablecoin supply.

• Monthly reserve disclosures: Issuers must publish detailed reports of reserve composition, verified by registered public accounting firms.

• Interest/yield ban: Issuers are prohibited from paying interest or offering yield on stablecoin holdings.

• Approved issuer requirement: Only federally or state-approved issuers can offer stablecoins in the U.S. market after a three-year transition period.

• Foreign stablecoin carve-outs: Foreign issuers may serve U.S. customers if their home country has comparable regulations and they register with U.S. authorities.

The Act also authorizes multiple regulators, including the Federal Reserve, Treasury, OCC, FDIC, and state agencies, to oversee different categories of issuers. Smaller issuers under $10 billion in circulation can choose state-level regulation if states establish a stablecoin regulator.

Experts warn the law leaves significant uncertainty for DeFi platforms and decentralized protocols that use stablecoins, with further legislation expected to address these gaps.

GENIUS Act Establishes Federal Stablecoin Framework

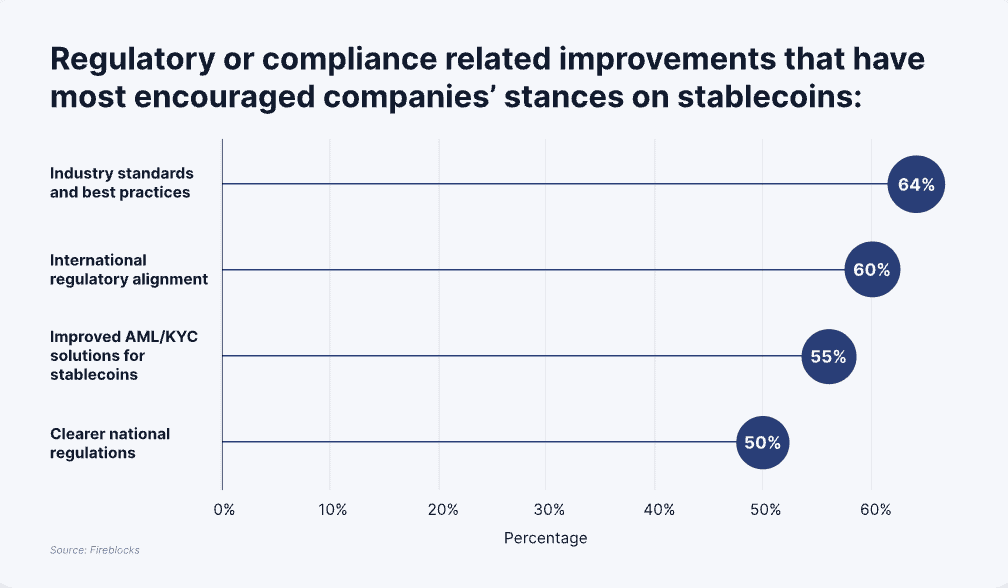

The GENIUS Act’s passage marks a historic step for the U.S. digital asset industry. Backed by a bipartisan vote of 308–122 in the House, it reflects growing political support for establishing clear rules around stablecoins.

The legislation requires issuers to obtain federal or state approval and comply with strict operational and transparency standards. Many issuers are now expected to seek national trust bank charters to streamline operations across all U.S. states, bypassing individual state money transmission licenses.

Industry leaders see the Act as a foundation for broader institutional participation, while critics point to potential challenges for innovation and DeFi integration. The law’s ban on yield-bearing stablecoins is particularly controversial, as it removes a key feature used by platforms to attract users.

What is Crypto Week and Why is It Monumental for Stablecoins?

What happens when Wall Street, Washington, and Silicon Valley unite behind digital assets? The U.S. House of Representatives is set to vote this week on the Guiding and Establishing National Innovation for U.S. Stablecoins, better known as the GENIUS Act, is part of what lawmakers are calling "Crypto Week." This landmark legislation, which has already passed the Senate with strong bipartisan support, aims to establish the first comprehensive federal regulations for the stablecoin market. Lawmakers hope that the U.S. House of Representatives' approval will send the GENIUS Act straight to President Trump's desk for final signature, potentially marking a historic turning point for digital asset regulation in the United States.

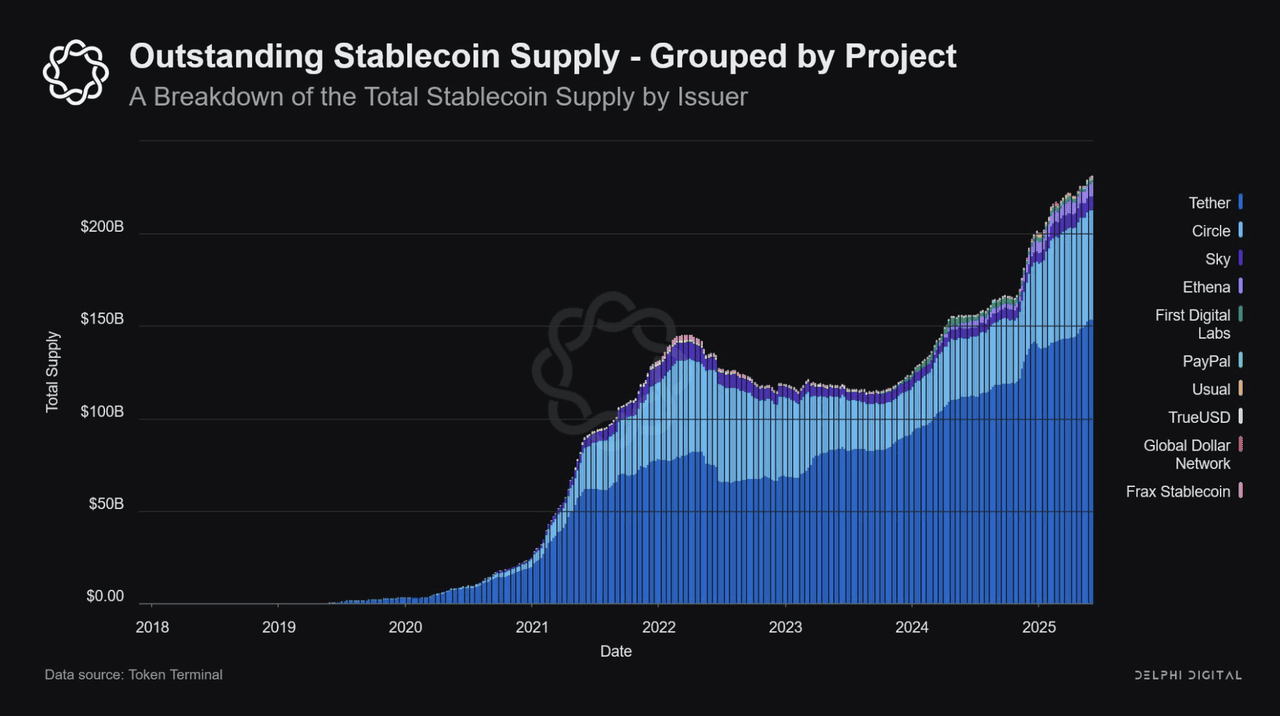

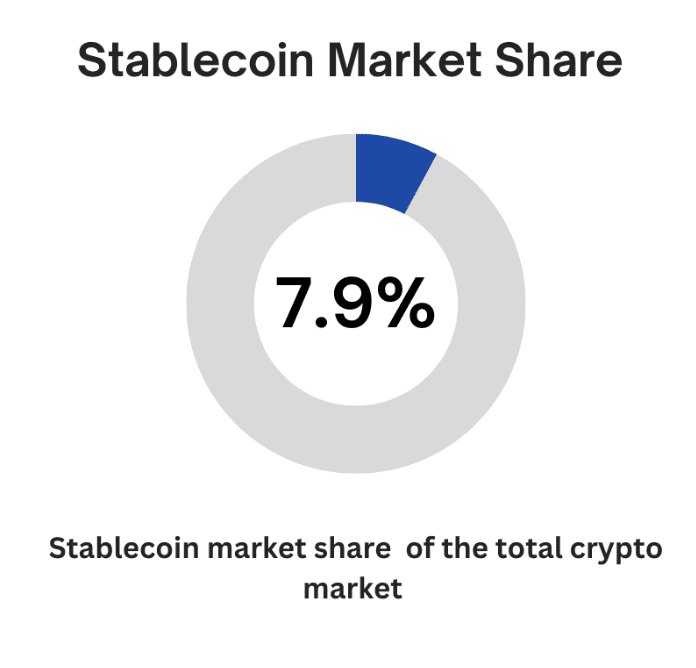

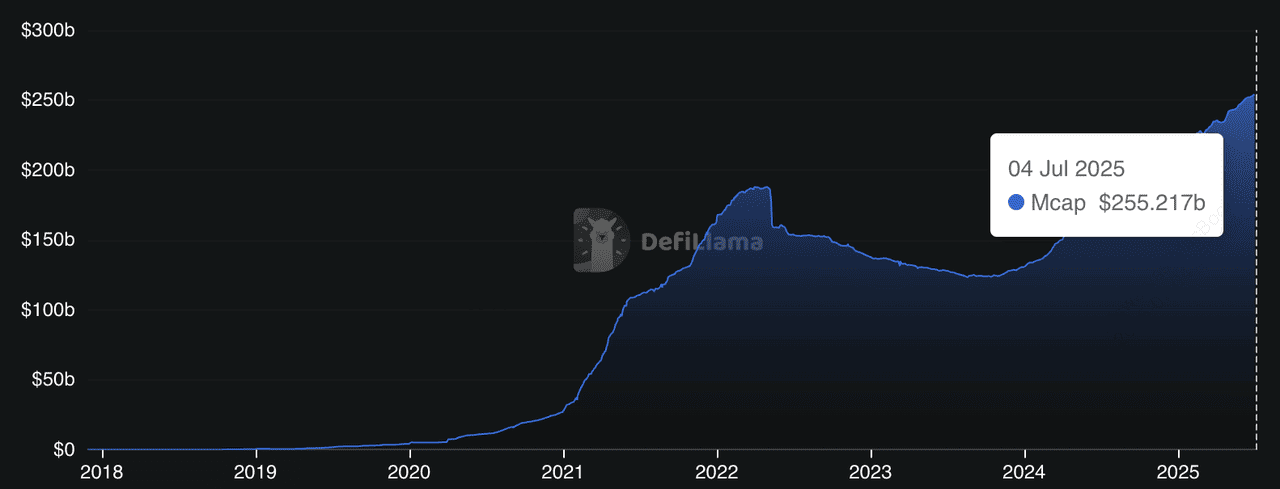

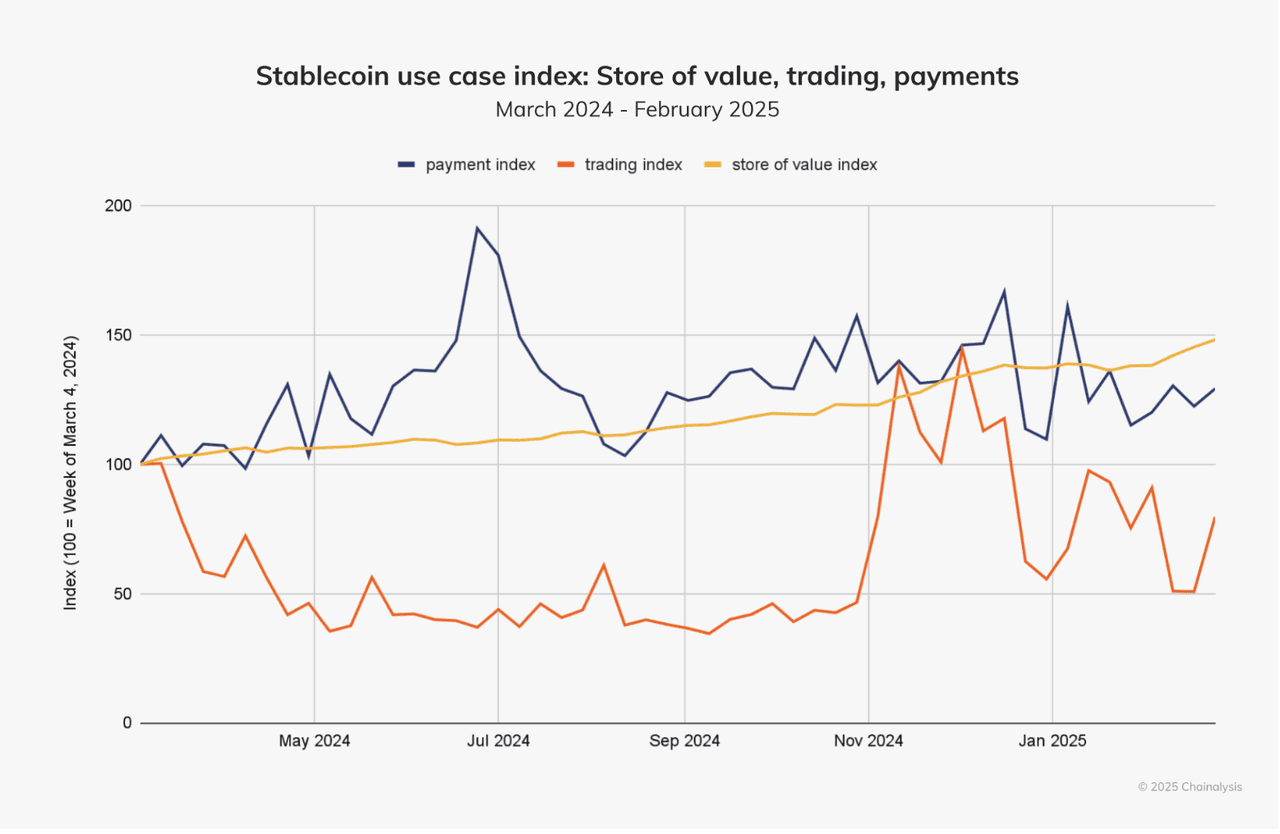

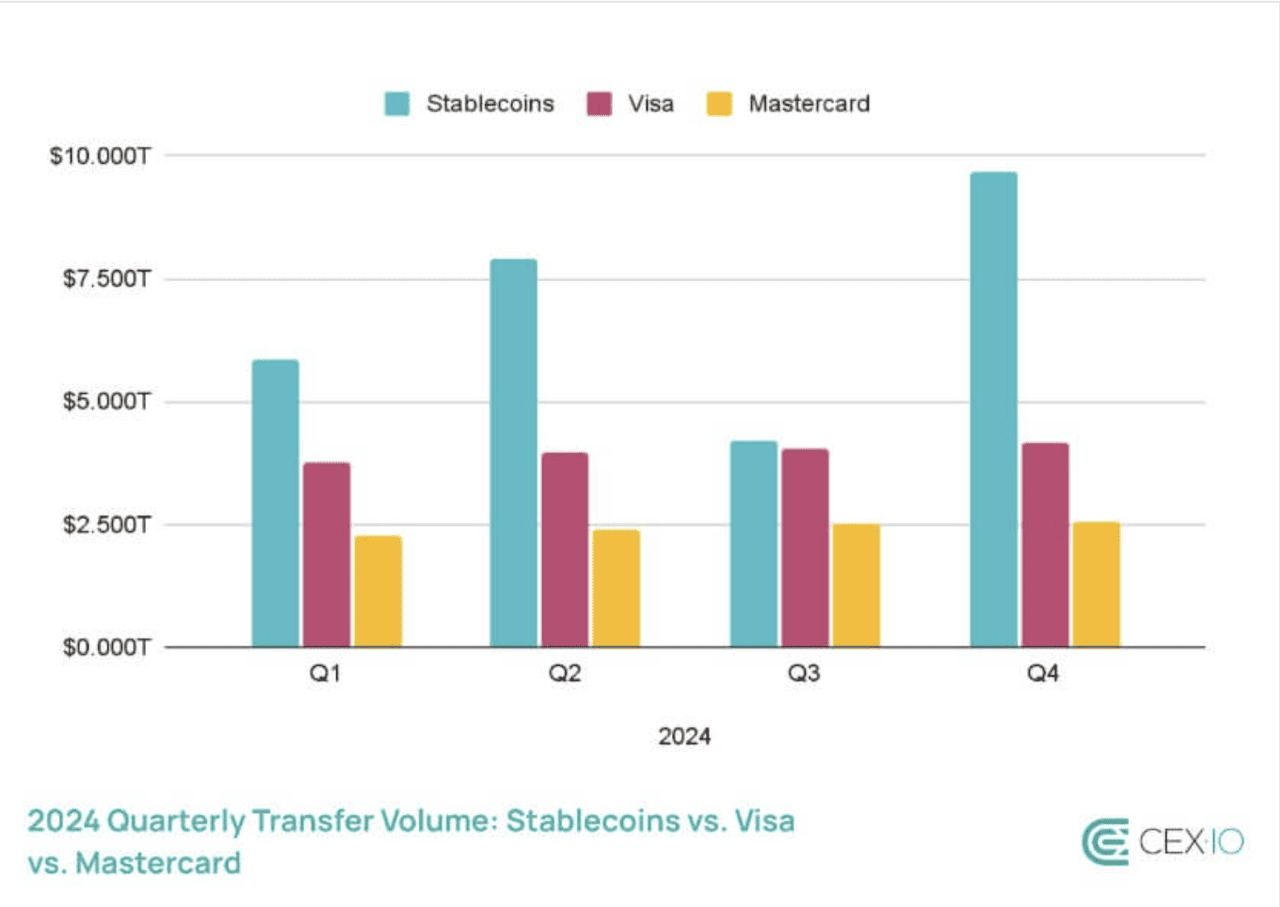

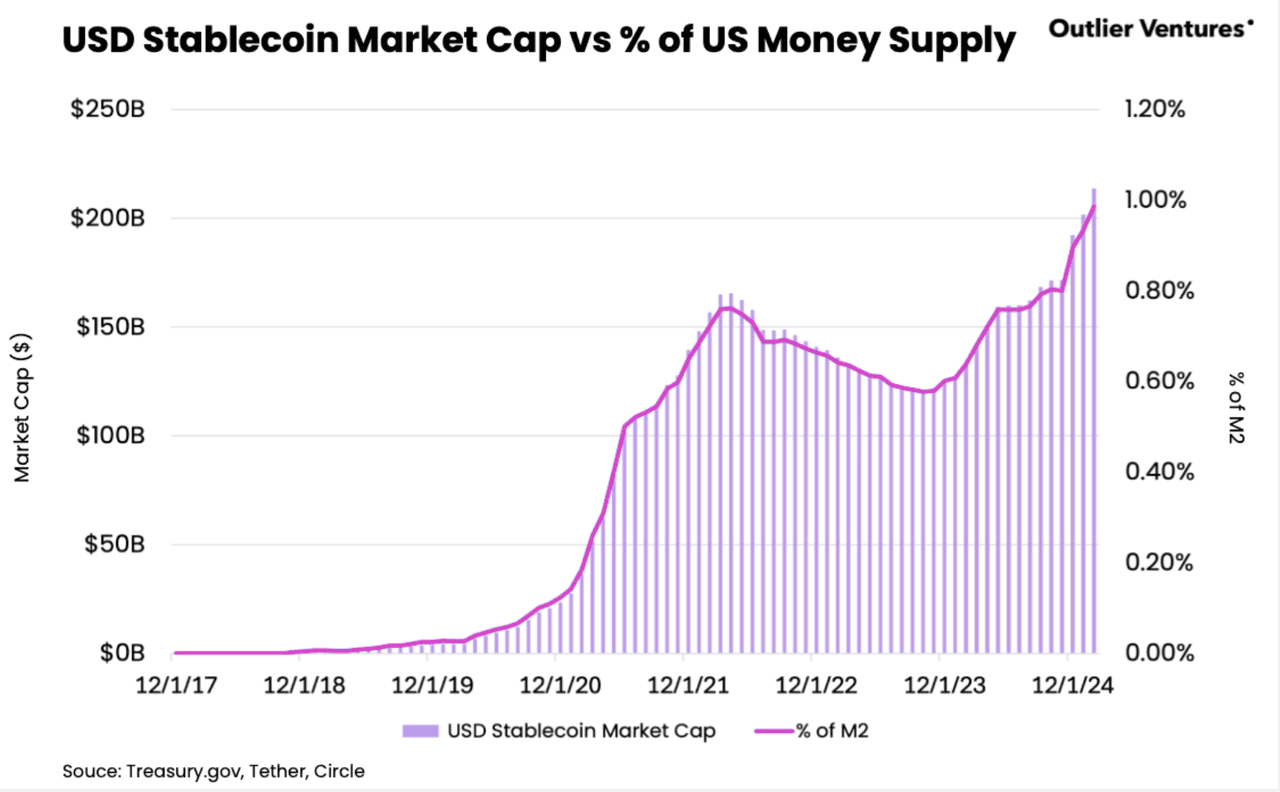

This is the first time Congress has moved to establish clear federal guardrails for U.S. dollar-pegged stablecoins, a sector that has exploded to a market cap of about $238 billion and is now driving trillions in transaction volume annually. The GENIUS Act will require stablecoins to be 100% backed by reserves, undergo monthly audits, and follow anti-money laundering laws. This sets the stage for banks, fintech firms, and even major retailers to confidently issue their own digital dollars with federal backing.

CNBC reports that the digital asset industry invested roughly $250 million into the 2024 election cycle, helping install the most crypto-forward Congress in U.S. history. Stablecoins also took the spotlight at this year's Bitcoin 2025, one of the largest crypto conferences worldwide where U.S. officials repeatedly emphasized that digital dollars bolster the dominance of the U.S. dollar on the world stage. Vice President JD Vance even declared stablecoins key to strengthening the nation's economic future, and administration officials revealed that demand for such assets could unlock trillions in global purchases of U.S. Treasuries.

In addition to the GENIUS Act, the House of Representatives will take up two other major crypto bills during Crypto Week. The Digital Asset Market Clarity Act aims to define clear roles for the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) in regulating digital tokens, establishing a comprehensive framework for how digital assets are overseen and classified. Meanwhile, the Anti-CBDC Surveillance State Act would prohibit the Federal Reserve from creating or issuing a digital U.S. dollar, ensuring that any move toward a central bank digital currency would not proceed. These legislative efforts are central to shaping the future of crypto regulation in the United States and will determine how digital assets are governed.

With the U.S. stablecoin market projected by policymakers to soar past $2 trillion in coming years, Crypto Week is more than a series of policy debates. It's a pivotal moment that could cement the country's financial leadership worldwide.

The U.S. House of Representatives Advances Landmark Crypto Bills After Lengthy Procedural Vote During Crypto Week

The U.S. House of Representatives is the lower chamber of the United States Congress responsible for introducing and voting on federal legislation, including the recent key cryptocurrency bills mentioned above during "Crypto Week" in July 2025. This House is composed of elected officials representing congressional districts from all 50 states and plays a central role in shaping U.S. law and policy.

During Crypto Week, the U.S. House of Representatives made significant progress on landmark crypto bills after a procedural vote failed 196-223 on Tuesday, July 15, 2025 due to opposition from some Republicans, the party regrouped the next day.

According to

CoinDesk, Wednesday July 16's vote cleared the way for final votes on the CLARITY and GENIUS Acts. The first procedural motion passed narrowly (217-215), signaling smooth approval ahead. A second, longer 10 hour voting process faced initial GOP opposition but ultimately passed 217-212, advancing the GENIUS and CLARITY Acts toward final consideration. This progress happened after President Trump's intervention and the addition of key anti-CBDC provisions to the must-pass National Defense Authorization Act.

Final votes on the GENIUS Act are scheduled for Thursday July 17, 2025, setting the stage for the first comprehensive U.S. crypto legislation to potentially reach the president's desk for signing shortly after.

GENIUS Act Establishes Federal Stablecoin Framework

The U.S. Senate has approved the GENIUS Act with a bipartisan vote of 68–30, marking a pivotal legislative milestone for the stablecoin sector. This act is designed to create the first comprehensive federal regulatory framework for payment stablecoins in the United States, establishing clear standards for issuers and providing a foundation for further innovation in digital finance.

The GENIUS Act advanced to the House of Representatives, where it's considered alongside the STABLE Act and broader market structure legislation. If enacted, the GENIUS Act will require stablecoin issuers to obtain federal or state approval, adhere to strict reserve requirements, and comply with operational and transparency standards.

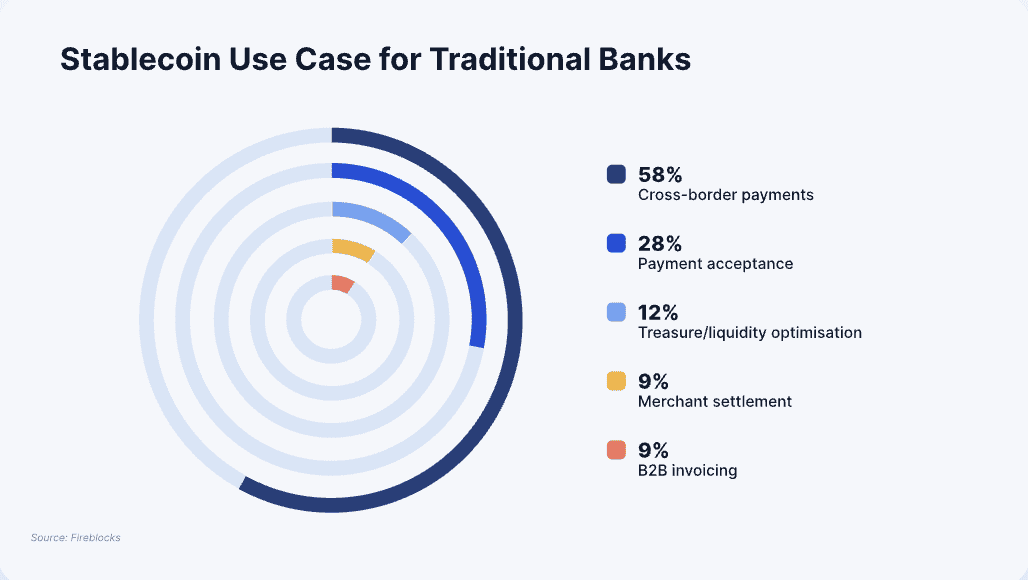

The legislation will permit both licensed entities and federally chartered banks to issue stablecoins, facilitating large-scale participation from major financial institutions. Treasury Secretary Scott Bessent has described the bill as a landmark step for responsible innovation, reflecting the sentiment of both policymakers and industry leaders who view this framework as critical for the future of digital dollar adoption. The GENIUS Act's passage in the Senate signals broad political support for stablecoin regulation and is expected to accelerate institutional entry and product development across the digital asset market.

Stablecoin Market Outlook and Projections