On July 14, 2025,

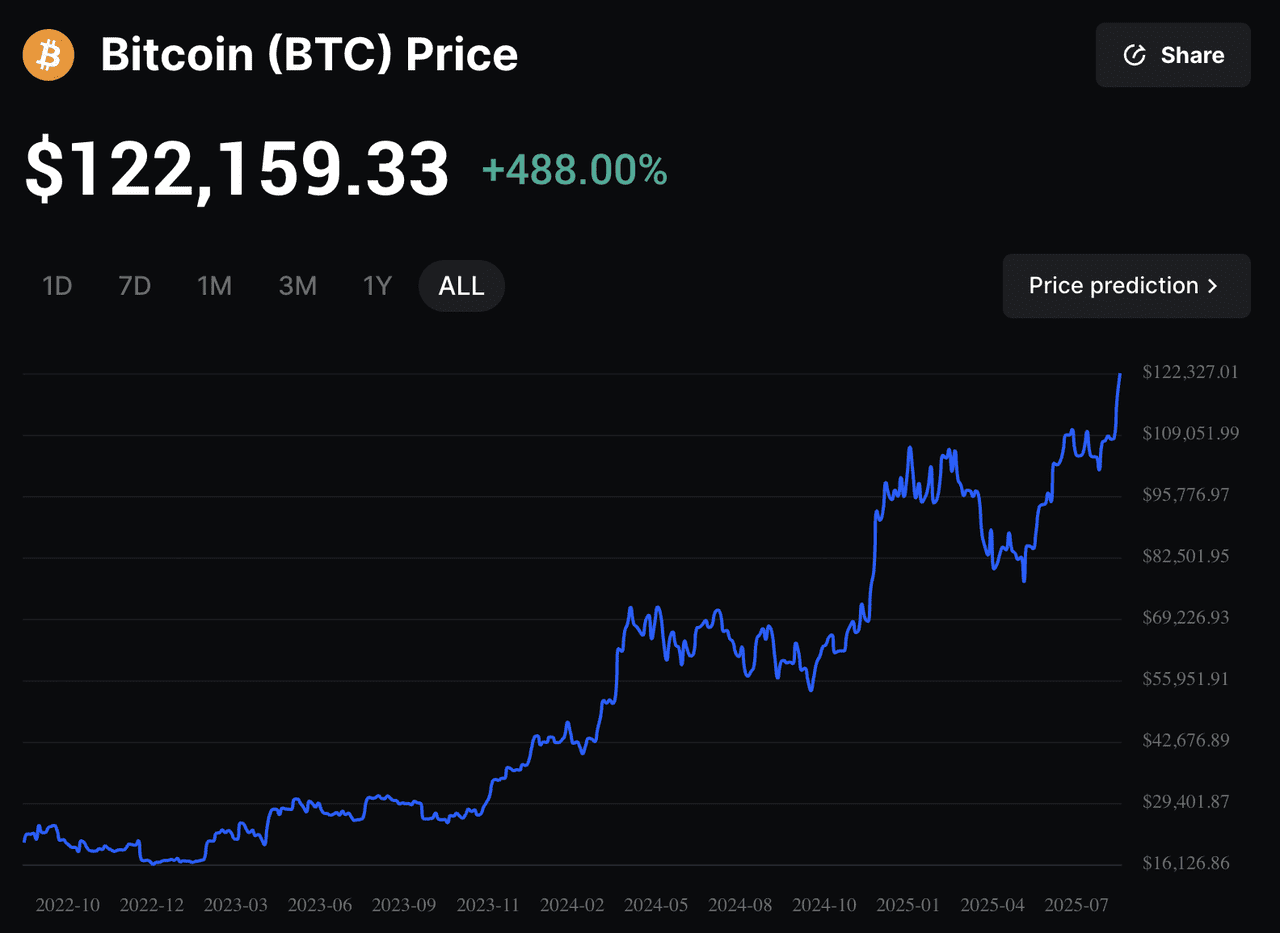

Bitcoin soared to a new all-time high above $122,200, cementing its position as a trillion-dollar asset and sparking fresh debates about its mysterious creator. Behind this $2.4 trillion revolution lies a shadowy figure, or perhaps a team, known only as Satoshi Nakamoto.

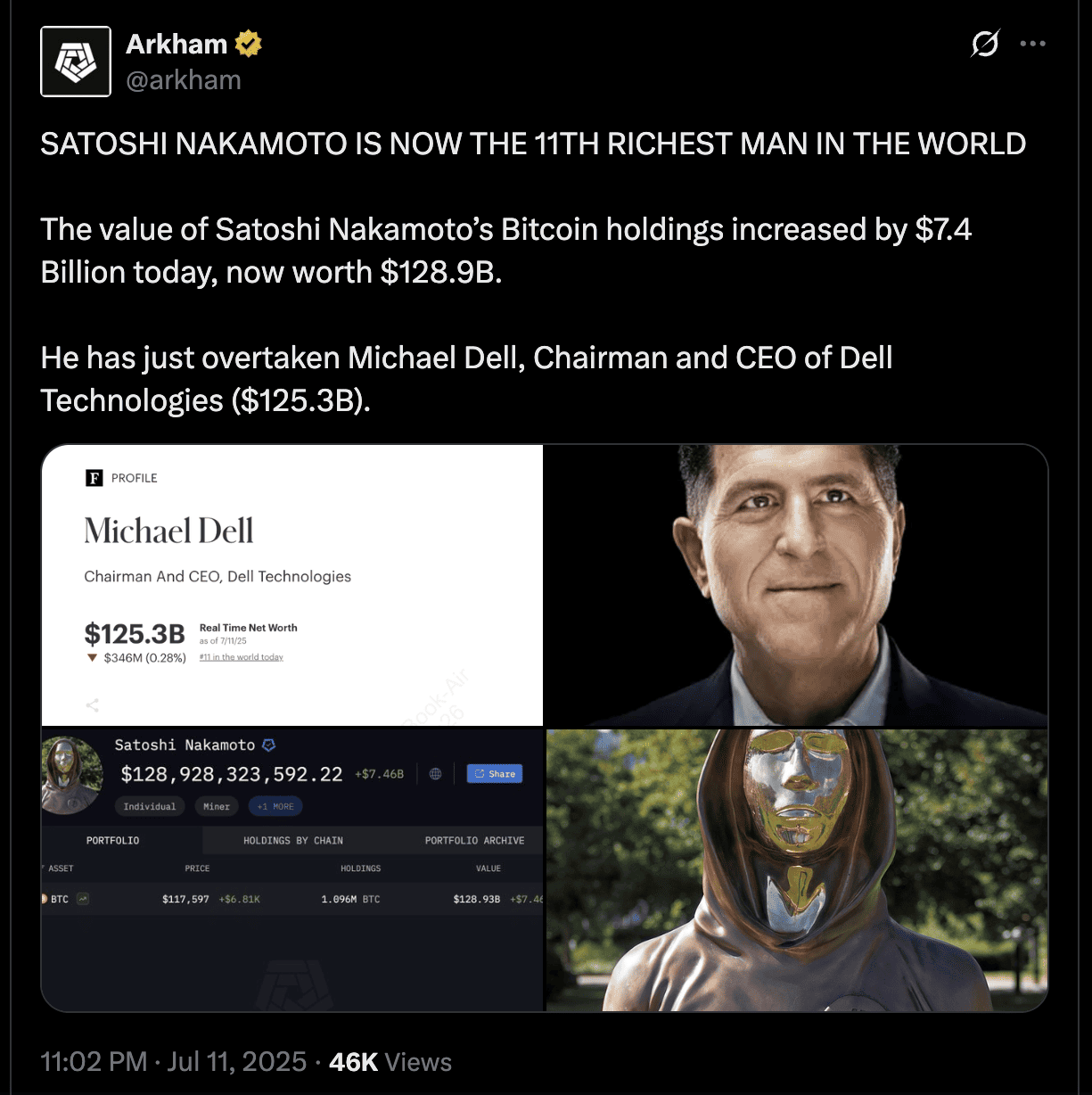

Source: X

Since introducing Bitcoin in 2008, Nakamoto has remained silent, unseen, and untouched by the riches their creation has generated. With an estimated 1.1 million BTC now worth over $134 billion as of July 2025, Nakamoto quietly holds the keys to one of the largest fortunes in history. Yet none of their coins have ever moved.

This is the story of Bitcoin’s anonymous architect, the fortune that could reshape global wealth, and why their enduring silence may be Bitcoin’s greatest strength. To this day, the crypto community still has no answer about his, her, or their true identity, a mystery that continues to fuel speculation and fascination across the world.

What Is Satoshi Nakamoto?

Satoshi Nakamoto is the mysterious figure, or possibly a group, credited with creating Bitcoin and writing its groundbreaking whitepaper,

“Bitcoin: A Peer-to-Peer Electronic Cash System”, released on October 31, 2008. This nine-page document introduced the idea of a decentralized, borderless currency that could operate without banks or governments. It also laid out Bitcoin’s unique monetary design: a fixed supply of 21 million coins and a built-in mechanism called the

Bitcoin halving, which cuts the block reward for miners in half roughly every four years. These features ensure Bitcoin remains scarce over time, reinforcing its appeal as “

digital gold” and a hedge against inflation.

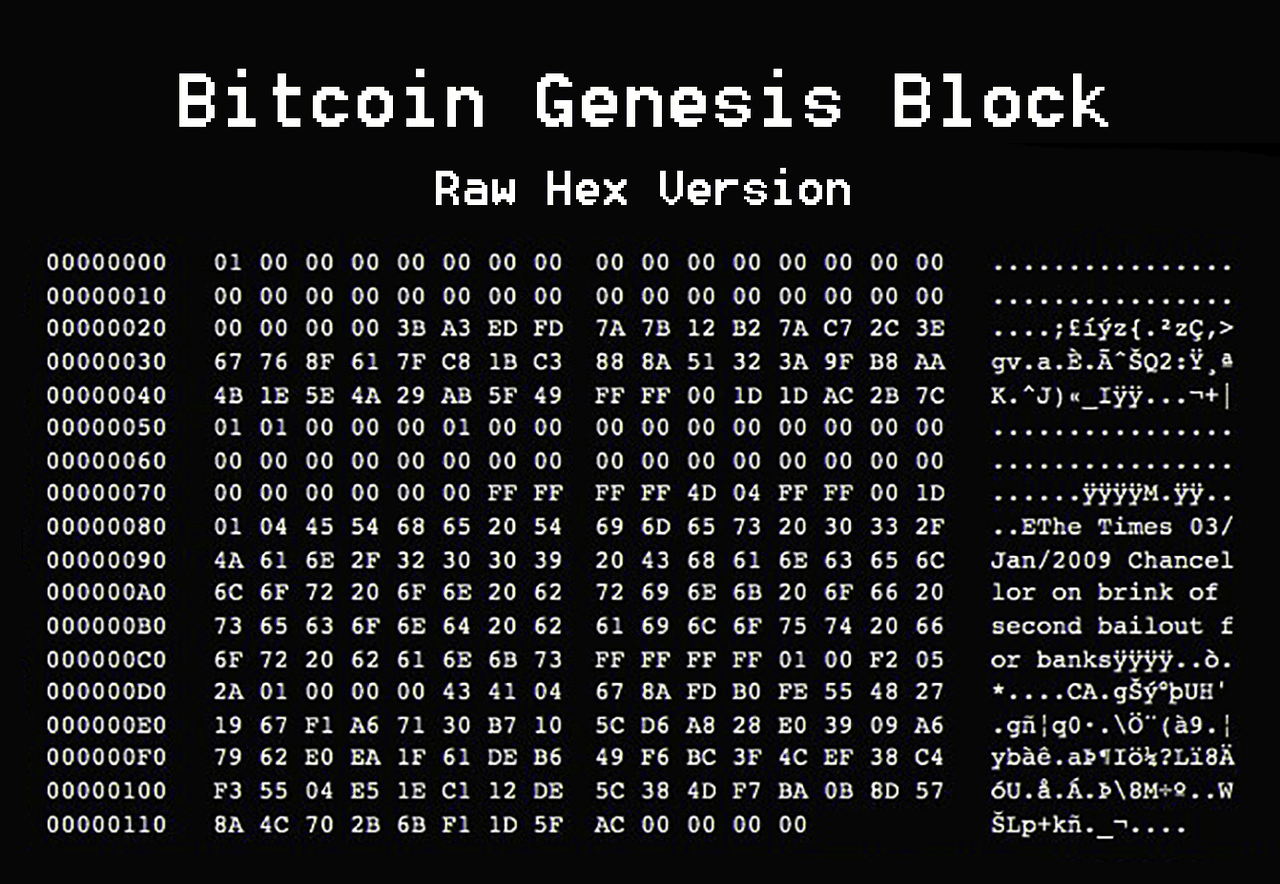

Just months later, on January 3, 2009, Nakamoto mined Bitcoin’s first-ever block, known as the Genesis Block or Block 0. Hidden in its code was a now-famous message:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This cryptic note referenced a headline from The Times newspaper on that day, hinting at Nakamoto’s motivation: frustration with the traditional financial system and its reliance on bailouts.

Bitcoin Genesis Block | Source: Wikipedia

In Bitcoin’s first year, Nakamoto actively participated in forums and collaborated with early developers to refine the protocol. They mined an estimated 1.1 million BTC during this period, coins that remain untouched to this day.

But by April 2011, Nakamoto abruptly disappeared from all online communication, leaving behind only a legacy and a fortune worth over $134 billion at today’s prices. Since then, there has been no confirmed activity from their wallets or identity, fueling speculation about who, or what, Satoshi Nakamoto really is.

What Is Satoshi Nakamoto's Net Worth?

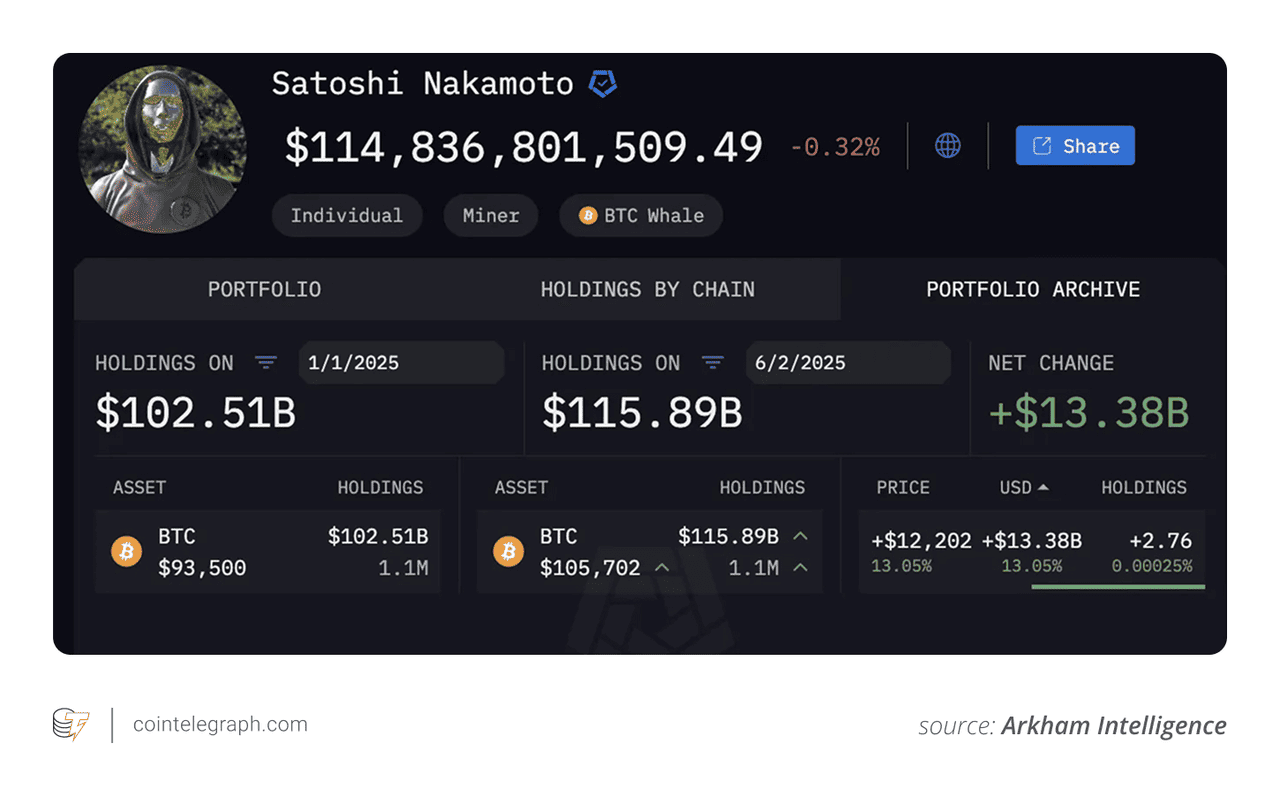

Satoshi Nakamoto's BTC holdings: A snapshot | Source: Cointelegraph

As of July 2025, with Bitcoin trading at an all-time high of $122,000, Nakamoto’s net worth is an estimated $134 billion. This places them as the 11th richest person on Earth, ahead of tech titans like Michael Dell and just behind Oracle co-founder Larry Ellison.

If Bitcoin were to climb another 208% to $370,000 per coin, a figure some analysts predict could happen within the next market cycle, Nakamoto’s net worth would surpass $400 billion. This would make them the world’s richest person, overtaking Elon Musk’s current estimated fortune of $404 billion.

What makes this even more remarkable is Nakamoto’s complete inactivity. Since mining these coins, there has been no recorded movement from any of Nakamoto’s wallets. Blockchain analytics firms have monitored these addresses for over a decade, and their untouched status has become one of Bitcoin’s most closely watched metrics.

The crypto community often debates what might happen if Nakamoto’s coins were ever moved. Would it spark panic selling? Or would it simply prove Nakamoto is still alive? For now, their silence adds another layer to Bitcoin’s mystique and reinforces the currency’s decentralization; there’s no single point of control, even from its creator.

Interesting Facts About Satoshi Nakamoto's Indentity

1. A Billionaire Without Spending a Cent: Satoshi Nakamoto’s Bitcoin wallet, holding an estimated 1.1 million BTC, has remained completely untouched since their mining activity ended in 2010. There have been no outgoing transactions from these addresses, which collectively hold a fortune worth over $134 billion at current prices. This inactivity has fueled speculation about whether Nakamoto is still alive or has deliberately chosen to leave the Bitcoin ecosystem to preserve its decentralization.

2. Satoshi Could Be More Than One Person: Analysis of Nakamoto’s writing style and the Bitcoin whitepaper has led some researchers to believe there may have been multiple contributors. Linguistic studies have identified shifts between British and American English, along with changes in sentence structure and technical tone, which suggest collaborative authorship. Others point to the scale and precision of Bitcoin’s code as evidence that it may have been the work of a team rather than a lone developer.

The Satoshi Nakamoto statue in Budapest | Source: Wikipedia

3. A Statue in Budapest Honors Nakamoto: In September 2021, a bronze statue dedicated to Satoshi Nakamoto was unveiled in Budapest, Hungary. Designed with a reflective face, the statue symbolizes the anonymity of Bitcoin’s creator and the idea that “we are all Satoshi.” The sculpture has since become a pilgrimage site for crypto enthusiasts, reflecting Nakamoto’s influence on technology and finance worldwide.

4. The “Patoshi Pattern” Reveals Early Mining Activity: Blockchain researchers identified a unique mining signature in Bitcoin’s first 22,000 blocks, now known as the “Patoshi Pattern.” This pattern is believed to be linked to Nakamoto’s personal

BTC mining operation, which secured the network in its infancy. The distinct non-overlapping mining intervals suggest Nakamoto used a custom setup, possibly to avoid creating competition with other miners and to distribute coins fairly in Bitcoin’s early days.

The List of Possible Suspects of Satoshi Nakamoto

Satoshi Nakamoto's documentary | Source: PrimeVideo

For over 15 years, Satoshi Nakamoto’s identity has remained one of the greatest unsolved mysteries in technology and finance. We know Nakamoto created Bitcoin, published its 2008 whitepaper, and mined over 1.1 million BTC between 2009 and 2010. Yet despite countless theories, investigations, and even claims of self-identification, their true identity remains unconfirmed.

Here are some of the leading suspects:

1. Hal Finney: A pioneering cryptographer and one of Bitcoin’s first developers, Finney was the recipient of the very first Bitcoin transaction sent by Nakamoto. His proximity to a man named Dorian Nakamoto (living just blocks away) added fuel to speculation. Finney passed away in 2014 from ALS, but some believe he may have been Satoshi or closely connected to them.

2. Nick Szabo: A computer scientist and creator of Bit Gold, a precursor to Bitcoin, Szabo is often cited due to the conceptual similarities between Bit Gold and Bitcoin. Linguistic analysis has found parallels between Szabo’s writings and Nakamoto’s. Despite this, Szabo has repeatedly denied being Satoshi.

3. Dorian Nakamoto: In 2014, Newsweek controversially claimed Dorian Nakamoto, a Japanese-American engineer, was Bitcoin’s creator based on circumstantial evidence. Dorian denied any involvement, saying he had never heard of Bitcoin before the media attention, and there’s no verifiable link between him and the pseudonymous creator.

4. Adam Back: The CEO of Blockstream and inventor of Hashcash, a system referenced in Bitcoin’s whitepaper, Back is a technically credible candidate. However, he has consistently denied being Nakamoto and supports Bitcoin’s ethos of anonymity.

5. Jack Dorsey: A more recent theory from early 2025 suggests Jack Dorsey, co-founder of Twitter (now X) and Block (formerly Square), could be Satoshi. Proponents highlight Dorsey’s early involvement in cypherpunk culture, cryptography, and writings about alternative financial systems. They also point to coincidences between key Bitcoin events and dates significant in Dorsey’s life. However, Dorsey has neither confirmed nor denied the possibility, once saying on a podcast that even if he were Satoshi, he wouldn’t admit it. Critics argue his high-profile roles at Twitter and Square during Bitcoin’s early years make this theory unlikely.

6. Peter Todd: Canadian cryptographer Peter Todd became a surprising suspect in 2024 after an HBO documentary suggested he might be Satoshi. The theory was based on his deep knowledge of Bitcoin’s code and involvement in the early crypto community. Todd denied the claims and later went into hiding citing safety concerns, leaving the theory unresolved.

Despite documentaries, court battles, and Australian entrepreneur Craig Wright’s controversial claims of being Satoshi (which lack definitive proof), the mystery endures. Many believe Nakamoto’s anonymity was intentional, designed to protect Bitcoin’s decentralization. By remaining absent, Nakamoto ensures no individual controls or influences the network, a principle that lies at the heart of Bitcoin’s design.

Beyond Satoshi: Who Owns the Most Bitcoin in 2025?

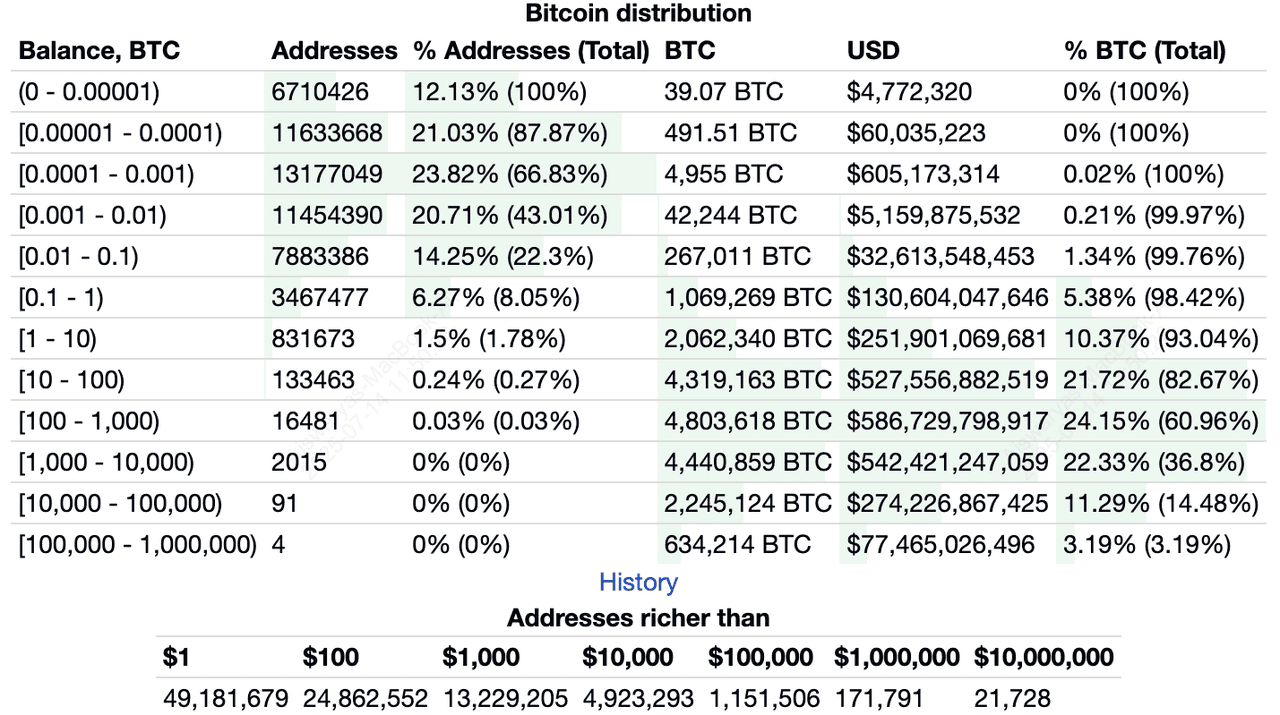

Bitcoin distribution across wallets, July 2025 | Source: BitInfoCharts

Bitcoin ownership in 2025 reflects a diverse mix of institutional investors, exchanges, sovereign reserves, and individual holders. At the top of the list are major custodians and ETFs, which now manage significant portions of Bitcoin’s total supply.

1. BlackRock’s Spot Bitcoin ETF (IBIT): BlackRock’s iShares Bitcoin Trust (IBIT), launched in 2024, has rapidly grown to become the largest institutional holder of Bitcoin. As of mid-2025, the leading

spot Bitcoin ETF manages over 700,000 BTC, valued at approximately $85 billion. IBIT’s success highlights the increasing demand for regulated Bitcoin investment vehicles among institutional and retail investors.

2. Binance Cold Wallets: Binance operates the largest known exchange cold wallet, holding approximately 248,600 BTC worth over $30 billion. A secondary

cold wallet managed by the platform contains an additional 115,000 BTC. These reserves are used for

liquidity management and safeguarding customer assets.

3. Strategy (formerly MicroStrategy): Strategy remains the

largest corporate Bitcoin holder. Under the leadership of Michael Saylor, the company has accumulated approximately 597,325 BTC, valued at over $73 billion. This represents about 3% of Bitcoin’s circulating supply, underscoring the firm’s long-term commitment to Bitcoin as a treasury asset.

4. Grayscale Bitcoin Trust (GBTC): Grayscale Bitcoin Trust continues to hold a significant amount of Bitcoin for institutional and accredited investors. As of 2025, it manages approximately 292,000 BTC, valued at roughly $35 billion.

5. Robinhood (HOOD): Robinhood’s custodial cold wallet contains approximately 140,600 BTC, with an estimated value of $17 billion. This reserve supports customer trading activities on the platform.

6. Bitfinex Cold Wallets: Bitfinex manages a primary cold wallet holding approximately 130,010 BTC and a recovered hack wallet now under government control containing 94,600 BTC. Combined, these reserves account for over $27 billion in Bitcoin.

Sovereign BTC Reserves

Governments around the world have accumulated Bitcoin holdings, often through seizures and strategic reserves. Combined, sovereign reserves account for over 529,000 BTC, or approximately 2.5% of Bitcoin’s total supply.

2. China: Retains an estimated 194,000 BTC from law enforcement actions.

3. United Kingdom: Holds around 61,245 BTC.

4. Ukraine: Manages approximately 46,351 BTC, much of it received in donations during conflicts.

5. Bhutan: Operates state-run mining operations that have amassed about 11,924 BTC.

6. El Salvador: Holds 6,229 BTC as part of its Bitcoin legal tender strategy.

Who Are the Largest Individual BTC Holders?

Several early adopters and crypto advocates maintain significant personal Bitcoin holdings:

• Winklevoss Twins: Estimated holdings of approximately 70,000 BTC.

• Tim Draper: Holds about 30,000 BTC, acquired in a 2014 U.S. Marshals auction.

• Michael Saylor: Personally owns approximately 17,732 BTC in addition to Strategy’s corporate holdings.

The top 10 Bitcoin wallets, excluding Nakamoto’s, control approximately 1.1 million BTC, representing 5.5% of Bitcoin’s circulating supply. The top 100 wallets hold around 2.9 million BTC, or nearly 15% of the total supply. However, there has been a notable rise in mid-sized wallets holding between 100 and 1,000 BTC, indicating a gradual broadening of ownership across institutions and high-net-worth individuals.

How could Satoshi’s Silence Affect Bitcoin's Value?

Bitcoin's price trajectory | Source: BingX

Satoshi Nakamoto’s disappearance is more than a personal choice; it’s a defining feature of Bitcoin’s success. Without a visible founder, Bitcoin has avoided the leadership conflicts, corporate takeovers, and regulatory crackdowns that often destabilize other projects. This absence strengthens Bitcoin’s decentralized design, ensuring no single person or entity can claim ownership or exert influence over its direction.

Nakamoto’s untouched fortune, now estimated at over $134 billion in 2025, also provides critical market stability. If their 1.1 million BTC were suddenly moved or sold, it could trigger significant volatility across the crypto market. Instead, the dormancy of these coins keeps Bitcoin’s supply predictable, allowing investors and institutions to focus on adoption, innovation, and long-term value.

This stability feeds into broader optimism about Bitcoin’s future. Analysts like PlanB, creator of the Stock-to-Flow model, continue to predict bold price targets, with forecasts suggesting

Bitcoin could reach $1 million per coin in the coming years as supply tightens and institutional demand accelerates. Beyond the numbers, Nakamoto’s anonymity has taken on symbolic weight, representing Bitcoin’s ethos as a global, borderless currency free from central authority and rooted in community trust.

Final Thoughts

Satoshi Nakamoto may never return, but their impact is undeniable. By stepping away, they allowed Bitcoin to grow as a truly leaderless system, governed by code and community rather than personality or politics. From nothing in 2009 to the launch of Bitcoin ETFs and even national strategic reserves, Bitcoin’s rise has been extraordinary. Today, its transformation into a global financial asset, surpassing $122,000 in July 2025, stands as a testament to that vision.

More than just software, Bitcoin sparked a movement toward financial empowerment and self-sovereignty. Nakamoto’s silent fortune serves as a powerful reminder of those revolutionary beginnings, proving that a single idea can change the world without a face to lead it.

Related Reading