เมื่อ Model Context Protocol (MCP) เปิดเป็น open source ในเดือนพฤศจิกายน 2024 ระบบนี้ได้แนะนำมาตรฐาน "plug-and-play" ที่เรียบง่ายและใช้ร่วมกันได้ ซึ่งช่วยให้

โปรแกรม AIสามารถเชื่อมต่อกับเครื่องมือภายนอกและข้อมูลสดได้โดยไม่ต้องใช้โค้ดแบบกำหนดเอง ภายในไม่กี่เดือน บริษัทใหญ่อย่าง Microsoft และ OpenAI ก็สนับสนุน MCP อย่างเป็นทางการ และ Google DeepMind ยังสร้างมันเข้าไปในโมเดล Gemini ทำให้ MCP กลายเป็นวิธีหลักในอุตสาหกรรมสำหรับการสื่อสารระหว่าง AI กับเครื่องมือ ปัจจุบัน MCP ขับเคลื่อนทุกอย่างตั้งแต่ตัวเชื่อมต่อการวิเคราะห์ธุรกิจไปจนถึง

บอทเทรดคริปโต โดยมีเครื่องมือบล็อกเชนมากกว่า 20 รายการใช้งานแล้วในการดึงข้อมูลราคาแบบเรียลไทม์ ดำเนินการซื้อขาย และทำงานออนเชนแบบอัตโนมัติด้วยการกดปุ่มเพียงครั้งเดียว

ในโลกคริปโต ทุกวินาทีมีความสำคัญ และ MCP เป็นเครื่องมือที่ให้โมเดล AI ทำงานเหมือนผู้ช่วยอัจฉริยะมากกว่าแค่แชทบอท แทนที่คุณจะต้องดึงราคา เรียกใช้ smart contract หรือตรวจสอบยอดเงินใน wallet ด้วยตัวเอง MCP ให้ "ภาษา" ทั่วไปแก่ AI ในการทำสิ่งเหล่านั้นโดยอัตโนมัติ นั่นหมายความว่า AI ของคุณสามารถเฝ้าติดตามตลาดแบบเรียลไทม์ ปรับสมดุลการลงทุน DeFi ของคุณเมื่อสภาวะเปลี่ยนแปลง หรือแม้แต่ใช้ประโยชน์จากความแตกต่างของราคาในเชนต่างๆ โดยที่คุณไม่ต้องยกนิ้วเลย

MCP (Model Context Protocol) คืออะไร?

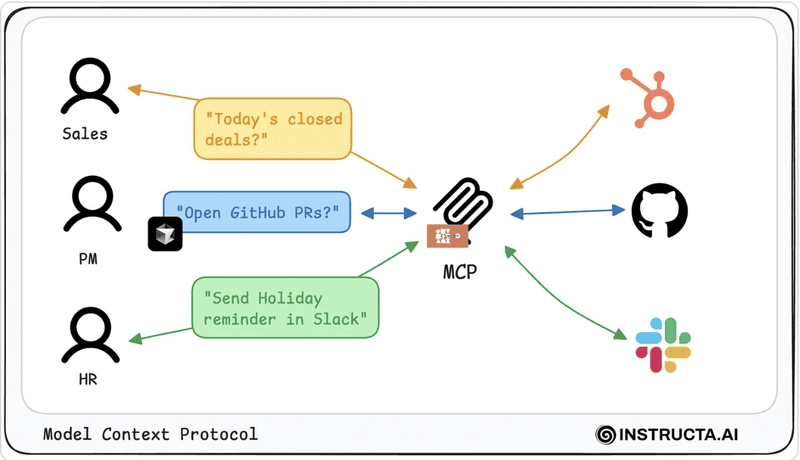

Model Context Protocol (MCP) เป็นอินเทอร์เฟซแบบสองทิศทางที่เป็นมาตรฐานเปิด ซึ่งให้ LLM สามารถเข้าถึงแหล่งข้อมูลภายนอกและเครื่องมือต่างๆ ได้อย่างราบรื่น ตั้งแต่ RESTful API ไปจนถึงจุดปลาย RPC ของบล็อกเชน โดยไม่ต้องใช้โค้ดตัวเชื่อมต่อแบบกำหนดเอง

คิดถึง Model Context Protocol (MCP) เป็น "อะแดปเตอร์" สากลที่ให้โมเดล AI สื่อสารกับแหล่งข้อมูลภายนอกใดๆ ได้ ตั้งแต่ web API ไปจนถึงโหนดบล็อกเชน โดยไม่ต้องสร้างตัวเชื่อมต่อใหม่ในแต่ละครั้ง ด้วย MCP คุณติดตั้งไคลเอ็นต์ขนาดเล็กภายในแอป AI ของคุณ ("โฮสต์") ที่เพียงแค่ชี้ไปที่เซิร์ฟเวอร์ MCP หนึ่งรายการหรือมากกว่า เซิร์ฟเวอร์เหล่านั้นจะจัดการทุกอย่างที่เหลือ ไม่ว่าจะเป็นการดึงฟีดราคาสด การตรวจสอบยอดเงิน

wallet หรือการส่งธุรกรรม

smart-contract โดยใช้ API ที่ปลอดภัยและมีการอนุญาต การแยกโฮสต์ ไคลเอ็นต์ และเซิร์ฟเวอร์อย่างชัดเจน ทำให้ MCP ช่วยคุณเพิ่มแหล่งข้อมูลหรือเครื่องมือใหม่ได้ทันที เพื่อให้ AI ของคุณสามารถเรียนรู้ ตอบสนอง และดำเนินการกับข้อมูลใหม่ได้โดยไม่มีปัญหาการเขียนโค้ดเพิ่มเติมหรือการบำรุงรักษา

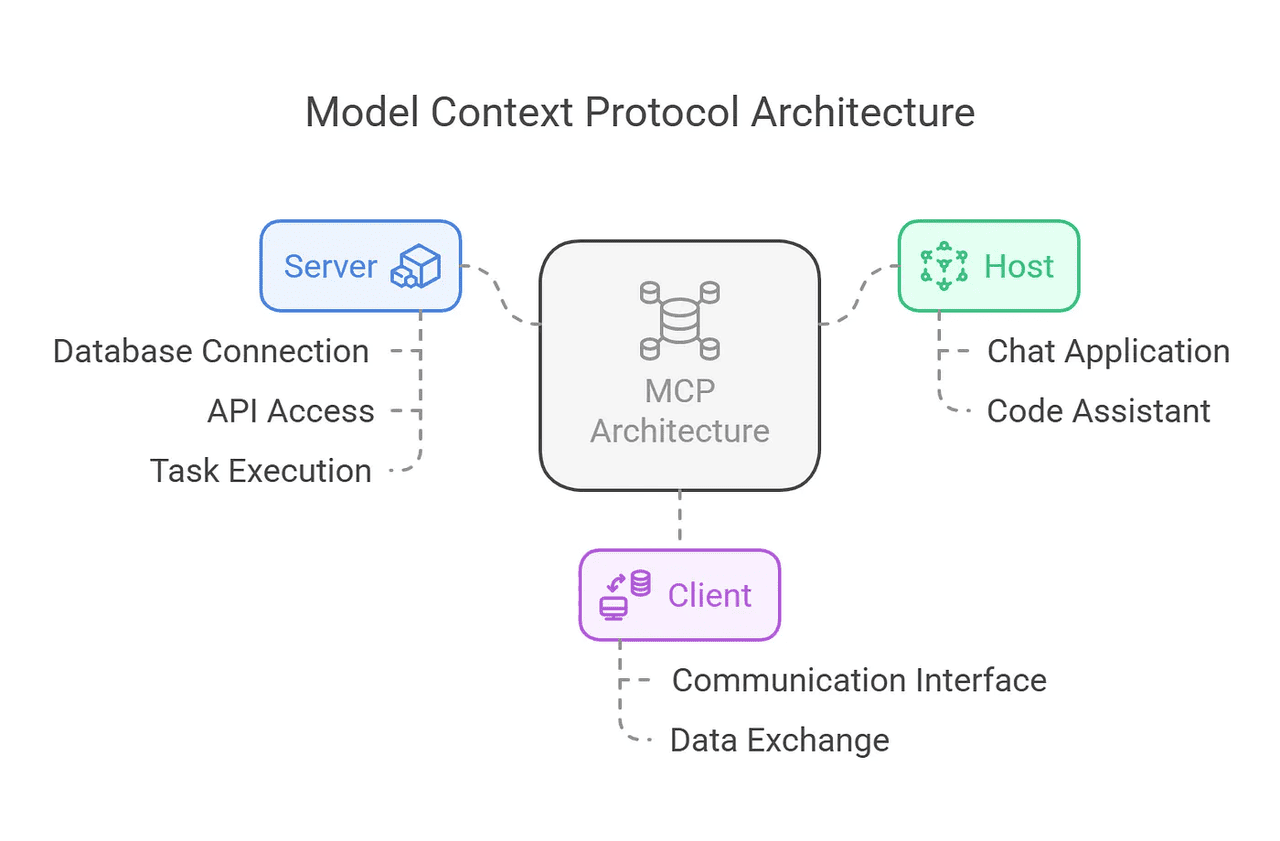

ภาพรวมของ Model Context Protocol (MCP) | ที่มา: Dev.to

เซิร์ฟเวอร์ MCP คืออะไร?

เซิร์ฟเวอร์ MCP คือ "ผู้ให้บริการเครื่องมือ" ในระบบนิเวศ Model Context Protocol เป็นบริการแบบสแตนด์อโลนที่เปิดเผย API มาตรฐานหนึ่งรายการหรือมากกว่า (หรือ "เครื่องมือ") สำหรับ AI agent ให้เรียกใช้ คิดเหมือนเว็บเซิร์ฟเวอร์ที่เสนอฟังก์ชันที่พร้อมใช้งานเช่น "getTokenPrice," "sendTransaction," หรือ "checkWalletBalance" แทนที่จะเขียนโค้ดแบบกำหนดเองทุกครั้งที่คุณต้องการให้ AI ดึงข้อมูลตลาดสดหรือดำเนินการเรียกใช้ smart-contract คุณเพียงแค่ชี้ไคลเอ็นต์ AI ของคุณไปที่ URL เซิร์ฟเวอร์ MCP และเรียกใช้ฟังก์ชันเหล่านั้นผ่านอินเทอร์เฟซ JSON-RPC ทั่วไป

ภายใต้ฝาครอบ เซิร์ฟเวอร์ MCP จัดการการตรวจสอบสิทธิ์ การตรวจสอบอินพุต และการเชื่อมต่อที่ปลอดภัย (มักใช้ TLS) จากนั้นแปลงคำขอที่เข้ามาแต่ละรายการให้เป็นการดำเนินการแบ็กเอนด์ที่เหมาะสม ไม่ว่าจะเป็นการสอบถามโหนดบล็อกเชน การเรียกใช้ API ภายนอก หรือการรันการคำนวณออฟเชนใน Trusted Execution Environment การรวมการดำเนินการเหล่านี้ไว้ภายใต้โปรโตคอลที่สอดคล้องกัน เซิร์ฟเวอร์ MCP ลดเวลาการพัฒนาได้อย่างมาก ทำให้การบำรุงรักษาง่ายขึ้น และให้โฮสต์ AI ที่เปิดใช้งาน MCP ใดๆ ใช้ประโยชน์จากแหล่งข้อมูลหรือความสามารถใหม่ได้โดยไม่ต้องเปลี่ยนแปลงโค้ดเลย

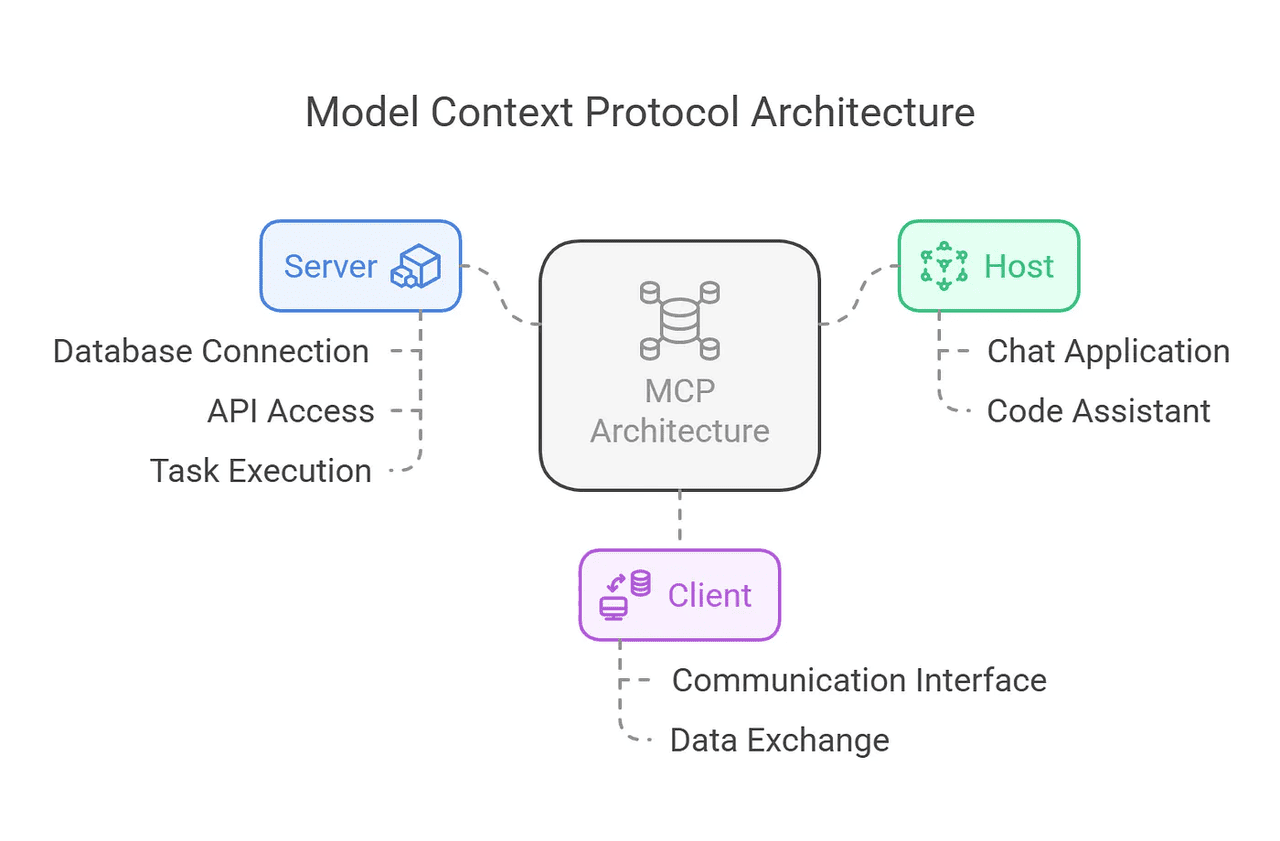

Model Context Protocol (MCP) ทำงานอย่างไร?

วิธีการทำงานของ Model Context Protocol (MCP) | ที่มา: Medium

ที่แก่นแท้ MCP กำหนดเลเยอร์การส่งข้อความแบบ JSON-RPC สากล เพื่อให้แอปพลิเคชัน AI สามารถ "เรียกใช้" เครื่องมือหรือขอข้อมูลผ่านโปรโตคอลที่สอดคล้องกัน แทนการผสานรวมแบบกำหนดเอง

สถาปัตยกรรมของ MCP ประกอบด้วยส่วนประกอบหลักสามส่วน:

1. โฮสต์: แอปพลิเคชัน AI หรือแพลตฟอร์ม (เช่น Claude Desktop) ที่เรียกใช้ไคลเอ็นต์ MCP

2. ไคลเอ็นต์: ฝังอยู่ภายในโฮสต์ ไคลเอ็นต์แต่ละตัวรักษาการเชื่อมต่อแบบ stateful กับเซิร์ฟเวอร์ MCP หนึ่งรายการหรือมากกว่า จัดการการจับมือ การค้นหา และการแลกเปลี่ยนบริบท

3. เซิร์ฟเวอร์: บริการแบบสแตนด์อโลนที่เปิดเผย API เครื่องมือและทรัพยากรมาตรฐาน เช่น ออราเคิลราคา ฟังก์ชันการจัดการ wallet หรือตัวเรียกใช้ smart-contract ที่ได้รับการสนับสนุนด้วยความปลอดภัยด้านการเข้ารหัสและการควบคุมการเข้าถึงแบบละเอียด

ทำไม MCP จึงเป็นจุดเปลี่ยนสำหรับโปรเจกต์คริปโต?

ก่อน MCP

AI ในคริปโตส่วนใหญ่หมายถึงแชทบอทที่ตอบคำถามหรือรันการวิเคราะห์แบ็กออฟฟิศหลังเกิดเหตุการณ์มานานแล้ว MCP เปลี่ยนสคริปต์นั้นโดยให้

AI agentเส้นทางตรงไปยังข้อมูลบล็อกเชนสดและอำนาจในการดำเนินธุรกรรมจริง โดยไม่มีมนุษย์ในลูป ลองจินตนาการว่าแค่บอก AI ของคุณว่า "หาก

ETH/BTCเปลี่ยนแปลงมากกว่า 0.5% ให้ปรับสมดุลพอร์ตโฟลิโอของฉันโดยอัตโนมัติ" และดูมันดึงฟีดราคา เรียกใช้ smart contract และวางการซื้อขายแทนคุณ สิ่งนี้เปลี่ยน AI จากที่ปรึกษาเฉยๆ ให้กลายเป็นพันธมิตรออนเชนที่ทำงาน 24/7 พร้อมที่จะคว้า

โอกาสอาร์บิทราจ เพิ่มผลตอบแทน

DeFi หรือป้องกันพอร์ตโฟลิโอของคุณจากการเคลื่อนไหวของตลาดอย่างกะทันหัน

กรณีการใช้งานหลักที่แสดงผลกระทบของ MCP ต่อคริปโต ได้แก่:

1. การเทรดอัตโนมัติ: ให้ AI เฝ้าดู

order bookและ

พูลสภาพคล่องแบบเรียลไทม์ วางคำสั่งซื้อหรือขายทันทีที่เงื่อนไขที่คุณตั้งไว้ตรงตาม

2. การเพิ่มประสิทธิภาพ DeFi: ให้ AI agent ของคุณเปลี่ยนเงินระหว่างแพลตฟอร์มปล่อยกู้และ

ฟาร์มผลตอบแทนตามการเปลี่ยนแปลง APR แบบสด เพื่อให้มั่นใจว่าคุณจะไล่ตามผลตอบแทนที่ดีที่สุดเสมอ

3. การปรับสมดุลพอร์ตโฟลิโอ: กำหนดตารางเวลา

การปรับสมดุลปกติหรือตามเงื่อนไขเพื่อให้การลงทุนของคุณสอดคล้องกับเป้าหมายของคุณ แม้เมื่อความผันผวนเพิ่มขึ้น

4. การวิเคราะห์ออนเชน: ใช้ AI ในการสแกนประวัติธุรกรรมและสถานะ smart-contract ค้นหาการเคลื่อนไหวของ

นักลงทุนรายใหญ่ ตรวจจับสัญญาณเตือน

การหลอกลวง หรือคาดการณ์สถานการณ์กำไรและขาดทุนได้ทันที

การทำให้วิธีการสื่อสารของ AI กับบล็อกเชนเป็นมาตรฐาน MCP ทำให้ใครก็ตาม ตั้งแต่นักสร้างสรรค์งานอดิเรกไปจนถึงกองทุนมืออาชีพ สามารถเปิดตัว AI agent คริปโตที่อัจฉริยะและขับเคลื่อนตัวเองและปลดปล่อยพลังเต็มรูปแบบของ

Web3โปรเจกต์คริปโต MCP + AI ชั้นนำที่ควรจับตามองในปี 2025

นี่คือโปรเจกต์ชั้นนำห้าโปรเจกต์ที่ใช้ประโยชน์จาก Model Context Protocol เพื่อขับเคลื่อน AI agent รุ่นใหม่ในคริปโต แต่ละโปรเจกต์ผสมผสานอินเทอร์เฟซมาตรฐานของ MCP กับนวัตกรรมออนเชนที่เป็นเอกลักษณ์ ทำให้เป็นสิ่งที่นักสร้างและนักลงทุนต้องจับตามอง

1. Alaya AI (AGT)

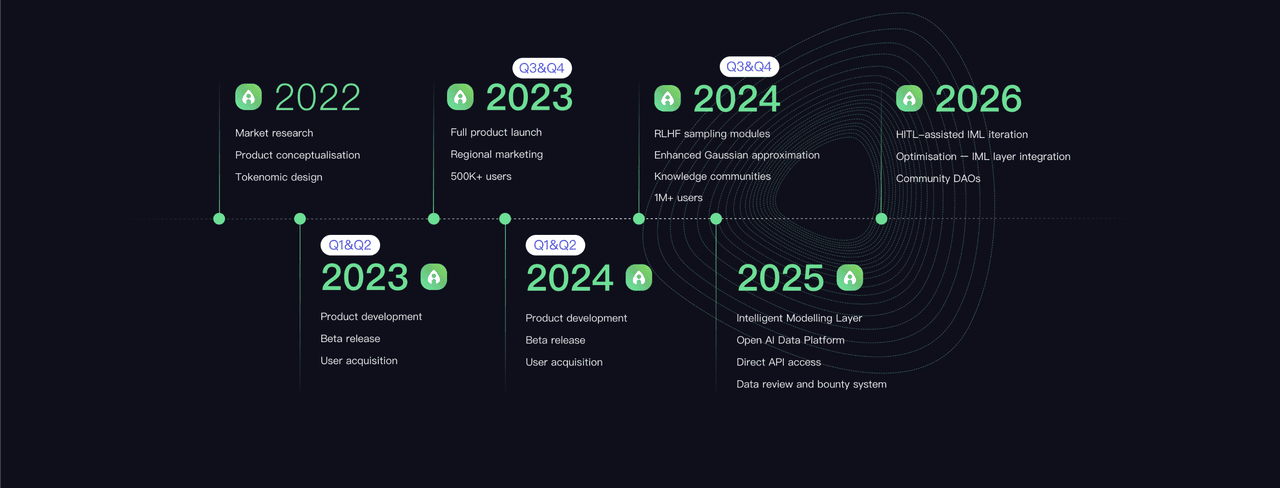

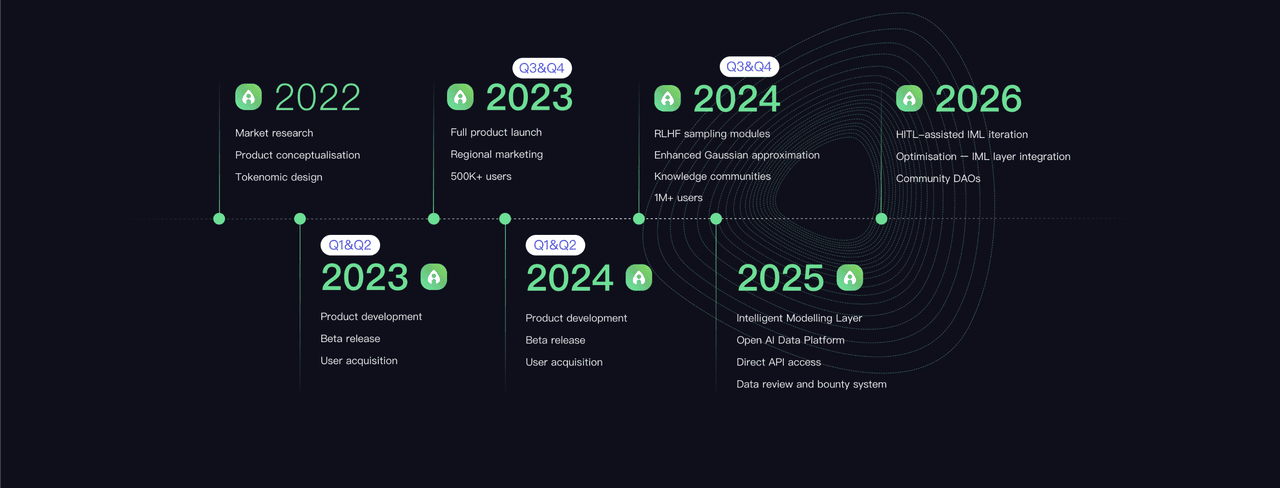

โรดแมป Alaya AI | ที่มา: Alaya AI

Alaya AI เป็นแพลตฟอร์มโครงสร้างข้อมูล Web3 แบบกระจายและสามารถประกอบได้ที่ใช้ประโยชน์จาก MCP เพื่อขับเคลื่อนการสุ่มตัวอย่างข้อมูลที่ปรับแต่งได้ การติดป้ายอัตโนมัติ และการวิเคราะห์แบบเรียลไทม์สำหรับแอปพลิเคชันทั้งออนเชนและออฟเชน ด้วยการอาศัยหลักการ swarm-intelligence ระบบเชื่อมต่อผู้ใช้ที่ลงทะเบียนมากกว่า 3.6 ล้านคนและผู้มีส่วนร่วมที่ใช้งานจริงรายวัน 327,000 คน ซึ่งร่วมกันขับเคลื่อนธุรกรรมออนเชนมากกว่า 305,000 รายการต่อวัน เพื่อส่งมอบชุดข้อมูลฝึกอบรมคุณภาพสูงผ่านพูลรางวัลที่กำหนดเองและการสุ่มตัวอย่างความแม่นยำ RLHF/HITL ตรวจสอบโดย CertiK, Alaya AI ได้นำผู้มีส่วนร่วมด้านข้อมูลที่ใช้งานจริงมากกว่า 200,000 คนเข้าร่วมและขณะนี้ประมวลผลคำขอข้อมูลหลายล้านรายการต่อเดือน POLIS governance DAO และสิ่งจูงใจแบบเกมมิฟิเคชันได้ส่งเสริมการเติบโตของชุมชนอย่างรวดเร็ว ในขณะที่การผสานรวม MCP ให้นักพัฒนาสามารถดึงข้อมูลเชิงลึกตลาดสดและการแจ้งเตือนอัจฉริยะโดยไม่ต้องเขียนโค้ดอะแดปเตอร์แบบกำหนดเอง Alaya AI ได้รับการจดทะเบียนสำหรับการซื้อขายสปอตใน BingX ในเดือนพฤษภาคม 2025

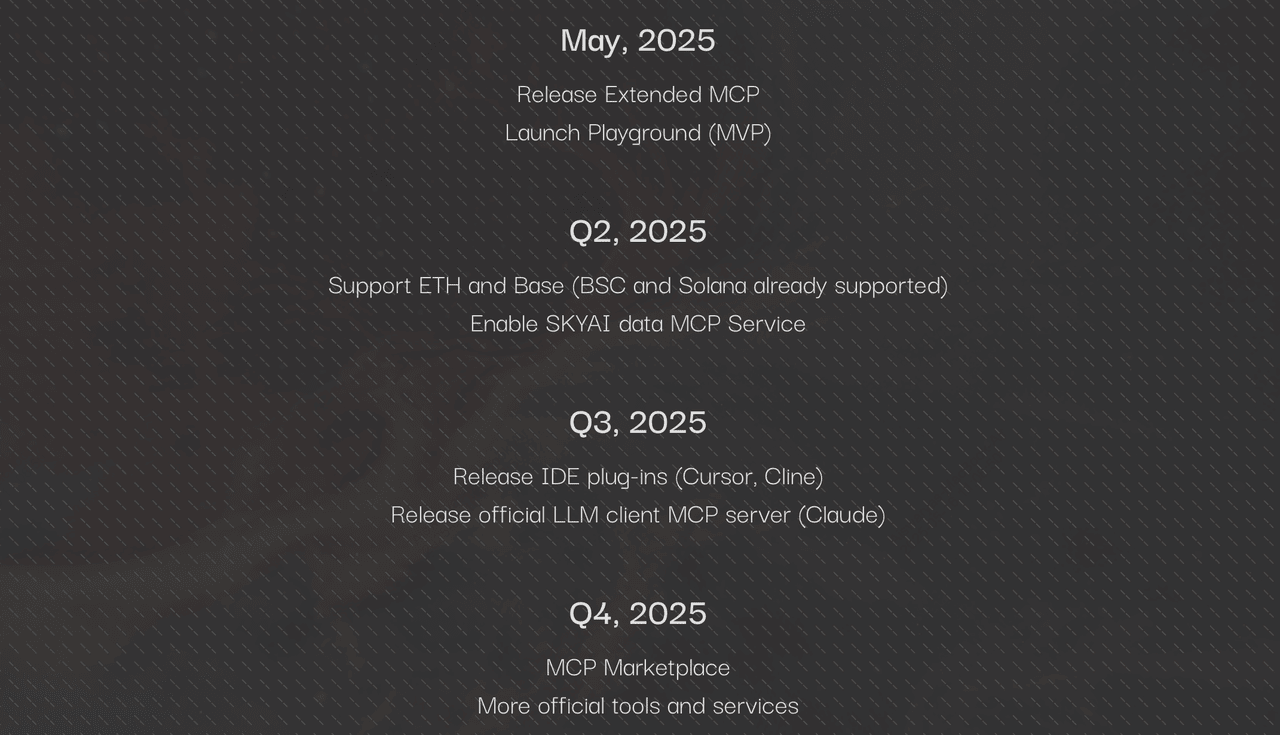

2. SkyAI (SKYAI)

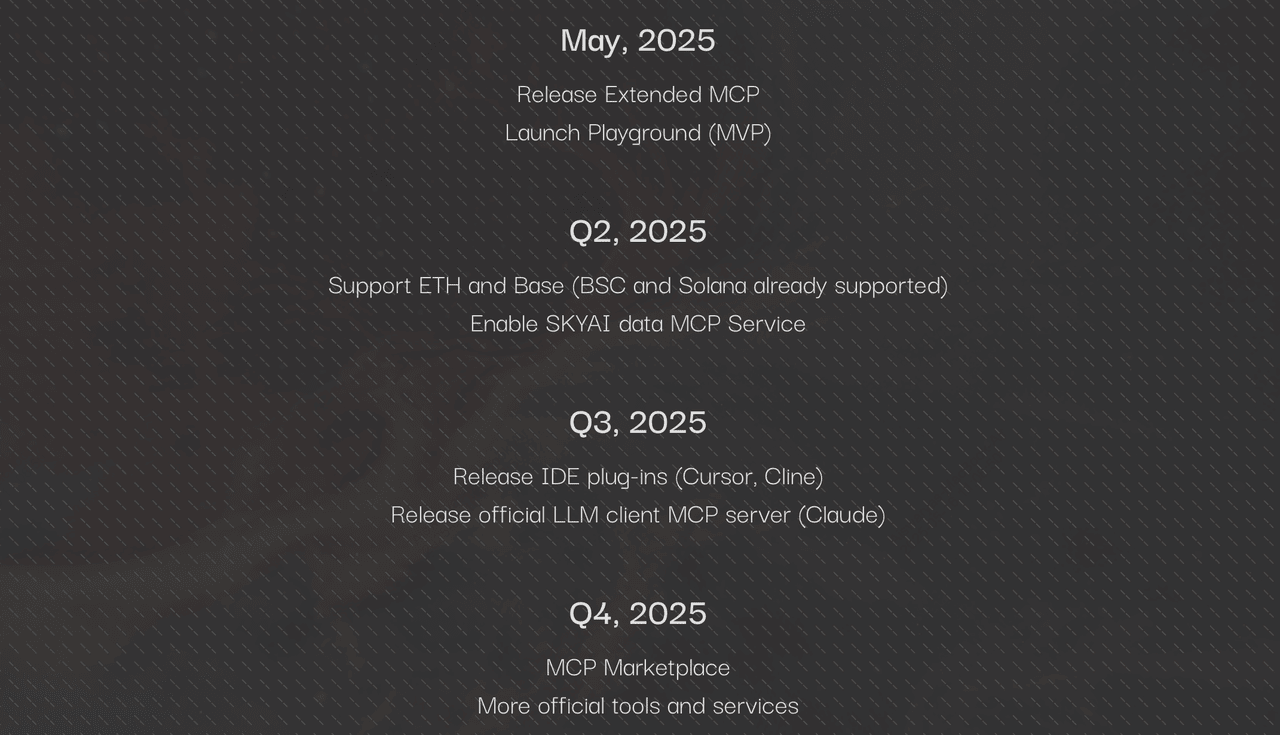

โรดแมป SkyAI | ที่มา: SkyAI

SkyAI เป็นแพลตฟอร์มโครงสร้างข้อมูล Web3 แบบเปิดและใช้งานง่ายที่ขยาย MCP เข้าสู่โซลูชันแบบเต็มสแต็กใน

BNB Chainและ

Solana เร็วๆ นี้จะเพิ่ม

Ethereumและ Base โดยเสนอเซิร์ฟเวอร์ MCP แบบ plug-and-play ที่รวบรวมแถวข้อมูลมากกว่า 10 พันล้านแถว เปิดใช้งานการปรับใช้ AI agent และทำให้การดำเนินการออนเชนเช่น การสอบถามข้อมูล การสร้างธุรกรรม และการตรวจสอบลายเซ็นง่ายขึ้น ด้วยมูลค่าตลาดประมาณ 42.7 ล้านเหรียญดอลลาร์สหรัฐ ณ วันที่ 8 พฤษภาคม 2025 และการสนับสนุนเครื่องมือและทรัพยากรอย่างเป็นทางการมากกว่า 60 รายการ SkyAI ได้กลายเป็นตัวเลือกแรกสำหรับนักพัฒนาที่สร้าง

dAppที่ขับเคลื่อนด้วย AI การเข้าร่วมในแฮ็กคาธอนใหญ่และการรับรองจากโปรแกรม BNB Chain Most Valuable Builder (MVB) ได้ส่งเสริมการรับรองอย่างรวดเร็ว ในขณะที่ SDK และปลั๊กอิน IDE แบบ MCP-native ทำให้การผสานรวมข้อมูลบล็อกเชนสดเข้าสู่เวิร์กโฟลว์ LLM ใดๆ ง่ายดายเหลือเกิน BingX จดทะเบียน SkyAI สำหรับการซื้อขายในตลาดสปอตในเดือนพฤษภาคม 2025

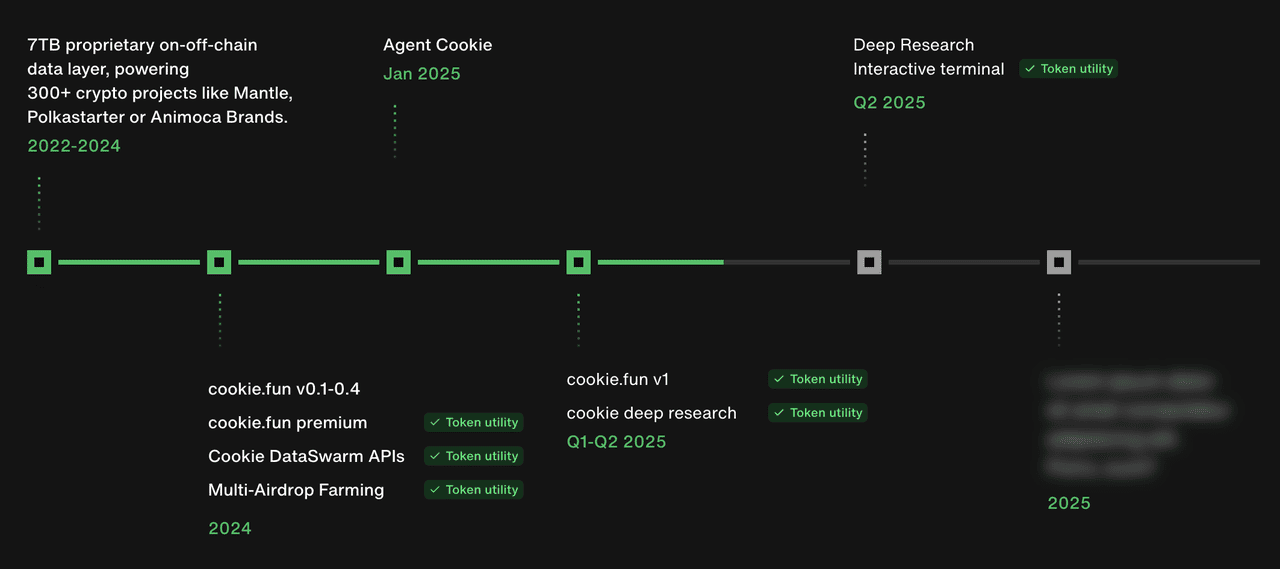

3. Cookie.fun (COOKIE)

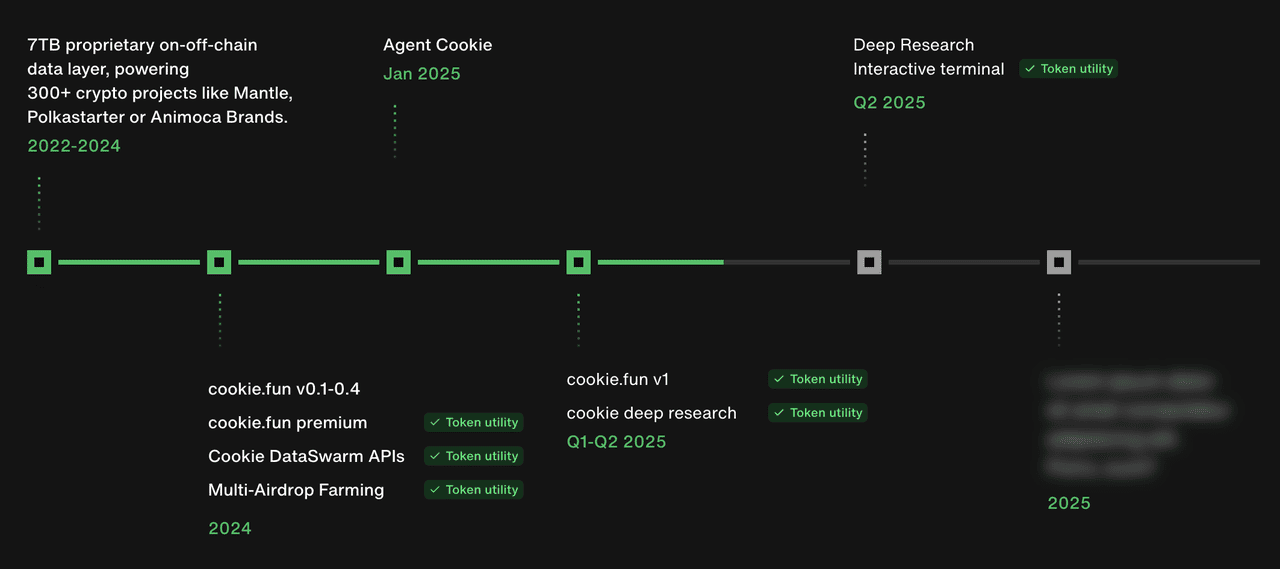

โรดแมป Cookie DAO | ที่มา: Cookie DAO

Cookie.fun (COOKIE) เป็นดัชนี AI-Agent แบบครบวงจรแรกสำหรับ Web3 ขับเคลื่อนโดยเซิร์ฟเวอร์ MCP แบบ plug-and-play ที่รวบรวมข้อมูลออนเชนและโซเชียลแบบเรียลไทม์ 7 TB เพื่อวัดประสิทธิภาพ agent ติดตามความแม่นยำของการตอบสนอง การใช้ gas ปริมาณการทำงานออนเชน เมตริกส์ mindshare และอื่นๆ ในการปรับใช้สดมากกว่า 50 รายการ นับตั้งแต่เปิดตัว Cookie.API 1.0 ในเดือนเมษายน 2025 ระบบประมวลผลกิจกรรมเมตริกมากกว่า 100 รายการต่อ agent ทุกนาทีและได้ดึงดูดผู้ใช้เฉพาะ 934,724 คนที่ใช้ประโยชน์จากแอปพลิเคชัน API มากกว่า 120 รายการ ด้วยการสนับสนุนจากโมเดล data-swarm ที่ให้รางวัลผู้ stake $COOKIE ด้วยการเข้าถึงแอร์ดรอปเฉพาะ Cookie.fun ทำให้การเข้าถึงเครื่องมือ AI เป็นประชาธิปไตยสำหรับนักพัฒนาและ

DAOเหมือนกัน ไม่จำเป็นต้องใช้โค้ดการผสานรวม ในขณะที่มูลค่าตลาด 86 ล้านเหรียญดอลลาร์สหรัฐและผู้ถือ 88,620 คนเป็นหลักฐานการรับรองจากชุมชนอย่างรวดเร็ว

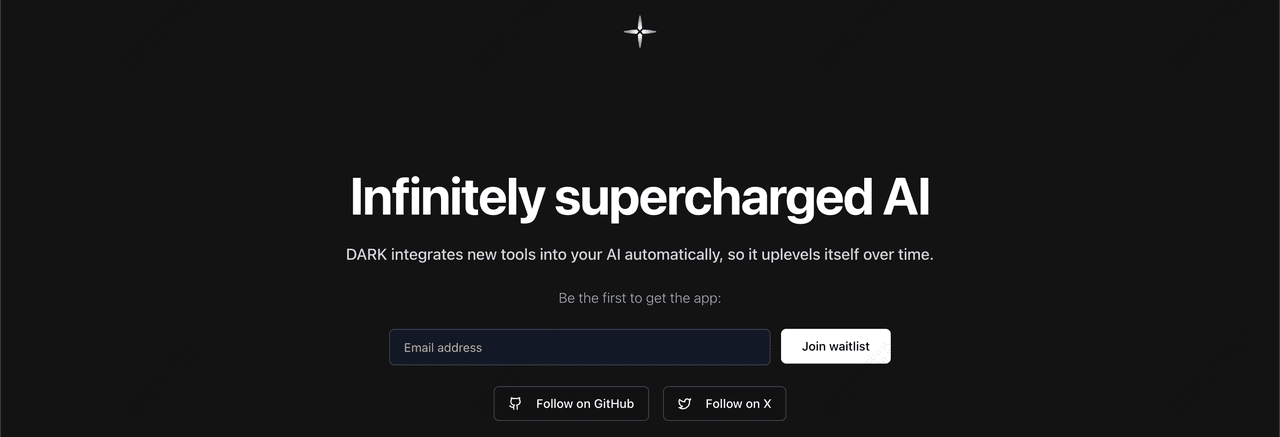

4. Dark Eclipse (DARK)

Dark Eclipse (DARK) เป็นเครือข่าย AI บน Solana ที่รวม Model Context Protocol เข้ากับ Trusted Execution Environment (TEE) ที่ได้รับการสนับสนุนจากฮาร์ดแวร์เพื่อให้การคำนวณออนเชนที่ปลอดภัยและมีเวลาแฝงต่ำ ด้วยการแยกคีย์ส่วนตัวและข้อมูลที่ละเอียดอ่อนภายใน TEE, DARK ช่วยให้มั่นใจว่า AI agent สามารถดำเนินการเรียกใช้

smart-contract การวิเคราะห์สถานะเกม และการดำเนินการ DeFi แบบเรียลไทม์โดยไม่เปิดเผยข้อมูลประจำตัวหรือยอมจำนนต่อการใช้ประโยชน์จาก MEV ณ วันที่ 8 พฤษภาคม 2025 โทเค็น DARK มีมูลค่าตลาดประมาณ 11.8 ล้านเหรียญดอลลาร์สหรัฐและได้ดึงดูดนักพัฒนามากกว่า 5,000 คนเข้าร่วมรายชื่อรอการเข้าถึงก่อนใคร ผู้ใช้สถาบันและสตูดิโอเกมต่างแห่ไปที่ DARK เพราะใช้ประโยชน์จากความสิ้นสุดแบบซับเซคเคนด์ของ Solana ในขณะที่กำจัดความเสี่ยงด้านความเป็นส่วนตัวและความสมบูรณ์ที่พบบ่อย ทำให้เป็นหนึ่งในเฟรมเวิร์กที่ขับเคลื่อนโดย MCP ที่มีแนวโน้มดีที่สุดสำหรับแอปพลิเคชัน Web3 ที่ขับเคลื่อนด้วย AI ในระดับองค์กร

5. DeMCP (DMCP)

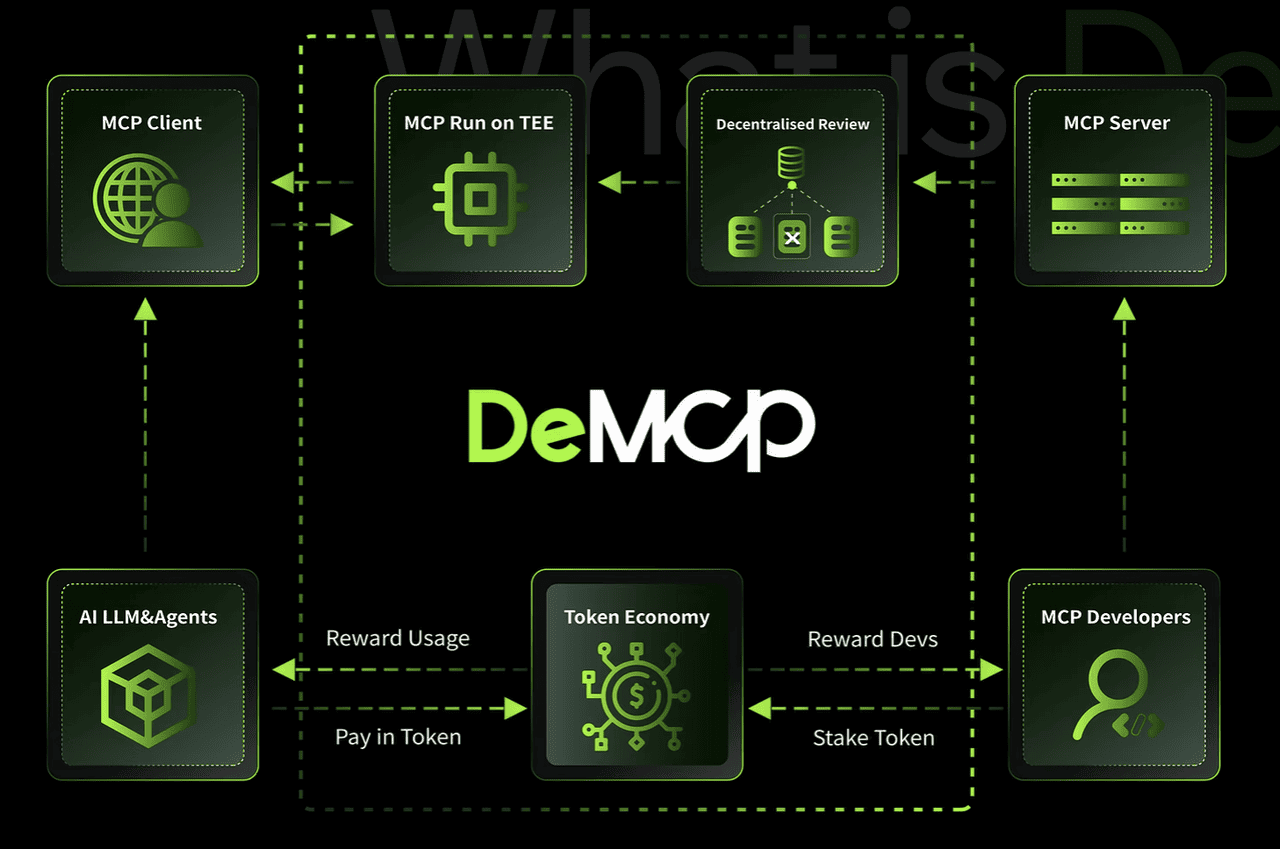

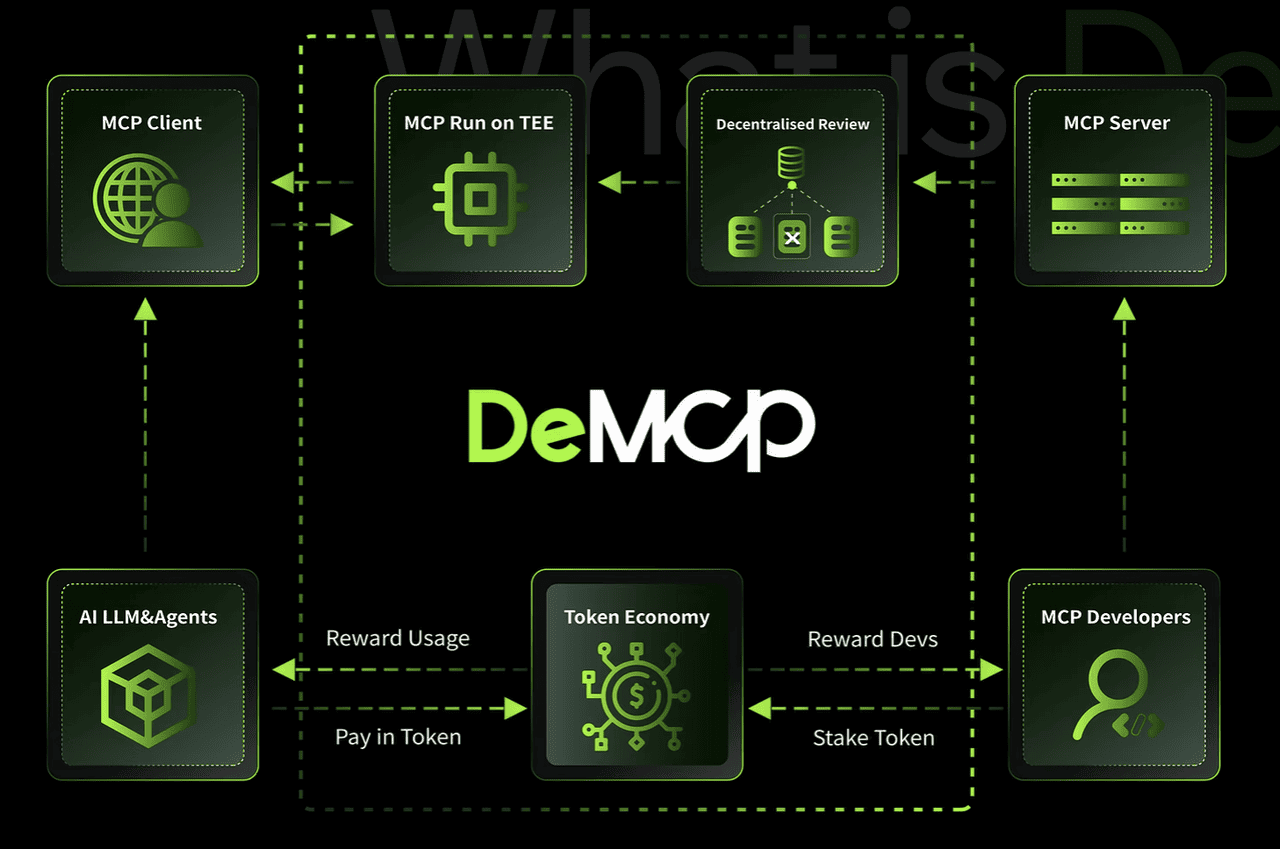

วิธีการทำงานของ DeMCP | ที่มา: DeMCP

วิธีการทำงานของ DeMCP | ที่มา: DeMCP

DeMCP (DMCP) เป็นเครือข่าย MCP แบบกระจายอำนาจแรก เสนอการเข้าถึง LLM ชั้นนำเช่น GPT-4 และ Claude แบบราบรื่นและจ่ายตามการใช้งานผ่านอินสแตนซ์ MCP ตามความต้องการ ทั้งหมดชำระใน

สเตเบิลคอยน์ (

USDT/

USDC) และควบคุมโดยโมเดลการแบ่งปันรายได้ ด้วยมูลค่าตลาดประมาณ 1.6 ล้านเหรียญดอลลาร์สหรัฐ ณ วันที่ 8 พฤษภาคม 2025 DeMCP สนับสนุนจุดปลายโมเดลโฮสต์มากกว่า 10 รายการแล้วและเห็นปริมาณการซื้อขาย 24 ชั่วโมงเกินหกหลักเมื่อเปิดตัว โรดแมป open source นวัตกรรมรีจิสทรีความปลอดภัยที่ได้รับการสนับสนุนจาก TEE และไลบรารีของตัวเชื่อมต่อ MCP ที่สร้างไว้ล่วงหน้าได้ดึงดูดนักพัฒนาหลายพันคน ลดเวลาการผสานรวมสำหรับโปรเจกต์ AI-บล็อกเชนใดๆ และเติมพลังให้การเติบโตของระบบนิเวศอย่างรวดเร็ว

โปรเจกต์เหล่านี้รวมกันแสดงให้เห็นถึงอำนาจการเปลี่ยนแปลงของ MCP ในการรวม AI และคริปโต ส่งมอบข้อมูลแบบเรียลไทม์ การดำเนินการออนเชนแบบอัตโนมัติ และการดำเนินการเครื่องมือที่ปลอดภัยข้ามหลายเครือข่าย จับตาดูพวกเขาเมื่อเปิดตัวฟีเจอร์และการผสานรวมใหม่ตลอดปี 2025

วิธีการซื้อขายโปรเจกต์คริปโต MCP + AI ใน BingX

การซื้อขายโทเค็นที่ขับเคลื่อนด้วย MCP และ AI ใน BingX เป็นเรื่องที่รวดเร็วและปลอดภัย ไม่ว่าคุณจะอยู่ใน

ตลาดสปอตหรือใช้ประโยชน์จากความสะดวกออนเชนของ

ChainSpotคู่มือทีละขั้นตอน สำหรับการซื้อขายโทเค็นในตลาดสปอต BingX

ปฏิบัติตามขั้นตอนเหล่านี้เพื่อซื้อหรือขายโปรเจกต์ MCP + AI ที่คุณชื่นชอบในการซื้อขายสปอต BingX:

1. เติมเงินเข้าบัญชีของคุณ: เข้าสู่ระบบบัญชี BingX ของคุณและฝาก USDT หรือสเตเบิลคอยน์อื่นเข้าสู่ Spot Wallet ของคุณ

2. ไปที่สปอตเทรดดิ้ง: จากหน้าแรก คลิก เทรด → สปอต

3. ค้นหาโทเค็นของคุณ: ป้อนสัญลักษณ์ของโปรเจกต์ (เช่น ALAYA, SKYAI, DMCP) ในแถบค้นหาและเลือกคู่ (เช่น

ALAYA/USDT)

4. เลือกประเภทคำสั่งซื้อ: สำหรับการดำเนินการทันที เลือก

คำสั่งราคาตลาด เพื่อตั้งราคาของคุณ เลือก

ลิมิตออเดอร์

5. ป้อนจำนวนและยืนยัน: ระบุจำนวนที่คุณต้องการซื้อหรือขาย จากนั้นคลิก ซื้อ หรือ ขาย และยืนยัน โทเค็นใหม่ของคุณจะปรากฏในสปอต Wallet ของคุณทันที

เทรดโปรเจกต์ MCP ยอดนิยมใน BingX ChainSpot

ChainSpot ใน BingX เชื่อมต่อความง่ายของ CEX กับความโปร่งใสออนเชนของระบบนิเวศ Solana เพียงเปิดแท็บ ChainSpot ตรวจสอบให้แน่ใจว่า USDT ของคุณอยู่ในยอดเงินสปอตของคุณ จากนั้นวางที่อยู่ smart-contract ของโปรเจกต์หรือสัญลักษณ์ กดซื้อ (ตลาด) เพื่อดำเนินการโดยตรงออนเชน ไม่จำเป็นต้องสลับ wallet หรือนำทาง

DEX โทเค็นของคุณจะเข้าสู่บัญชีสปอตของคุณ ได้รับการสนับสนุนจาก

การตรวจสอบสองปัจจัยของ BingX และความปลอดภัยจากคลังเย็น เรียนรู้เพิ่มเติมในคู่มือ

ChainSpotของเรา

ข้อพิจารณาหลักเมื่อซื้อขายโปรเจกต์คริปโต MCP + AI

ก่อนที่คุณจะซื้อหรือขายโทเค็นที่ขับเคลื่อนด้วย MCP ให้คำนึงถึงปัจจัยเหล่านี้เพื่อซื้อขายอย่างชาญฉลาดและปลอดภัยยิ่งขึ้น:

1. ตรวจสอบสภาพคล่องและ Slippage: โทเค็น MCP + AI จำนวนมากยังใหม่ ดังนั้นปริมาณการซื้อขายอาจต่ำ ตรวจสอบปริมาณการซื้อขาย 24 ชั่วโมงและความลึกของ order book เสมอ สภาพคล่องที่ต่ำอาจนำไปสู่การเปลี่ยนแปลงราคาครั้งใหญ่ (slippage) เมื่อวางคำสั่งซื้อขนาดใหญ่

2. ประเมินความแก่กล่าวของโปรเจกต์และการตรวจสอบ: โปรเจกต์ AI-คริปโตเกิดใหม่อาจยังอยู่ในขั้นตอนการพิสูจน์แนวความคิดหรือการเปิดตัวในช่วงเริ่มต้น มองหา

การตรวจสอบ smart-contractโดยบริษัทที่มีชื่อเสียง (CertiK, Halborn) และยืนยันว่าการผสานรวม MCP หลักได้รับการทดสอบในสนามรบบนเทสต์เน็ตหรือในการสาธิตสาธารณะ

3. ทบทวนประโยชน์ของโทเค็นและโรดแมปของแต่ละโปรเจกต์: ประเมินกรณีการใช้งานจริงของโทเค็นแต่ละตัว ตัวอย่างเช่น โฟกัสโครงสร้างข้อมูลของ SKYAI หรือเครื่องมือการจัดดัชนี agent ของ Cookie.fun โรดแมปที่ชัดเจนพร้อมผลิตภัณฑ์ที่ใช้งานได้และความร่วมมือส่งสัญญาณถึงศักยภาพระยะยาวที่แข็งแกร่งกว่า

4. ป้องกันความเสี่ยงจาก Smart-Contract และโปรโตคอล: เซิร์ฟเวอร์ MCP เปิดเผยฟังก์ชันออนเชนที่ทรงพลัง หากเซิร์ฟเวอร์หรือสัญญาพื้นฐานมีช่องโหว่ เงินทุนอาจเสี่ยง เลือกโปรเจกต์ที่มีโค้ดเบสโปร่งใส โปรแกรมการล่ารางวัลบักที่ใช้งานอยู่ และโครงสร้างการกำกับดูแลแบบเปิด

5. ทบทวนค่าธรรมเนียมเครือข่ายและแพลตฟอร์ม: ไม่ว่าจะซื้อขายใน BingX Spot หรือผ่าน ChainSpot ให้พิจารณาค่าธรรมเนียมธุรกรรมและต้นทุนการฝาก/ถอนที่อาจเกิดขึ้น การซื้อขายออนเชนอาจเสียค่า gas ในขณะที่การซื้อขาย CEX มีค่าธรรมเนียม maker/taker รวมสิ่งเหล่านี้เข้าไปในการคำนวณต้นทุนของคุณ

6. ปกป้องคีย์ส่วนตัวของคุณ: ใช้

ฮาร์ดแวร์วอลเล็ตหรือโซลูชันดูแลรักษาที่ปลอดภัยสำหรับการถือครองระยะยาว อย่าแบ่งปันคีย์ส่วนตัวหรือความลับ API และเปิดใช้งานการตรวจสอบสองปัจจัย (2FA) ในบัญชี BingX ของคุณเพื่อปกป้องจากการเข้าถึงโดยไม่ได้รับอนุญาต

7. ใช้กลยุทธ์การจัดสรรขนาดโพสิชันและการกระจายความเสี่ยง: จัดสรรเพียงส่วนเล็กของพอร์ตโฟลิโอของคุณให้กับโทเค็น MCP ทดลอง ไม่เกินที่คุณสามารถทนเสียได้

กระจายความเสี่ยงข้ามหลายโปรเจกต์เพื่อกระจายความเสี่ยง และพิจารณาตั้งคำสั่ง stop-loss เพื่อจำกัดข้อเสียในตลาดที่ผันผวน

บทสรุป: โปรเจกต์คริปโต MCP มาเพื่ออยู่หรือไม่?

MCP กำลังเปลี่ยนรูปแบบวิธีที่โมเดล AI โต้ตอบกับข้อมูลโลกแห่งความจริงและเครือข่ายบล็อกเชน เปลี่ยนโมเดลภาษาที่เฉยๆ ให้กลายเป็น agent ออนเชนที่เชิงรุก สามารถทำการซื้อขายอัตโนมัติ การเพิ่มประสิทธิภาพ DeFi และการวิเคราะห์อัจฉริยะได้ ด้วยการรับรองอินเทอร์เฟซมาตรฐานของ MCP คุณปลดล็อคความสามารถในการทำงานร่วมกันได้อย่างราบรื่นข้ามเครื่องมือที่หลากหลาย ไม่ว่าคุณจะสอบถามราคาโทเค็น ดำเนินการเรียกใช้ smart-contract หรือปรับสมดุลพอร์ตโฟลิโอแบบเรียลไทม์

เมื่อคุณสำรวจศักยภาพของ MCP โปรดจำไว้ว่าการทำงานแบบอัตโนมัติที่มากขึ้นมาพร้อมกับความเสี่ยงใหม่ ทดสอบ agent บนเทสต์เน็ตก่อนเสมอ รักษาความปลอดภัยคีย์ส่วนตัวของคุณ และใช้การตรวจสอบที่แข็งแกร่ง เริ่มต้นเล็กๆ ทำซ้ำอย่างปลอดภัย และทำการวิจัยของคุณเองก่อนที่จะไว้ใจสินทรัพย์ที่สำคัญให้กับระบบอัตโนมัติใดๆ จากนั้นคุณจะมีตำแหน่งที่ดีในการใช้พลังของ MCP ในขณะที่จัดการกับความท้าทายที่มีอยู่แล้ว

บทความที่เกี่ยวข้อง

วิธีการทำงานของ Model Context Protocol (MCP) | ที่มา: Medium

วิธีการทำงานของ Model Context Protocol (MCP) | ที่มา: Medium โรดแมป Alaya AI | ที่มา: Alaya AI

โรดแมป Alaya AI | ที่มา: Alaya AI โรดแมป SkyAI | ที่มา: SkyAI

โรดแมป SkyAI | ที่มา: SkyAI โรดแมป Cookie DAO | ที่มา: Cookie DAO

โรดแมป Cookie DAO | ที่มา: Cookie DAO

วิธีการทำงานของ DeMCP | ที่มา: DeMCP

วิธีการทำงานของ DeMCP | ที่มา: DeMCP