Sui เป็นบล็อกเชนประสิทธิภาพสูงที่กำลังได้รับความสนใจอย่างรวดเร็วในตลาดคริปโต เปิดตัวในเดือนพฤษภาคม 2023 โดยอดีตวิศวกรของ Meta, Sui เป็น

บล็อกเชน Layer-1 ประสิทธิภาพสูงที่ออกแบบมาเพื่อความเร็ว ความสามารถในการปรับขนาด และประสบการณ์ผู้ใช้ที่ราบรื่น ลองนึกภาพว่าเป็นเครือข่ายยุคใหม่ที่ขับเคลื่อนทุกสิ่งตั้งแต่แอป

DeFi ไปจนถึง

NFT และทำได้ด้วยความเร็วในการทำธุรกรรมที่รวดเร็วปานสายฟ้าแลบและค่าธรรมเนียมต่ำ

ตอนนี้ Sui กำลังก้าวเข้าสู่โลกการเงินแบบดั้งเดิม

เมื่อวันที่ 23 พฤษภาคม 2025 Nasdaq ได้ยื่นคำร้องต่อสำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ของสหรัฐอเมริกา (SEC) เพื่อขอจดทะเบียน 21Shares Sui ETF การเคลื่อนไหวนี้ถือเป็นการเริ่มต้นกระบวนการตรวจสอบของ SEC สำหรับสิ่งที่อาจกลายเป็น Spot Sui ETF แห่งแรกในสหรัฐอเมริกา หลังจากที่ Spot Bitcoin และ Ethereum ETF ประสบความสำเร็จในการเปิดตัวในปี 2024 บริษัท Canary Capital อีกแห่งได้ยื่นใบสมัครที่คล้ายกันเมื่อหลายสัปดาห์ก่อน หากได้รับการอนุมัติ กองทุนเหล่านี้จะทำให้นักลงทุนทั่วไปมีวิธีใหม่ในการลงทุนในระบบนิเวศ Sui โดยไม่จำเป็นต้องมี

กระเป๋าคริปโต หรือกระดานเทรด

ในคู่มือนี้ คุณจะได้เรียนรู้ว่า Sui ETF คืออะไร เหตุใดจึงมีความสำคัญ และจะเปิดตัวเมื่อใด

Spot Sui ETF คืออะไร?

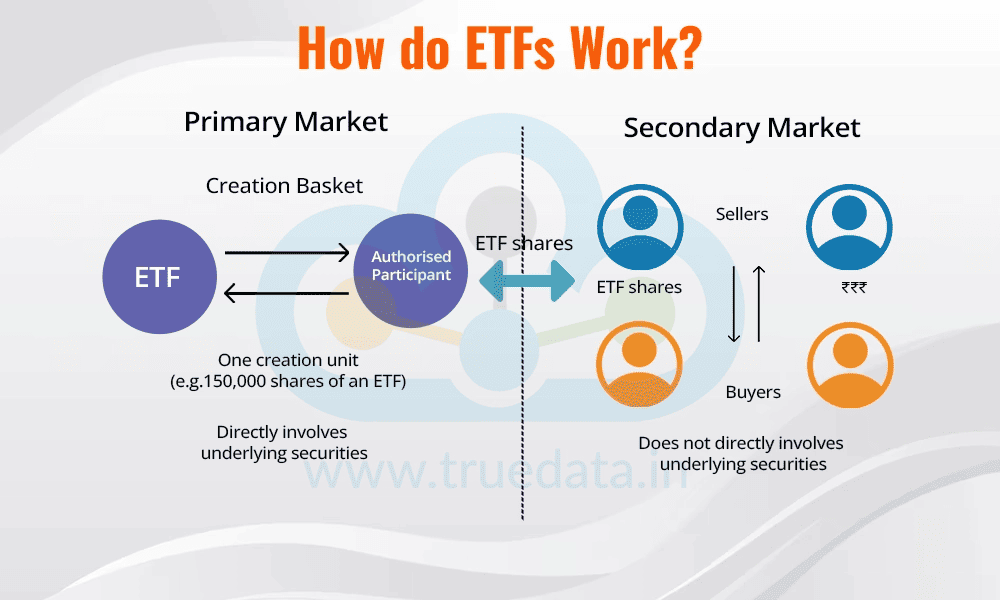

ETF หรือ Exchange-Traded Fund เป็นประเภทของกองทุนรวมที่คุณสามารถซื้อและขายได้เหมือนหุ้น โดยจะติดตามราคาของสินทรัพย์ หรือกลุ่มของสินทรัพย์ เพื่อให้คุณสามารถลงทุนได้โดยไม่ต้องเป็นเจ้าของสินทรัพย์โดยตรง

ETF ทำงานอย่างไร? | ที่มา: TrueData.in

Spot Sui ETF คือกองทุนซื้อขายแลกเปลี่ยนที่ถือโทเค็น SUI โดยตรง ทำให้คุณสามารถเข้าถึงบล็อกเชน Sui ได้โดยไม่จำเป็นต้องซื้อหรือจัดการคริปโตด้วยตัวเอง

เช่นเดียวกับ ETF อื่นๆ Spot Sui ETF ซื้อขายในตลาดหลักทรัพย์แบบดั้งเดิมและสะท้อนราคาแบบเรียลไทม์ของสินทรัพย์อ้างอิง ซึ่งในกรณีนี้คือ SUI ซึ่งเป็นโทเค็นดั้งเดิมของเครือข่าย Sui คุณสามารถลงทุนได้ผ่านบัญชีโบรกเกอร์ทั่วไป เช่นเดียวกับการซื้อหุ้นของ Apple หรือ Google

สิ่งนี้ทำให้การลงทุนในคริปโตเป็นเรื่องง่าย ไม่จำเป็นต้องตั้งค่า

กระเป๋า Sui จัดการคีย์ส่วนตัว หรือสำรวจแพลตฟอร์ม DeFi ที่ซับซ้อน ผู้ให้บริการกองทุน เช่น 21Shares หรือ Canary Capital จะจัดการเรื่องการดูแลสินทรัพย์ ความปลอดภัย และการปฏิบัติตามกฎระเบียบ

Spot ETF มีคุณค่าเป็นพิเศษเนื่องจากถือโทเค็นจริง ซึ่งแตกต่างจาก Futures ETF ที่ติดตามตราสารอนุพันธ์ หากได้รับการอนุมัติ Spot Sui ETF ที่จดทะเบียนในสหรัฐอเมริกาอาจนำมาซึ่งการมองเห็นและความน่าเชื่อถือใหม่ๆ ให้กับระบบนิเวศ Sui ปลดล็อกการลงทุนจากสถาบัน และเพิ่มอุปสงค์สำหรับโทเค็น SUI

เหตุใด Spot Sui ETF จึงมีความสำคัญ

Sui ETF เป็นมากกว่าผลิตภัณฑ์การลงทุนคริปโตอีกตัวหนึ่ง เป็นประตูสู่หนึ่งในบล็อกเชนที่เติบโตเร็วที่สุดและเป็นนวัตกรรมใหม่ที่สุดในตลาดสหรัฐอเมริกา

Sui เป็นเครือข่าย Layer-1 ที่พัฒนาขึ้นภายในประเทศโดยอดีตวิศวกรของ Meta นับตั้งแต่เปิดตัวในเดือนพฤษภาคม 2023 ได้มอบประสิทธิภาพที่รวดเร็วอย่างน่าทึ่งด้วยธุรกรรมสูงสุด 297,000 ธุรกรรมต่อวินาที (TPS) และ

ค่าธรรมเนียม Gas เกือบเป็นศูนย์ สถาปัตยกรรมแบบ Object-based ทำให้แตกต่างจาก

Ethereum และ

Solana ทำให้เป็นตัวเลือกอันดับต้นๆ สำหรับนักพัฒนาที่สร้างโปรโตคอล DeFi แพลตฟอร์ม NFT และ

เกมบนบล็อกเชน

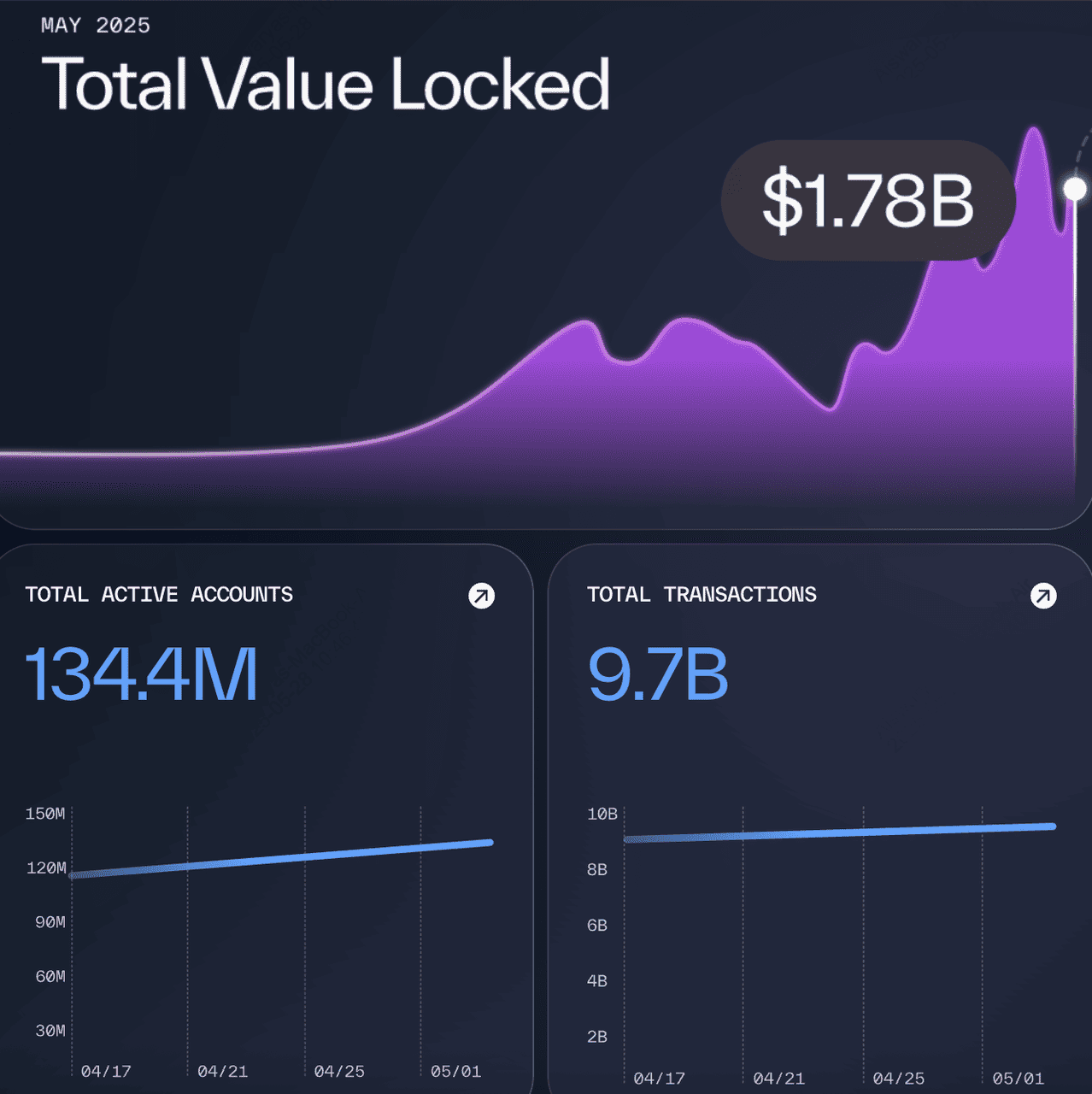

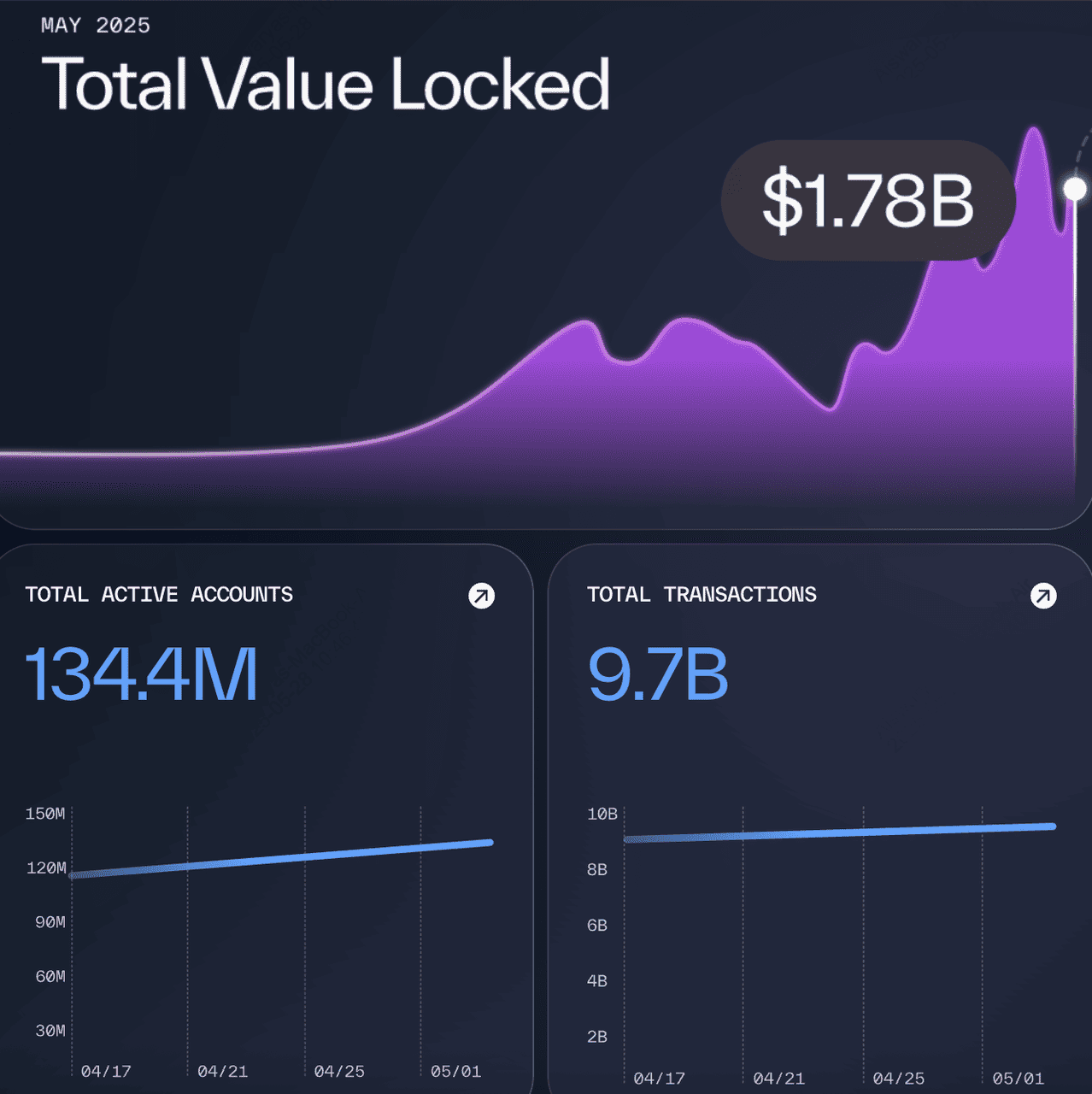

ณ เดือนพฤษภาคม 2025 Sui มีมูลค่ารวมที่ถูกล็อก (TVL) มากกว่า 1.7 พันล้านดอลลาร์ และมีบัญชีที่ใช้งานอยู่ทั้งหมดมากกว่า 134 ล้านบัญชี ระบบนิเวศกำลังเติบโตอย่างรวดเร็ว โดยมีโปรเจกต์ที่โดดเด่น เช่น

Cetus ซึ่งเป็น

DEX ชั้นนำ; SuiNS สำหรับข้อมูลประจำตัวบนบล็อกเชน; และ

Turbos Finance ซึ่งเป็นแพลตฟอร์มการซื้อขายแบบกระจายอำนาจชั้นนำ

มีมคอยน์ ยอดนิยม เช่น

SUIA,

LOFI และ

sudeng ก็ได้รับความนิยมอย่างมากเช่นกัน ซึ่งขับเคลื่อนกิจกรรมของผู้ใช้และการมีส่วนร่วมของชุมชน

สถิติเครือข่าย Sui | ที่มา: Sui.io

ETF ช่วยให้คุณเข้าถึง SUI ได้อย่างถูกกฎหมายโดยไม่ต้องจัดการกับกระเป๋า Gas หรือคีย์ส่วนตัว คุณสามารถซื้อและขายหุ้นจากบัญชีโบรกเกอร์ทั่วไปของคุณได้ เช่นเดียวกับหุ้น ความง่ายในการใช้งานนี้เปิดประตูสำหรับนักลงทุนรายย่อยและนักลงทุนสถาบัน ขยายการเข้าถึงระบบนิเวศที่กำลังเติบโตของ Sui

ETF ยังสามารถเพิ่มสภาพคล่องและเสริมสร้างความชอบธรรมได้อีกด้วย ETF ที่ได้รับการอนุมัติจาก SEC เป็นสัญญาณของความไว้วางใจ ความโปร่งใส และมาตรฐานระดับสถาบัน เราได้เห็นแล้วว่าเกิดอะไรขึ้นเมื่อคริปโตได้รับการอนุมัติดังกล่าว หลังจากที่ Spot

Bitcoin ETF เปิดตัวในช่วงต้นปี 2024 มีเงินกว่า 9.5 หมื่นล้านดอลลาร์ไหลเข้าสู่ตลาด

Ethereum ETF ตามมา โดยดึงดูดสินทรัพย์ภายใต้การบริหาร (AUM) ได้ 1 หมื่นล้านดอลลาร์

โมเมนตัมกำลังก่อตัวขึ้นสำหรับ Sui แล้ว ในเดือนมีนาคม 2025

World Liberty Financial (WLFI) ซึ่งเป็นโปรโตคอล DeFi ที่เกี่ยวข้องกับทรัมป์ ได้ประกาศว่าได้เพิ่ม SUI เข้าไปในเงินสำรองโทเค็นเชิงกลยุทธ์ พอร์ตโฟลิโอของ WLFI ประกอบด้วย Bitcoin, Ethereum,

Chainlink และ

TRON การเพิ่ม SUI ทำให้เป็นหนึ่งในสินทรัพย์ชั้นนำ กลุ่มนี้ยังบอกใบ้ถึงการพัฒนาผลิตภัณฑ์ในอนาคตบนเครือข่าย Sui ราคาของ SUI พุ่งขึ้นกว่า 10% จากข่าวนี้ ซึ่งทำผลงานได้ดีกว่าสินทรัพย์อื่นๆ ในดัชนี CoinDesk 20 ในวันนั้น

ยิ่งไปกว่านั้น Sui กำลังปรากฏในการสนทนานโยบายระดับชาติ รายงานเชื่อมโยง SUI กับสถานะสินทรัพย์สำรองคริปโตของสหรัฐอเมริกาที่อาจเกิดขึ้น ควบคู่ไปกับ

Cardano (ADA) ด้วยการยื่นเอกสารจาก 21Shares และ Canary Capital ที่อยู่ระหว่างการตรวจสอบของ SEC ตอนนี้ Sui ETF อาจวางตำแหน่งเครือข่ายให้เป็นส่วนสำคัญของอนาคตบล็อกเชนของอเมริกา

กล่าวโดยสรุป Sui ETF ไม่ได้ช่วยแค่นักลงทุนเท่านั้น แต่ยังผลักดัน Sui ให้เข้าใกล้การยอมรับในวงกว้างมากขึ้น เชื่อมโยงนวัตกรรมคริปโตกับการเงินแบบดั้งเดิม และนำ SUI เข้าสู่พอร์ตการลงทุนทั่วโลก

การยื่นเอกสาร Sui ETF: สถานการณ์ปัจจุบัน (พฤษภาคม 2025)

ผู้จัดการสินทรัพย์รายใหญ่สองราย ได้แก่ 21Shares และ Canary Capital กำลังเป็นผู้นำในการนำ Spot Sui ETF ตัวแรกเข้าสู่ตลาดสหรัฐอเมริกา

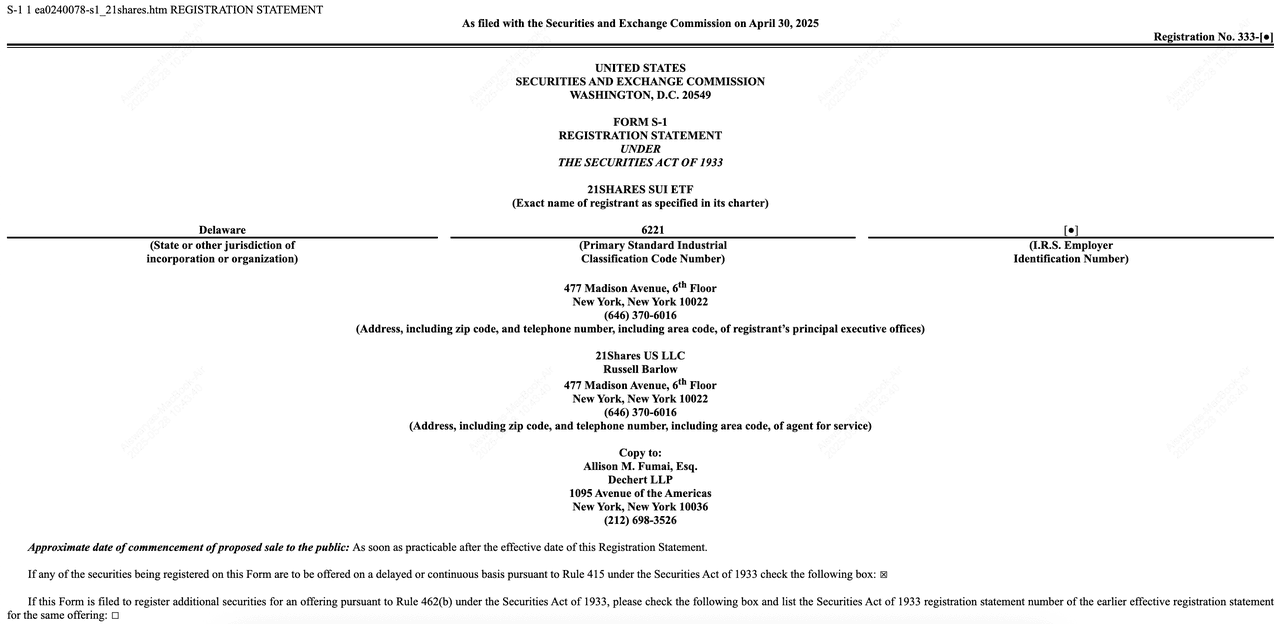

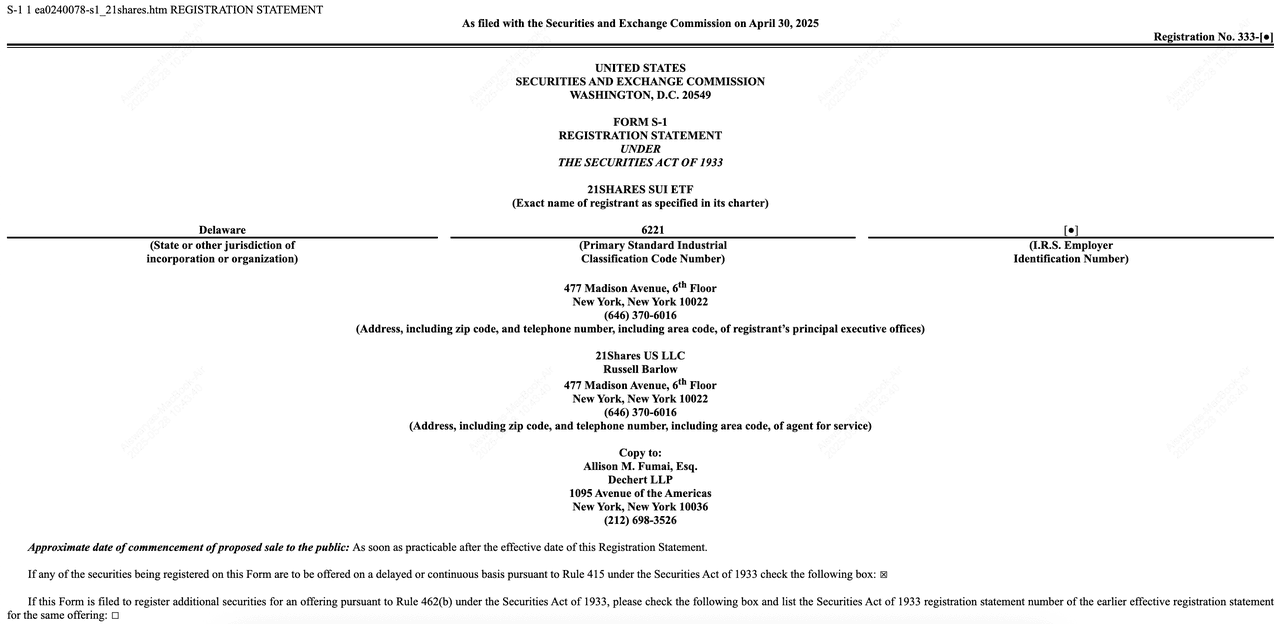

ใบสมัครของ 21Shares

ใบสมัคร Sui ETF ของ 21 Shares | ที่มา: SEC.gov

เมื่อวันที่ 30 เมษายน 2025 21Shares ได้ยื่นคำแถลงการลงทะเบียน S-1 ต่อสำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ของสหรัฐอเมริกา (SEC) โดยสรุปแผนการเปิดตัว Spot Sui ETF เพียงไม่กี่สัปดาห์ต่อมา ในวันที่ 23 พฤษภาคม Nasdaq ได้ยื่นแบบฟอร์ม 19b-4 ซึ่งเป็นการเริ่มต้นกระบวนการตรวจสอบอย่างเป็นทางการของ SEC ETF จะติดตามราคาของ SUI และใช้ Coinbase Custody และ BitGo เป็นผู้ดูแลสินทรัพย์

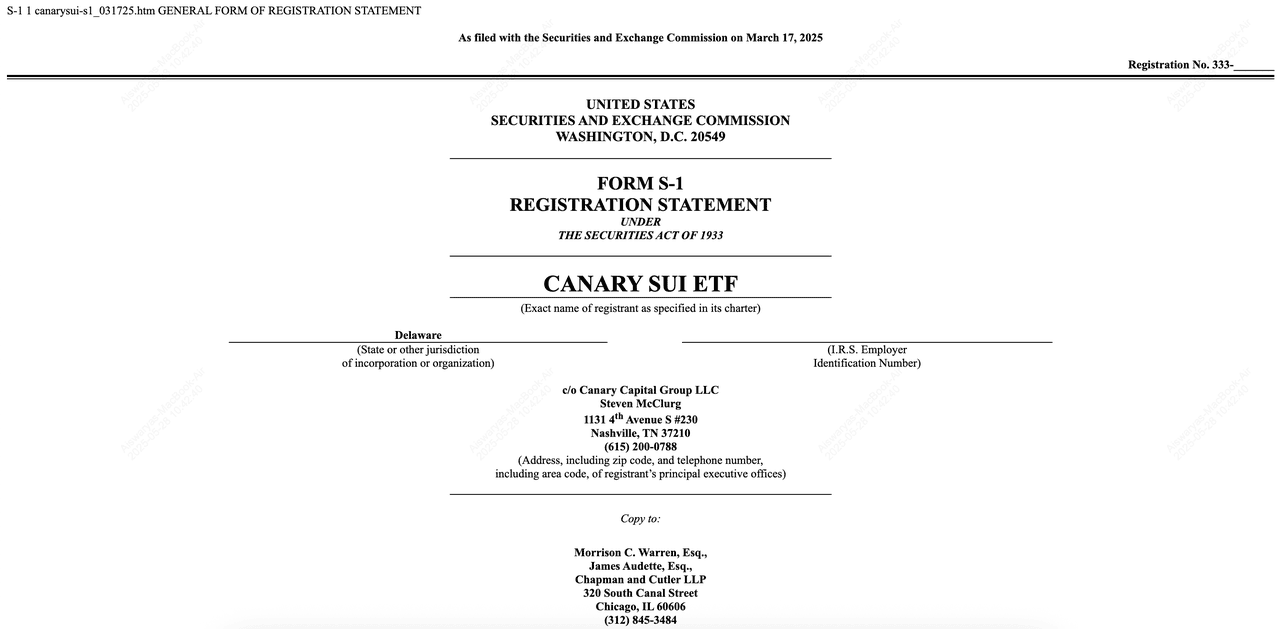

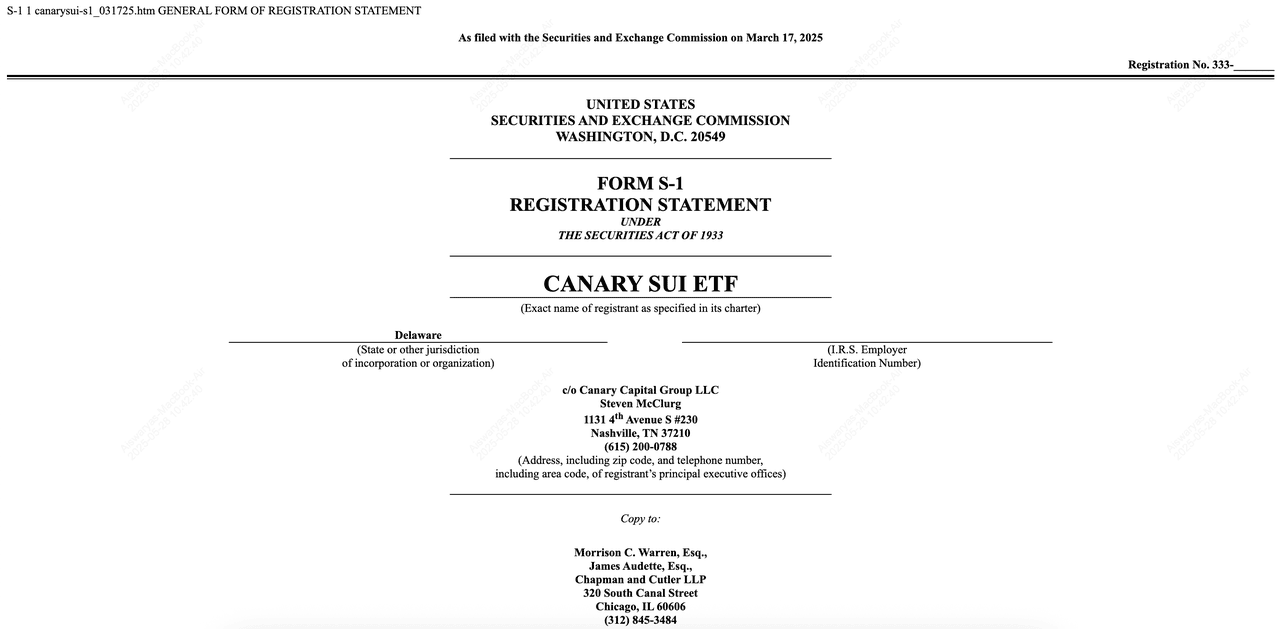

การยื่นเอกสารของ Canary Capital

ใบสมัคร Canary Sui ETF | ที่มา: SEC.gov

Canary Capital เป็นผู้ดำเนินการรายแรก บริษัทได้ยื่นคำแถลงการลงทะเบียน S-1 ของตนเองเมื่อวันที่ 17 มีนาคม 2025 ซึ่งถือเป็นความพยายามแรกสุดในการนำ Sui ETF ที่มีฐานในสหรัฐอเมริกามาสู่ชีวิต การเคลื่อนไหวนี้สะท้อนให้เห็นถึงความเชื่อมั่นของสถาบันที่เพิ่มขึ้นใน Sui ในฐานะเครือข่ายบล็อกเชนที่ปรับขนาดได้และมีต้นกำเนิดในสหรัฐอเมริกาซึ่งมีศักยภาพในระยะยาว

Spot Sui ETF จะเปิดตัวเมื่อใด?

ทุกอย่างขึ้นอยู่กับกรอบเวลาของ SEC เมื่อมีการยื่นแบบฟอร์ม 19b-4 แล้ว SEC มีเวลา 45 วันในการตอบกลับ แต่สามารถขยายระยะเวลาการตรวจสอบได้หลายครั้ง ระยะเวลาการตรวจสอบสูงสุดคือ 240 วัน สำหรับ 21Shares กำหนดเส้นตายสุดท้ายคือวันที่ 18 มกราคม 2026

อะไรที่อาจทำให้การอนุมัติล่าช้าหรือเร็วขึ้น?

ปัจจัยสำคัญหลายประการอาจส่งผลต่อความเร็วในการอนุมัติ Sui ETF:

• สภาพแวดล้อมด้านกฎระเบียบ: จุดยืนที่เปลี่ยนแปลงไปของ SEC ต่อ Crypto ETF มีความสำคัญ แม้ว่า Spot Bitcoin และ Ethereum ETF จะได้รับการอนุมัติในปี 2024 แต่สินทรัพย์ใหม่แต่ละรายการจะได้รับการประเมินตามคุณสมบัติของตนเอง

• ความพร้อมของเครือข่าย: SEC จะประเมินอัตราการยอมรับของ Sui มูลค่าตลาด สภาพคล่อง และความแข็งแกร่งทางเทคนิค เพื่อพิจารณาว่าเหมาะสมสำหรับ ETF หรือไม่

• การดูแลสินทรัพย์และความปลอดภัย: ผู้ดูแลสินทรัพย์ของ ETF เช่น Coinbase และ BitGo ต้องเป็นไปตามมาตรฐานของ SEC สำหรับการจัดเก็บสินทรัพย์ดิจิทัลที่ปลอดภัย

หากคุณกำลังวางแผนที่จะลงทุน โปรดจับตาดูการอัปเดตและประกาศอย่างเป็นทางการจาก SEC และจากทั้ง 21Shares และ Canary Capital การนับถอยหลังได้เริ่มขึ้นแล้ว

วิธีเตรียมตัวสำหรับการเปิดตัว Sui ETF

หากคุณสนใจ Sui ETF ที่กำลังจะมาถึง สิ่งสำคัญคือต้องติดตามข่าวสารและเตรียมพร้อม เริ่มต้นด้วยการติดตามการอัปเดตอย่างเป็นทางการจาก 21Shares และ Canary Capital และจับตาดูสำนักข่าวคริปโตและแหล่งข้อมูลที่เชื่อถือได้ เช่น BingX Academy ใช้เวลาทำความเข้าใจว่า ETF ทำงานอย่างไร และแตกต่างจากการซื้อและถือคริปโตเคอร์เรนซีโดยตรงอย่างไร

ลองคิดดูว่า Sui ETF จะเข้ากับกลยุทธ์การลงทุนโดยรวมของคุณได้อย่างไร พิจารณาความเสี่ยงที่คุณยอมรับได้ กรอบเวลา และเป้าหมายทางการเงินของคุณ นอกจากนี้ ควรปรึกษาที่ปรึกษาทางการเงินเพื่อทำความเข้าใจความเสี่ยงและผลประโยชน์ที่อาจเกิดขึ้นอย่างถ่องแท้

มีวิธีอื่นใดในการลงทุนใน Sui (SUI) อีกบ้าง?

ในขณะที่ Sui ETF ยังอยู่ระหว่างการตรวจสอบของ SEC คุณไม่จำเป็นต้องรอเพื่อเข้าร่วม นี่คือสามวิธีที่มีประสิทธิภาพและเข้าถึงได้ในการลงทุนใน SUI วันนี้:

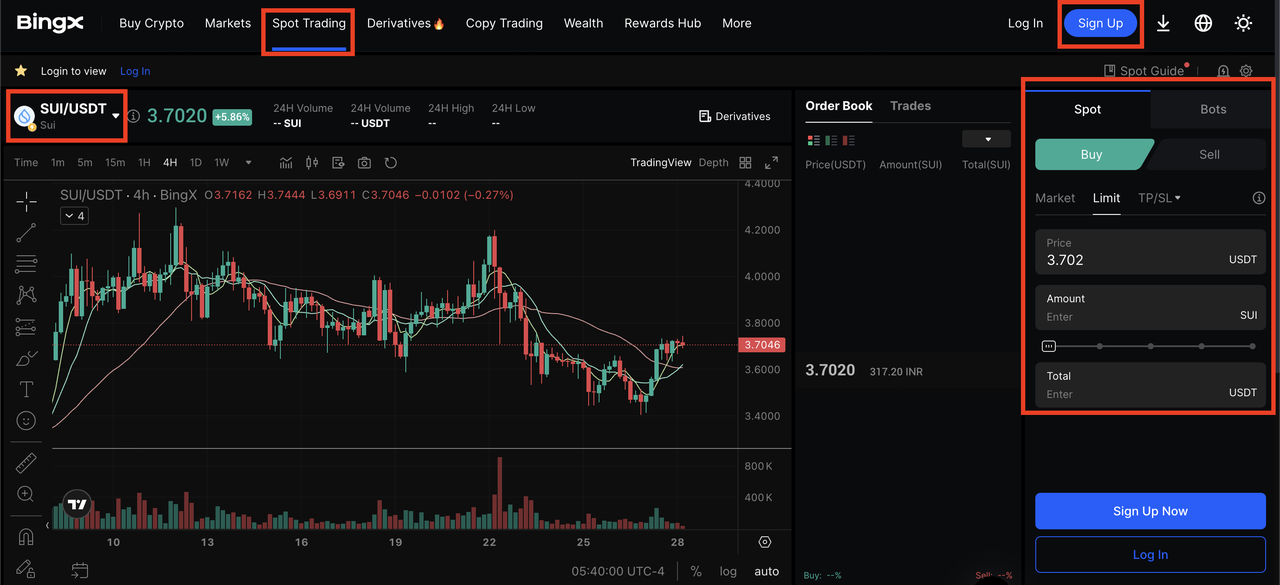

1. ซื้อหรือเทรด SUI บน BingX

วิธีที่ง่ายที่สุดและเข้าถึงได้มากที่สุดในการลงทุนใน Sui ตอนนี้คือผ่าน BingX ซึ่งเป็นแพลตฟอร์มแลกเปลี่ยนคริปโตระดับโลกที่เชื่อถือได้

นี่คือวิธีเริ่มต้น:

• สร้างบัญชี: ลงทะเบียนบน

BingX.com และดำเนินการยืนยันตัวตน (

KYC) เพื่อเข้าถึงการซื้อขายได้อย่างเต็มที่

• ฝากเงิน: เพิ่ม

USDT หรือคริปโตเคอร์เรนซีอื่นๆ ที่รองรับไปยัง Spot Wallet ของคุณ คุณสามารถฝากคริปโตโดยตรงหรือซื้อ USDT โดยใช้บัตรเครดิตหรือการเทรด P2P

• ค้นหา SUI: ไปที่ส่วน

การเทรด Spot ในแถบค้นหา พิมพ์ "SUI" เพื่อค้นหาคู่การซื้อขาย เช่น SUI/USDT

• ส่งคำสั่ง: เลือกประเภทคำสั่งที่คุณต้องการ

Market หรือ Limit ป้อนจำนวนเงิน และคลิก ซื้อ SUI

• จัดการโทเค็นของคุณ: เมื่อซื้อแล้ว โทเค็น SUI ของคุณจะปรากฏใน Spot Wallet ของคุณ คุณสามารถถือ เทรด หรือโอนได้ตามต้องการ

ด้วย BingX คุณจะได้รับการซื้อขายแบบเรียลไทม์ ค่าธรรมเนียมต่ำ และแพลตฟอร์มที่ปลอดภัยเพื่อเริ่มต้นเข้าร่วมใน

ระบบนิเวศ Sui ได้ทันที

2. ลงทุนผ่าน Grayscale Sui Trust

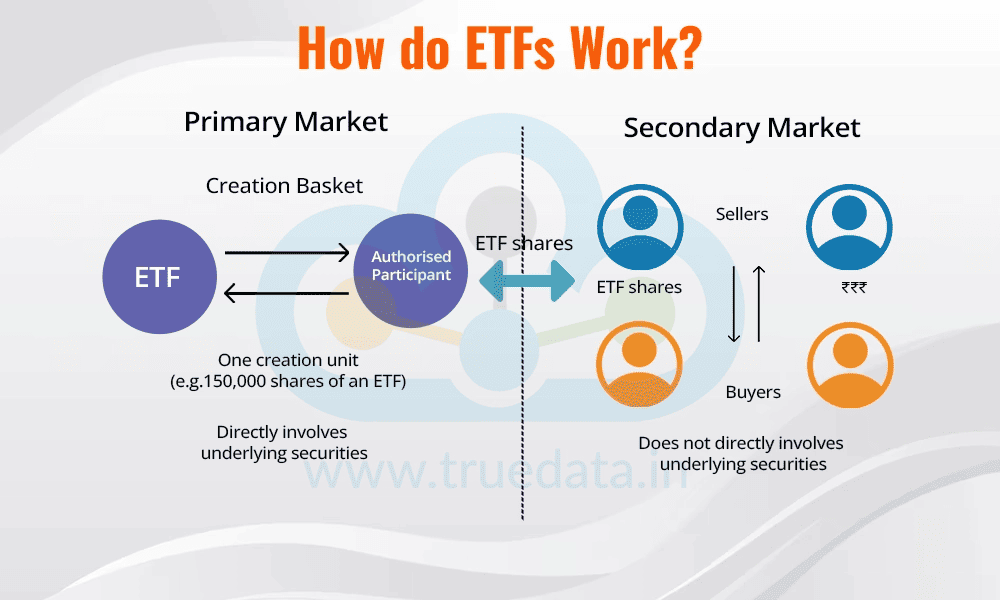

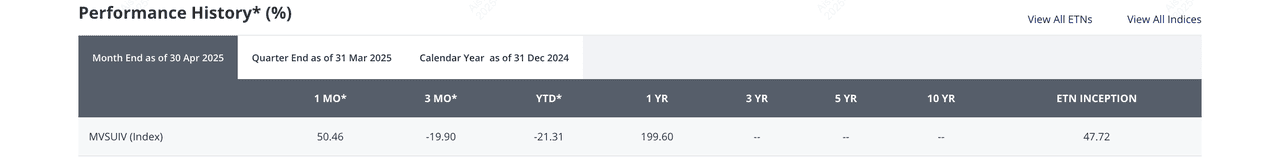

NAV ต่อหุ้นของ Grayscale Sui Trust | ที่มา: Grayscale

สำหรับนักลงทุนที่ได้รับการรับรอง Grayscale Sui Trust เสนออีกเส้นทางหนึ่งในการเข้าถึง SUI ทรัสต์นี้มีโครงสร้างเป็นยานพาหนะการลงทุนส่วนตัวที่ถือโทเค็น SUI และสะท้อนมูลค่าตลาดของโทเค็น

ณ สิ้นเดือนพฤษภาคม 2025 มูลค่าสินทรัพย์สุทธิ (NAV) ต่อหุ้นของทรัสต์อยู่ที่ 54.38 ดอลลาร์ โดยบริหารสินทรัพย์กว่า 11.46 ล้านดอลลาร์ ซึ่งเป็นวิธีที่ได้รับการจัดการอย่างมืออาชีพในการลงทุนใน Sui โดยไม่ต้องจัดการกับโทเค็นหรือบล็อกเชนโดยตรง

ตัวเลือกนี้เหมาะอย่างยิ่งหากคุณกำลังมองหาการเข้าถึงแบบ Passive ภายในโครงสร้างการลงทุนที่มีการกำกับดูแล

3. เทรด VanEck Sui ETN ในยุโรป

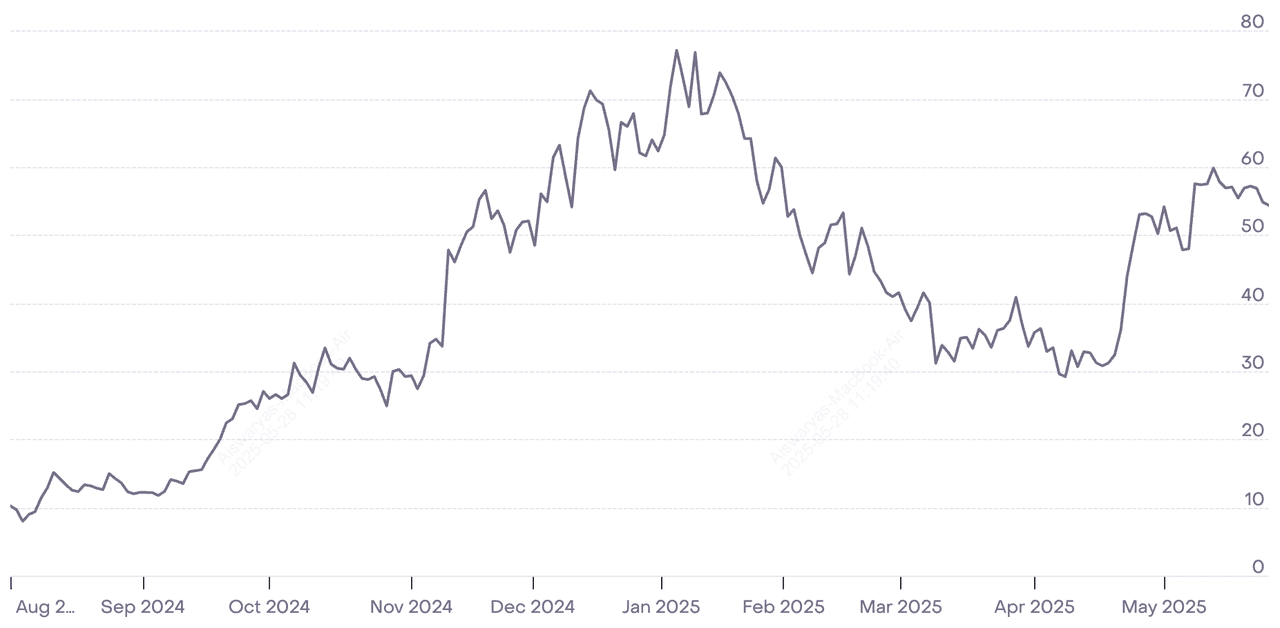

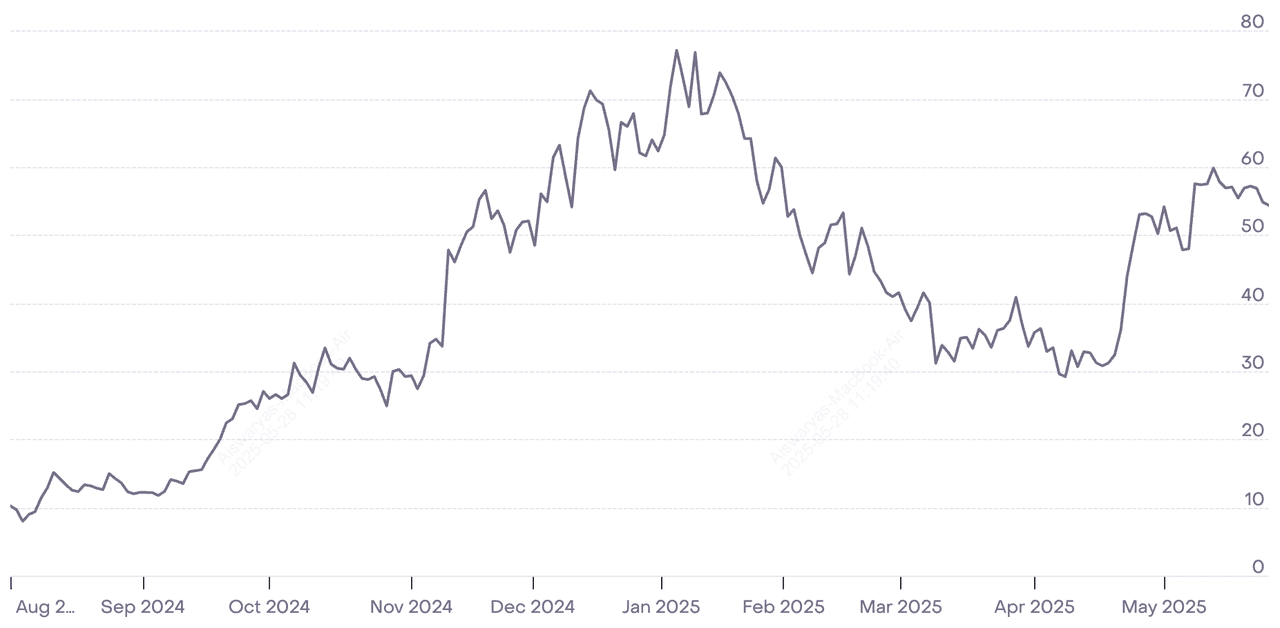

ประวัติผลการดำเนินงานของ VanEck Sui ETC | ที่มา: VanEck

หากคุณอยู่ในยุโรป คุณสามารถลงทุนใน Sui ผ่าน VanEck Sui ETN (VSUI) ตราสารหนี้ซื้อขายแลกเปลี่ยนนี้ได้รับการสนับสนุน 100% ด้วยโทเค็น SUI และซื้อขายในตลาดหลักทรัพย์ยุโรปที่มีการกำกับดูแล ณ วันที่ 27 พฤษภาคม 2025 VanEck Sui ETN มี NAV อยู่ที่ 15.75 ดอลลาร์ บริหารสินทรัพย์ 147.84 ล้านดอลลาร์ และมีอัตราส่วนค่าใช้จ่ายรวม 1.50%

ETN ติดตามดัชนี MarketVector™ Sui VWAP Close (MVSUIV) และได้รับการดูแลอย่างปลอดภัยโดยผู้ดูแลสินทรัพย์คริปโตที่ได้รับการกำกับดูแล เหมาะสำหรับนักลงทุนชาวยุโรปที่กำลังมองหาวิธีการลงทุนใน Sui ที่มีการกำกับดูแลโดยไม่ต้องจัดการกระเป๋าเงินโดยตรง

จนกว่า Sui ETF ที่ได้รับการอนุมัติจากสหรัฐอเมริกาจะเข้าสู่ตลาด ตัวเลือกทั้งสามนี้เสนอเส้นทางที่เข้าถึงได้และหลากหลายในการลงทุนในหนึ่งในบล็อกเชนที่ทันสมัยที่สุดในโลกคริปโต ไม่ว่าคุณจะเป็นนักเทรดรายย่อยหรือนักลงทุนสถาบัน ก็มีกลยุทธ์การลงทุนใน Sui ที่เหมาะกับความต้องการของคุณในวันนี้

ข้อคิดสุดท้าย

Sui ETF ที่เสนอโดย 21Shares และ Canary Capital แสดงให้เห็นถึงความสนใจที่เพิ่มขึ้นในการรวมคริปโตเคอร์เรนซีเข้ากับเครื่องมือทางการเงินแบบดั้งเดิม หากได้รับการอนุมัติ ETF เหล่านี้จะช่วยให้นักลงทุนเข้าถึงโทเค็นดั้งเดิมของบล็อกเชน Sui อย่าง SUI ได้อย่างถูกกฎหมายและง่ายขึ้น

การอนุมัติ Sui ETF จะไม่เพียงแต่เพิ่มความชอบธรรมของโทเค็นเท่านั้น แต่ยังอาจเพิ่ม

สภาพคล่อง และการยอมรับอีกด้วย ในขณะที่ตลาดคริปโตยังคงพัฒนาต่อไป การติดตามข่าวสารและเตรียมพร้อมจะทำให้คุณสามารถใช้ประโยชน์จากโอกาสการลงทุนใหม่ๆ ที่เกิดขึ้นได้

บทความที่เกี่ยวข้อง

ETF ทำงานอย่างไร? | ที่มา: TrueData.in

ETF ทำงานอย่างไร? | ที่มา: TrueData.in สถิติเครือข่าย Sui | ที่มา: Sui.io

สถิติเครือข่าย Sui | ที่มา: Sui.io ใบสมัคร Sui ETF ของ 21 Shares | ที่มา: SEC.gov

ใบสมัคร Sui ETF ของ 21 Shares | ที่มา: SEC.gov ใบสมัคร Canary Sui ETF | ที่มา: SEC.gov

ใบสมัคร Canary Sui ETF | ที่มา: SEC.gov

NAV ต่อหุ้นของ Grayscale Sui Trust | ที่มา: Grayscale

NAV ต่อหุ้นของ Grayscale Sui Trust | ที่มา: Grayscale ประวัติผลการดำเนินงานของ VanEck Sui ETC | ที่มา: VanEck

ประวัติผลการดำเนินงานของ VanEck Sui ETC | ที่มา: VanEck