ทุนสำรองเชิงยุทธศาสตร์คือสต็อกฉุกเฉินของสินค้าโภคภัณฑ์ที่จำเป็น ซึ่งรัฐบาลถือครองไว้เพื่อปกป้องความมั่นคงของชาติและเสถียรภาพทางเศรษฐกิจระหว่างที่เกิดการหยุดชะงักของอุปทานหรือความผันผวนทางการเงิน ตัวอย่างเช่น ทุนสำรองปิโตรเลียมเชิงยุทธศาสตร์ของสหรัฐฯ (SPR) ก่อตั้งขึ้นในปี 1975 เพื่อบรรเทาผลกระทบจากการคว่ำบาตรน้ำมัน และปัจจุบันจัดเก็บน้ำมันดิบประมาณ 395 ล้านบาร์เรลในถ้ำใต้ดินตามแนวชายฝั่งอ่าวไทย ในทำนองเดียวกัน ทุนสำรองทองคำ ที่เก็บไว้ใน Fort Knox และห้องนิรภัยอื่น ๆ ทำหน้าที่เป็นเครื่องมือป้องกันความเสี่ยงแบบดั้งเดิมจากภาวะเงินเฟ้อและการลดค่าของสกุลเงิน

เมื่อวันที่ 6 มีนาคม 2025 ประธานาธิบดีโดนัลด์ ทรัมป์ ของสหรัฐฯ ได้ลงนามในคำสั่งผู้บริหารจัดตั้ง ทุนสำรองบิตคอยน์เชิงยุทธศาสตร์ของสหรัฐฯ (SBR) ซึ่งนับเป็นการยอมรับอย่างเป็นทางการครั้งแรกของ

บิตคอยน์ ในฐานะสินทรัพย์สำรองของรัฐ บทความนี้จะอธิบายว่าทุนสำรองเชิงยุทธศาสตร์คืออะไร เหตุใดบิตคอยน์จึงมีคุณสมบัติ การดำเนินการของ SBR ของสหรัฐฯ จะเป็นอย่างไร บิตคอยน์เปรียบเทียบกับทองคำและดอลลาร์สหรัฐอย่างไร และสิ่งนี้อาจมีความหมายต่อราคาของมันอย่างไร

ทุนสำรองทองคำสูงสุด (เป็นตัน) ตามประเทศในปี 2024 | ที่มา: World Gold Council

ทุนสำรองบิตคอยน์เชิงยุทธศาสตร์ (SBR) คืออะไร?

ทุนสำรองบิตคอยน์เชิงยุทธศาสตร์ (SBR) คือสต็อกของบิตคอยน์ที่รัฐบาลจัดการ ซึ่งเดิมมาจากทรัพย์สินที่ถูกยึดโดยหน่วยงานบังคับใช้กฎหมาย และอาจถูกเสริมด้วยการซื้อที่ไม่กระทบงบประมาณ โดยเก็บรักษาไว้เป็นแหล่งเก็บรักษามูลค่าในระยะยาว คล้ายกับทุนสำรองทองคำหรือน้ำมันของประเทศ มันดำเนินการภายใต้การกำกับดูแลระหว่างหน่วยงานอย่างเข้มงวด การดูแลโดยใช้ระบบหลายลายเซ็นที่ปลอดภัย และโปรโตคอลการปฏิบัติตามกฎหมายที่เข้มงวด เพื่อป้องกันความเสี่ยงจากการลดค่าของสกุลเงินเฟียตและความเสี่ยงทางภูมิรัฐศาสตร์ ด้วยการ

กระจายความเสี่ยง ของทุนสำรองของรัฐด้วยบิตคอยน์ SBR มีเป้าหมายเพื่อเสริมสร้างความยืดหยุ่นและความมั่นคงทางการเงินในช่วงที่เกิดความวุ่นวายทางเศรษฐกิจ

เอลซัลวาดอร์เป็นประเทศแรกที่ปฏิบัติต่อบิตคอยน์ในฐานะสินทรัพย์สำรองอย่างเป็นทางการ นับตั้งแต่การยอมรับ BTC เป็นสกุลเงินที่ถูกกฎหมายในปี 2021 ประเทศนี้ได้สะสม BTC ไปแล้วกว่า 6,100 BTC (ประมาณ 550 ล้านดอลลาร์) ซึ่งคิดเป็นประมาณ 1.6% ของ GDP และกำหนดการถือครองเหล่านี้อย่างชัดเจนว่าเป็นส่วนหนึ่งของทุนสำรองเชิงยุทธศาสตร์ นอกจากนี้ กองทุนเพื่อการลงทุนแห่งชาติของภูฏานได้ใช้การขุดที่ขับเคลื่อนด้วยพลังงานน้ำเพื่อสะสม BTC ประมาณ 13,000 BTC (ประมาณ 750 ล้านดอลลาร์) ซึ่งเทียบเท่ากับประมาณ 28% ของ GDP โดยใช้บิตคอยน์อย่างมีประสิทธิภาพควบคู่ไปกับสินทรัพย์แบบดั้งเดิมอื่น ๆ ในทุนสำรองของชาติ

เหตุใดจึงควรพิจารณาบิตคอยน์เป็นสินทรัพย์สำรองเชิงยุทธศาสตร์?

การเดินทางของบิตคอยน์เริ่มต้นด้วย

Satoshi Nakamoto ขุดบล็อกแรกในเดือนมกราคม 2009 และในวันที่ 22 พฤษภาคม 2010 โปรแกรมเมอร์ชื่อ Laszlo Hanyecz ได้จ่าย 10,000 BTC (ประมาณ 41 ดอลลาร์ในขณะนั้น) เพื่อแลกกับพิซซ่าสองถาด ซึ่งตอนนี้มีมูลค่าหลายร้อยล้าน เป็นสัญญาณแรกของศักยภาพในโลกแห่งความเป็นจริงของบิตคอยน์ และมีการเฉลิมฉลองเป็นประจำทุกปีในชื่อ

วันพิซซ่าบิตคอยน์ เครือข่ายรอดพ้นจากเหตุการณ์สำคัญ เช่น การล่มสลายของ

Mt. Gox ในปี 2014 และปรับปรุงโครงสร้างพื้นฐานอย่างต่อเนื่อง โดยเฉพาะอย่างยิ่งกับการเปิดตัว

Lightning Network ในปี 2018 เพื่อเปิดใช้งานธุรกรรมที่เร็วขึ้นและถูกลง

การยอมรับจากสถาบันพุ่งสูงขึ้นในช่วงทศวรรษ 2020: MicroStrategy เป็นผู้นำการยอมรับในระดับองค์กร โดยสะสม BTC มากกว่า 70,000 BTC เป็นทุนสำรองคลังตั้งแต่เดือนสิงหาคม 2020 และ Tesla เป็นที่รู้จักกันดีในการซื้อบิตคอยน์มูลค่า 1.5 พันล้านดอลลาร์ในช่วงต้นปี 2021 รวมถึงการยอมรับ BTC สำหรับการซื้อรถยนต์ ก่อนที่จะระงับเนื่องจากความกังวลด้านสิ่งแวดล้อม ในเดือนมิถุนายน 2021 เอลซัลวาดอร์กลายเป็นประเทศแรกที่ยอมรับบิตคอยน์เป็นสกุลเงินที่ถูกกฎหมาย ซึ่งตอกย้ำสถานะของมันในฐานะสินทรัพย์ทางการเงินระดับโลก

เหตุการณ์สำคัญด้านกฎระเบียบตามมา เมื่อ ก.ล.ต. สหรัฐฯ อนุมัติ Spot Bitcoin ETFs จำนวน 11 รายการในวันที่ 10 มกราคม 2024 ซึ่งกระตุ้นให้เกิดปริมาณการซื้อขาย 4.6 พันล้านดอลลาร์ในวันแรก และเป็นสัญญาณของการยอมรับในวงกว้างของตลาด หลังจากการ halving บิตคอยน์ครั้งที่สี่ในเดือนเมษายน 2024 และการเข้ารับตำแหน่งของประธานาธิบดีทรัมป์ในเดือนมกราคม 2025 บิตคอยน์ก็พุ่งสูงขึ้นไปสู่ระดับสูงสุดตลอดกาลที่กว่า 109,071 ดอลลาร์ต่อเหรียญ ซึ่งได้รับแรงหนุนจากการลดลงของอุปทานจากการ halving และการมองโลกในแง่ดีเกี่ยวกับนโยบายที่เป็นมิตรกับคริปโต

หลังจากเหตุการณ์สำคัญทั้งหมดในเส้นทางของการยอมรับบิตคอยน์ที่เพิ่มขึ้น นี่คือเหตุผลที่การรวมบิตคอยน์ไว้ในทุนสำรองเชิงยุทธศาสตร์ของประเทศเป็นความคิดที่ดี:

• การกระจายความเสี่ยงผ่านความขาดแคลนทางดิจิทัล: ข้อจำกัดที่เข้มงวดของบิตคอยน์ที่ 21 ล้านเหรียญสร้างโปรไฟล์ความขาดแคลนในตัวที่คล้ายกับทองคำ ทำให้กระทรวงการคลังสามารถกระจายความเสี่ยงนอกเหนือจากสกุลเงินเฟียตและสินค้าโภคภัณฑ์แบบดั้งเดิม

• การป้องกันความเสี่ยงจากภาวะเงินเฟ้อที่แข็งแกร่ง: หากบิตคอยน์มีการเติบโตในอัตราประวัติศาสตร์ (เช่น การเติบโต 25% ต่อปีตามที่ VanEck คาดการณ์) แม้แต่ทุนสำรอง 200,000–400,000 BTC ก็สามารถสร้างการเพิ่มขึ้นของมูลค่าที่แท้จริงอย่างมากตลอดหลายทศวรรษ

• การโอนเงินแบบทันทีไร้พรมแดน: ต่างจากการขนส่งทองคำที่มีขนาดใหญ่ บิตคอยน์สามารถเคลื่อนย้ายไปทั่วโลกได้ในไม่กี่นาที ทำให้สามารถปรับใช้ทุนสำรองใหม่ได้เกือบจะในทันทีโดยไม่ต้องมีค่าใช้จ่ายด้านโลจิสติกส์หรือการอนุมัติทางการทูต

• ความยืดหยุ่นทางภูมิรัฐศาสตร์: การออกแบบแบบกระจายอำนาจของบิตคอยน์ช่วยปกป้องทุนสำรองจากการถูกอายัดหรือยึด ต่างจากสกุลเงินเฟียต ซึ่งเห็นได้จากการที่สินทรัพย์ของรัสเซียประมาณ 300 พันล้านดอลลาร์ถูกอายัดภายใต้การคว่ำบาตรในปี 2022 ซึ่งป้องกันการถือครองของรัฐจากความเสี่ยงทางการเมือง

• การดูแลและโปร่งใสที่ตั้งโปรแกรมได้: การกำกับดูแลแบบ on-chain อย่างสมบูรณ์ด้วย

กระเป๋าสตางค์แบบหลายลายเซ็น และโมดูลความปลอดภัยฮาร์ดแวร์ (HSM) รับประกันการควบคุมที่ปลอดภัยและสามารถตรวจสอบได้ กระทรวงการคลังสามารถติดตามทุกธุรกรรมได้แบบ เรียลไทม์ ซึ่งช่วยเพิ่มความรับผิดชอบและลดการพึ่งพาผู้รับฝากบุคคลที่สาม

ทุนสำรองบิตคอยน์เชิงยุทธศาสตร์ของสหรัฐฯ จะทำงานอย่างไร

ทุนสำรองบิตคอยน์ของสหรัฐฯ จะชดเชยหนี้ของสหรัฐฯ ได้อย่างไรเมื่อเวลาผ่านไป | ที่มา: VanEck

ภายใต้คำสั่งผู้บริหารเมื่อวันที่ 6 มีนาคม 2025 ทุนสำรองบิตคอยน์เชิงยุทธศาสตร์ของสหรัฐฯ (SBR) ได้รับการออกแบบมาเพื่อเปลี่ยนการถือครองสินทรัพย์ที่ถูก ยึด ที่มีอยู่ของรัฐบาลให้เป็น ทุนสำรองของรัฐแบบถาวร แทนที่จะขายทอดตลาด

ด้วยการรวบรวมเหรียญที่ถูกยึด การนำการดูแลระดับทหารมาใช้ การอนุญาตให้มีการเติบโตอย่างรอบคอบและไม่กระทบงบประมาณ และการบังคับใช้การรายงานและการปฏิบัติตามกฎระเบียบที่เข้มงวด SBR ของสหรัฐฯ พยายามรวมจุดแข็งทางดิจิทัลของบิตคอยน์เข้ากับการปฏิบัติของทุนสำรองของรัฐที่ผ่านการพิสูจน์แล้วและถูกต้อง นี่คือวิธีการทำงานในทางปฏิบัติ:

การระดมทุนและการรวมบัญชี

ภายใน 30 วันหลังจากคำสั่ง หน่วยงานรัฐบาลกลางแต่ละแห่งจะต้องจัดทำบัญชีและโอนบิตคอยน์ที่ถูกยึด — ซึ่งคาดว่ามีมากกว่า 207,000 BTC (มีมูลค่าประมาณ 17 พันล้านดอลลาร์ ณ กลางเดือนมีนาคม 2025) — ไปยังบัญชีสำรองเดียวที่บริหารจัดการโดยกระทรวงการคลัง เหรียญเหล่านี้ ซึ่งเดิมถือครองโดย DOJ, IRS, Homeland Security และหน่วยงานอื่น ๆ จะถูกรวมศูนย์เพื่อสร้าง "Fort Knox ดิจิทัล" เพื่อให้มั่นใจว่าบิตคอยน์ที่รัฐบาลถือครองจะไม่ถูกขายโดยไม่ได้รับอนุญาตตามกฎหมายในอนาคต

การดูแลและการกำกับดูแล

เพื่อป้องกันการสูญหาย การโจรกรรม หรือการใช้ในทางที่ผิดแต่ฝ่ายเดียว ทุนสำรองจะใช้ กระเป๋าสตางค์แบบหลายลายเซ็น และโมดูลความปลอดภัยฮาร์ดแวร์ (HSM) ส่วนของคีย์ส่วนตัวจะถูกกระจายไปยังสำนักงานหลายแห่ง — อาจจะเป็นกระทรวงการคลัง กระทรวงพาณิชย์ และคณะทำงานด้านตลาดสินทรัพย์ดิจิทัลของประธานาธิบดีแห่งทำเนียบขาว — เพื่อไม่ให้บุคคลใดสามารถเคลื่อนย้ายเงินทุนได้โดยลำพัง แนวทางหลายชั้นนี้สะท้อนให้เห็นถึงแนวทางปฏิบัติที่ดีที่สุดทั้งในด้านการเงินที่มีความปลอดภัยสูงและความมั่นคงของชาติ (เช่น โปรโตคอลการปล่อยอาวุธนิวเคลียร์) โดยกำหนดการตรวจสอบที่ชัดเจน บันทึกการตรวจสอบ และขั้นตอนการสืบทอดตำแหน่งระหว่างการบริหารงานต่าง ๆ

การจัดซื้อที่ไม่กระทบงบประมาณ

นอกเหนือจากเหรียญที่ถูกยึดแล้ว คำสั่งดังกล่าวยังให้อำนาจแก่รัฐมนตรีกระทรวงการคลังและกระทรวงพาณิชย์ในการพัฒนากลยุทธ์ ที่ไม่กระทบงบประมาณ เพื่อเพิ่มบิตคอยน์ ซึ่งหมายความว่าการซื้อเพิ่มเติมใด ๆ จะต้องได้รับเงินทุนจากแหล่งที่ไม่ใช่ผู้เสียภาษี เช่น รายได้จากการยึดทรัพย์สินหรือค่าปรับ ไม่ใช่จากเงินทุนของรัฐบาลกลางที่จัดสรรไว้ SBR จะไม่เสียค่าใช้จ่ายใด ๆ ให้แก่ผู้เสียภาษีของสหรัฐฯ เลย สิ่งนี้ช่วยรักษาศักยภาพในการเติบโตของทุนสำรอง ในขณะที่หลีกเลี่ยงกระแสต่อต้านทางการเมืองเกี่ยวกับการใช้เงินสาธารณะเพื่อซื้อสินทรัพย์ดิจิทัลที่มีความผันผวน

การรายงานและการปฏิบัติตามกฎระเบียบ

ความโปร่งใสและการปฏิบัติตามกฎระเบียบเป็นรากฐานสำคัญของกรอบงาน SBR คำสั่งผู้บริหารกำหนดให้มีการ บัญชีอย่างเต็มรูปแบบ ของการถือครองสินทรัพย์ดิจิทัลทั้งหมดต่อคณะทำงานของประธานาธิบดี และกำหนดให้มีการเปิดเผยข้อมูลต่อสาธารณะเป็นระยะ — คล้ายกับวิธีที่กระทรวงพลังงานรายงานเกี่ยวกับทุนสำรองปิโตรเลียมเชิงยุทธศาสตร์

นอกจากนี้ ผู้ดูแลทุนสำรองจะต้องดำเนินการ คัดกรอง AML/การคว่ำบาตรอย่างเข้มงวด สำหรับธุรกรรมเข้าและออก เพื่อให้แน่ใจว่ากระเป๋าสตางค์ของรัฐบาลปฏิบัติตามมาตรฐาน OFAC และ FinCEN บันทึกการตรวจสอบโดยละเอียดและการกระทบยอดแบบ on-chain เป็นประจำจะตรวจสอบว่าการเคลื่อนไหวของบิตคอยน์ทุกครั้งได้รับการบันทึก ได้รับอนุญาต และสามารถปกป้องได้ตามกฎหมาย

การประเมิน Bitcoin เทียบกับทองคำและดอลลาร์สหรัฐฯ ในฐานะสินทรัพย์ทุนสำรองแห่งชาติ

ความสัมพันธ์ของ Bitcoin เทียบกับทองคำ | ที่มา: Newhedge

ต่อไปนี้คือการเปรียบเทียบ Bitcoin กับสินทรัพย์สำรองเชิงกลยุทธ์ที่ได้รับความนิยมมากที่สุดในโลกสองชนิด: ทองคำและดอลลาร์สหรัฐฯ:

| สินทรัพย์ |

Bitcoin |

ทองคำ |

ดอลลาร์สหรัฐฯ (M2) |

| ขีดจำกัดอุปทาน |

21 ล้านเหรียญ |

~190,040 เมตริกตันที่ขุดได้ |

ไม่จำกัด (M2 ≈ $21.56 ล้านล้าน ณ ม.ค. 2025) |

| ความผันผวน |

สูง; การแกว่งตัวรายวันมักจะ > 5 % |

ต่ำ; การเคลื่อนไหวรายปีมักจะ < 10 % |

ต่ำมาก; การเปลี่ยนแปลงของปริมาณเงินกว้าง < 5 % ต่อปี |

| ความสามารถในการพกพา |

ทันที ทั่วโลก ดิจิทัล |

เทอะทะ ต้องมีการขนส่งทางกายภาพ |

การโอนเงินอิเล็กทรอนิกส์ผ่านเครือข่ายธนาคาร |

| ความเสี่ยงทางภูมิรัฐศาสตร์ |

ทนทานต่อการอายัดบนบล็อกเชน |

ความเสี่ยงในการถูกอายัด/ยึดตู้เซฟในต่างประเทศ |

อยู่ภายใต้มาตรการคว่ำบาตรและการควบคุมอัตราแลกเปลี่ยน |

| การป้องกันความเสี่ยงจากเงินเฟ้อ |

กำลังพัฒนา; การเก็บรักษามูลค่าในระยะยาว |

การเก็บรักษามูลค่าที่ได้รับการพิสูจน์มาเป็นเวลาหลายพันปี |

สูญเสียมูลค่าเมื่อธนาคารกลางขยายอุปทาน |

ความขาดแคลนของ Bitcoin เทียบกับสภาพคล่องของทองคำและดอลลาร์

สหรัฐอเมริกาถือครองทองคำกว่า 8,100 เมตริกตัน ซึ่งมีมูลค่าตามบัญชีประมาณ 425 พันล้านดอลลาร์ และมีปริมาณเงิน M2 อยู่ที่ 21.76 ล้านล้านดอลลาร์ ซึ่งสะท้อนถึงสภาพคล่องในวงกว้างของดอลลาร์สหรัฐฯ ในทางตรงกันข้าม อุปทานของ Bitcoin ถูกจำกัดอย่างเคร่งครัดที่ 21 ล้านเหรียญ โดยมีประมาณ 19.5 ล้านเหรียญที่หมุนเวียนอยู่แล้ว ทำให้มีมูลค่าตลาดประมาณ 1.2 ล้านล้านดอลลาร์ ณ ไตรมาส 2 ปี 2025 อุปทานคงที่นี้สนับสนุน

เรื่องเล่าของ Bitcoin ในฐานะ "ทองคำดิจิทัล" โดยนำเสนอรูปแบบความขาดแคลนที่แตกต่างจากการพิมพ์เงินเฟียต (fiat) แบบไม่จำกัดอย่างแท้จริง

การเติบโตและความผันผวนของ Bitcoin เทียบกับทองคำเทียบกับดอลลาร์

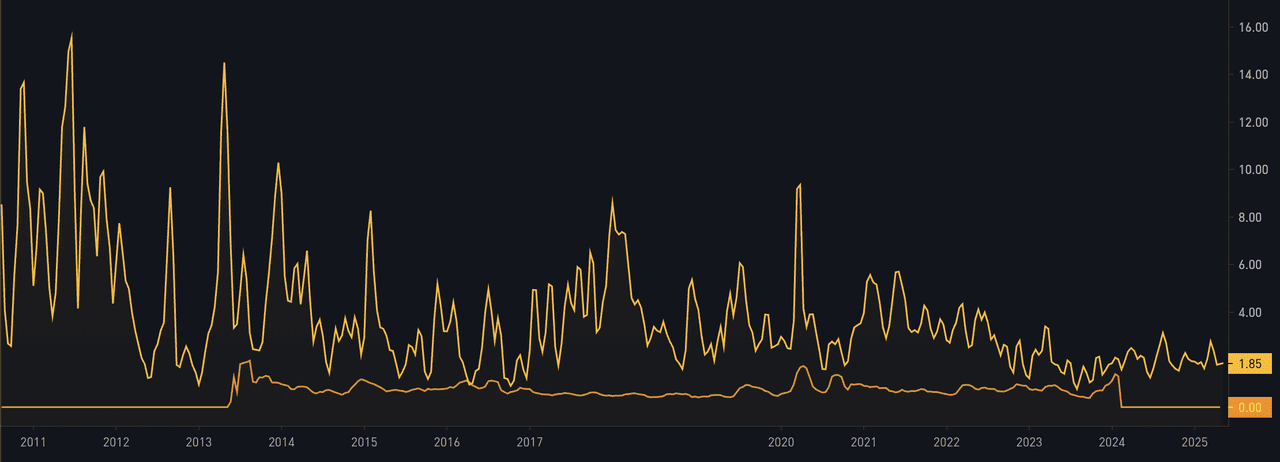

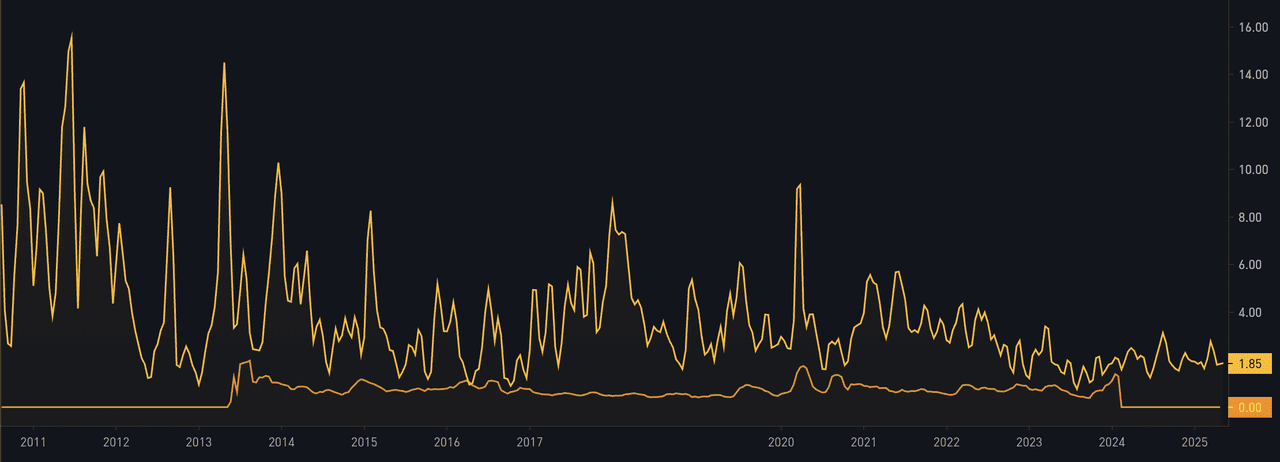

ความผันผวนของ Bitcoin เทียบกับทองคำ | ที่มา: BiTBO

ความผันผวนที่แท้จริงของ Bitcoin ยังคงสูง โดยอยู่ที่ 52.2% ต่อปี ณ ไตรมาส 1 ปี 2025 แม้ว่าจะลดลงจากระดับเลขสามหลักแล้วก็ตาม ในขณะที่ความผันผวนของทองคำอยู่ที่ระดับค่อนข้างต่ำที่ 15.5% เพื่อเปรียบเทียบ M2 ของสหรัฐฯ เติบโตเพียง 3.9% เมื่อเทียบเป็นรายปีในเดือนมกราคม 2025 ซึ่งสะท้อนให้เห็นถึงความผันผวนของปริมาณเงินที่ค่อนข้างน้อย สำหรับสินทรัพย์สำรอง ทองคำและเงินเฟียตมีความมั่นคงด้านราคา—ซึ่งมีค่าสำหรับการจัดทำงบประมาณและการจัดการหนี้—ในขณะที่การแกว่งตัวที่สูงขึ้นของ Bitcoin นำเสนอทั้งความเสี่ยงและโอกาสสำหรับผู้จัดการทุนสำรองเชิงกลยุทธ์

โลจิสติกส์ของ Bitcoin เทียบกับทองคำ การอายัดดอลลาร์ และความเสี่ยงทางภูมิรัฐศาสตร์

Bitcoin สามารถเคลื่อนย้ายไปทั่วโลกได้โดยมีความยุ่งยากน้อยที่สุด—ธุรกรรมบนบล็อกเชนยืนยันได้ภายในเวลาเฉลี่ยประมาณ 19 นาที—ทำให้สามารถจัดสรรเงินสำรองใหม่ได้เกือบจะทันทีโดยไม่จำเป็นต้องขนส่งทางกายภาพ ทองคำในทางกลับกัน ต้องใช้การขนส่งที่ปลอดภัยและการจัดเก็บในห้องนิรภัยที่เสริมความแข็งแกร่ง (เช่น Fort Knox เก็บทองคำของสหรัฐฯ มากกว่า 4,175 ตัน) ซึ่งก่อให้เกิดค่าใช้จ่ายด้านโลจิสติกส์และประกันภัยจำนวนมาก ในขณะเดียวกัน เงินสำรองดอลลาร์สหรัฐฯ แม้จะอยู่ในกรอบ M2 ที่ 21.76 ล้านล้านดอลลาร์—ก็อยู่ภายใต้มาตรการคว่ำบาตรและการอายัด: ประเทศตะวันตกได้อายัดสินทรัพย์เฟียตและเงินสำรองของรัสเซียประมาณ 300 พันล้านดอลลาร์ในปี 2022 ซึ่งเน้นย้ำถึงความเปราะบางทางภูมิรัฐศาสตร์ของสกุลเงินอธิปไตย

Strategic Bitcoin Reserve (SBR) ของสหรัฐฯ มีผลกระทบต่อราคา Bitcoin อย่างไร?

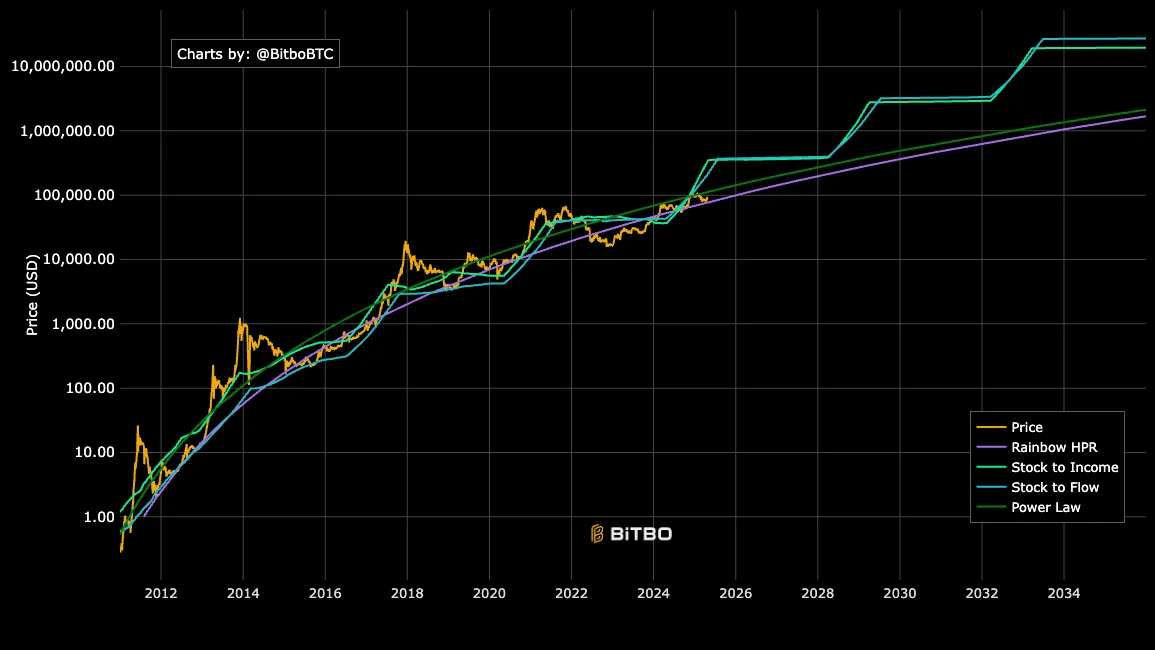

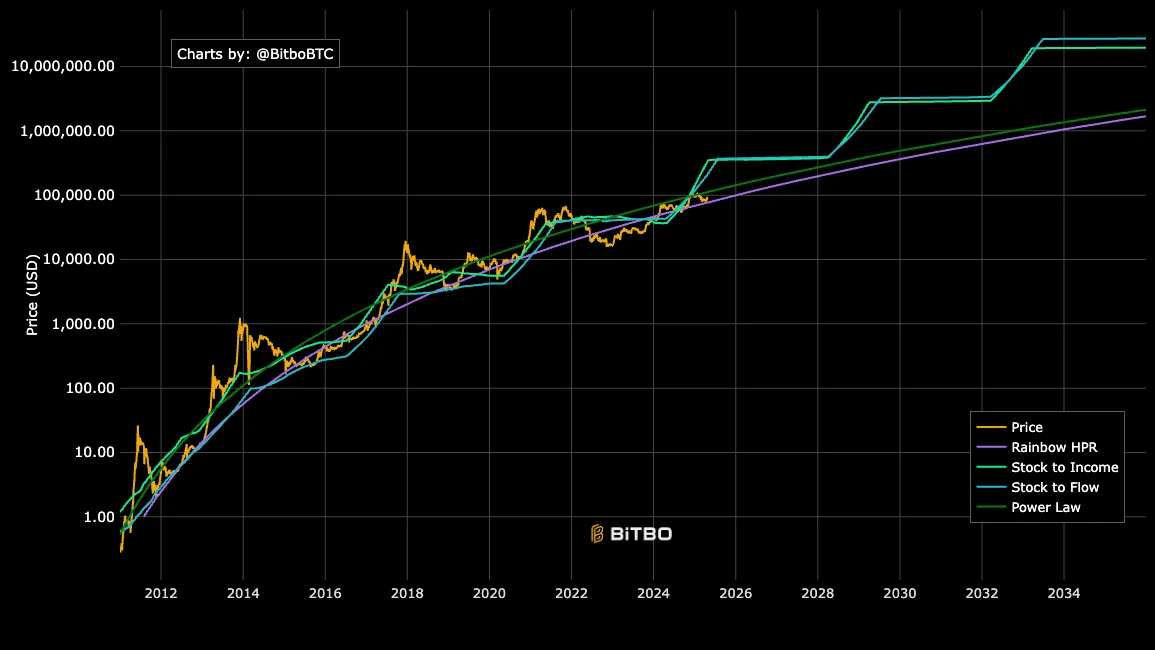

การคาดการณ์ราคา Bitcoin | ที่มา: BiTBO

เมื่อคำสั่งบริหารเพื่อจัดตั้ง Strategic Bitcoin Reserve (SBR) ได้รับการลงนามเมื่อวันที่ 6 มีนาคม 2025 ตลาดเริ่มแรกตอบสนองด้วยความผิดหวัง Bitcoin ซึ่งขณะนั้นซื้อขายอยู่ที่ประมาณ $90,000 ร่วงลงมากกว่า 5% สู่ระดับต่ำกว่า $85,000 ภายในไม่กี่นาที เนื่องจากนักลงทุนตระหนักว่าเงินสำรองจะรวมเฉพาะเหรียญที่ถูกยึดเท่านั้น และไม่มีแผนสำหรับการซื้อ BTC ใหม่ ผลกระทบ "ขายข่าว" นี้เน้นย้ำว่าแม้แต่การเคลื่อนไหวที่เป็นสัญลักษณ์ของรัฐบาลก็สามารถกระตุ้นให้เกิดการแกว่งตัวอย่างรวดเร็วในตลาดที่ประมาณ 19.5 ล้านเหรียญจาก 21 ล้านเหรียญทั้งหมดกำลังหมุนเวียนอยู่แล้ว อย่างไรก็ตาม ในการซื้อขายของยุโรปในเช้าวันรุ่งขึ้น Bitcoin ได้ฟื้นตัวกลับมาอยู่ที่ประมาณ $89,200 โดยฟื้นตัวจากความสูญเสียส่วนใหญ่ เนื่องจากนักลงทุนพิจารณาผลกระทบที่เป็นสัญลักษณ์ของคำสั่งดังกล่าว

ความท้าทายในการสร้างทุนสำรอง Bitcoin เชิงกลยุทธ์

แม้จะมีโอกาส แต่ SBR ก็มีความเสี่ยงที่อาจเกิดขึ้นบางประการ: ความผันผวนของ Bitcoin ที่ค่อนข้างสูง การแกว่งตัวต่อปีที่เกิน 52% ในต้นปี 2025 อาจทำให้ทุนสำรองประสบกับการขาดทุนตามราคาตลาด (mark-to-market losses) ที่มากขึ้นในช่วงขาลง ความปลอดภัยของการเก็บรักษา ก็มีความเสี่ยงเช่นกัน แม้จะมีกระเป๋าเงินแบบ multi-sig และโมดูลความปลอดภัยของฮาร์ดแวร์ แต่การโจมตีทางไซเบอร์ที่ประสบความสำเร็จหรือการละเมิดกุญแจภายในอาจทำให้การถือครองสินทรัพย์หายไปอย่างถาวร

นอกเหนือจากนี้ ยังมี ความไม่แน่นอนทางการเมืองและกฎระเบียบ รัฐบาลชุดถัดไปหรือรัฐสภาอาจเขียนกรอบกฎหมายของ SBR ใหม่ บังคับขายสินทรัพย์ หรือหยุดการเข้าซื้อกิจการ ซึ่งจะทำให้เกิดกลไก "การขายแบบบังคับ" (fire-sale dynamics) สุดท้ายนี้ การที่รัฐบาลทำหน้าที่เป็นทั้งผู้ตัดสินและผู้เข้าร่วมตลาด ทำให้เกิด ความกังวลเกี่ยวกับผลประโยชน์ทับซ้อน ธุรกรรมสำรองขนาดใหญ่ที่มองเห็นได้อาจถูกมองว่าเป็นการเคลื่อนไหวของ "คนใน" ซึ่งบ่อนทำลายความสมบูรณ์ของตลาดและความเชื่อมั่นของสาธารณชน

นี่คือตัวอย่างบางส่วนของปฏิกิริยาเชิงลบที่แผน SBR ของประธานาธิบดีทรัมป์ได้รับตั้งแต่เขาลงนามในคำสั่งบริหาร:

1. สัญลักษณ์ของ "หมูทาลิปสติก" (A Pig in Lipstick): Charles Edwards ผู้ก่อตั้งกองทุนเฮดจ์ฟันด์ Bitcoin Capriole Investments วิพากษ์วิจารณ์ SBR ว่า "ไม่น่าประทับใจ" โดยเรียกมันว่า "หมูทาลิปสติก" เพราะมันเป็นเพียงการเปลี่ยนชื่อเหรียญที่กระทรวงการคลังมีอยู่แล้ว—โดยไม่มีแผนการซื้อใหม่

2. ผลกระทบที่น่าสงสัยหากไม่มีแผนการซื้อ: Andrew O’Neill จาก S&P Global Ratings เตือนว่าคำสั่งนี้ "เป็นสัญลักษณ์เป็นหลัก" โดยระบุว่าไม่มีกำหนดเวลาหรือกลไกที่ชัดเจนในการซื้อ Bitcoin ใหม่ ซึ่งจำกัดประสิทธิภาพของทุนสำรองนอกเหนือจากการเป็นกลยุทธ์ประชาสัมพันธ์

3. ความกังวลเรื่องความโปร่งใสและการกำกับดูแล: Jason Yanowitz ผู้ร่วมก่อตั้ง Blockworks เตือนว่าหากไม่มีการตรวจสอบอิสระและการรายงานต่อสาธารณะเป็นประจำ การเลือกและการจัดการสินทรัพย์คริปโตมีความเสี่ยงที่จะเป็นไปตามอำเภอใจ ซึ่งบ่อนทำลายทั้งความเชื่อมั่นของตลาดและความน่าเชื่อถือของ SBR

4. ความกลัวเรื่องผลประโยชน์ทับซ้อน: นักวิจารณ์ชี้ให้เห็นถึงความสัมพันธ์ทางการเมืองและทางธุรกิจของทรัมป์กับผู้บริจาคคริปโตและกิจการ meme-coin โดยเรียกร้องให้มีกฎการกำกับดูแลที่เข้มงวดเพื่อป้องกันไม่ให้ SBR กลายเป็นเครื่องมือในการ "ปั่น" มูลค่าสินทรัพย์สำหรับคนใน แทนที่จะเป็นเครื่องมือป้องกันความเสี่ยงของชาติอย่างแท้จริง

ข้อคิดสุดท้าย

การเข้าสู่ขอบเขตของทุนสำรองอธิปไตยของ Bitcoin แสดงถึงการเปลี่ยนแปลงกระบวนทัศน์ โดยผสมผสานนวัตกรรมดิจิทัลเข้ากับการจัดการทุนสำรองแบบดั้งเดิม แม้ว่าการดำเนินการจะต้องอาศัยการเก็บรักษาที่แข็งแกร่ง การปฏิบัติตามข้อกำหนด และความร่วมมือระหว่างหน่วยงาน แต่ SBR ของสหรัฐฯ อาจปูทางไปสู่การยอมรับการสำรองสินทรัพย์ดิจิทัลที่กว้างขึ้นทั่วโลก

โปรดติดตาม BingX Academy เพื่อรับข้อมูลอัปเดตเกี่ยวกับการพัฒนานโยบาย นวัตกรรมการเก็บรักษา และผลกระทบต่อตลาดในขณะที่ความคิดริเริ่มครั้งสำคัญนี้ดำเนินไป

คำถามที่พบบ่อยเกี่ยวกับ Strategic Bitcoin Reserve

1. เงินของผู้เสียภาษีจะถูกนำมาใช้เพื่อเพิ่ม Bitcoin เข้าสู่ SBR ของสหรัฐฯ หรือไม่?

ไม่ SBR ได้รับทุนจากรายได้จากสินทรัพย์ที่ถูกยึดเท่านั้น และกลยุทธ์ "เป็นกลางทางงบประมาณ" ที่ได้รับอนุญาตจากคำสั่งบริหาร

2. สหรัฐฯ จะถือครอง Bitcoin ใน SBR เท่าใด?

เบื้องต้นประมาณ ~200,000 BTC ส่วนการเพิ่มเติมในอนาคตขึ้นอยู่กับกระแสเงินเข้าจากการยึดทรัพย์และการเข้าซื้อที่ได้รับอนุมัติ

3. ประเทศใดบ้างที่จัดตั้ง Strategic Bitcoin Reserves (SBR)?

ใช่ เอลซัลวาดอร์ ภูฏาน และหลายประเทศได้ถือครองหรือขุด Bitcoin เป็นส่วนหนึ่งของทุนสำรองอธิปไตยแล้ว

4. ฉันจะติดตามขนาดของกองทุน SBR ของสหรัฐฯ ได้อย่างไร?

กระทรวงการคลังอาจเผยแพร่รายงานเป็นระยะ แพลตฟอร์มการวิเคราะห์ On-Chain ก็สามารถติดตามที่อยู่ SBR ที่ทราบได้

บทความที่เกี่ยวข้อง

ความผันผวนของ Bitcoin เทียบกับทองคำ | ที่มา: BiTBO

ความผันผวนของ Bitcoin เทียบกับทองคำ | ที่มา: BiTBO การคาดการณ์ราคา Bitcoin | ที่มา: BiTBO

การคาดการณ์ราคา Bitcoin | ที่มา: BiTBO