As of August 2025,

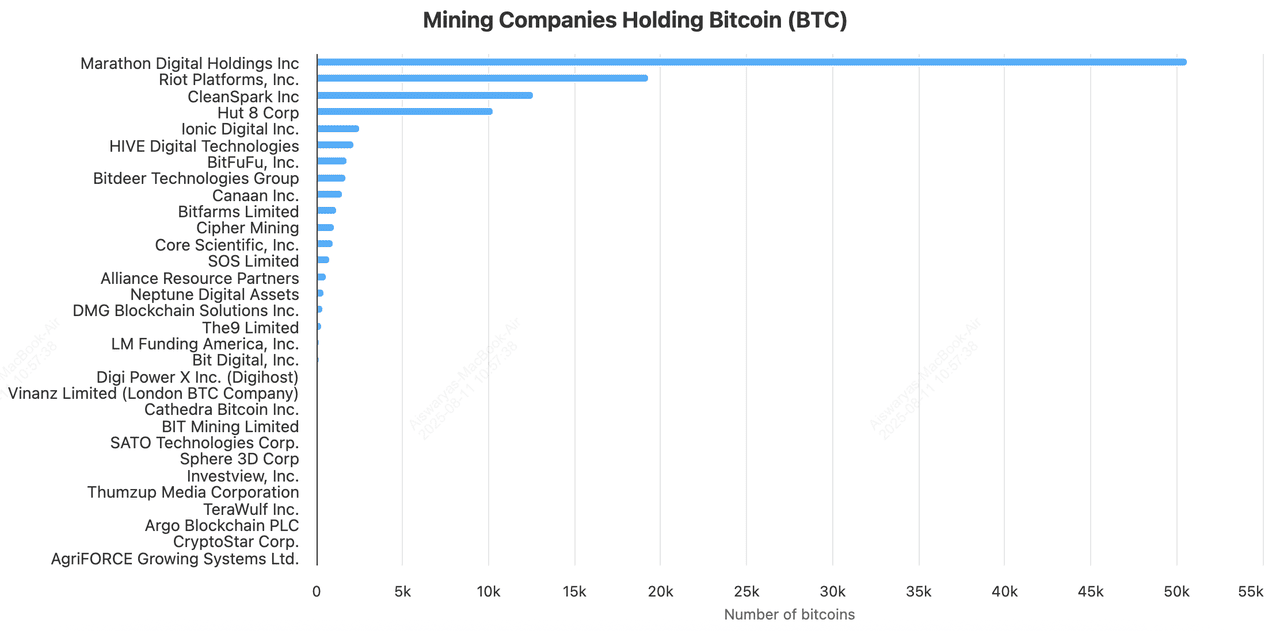

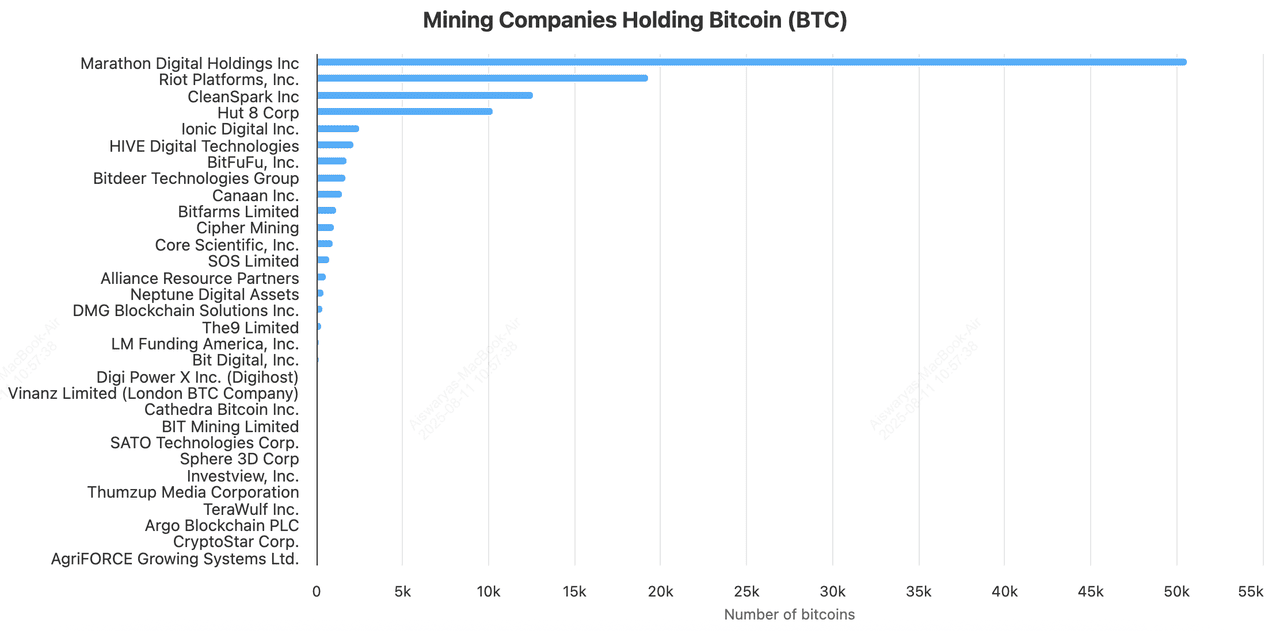

Bitcoin mining stocks are stealing the spotlight, fueled by BTC’s record-breaking rally past $123,000 and forecasts calling for $145,000–$225,000 in the coming cycles. Publicly traded miners collectively hold over 108,763 BTC, worth $13.28 billion, representing 0.52% of Bitcoin’s total supply. Some analysts are even more bullish, with PlanB, creator of the Stock-to-Flow model, projecting that

Bitcoin could eventually reach $1 million, underscoring the long-term leverage that mining stocks offer in a rising market.

BTC holdings of top public Bitcoin mining firms | Source: Bitbo

On July 15, 2025, when

Bitcoin price surged to a new all-time high, these equities outperformed: Marathon Digital jumped almost 10%, CleanSpark gained 7.5%, and peers like Riot Platforms and Core Scientific rose 4–5% in a single trading session. With institutional investors eyeing mining stocks as high-beta proxies for BTC exposure, the sector’s momentum is becoming impossible to ignore. With

Bitcoin dominance holding above 56%, institutional investors are increasingly eyeing mining stocks as high-beta proxies for BTC exposure, making the sector’s momentum harder than ever to ignore.

This article explores the leading publicly traded Bitcoin mining companies, highlighting their operational strengths, expansion strategies, and how they are adapting to emerging trends like

AI integration and renewable energy.

What Are Bitcoin Mining Companies and How Do They Work?

Bitcoin mining companies are businesses that operate large-scale facilities dedicated to validating transactions on the Bitcoin network and securing the blockchain. This process, called proof-of-work (PoW), involves using specialized hardware known as ASIC miners to solve complex mathematical problems. The first miner to solve a block earns a fixed block reward in BTC, plus transaction fees.

While early Bitcoin mining could be done on personal computers, today’s competition requires industrial setups with massive computing power measured in exahashes per second (EH/s). These companies typically:

1. Build or lease data centers in regions with cheap, reliable electricity.

2. Deploy thousands of ASIC miners, often cooled with advanced air or immersion systems.

3. Optimize operations through custom firmware, energy arbitrage, and renewable power sourcing.

4. Manage treasuries by holding mined BTC or selling strategically to cover operating expenses.

Many leading miners also diversify their revenue streams by:

• Offering hosting services for other miners.

• Renting out computing power for AI, cloud, or high-performance computing (HPC) workloads.

• Expanding into renewable energy projects to lower costs and improve ESG profiles.

In essence, Bitcoin mining companies act as the backbone of the BTC network while operating as high-capital, high-efficiency industrial enterprises.

Why Bitcoin Mining Stocks Deserve Your Attention in 2025

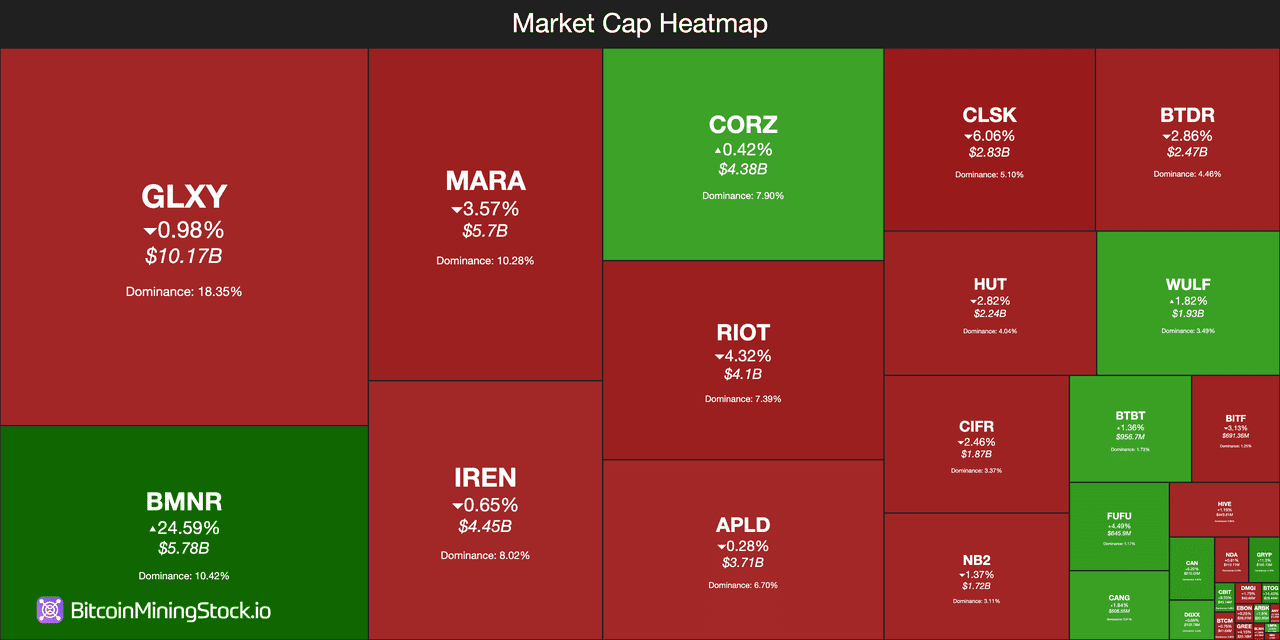

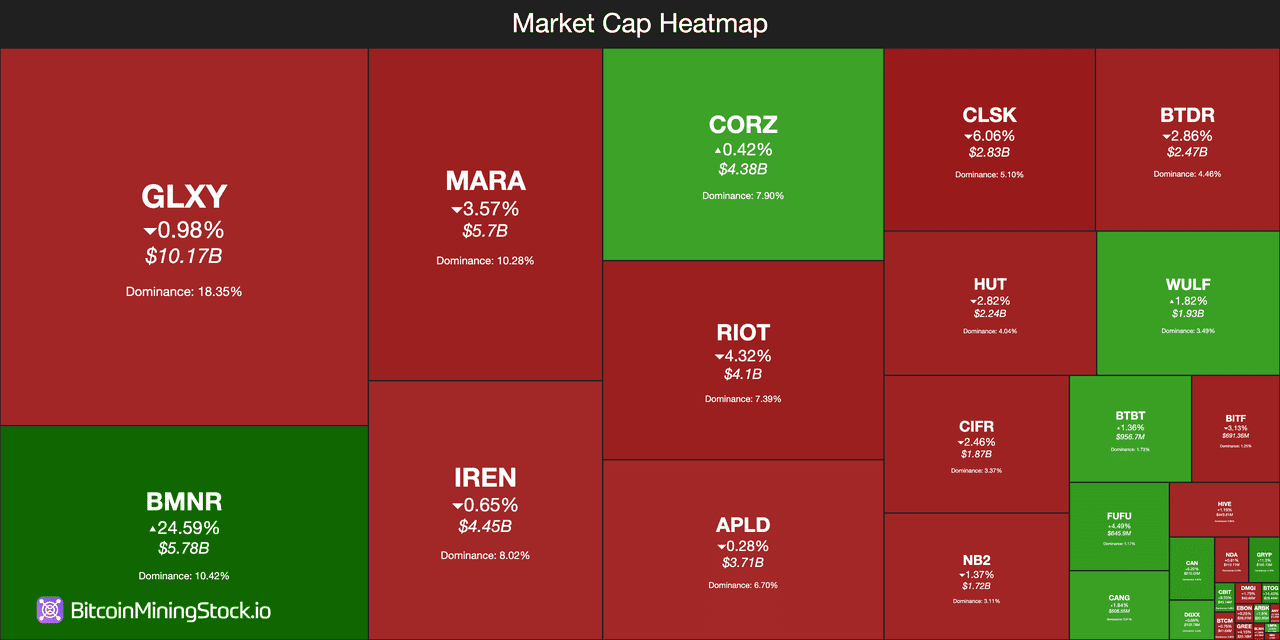

Bitcoin mining stocks are more than just a bet on the cryptocurrency market, they act as a leveraged proxy for Bitcoin’s long-term adoption and network growth. As of August 2025, the combined market capitalization of publicly traded Bitcoin miners stood at $55.42 billion, marking a 0.54% daily increase, with a trading volume of $434.25 million. These companies blend blockchain infrastructure, advanced ASIC hardware, and strategic capital allocation to maximize returns. With BTC touching an all-time high (ATH) above $123,000 and institutional demand accelerating, Bitcoin miners are well-positioned to capture outsized gains while diversifying into high-margin sectors like artificial intelligence (AI) and renewable energy infrastructure.

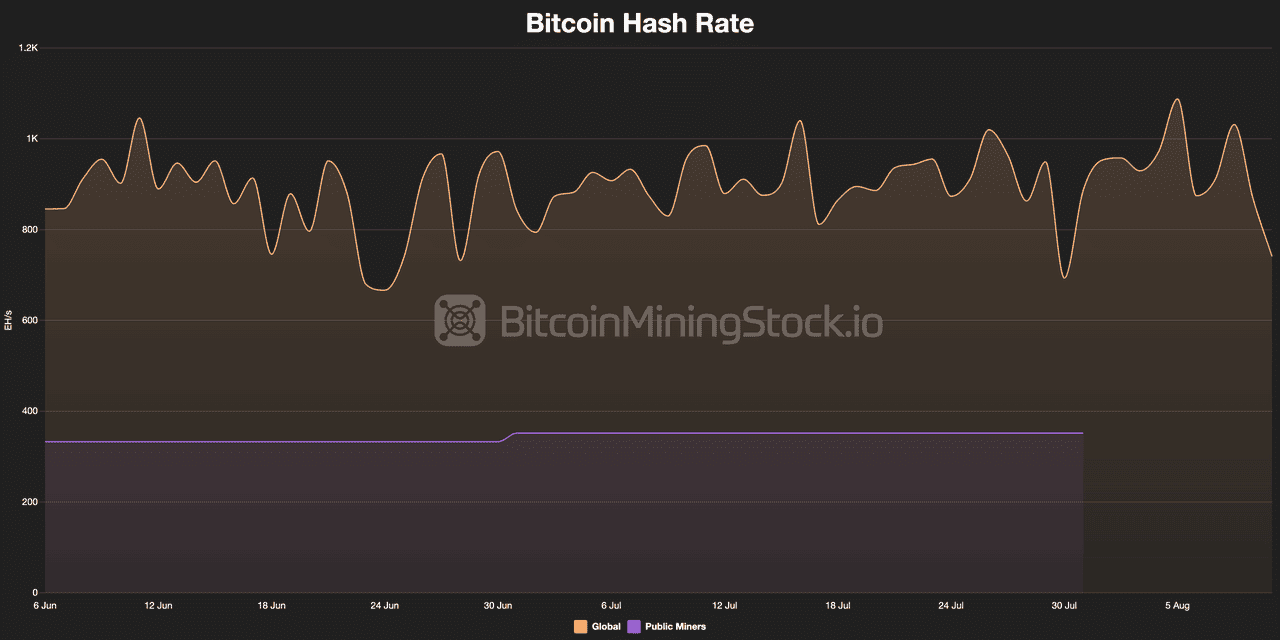

1. Bullish Bitcoin dynamics: Bitcoin’s 2025 rally past $123,500 has lifted average miner revenue per block above $250,000, compared to ~$150,000 in late 2023. Public miners with >10 EH/s capacity, such as Marathon Digital and Riot Platforms, are now generating record monthly BTC production while maintaining lower breakeven costs thanks to next-gen ASIC efficiency.

2. Strategic diversification: To counter the April 2024 halving’s 50% block reward cut, several miners have diversified beyond Bitcoin. Hut 8 and Bitfarms have added AI compute leasing, CleanSpark is expanding into data center colocation, and Cipher Mining is investing in behind-the-meter renewable energy projects to reduce power costs and create parallel revenue streams.

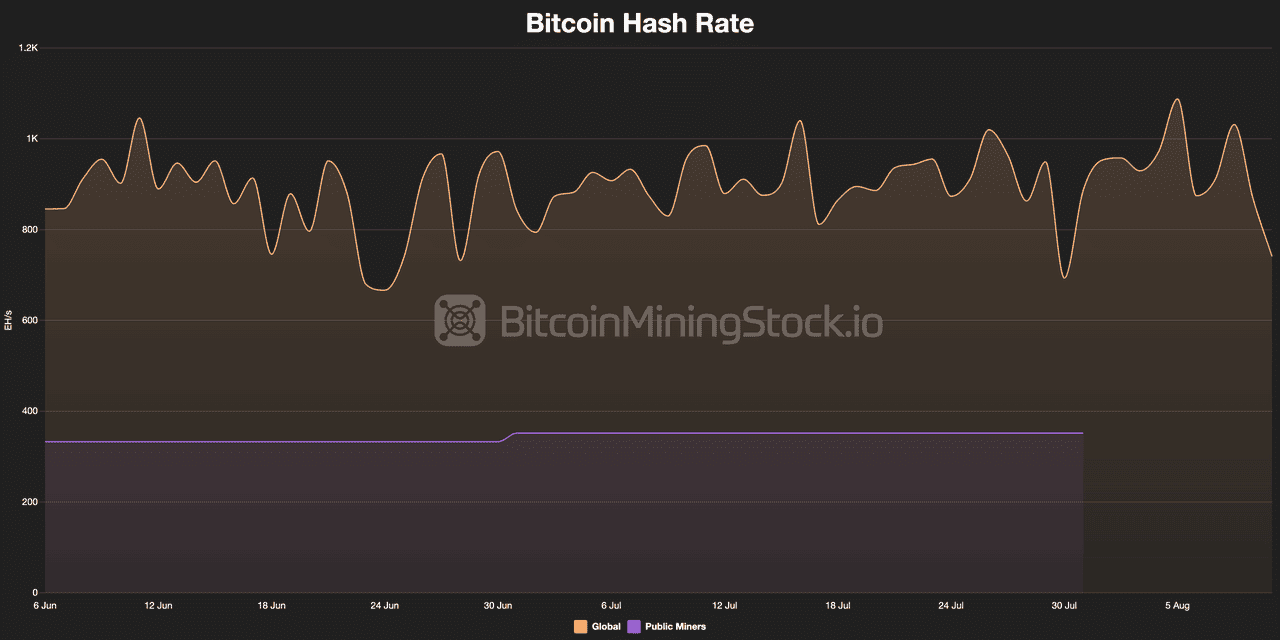

Bitcoin hash rate changes over the past three months | Source: BitcoinMiningStock

3. Capital market confidence: Industry leaders have tapped capital markets aggressively. Marathon Digital raised $750M via zero-coupon convertible notes in early 2025, Riot Platforms secured $500M in similar financing, and CleanSpark issued $300M in equity to boost BTC reserves. This war chest allows them to weather volatility and opportunistically buy distressed assets.

4. Regulatory tailwinds: With the U.S. House Financial Services Committee advancing pro-mining bills and the SEC approving multiple spot Bitcoin ETFs in January 2025, mining equities are benefiting from renewed institutional inflows. The sector’s combined market cap now exceeds $25 billion, with increased analyst coverage and inclusion in crypto equity ETFs.

Top 10 Bitcoin Mining Stocks to Invest in 2025

Bitcoin mining stocks' heatmap | Source: BitcoinMiningStock

The following publicly traded Bitcoin mining companies are leading the industry in scale, technology, and strategic diversification. They combine high hashrate capacity, robust BTC reserves, and expansion into adjacent sectors like AI computing and renewable energy infrastructure, positioning them as key beneficiaries of Bitcoin’s 2025 bull market.

1. MARA Holdings (NASDAQ: MARA)

MARA Holdings, formerly Marathon Digital Holdings, is one of the world’s largest publicly traded Bitcoin miners, with 30.6 EH/s of installed hashrate and 50,639 BTC in reserves as of July 31, 2025. Founded in 2010 and headquartered in Fort Lauderdale, Florida, the company focuses exclusively on Bitcoin mining, operating large-scale data centers in Texas, Nebraska, and North Dakota. Its strategy has traditionally been to “mine and hold” Bitcoin, though it occasionally sells small portions of its production, such as the 1,700 BTC sold in September–October 2023, to cover operating expenses and fund growth initiatives.

The firm’s growth is supported by experienced leadership, with Fred Thiel as Chairman and CEO since 2021, alongside a seasoned executive team managing operations, growth strategy, and technology innovation. In 2025, MARA began expanding into AI-driven high-performance computing (HPC) to monetize excess power capacity and diversify beyond Bitcoin. Infrastructure projects exceeding 200 MW are designed to maintain profitability post-halving, while a market cap north of $8 billion and low debt ratios provide financial flexibility. MARA’s rising Bitcoin reserves, up from 25,945 BTC in September 2024 to over 50,000 BTC in mid-2025, demonstrate its operational efficiency and ability to capitalize on bullish Bitcoin market dynamics.

2. Riot Platforms (NASDAQ: RIOT)

Riot Platforms, Inc. (NASDAQ: RIOT) is one of the largest publicly traded Bitcoin mining and digital infrastructure companies in North America, with 19,287 BTC in reserves as of July 31, 2025. Headquartered in Castle Rock, Colorado, Riot operates a 35.5 EH/s deployed hash rate across facilities in Texas and Kentucky, supported by vertically integrated operations in electrical engineering and fabrication. Its flagship Rockdale, TX facility remains the continent’s largest Bitcoin mining site by capacity, while the Corsicana, TX expansion covers 858 acres and is positioned for 1.0 GW of available power.

In July 2025 alone, Riot produced 484 BTC at an all-in power cost of just $28/MWh (2.8¢/kWh), among the lowest in the industry, while generating $13.9 million in total power credits from ERCOT grid-balancing and demand-response programs. The company maintains a strong fleet efficiency of 21.2 J/TH, reflecting ongoing optimization of ASIC deployments.

In 2025, Riot strategically paused portions of the Corsicana buildout to pursue AI and high-performance computing (HPC) hosting, targeting the fast-growing demand for AI compute infrastructure. This diversification leverages its long-term, fixed-rate power contracts, allowing the company to monetize both Bitcoin mining and emerging HPC workloads.

3. CleanSpark (NASDAQ: CLSK)

CleanSpark Inc. (NASDAQ: CLSK) is a leading U.S.-based Bitcoin miner that reached a record 50 EH/s operational hashrate in June 2025, becoming the first public company to achieve the milestone exclusively using American infrastructure. The firm now controls roughly 5.8% of the global Bitcoin network hashrate, powered primarily by low-carbon and renewable energy sources. As of June 30, 2025, CleanSpark holds 12,703 BTC in its treasury, worth approximately $1.48 billion, ranking it as the ninth-largest public Bitcoin holder globally.

In fiscal Q3 2025 (April–June), CleanSpark reported its most profitable quarter ever, with revenue of $198.6 million (up 91% year-over-year) and net income of $257.4 million, compared to a $236.2 million loss a year earlier. The company’s operational model funds all expenses from monthly Bitcoin production, avoiding dilution from equity raises, while steadily expanding its BTC reserves.

CleanSpark’s growth is fueled by strategic fleet expansion, including the acquisition of over 100,000 next-gen ASIC miners, and operational efficiency gains that bolster throughput and profitability. With a market capitalization of about $4.5 billion, the company is also exploring renewable-powered AI and high-performance computing (HPC) hosting, positioning itself to diversify revenue streams while maintaining leadership in sustainable Bitcoin mining.

4. Core Scientific (NASDAQ: CORZ)

Core Scientific (NASDAQ: CORZ) is one of North America’s largest Bitcoin mining and high-performance computing (HPC) infrastructure providers, with over 20 EH/s of self-mining capacity and 1.2 GW of data center infrastructure. Since emerging from Chapter 11 bankruptcy in 2023, the company has expanded its role beyond crypto, hosting AI workloads for clients like OpenAI and Microsoft. This dual exposure to BTC mining and AI/HPC gives it a diversified revenue model and positions it to capitalize on both Bitcoin price cycles and the rising demand for AI compute.

In July 2025, Core Scientific agreed to a $9 billion all-stock acquisition by CoreWeave, offering a 66% premium to its pre-announcement share price. The deal would fold its infrastructure into CoreWeave’s AI operations and cancel a prior $10 billion hosting agreement. However, the proposal faces resistance from Two Seas Capital, the largest active shareholder with a 6.3% stake, which argues the offer undervalues the company and exposes investors to CoreWeave’s stock volatility. Shares have gained 46.7% in the past year, reflecting investor confidence in its growth prospects regardless of the deal’s outcome.

5. Iren Limited (NASDAQ: IREN)

Iren Limited (NASDAQ: IREN), formerly Iris Energy, is a Sydney-based Bitcoin miner and renewable-powered data center operator founded in 2018 by brothers Will and Daniel Roberts. The company operates entirely on renewable energy, primarily hydroelectric, and has rapidly scaled to become the leading mining company by hashrate. By June 30, 2025, IREN reached its targeted 50 EH/s capacity, with an average realized hashrate of 45.4 EH/s in July. That month, it produced 728 BTC, surpassing Marathon Digital’s 703 BTC, while utilizing over 90% of its fleet. July also marked record monthly revenue of $86 million, with hardware profits of $66 million, thanks to strong Bitcoin mining economics.

While mining remains its core business, IREN has strategically diversified into AI-optimized high-performance computing (HPC). Since late 2024, the firm has invested in liquid-cooled NVIDIA H100 and H200 GPU infrastructure, growing its AI Cloud revenue by 33% quarter-on-quarter in Q3 2025. Flagship AI data center projects like Horizon One and Sweetwater reflect its pivot toward high-margin compute services, with $2.3 million in AI revenue recorded in July alone. This dual-revenue model, underpinned by a 100% renewable energy commitment, positions IREN as both a top-tier Bitcoin miner and a green infrastructure provider for the surging AI market, mitigating exposure to BTC price volatility while tapping into new growth verticals.

6. Bitdeer Technologies (NASDAQ: BTDR)

Bitdeer Technologies (NASDAQ: BTDR), founded by former Bitmain co-founder Jihan Wu, is among the fastest-scaling Bitcoin mining companies in the public markets. As of June 2025, it operates at 16.5 EH/s of self-mining capacity, with a bold target to expand to 40 EH/s by October 2025. The company runs a global network of data centers in North America, Norway, and Bhutan, offering both proprietary mining and hosting services. In June, Bitdeer increased self-mined Bitcoin output by 4% and deployed its in-house SEALMINER ASICs, underscoring its push toward vertical integration through low-cost power projects and proprietary chip innovation.

Beyond mining, Bitdeer is investing heavily in AI cloud computing, leveraging its global infrastructure and energy agreements to host machine learning and HPC workloads. Analysts have recently turned more optimistic ahead of its Q2 2025 earnings call on August 18, anticipating a potential EPS beat despite revenue and earnings headwinds. The company’s long-term projections target $1.6 billion in revenue and $225 million in earnings by 2028, implying a 75% CAGR, though margin pressure from high R&D and operational costs remains a key risk. With strong leadership, technology deployment momentum, and a diversified business model, Bitdeer remains one of the most ambitious and globally positioned plays in Bitcoin mining and AI infrastructure.

7. Hut 8 Mining (NASDAQ: HUT)

Hut 8 Mining (NASDAQ: HUT) has transformed from a pure-play Bitcoin miner into a vertically integrated energy and digital infrastructure platform. As of June 30, 2025, the company managed 1,020 MW of energy capacity across 15 sites, with a 10,800 MW development pipeline, including 3,100 MW under exclusivity, anchored by AI-ready infrastructure initiatives. Q2 2025 revenue rose 17% year-over-year to $41.3 million, driven by a $16.4 million boost in Bitcoin mining revenue from infrastructure upgrades and favorable market conditions. Nearly 90% of its energy capacity is now under contracts of one year or longer, a sharp rise from less than 30% in Q2 2024, thanks to strategic deals with American Bitcoin and Bitmain.

The company’s “Power First” strategy prioritizes long-term, contracted revenue while enabling scalable growth in AI and HPC workloads. Its majority-owned subsidiary, American Bitcoin Corp., currently contributes 10.2 EH/s of mining capacity, with potential to scale to 50 EH/s. Hut 8 has also expanded its credit facility to $130 million at favorable terms, executed innovative Bitcoin-backed financing structures, and grown institutional ownership from 12% to 55% in just over a year. Coupled with a 10,667 BTC treasury and a spin-off plan for its hosting and data services business, Hut 8 is positioning itself as both a leader in Bitcoin mining and a major player in the next generation of AI-driven digital infrastructure.

8. TeraWulf (NASDAQ: WULF)

TeraWulf sources over 90% of its energy from zero-carbon power, including nuclear and hydro, enabling low-cost operations and aligning with ESG-focused investor priorities. In Q2 2025, the company reported $82 million in revenue, driven by higher hash computation services, and expanded its capacity to 245 MW across five buildings at its Lake Mariner Facility in New York. The recent acquisition of Beowulf Electricity & Data LLC integrated power generation into its operations, further enhancing efficiency and cost control.

The company’s WULF Compute division is spearheading diversification into high-performance computing (HPC) hosting, colocation, and GPU-based workloads. With 90%+ renewable energy sourcing, scalable infrastructure, and active plans to expand HPC hosting at Lake Mariner, TeraWulf is positioning itself as both a competitive Bitcoin miner and a sustainable AI infrastructure provider, targeting high-density compute markets where energy cost and carbon footprint are critical factors.

9. Cipher Mining (NASDAQ: CIFR)

Cipher Mining ended July 2025 with a 20.4 EH/s operating hashrate, producing ~214 BTC and holding ~1,219 BTC in reserves after selling ~52 BTC for treasury management. The company’s Black Pearl Phase I site, representing 150 MW of a planned 300 MW, began contributing meaningfully to production ahead of schedule and now accounts for roughly 24% of monthly output. With two fully funded orders for latest-generation rigs, Cipher expects to boost self-mining capacity to ~23.5 EH/s by Q3 2025.

Beyond mining scale, Cipher is positioning itself for future high-performance computing (HPC) demand through strategic infrastructure design at Black Pearl Phase II, allowing rapid conversion for AI compute or continued bitcoin mining. With a 2.6 GW project pipeline, $172.5 million raised via convertible notes, and a dual focus on industrial bitcoin mining and HPC hosting, Cipher is targeting both near-term post-halving profitability and long-term data center market growth.

10. Phoenix Group (ADX: PHX)

Phoenix Group, the largest Bitcoin miner in the MENA region and a top 10 miner globally, operates over 500 MW of capacity across the UAE, U.S., Canada, Oman, and Ethiopia, including the region’s largest mining farm. In Q2 2025, the company generated $29 million in revenue, mined 336 BTC at a 31% gross margin, and reduced energy costs by 14%, reinforcing its position as one of the most efficient miners in the industry. It holds a substantial $150M+ digital asset treasury, 514 BTC and over 630,000 SOL, making it the first ADX-listed company to formalize such a reserve.

The company’s strategic evolution now extends beyond mining into AI and high-performance computing (HPC). With a target of 1 GW of hybrid infrastructure by 2027, Phoenix is repurposing U.S. facilities and scouting global sites to capture the surging demand for compute power. Backed by the IHC ecosystem, nearly debt-free with just $16M in obligations, and supported by strong government and institutional relationships, Phoenix combines scale, financial resilience, and diversification. H.C. Wainwright & Co. reaffirmed a “Buy” rating with a AED 3.00 target, more than 100% above its early August price, reflecting investor confidence in its expansion strategy and long-term growth outlook.

Key Factors to Consider Before Adding Bitcoin Mining Stocks to Your Portfolio

Before investing in Bitcoin mining companies, it’s important to weigh the unique risks and market dynamics that can significantly impact their performance.

• High Volatility – Bitcoin mining stocks often move more sharply than BTC itself, amplifying both gains and losses. Careful entry timing and disciplined risk management are critical.

• Operational Cost Pressures – Rising electricity prices, hardware upgrades, and halving events can reduce mining profitability and compress margins.

• Infrastructure Competition – AI and high-performance computing (HPC) data centers compete for the same power sources and grid capacity, which can limit miners’ ability to scale.

• Regulatory Uncertainty – Shifting global and local crypto regulations can affect licensing, taxation, and overall operational viability.

If you prefer direct exposure to Bitcoin without the operational risks of mining companies, consider buying BTC directly on BingX, where BingX AI provides real-time market insights, sentiment analysis, and trade optimization to help you make informed decisions.

Closing Thoughts: Outlook for Investors

Bitcoin’s ongoing bull cycle and growing institutional adoption through ETFs could create favorable conditions for select Bitcoin mining stocks, particularly those expanding into AI, renewable energy, and strategic treasury management.

However, mining equities remain highly sensitive to Bitcoin price swings, energy market shifts, and regulatory developments. A balanced approach, focusing on companies with efficient operations, strong balance sheets, and adaptable growth strategies, can help manage these risks while positioning for potential upside.

Related Reading