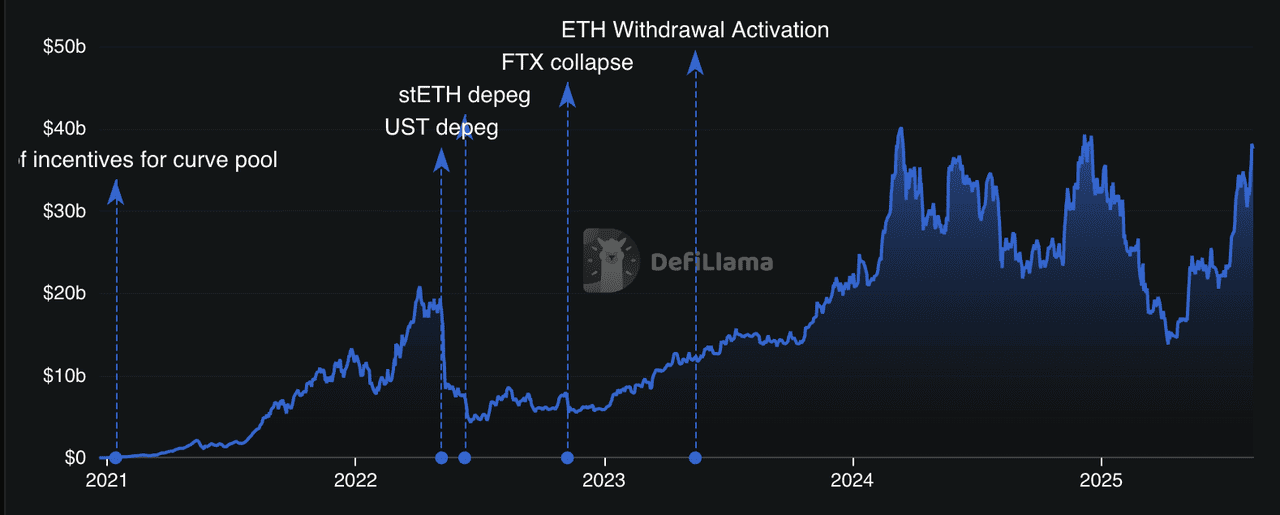

With over $38 billion in total value locked (TVL) and more than 800 node operators globally, Lido has emerged as the largest

liquid staking protocol in the

Ethereum ecosystem. Since its launch in 2020, the platform has enabled users to stake any amount of

ETH while retaining liquidity through its

liquid staking token (LST), stETH. Whether you want to earn staking rewards, use staked assets in DeFi, or participate in protocol governance with LDO, Lido serves up a seamless and secure staking experience.

Lido Finance TVL | Source: DefiLlama

In this guide, you’ll discover what

Lido (LDO) is, how its staking model works, the role of the Lido DAO and LDO token, key security considerations, and the various ways stETH can be used across the DeFi ecosystem.

What Is Lido DAO and What Sets It Apart?

Lido DAO is the decentralized autonomous organization (DAO) that governs the

Lido Finance liquid staking protocol. As of August 2025, Lido has distributed more than $4.22 billion in staking rewards since launching in 2020. Governance is powered by the LDO token, where each token represents voting power.

The DAO’s operations are structured through Aragon, a leading DAO framework, and streamlined with tools like Easy Track, which enables faster approval of routine proposals such as validator onboarding or parameter updates without requiring full community votes. The validator network is extensive, with 800+ independent node operators participating via both permissioned and permissionless modules. Lido’s validator set consistently delivers high performance, recording 98.14% network performance and 97.50% participation according to Rated Network data.

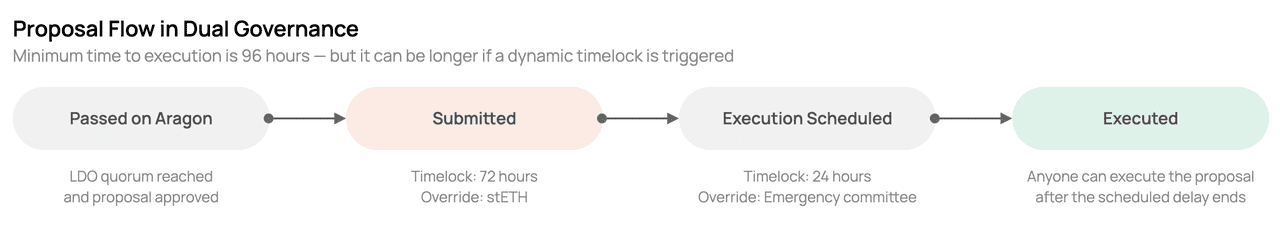

In 2025, Lido introduced a Dual Governance model, an industry-first for liquid staking. This upgrade gives stETH holders, not just LDO holders, a direct voice in decision-making. Under this model, stETH holders can activate timelocks to delay controversial proposals and use a “rage-quit” mechanism to exit governance changes they fundamentally oppose. This ensures that both governance token holders and the primary users of the protocol’s staking service have meaningful influence over its future.

Security and decision-making safeguards go even further. Lido DAO now employs extended two-phase voting to allow for deeper community review, an emergency GateSeal function to pause harmful proposals before execution, and specialized expert committees for technical, security, and financial oversight. These measures are designed to balance agility with robust checks, ensuring that protocol upgrades, validator selections, and treasury allocations are made with broad consensus and minimal risk to users.

How Lido DAO Powers Lido’s Liquid Staking Operations

Lido DAO is the decentralized decision-making body behind Lido Finance, overseeing everything from staking mechanics to treasury management. It ensures that Lido’s $38+ billion in TVL is managed securely, efficiently, and transparently while keeping the protocol competitive in Ethereum’s rapidly growing liquid staking market.

At the core of Lido’s service is its staking process. Users can stake any amount of ETH, no need to meet Ethereum’s 32 ETH validator requirement, through the Lido platform. In return, they receive stETH, a token that represents their staked ETH plus accrued rewards. The stETH token, Ethereum’s most widely used liquid staking token, is integrated into 100+ DeFi platforms including

Curve,

Aave,

Balancer, and

Uniswap.

Liquidity reserves (Value of paired tokens) | Source: Dune analytics

This token’s balance increases automatically as staking rewards are generated, allowing users to earn yield while keeping their assets liquid.

Unlike traditional staking, stETH can be traded, lent, restaked, or deployed across DeFi platforms like Curve, Aave, and Uniswap to generate additional returns, boosting overall capital efficiency.

Security and decentralization are baked into the protocol. Funds are held in a non-custodial smart contract, with deposits distributed among a curated network of professional validators to reduce single points of failure. The protocol is open-source, regularly audited by firms such as Certora and Quantstamp, and supported by a bug bounty program to encourage continuous security improvements.

The DAO governs all operational and financial aspects of Lido Finance. This includes:

• Validator selection and performance monitoring to maintain network security.

• Treasury management, with a Resourcing and Compensation Committee allocating funds, often in stablecoins, to maintain contributor payments, fund development, and support ecosystem integrations.

• Protocol upgrades, such as staking module expansions or reward distribution changes, determined through a three-step governance process: open community discussion, off-chain Snapshot voting, and on-chain execution.

How Lido DAO's Decentralized Governance Works

Proposal flow in Lido's dual governance model | Source: Lido DAO

Governance decisions on Lido DAO are transparent and data-backed. Public dashboards on Dune Analytics track validator performance, staking yields, and treasury flows in real time. The DAO has also implemented safeguards like Dual Governance, giving stETH holders the power to delay or block proposals via timelocks or a “rage-quit” option. Additional tools include two-phase voting for complex proposals and an emergency GateSeal function to halt harmful actions before they’re executed.

However, there are legal and organizational considerations. In late 2024, a U.S. court ruling classified Lido DAO as a general partnership, potentially exposing tokenholders and venture backers to liability under securities law. While this does not impact the protocol’s technical operations, it underscores the evolving regulatory risks facing DAOs and liquid staking providers.

What Is LDO, Lido's Governance Token?

LDO is the native governance token of Lido DAO, giving holders direct influence over one of the largest liquid staking protocols in the world. By holding LDO, you gain voting rights on crucial decisions such as setting staking fee percentages (currently 10% on rewards), onboarding or removing validator operators, managing the DAO’s multi-billion-dollar treasury, and approving protocol upgrades that shape the platform’s long-term roadmap. Voting power is proportional to the number of LDO tokens held, meaning larger stakes carry greater influence in governance outcomes.

The governance process is conducted through Aragon, a leading DAO framework, and supported by Easy Track, a proposal fast-tracking system for routine changes like validator performance adjustments. This combination ensures both transparency and efficiency in decision-making.

Beyond governance, LDO indirectly supports the protocol’s sustainability. Service fees generated by Lido’s staking operations are directed into the DAO treasury, which funds core development, security audits, bug bounties, insurance reserves, ecosystem growth programs, and community grants. In effect, LDO holders act as stakeholders in a decentralized financial network, collectively steering the protocol while ensuring it remains secure, competitive, and aligned with the interests of both ETH stakers and DeFi users.

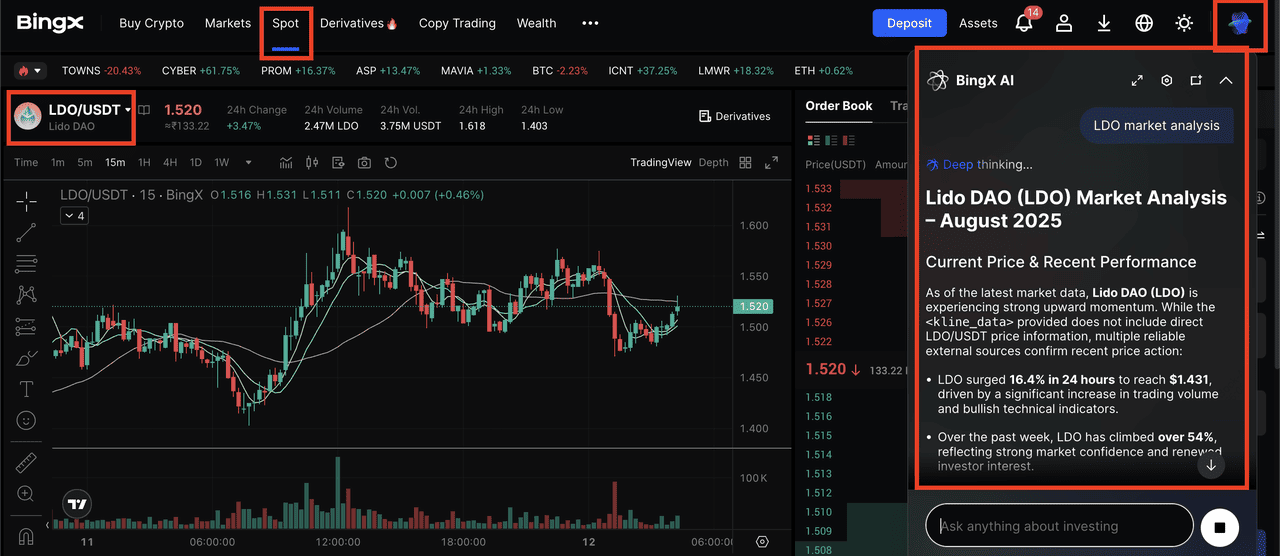

How to Trade Lido (LDO) Token on BingX

LDO, the governance token of Lido DAO, can be traded on BingX through both the Spot Market and the Perpetual Futures Market, giving you flexibility whether you’re looking to hold for the long term or trade short-term price swings. BingX also offers AI-powered analysis tools that help identify better trade setups and manage risk more effectively.

1. Buy, Sell, or Hold LDO on BingX Spot Market

LDO/USDT trading pair on the spot market with BingX AI insights

Spot trading is best suited for users who want to accumulate LDO over time, hold it for governance participation, or keep it as part of a diversified crypto portfolio without worrying about leverage or liquidation risk.

• You can buy instantly at the current market price or use a

limit order to set your preferred entry price.

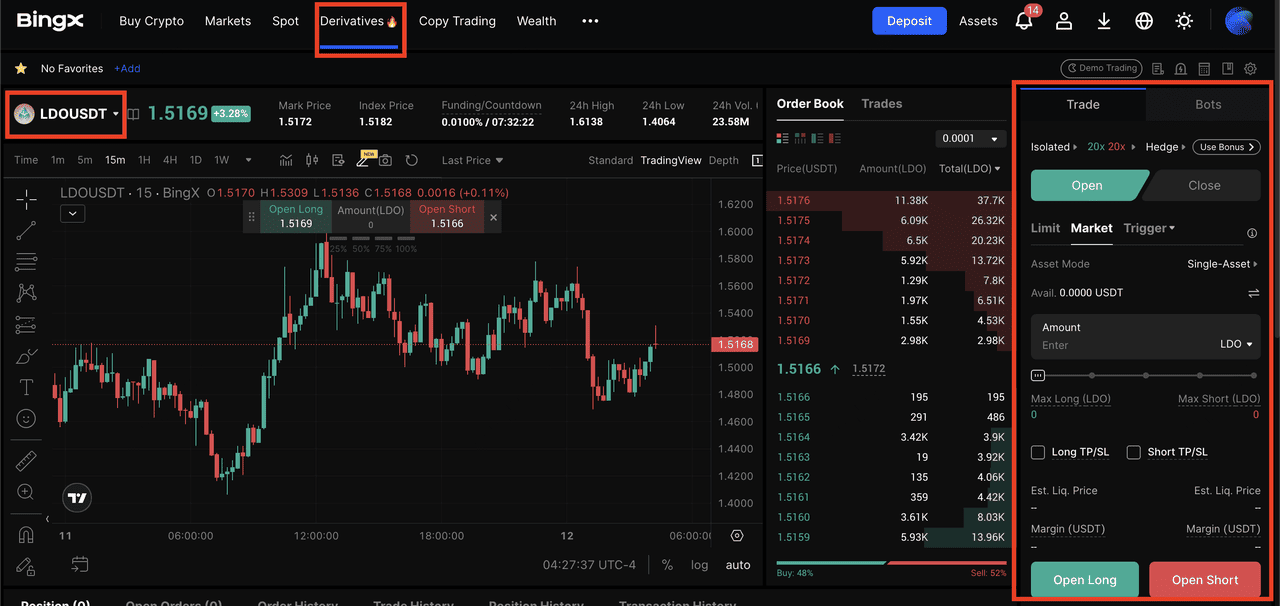

2. Go Long or Short on LDO Perpetual Futures

LDO/USDT perpetual futures contract on BingX futures market

Perpetual contracts have no expiry date, but leveraged trading increases risk, so it’s important to use stop-loss orders and size positions carefully to protect your capital.

• This allows you to go long if you expect the price to rise or short if you think it will fall, using leverage to potentially amplify returns.

With

BingX AI, you can trade LDO more strategically by clicking the AI icon on the chart to access automated analysis. The tool pinpoints key support and resistance levels, tracks trend direction, and flags market-moving events like Ethereum staking adoption updates, governance proposals, or regulatory shifts. By combining these insights with your own research, you can refine entry points, take-profit targets, and stop-loss levels, helping to avoid impulsive decisions. Backed by real-time data, AI-driven analysis, and low fees, BingX gives both beginners and experienced traders an analytical edge in the market.

Final Takeaway

Lido remains a leading force in Ethereum’s staking ecosystem, combining liquid staking with evolving governance, strong security measures, and transparent operations. The protocol’s position has been further reinforced by growing institutional interest, particularly following the approval of

spot Ethereum ETFs and discussions around potential

Ethereum staking ETFs, which could drive greater demand for liquid staking solutions like Lido.

With LDO trading supported by

AI tools on BingX, users can access market opportunities with added analytical insights. That said, potential participants should carefully consider both legal and technical risks, as well as market volatility, before engaging with the protocol or its token.

FAQs on Lido (LDO) and stETH

1. Is Lido staking safe?

Lido is designed to be secure and

non-custodial, meaning your funds remain in your control and aren’t held by a centralized intermediary. Its code is open-source, audited by leading firms like Certora and Quantstamp, and staked ETH is distributed across a decentralized network of vetted validators. However, risks such as smart contract bugs, validator slashing penalties, and temporary stETH price deviations can still occur, so users should stake with awareness.

2. What can you do with stETH, Lido's liquid staking token (LST)?

stETH can be traded on exchanges for immediate liquidity without waiting for the staking lock-up to end. You can also use it as collateral in lending platforms, provide liquidity in DeFi pools, or participate in restaking and third-party yield strategies for extra rewards. With over 100 integrations, including Curve, Aave, Uniswap, and

MetaMask, stETH offers one of the broadest utility ranges in DeFi.

3. What is the role of the LDO token in Lido Finance?

In Lido Finance’s liquid staking ecosystem, the LDO token serves as the governance backbone of the protocol. Holding LDO grants you the ability to vote on key decisions such as protocol upgrades, staking fee adjustments, onboarding or removing validators, and allocating funds from the DAO’s treasury. Voting power is proportional to your LDO holdings, ensuring that those most invested in the protocol have a stronger voice. This governance model keeps Lido community-driven and ensures that its development and operations align with the interests of stakers, validators, and the wider ecosystem.

4. How does Lido DAO's decentralized governance work?

Lido DAO uses a transparent, three-step governance process: forum discussions, off-chain Snapshot voting, and on-chain execution for approved proposals. Recent governance upgrades like Dual Governance allow stETH holders to challenge or delay proposals they find concerning. This layered approach balances efficiency with safeguards against hasty or risky changes.