PumpBTC has quickly become one of the most talked-about projects in

Bitcoin DeFi (BTCFi), with its governance token PUMP (PUMPBTC on BingX) surging over 400% in the past month and trading volumes spiking more than 1,300% in 24 hours. This momentum reflects growing demand for Bitcoin

liquid staking and DeFi integrations, as users look for ways to earn yield on

BTC without giving up liquidity. With a market cap of over $61 million and expanding multi-chain support, PumpBTC is positioning itself as a key player in the emerging BTCFi ecosystem.

At its core, PumpBTC is a

Bitcoin liquid-staking protocol powered by

Babylon, a shared-security network that enables BTC holders to stake native Bitcoin directly on L1. In return, users receive pumpBTC, a transferable liquidity token that’s fully backed 1:1 by BTC held in custody and delegated to Babylon’s finality providers. This structure lets BTC

earn staking rewards while remaining usable across EVM chains for lending, liquidity pools, and other DeFi strategies, all underpinned by institutional custodianship and audited smart contracts.

This article explores PumpBTC’s Babylon-powered Bitcoin liquid staking, the PUMPBTC governance token, how pumpBTC works across EVM DeFi, security and tokenomics, trading on BingX, and key risks to know.

What Is PumpBTC Bitcoin Liquid Staking Protocol?

PumpBTC lets you stake BTC once, keep liquidity everywhere: deposit BTC (or wrapped forms like WBTC/BTCB) → receive pumpBTC 1:1 on an EVM chain → custodians delegate equivalent native BTC to Babylon finality providers → you collect Babylon staking rewards while using pumpBTC across DeFi. Unstake via standard queue, fee-light or instant, fee-based exits. Contracts are BlockSec-audited; custody is handled by Cobo and Coincover with on-chain transparency for proof of assets.

PumpBTC is expanding its footprint across major EVM chains like

Ethereum and

BNB Chain, with Base,

Berachain, and Layer 2 integrations on the horizon to boost utility. Backed by a $10 million seed round in October 2024 led by SevenX Ventures and Mirana Ventures with support from UTXO and

Mantle, the project continues to attract strong investor confidence. Seasonal points snapshots, starting with Season 1 on January 1, 2025, have become key catalysts for user activity and on-chain engagement.

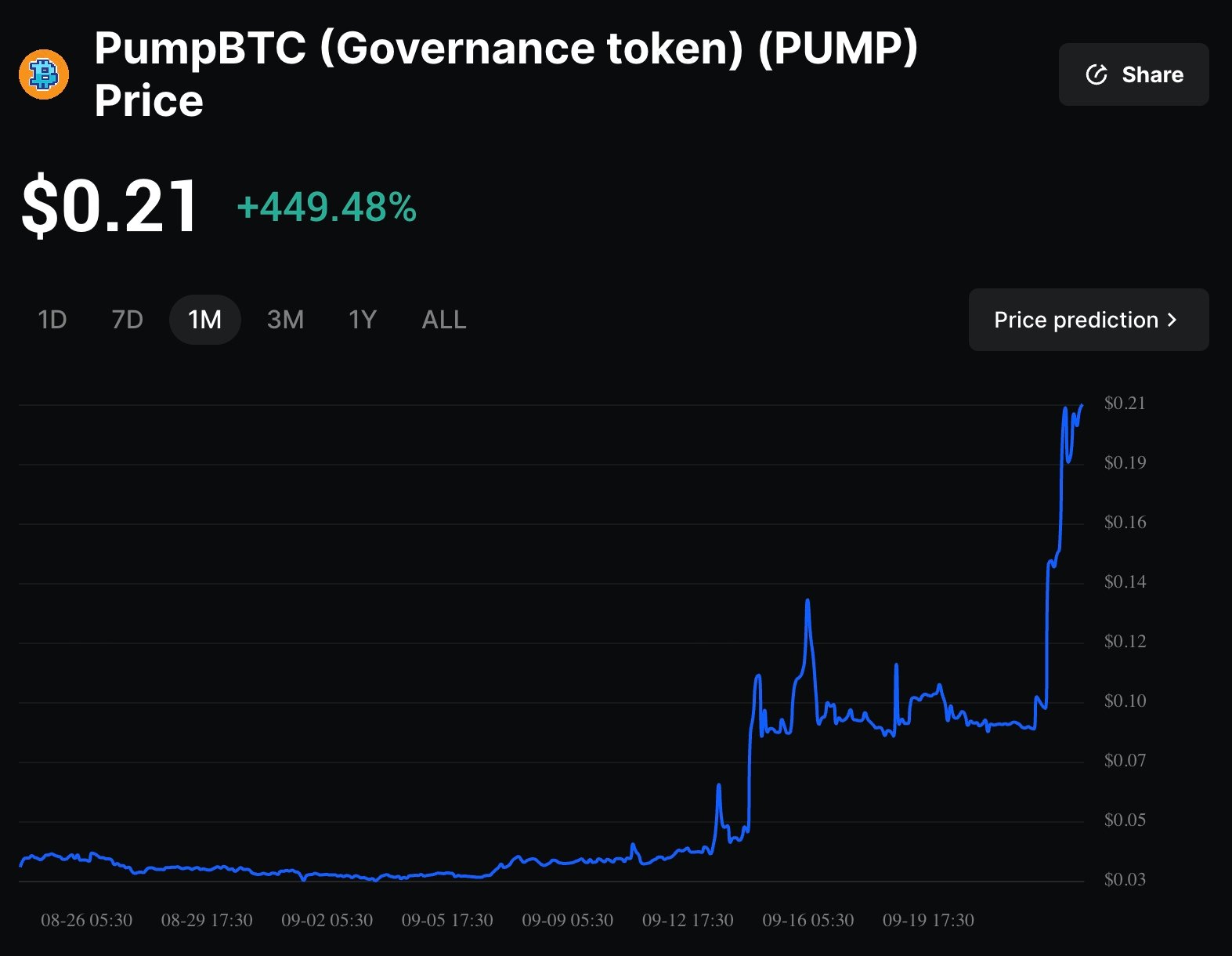

PUMPBTC Token Surged Over 400% in September 2025

PUMPBTC price surges by over 400% in one month | Source: BingX

PUMP’s price has surged thanks to growing momentum around Babylon staking, which underpins PumpBTC’s model, alongside fresh DeFi integrations and trading activity spikes. Each milestone, whether it’s Babylon updates, seasonal points programs, or new listings, tends to drive investor interest in the governance token, concentrating liquidity and attention around protocol growth.

The numbers back this up: pumpBTC's governance token PUMP is ranked #490 with a $61.78 million market cap. Its price has jumped 409% in the last month and 132% in just the past week, supported by a circulating supply of 285 million tokens out of a 1 billion max supply. This extreme volume-to-market-cap ratio of 445% highlights the token’s current momentum.

How Does PumpBTC Bitcoin Staking Work?

PumpBTC simplifies Bitcoin staking by combining Babylon’s shared security with liquid tokens you can actually use in DeFi. Instead of locking BTC for months, you stake once and gain a transferable asset (pumpBTC) that accrues rewards while staying liquid across multiple chains. Here’s how the process works in practice:

1. Deposit & Mint Liquidity Tokens: Start by staking tokenized BTC such as WBTC or BTCB into PumpBTC’s smart contracts. For every unit deposited, you mint 1 pumpBTC in return. This token is transferable, DeFi-ready, and always backed 1:1 by native BTC held in custody.

2. Secure Custody & Delegate to Babylon: Assets are safeguarded with professional custodians like Cobo and Coincover, who manage MPC (multi-party computation) custody. These custodians delegate equivalent native BTC to Babylon’s finality providers on the Bitcoin mainnet, ensuring that your staked BTC contributes directly to Babylon’s security while remaining auditable and verifiable on-chain.

3. Earn Rewards and Multi-Layered Points: Yields are sourced from Babylon’s protocol revenue, which comes from inflation and fees paid by PoS chains and decentralized systems borrowing Bitcoin’s economic security. On top of this base yield, users collect multi-layered points, including Babylon Points, PumpBTC Points, FBTC Points, and soon Layer 2 points, all of which boost long-term reward potential and ecosystem participation.

4. Deploy pumpBTC Across DeFi Ecosystems: With pumpBTC in hand, you’re free to bridge across EVM chains like

Ethereum, BNB Chain, and upcoming L2 networks such as

Scroll or Zircuit. You can deploy pumpBTC as collateral in

lending protocols, liquidity in pools, or leverage in structured products, multiplying both utility and yield opportunities.

5. Unstake with Flexible Withdrawal Options: When you want to exit, you can either select the standard withdrawal option, which involves a ~7-day unstaking period once Babylon mainnet is live, or opt for instant withdrawals via liquidity routes with fees. This dual-path system balances user flexibility with protocol stability, ensuring you can reclaim BTC when needed.

What Is PumpBTC Tokenomics: PUMP vs pumpBTC?

PumpBTC operates with a dual-token model, where pumpBTC represents the liquidity side of Bitcoin staking and PUMP powers governance and incentives. Understanding the difference between the two is key for users who want to both participate in DeFi and influence the protocol’s long-term direction.

pumpBTC Liquidity Token

pumpBTC is minted 1:1 when you stake WBTC, BTCB, or other supported forms of Bitcoin through PumpBTC contracts. Backed by native BTC held in licensed custody and delegated to Babylon’s finality providers, it ensures security and verifiability. Holders automatically accrue rewards generated by Babylon’s protocol revenue while retaining full DeFi liquidit. pumpBTC can be bridged across EVM chains, used as collateral, or supplied to liquidity pools.

PUMP Governance and Incentives Token

PUMP vs. vePUMP tokens on pumpBTC | Source: pumpBTC

PUMP is the governance and emissions token of the ecosystem. Holders can vote-escrow PUMP into vePUMP (ERC-721 NFTs) to gain governance rights, boost liquidity provider (LP) rewards by up to 250%, and participate in bribe/voting markets that redirect incentives across chains and protocols.

Locks can last up to 4 years, and unlike veCRV, vePUMP balances do not decay before expiry, encouraging long-term alignment. Some proposals and third-party notes also reference a buyback-and-burn mechanism, potentially funded from protocol earnings, though this is treasury- and governance-dependent rather than guaranteed.

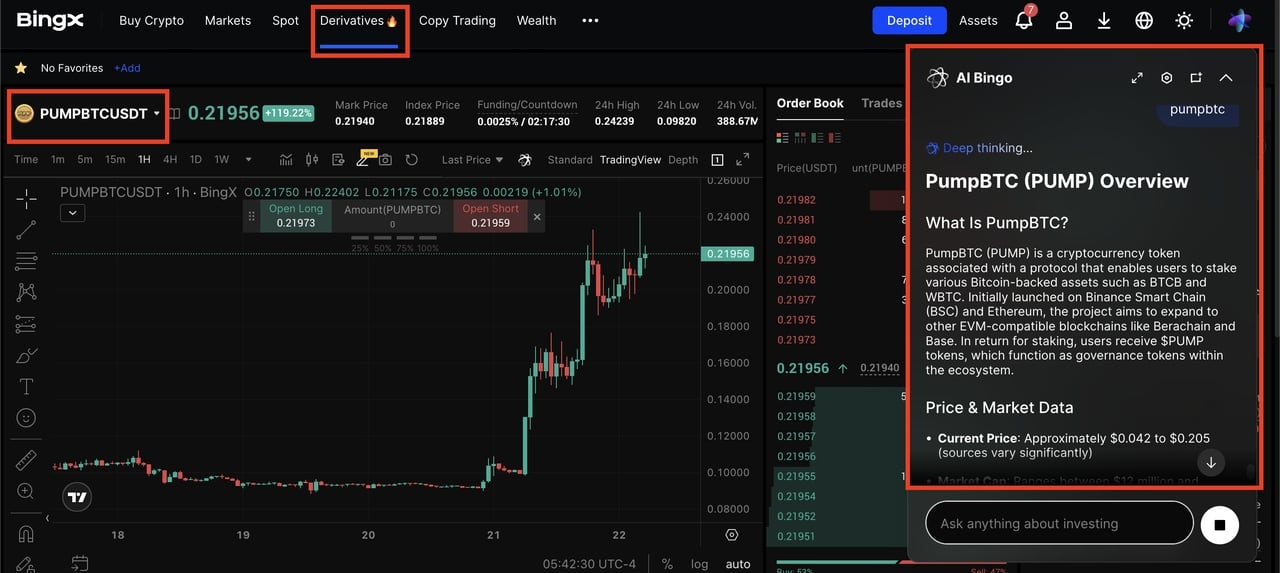

How to Trade PUMPBTC on BingX

BingX has officially listed PUMPBTC (PUMP) on both the Spot and Futures markets, giving traders the flexibility to either buy and hold the governance token directly or speculate with leverage on short-term price moves.

How to Buy and Sell PUMPBTC on BingX Spot Market

PUMPBTC/USDT trading pair on the spot market, powered by AI Bingo trading assistant

1. Open and Verify Your Account: Register on BingX with your email or phone number, then complete

KYC verification to unlock higher withdrawal limits, stronger security, and access to full trading features.

2. Fund Your Wallet: Deposit USDT into your BingX wallet using bank card, crypto transfer, or

P2P options. If you already hold PUMPBTC's governance token, you can deposit it directly after you check the supported network.

3. Locate the Trading Pair: In the Spot section, search for

PUMPBTC/USDT. This is the main market for buying and selling PUMP tokens.

4. Choose Order Type:

• Limit Order to set your own buy/sell price and wait for execution.

5. Use BingX's AI Bingo Tool: Leverage AI-powered momentum signals to identify support/resistance zones, track volatility spikes, and optimize

stop-loss/take-profit levels. Beginners should start small and scale up gradually.

Pro Tip: Don’t confuse pumpBTC, the BTC-backed liquid staking token, with PUMP, the governance token. Always double-check the ticker and network before sending or trading. On BingX, the PUMP token is listed under the ticker PUMPBTC.

How to Long or Short PUMPBTC on BingX Futures Market

PUMPBTC/USDT perpetual contract on the futures market powered by AI Bingo

For traders seeking leverage or directional strategies, BingX Futures lets you go long or short on PUMP/USDT with advanced risk controls.

1. Access the Futures Section: From your BingX dashboard, select

Futures →

PUMP/USDT Perpetual. Ensure your account is futures-enabled and funded with margin in USDT.

2. Set Leverage: Choose a leverage level, e.g., 2x–3x for beginners. Higher leverage amplifies both gains and losses, so start conservatively.

3. Open a Position:

• Long (Buy) if you expect PUMP’s price to rise.

• Short (Sell) if you anticipate a price drop.

4. Manage Risk: Use

BingX AI to set dynamic stop-loss and take-profit orders based on real-time volatility analysis. Always size positions relative to your portfolio and avoid overexposure.

5. Monitor and Adjust Your Positions: Keep track of funding rates, open interest, and AI-driven alerts for trend reversals or liquidation clusters. Futures require active monitoring compared to spot trading.

Practical Tip: News around Babylon's milestones, PumpBTC snapshots, or liquidity expansions can trigger sudden spikes in PUMP volatility. Futures traders should factor these catalysts into entry timing and risk management.

Key Considerations Before Trading PumpBTC

Like any DeFi protocol, PumpBTC carries risks that traders should understand before committing capital. Knowing these factors helps you plan your entries, manage exposure, and avoid common pitfalls.

• Smart Contract Risk: PumpBTC’s contracts have been audited by BlockSec, but no audit eliminates all vulnerabilities. Bugs or exploits could impact minting, burning, or reward distribution. Always start with smaller amounts if testing new features.

• Custodial & Operational Risk: Your staked BTC is managed by third-party custodians such as Cobo and Coincover, who delegate to Babylon. While this reduces bridge risk, it also concentrates operational responsibility. Policy changes, downtime, or custodian failures can disrupt flows.

• Cross-Chain/Bridge Risk: pumpBTC’s liquidity depends on mint/burn mechanics across EVM chains and L2s. Any issue in bridging contracts or integration partners could freeze liquidity or cause depegging. Diversify exposure and monitor on-chain dashboards for anomalies.

• Protocol & Roadmap Risk: Babylon’s phased mainnet rollout, evolving finality provider incentives, or changes to reward schedules could reduce yields or extend withdrawal times. Keep an eye on official announcements to avoid surprises.

• Market Risk: The PUMP governance token is highly volatile, often spiking around listings, snapshots, or seasonal point updates. Liquidity surges can drive sharp moves both ways, so use AI Bingo - BingX's AI-powered trading assistant, to set stop-losses and avoid oversized positions.

Conclusion: Why PumpBTC Matters for BTC DeFi

PumpBTC brings Bitcoin into the multi-chain economy by combining Babylon’s trustless staking with secure custody, delegated finality providers, and a liquid token (pumpBTC) that can move across EVM and Layer 2 ecosystems. This design allows BTC holders to earn yield while retaining on-chain liquidity, turning otherwise idle assets into productive capital. Meanwhile, the PUMP governance token and its vePUMP model coordinate incentives, emissions, and protocol decisions to guide long-term ecosystem growth.

That said, PumpBTC remains an emerging DeFi protocol. Smart contract vulnerabilities, custodial dependencies, and volatile governance token markets are risks every participant should weigh carefully. Traders and stakers should approach with prudent allocations, monitor official updates, and apply risk management when engaging with PumpBTC or PUMP.

FAQs on pumpBTC ($PUMP)

1. What is PumpBTC and how does it work?

PumpBTC is a liquid-staking protocol that allows you to stake native BTC through the Babylon network while receiving pumpBTC, a 1:1 backed liquidity token that accrues rewards and can be used seamlessly across EVM-based DeFi ecosystems.

2. Where do pumpBTC's rewards and APRs come from?

pumpBTC’s rewards and APRs come from Babylon’s protocol revenue, which is generated through issuance and fees paid by networks that rent Bitcoin’s security, then distributed back to BTC stakers via PumpBTC’s delegation system.

3. Is PumpBTC audited and how are assets secured?

Yes, BlockSec audited the contracts; assets are held by Cobo and Coincover, with proof-of-assets transparency and on-chain tracking.

4. Can I deposit native BTC yet on pumpBTC protocol?

Native BTC deposits are part of pumpBTC's staged roadmap; initial flows commonly use WBTC/BTCB with native delegation handled by custodians. Check the official PumpBTC app and documentation for the latest status on supported assets, staking options, and feature availability.

5. What’s the difference between PUMP and pumpBTC tokens?

PUMP is the governance/incentives token with vePUMP locks and boosts. pumpBTC is the BTC-backed liquidity token tied 1:1 to delegated native BTC.

6. How long does unstaking on pumpBTC take?

Unstaking pumpBTC typically requires a standard waiting period of about seven days once the Babylon mainnet is live, though users may also opt for an instant withdrawal option with a fee if immediate access to funds is needed.

Related Reading