As blockchain adoption expands beyond digital assets, commodities such as gold, oil, and silver are increasingly being traded using crypto-native tools. With

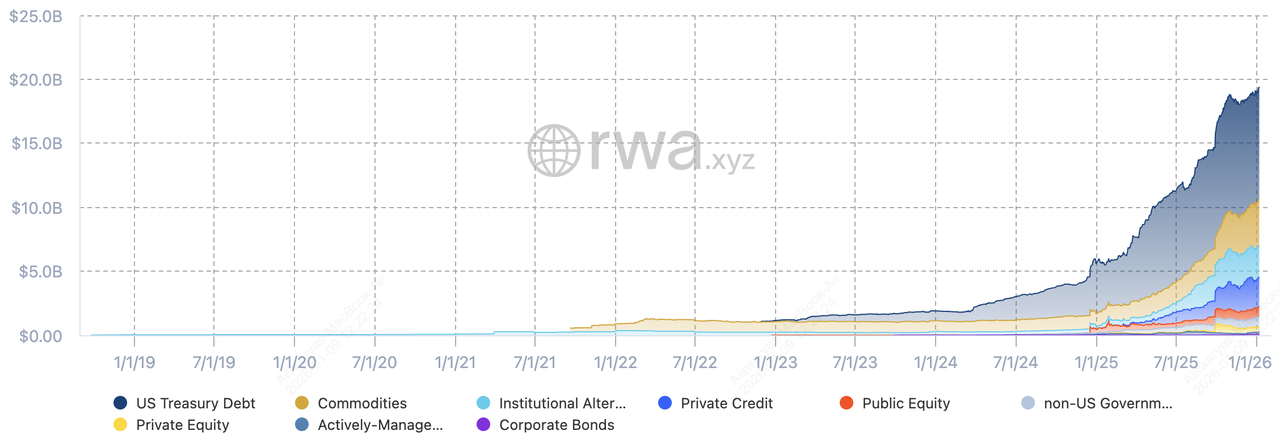

tokenized real-world assets (RWAs) approaching $20 billion in on-chain value and stablecoins exceeding $300 billion in circulation as of January 2026, traders are turning to crypto platforms to access traditional financial instruments like forex, commodities, stocks, and indices more efficiently.

Total value of tokenized RWAs on-chain | Source: RWA.xyz

In 2026, commodity trading no longer requires commodity brokers, physical delivery, or fiat settlement. Platforms like BingX now allow traders to speculate on global commodity prices using USDT-margined perpetual futures, combining traditional market exposure with crypto-style speed, leverage, and risk controls.

This beginner’s guide explains what commodity trading with crypto is is, how commodity perpetual futures work, and how to trade commodities with crypto on

BingX TradFi.

What Are Commodities, and Why Are They Popular to Trade?

Commodities are essential raw materials that form the backbone of the global economy, including precious metals like gold and silver and energy resources such as crude oil and natural gas. These assets are traded worldwide and play a direct role in manufacturing, energy production, and financial stability.

In financial markets, commodity trading focuses on price movements rather than physical ownership. Instead of buying barrels of oil or storing gold bullion, traders use derivative contracts to speculate on or hedge against changes in commodity prices.

Top 5 Reasons Why Commodities Attract Traders in 2026

1. Inflation protection: Commodities, particularly gold and energy, often perform well when inflation rises or real interest rates fall. For example,

gold surged more than 60% during 2025, reaching record highs as central banks and investors sought inflation hedges.

2. Macro sensitivity: Commodity prices react quickly to geopolitical events, interest-rate decisions, supply disruptions, and weather patterns, creating frequent trading opportunities.

3. Global demand drivers: Energy commodities like WTI and Brent crude are influenced by OPEC policy, global growth, and inventory data, while metals are driven by industrial demand and central-bank activity.

4. Diversification benefits: Commodities tend to behave differently from stocks and crypto, making them useful for diversifying portfolios during periods of market stress.

5. High liquidity: Major commodities such as gold and oil trade in deep, liquid global markets, allowing traders to enter and exit positions efficiently.

Because of these characteristics, commodities are widely used by institutions, hedge funds, and retail traders to express macro views, hedge risk, and trade volatility, and now increasingly through crypto-native platforms rather than traditional commodity exchanges.

How Commodity Trading Works With Crypto

Traditional commodity futures, such as gold or crude oil, are typically traded on regulated exchanges like CME Group (COMEX) or Intercontinental Exchange (ICE). To access them, traders usually need a dedicated brokerage account, fiat funding, contract rollovers at expiry, and an understanding of contract sizes and delivery rules. Crypto-native platforms remove much of this complexity.

How Commodity Trading Works on BingX TradFi

On BingX TradFi, commodities are traded using

USDT-margined perpetual futures, a format designed to feel familiar to crypto traders while tracking real-world commodity prices. Here’s what that means in practice:

1. You trade price movements, not physical goods. You’re speculating on whether gold, oil, or silver prices will rise or fall, and there’s no storage, delivery, or handling of the actual commodity.

2. No expiry dates or contract rollovers. Unlike traditional futures that expire monthly, forcing traders to close or roll positions, perpetual futures have no expiry. You can hold a position as long as you meet margin requirements.

3. USDT is your trading currency. All profits, losses, and margin are settled in

USDT, so you don’t need bank wires, FX conversions, or multiple currency balances.

4. Trade both directions with leverage

• Go long if you expect gold or oil prices to rise

• Go short if you expect prices to fall

Adjustable leverage lets you start with a smaller capital outlay, though higher leverage also increases risk.

5. Prices stay aligned with real markets. A funding rate mechanism helps keep futures prices closely tied to spot commodity prices, similar to how crypto perpetuals work.

This structure lets you trade global commodities using the same tools and interface you already know from crypto futures, while still respecting traditional market behavior such as trading hours and volatility patterns.

What Commodities Can You Trade on BingX TradFi?

As of January 2026, BingX TradFi supports nearly 20 USDT-margined commodity perpetual futures, covering precious metals, energy products, industrial metals, and agricultural commodities. Below is a beginner-friendly, data-driven overview of the most actively traded contracts, with practical context on how traders typically use them.

2. SILVER: Silver sits at the intersection of precious metals and industrial demand, which makes it more volatile than gold. It is frequently traded around industrial cycles, solar and electronics demand, and relative-value strategies such as the gold-silver ratio.

3. Crude Oil – WTI: WTI crude oil reflects U.S. energy market conditions and responds quickly to inventory reports, OPEC decisions, and macroeconomic data. Traders often use WTI for short-term, event-driven strategies tied to economic growth expectations.

4. Crude Oil – Brent: Brent crude is the global benchmark for oil pricing and is more sensitive to geopolitical risk, shipping disruptions, and international supply dynamics. It is commonly used to trade global energy trends rather than U.S.-specific factors.

5. Natural Gas: Natural gas is one of the most volatile energy commodities, driven by weather forecasts, seasonal demand, and storage levels. Because of its sharp price swings, it is typically favored by active traders using tight risk controls.

6. Gasoline: Gasoline futures track downstream energy demand and refinery capacity rather than raw oil production. Traders often use gasoline to position around seasonal driving demand, refinery outages, and fuel supply constraints.

7. Heating Oil: Heating oil prices are closely tied to winter weather patterns and regional energy demand, especially in colder climates. It is commonly traded as a seasonal energy play and as a spread trade against crude oil or natural gas.

8. Copper: Often referred to as “Dr. Copper,” this metal is viewed as a proxy for global economic health due to its widespread industrial use. Copper is widely traded to express views on infrastructure spending, manufacturing activity, and emerging-market demand.

9. Aluminium: Aluminium prices are influenced by industrial production, energy costs, and supply chain disruptions. Traders often use aluminium to track trends in manufacturing, construction, and green-energy infrastructure.

10. Industrial Metals - Zinc, Lead, and Nickel: These industrial metals are tied closely to construction, batteries, and manufacturing:

• Zinc: Zinc prices closely track global construction and steel production activity, making zinc perpetuals useful for trading infrastructure demand and industrial growth cycles.

•

Lead: Lead is primarily tied to battery manufacturing and energy storage, so its price often reflects trends in automotive demand and industrial power systems.

• Nickel: Nickel is a key input for EV and lithium-ion batteries, causing its price to move sharply with shifts in electric vehicle production, supply constraints, and energy transition policies.

They tend to show medium liquidity and are best suited for traders following industrial and commodity-cycle narratives.

11. Palladium: Palladium is a niche precious metal mainly used in automotive catalytic converters. Its market is supply-constrained, which often leads to sharp, supply-driven price moves favored by experienced commodity traders.

12. Agricultural Commodities - Soybeans, Cocoa, Coffee: Agricultural futures introduce exposure to weather risk, crop yields, and seasonal cycles:

• Soybeans: Soybean prices are driven by planting and harvest cycles, weather conditions, and global food and feed demand, making them highly seasonal commodities.

• Cocoa: Cocoa prices react sharply to weather patterns and supply disruptions in major producing regions, leading to frequent volatility spikes.

• Coffee: Coffee is one of the most volatile agricultural commodities, with prices heavily influenced by climate events, export volumes, and crop yield reports.

These markets are often used for event-driven or seasonal strategies rather than long-term positioning.

How to Trade Commodities With Crypto on BingX: Step-by-Step

With BingX TradFi’s USDT-margined perpetual futures, you can trade global commodity markets using crypto in just a few simple steps, no brokers, physical delivery, or fiat settlement required.

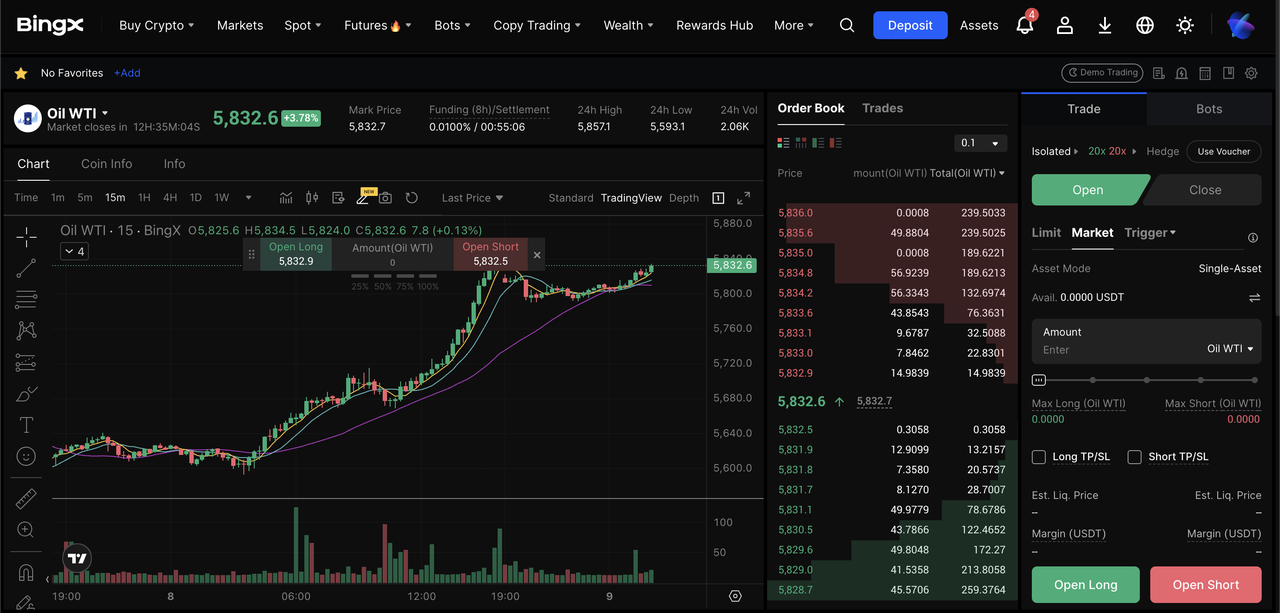

WTI oil perpetual futures on BingX futures market

Step 1: Set Up Your BingX Account

Create or log in to your BingX account and complete

identity verification (KYC) to unlock access to commodity perpetual futures.

Deposit USDT and transfer it to your Futures wallet to use as trading margin.

All BingX commodity contracts are USDT-margined, which simplifies risk management and profit-and-loss tracking across positions.

Step 2: Select a Commodity Market

Go to

Perpetual Futures and Commodities on BingX to view the available commodity markets. Select the contract you want to trade, such as gold, silver, Brent oil, WTI oil, or natural gas.

Step 3: Set Leverage

Choose leverage based on your strategy:

• Lower leverage for beginners and macro trades

• Higher leverage for short-term strategies

Note: Higher leverage increases both potential returns and liquidation risk.

Step 4: Choose Order Type

• Limit order: Execute at a specific price

Note: Advanced tools such as grid bots and API trading are not yet supported for TradFi commodities.

Step 5: Open and Manage Your Position

• Open Long if you expect prices to rise

• Open Short if you expect prices to fall

Why Trade Commodities With Crypto on BingX: 5 Key Benefits

Trading commodities through BingX TradFi combines traditional market exposure with crypto-native efficiency, offering several practical advantages for modern traders:

1. USDT-based trading: All commodity perpetual futures on BingX are margined and settled in USDT, eliminating the need for fiat deposits, bank transfers, or physical commodity custody. This allows you to manage commodity positions using the same stablecoin balance you already use for crypto trading.

2. Leverage flexibility: BingX offers adjustable leverage of up to 500× on selected commodity contracts, enabling traders to control larger positions with less upfront capital. Lower leverage can be used for longer-term or volatile markets, while higher leverage suits short-term, tactical trades, depending on risk tolerance.

3. Long & short access: You can open long positions to benefit from rising commodity prices or short positions to profit during market downturns. This makes commodities tradable in both inflationary and deflationary macro environments, unlike spot-only markets.

4. Unified trading platform: BingX allows you to trade commodities alongside forex, stocks, indices, and crypto futures from a single account and interface. This simplifies portfolio management and enables cross-market strategies based on macro events, economic data, or risk sentiment shifts.

5. Crypto-native experience: Commodity trades use the same perpetual futures mechanics familiar to crypto traders, including real-time PnL, funding rates, liquidation price visibility, and built-in risk controls. This lowers the learning curve for crypto-native users entering commodity markets while preserving traditional market behavior.

Key Things to Know Before Trading Commodity Futures

Trading commodity perpetual futures using crypto offers flexibility and access, but it also comes with market-specific mechanics that differ from 24/7 crypto markets. Understanding these factors upfront helps you manage risk more effectively and avoid unexpected outcomes.

1. Trading Hours and Market Closures

Commodity perpetual futures on BingX follow the official trading hours of their underlying traditional markets, not continuous crypto trading. During non-trading sessions:

• You can cancel existing orders, but

• You cannot open or close positions, and

• Funding fees may still be charged, which can affect margin and PnL for overnight or multi-day positions.

Because commodities often reopen with price gaps driven by macro news, inventory data, or geopolitical events, it’s important to reassess margin and exposure before markets close.

2. Opening Protection and Volatility Control

To manage volatility at market reopen, BingX applies an opening protection mechanism that temporarily caps take-profit at a 20× profit multiple during the first minute of trading, with positions auto-closing if that level is reached. Normal take-profit rules resume automatically after the first minute, helping stabilize execution without affecting regular trading conditions.

3. Funding Rates and Ongoing Costs

Commodity perpetual futures use a funding rate mechanism, typically settled every 4–8 hours, depending on the contract.

• If the

funding rate is positive, long positions pay shorts.

• If negative, short positions pay longs.

Funding helps keep futures prices aligned with underlying

spot markets, but over time it can add to trading costs, especially for longer holding periods.

4. Leverage and Margin Risk

Commodity futures are highly sensitive to macro data, supply disruptions, and geopolitical events, and leverage amplifies both gains and losses.

• Higher leverage increases liquidation risk during sudden price moves.

• Maintenance margin requirements may rise near market close, tightening risk thresholds.

• Liquidation can occur if margin falls below required levels due to price movement or accumulated funding fees.

Using conservative leverage, setting stop-loss orders, and maintaining margin buffers are critical for risk control.

5. Price Gaps and Market Behavior

Unlike crypto markets, commodities can experience significant price gaps between sessions, especially after:

• Economic data releases

• OPEC or central bank announcements

• Weather-related supply disruptions

These gaps can bypass stop levels and accelerate losses, making pre-close risk checks and position sizing especially important.

Bottom line: Trading commodity futures with crypto on BingX offers powerful access and flexibility, but success depends on understanding trading hours, funding costs, leverage effects, and volatility controls. Always trade with defined risk limits, appropriate leverage, and a clear plan for holding positions across market sessions.

Final Thoughts: Should You Trade Commodities With Cryptocurrency in 2026?

In 2026, trading commodities with cryptocurrency has become a more accessible and streamlined option for traders seeking exposure to macro markets such as gold, oil, silver, and natural gas. Platforms like BingX TradFi allow you to trade these commodities using USDT-margined perpetual futures, removing the need for traditional brokers, physical delivery, or fiat-based settlement while preserving familiar market structures.

That said, commodity futures remain leveraged and volatility-driven instruments, influenced by inflation data, geopolitics, and supply shocks. If you choose to trade commodities with crypto, it’s essential to start with conservative position sizes, use appropriate leverage, and apply risk controls such as stop-losses and margin buffers.

Risk reminder: Commodity perpetual futures involve significant risk and may not be suitable for all traders. This article is for educational purposes only and does not constitute financial or investment advice.

Related Reading