The global stablecoin market capitalization has surpassed $307 billion, fragmentation remains a persistent challenge. Protocols often rely on competing

stablecoins like

USDT and

USDC, leading to inconsistent pricing, conversion overhead, and inefficient liquidity management for traders and developers alike. On February 18, 2026, Nexus Labs announced the launch of USDX, a revenue-sharing stablecoin designed as the native dollar of the Nexus verifiable finance ecosystem. This purpose-built asset aims to unify capital flows by serving as the default settlement currency quoted across every market, application, and trade on the Nexus

Layer 1 blockchain.

Fully backed 1:1 by U.S. Treasuries and cash equivalents, USDX generates sustainable yield primarily from T-bill reserves while introducing the Global Yield Distribution System (GYDS) to automatically reward applications based on their USDX holdings and contributions such as

Total value locked (TVL) and trading volume. Developed in collaboration with M0 for programmable, institution-ready stablecoin infrastructure and shared liquidity, this initiative seeks to streamline operations, align incentives across protocols, developers, and users, and foster greater ecosystem coherence in the emerging era of verifiable finance, where cryptographic proofs ensure transaction integrity without compromising privacy or performance.

What Is Nexus's USDX Stablecoin?

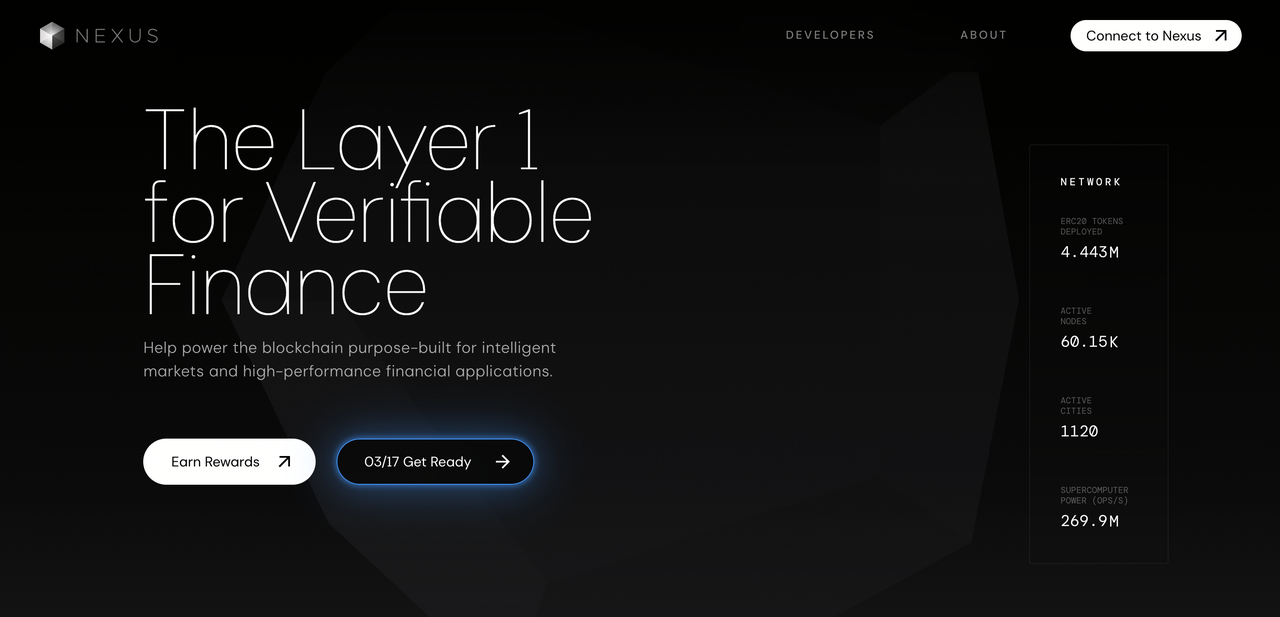

Nexus is a

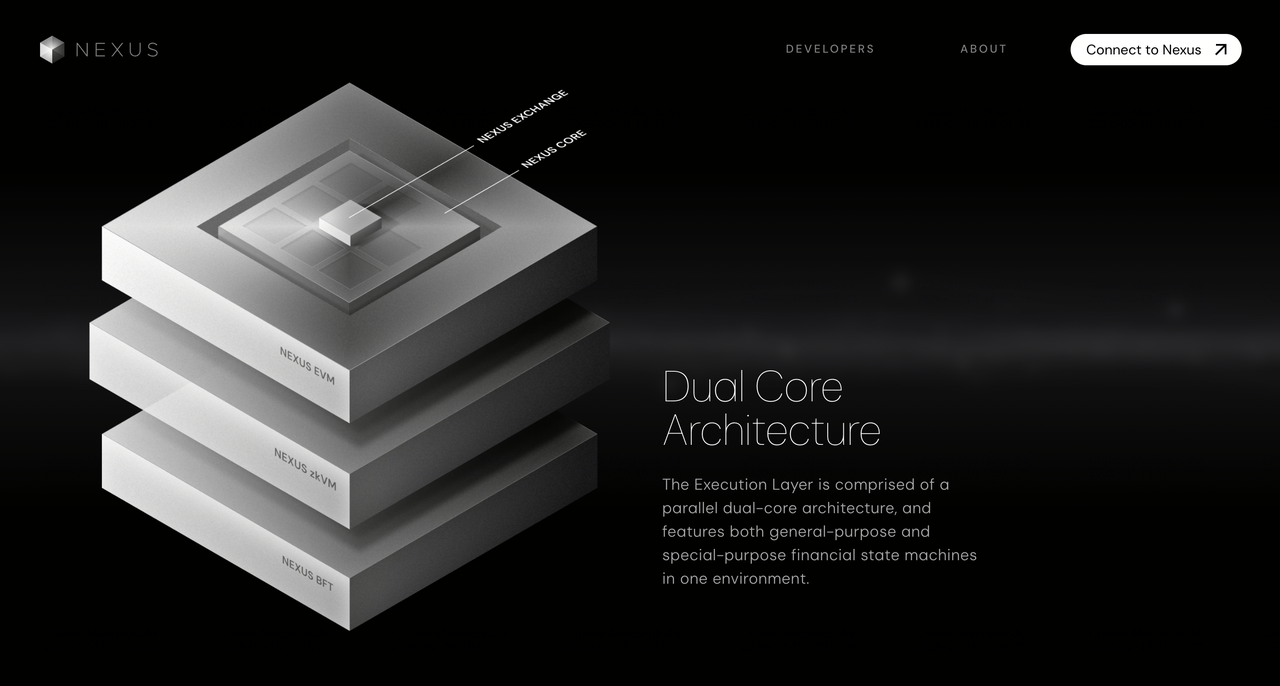

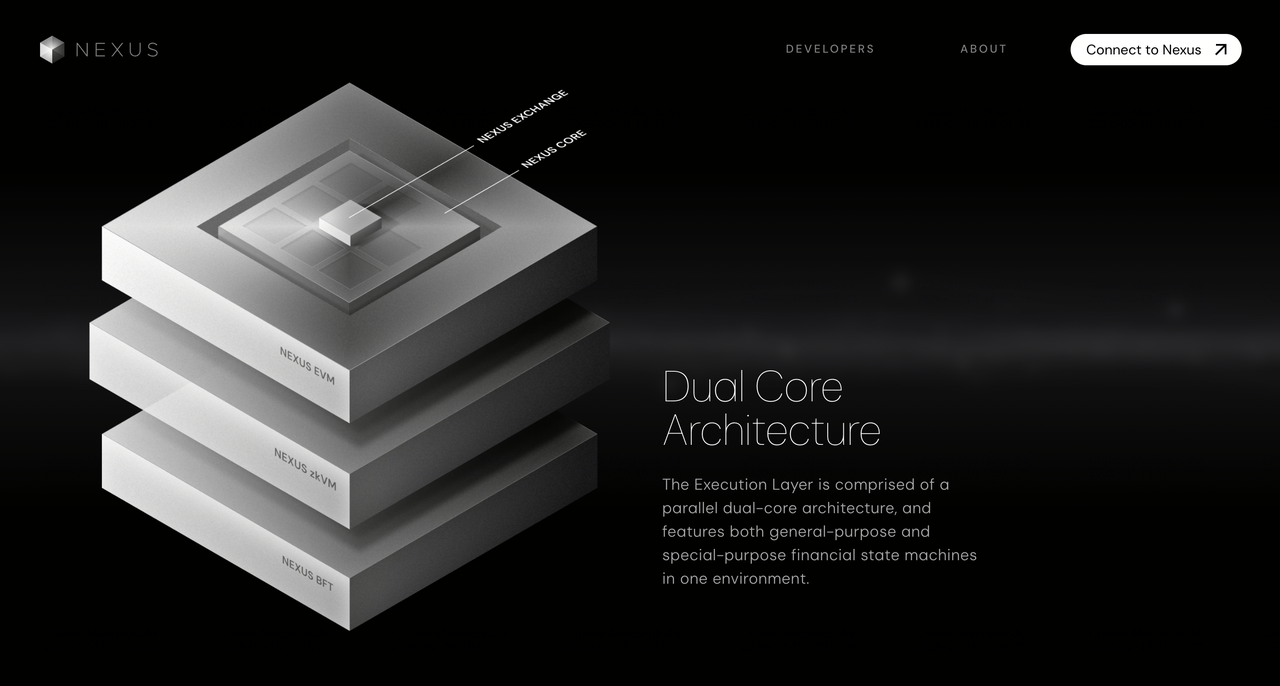

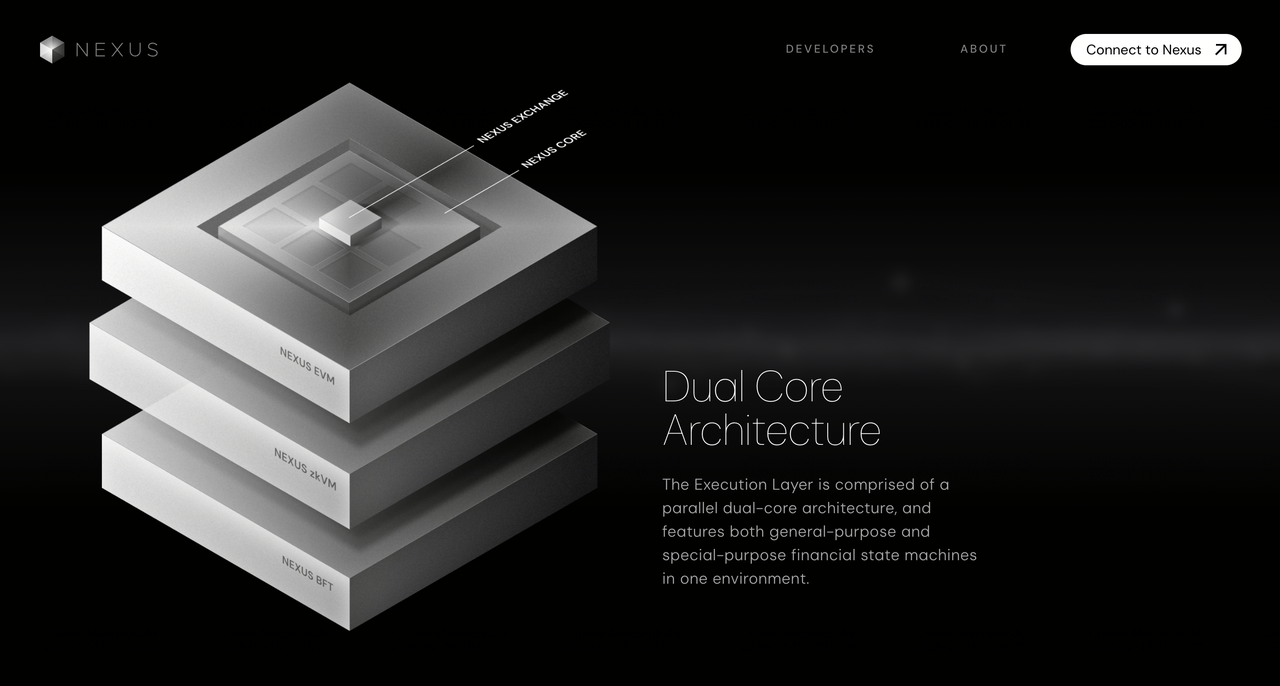

Layer 1 blockchain engineered for verifiable finance, where transactions and computations are guaranteed by cryptographic proofs rather than institutional trust. Founded in 2022 by CEO Daniel Marin, who holds a bachelor's degree in computer science from Stanford University and previously worked at Google, Nexus features a dual-core architecture with general-purpose and special-purpose financial state machines, powered by the Nexus zkVM 3.0 for low-latency, verifiable execution.

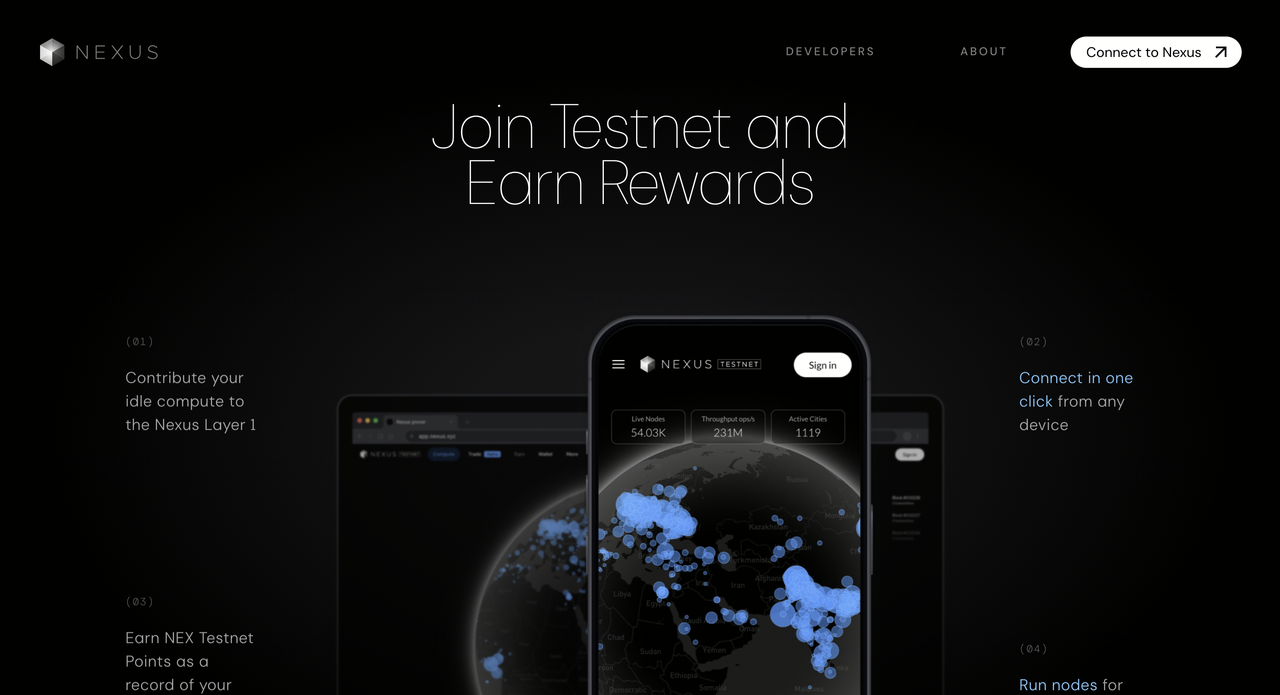

The network has processed over 87.2 million transactions and attracted 3.2 million accounts across its testnets as of late 2025, with strong participation from Asia, Europe, and the Americas, and has built a global network including millions of nodes contributing compute power. Nexus raised a total of $27.2 million in funding, including a $2.2 million seed round led by Dragonfly in late 2022 and a $25 million Series A in June 2024 co-led by Lightspeed Venture Partners and Pantera Capital, with participation from Dragonfly, Faction, Blockchain Builders Fund, Alliance, and SV Angel. The project collaborates with over 100 partners and integrates with M0 for

stablecoin infrastructure.

USDX functions as the native dollar of the Nexus economy, fully backed 1:1 by U.S. Treasuries and cash equivalents to maintain a stable $1 peg. It generates yield primarily from T-bill reserves and operates as a purpose-built settlement currency quoted across every market, application, and trade on Nexus. All trading pairs on the Nexus Exchange, along with PnL, margin, fees, and collateral, settle in USDX, eliminating the need for multiple stablecoin management. USDX integrates with the broader ecosystem by allowing seamless conversions from assets like

USDT and

USDC with zero slippage from deep liquidity sources.

What Are the Key Features of USDX Stablecoin?

The key features of USDX include its unified settlement layer that streamlines trading and reduces conversion overhead, as well as the Global Yield Distribution System (GYDS), which automatically distributes protocol revenue to applications based on metrics such as

total value locked (TVL) and user holdings of USDX. Yield distribution follows contributions like

TVL and volume, governed by the protocol's monetary policy, with exact formulas determined periodically.

Built on the Nexus zkVM, USDX ensures cryptographic verifiability of transactions while preserving user privacy. It prioritizes sustainability without relying on inflationary emissions, focusing instead on composability, capital efficiency, and ecosystem alignment.

Who Created USDX?

USDX was created by Nexus Labs, the team developing the Nexus blockchain, under the leadership of CEO Daniel Marin. Marin has highlighted USDX's design to support decentralized governance, onchain activities, and yield streaming while aligning incentives for the protocol, developers, and users. The stablecoin was developed in collaboration with M0, which provides programmable, institution-ready stablecoin infrastructure and shared liquidity. This partnership combines Nexus's high-performance trading layer with M0's stablecoin capabilities to create a unified native dollar for the verifiable economy.

What Are the Key Use Cases of USDX?

USDX supports several practical use cases within the Nexus ecosystem. For traders, it eliminates inconsistencies in quotes, inefficient collateral allocation, and slippage from managing multiple

stablecoins, allowing users to fund once and trade across spot, perpetuals, and other products seamlessly. For developers and applications, GYDS offers automatic, protocol-native yield rewards proportional to USDX holdings and TVL, creating a self-reinforcing loop where higher usage drives greater rewards without grants or governance negotiations. USDX also promotes ecosystem unification by incentivizing conversions from legacy

stablecoins like

USDT and

USDC, fostering shared liquidity and coherence across markets and applications.

What Are the Tokenomics of USDX?

The tokenomics of USDX emphasize stability and alignment over speculation. As a fully collateralized stablecoin backed by U.S. Treasuries, it maintains a 1:1 peg and generates sustainable yield from T-bill reserves rather than short-term incentives. Supply is minted through conversions from liquid assets and

stablecoins, with no fixed cap but demand tied to Nexus ecosystem activity.

Revenue from underlying yields flows through GYDS to applications based on protocol contributions such as TVL and trading volume, as determined by monetary policy. This structure rewards real usage and ecosystem growth, with yield directed primarily to the application layer to drive adoption and developer sustainability.

How to Buy Stablecoins on BingX: Step-By-Step Guide

USDC/USDT trading pair on the spot market powered by BingX AI insights

While USDX is not yet listed on BingX, USDT is the primary global-exposure stablecoin, widely used for spot and futures trading, hedging, and value transfer.

2. Fund your account – Add funds via fiat on-ramps (cards, bank transfers, local rails where supported) or deposit crypto from an external wallet.

4. Use USDT – Trade spot or futures pairs,

manage risk, or transfer USDT across supported networks for low-cost, 24/7 settlement.

Learn more about

how to buy USDT in our comprehensive guide. USDT on BingX offers immediate, deep liquidity and broad utility across trading and transfers.

Conclusion

In conclusion, USDX introduces a cohesive approach to

stablecoins by unifying liquidity and distributing revenue through GYDS, backed by $27.2 million in funding and strong partnerships including M0. Fully collateralized by U.S. Treasuries and integrated natively into the Nexus verifiable finance stack, USDX reduces fragmentation, enhances capital efficiency, and aligns incentives for sustainable ecosystem growth as of its February 18, 2026 launch.

Related Reading