Blockchain technology has transformed digital transactions, offering decentralized and secure systems. However, as adoption grows, traditional blockchains like

Ethereum and

Solana face challenges in speed, scalability, and efficiency, known collectively as the

blockchain trilemma. This trilemma refers to the difficulty of achieving decentralization, security, and scalability all at once. As a result, networks often sacrifice one element to improve the others, leading to issues like congestion, high fees, or delayed transactions during peak activity.

Solayer (LAYER) emerges as an innovative solution to these issues within the Solana ecosystem. By introducing a

Layer-2 protocol, Solayer aims to enhance scalability and

liquidity, enabling users to maximize the utility of their staked assets and support decentralized applications (

dApps) more effectively.

In this article, you’ll learn what Solayer is, how it works, and why it could play a key role in the future of the Solana ecosystem.

What Is Solayer?

Solayer is a Layer-2 protocol built on top of Solana, designed to improve the network's scalability and liquidity. It introduces a

restaking mechanism that allows users to re-deploy their staked

SOL tokens or

liquid staking okens (LSTs) to support additional network functions, enhancing overall efficiency.

Core Objectives of Solayer Protocol

Through these objectives, Solayer contributes to a more scalable and liquid Solana ecosystem, addressing some of the fundamental challenges faced by traditional blockchain networks:

• Maximize Utility of Staked Assets: Solayer enables users to earn additional rewards by restaking their assets, thereby increasing their potential returns.

• Support dApps: By improving scalability, Solayer facilitates a more robust environment for dApps to operate efficiently on the Solana network.

Solayer's Ecosystem and Key Components

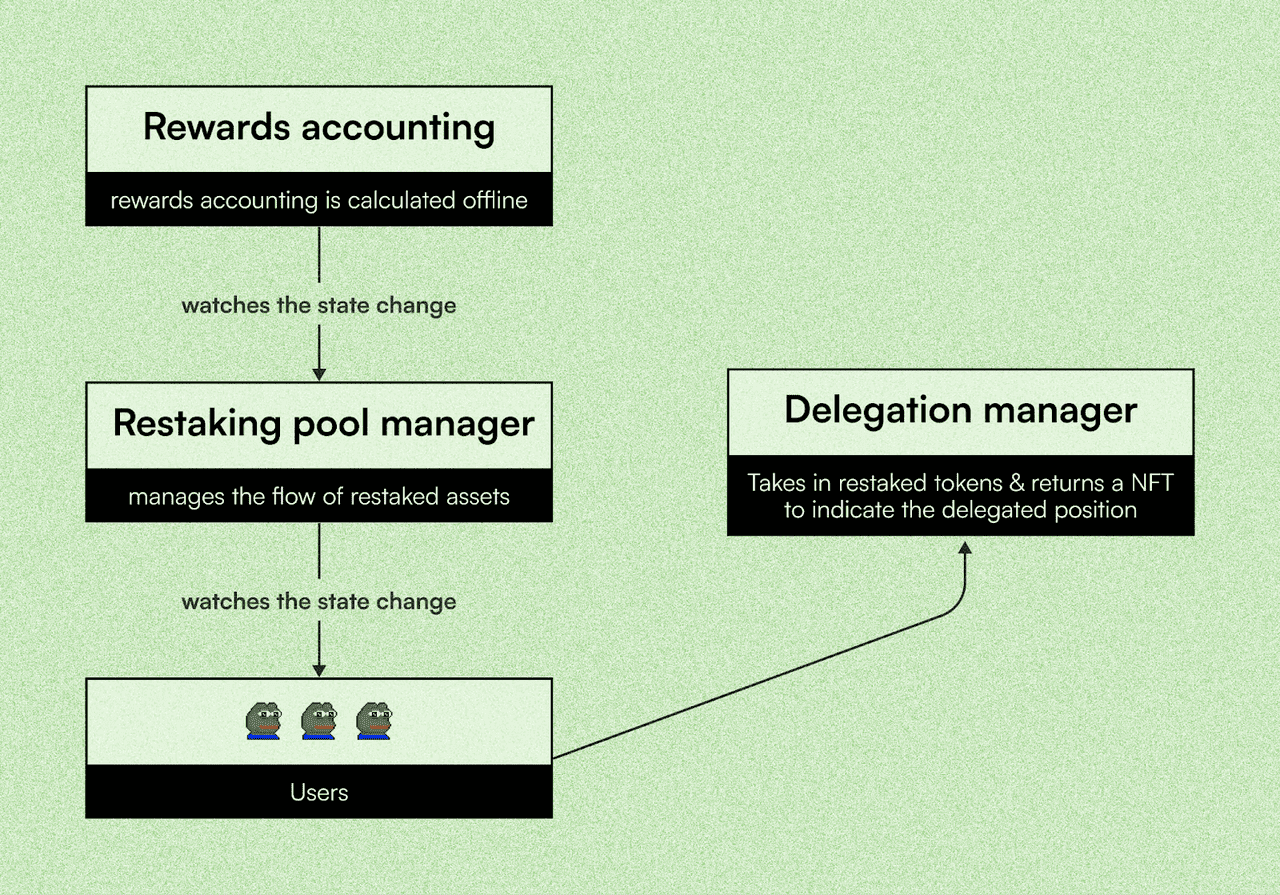

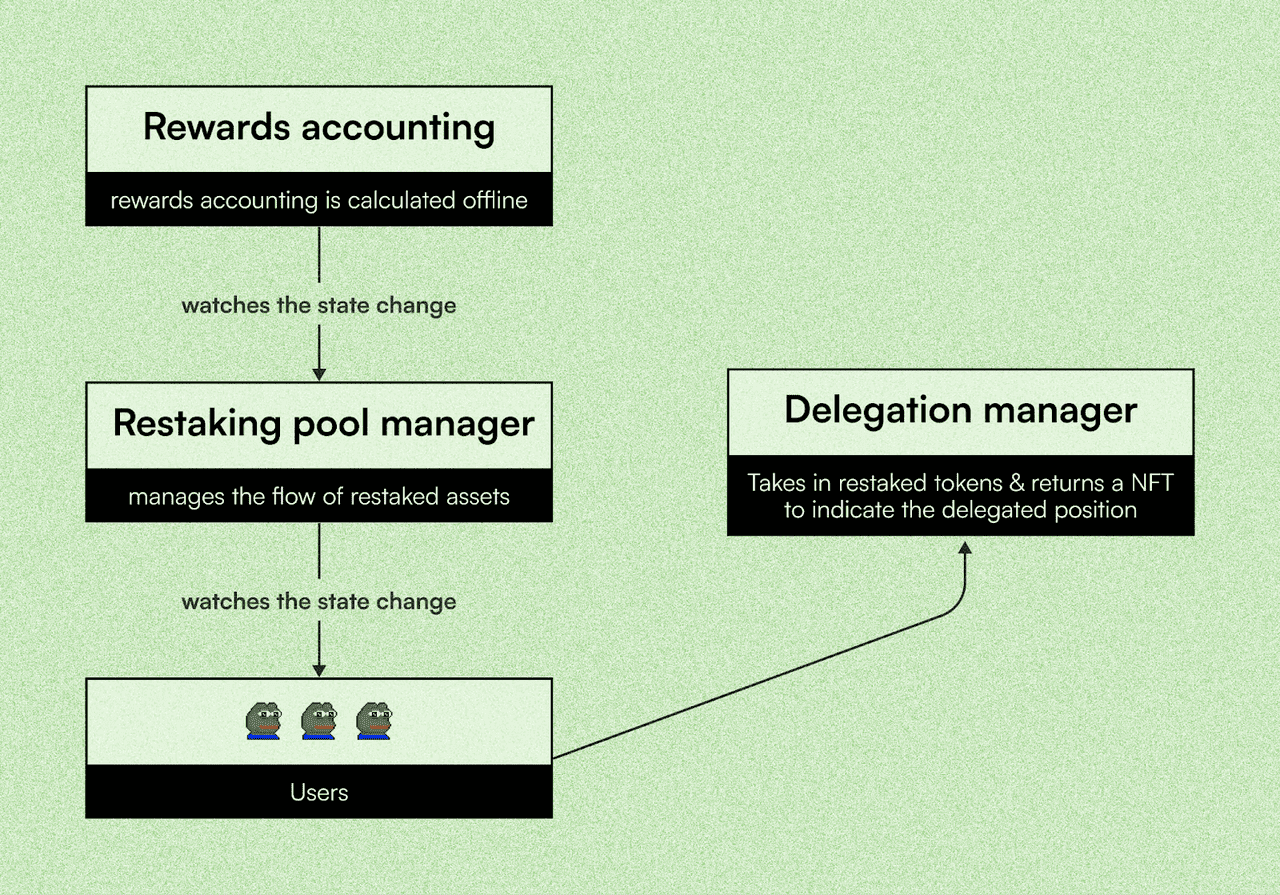

An overview of Soilayer's restaking ecosystem | Source: Solayer docs

Solayer isn’t just a

liquid staking protocol, it’s a full-stack ecosystem powered by several core components working together. Together, the following components form the backbone of Solayer, enabling a scalable, efficient, and reward-driven staking environment on the Solana network:

1. Restaking Pool Manager: This module manages pooled assets from restakers. It ensures that funds are allocated efficiently and that rewards are distributed fairly across participants.

2. Delegation Manager: It handles the assignment of staked and restaked assets to different validators and services. This helps optimize performance and maximize yields for users.

3. Reward Accounting Unit: This system tracks user activity and calculates staking rewards with precision. It ensures every participant receives the correct payout based on their contribution.

4. Oracle Price Feeds: Solayer relies on price oracles to keep the value of sSOL aligned with SOL. These

oracles deliver real-time market data, helping maintain peg stability across the protocol.

LAYER Token Utility: Solayer's Native Token

Solayer also introduces its native token,

LAYER, which plays a central role in the protocol's functionality and governance. As a utility and governance token, LAYER gives holders the power to shape the future of the network.

You can use LAYER to pay for fees within the Solayer ecosystem, including restaking operations and access to Actively Validated Services (AVSs). Holding LAYER also allows you to participate in governance by voting on protocol upgrades, reward allocations, and ecosystem proposals.

In the future, additional use cases for LAYER may emerge as the platform expands. These could include staking incentives, access to exclusive

Solana DeFi integrations, and rewards for active community participation.

How Does Solayer Work: Understanding Restaking and sSOL?

Blockchain staking is a way to earn rewards by locking up your tokens to help secure the network. Solayer takes this a step further with restaking.

Restaking lets you reuse your already staked SOL tokens to secure additional services and applications on the network. This means you can earn more rewards on the same assets, without having to unstake or move your funds. It's a powerful way to boost your yield while contributing to network security and scalability.

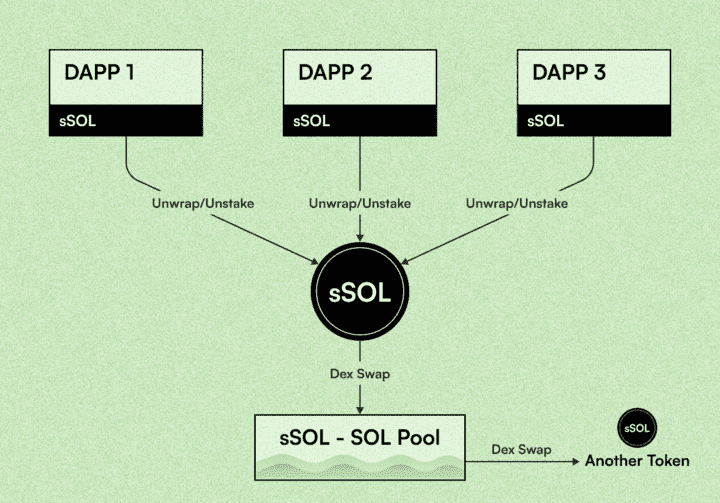

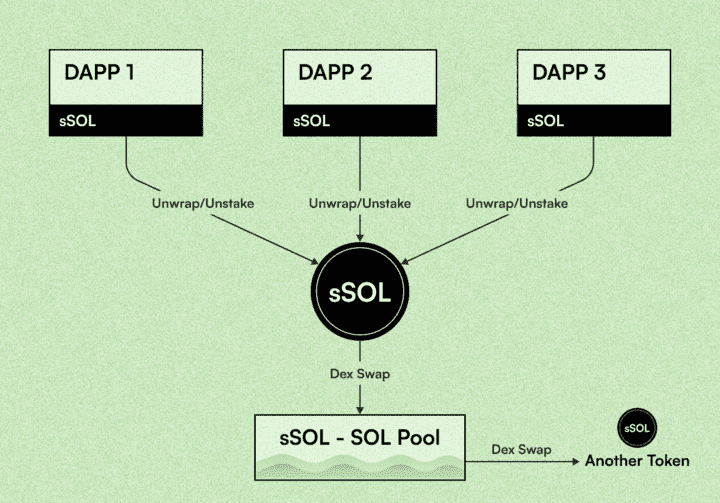

How sSOL, Solayer's liquid staking token, works | Source: Solayer docs

To make this possible, Solayer introduces sSOL, a liquid staking token. When you stake SOL through Solayer, you receive sSOL in return. This token represents your staked position but stays liquid, so you can trade it or use it across

DeFi platforms. With sSOL, you don’t have to choose between staking and using your assets in DeFi. You can do both.

As Solana continues to roll out network upgrades like

Firedancer and Alpenglow, Solayer stands to benefit from faster execution, lower fees, and improved validator performance. These improvements could further enhance the efficiency and scalability of Solayer’s restaking infrastructure.

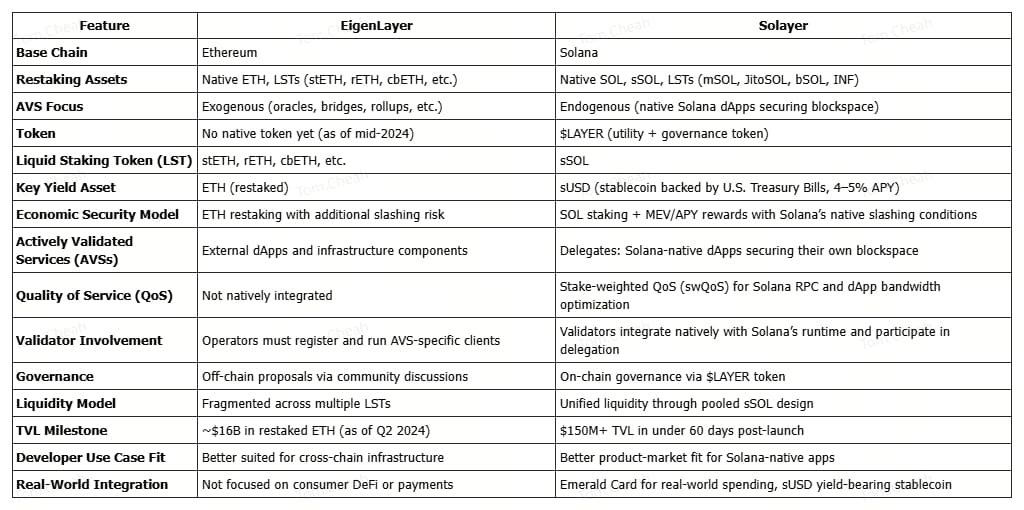

Solayer vs. EigenLayer for Restaking

Solayer and

EigenLayer both leverage the concept of restaking, but they serve different ecosystems and use cases. EigenLayer focuses on enhancing the security of Ethereum by allowing users to restake ETH or Liquid Staking Tokens (LSTs) to secure external applications like oracles, bridges, and

rollups, known as exogenous Actively Validated Services (AVSs).

In contrast, Solayer is purpose-built for the Solana ecosystem and prioritizes native (endogenous) AVSs, enabling Solana-based dApps to secure their own blockspace and improve network performance using stake-weighted quality of service (swQoS). While EigenLayer helps external systems borrow Ethereum’s trust layer, Solayer acts as a blockspace marketplace that unifies liquidity and boosts bandwidth for native applications. This gives Solayer a stronger product-market fit for developers building directly on Solana.

What Is the Role of InfiniSVM in Solayer?

Solayer is powered by InfiniSVM, a high-performance execution environment designed to scale with the demands of modern blockchain apps. Together, Solayer and InfiniSVM bring next-level speed, scalability, and efficiency to the Solana ecosystem.

InfiniSVM uses hardware acceleration to push beyond the limits of traditional blockchain systems. It’s built for speed, handling over 1 million transactions per second with 0.01-second finality and near-zero latency.

How does it do this? It leverages cutting-edge technologies like Remote Direct Memory Access (RDMA) and InfiniBand networking. These tools allow direct memory communication between nodes, skipping the usual OS bottlenecks. The result is faster data transfer and lower CPU usage.

InfiniSVM also uses a multi-executor model, meaning it can process many transactions in parallel. This architecture enables scalable, secure execution of

smart contracts and dApps, making Solayer ideal for high-demand environments.

What Is sUSD: The Yield-Bearing Stablecoin on Solayer?

Solayer introduces sUSD as its native

yield-bearing stablecoin. It’s pegged to the U.S. dollar and backed by

real-world assets, specifically, U.S. Treasury Bills. This backing helps maintain price stability while offering a steady 4–5% annual yield.

Unlike most stablecoins, sUSD isn't just for holding value. It earns passive income through an auto-rebasing mechanism, which automatically adjusts your sUSD balance to reflect accrued yield. You earn simply by holding it.

sUSD also plays a vital role in securing Actively Validated Services (AVSs) on Solayer. These services rely on sUSD-backed incentives to run efficiently and securely. Plus, sUSD integrates seamlessly into the broader

Solana DeFi ecosystem, giving you multiple ways to put it to work across lending, trading, and staking platforms.

In short, sUSD combines the stability of the dollar with the earning power of on-chain finance.

The Emerald Card: Real-World Applications of Solayer

Beyond restaking, Solayer also brings crypto into your daily life. The Emerald Card is a crypto debit card that lets you spend your digital assets anywhere, just like cash.

With the Emerald Card, you can pay directly in crypto at millions of merchants worldwide. It also gives you access to ATMs, so you can withdraw fiat when needed. What’s more, if you're holding sUSD, your balance keeps earning yield, even while it’s ready to spend.

This card bridges the gap between

Web3 and traditional finance (TradFi). You keep control of your assets while enjoying the convenience of traditional payment systems.

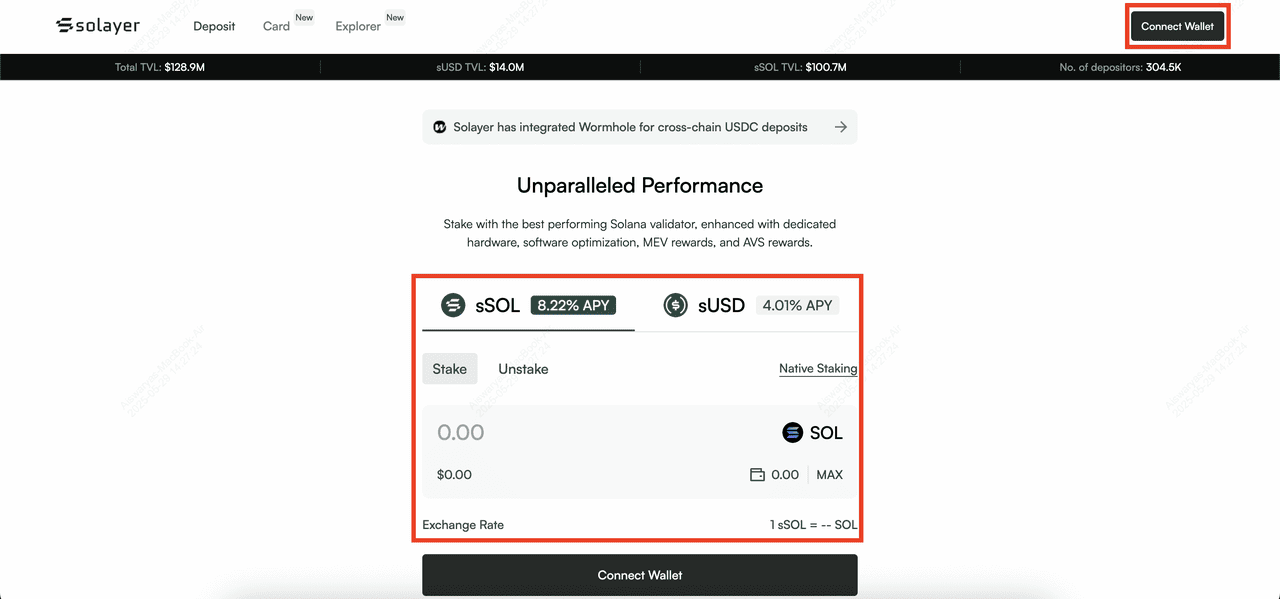

How to Get Started with Solayer

Getting started with staking, earning, and spending with Solayer is simple. Here’s how you can begin:

• Stake SOL and Receive sSOL: First, connect your wallet to the Solayer app. Stake your SOL tokens through the platform. In return, you’ll receive sSOL, a liquid staking token that lets you keep earning while staying active in DeFi.

• Use sUSD in the Ecosystem: To earn a stable yield, you can convert supported assets into sUSD. This yield-bearing stablecoin integrates into DeFi apps, supports AVSs, and even works with the Emerald Card.

• Access the Emerald Card: Visit the official Solayer site or app to apply for the Emerald Card. Once verified, link your

wallet and start spending crypto or withdrawing cash while earning passive rewards on your sUSD balance.

What Are the Risks of Using Solayer?

While Solayer brings new opportunities in staking, liquidity, and real-world utility, it also comes with certain risks. Like many DeFi platforms, it relies on complex smart contracts that may carry bugs or vulnerabilities. Any flaw in these contracts, especially within restaking pools, sSOL, or sUSD, could result in the loss of funds. Additionally, assets like sSOL and sUSD may face price fluctuations or depegging risks, particularly during periods of market stress or low liquidity. Yields are variable and not guaranteed.

As an emerging protocol, Solayer is still in its early stages and may undergo changes to its features or tokenomics. Regulatory uncertainty is another factor, as yield-bearing assets and staking products are increasingly scrutinized by authorities worldwide. Since Solayer is built on Solana, any disruption or technical issue in the Solana network could directly affect its operations. Always do your own research (

DYOR), start with small amounts, and consider your risk tolerance before getting involved.

Conclusion

Solayer is building a more scalable, efficient, and liquid future for the Solana ecosystem. With innovations like restaking, sSOL, sUSD, and InfiniSVM, it offers new ways to earn, build, and interact with crypto. Real-world tools like the Emerald Card bring added usability, making DeFi more accessible for everyday transactions.

As Solayer evolves, it may influence how next-generation Layer-2 solutions shape the blockchain and DeFi space. However, like any Web3 protocol, it carries risks, including smart contract vulnerabilities, market volatility, and evolving regulatory landscapes. Always do your own research and evaluate your risk tolerance before getting involved.

Related Reading

An overview of Soilayer's restaking ecosystem | Source: Solayer docs

An overview of Soilayer's restaking ecosystem | Source: Solayer docs How sSOL, Solayer's liquid staking token, works | Source: Solayer docs

How sSOL, Solayer's liquid staking token, works | Source: Solayer docs