Crypto airdrops have created some of the most talked-about windfalls in the industry. When

Arbitrum dropped tokens worth $12.6 billion, the average user walked away with around $2,200. Go back to

Uniswap’s 2020 airdrop, and early participants in some cases earned nearly $30,000 worth of UNI just for using the platform. Even in 2024, 36 airdrops, from projects like

Ethena,

Pudgy Penguins,

Hyperliquid, and

MagicEden, collectively added over $20 billion to the crypto market, according to CoinGecko.

These headline numbers explain why airdrops spark so much excitement. But behind the hype lies a mix of opportunity and risk. In this beginner’s guide, we break down what a crypto airdrop is, how it works, real examples, and the steps you can take to safely participate.

What Is a Crypto Airdrop?

A crypto airdrop is when blockchain projects distribute free tokens directly to users’ wallets. The goal is often to reward early adopters, boost community engagement, or spread awareness of a new project. Unlike buying tokens on an exchange, airdrops don’t require upfront payment, though users may need to meet conditions such as holding a specific token, interacting with a dApp, or completing tasks like joining a Telegram group. This makes them a low-barrier entry point for newcomers who want exposure to emerging ecosystems.

Airdrops differ from other token launch methods like Initial Coin Offerings (ICOs) or Initial Exchange Offerings (IEOs), where investors must purchase tokens, often at a fixed price before trading goes live. With airdrops, the distribution is free, and the focus is less on fundraising and more on marketing, decentralization, and network bootstrapping. While ICOs raise capital for projects, airdrops distribute ownership to users, creating broader participation and, ideally, stronger alignment between the project and its community.

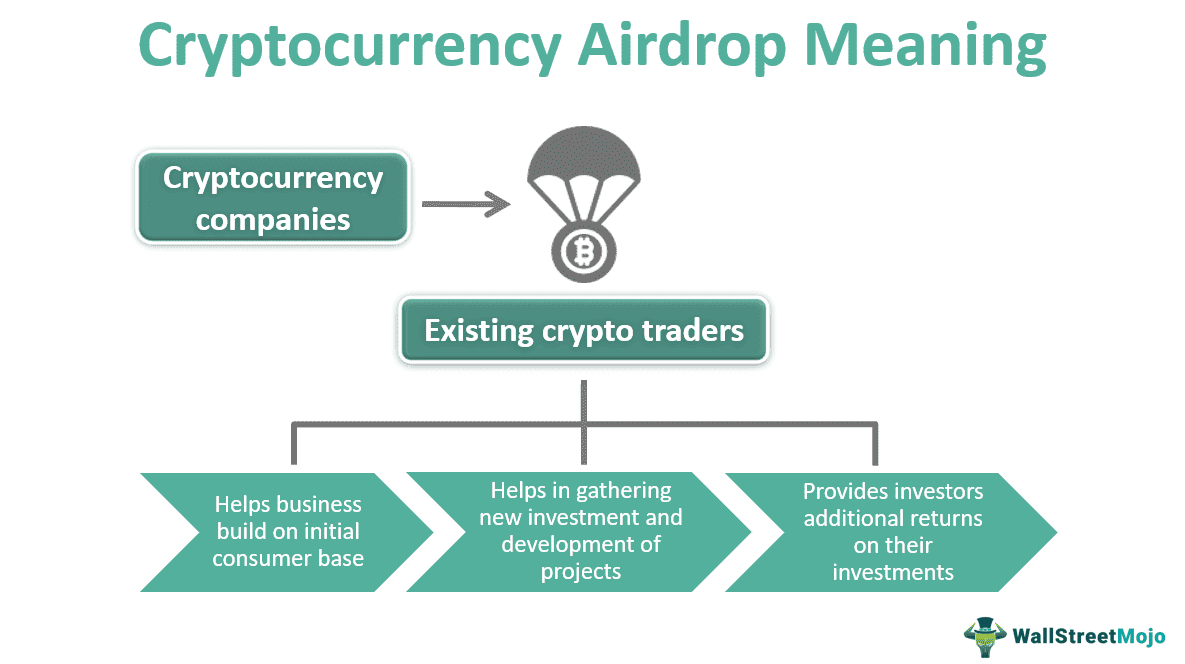

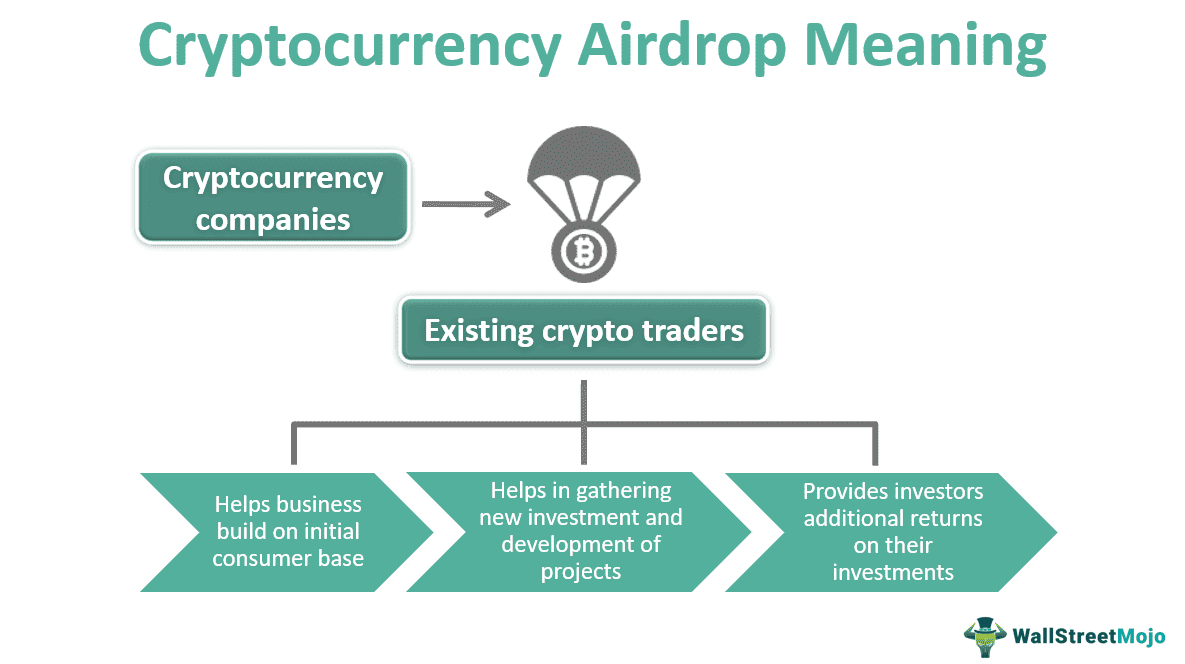

What an airdrop in crypto means | Source: Wall Street Mojo

Here are some concrete reasons why projects do airdrops:

• To reward early users who used or tested the protocol.

• To spread awareness, especially in Web3 / DeFi communities.

• To incentivize certain behaviors, such as holding tokens, staking, providing liquidity, or participating in governance.

• To decentralize token distribution, making ownership more widely spread.

How Does a Crypto Airdrop Work?

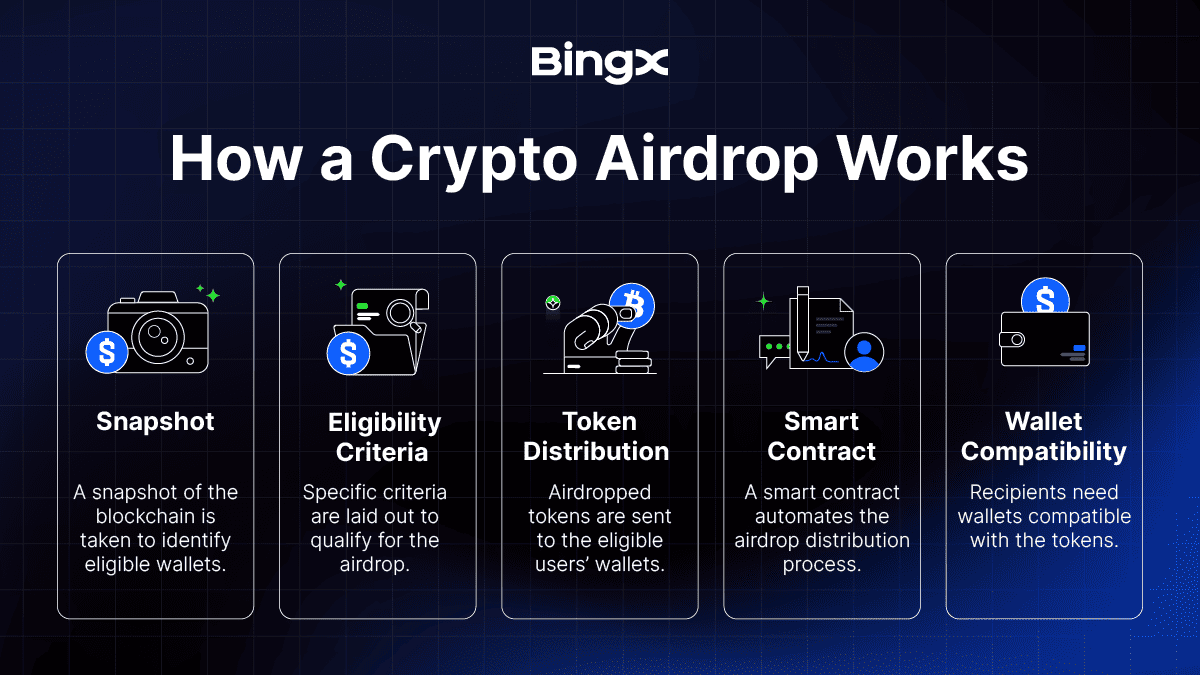

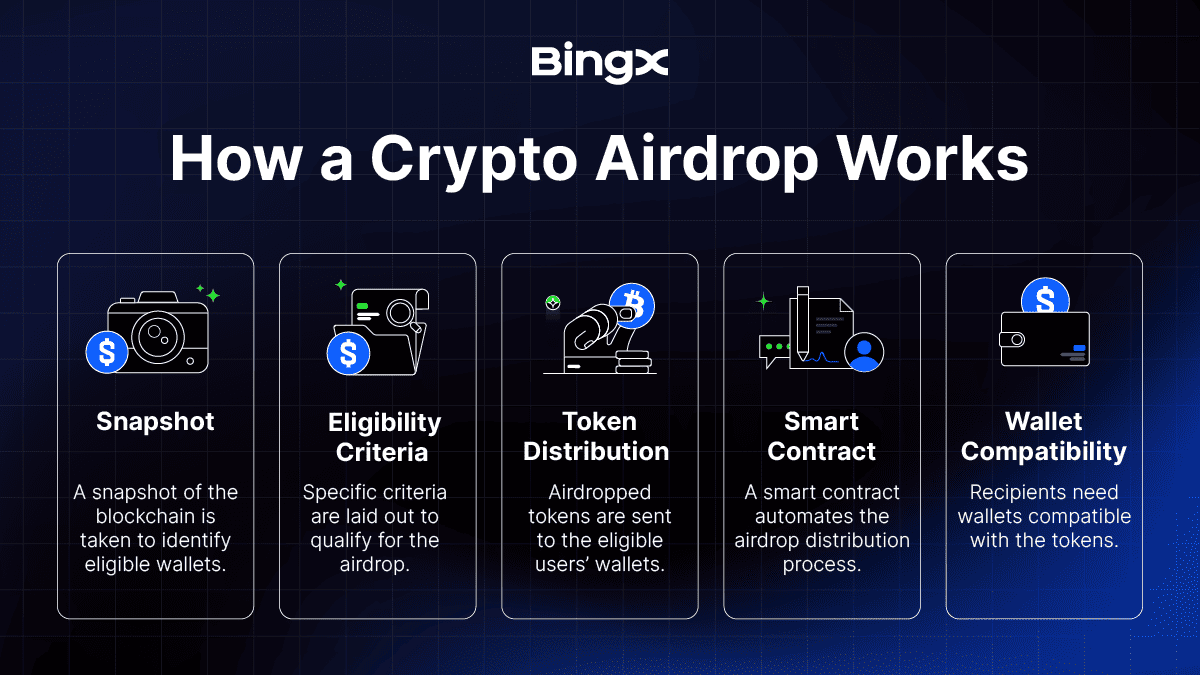

How an airdrop works

For beginners, it helps to think of airdrops as a step-by-step process. Here’s how most of them play out in practice:

Step 1: Eligibility Announced

Projects usually define clear rules for who qualifies for an airdrop. You might need to hold a certain token in your wallet, interact with a protocol before a set date, or complete simple tasks such as referrals or joining a project’s community. For example, in 2020, Uniswap rewarded every wallet that interacted with its protocol before a certain date with 400 UNI tokens, worth thousands of dollars at their peak.

Step 2: Snapshot or Task Verification

To determine who receives tokens, projects may take a blockchain “snapshot” of eligible wallets at a specific time or require users to complete tasks such as staking, trading, or social promotions. For instance, Arbitrum’s 2023 airdrop distributed around $12.6 billion worth of ARB tokens, with the average user earning about $2,200 based on prior network activity.

Step 3: Distribution of Tokens

Tokens are either sent automatically to your wallet or made available to claim through a project’s official website or smart contract. Always double-check links, as phishing scams around airdrops are a frequent risk.

Step 4: Vesting or Lock-ups

Many airdrops include vesting rules to prevent sudden sell-offs, such as locking tokens for months or even years, or releasing only a portion upfront. These measures help maintain price stability and encourage long-term community participation.

Step 5: Use, Trade, or Hold

Once you’ve received tokens, you can:

• Hold them as a speculative investment

• Trade or sell them on exchanges if liquidity exists

• Stake them for rewards or use them in DeFi

• Vote in governance if the token has decision-making power

The eventual value of your airdropped tokens depends on adoption, utility, and market demand; not all airdrops hold their value.

What Are the Different Types of Token Airdrops in the Crypto Market?

Understanding the main types of airdrops helps you separate genuine opportunities from hype and prepare effectively.

1. Holder/Snapshot Airdrops: These reward users who hold a certain token or interact with a protocol before a specific date. The project takes a “snapshot” of wallets at that moment, and eligible users receive tokens later.

Example: For its first

Boundless airdrop round, the project took a snapshot on August 19, 2025 at 11:59 PM ET of addresses on its Prover Leaderboard, users who participated in a proving competition. That snapshot determined eligibility for 0.5% of the

ZKC token supply, which was unlocked at the Token Generation Event (TGE).

2. Retroactive Airdrops: Retroactive airdrops surprise users by rewarding past activity, even before the project mentions an airdrop. They encourage early adoption and loyalty by recognizing those who used a protocol early.

Example: Newer retroactive distributions include

Sui Network: In 2023, they rewarded early users with native tokens worth roughly $2,000 per person, based on active engagement prior to certain milestones.

3. Bounty or Promotional Airdrops: These require completing simple marketing tasks like following a Twitter account, sharing posts, joining a Telegram or Discord group, or writing content. While the payouts are usually smaller than retroactive drops, they are easier to access for beginners.

Example:

Hamster Kombat’s airdrop worked like a bounty program, where players earned HMSTR tokens by completing in-game tasks such as linking a TON wallet, referring friends, or joining social media channels. Rewards were tied to activity and engagement, with players earning tokens based on their score and boosted through extra tasks.

4. Exclusive/Whitelist Airdrops: In these cases, projects handpick users or allow sign-ups to a whitelist, often targeting loyal community members, early testers, or contributors. This makes the rewards more limited but often higher in value.

Example:

Kamino Finance (KMNO) allocated around $26 million worth of KMNO tokens for its airdrop in April 2024. Eligible participants were Solana users who staked during “Season 3” or provided liquidity, though exact per-user rewards remain undisclosed.

5. Hard Fork-Based Airdrops: When a blockchain splits into two versions (a hard fork), holders of the original chain may automatically receive tokens from the new chain. This is less about marketing and more about technical continuity.

Example: Holders of

Bitcoin received

Bitcoin Cash (BCH) during the 2017 hard fork. According to the IRS, these new tokens are treated as taxable airdrops.

How Beginners Can Participate in Airdrop and Earn More Tokens

Here are practical steps to get started with crypto airdrops, with tactics to improve your earnings while staying safe:

2. Monitor upcoming airdrops and official announcements: Tools or aggregators like CoinGecko’s “Upcoming Airdrops” list, airdrops.io, or leading crypto news publications help.

3. Perform on-chain interactions early: Use new DeFi or testnet protocols (even small transactions) that might later reward early users via retroactive airdrops.

4. Hold/stake commonly used tokens: Some airdrops reward holders of specific tokens; by keeping a minimal balance, you might qualify for holder airdrops. But don’t invest in tokens solely for potential airdrops without understanding risk.

5. Complete tasks judiciously: Bounty or promotional airdrops often require tasks: social media engagement, referrals. Do only from trusted projects; they often bring small rewards compared to effort.

6. Track everything: For every airdrop you qualify for or receive, track: project name, date, wallet address, snapshot date, FMV (fair market value), claim cost. This helps with tax and determining real profit.

What Are the Risks of Airdrop Campaigns and How to Stay Safe?

Airdrops sound great, but beginners need to be aware of the risks and how to avoid them:

1. Scams and Phishing: Fake projects pretend to run airdrops to steal private keys, seed phrases, or trick users into signing malicious contracts. Only trust official project channels, never share your seed phrase or private keys, and use hardware wallets for storing high-value assets.

2. Fake or Spam Tokens: Unknown or malicious projects sometimes drop worthless tokens to clutter your wallet or lure you into scams. Don’t claim every token you see, check if the project is listed on reputable exchanges, and use wallet tools or filters to block spam tokens.

3. No Liquidity or Exchange Listing: Some tokens never get listed or have very little trading volume, making them hard to sell or swap. Research the project’s plans for exchange listings, check community discussions, and be aware of potential lock-ups that delay trading.

4. Vesting Periods: Projects may release only a small portion of tokens upfront, with the rest unlocked over months or years to avoid mass dumping. Read the airdrop’s terms carefully, understand the vesting schedule, and adjust expectations in case the token price falls before full release.

5. Tax & Regulatory Risks: In many countries, airdropped tokens are treated as taxable income when received, even if you can’t sell them easily. Future law changes could also impact your tax obligations. Keep detailed records of every airdrop, note the fair market value at the time of receipt, and consider using crypto tax software or consulting a tax professional.

How Are Airdrops Taxed? What Beginners Should Know

One of the most overlooked aspects of crypto airdrops is taxation. In the United States, the IRS requires you to report the value of airdropped tokens as ordinary income the moment you gain control over them, based on their fair market value. For example, if you receive $500 worth of tokens in an airdrop, you must include that $500 as income in your tax return, even if the tokens are locked or hard to sell at that moment. If the airdrop came from a hard fork, IRS Revenue Ruling 2019-24 makes clear that these are also treated as taxable income once the tokens are accessible.

Later, when you sell or trade those tokens, any profit above the original value is subject to capital gains tax. If you hold them for less than a year, this is usually taxed at a higher short-term rate; if you hold longer, you may qualify for a lower long-term capital gains rate. For example, if you reported $500 of income when you received your tokens and later sell them for $1,200, you owe tax on the $700 profit as capital gains.

For beginners, the most practical step is keeping good records. Note the exact date and time when you received or could claim the airdrop, along with its value in your local currency. Track any expenses like gas fees, which can sometimes be deducted from your taxable gains. Since rules vary widely between countries, always check local laws or consult a crypto tax professional before filing; some regions may exempt airdrops, while others tax them heavily.

How to Spot a Good Airdrop in 2025: Your Essential Checklist

Here are some useful benchmarks to help you distinguish high potential airdrops from weak ones:

1. Verify the Project’s Legitimacy and Backing: Check if the team is public and reputable, the roadmap is transparent, the community is active, and audits are available. Strong partnerships or backing from known investors add extra credibility.

2. Assess the Token’s Real Utility: Make sure the token does more than just exist. Look for concrete use cases like governance voting, staking rewards, fee payments, or integration within DeFi apps. Tokens without real-world utility often fade in value.

3. Check Liquidity and Exchange Listings Plans: See if the project has confirmed or credible plans for exchange listings. Tokens with good trading volume and liquidity give you more flexibility to sell, swap, or stake.

4. Evaluate Distribution Fairness: Look at how widely tokens are being distributed. Projects with anti-bot measures and broad community participation are more trustworthy than those where most tokens go to a handful of wallets.

5. Read the Airdrop’s Terms Carefully: Reliable airdrops clearly state their snapshot dates, vesting schedules, claim procedures, and eligibility rules. Avoid any airdrop that leaves these details vague or hidden.

Final Thoughts

Crypto airdrops can be an attractive way for beginners to gain free exposure to new blockchain projects. By interacting with promising protocols early, staying connected to official channels, and understanding eligibility requirements, you improve your chances of qualifying for meaningful rewards. Airdrops can help you explore different ecosystems without needing upfront investment, making them a popular entry point into crypto.

That said, not every airdrop delivers lasting value. Many tokens never gain liquidity or utility, and risks such as scams, phishing attempts, or unexpected tax obligations are common. Approach airdrops with caution, weigh the effort against the potential reward, and always prioritize security and compliance when participating.

FAQs on Crypto Airdrops

1. What is a crypto airdrop and how does it work?

A crypto airdrop is when blockchain projects distribute free tokens to users’ wallets to promote adoption and reward early supporters. Projects may take a snapshot of eligible wallets or require simple tasks like trading, staking, or joining a community before distributing tokens.

2. How do I get crypto airdrops for free?

To get free airdrops, you usually need to hold specific tokens, interact with a protocol before a set date, or complete basic tasks such as referrals or following social media channels. Always check official announcements and avoid suspicious links to protect your funds.

3. Are crypto airdrops safe and legit?

Some airdrops are legitimate, like Uniswap and Arbitrum, which distributed billions in tokens. However, scams and fake airdrops are common. Never share your seed phrase, and only claim tokens from verified project websites or smart contracts.

4. Do I have to pay taxes on crypto airdrops?

In many countries, including the U.S., airdrops are treated as taxable income when received, based on their fair market value. If you later sell them, any additional profit is subject to capital gains tax. Always keep records and consult a tax professional.

5. Are crypto airdrops worth it for beginners?

Airdrops can be worthwhile, especially for exploring new projects without upfront cost. But many tokens may have low value, no liquidity, or long vesting periods. Beginners should balance effort against potential rewards and focus on reputable projects.

Related Reading