Polymarket has grown into a dominant force in the crypto prediction market space. As of 2025, it processes billions of dollars in weekly trading volume across markets tied to politics, sports, macroeconomic events, and culture. While competitors, especially U.S.-based platforms like Kalshi, valued at $5 billion, have made strides in regulated event trading, Polymarket has attracted institutional backing and infrastructure plans that position it for a hybrid future.

Yet, despite all the hype and speculation, Polymarket still doesn’t have a native token. As per a tweet by Shayne Coplan, Polymarket's CEO, on October 8, 2025, it's widely expected to issue one, likely called POLY, although the timing and other details have not yet been confirmed as of mid-October 2025. Common industry consensus now points to a 2026 launch, assuming key regulatory, product, and U.S. operations milestones are met.

This article breaks down how Polymarket works, why the POLY token launch is delayed, key milestones and partnerships shaping its roadmap, what utilities the token may offer, and how you can prepare safely while understanding the main risks and red flags.

An Overview of Polymarket and How It Works

Polymarket is a decentralized prediction market that lets users trade on the outcome of real-world events, from elections and sports to crypto price movements and global affairs. Each market consists of “Yes” or “No” shares priced between $0 and $1, representing the crowd’s probability estimate for a given outcome. When the event concludes, winners receive $1 per correct share, while losing shares expire worthless. All trades are conducted in

USDC, and transactions are settled on

Polygon, ensuring fast confirmations and minimal gas fees.

What makes Polymarket unique is how it transforms information into a tradable asset. Market prices dynamically adjust as traders buy and sell, effectively reflecting real-time public sentiment and probability. This mechanism aggregates thousands of independent opinions into one forecast, giving a more accurate snapshot of what people collectively expect to happen, making Polymarket a powerful “wisdom-of-the-crowd” tool for prediction and analysis.

The platform’s activity has surged in 2025. As of October 2025, Polymarket’s weekly trading volume has climbed more than tenfold compared to early 2024, with over 1.3 million registered traders and an estimated $18–19 billion in cumulative trading volume since launch. Competing platforms like Kalshi, valued at $5 billion, dominate the U.S. market, but Polymarket holds about one-third of global volume with 40–100 active markets live at any time across categories such as crypto, politics, and macroeconomics.

Technically, Polymarket’s foundation remains on Polygon, but the team continues to explore infrastructure improvements, including developing an in-house

stablecoin to better manage reserves and yield. It has also hinted at “future drops,” fueling speculation about a forthcoming token launch. Together, these moves suggest Polymarket is evolving from a simple on-chain prediction platform into a full-scale financial data marketplace bridging Web3 and traditional finance.

While Polymarket has yet to release official tokenomics, credible reports and industry norms offer a glimpse into what the POLY token might enable once launched. The token is expected to serve as the economic backbone of the Polymarket ecosystem, tying together governance, incentives, and liquidity in a single framework designed for both retail and institutional participants.

1. Governance and Protocol Voting: POLY holders may help shape Polymarket’s future through token-based voting on market categories, trading fees, oracle settings, and partnerships. Over time, this could evolve into a DAO-style governance model, similar to

Uniswap or

dYdX.

2. Incentives and Rewards Layer: POLY could serve as a reward token for active traders, liquidity providers, and accurate resolvers. By earning tokens through trading volume or engagement, users would be directly incentivized to grow the ecosystem.

3. Staking and Market Integrity: To maintain trust, market creators and resolvers might stake POLY as collateral. Misreporting outcomes or market manipulation could lead to slashed stakes, ensuring transparency and honest participation across events.

4. Fee Discounts and Access Tiers: Like exchange tokens such as

BNB, POLY may offer fee reductions, early access to new markets, or advanced analytics tools. Institutional users could gain additional benefits through higher staking tiers or premium access.

5. Capital Yield and Treasury Utility: If Polymarket launches its own stablecoin or revenue-sharing model, POLY holders might earn a portion of platform fees, stablecoin yields, or oracle revenues, turning it into a yield-generating governance asset.

6. Liquidity Bootstrapping and Long-Term Alignment: Founders, investors, and partners are expected to face vesting or lockups to prevent sell pressure. Future liquidity mining programs could also distribute POLY to active traders, enhancing liquidity and long-term ecosystem stability.

When Is the Polymarket (POLY) Token Expected to Launch?

As per news reports on Bloomberg and Cointelegraph, Polymarket’s roadmap shows that several key milestones must be completed before the POLY token can launch. In July 2025, the company acquired QCX/QCEX for $112 million, giving it a fully regulated U.S. exchange and clearinghouse. This was followed by a CFTC no-action letter in September 2025, granting regulatory flexibility to resume event markets legally. Then, in October 2025, the Intercontinental Exchange (ICE) invested up to $2 billion, valuing Polymarket at around $9 billion and setting the stage for data distribution to institutional partners. These steps signal a shift from rebuilding compliance to preparing a framework for token issuance.

Given this progression, a token generation event (TGE) appears unlikely before 2026. Industry sources expect a whitepaper or token framework by late 2025 or early 2026, detailing POLY’s governance and incentive structure. If regulatory and operational goals stay on track, Q1–Q4 2026 remains the most realistic window for the token’s debut, potentially followed by a community airdrop or reward phase for early users.

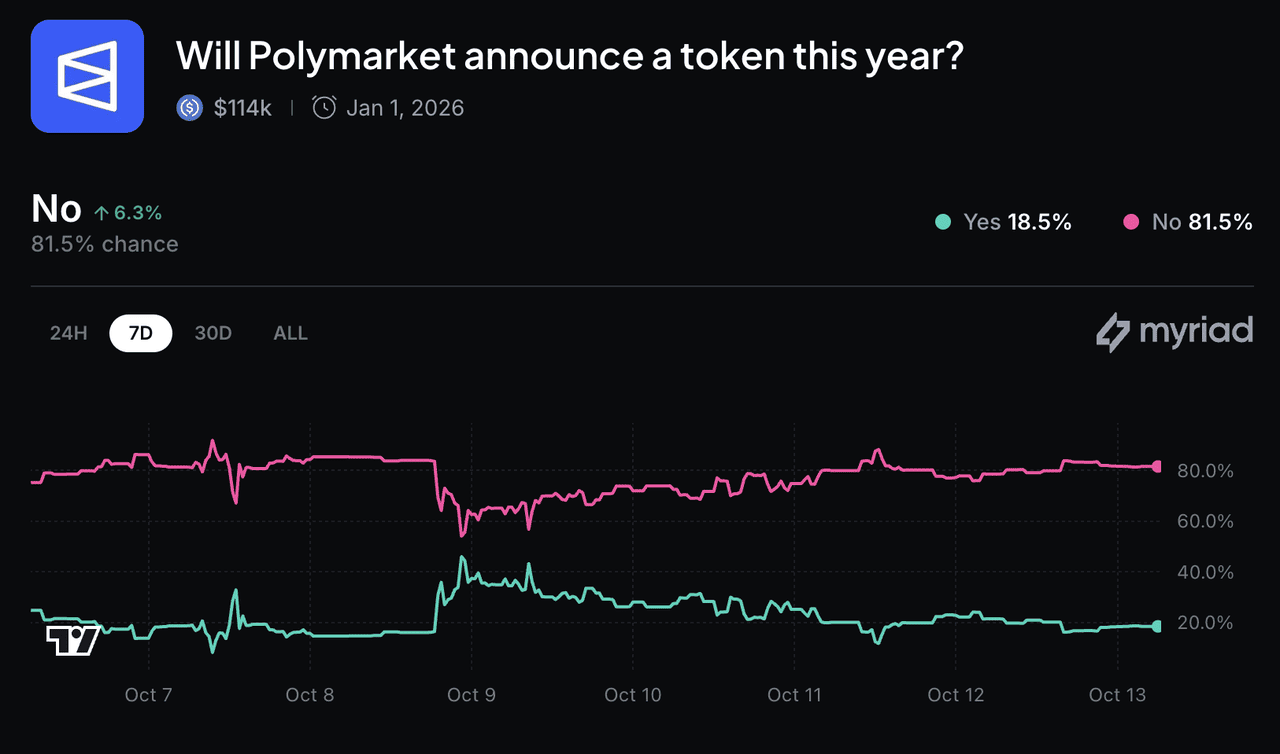

Myriad Markets Poll: Community Bets on POLY’s Launch

Myriad Markets poll on POLY token launch | Source: Myriad Markets

The crypto community is already speculating on when Polymarket will officially announce its token. On Myriad, a rival decentralized prediction platform, a popular market titled “Will Polymarket announce a token this year?” has drawn over $114,000 in bets. As of October 2025, the odds stand at:

• Yes: 18.5% chance

• No: 81.5% chance

The market runs until December 31, 2025, and will resolve to “Yes” only if Polymarket makes an official announcement, via its verified X (Twitter) account or official channels, confirming a Token Generation Event (TGE), ICO, exchange listing, or airdrop before year-end. Rumors or media leaks do not count toward resolution.

These on-chain prediction odds reflect investor sentiment that a POLY launch is unlikely before 2026, aligning closely with reports from industry insiders. In short, even the prediction markets, Polymarket’s own specialty, are betting against a 2025 token debut.

How to Prepare for the Possible $POLY Token Launch or Airdrop

Although Polymarket hasn’t announced an official POLY token launch date yet, you can still take practical steps to increase your chances of qualifying for a potential POLY airdrop, based on what’s typical in past airdrop campaigns across the crypto space. Here’s a simple, step-by-step guide to help you prepare safely and effectively.

1. Before Polymarket Launches the POLY Token

1. Start using Polymarket now: Try trading small amounts or creating prediction markets to get familiar with how it works. Early participation may not guarantee rewards, but it often helps build an activity record that could count toward future airdrops or community incentives.

2. Join Polymarket US (QCX): Once Polymarket reopens to U.S. users through its regulated exchange QCX, sign up and make a few small trades in approved markets such as sports or elections. These verified on-chain actions could later help establish eligibility for possible POLY rewards.

3. Follow official channels only: Keep an eye on Polymarket’s verified X (Twitter), blog, and Discord for updates about the token, snapshots, or airdrops. Avoid relying on rumors or unverified news.

4. Beware of scams: Fake “POLY claim portals” and

phishing links often appear before major token launches. Always double-check website URLs, wallet prompts, and official announcement sources before connecting your wallet or signing transactions.

5. Understand tokenomics basics: Learn what total supply, vesting, and unlock schedules mean. Knowing how tokens are distributed will help you make better decisions once POLY goes live.

2. At Token Launch or Listing

1. Verify everything: Check that the official contract address matches Polymarket’s announcements and that the token has been audited.

2. Check for airdrop eligibility: If you’ve been active on the platform, watch for claim windows tied to on-chain snapshots. Missing these could mean losing potential rewards.

3. Monitor unlock schedules: Early investor or team tokens may unlock after listing, which can create sell pressure. Tracking these dates helps you plan your entries and exits more strategically.

What Are the Key Risks to Watch Ahead of Polymarket Token Launch?

Before getting involved with the upcoming POLY token, it’s important to understand the potential risks that could affect both the project’s stability and your investment decisions. Here are some key red flags and factors to watch closely:

1. Tokenomics Design Risks – Poorly structured tokenomics, such as high supply, weak staking incentives, or unclear distribution, could dilute value and limit long-term growth.

2. Market Manipulation and Oracle Integrity – Large bets or inaccurate oracle data may distort market outcomes and reduce user trust, especially in thinly traded events.

3. Insider Trading Concerns – A Forbes report (Oct 2025) noted how Nobel Peace Prize odds for María Corina Machado jumped from 3.6% to 73% hours before the announcement, raising questions about insider activity on Polymarket and its fairness.

4. Dump Pressure from Early Unlocks – Once POLY launches, early investors or institutions could sell large token allocations, creating price volatility.

5. Scams and Impersonation Attempts – Watch for fake airdrop links, claim portals, or token contracts. Always rely on official Polymarket channels before connecting your wallet or signing transactions.

Bottom line: Prediction markets remain one of the most experimental areas of crypto finance. While Polymarket’s innovation and ICE partnership bring legitimacy, its regulatory ambiguity and susceptibility to insider trading remind investors to stay cautious, use small position sizes, and rely only on verified sources when the token launch approaches.

Final Thoughts

Polymarket is entering a new growth phase, shifting from a fast-moving crypto-native prediction platform to a regulated, institution-backed player with real-world credibility. The upcoming POLY token could serve as a major turning point, linking governance, incentives, and liquidity under one unified ecosystem. With strong institutional support from Intercontinental Exchange (ICE) and a U.S. regulatory pathway through QCX, the foundation for long-term sustainability looks solid.

However, the road to launch isn’t risk-free. Regulatory policy shifts, tokenomics design flaws, or excessive speculation could impact both launch timing and market performance. For now, the best strategy is to stay informed, use verified channels, and engage with Polymarket responsibly as it builds toward the token generation event expected in 2026. Always remember: crypto tokens remain highly volatile assets, and investing in them should align with your personal risk tolerance and research.

Related Reading