Dogecoin, cel mai mare memecoin după capitalizarea de piață, a atins o nouă etapă în lunga sa călătorie, propulsată de meme, către finanțele mainstream: primul ETF spot Dogecoin din S.U.A. (simbol bursier: DOJE) este așteptat să înceapă tranzacționarea joi, 11 septembrie 2025, în conformitate cu Legea Companiilor de Investiții din 1940. Eric Balchunas de la Bloomberg a semnalat debutul, numindu-l probabil primul ETF din S.U.A. care deține un activ „fără utilitate în mod intenționat”. În săptămâna premergătoare știrii,

DOGE a sărit cu ~13–17%, cu prețurile spot oscilând în jurul valorii de 0,24 USD și o capitalizare de piață de aproximativ 3,8 miliarde USD.

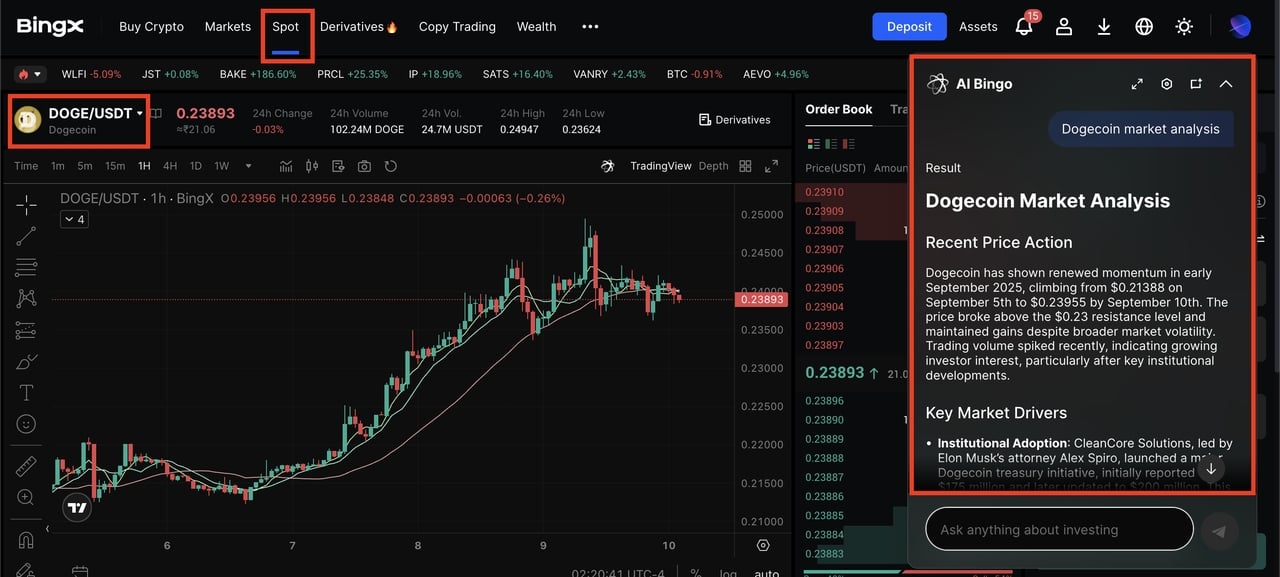

Prețul Dogecoin crește la știrea potențialei aprobări a ETF-ului DOGE | Sursa: BingX

Dincolo de ETF-ul DOGE, SEC analizează zeci de propuneri de ETF-uri cripto, pe lângă

Bitcoin și

Ether. 92 de depuneri au fost înregistrate la sfârșitul lunii august, în timp ce decizia privind ETF-ul Dogecoin al Bitwise a fost amânată în mod specific pentru 12 noiembrie 2025. Acest amestec de progres și pauză stabilește contextul pentru lansarea DOJE printr-o rută legală diferită.

Acest articol este ghidul dumneavoastră complet despre ETF-urile Dogecoin, ce sunt acestea, cum funcționează noul ETF REX-Osprey Doge (DOJE), detalii cheie de lansare, riscuri și instrucțiuni pas cu pas pentru a cumpăra DOJE printr-un broker sau tokenul DOGE direct pe BingX.

Ce este un ETF Dogecoin?

Un ETF Dogecoin (Fond Tranzacționat la Bursă) este un produs de investiții reglementat care vă permite să obțineți expunere la prețul Dogecoin (DOGE) fără a cumpăra sau stoca direct criptomoneda. În loc să configurați un

portofel cripto, să gestionați cheile private sau să tranzacționați pe un schimb de criptomonede, puteți pur și simplu să achiziționați acțiuni ETF printr-un cont de brokeraj tradițional, la fel cum ați face cu acțiunile sau ETF-urile S&P 500.

ETF-urile s-au dovedit a fi o punte puternică pentru adoptarea cripto. Conform datelor The Block,

ETF-urile spot Bitcoin din S.U.A. au atras peste 107 miliarde de dolari în active în primul lor an, devenind unele dintre fondurile cu cea mai rapidă creștere din istorie. Analiștii se așteaptă ca ETF-urile Dogecoin să extindă această tendință și la

memecoin-uri.

Sursa: Analistul Bloomberg Eric Balchunas pe X

ETF-ul reunește banii investitorilor și îi alocă către active care replică performanța DOGE. Acest lucru îl face un punct de intrare convenabil pentru începători și instituții care doresc expunere la memecoin-uri într-un cadru familiar și reglementat. De exemplu:

• Accesibilitate – Puteți cumpăra DOJE pe o bursă de valori în timpul orelor normale de tranzacționare din S.U.A., de la 9:30 AM la 4:00 PM ET, folosind platforme precum Fidelity sau Robinhood.

• Nu este necesar un portofel – Fondul gestionează custodia și conformitatea, eliminând riscul de a pierde cheile private.

• Conturi de pensii – Spre deosebire de deținerea directă a DOGE, acțiunile ETF pot fi adesea deținute în conturi cu avantaje fiscale, cum ar fi IRA-uri sau 401(k)-uri.

• Dezavantaj – Spre deosebire de deținerea DOGE în sine, acțiunile ETF nu pot fi utilizate pentru plăți, bacșișuri sau activități on-chain. Ele sunt pur și simplu pentru expunere la preț.

Ce este ETF-ul REX-Osprey Dogecoin (DOJE)?

ETF-ul REX-Osprey Dogecoin (Simbol bursier: DOJE) este primul ETF Dogecoin din S.U.A., așteptat să fie lansat pe 11 septembrie 2025. Este sponsorizat de REX Shares și Osprey Funds, aceeași echipă din spatele

ETF-ului de Staking Solana (SSK), care a fost lansat la mijlocul anului 2025.

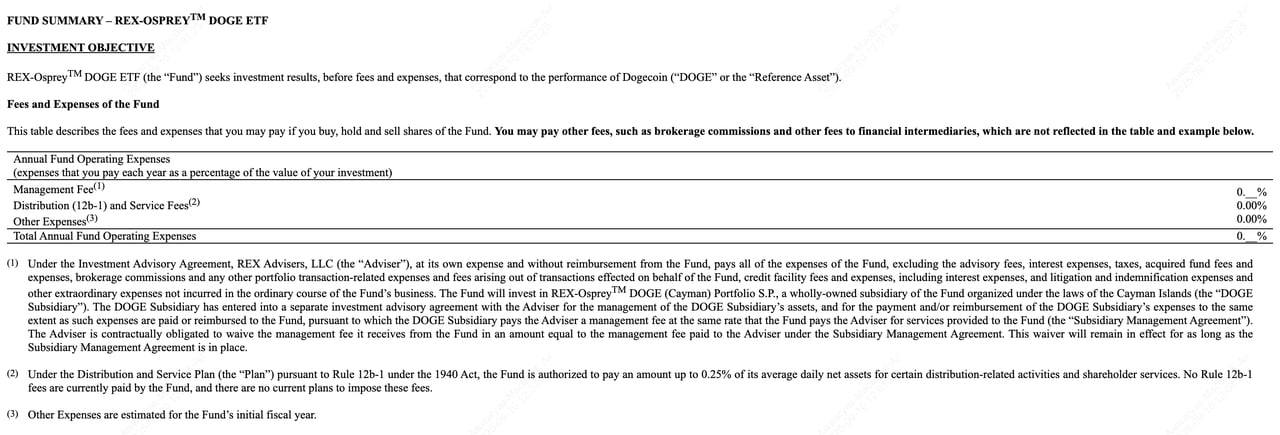

Rezumatul fondului ETF Rex-Osprey DOGE | Sursa: SEC.gov

Ceea ce face DOJE unic este structura sa legală:

• Înregistrat în conformitate cu Legea Companiilor de Investiții din 1940 („Legea din '40”) – Spre deosebire de majoritatea ETF-urilor spot Bitcoin și

Ether care au fost aprobate în conformitate cu Legea din 1933, DOJE utilizează Legea din '40, care este mai apropiată de modul în care sunt reglementate fondurile mutuale. Această cale i-a permis să ocolească unele dintre obstacolele lungi de aprobare ale SEC.

• Filială din Insulele Cayman – Până la 25% din activele fondului pot fi investite printr-o filială din Cayman deținută integral, care deține direct DOGE sau instrumente derivate legate de DOGE, cum ar fi

contracte futures și swap-uri. Această structură ajută ETF-ul să își mențină statutul fiscal din S.U.A. ca societate de investiții reglementată (RIC).

• Cerințe de diversificare – ETF-ul trebuie să dețină și alte titluri de valoare reglementate, cum ar fi titluri de trezorerie americane sau ETP-uri legate de cripto, pentru a îndeplini regulile de diversificare ale Legii din '40. Acest lucru înseamnă că DOJE s-ar putea să nu urmărească perfect prețul spot al DOGE, mai ales pe piețele volatile.

• Comisioane și costuri – Deși ratele finale de cheltuieli vor fi dezvăluite după lansare, ETF-urile memecoin implică adesea comisioane mai mari, uneori până la 1,5%, comparativ cu ETF-urile Bitcoin, care au o medie de aproximativ 0,25%–0,50%.

De ce structura DOJE este diferită de majoritatea ETF-urilor BTC/ETH

Majoritatea ETF-urilor spot Bitcoin și Ether au fost lansate în conformitate cu Legea Valorilor Mobiliare din 1933, cu aprobări explicite din partea SEC. DOJE utilizează calea Legii din '40, un cadru de tip fond mutual utilizat de REX-Osprey pentru alte produse, de exemplu, ETF-ul său Solana + Staking. ETF-ul SOL + Staking (SSK) al REX-Osprey a fost lansat în iulie 2025, ilustrând istoricul acestei echipe în aducerea expunerii non-BTC/ETH către casele de brokeraj din S.U.A.

Practic, ETF-ul DOJE obține expunere la DOGE direct și/sau prin instrumente derivate deținute printr-o filială din Cayman; fondurile care utilizează această abordare limitează de obicei filiala la ~25% din activele totale pentru a menține statutul fiscal din S.U.A. ca societate de investiții reglementată (RIC).

Cum funcționează un ETF Dogecoin?

Iată cum funcționează un ETF Dogecoin în practică, cu ETF-ul DOJE ca exemplu:

1. Configurarea fondului – ETF-ul REX-Osprey Dogecoin (DOJE) este organizat în conformitate cu Legea Companiilor de Investiții din 1940 și utilizează o filială din Cayman pentru a deține DOGE și instrumente derivate. Fondul poate deține, de asemenea, numerar, titluri de trezorerie americane sau alte ETP-uri cripto pentru a echilibra expunerea.

2. Crearea și răscumpărarea acțiunilor – Participanții autorizați (firme mari de tranzacționare) creează sau răscumpără acțiuni ETF în raport cu portofoliul, menținând prețul ETF-ului aproape de valoarea sa activului net (VAN). Tranzacționarea timpurie poate înregistra spread-uri mai largi, astfel încât investitorii utilizează adesea

ordine limită.

3. Tranzacționare – Investitorii cumpără și vând DOJE pe bursele din S.U.A. în timpul orelor normale. Randamentele reflectă performanța prețului DOGE, minus comisioanele fondului și orice impact fiscal sau structural din cauza configurării din Cayman.

Cum să cumpărați ETF-ul Dogecoin (DOJE)

Cumpărarea ETF-ului Dogecoin este similară cu cumpărarea oricărei alte acțiuni sau ETF, dar există câteva detalii importante de reținut. Mai jos este un ghid pas cu pas atât pentru investitorii din S.U.A., cât și pentru cei din afara S.U.A.

Pentru investitorii din S.U.A. - Ruta prin brokeraj

1. Deschideți un cont de brokeraj – Înregistrați-vă la un broker care oferă acces la bursele de valori din S.U.A., cum ar fi Fidelity, Charles Schwab, E*TRADE sau Robinhood. Mulți permit acum tranzacții ETF fără comision.

2. Căutați simbolul bursier „DOJE” – În ziua lansării oficiale sau după aceasta, introduceți DOJE în aplicația sau pe site-ul web de tranzacționare al brokerului dumneavoastră.

3. Plasați un ordin – Deoarece noile ETF-uri pot avea un volum de tranzacționare mai scăzut la lansare, utilizați un ordin limită pentru a controla prețul pe care îl plătiți și pentru a evita să plătiți în exces din cauza spread-urilor bid-ask mai largi.

4. Alegeți tipul de cont – Decideți dacă doriți să dețineți acțiuni într-un cont de brokeraj impozabil sau într-un cont cu avantaje fiscale, cum ar fi un IRA sau un 401(k). Conturile de pensii pot oferi amânare a impozitului sau creștere fără impozit, făcându-le atractive pentru investitorii pe termen lung.

Sunt ETF-urile Dogecoin accesibile în afara S.U.A.?

La lansare, DOJE este listat doar pe o bursă de valori din S.U.A., astfel că accesul depinde de faptul dacă brokerul dumneavoastră local oferă tranzacționare pe piața din S.U.A. Unele platforme globale oferă acces, dar în regiuni precum UE/UK, reguli precum reglementările PRIIPs pot restricționa investitorii de retail să cumpere ETF-uri din S.U.A. fără dezvăluiri speciale. Pentru mulți utilizatori internaționali, cumpărarea directă de DOGE pe o bursă cripto globală precum BingX este adesea opțiunea mai simplă.

Pentru investitorii din afara S.U.A.

1. Găsiți un broker cu acces la piața din S.U.A. – Opțiunile includ Interactive Brokers, eToro sau TradeStation Global, în funcție de ce este disponibil în țara dumneavoastră.

2. Verificați reglementările locale – De exemplu, investitorii de retail din UE și UK se pot confrunta cu restricții din cauza regulilor PRIIPs, care blochează accesul la ETF-urile din S.U.A. care nu dispun de un Document cu Informații Cheie (KID). Unii investitori ocolesc această problemă utilizând brokeri care oferă acces internațional, dar regulile variază în funcție de țară.

3. Luați în considerare conversia valutară – Deoarece DOJE este cotat în dolari americani (USD), brokerul dumneavoastră va converti moneda locală în USD atunci când plasați o comandă. Fiți atenți la comisioanele de schimb valutar (FX), care pot reduce profiturile dacă tranzacționați frecvent.

Cum să cumpărați Dogecoin (DOGE) pe BingX

Perechea de tranzacționare DOGE/USDT pe piața spot, susținută de BingX AI

Dacă preferați să dețineți Dogecoin direct în loc să cumpărați ETF-ul, cea mai simplă cale este printr-o bursă de criptomonede precum BingX. Această opțiune vă oferă acces la tranzacționare 24/7, posibilitatea de a transfera DOGE în propriul portofel și zero comisioane de administrare a fondurilor. Iată cum să începeți:

1. Creați și verificați-vă contul – Înregistrați-vă pe BingX, apoi finalizați

verificarea KYC pentru a debloca toate funcțiile de tranzacționare și depunere.

2. Depuneți fonduri – Adăugați bani în contul dumneavoastră folosind un card de debit/credit, transfer bancar sau

piața P2P pentru depuneri în monedă locală fără comisioane.

3. Cumpărați DOGE direct – Navigați la secțiunea

Tranzacționare Spot, căutați

DOGE/USDT, introduceți suma pe care doriți să o achiziționați și faceți clic pe Cumpără. DOGE-ul dumneavoastră va apărea instantaneu în portofelul BingX.

De ce să alegeți DOGE direct în detrimentul ETF-ului DOJE?

Spre deosebire de DOJE, deținerea directă de DOGE vă permite să trimiteți, să cheltuiți sau să utilizați tokenuri în ecosistemul cripto, cum ar fi plăți, staking și aplicații DeFi. De asemenea, evitați comisioanele de administrare ale ETF-ului și nu sunteți restricționat la orele de funcționare ale pieței bursiere; DOGE se tranzacționează 24/7 la nivel mondial.

Riscuri și considerații cheie ale investiției în ETF-uri Dogecoin

Înainte de a investi în ETF-ul Dogecoin (DOJE), este important să înțelegeți riscurile. Chiar dacă ETF-urile facilitează accesul la criptomonede, ele nu elimină provocările care vin odată cu activele extrem de volatile precum Dogecoin.

1. Volatilitatea prețului: Fiind o memecoin de top, Dogecoin este cunoscut pentru fluctuațiile puternice de preț. De exemplu, la începutul lunii septembrie 2025, DOGE a trecut de la aproximativ 0,216 $ la 0,249 $ în doar câteva zile, o creștere de 15%. ETF-ul DOJE va reflecta aceste mișcări, ceea ce înseamnă că investiția dumneavoastră poate crește sau scădea rapid, chiar și într-o singură săptămână.

2. Structura fondului și diferențele de urmărire: Spre deosebire de ETF-urile Bitcoin și Ethereum care dețin direct activele, DOJE utilizează o structură de fond de tip „40 Act” cu o filială în Insulele Cayman. Acest design poate cauza ușoare diferențe de urmărire între DOJE și prețul real al DOGE. De asemenea, poate crea o povară fiscală, deoarece ETF-urile de tip C-corp pot datora impozite la nivel corporativ înainte de a transmite câștigurile investitorilor.

3. Lichiditate și spread-uri de tranzacționare: Noile ETF-uri au adesea un volum de tranzacționare mai mic la lansare. Acest lucru poate duce la spread-uri bid-ask mai mari sau la tranzacționarea ETF-ului la o primă sau un discount în comparație cu valoarea sa activă netă (NAV). În termeni practici, ați putea ajunge să plătiți mai mult decât valoarea de piață a DOGE sau să vindeți pentru mai puțin. Pentru a reduce acest risc, începătorii ar trebui să utilizeze ordine limită în loc de ordine la piață atunci când tranzacționează DOJE.

4. Implicații fiscale: La fel ca majoritatea ETF-urilor, distribuțiile DOJE, cum ar fi dividendele sau câștigurile de capital, sunt impozabile în S.U.A. Dacă fondul realizează profituri din vânzarea DOGE sau a instrumentelor derivate, aceste câștiguri pot fi transmise acționarilor și impozitate ca venituri obișnuite sau câștiguri de capital. Investitorii care dețin DOJE în conturi impozabile ar trebui să fie conștienți de acest lucru, în timp ce cei care utilizează IRA-uri sau 401(k)-uri pot amâna sau evita aceste impozite în funcție de regulile planului lor.

5. Incertitudine de reglementare: SEC încă analizează alte cereri de ETF-uri DOGE. De exemplu, decizia privind ETF-ul Bitwise Dogecoin a fost amânată pentru 12 noiembrie 2025. Acest lucru arată că autoritățile de reglementare sunt precaute. Modificările viitoare ale regulilor sau întârzierile ar putea afecta operațiunile DOJE, lichiditatea sa sau chiar dacă produse similare rămân disponibile în S.U.A.

Concluzie: Deși DOJE oferă o expunere reglementată la Dogecoin, nu elimină riscurile subiacente. Fiți pregătiți pentru volatilitate, posibile probleme de urmărire și schimbări de reglementare înainte de a investi.

Concluzie

Apariția DOJE face ca expunerea la Dogecoin să fie la fel de simplă ca achiziționarea unei acțiuni, extinzând accesul pentru investitorii care preferă canalele de brokeraj reglementate în detrimentul burselor de criptomonede. Dacă doriți comoditate și integrare a contului, ruta ETF este convingătoare. Pe de altă parte, dacă doriți tranzacționare non-stop, auto-custodie și utilitate on-chain, cumpărarea directă de DOGE pe BingX s-ar putea potrivi mai bine.

Oricum ar fi, dimensionați pozițiile cu atenție: Dogecoin rămâne extrem de volatil, iar structura „40-Act/Cayman” a ETF-ului poate introduce diferențe de urmărire și o povară fiscală/comisioane în comparație cu DOGE spot. Rămâneți informat pe măsură ce deciziile SEC evoluează și revizuiți documentele și costurile produsului înainte de a investi.

Lecturi conexe

Întrebări frecvente despre ETF-urile Dogecoin

1. Când se lansează ETF-ul Rex-Osprey Dogecoin (DOJE)?

ETF-ul DOJE este de așteptat să înceapă tranzacționarea pe 11 septembrie 2025, în timpul orelor normale de funcționare ale pieței bursiere din S.U.A., între 9:30 AM și 4:00 PM ET. Simbolul său oficial va fi DOJE.

2. Cine sponsorizează fondul ETF DOGE?

ETF-ul DOJE este gestionat de REX Shares și Osprey Funds, cu distribuția asigurată de Foreside Fund Services, aceeași echipă din spatele altor ETF-uri cu tematică cripto.

3. Este DOJE un „ETF Dogecoin spot”?

Nu exact. În loc de structura standard „spot” de tip „33 Act” utilizată pentru ETF-urile Bitcoin și Ethereum, DOJE este un ETF de tip „40 Act” care obține expunere la Dogecoin printr-o filială din Insulele Cayman care deține DOGE și instrumente derivate legate de DOGE.

4. Pot deține DOJE într-un IRA/401(k)?

Da, la fel ca majoritatea ETF-urilor, acțiunile DOJE pot fi deținute, de obicei, în conturi de pensii cu avantaje fiscale. Cu toate acestea, ar trebui să confirmați cu brokerul sau furnizorul planului dumneavoastră.

5. Ar trebui să cumpăr ETF Dogecoin?

DOJE oferă o opțiune reglementată, bazată pe brokeraj, pentru a obține expunere la DOGE. Este potrivit dacă preferați platforme familiare, structuri tradiționale de cont sau eligibilitate pentru conturi de pensii.

În schimb,

cumpărarea directă de DOGE pe BingX permite tranzacționare 24/7, utilitate on-chain, cum ar fi transferuri și bacșișuri, și control direct al portofelului. Această opțiune se potrivește mai bine dacă prețuiți flexibilitatea, accesul rapid și proprietatea directă.