Peisajul global al investițiilor în criptomonede a evoluat rapid în 2025. După aprobarea de către SEC a

ETF-urilor Bitcoin spot și

ETF-urilor Ethereum în 2024, lansarea ETF-urilor Solana cu staking a marcat următorul pas major în conectarea finanțelor tradiționale cu randamentele bazate pe blockchain.

Un ETF Solana cu Staking este un fond de investiții reglementat care oferă investitorilor expunere la mișcările de preț ale Solana (SOL), distribuind totodată recompensele de staking obținute prin participarea în rețea. Permite investitorilor să beneficieze de creșterea și potențialul de randament al Solana fără să gestioneze portofele, validatori sau chei private.

Primul ETF Solana cu Staking din SUA a fost lansat în iulie 2025, oferind investitorilor o modalitate nouă de a câștiga recompense on-chain prin intermediul unei structuri de piață tradiționale. Doar câteva luni mai târziu, Bitwise Solana ETF (BSOL) a început tranzacționarea pe 28 octombrie 2025, devenind primul ETF Solana spot cu staking listat la New York Stock Exchange, consolidând poziția Solana ca lider în noua eră a ETF-urilor crypto generatoare de randament.

Interesul investitorilor pentru ETF-urile Solana cu Staking crește vertiginos

Interesul pentru ETF-urile cu staking a crescut brusc în 2025, deoarece investitorii caută modalități reglementate de a obține randamente bazate pe blockchain.

Solana (SOL), cunoscută pentru viteza și comisioanele reduse, a devenit alegerea principală pentru această nouă clasă de fonduri crypto.

REX-Osprey Solana Staking ETF (SSK), lansat pe 2 iulie 2025, pe Cboe BZX Exchange, a fost primul ETF din SUA care combină expunerea la prețul SOL cu recompensele de staking. Susținut de Anchorage Digital, a atras 12 milioane de dolari în intrări și 33 milioane de dolari în volum în prima zi. Fondul deține un amestec diversificat de active Solana, inclusiv

JitoSOL și ETP-ul Staked Solana de la CoinShares, cu un raport de cheltuieli de 0,75% și un randament anual estimat de 5-7%.

Bitwise Solana ETF (BSOL) a urmat pe 28 octombrie 2025, lansându-se la New York Stock Exchange cu 69,5 milioane de dolari în intrări în prima zi. Gestionat de Helius Technologies, oferă expunere directă spot la Solana cu staking complet integrat, țintind aproximativ 7% randament și renunțând la comisionul de management de 0,20% pentru primele trei luni.

Împreună, SSK și BSOL semnalează începutul unei noi ere pentru ETF-urile legate de crypto, combinând accesibilitatea tradițională cu generarea de venituri on-chain.

Performanța de debut a Rex Osprey SOL Staking ETF | Sursa: X

Ce este Solana (SOL)?

Solana este un blockchain de înaltă performanță, adesea numit “

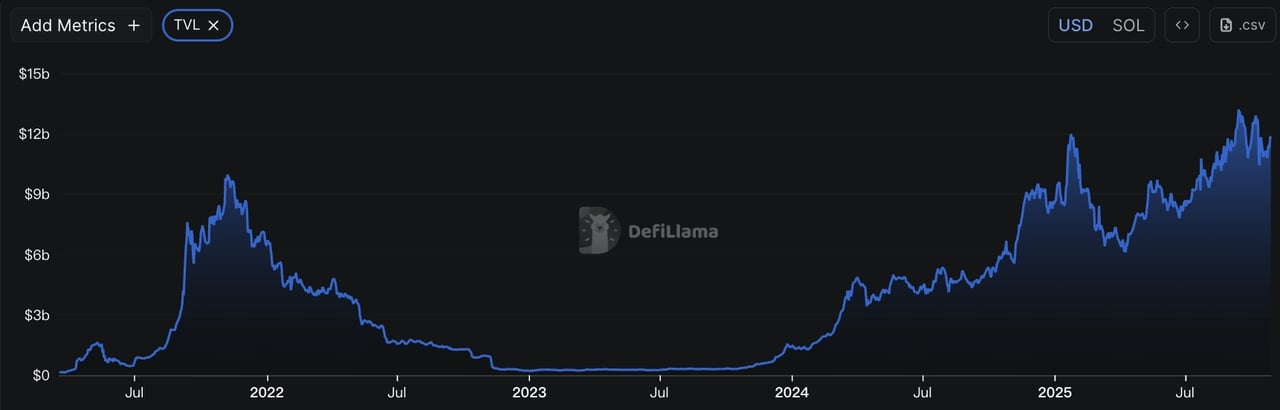

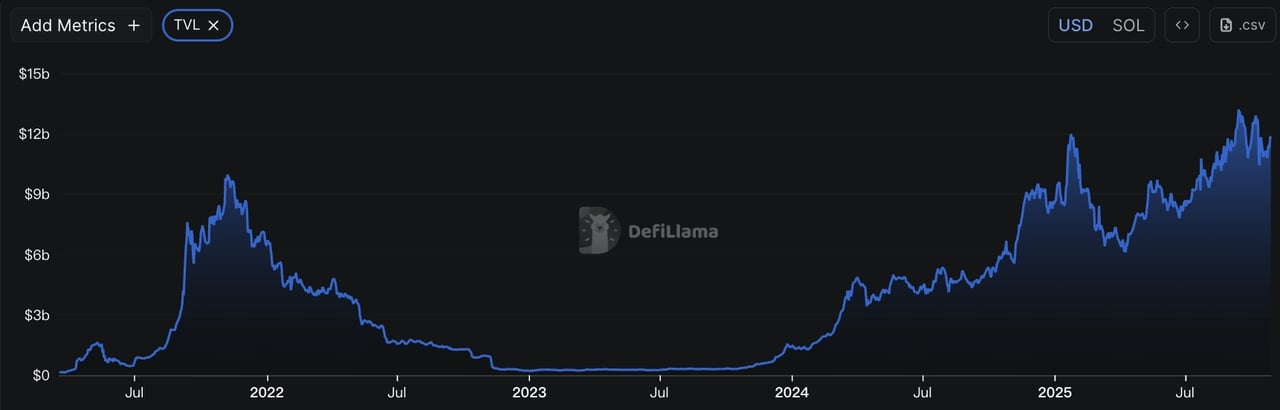

ucigașul Ethereum” pentru capacitatea sa de a procesa mii de tranzacții pe secundă la costuri extrem de reduse. În 2025, rămâne una dintre rețelele Layer 1 cu cea mai bună performanță, cu o valoare totală blocată (TVL) de aproximativ 11,8 miliarde de dolari, impulsionată de creșterea puternică în

DeFi,

NFT-uri,

memecoin-uri și gaming. Solana folosește un sistem hibrid Proof of History (PoH) și Proof of Stake (PoS) pentru a obține finalizare rapidă și scalabilitate.

Actualizările sale majore din 2025, inclusiv Firedancer de la Jump Crypto și Alpenglow, sunt concepute pentru a crește debitul, reduce latența și a face rețeaua mai sigură și fiabilă pentru adopția la scară largă.

Ecosistemul Solana a devenit unul dintre cele mai active din crypto. Platformele DeFi precum

Raydium și

Jupiter conduc tranzacționarea descentralizată, în timp ce

Pump.fun și

LetsBonk.fun domină spațiul

launchpad-urilor de memecoin. Dincolo de finanțe, Solana se extinde în tehnologia de consum cu

smartphone-ul Solana Seeker, integrând identitatea Web3 și funcționalitatea portofelului în hardware-ul mobil. Împreună, aceste progrese consolidează poziția Solana ca unul dintre cele mai inovatoare și scalabile blockchain-uri în 2025.

Ce este un ETF Solana cu Staking?

Un ETF Solana cu Staking este un fond tranzacționat la bursă reglementat care oferă investitorilor expunere la mișcările de preț ale Solana (SOL), câștigând totodată recompense de staking generate de rețea. În loc să cumpere și să facă staking SOL direct, investitorii pot cumpăra acțiuni ETF printr-un cont de brokeraj tradițional, obținând atât apreciere de capital, cât și randament pasiv fără a gestiona portofele sau validatori.

REX-Osprey Solana Staking ETF (SSK), lansat pe 2 iulie 2025, a fost primul de acest fel din Statele Unite. Fondul deține token-uri SOL reale și le face staking prin Anchorage Digital, un custode federalmente autorizat și partener de staking. Această configurație permite ETF-ului să câștige aproximativ 7% randament anual, care este distribuit investitorilor. Pentru indivizi, aceasta este comparabilă cu câștigarea de dobânzi dintr-un cont de economii cu randament ridicat, dar într-un context de investiție crypto, combinând recompensele blockchain cu accesibilitatea pieței tradiționale.

Cum funcționează un ETF Solana cu Staking?

Un ETF Solana cu Staking simplifică investițiile în crypto permițându-vă să câștigați recompense de staking fără a fi nevoie să gestionați portofele, validatori sau chei private. Iată cum funcționează pas cu pas:

1. Crearea ETF-ului – Managerul fondului, REX-Osprey, cumpără token-uri Solana (SOL) reale pentru a susține ETF-ul. Aceste token-uri formează activele de bază ale fondului, care se tranzacționează sub ticker-ul SSK.

2. Integrarea Staking-ului – În loc să dețină SOL pasiv, ETF-ul face staking acestor token-uri pe rețeaua Solana prin Anchorage Digital, un custode crypto reglementat. Aceasta înseamnă că SOL deținut de fond participă activ la validarea tranzacțiilor și securizarea blockchain-ului.

3. Distribuirea Recompenselor – Pe măsură ce SOL în staking câștigă recompense din rețea (în prezent aproximativ 7,3% anual), aceste recompense sunt colectate și transmise investitorilor. Aceasta creează un flux de venituri pasive similar cu câștigarea de dividende de la acțiuni sau dobânzi de la obligațiuni.

4. Accesul Investitorilor – Investitorii pot cumpăra sau vinde acțiuni din ETF pe Cboe BZX Exchange la fel cum ar face cu orice acțiune tradițională sau ETF, folosind un cont de brokeraj obișnuit.

Această structură inovatoare respectă reglementările din SUA deoarece ETF-ul operează sub Investment Company Act din 1940 și folosește un format de C-Corporation. Această abordare asigură că recompensele de staking pot fi distribuite legal și în siguranță, făcându-l o modalitate convenabilă și reglementată pentru investitorii de retail și instituționali de a accesa creșterea de preț a Solana și veniturile din staking.

ETF Solana cu Staking vs. ETF Solana Spot: Care este diferența principală?

Cu lansarea noilor

ETF-uri Solana spot cu staking, diferența dintre ETF-urile Solana cu Staking și ETF-urile Solana spot s-a redus considerabil. Ambele oferă expunere la performanța de preț a Solana (SOL) și recompense de staking, dar diferă în modul în care aceste recompense sunt gestionate și reglementate. Împreună, ele arată cum staking-ul și expunerea spot converg într-o nouă clasă de investiții crypto reglementate, generatoare de randament.

REX-Osprey Solana Staking ETF (SSK) lansat pe 2 iulie 2025, operează sub o structură de companie de investiții înregistrată (RIC) și este depus sub Investment Company Act din 1940. Acest cadru, similar reglementării fondurilor mutuale, permite SSK să distribuie recompensele de staking direct investitorilor. Fondul face staking SOL prin Anchorage Digital, câștigând aproximativ 7% anual, cu venituri plătite regulat.

Bitwise Solana ETF (BSOL) și Grayscale Solana ETF (GSOL) operează ca ETF-uri spot sub Actul din 1933. Ele urmăresc prețul de piață al SOL în timp ce fac staking unei părți din deținerile lor on-chain pentru a îmbunătăți randamentele. În loc să distribuie randamentul, recompensele de staking sunt reinvestite în fond pentru a-i crește valoarea. BSOL a început tranzacționarea pe 28 octombrie 2025, iar GSOL a urmat pe 29 octombrie, ambele listate la NYSE.

Diferențele cheie între SSK, BSOL și GSOL

1. Distribuirea Recompenselor:

• SSK plătește recompensele de staking direct investitorilor ca venit.

• BSOL și GSOL reinvestesc recompensele de staking în fond, crescându-i valoarea activului net.

2. Cadrul de Reglementare:

• SSK este depus sub "Investment Company Act din 1940", similar fondurilor mutuale.

• BSOL și GSOL operează sub "Securities Act din 1933", ca majoritatea ETF-urilor crypto spot.

3. Focusul Investitorilor:

• SSK vizează investitori orientați pe randament care caută venituri regulate.

• BSOL și GSOL se concentrează pe creșterea pe termen lung prin compunerea valorii.

Ambele structuri oferă acces reglementat și convenabil la randamentul Solana fără a necesita portofele, chei private sau configurări de validatori.

| Caracteristică |

ETF Solana cu Staking (SSK) |

ETF-uri Solana Spot (BSOL / GSOL) |

| Data lansării |

2 iulie 2025 |

BSOL: 28 oct 2025 / GSOL: 29 oct 2025 |

| Structură |

Companie de Investiții (RIC) |

Trust de Investiții (ETF Spot) |

| Act de Reglementare |

Investment Company Act din 1940,

similar fondurilor mutuale. |

Securities Act din 1933,

similar majorității ETF-urilor crypto spot |

| Cum funcționează |

Deține și face staking SOL direct, distribuind recompensele ca venit |

Urmărește prețul SOL și face staking on-chain, reinvestind recompensele |

| Custode / Partener |

Anchorage Digital |

Helius Technologies (BSOL) / Grayscale intern (GSOL) |

| Comision de Management |

0,75% |

BSOL: 0,20% (renunțat pentru 3 luni) / GSOL: 0,25% |

| Gestionarea Randamentului |

Recompensele plătite ca venit |

Recompensele reinvestite în valoarea fondului |

| Randament Anual (Est.) |

~7% |

~5–7% |

| Platformă de Tranzacționare |

Cboe BZX Exchange |

NYSE / NYSE Arca |

| Focusul Investitorilor |

Venit pasiv |

Creștere pe termen lung și lichiditate |

Dincolo de piețele din SUA: ETF-urile SOL cu Staking din Canada și Europa

În timp ce Statele Unite au introdus doar recent ETF-urile cu staking, alte regiuni s-au mișcat mai devreme pentru a adopta produse de investiții bazate pe Solana care combină expunerea reglementată cu randamentul on-chain.

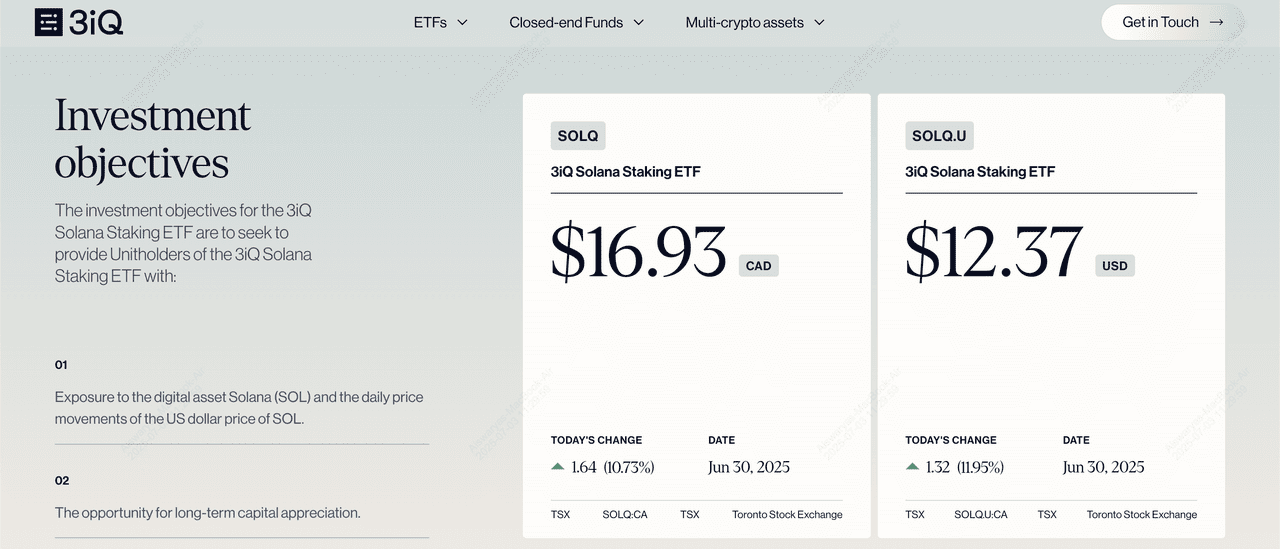

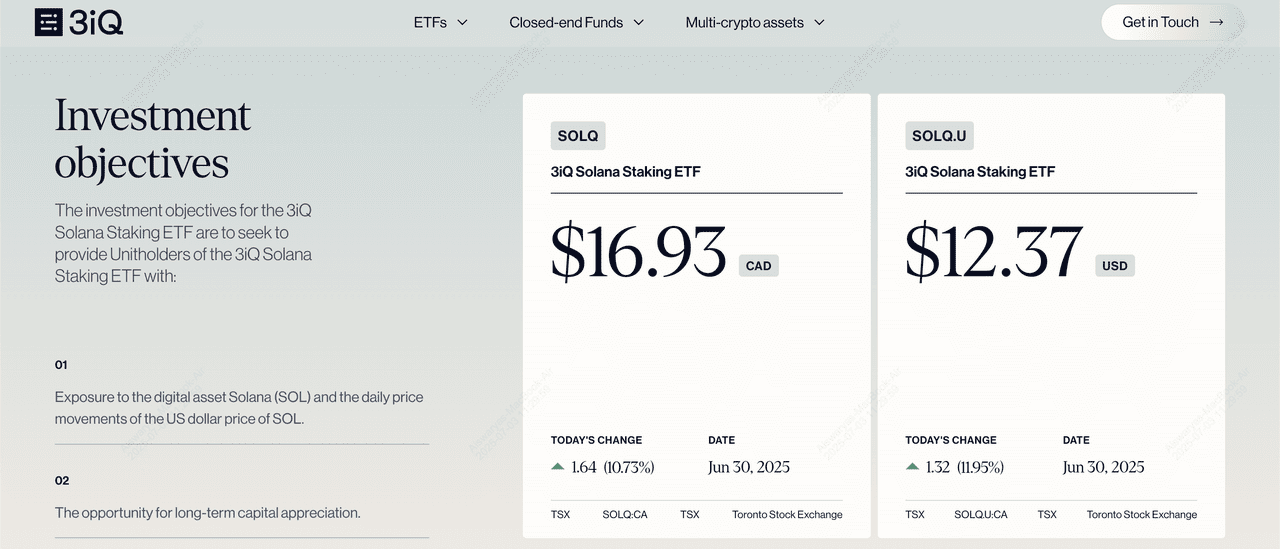

1. 3iQ Solana Staking ETF (SOLQ) – Canada:

Canada a devenit prima țară care a lansat ETF-uri Solana spot cu staking în aprilie 2025 la Toronto Stock Exchange. Emitentii, inclusiv 3iQ, Purpose Investments, Evolve și CI Galaxy, au lansat fonduri cu staking care alocă până la 50% din deținerile lor la staking on-chain, generând randamente anuale de 2-3,5%. 3iQ Solana Staking ETF (SOLQ) a condus rapid piața, atrăgând 87,6% din totalul intrărilor, sau aproximativ 191 milioane CAD până la mijlocul lui iunie 2025. SOLQ a fost lansat de asemenea cu zero comisioane de management pentru primul an, ajutând să conducă adopția timpurie puternică printre investitorii instituționali și de retail.

Performanța ETF-ului Solana cu staking de la 3iQ | Sursa: 3iQ

2. Bitwise Solana Staking ETP (BSOL) – Europa: În Europa, Bitwise și-a introdus Solana Staking ETP pe Xetra, oferind un APY de 6,48% cu un comision de management de 0,85%, depășind competitorii precum produsele de staking de la 21Shares, care au în medie 5,49% cu costuri mai mari. BSOL folosește depozitare la rece de grad instituțional și urmărește Compass Solana Total Return Monthly Index, oferind transparență completă și performanță fiabilă bazată pe staking. Combinația sa de randament puternic, benchmarking clar și structură reglementată l-a poziționat ca unul dintre cele mai atractive produse de investiții legate de Solana din Europa.

Cea mai bună modalitate de a investi în Solana în 2025: ETF-uri sau crypto?

Un ETF Solana oferă o modalitate simplă și reglementată de a obține expunere la Solana (SOL) fără nevoia de a gestiona portofele, chei private sau burse crypto. Se potrivește investitorilor care doresc securitatea și conveniența finanțelor tradiționale în timp ce participă la ecosistemul în creștere al Solana. Deoarece ETF-urile se tranzacționează pe burse publice, oferă prețuri transparente, lichiditate ridicată și, în unele cazuri, randament suplimentar prin recompense de staking.

Totuși, ETF-urile Solana nu sunt lipsite de risc. Prețurile lor se mișcă cu volatilitatea de piață a SOL, care este influențată de sentimentul investitorilor, actualizările de reglementare și tendințele macroeconomice mai ample. Este important de asemenea să înțelegeți cum funcționează fiecare produs. ETF-urile Solana cu Staking distribuie recompensele de staking direct investitorilor, în timp ce ETF-urile Solana spot cu staking reinvestesc acele recompense pentru a crește valoarea fondului în timp.

• Dacă ești un investitor tradițional: Un ETF Solana spot este un punct de plecare excelent. Oferă expunere la Solana prin platforme de brokeraj familiare, oferind lichiditate și conformitate într-o piață reglementată.

• Dacă ești un investitor orientat pe venit: Un ETF Solana cu Staking poate fi mai atractiv. Combină expunerea la prețul SOL cu venituri regulate din staking, creând un flux de randament constant sub o structură transparentă și reglementată.

• Dacă ești un investitor crypto nativ: S-ar putea să preferi să

cumperi SOL direct pe BingX, să îl transferi în propriul tău portofel și să faci staking on-chain pentru randamente mai mari și control total asupra activelor tale.

Gânduri finale

Lansarea ETF-urilor Solana spot și cu staking marchează un nou capitol în conectarea crypto cu finanțele tradiționale. Ceea ce a început cu ETF-urile Bitcoin și Ethereum s-a extins acum la Solana, oferind investitorilor o modalitate reglementată de a accesa atât expunerea la preț, cât și randamentul on-chain prin canale financiare familiare.

Fie prin REX-Osprey Solana Staking ETF (SSK) orientat pe venit, fie prin ETF-urile spot orientate pe creștere de la Bitwise (BSOL) și Grayscale (GSOL), investitorii pot alege acum produse care se potrivesc obiectivelor lor. Pe măsură ce ecosistemul Solana continuă să se extindă în DeFi, NFT-uri și Web3, aceste ETF-uri arată cum activele digitale devin o parte integrată a investițiilor mainstream.

Lectură conexă

Întrebări frecvente (FAQ)

1. Care este prețul ETF-ului Solana cu Staking (SSK)?

ETF-ul Solana cu Staking (SSK) se tranzacționează pe Cboe BZX Exchange sub ticker-ul SSK. Prețul său fluctuează pe parcursul zilei de tranzacționare bazat pe performanța de piață a Solana și cererea investitorilor, similar altor ETF-uri.

2. Care este dividendul ETF-ului Solana cu Staking (SSK)?

ETF-ul SSK distribuie dividende generate din recompensele de staking câștigate pe rețeaua Solana. Aceste recompense sunt de obicei în jur de 7% anual, deși suma exactă poate varia în funcție de performanța rețelei și randamentele validatorilor.

3. Cât de des vor fi plătite dividendele SSK?

Se așteaptă ca dividendele de la SSK să fie plătite lunar, aliniindu-se cu structura sa orientată pe venit sub Investment Company Act din 1940. Investitorii se pot aștepta ca recompensele de staking să fie distribute regulat ca parte din deținerile lor de ETF.

4. Este ETF-ul Solana cu Staking (SSK) diferit de Bitwise Solana ETF (BSOL)?

Da. SSK distribuie recompensele de staking direct investitorilor ca venit, în timp ce BSOL reinvestește recompensele de staking înapoi în fond pentru a-i crește valoarea activului net. Ambele oferă expunere la Solana, dar urmează abordări de investiții diferite.

5. Pot cumpăra ETF-uri Solana pe platformele obișnuite de tranzacționare cu acțiuni?

Da. Atât SSK, cât și BSOL pot fi cumpărate prin conturi de brokeraj standard, la fel ca ETF-urile tradiționale. Aceasta permite investitorilor să obțină expunere la Solana fără a folosi burse crypto sau a gestiona portofele digitale.