Aster (ASTER) is a next-generation decentralized perpetual exchange that has quickly become one of the hottest names in crypto trading in 2025. Launched after the merger of Astherus and APX Finance, Aster combines yield-generating products with advanced

perpetual contracts to create a unified, capital-efficient DeFi platform.

Since its

Token Generation Event (TGE) on September 17, 2025, Aster’s native token $ASTER has surged over 2,200%, trading at $2.32 with a $3.86B market cap on Sept 24, 2025. This rapid growth, paired with features like 1001x leverage, Pro Mode trading, and stock perpetuals, has made Aster one of the most discussed DeFi projects this year.

In this article, we’ll walk through what Aster DEX is, how it works, why it’s gaining attention in 2025, and provide an overview of its tokenomics along with key details from the recent TGE.

What Is Aster DEX (ASTER)?

Aster DEX is a

decentralized perpetual exchange (Perp DEX) created in late 2024 through the merger of Astherus and

APX Finance. The project combines Astherus’ yield-generating products with APX’s robust perpetuals infrastructure to build a one-stop platform for both traders and yield seekers.

At its core, Aster is designed to make derivatives trading simpler, faster, and more capital-efficient on-chain. The platform supports both spot and perpetual markets and runs across multiple networks including

BNB Chain,

Ethereum,

Solana, and

Arbitrum. Unlike many other DEXs, Aster also integrates its own yield-bearing assets such as

liquid staking derivative asBNB and

yield-bearing stablecoin USDF that can be used as trading collateral, allowing users to earn yield while keeping positions active.

By combining derivatives, yield, and multichain access, Aster positions itself as a next-generation

DeFi infrastructure built to rival centralized exchanges.

How Does Aster DEX (ASTER) Work?

Aster DEX operates through multiple modes and features that cater to different trading needs:

1. Pro Mode: Aster’s order book based interface comes with deep liquidity, multi-asset margin, and advanced tools like grid trading. It gives professional traders a CEX-like experience in DeFi, combining lower fees with full asset control.

2. Hidden Orders: A feature often compared to dark pools, Hidden Orders let traders place orders without revealing their size or presence in the book until execution, reducing slippage and front-running risks. The James Wynn episode on

Hyperliquid, where his visible positions became a target, highlighted the downsides of on-chain transparency. This makes Hidden Orders attractive for whales, high-frequency traders, and anyone who wants privacy without sacrificing liquidity access.

3. 1001x Mode: A one-click, MEV resistant system powered by the ALP liquidity pool, offering up to 1001x leverage with fully on-chain execution. It caters to users who want maximum exposure in a transparent and decentralized environment, with oracles from

Pyth,

Chainlink, and Binance Oracle.

4. Stock Perpetuals: Aster enables 24/7

stock perpetuals, bringing traditional equities into DeFi. It opens the door for traders who want to move seamlessly between crypto and stocks on the same platform.

5. Yield Integration: Yield-bearing assets like asBNB and USDF can be used as collateral, letting users earn rewards while trading. This approach makes collateral more efficient by keeping it productive even during active trades.

Aster Becomes a Leading Challenger in the DEX Landscape in 2025

The decentralized derivatives market is booming, and Aster has quickly become one of its standout projects. Three factors explain why it is drawing so much attention this year:

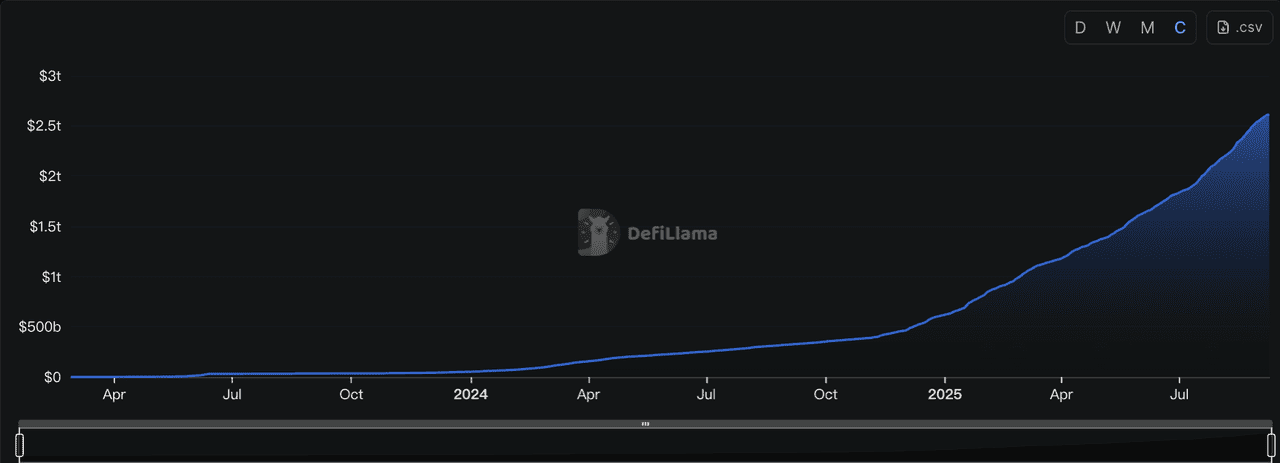

Cumulative trading volume on Hyperliquid perps has reached a mind-boggling $2.5T | Source: DefiLlama

1. DeFi Derivatives Grow over 650%, Hitting $408B Milestone

DeFi perpetuals have surged over 650% year-on-year, with

Hyperliquid (HYPE) dominating the market, and Aster (ASTER) and

MYX Finance (MYX) emerging as strong challengers. The overall perp DEX sector has now surpassed $408B in cumulative trading volume, highlighting the rapid expansion of on-chain derivatives. In this landscape, Aster is gaining attention with features like 24/7 stock perpetuals and 1001x leverage, positioning itself as one of the most competitive new platforms to watch.

2. $ASTER Surges 2,700% Post-TGE, Market Cap Hits $3.75B

Since its TGE on September 17, 2025, ASTER has skyrocketed from $0.08 to around $2.27 by Sept 24, giving it a multibillion-dollar market cap. Strong community demand, paired with visibility from Binance founder CZ, helped fuel this surge.

3. Hidden Orders and High Leverage Boost Trader Adoption

Aster differentiates itself with advanced features like Pro Mode, high-leverage trading, and Hidden Orders, which function like dark pools by concealing order details until execution. This appeals to professional traders who want stealth execution and efficiency, especially after high-profile episodes in the perp trading scene highlighted the risks of full transparency.

What Is $ASTER Crypto Token?

The $ASTER token is the native utility asset of Aster DEX. Rather than being just a tradable asset, it is designed to support the core functions of the platform and align long-term incentives between traders, liquidity providers, and the protocol itself.

Key Utilities of $ASTER

• Governance: Holders can vote on proposals that shape Aster’s future, from fee structures to new product launches and ecosystem upgrades.

• Trading Collateral and Fees: ASTER can be used as margin for perpetual trades and for paying fees, offering practical integration into the exchange.

• Incentives and Rewards: A significant portion of supply funds airdrops, loyalty programs, and liquidity incentives, rewarding active participation.

• Ecosystem Growth and Sustainability: ASTER allocations support grants, partnerships, and APX migration, while revenue buybacks create long-term value capture.

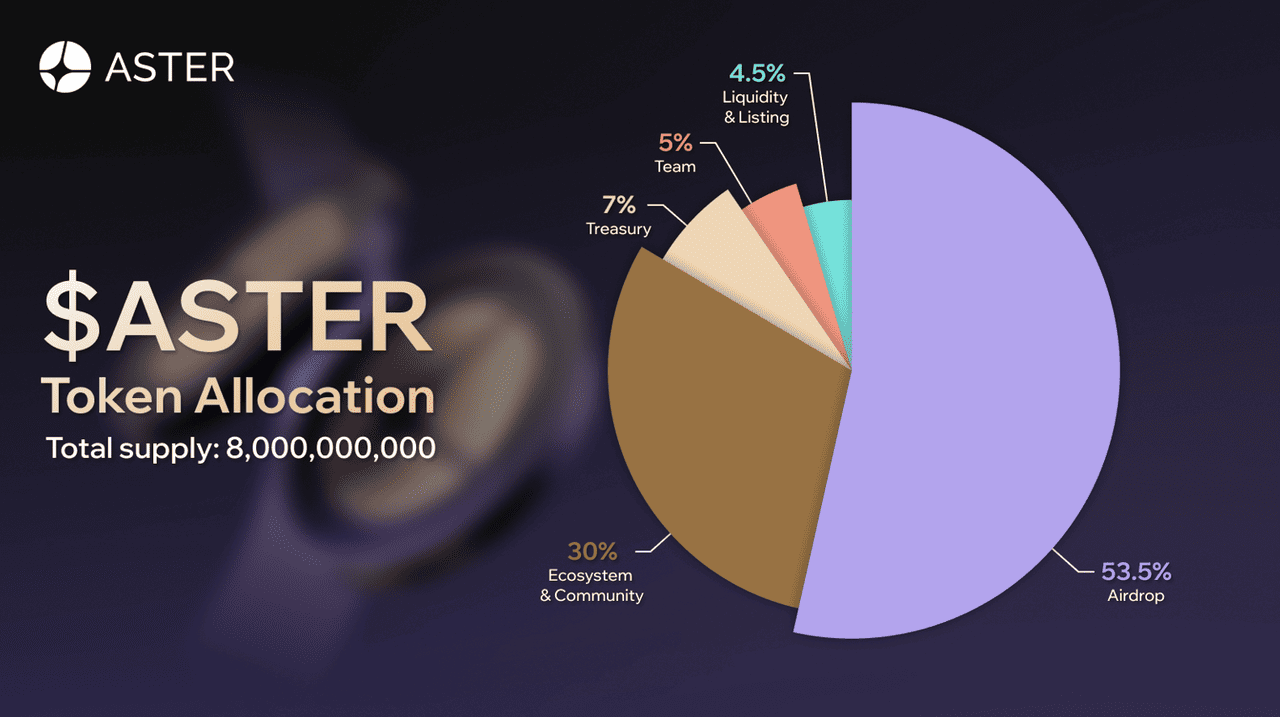

$ASTER Token Allocation

The distribution of $ASTER reflects Aster’s community-first approach, with the majority of supply dedicated to rewarding users and fueling ecosystem growth.

• Airdrop – 53.5% (4.28B): Rewards for traders and community members.

• Ecosystem & Community – 30% (2.4B): For APX migration, partnerships, and grants.

• Treasury – 7% (560M): Reserves for governance and growth.

• Team & Advisors – 5% (400M): Contributor allocation with cliff and vesting.

• Liquidity & Listings – 4.5% (360M): For exchange listings and market stability.

With over 80% of tokens tied to the community and ecosystem, Aster’s allocation is structured to reinforce utility rather than short-term speculation.

ASTER Token TGE on September 17: What You Need to Know

Aster officially launched its native token through a Token Generation Event (TGE) on September 17, 2025, releasing a portion of supply to early users. Participants in the Aster Spectra points programs, community campaigns, and APX token holders were eligible to claim, with the claim window open until October 17. Once collected, ASTER could be traded on Aster Spot or withdrawn to external wallets, giving the community instant access to the token. The event highlighted Aster’s community-first approach by rewarding loyal users and smoothly transitioning APX holders into the new ecosystem.

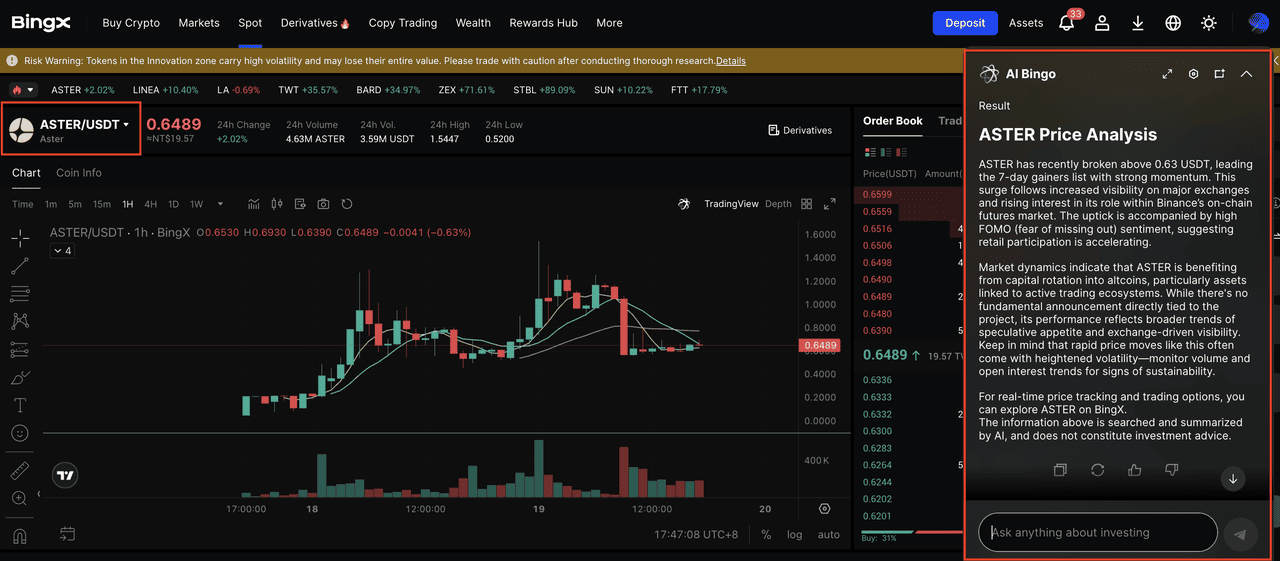

How to Buy and Trade ASTER on BingX

Whether you want to build a long-term ASTER position, trade short-term volatility, or capture opportunities after its TGE, BingX makes it simple with both spot and futures markets. With

BingX AI built directly into the interface, you can also access real-time insights to support smarter decisions.

1. Buy or Sell ASTER on the Spot Market

If your goal is to accumulate ASTER or buy dips during pullbacks, the spot market is the simplest option.

Step 2: Before placing your order, click the AI icon on the chart to activate BingX AI. It will show support and resistance levels, detect breakout zones, and suggest optimal entry points.

Step 3: Choose between a market order for instant purchase or a limit order at your desired entry price. Once filled, your ASTER will appear in your BingX account balance, ready to hold or withdraw to an external wallet.

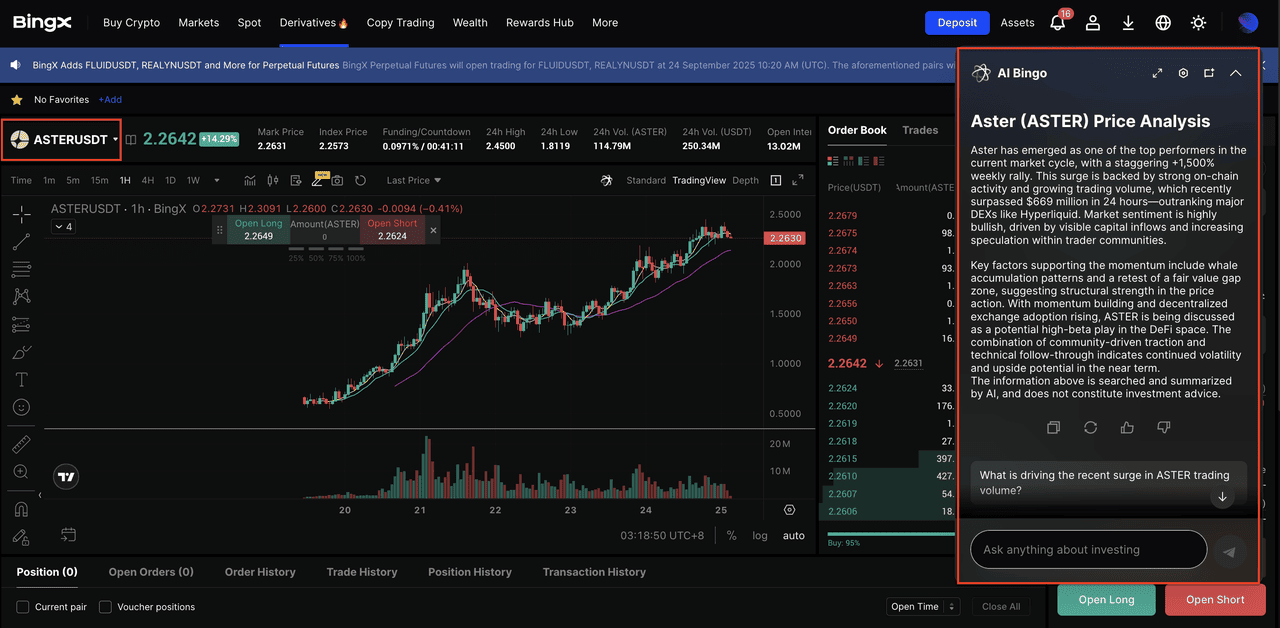

2. Trade ASTER with Leverage on Futures

For active traders, BingX

Futures Market allows you to go long or short on ASTER with leverage, so you can benefit from both upward and downward moves.

Step 1: Search for

ASTER/USDT in the BingX Futures section.

Step 2: Click the AI icon on the chart to activate BingX AI. It will analyze market momentum, volatility, and trend strength to guide your entry.

Step 3: Set your leverage, choose your entry price, and place a long (buy) or short (sell) order. Use stop-loss and take-profit levels to manage risk effectively.

What’s Next for Aster: Future Roadmap

Aster’s momentum in 2025 is only the start of its broader vision. The team is building Aster Chain, a high-performance Layer 1 designed to integrate zero-knowledge proofs for privacy and an intent-based system to automate execution across chains and liquidity sources. This would transform Aster from a single perp DEX into a base layer for decentralized derivatives.

Beyond the new chain, Aster plans to expand support for multi-asset and yield-bearing collateral, allowing traders to use assets like USDF or asBNB directly in margin accounts. This adds another layer of capital efficiency and positions Aster as one of the most flexible perp platforms.

On the user side, upgrades such as VIP tiers, fee discounts, and a mobile-first experience are in development, aiming to make professional-level trading tools more accessible to everyday users.

If delivered, these milestones could elevate Aster from a fast-growing exchange into a foundational layer of DeFi, bridging privacy, automation, and capital efficiency in one ecosystem.

Related Reading

Frequently Asked Questions (FAQs) on Aster

1. When was the ASTER token launched?

The ASTER token was officially launched during its Token Generation Event (TGE) on September 17, 2025.

2. What chain does Aster work on?

Aster is multichain, operating on BNB Chain, Ethereum, Arbitrum, and Solana, while the $ASTER token itself is a BEP-20 token on BNB Chain.

3. Which wallets support ASTER?