BingX is proud to dive into the world of institutional Bitcoin adoption by sponsoring and contributing to Cointelegraph’s latest research report, The Case for Bitcoin in an Institutional Portfolio. This has been an incredibly popular topic globally since the U.S. Securities and Exchange Commission approved rule changes allowing the creation of bitcoin exchange-traded funds in the United States.

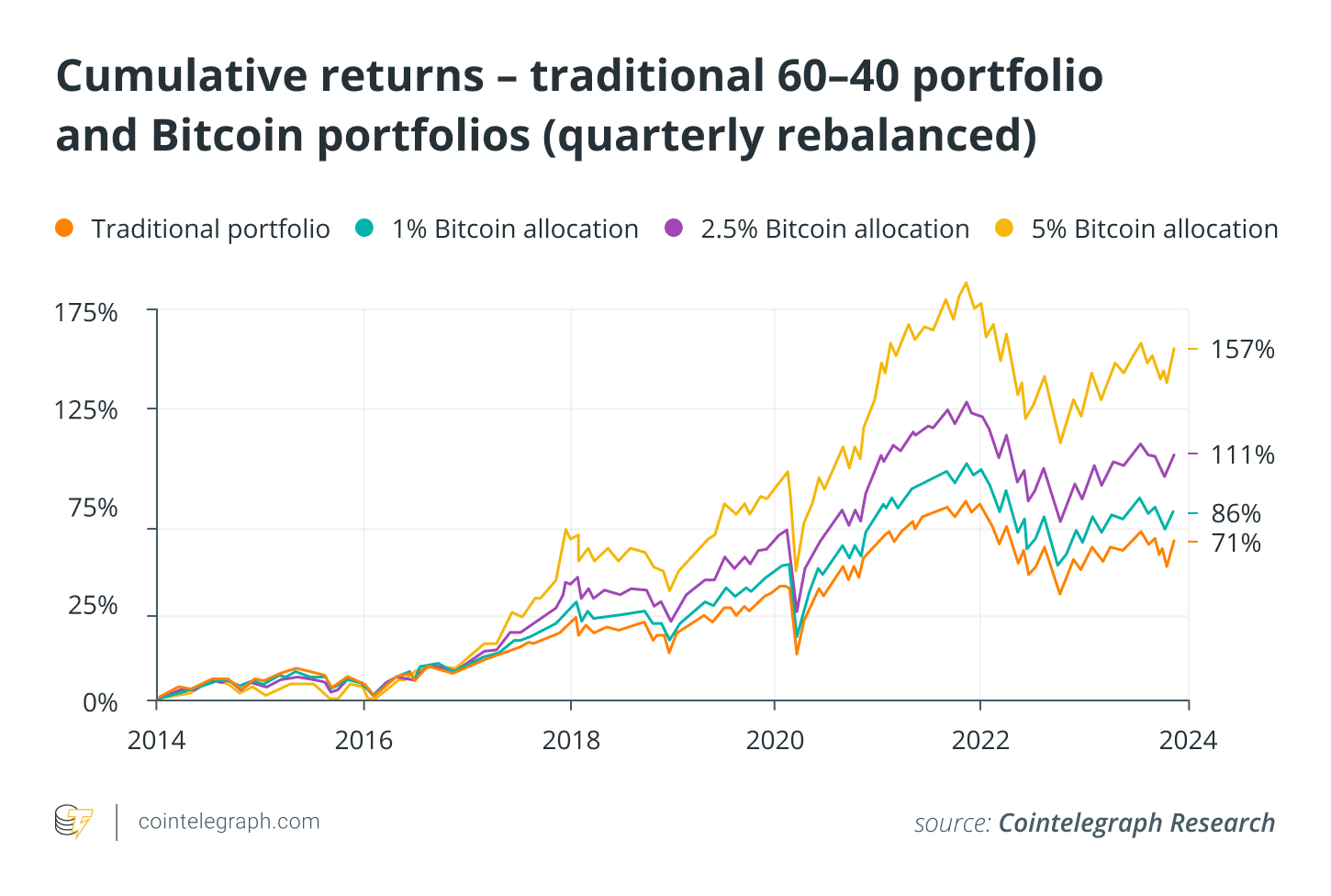

The Case for Bitcoin in an Institutional Portfolio represents a joint initiative by Cointelegraph Research and the Crypto Research Report. This collaborative effort delves into integrating Bitcoin (BTC) into conventional investment approaches for institutional investors. The report thoroughly examines Bitcoin’s historical performance, its strategic importance, and the influential factors propelling institutional adoption. It also discusses the challenges and opportunities of incorporating this digital asset into institutional portfolios.

The report explores the unique market behavior of Bitcoin, with a specific emphasis on optimal allocation strategies and investment timeframes for the cryptocurrency. It provides a well-rounded analysis of the balance between Bitcoin’s volatility and returns, highlighting its contribution to enhancing portfolio diversification. Additionally, the report examines the global regulatory landscape, recognizing its significance for institutions entering this innovative domain.

Megan Nyvold, Head of Brand at BingX, added, “Classifying Bitcoin has always been a conundrum. Bitcoin’s correlations with traditional assets have perplexed investors with their variability. From inception to 2020, Bitcoin was largely uncorrelated from any asset class, lending the asset a meaningful role as a portfolio diversifier. After the liquidity injections and inflationary impulse in 2020-22, Bitcoin behaved like a risk asset. And more recently, its correlations with risk-on assets have broken down as it has behaved more like gold. So, determining Bitcoin’s nature alongside other asset classes has been fiendishly difficult. Bitcoin’s purest correlation of late has been to changes in the broad money supply, making it a gauge of liquidity of sorts. As the U.S. nears a reckoning on the debt, and foreign buyers of Treasuries appear ever more scarce, alongside high and growing deficits, a monetization of the debt and a reliquification from central banks seems more likely. Amid these circumstances, Bitcoin would be a clear beneficiary. The likely potential for a spot ETF in the U.S. in Q1 2024 is another potent catalyst, alongside the highly touted quadrannual halving event. While many institutions have been disillusioned by crypto markets amid the credit crunch of 2022 and the subsequent drawdown, much of the largesse has been purged from the markets and the industry is quietly rebuilding. While Bitcoin is in the doldrums today, it endures as a global monetary asset of consequence, and brighter catalysts lie ahead.”

Download a PDF of the Report for free from the Cointelegraph Research Terminal.

About BingX Founded in 2018, BingX is a leading cryptocurrency exchange serving over 10 million users worldwide. BingX offers diversified products and services, including spot, derivatives, copy trading, and asset management – all designed for the evolving needs of users, from beginners to professionals. BingX is committed to providing a trustworthy and transparent platform that empowers users with innovative tools and features to elevate their trading proficiency.

Disclaimer: BingX does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to the company. BingX is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned in the article.