Bitcoin has soared to an all-time high of $111,925, breaking past key psychological resistance levels and reigniting bullish sentiment across the crypto market. This milestone comes amid a 6% weekly gain for BTC, pushing its year-to-date performance to nearly 74%.

Bitcoin price surges | Source: BingX

Key Highlights

- Bitcoin (BTC) sets a new all-time high near $112,000, sparking a broader crypto market surge.

- U.S. tax hike delay and Elon Musk’s “America Party” Bitcoin endorsement drive bullish sentiment.

- Over $330 million in Bitcoin short positions liquidated in just two hours.

- Spot Bitcoin ETFs cross $50 billion in net inflows, with IBIT holding over 700,000 BTC.

- Analysts eye “Crypto Week” in the U.S. Congress as a potential trigger for BTC’s climb to $120K and beyond.

Bitcoin and the Crypto Market Test Unprecedented Heights

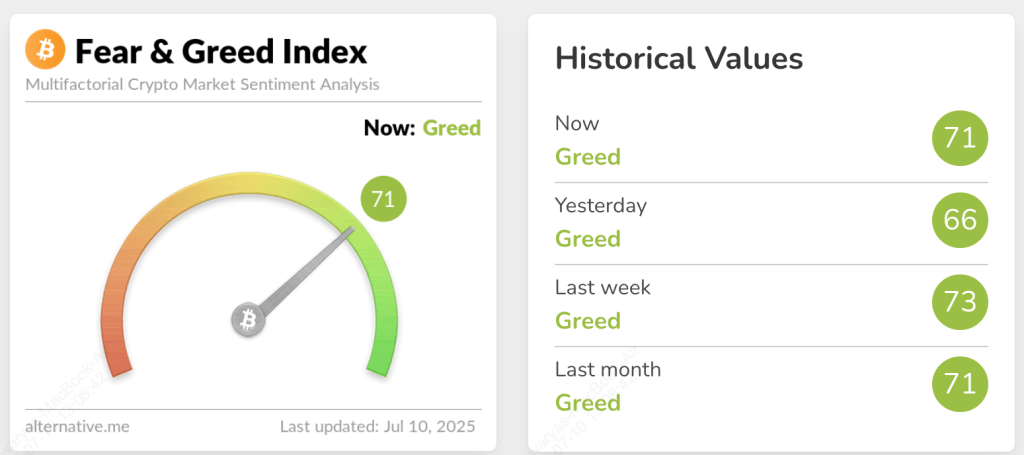

Fear & Greed Index on Jul 10, 2025

Bitcoin’s latest rally has lifted the total crypto market capitalization back to $3.47 trillion, inching closer to its December 2024 peak of $3.73 trillion, according to CoinMarketCap data. The Crypto Fear and Greed Index remains in Greed, surging from 66 yesterday to 71 today.

This surge has not gone unnoticed. On-chain metrics show declining BTC reserves on exchanges, with Glassnode reporting balances falling to 2.99 million BTC as of July 9, down from 3.11 million BTC in March. This suggests growing investor confidence and a potential supply crunch.

Snapshot of the crypto market | Source: Coinmarketcap

Top Altcoins Riding the Wave

Bitcoin’s rally has pulled other major cryptocurrencies higher, with several altcoins making significant moves and dominating CoinMarketCap’s trending list:

- Ethereum (ETH): up 6.4% in 24 hours to $2,796, with analysts eyeing a breakout toward the $3,000 level amid growing institutional inflows.

- Hyperlane (HYPER): the top gainer of the day, soaring 153% in 24 hours to $0.2935, driven by increased cross-chain messaging adoption and a 24-hour trading volume exceeding $194 million.

- Dogecoin (DOGE): up 5.1% to $0.1811, supported by renewed retail enthusiasm and memecoin momentum following Elon Musk’s pro-crypto remarks.

- Solana (SOL): climbed past $158, marking double-digit weekly gains as its DeFi and NFT ecosystems continue to grow rapidly.

- XRP (XRP): rose 3.9% in 24 hours to $2.42, buoyed by positive sentiment around Ripple’s global payments expansion and ongoing regulatory clarity in key markets.

These altcoin moves underscore the market-wide bullish sentiment, with traders rotating into high-performing assets beyond Bitcoin. However, the CoinMarketCap Altcoin Season Index at 26 currently signals a “Bitcoin Season,” suggesting BTC dominance remains strong for now.

Read more: What Is a Crypto Bull Run and How Does It Work?

Key Catalysts Behind the Rally

Bitcoin’s explosive move to $112,000 didn’t happen in isolation. A combination of macroeconomic events, political developments, and market dynamics have created the perfect storm for this historic rally.

1. U.S. Tax Hike Delay Spurs Optimism

The U.S. government’s decision to delay its controversial tax hike by three weeks has provided unexpected relief for investors. The move is widely interpreted as a signal of potential trade and fiscal reforms aimed at stabilizing markets ahead of the upcoming “Crypto Week” in Congress.

Traders now anticipate more favorable policies that could encourage institutional adoption of cryptocurrencies, adding to Bitcoin’s safe-haven appeal.

2. Elon Musk’s Political Endorsement of Bitcoin

Adding fuel to the fire, Elon Musk announced that his recently formed “America Party” will officially support Bitcoin as part of its broader financial reform platform. This endorsement has amplified retail and institutional enthusiasm, evoking parallels to Musk’s past influence on Dogecoin and other memecoins.

Read more: America Party (AP) Memecoin Price Explodes: What Is It?

3. Short Squeeze Intensifies the Breakout

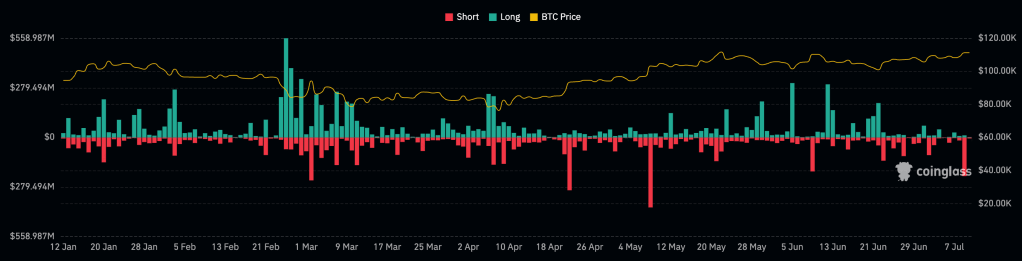

Bitcoin liquidations | Source: CoinGlass

The price rally triggered a massive liquidation of leveraged short positions. Data from CoinGlass shows:

- $330 million in BTC shorts liquidated in under two hours.

- Total crypto liquidations across BTC, ETH, and SOL exceeded $460 million over 12 hours.

- More than 114,000 traders were affected, with the single largest liquidation – a $51.5 million BTC short.

This short squeeze created a reflexive cycle, where forced liquidations accelerated upward price momentum, catching many traders off guard.

4. Institutional Momentum Driving the Market

Institutional investors are emerging as the dominant force behind Bitcoin’s latest rally. Spot Bitcoin ETFs in the U.S. have seen relentless inflows, crossing $50 billion in cumulative net inflows just 18 months after launching in January 2024.

- BlackRock’s iShares Bitcoin Trust (IBIT): $53 billion net inflow.

- Fidelity Wise Origin Bitcoin Fund (FBTC): $12.3 billion net inflow.

- Grayscale Bitcoin Trust (GBTC): $23.3 billion outflow due to fee competition and investor rotation.

IBIT alone now holds over 700,000 BTC, representing 55% of all Bitcoin held in spot ETFs globally. BlackRock’s revenue from IBIT has even surpassed its flagship S&P 500 ETF, signaling the growing dominance of crypto in traditional finance portfolios.

5. Corporate Treasuries Add Fuel

Institutional demand has never been stronger, with MicroStrategy (now trading as Strategy) holding 597,325 BTC, worth approximately $65 billion, as of July 6, 2025, despite pausing its purchases last week after a Q2 spree. Other corporations are also accumulating Bitcoin aggressively, further validating its role as a treasury reserve asset:

- On July 7, 2025, Japan’s Metaplanet announced the purchase of $237 million worth of BTC, making it the fifth-largest corporate holder with over 15,500 BTC in its treasury.

- On the same day, France’s Blockchain Group and the UK-based Smarter Web Company disclosed Bitcoin acquisitions worth $12.5 million and $24.3 million, respectively, expanding their existing crypto reserves.

- On July 8, 2025, Remixpoint, listed on the Tokyo Stock Exchange, revealed plans to raise $215 million to acquire an additional 3,000 BTC, underscoring its commitment to Bitcoin as a strategic asset.

These moves highlight Bitcoin’s growing role as a treasury reserve asset amid concerns over fiat currency debasement and geopolitical risks.

Read more: What are the Top Bitcoin Corporate Holders in 2025?

BTC Price Prediction: Analysts Predict Further Upside

Market analysts remain overwhelmingly bullish as Bitcoin’s momentum accelerates.

Markus Thielen of 10x Research noted their proprietary trend model flipped bullish on June 29. He projects a 60% probability of BTC reaching $133,000 by September, representing a 20% upside from current levels.

“Bitcoin is breaking out, fueled by relentless ETF demand and a series of policy catalysts on the horizon,” Thielen said, highlighting the upcoming U.S. Consumer Price Index (CPI) report on July 15 and “Crypto Week” in Congress as key events that could drive further gains.

Kyle Reidhead of Milk Road is equally optimistic. He predicts Bitcoin could climb to $150,000 in the coming months, pointing to a bullish “cup and handle” technical formation developing on longer timeframes.

Adding to the long-term bullish outlook, renowned analyst PlanB, creator of the Stock-to-Flow (S2F) model, recently reiterated his bold prediction that Bitcoin could reach $1 million by 2028. PlanB argues that BTC’s halving cycles and increasing scarcity, combined with accelerating institutional adoption and global monetary debasement, make a seven-figure price tag plausible.

“Bitcoin’s trajectory is following the Stock-to-Flow model almost perfectly. If this trend holds, $1 million per BTC is not just a dream—it’s a statistical probability before the end of this decade,” PlanB said in a recent X (Twitter) post.

Read more: Will Bitcoin Cross $1 Million? BTC Price Prediction Explained in 2025

What’s Next for Bitcoin?

Bitcoin’s historic surge towards $112,000 has fueled both short-term excitement and long-term optimism, with many analysts seeing this as the start of a new phase of price discovery. The upcoming “Crypto Week” in U.S. Congress could serve as a critical catalyst. Lawmakers are set to debate key issues, including:

- Regulatory frameworks for stablecoins and spot crypto ETFs.

- Tax policies impacting crypto transactions and holdings.

- Federal and state-level initiatives to integrate Bitcoin into treasury reserves.

A favorable outcome from these discussions could push BTC beyond $120,000, potentially establishing a higher trading range. However, caution remains warranted. Historically, Bitcoin’s performance in Q3 has been modest, with an average return of just 5.84% since 2013 as per CoinGlass data. Combined with macroeconomic uncertainty and lingering inflation concerns, volatility is likely to stay elevated in the near term.

Bitcoin’s latest rally underscores its resilience and growing institutional acceptance. But as with any bull run, traders should remain vigilant. The sharp wave of liquidations highlights the risks of over-leveraged positions in a highly volatile market.

Whether you’re preparing for the next altcoin season or hedging against a pullback, BingX offers advanced Spot and Futures trading tools to help you trade BTC and navigate these dynamic conditions with confidence.

Related Reading

1. How to Dollar‑Cost Average(DCA) Bitcoin in 2025: Buy Bitcoin Recurringly

2. Will Bitcoin Cross $1 Million? BTC Price Prediction Explained in 2025

3. What are the Top Bitcoin Corporate Holders in 2025?

4. How to Mine Bitcoin (BTC) in 2025: A Beginner’s Guide

5. What Is a Crypto Bull Run and How Does It Work?

6. What Is Bitcoin Dominance (BTC.D) and How to Use It in Crypto Trading?

Disclaimer: Cryptocurrency markets are highly volatile. This article does not constitute financial advice. Always do your own research (DYOR) and consider your risk tolerance before trading.