The crypto market extended its late-2025 consolidation this week with year-end profit-taking, thin holiday liquidity, and macro uncertainty weighing on sentiment. The total market cap hovered around $2.90-$3.01 trillion, down approximately 1.3-1.5% over the past 24 hours but relatively flat week-over-week, as daily volumes stabilized near $146-$360 billion amid rotations into selective narratives like entertainment tokenization, ZK compute, and institutional payments. Today's session remains range-bound ahead of U.S. inflation revisions and holiday thinning, with Bitcoin trading ~$86,000-$88,000 after brief spikes to $90K+ on thin liquidity.

In this cautious environment, standout catalysts included RaveDAO's multi-exchange listings fueling explosive gains, Cysic's mainnet launch amid ComputeFi hype and volatility, sustained XRP ETF inflows providing resilience, Solana's Alpenglow upgrade anticipation limiting downside, and Pi Network's ongoing unlocks adding supply pressure. These highlight niche strength in cultural Web3, decentralized compute, regulated payments, L1 upgrades, and mobile ecosystems as selective gems amid broader altcoin weakness.

What Are the Key Crypto Market Highlights From the Past Week?

Over the last seven days (December 11-18, 2025), the market consolidated with Bitcoin flat-to-down around $86,500-$88,000, Ethereum dipping ~3-4% to $2,800-$2,940, and altcoins mixed on launch/listing-driven moves. The last 24 hours showed mild weakness: market cap -1.3-1.5%, with most top coins red. Privacy and select infrastructure plays held better, while L1s and memes faced profit-taking. Broader news included ongoing ETF developments, regulatory debates, and leverage resets triggering ~$1B+ liquidations.

This week, five tokens emerged as high-momentum gems driven by listings/launches, institutional flows, upgrades, and supply events. Key watchpoints: entertainment adoption, ZK/AI compute traction, payments resilience, L1 performance boosts, and unlock dynamics.

•

RaveDAO (RAVE)'s multi-exchange listings: Simultaneous debuts on major exchanges sparked 220-285% surge amid real revenue of over $3 million in 2025 and cultural impact.

•

Cysic (CYS)'s mainnet and token launch: ZK ComputeFi L1 debuted Dec 11, peaking +47-60% before volatility/FUD pullback.

•

XRP ETF inflows continue: Around $18-50 million daily, cumulative nearing/exceeding $1 billion, providing structural support despite price consolidation.

•

Solana Alpenglow upgrade hype: Community approval for 100-150ms finality and higher throughput limits downside amid broader L1 correction.

•

Pi Network (PI) coin unlocks: 105-190 million tokens this month add dilution pressure amid low liquidity.

What Are the Top Crypto Gainers?

These tokens led to strong momentum and liquidity spikes.

| Token |

7D % |

Trigger |

| RaveDAO (RAVE) |

217.15 |

Multi-CEX listings, $223M+ volume, real event revenue ($3M 2025), partnerships (Warner Music, 1001Tracklists). |

| Cysic (CYS) |

+47-60% (peak) |

Mainnet launch, zero-fee promos, ComputeFi narrative, despite post-launch FUD/volatility. |

| Fasttoken (FTN) |

0.74 |

Gaming/DeFi integrations and volume surge. |

| Zcash (ZEC) |

0.12 |

Privacy rotation and lingering ETF buzz. |

| Nexo (NEXO) |

0.15 |

Lending rewards and institutional interest. |

What Are the Top Losers in the Crypto Market?

These faced steepest declines amid rotation and sell pressure.

| Token |

7D % |

Trigger |

| Solana (SOL) |

-15% |

Broader L1 correction, validator/meme concerns offsetting Alpenglow hype. |

| Pi Network (PI) |

-10% |

Ongoing unlocks (~105-190M this month), low liquidity amplifying dilution. |

| Monero (XMR) |

-10% |

Privacy sector debates and traceability FUD. |

| Dogecoin (DOGE) |

-8% |

Meme profit-taking in risk-off environment. |

| Cardano (ADA) |

-7% |

Delayed upgrades and alt weakness. |

What Are the Top Weekly Crypto Gems, Dec 11-18, 2025?

This week's standout performers blend innovative cultural tokenization, emerging ZK and AI compute infrastructure, institutional-backed payments resilience, high-performance Layer-1 upgrades, and community-driven mobile ecosystems, delivering notable activity amid broader market consolidation.

1. RaveDAO (RAVE)

RaveDAO is pioneering the tokenization of live entertainment events, ticketing, NFTs, and decentralized community governance. The project has already generated approximately $3 million in real-world revenue from over 20 global events in 2025, with projections reaching $7 million in 2026. These profits directly fund token buybacks and burns, creating a deflationary mechanism tied to tangible margins exceeding 20%. Key partnerships with Warner Music, 1001Tracklists, and AMF, combined with social impact initiatives such as funding over 400 cataract surgeries in Nepal, underscore its unique position bridging Web3 and cultural experiences.

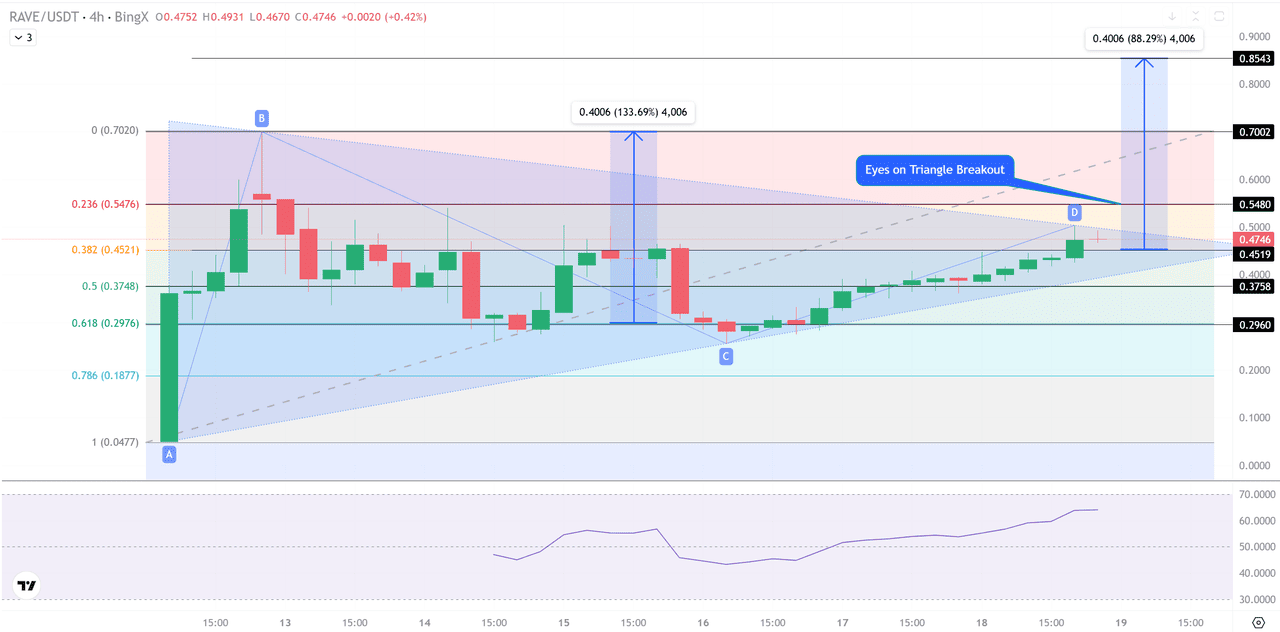

RAVE Price Outlook: Bullish Structure Builds as Breakout Above $0.55 Nears

RAVE/USDT is compressing into a tight ascending triangle on the 4-hour chart, signaling that a volatility expansion is approaching. Price is holding above rising trendline support while repeatedly pressing into horizontal resistance near $0.55–$0.56, showing improving demand for pullbacks. This structure reflects higher lows against flat resistance, a classic bullish continuation setup if confirmed.

RAVE/USDT Price Chart - Source:

BingX

Momentum is constructive.

RSI (relative strength index) is trending higher and holding above the mid-50s, suggesting buyers are gradually gaining control rather than chasing price.

Fibonacci levels show price stabilising above the 0.382–0.5 retracement zone, reinforcing the bullish bias as long as $0.45 holds.

A confirmed breakout above $0.55 opens the door toward $0.70, followed by a measured move targeting $0.85 if momentum accelerates.

Trade idea: Bullish on a clean 4H close above $0.55, targeting $0.70–$0.85, invalidated below $0.45.

2. Cysic (CYS)

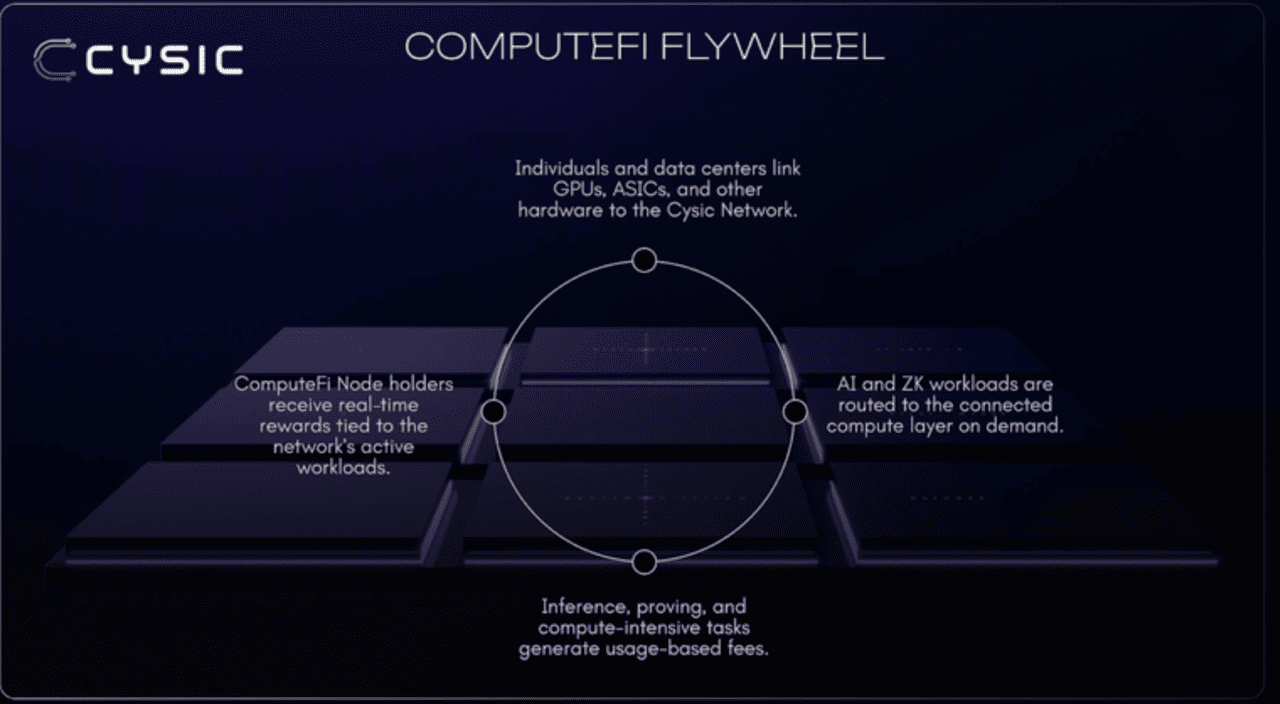

Cysic operates as a

Layer-1 blockchain dedicated to decentralized zero-knowledge proofs and AI compute, effectively tokenizing GPUs and ASICs through a Proof-of-Compute mechanism. The mainnet launched on December 10 to 11, supported by over 260,000 nodes and integrations with projects like

Scroll and

Succinct, positioning it at the forefront of the ComputeFi narrative.

CYS delivered a sharp initial surge of 47 to 60%, peaking at $0.33 to $0.35 shortly after launch, driven by listings on popular exchanges, zero-fee trading promotions, and trading volumes reaching $93 million. The rally aligned with growing interest in verifiable compute markets for

AI and blockchain applications. However, subsequent volatility emerged from community concerns over token distribution and revenue transparency, which were partially addressed through team AMAs and additional rewards, helping stabilize sentiment.

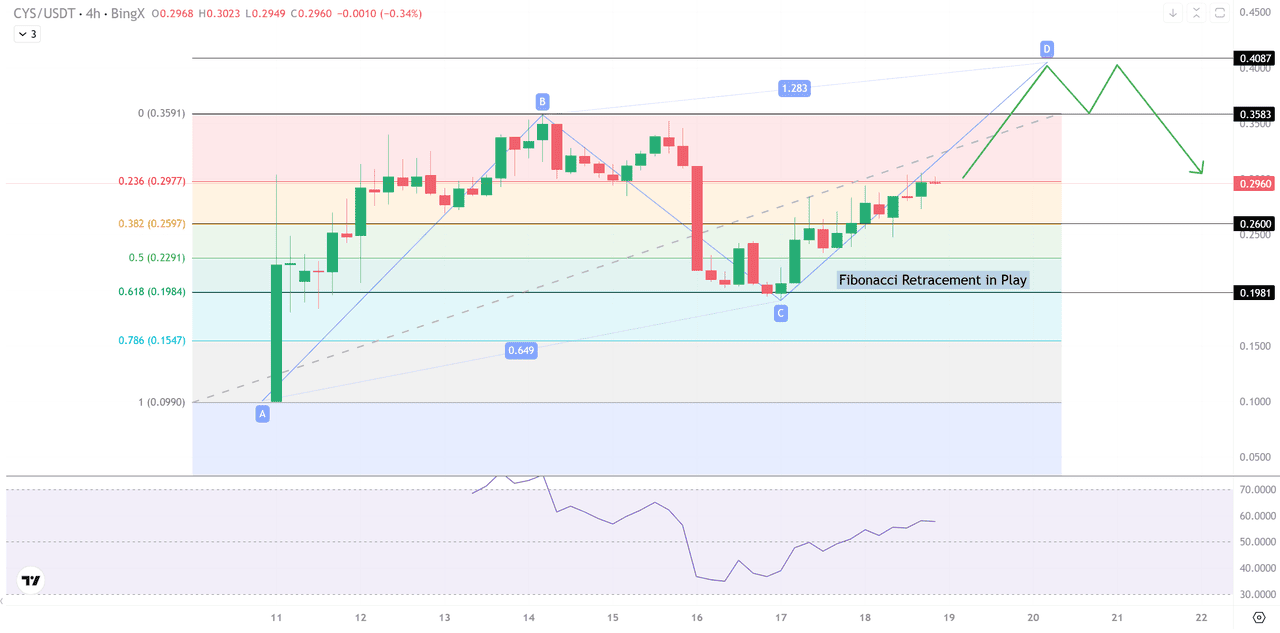

CYS Price Outlook: Fibonacci Pullback Sets Up Breakout Toward $0.40

CYS/USDT is trading within a bullish retracement phase on the 4-hour chart after a strong impulsive move higher. Price has respected the 0.618 Fibonacci retracement near $0.20, which acted as a clear demand zone and triggered a rebound, forming a higher low at point C.

Since then, CYS has been grinding higher within an ascending structure, reclaiming the 0.382 and 0.236 Fib levels, signaling improving bullish control.

CYS/USDT Price Chart - Source:

BingX

Momentum is recovering steadily. RSI has rebounded from oversold territory and is now holding above 50, suggesting buyers are regaining strength rather than chasing price. As long as price holds above $0.26–$0.27, the structure favors continuation toward the prior swing high near $0.36, with an extension target around $0.40–$0.41.

Trade idea: Bullish above $0.26, targeting $0.36 then $0.40, invalidated below $0.20.

3. XRP (XRP)

XRP remains the cornerstone of Ripple's ecosystem for fast, low-cost cross-border payments, bolstered by RLUSD stablecoin expansions and the maturation of spot ETFs that have attracted institutional capital.

In a week of relative market weakness, XRP demonstrated resilience, trading in a narrow range around $1.81 to $1.94 with only mild dips. This stability was underpinned by consistent ETF inflows of $18 to 50 million daily, pushing cumulative assets toward or beyond $1 billion, the fastest milestone for any major crypto spot ETF since Ethereum's. These flows effectively absorb supply pressure from whale distributions, highlighting structural institutional demand.

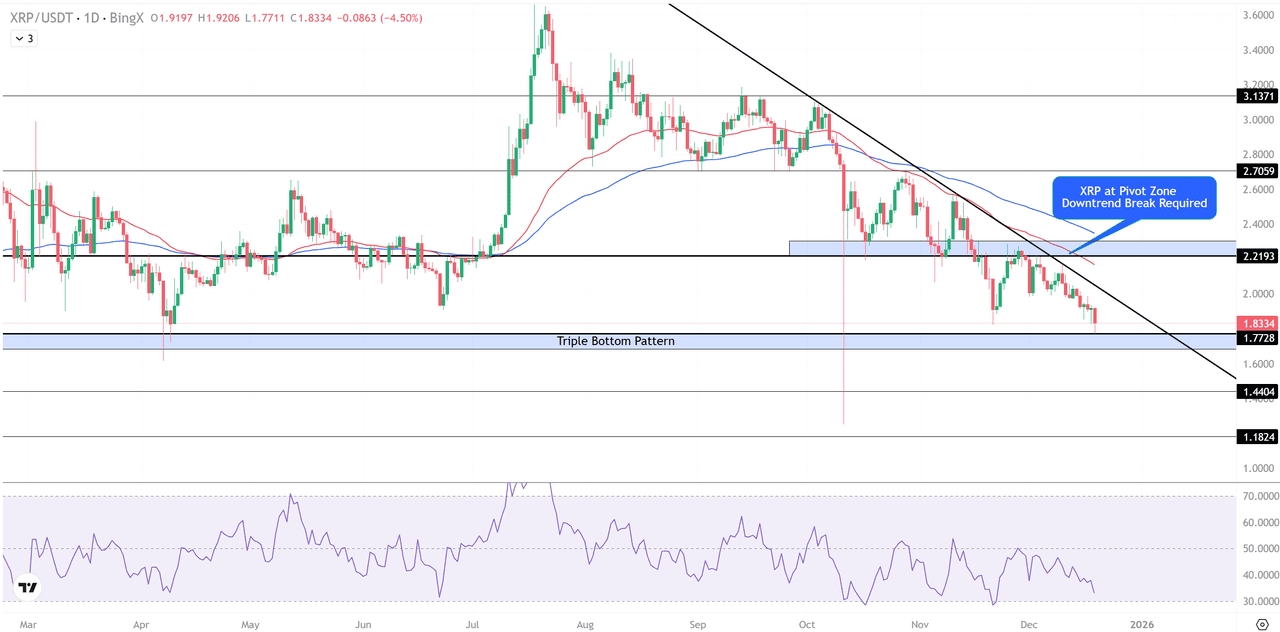

XRP Price Outlook: Downtrend Pressure Builds at Key $1.70 Pivot Zone

XRP/USDT remains technically weak on the daily chart, trading near $1.83 and still capped below a well-defined descending trendline, which continues to guide lower highs. Price has failed to reclaim both the 50-day and 100-day EMAs, now acting as dynamic resistance and reinforcing bearish control.

Structurally, XRP is hovering just above a triple-bottom support zone at $1.75–$1.78, an area that has repeatedly absorbed selling pressure but is now under renewed stress.

XRP/USDT Price Chart - Source:

BingX

Momentum remains fragile. RSI is drifting in the low-40s, signaling weak bullish conviction rather than capitulation. As long as XRP stays below the trendline and the $2.20 pivot, rebounds look corrective. A clean trendline break would be needed to open upside toward $2.70–$3.10, while a daily close below $1.75 risks acceleration toward $1.44.

Trade idea: Neutral-to-bullish only on a confirmed break above the downtrend and $2.20; bearish continuation below $1.75.

4. Solana (SOL)

Solana continues to lead as a high-throughput Layer-1, with the anticipated Alpenglow upgrade promising sub-150ms finality and significantly enhanced capacity. The announcement of the SKR token is Solana Mobile's upcoming asset designed to power on-chain identity and utility across its Seeker smartphone ecosystem. The SKR airdrop will arrive in January 2026, giving eligible users the chance to claim tokens once the distribution goes live. As of December 3, 2025,

Solana's Total Value Locked (TVL) stands at roughly $9.28 billion, reflecting strong network activity ahead of the launch, which perpetuated the hype.

SOL declined approximately 15% to around $127 amid a broader Layer-1 correction, yet the drawdown was capped by positive sentiment surrounding Alpenglow's community approval and ongoing ETF speculation. These developments limited deeper losses in an otherwise risky environment.

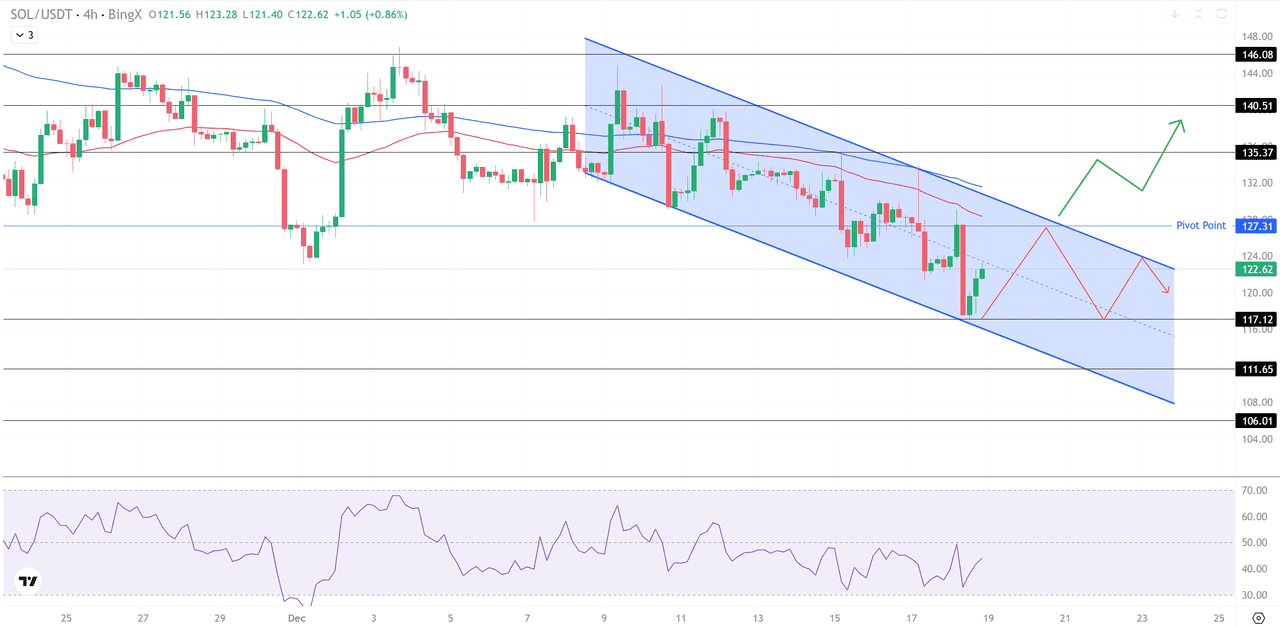

Solana Price Outlook: Descending Channel Signals Breakout to $117 Support

SOL/USDT is trading within a well-defined descending channel on the 4-hour chart, reflecting controlled bearish pressure rather than panic selling. Price is holding near $122–$123, just above the channel’s lower boundary and the $117 support, where buyers have repeatedly stepped in. This suggests selling momentum is slowing, even as the trend remains corrective.

SOL/USDT Price Chart - Source:

BingX

The 50-EMA and 100-EMA are still sloping lower and capping upside near $127–$130, marking a critical pivot zone. RSI is stabilising in the low-40s, hinting at waning bearish momentum but not yet a bullish reversal. A clean break above the channel and $127.30 would shift momentum toward $135 and $140, while rejection keeps downside risk toward $117 and $112.

Trade idea: Bullish only on a confirmed breakout above $127.30; bearish continuation below $117 targeting $112.

5. Pi Network (PI)

Pi Network facilitates mobile-based mining with AI-enhanced KYC processes, advancing toward full mainnet utility and ecosystem applications. Pi Network (PI) is a pioneering cryptocurrency project designed to make digital currency accessible to everyday users by enabling simple mining and participation. Through its mobile application, the project delivers a low-cost, low-threshold mining experience, eliminating the need for expensive specialized hardware that has traditionally dominated cryptocurrency mining.

PI traded flat to down 10%, hovering near $0.20, as ongoing monthly unlocks totaling 105 to 190 million tokens introduced dilution into a low-liquidity environment, amplifying selling pressure.

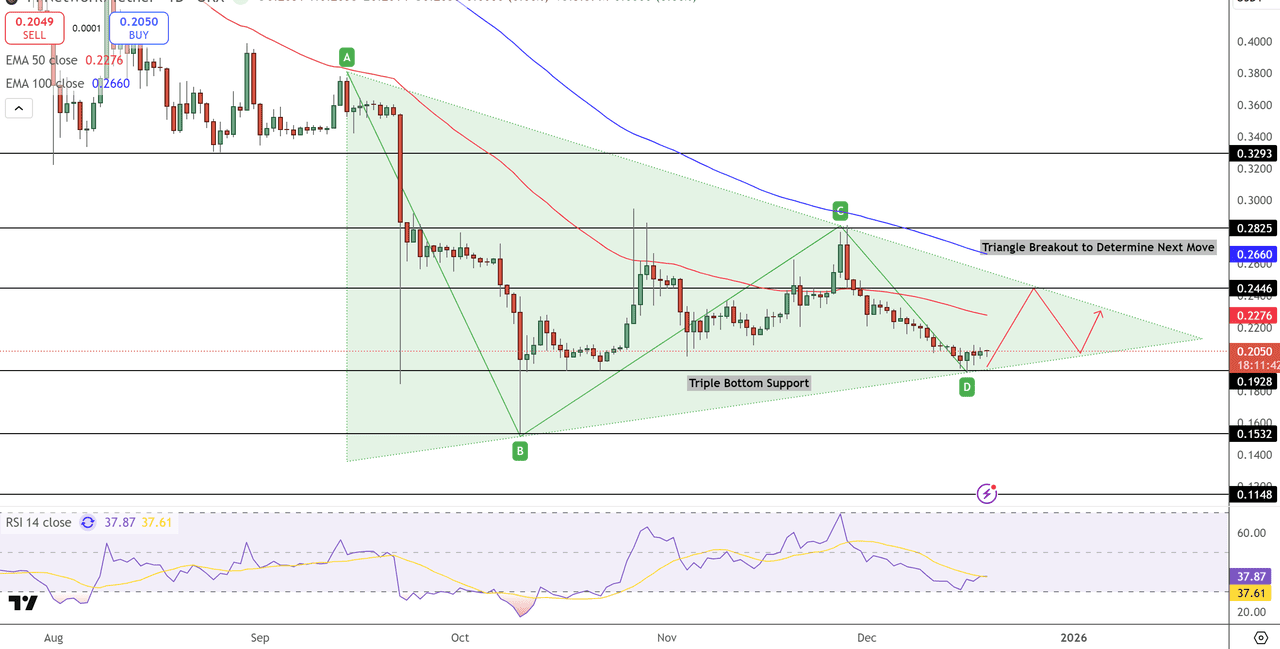

Pi Network Price Outlook: Triangle Compression Signals Breakout or Breakdown

Pi Network (PI) is tightening into a symmetrical triangle on the daily chart, signaling a major move ahead. Price is holding just above the $0.20 support zone, reinforced by a clear triple-bottom structure, while repeated lower highs remain capped by a descending trendline and the 50-day EMA near $0.23.

This compression reflects equilibrium, but trend control still favors sellers until resistance is broken.

PI/USDT Price Chart - Source: Tradingview

Momentum is stabilizing rather than reversing. RSI near 38 shows bearish pressure is fading, though bullish confirmation is still lacking. A decisive breakout above $0.24–$0.25 would invalidate the downtrend and open upside toward $0.28 and $0.33. Failure to defend $0.19–$0.20 would expose downside toward $0.15.

Trade idea: Bullish on a daily close above $0.25; bearish continuation below $0.19.

Conclusion

This week's gems navigated consolidation: RaveDAO's listings ignited 220%+ cultural surge; Cysic's launch delivered ComputeFi volatility with resilience; XRP absorbed weakness via over $1 billion ETF inflows, Solana limited dips on Alpenglow hype, and Pi weathered unlocks. Broader pressure hit SOL -15% and memes, underscoring beta risks as launches shone. Holidays thin liquidity, so always do your own research before investing as 2026 catalysts loom.

Related Reading