Ethereum Layer-2 growth has accelerated in 2025, and

ZKsync is one of the biggest drivers behind it. Backed by Matter Labs and secured by zero-knowledge proofs, ZKsync’s network has expanded into a full ecosystem of public and private chains built on its ZK Stack.

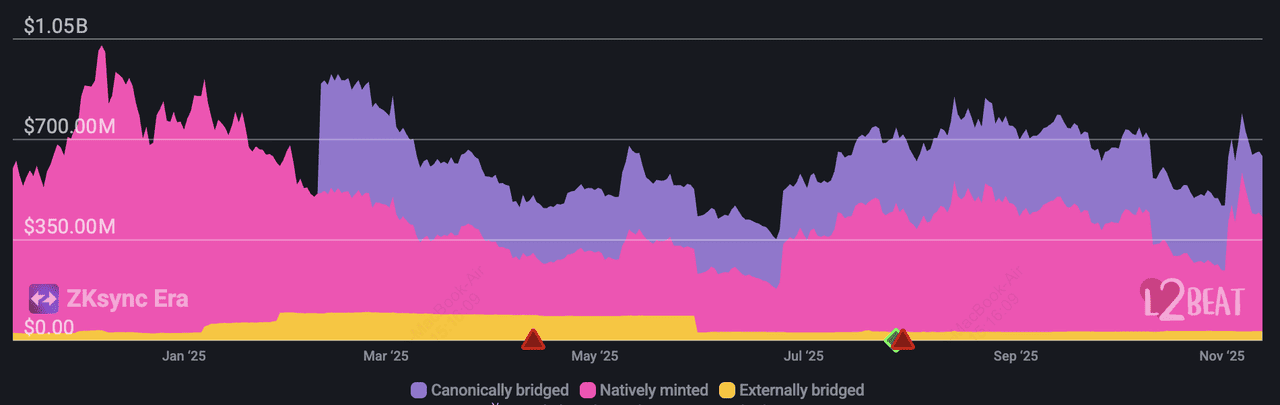

ZKsync Era total value secured | Source: L2Beat

The result? Faster transactions, lower fees, privacy-preserving settlement, and seamless interoperability across chains, all while inheriting

Ethereum-level security. With over $4 billion total value secured, 700 ,million+ transactions processed as of November 2025, and major institutional partners like Deutsche Bank, UBS, Sygnum, and

Chainlink, ZKsync has become one of the most active environments for

real-world asset tokenization, DeFi liquidity, cross-chain messaging, and

zero-knowledge infrastructure.

If you’re tracking Layer-2 innovation, this guide covers 10 top crypto projects building on or connected to the ZKsync ecosystem, each shaping its growth in 2025.

What Is ZKsync (ZK) and Why Is Its Ecosystem Growing?

ZKsync (ZK) is a Layer-2 scaling network built on zero-knowledge rollups, where thousands of transactions are compressed off-chain and verified on Ethereum using cryptographic validity proofs. Instead of having Ethereum process each transaction individually, ZKsync submits a single proof that mathematically confirms every state change inside a batch.

How ZKsync Ethereum Layer-2 Works

1. ZKsync's architecture delivers sub-second block proofs via Airbender, ZKsync’s RISC-V prover, reducing costs to as low as $0.0001 per transfer and supporting real-time settlement with minutes-to-Ethereum finality.

2. Because the proof is validated on Ethereum, security is inherited directly from

Layer-1 without relying on external validators or fraud challenges.

3. ZKsync is fully EVM-compatible, allowing developers to deploy Solidity smart contracts, integrate account abstraction, offer gasless transactions, and build consumer-grade apps with the same trust guarantees as Ethereum.

As of November 2025, ZKsync has evolved far beyond a single Layer-2 network, securing more than $4 billion in value across a growing ecosystem of 18 interconnected ZK chains, all capable of achieving minutes-to-Ethereum finality. Banks, asset managers, and fintech firms now rely on ZKsync to tokenize assets, settle transactions, run digital identity systems, and maintain compliance through privacy-preserving proofs. With the ZK Stack fully open-source, enterprises can launch custom chains while staying interoperable with the broader Elastic Network, positioning ZKsync as a multi-chain financial infrastructure layer bridging traditional institutions and Web3.

What’s Driving ZKsync Ecosystem's Momentum in 2025?

Three major trends have sparked rapid expansion this year:

1. Institutional Adoption and RWA Tokenization: In 2025, traditional finance firms are deploying private ZK chains to tokenize assets while keeping regulatory controls and sensitive data protected. Deutsche Bank is piloting compliance-first fund management, Sygnum has moved money market funds on-chain, and Tradable has tokenized $1.7 billion in alternative investments. Because zero-knowledge proofs verify transactions without revealing user information, ZKsync has become a preferred settlement layer for institutions that need privacy, auditability, and Ethereum-grade security.

2. ZK Stack + Airbender = High-Performance ZK Chains: The ZK Stack allows companies and developers to launch fully customized blockchains with EVM support, passkeys, smart accounts, and gasless onboarding, all while remaining interoperable with other ZKsync chains. Each chain inherits security from Ethereum, and proofs are verified trustlessly at Layer-1. Airbender, a RISC-V prover, produces sub-second block proofs on standard GPUs, enabling real-time settlement for financial apps, decentralized exchanges, cross-border payments, and even on-chain AI processing.

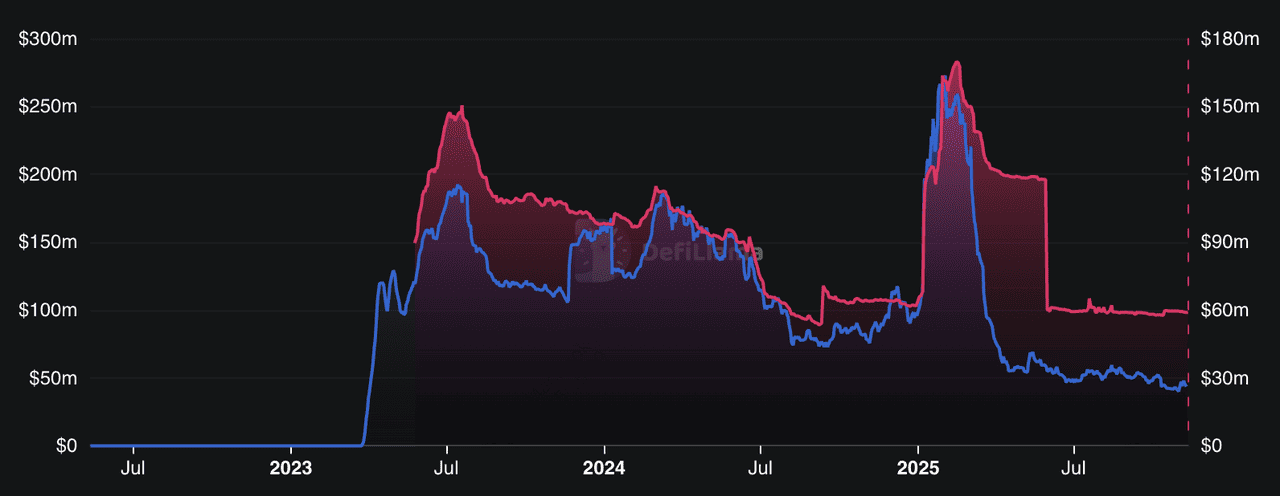

ZKsync DeFi TVL and stablecoin market cap | Source: DefiLlama

3. A Growing Web3 Developer Ecosystem: ZKsync has rapidly evolved into a high-volume developer hub, with 291+ dApps, roughly 162,000 daily transactions, and more than $44 million in DeFi TVL across the network. The ecosystem now spans DeFi lending markets, cross-chain messaging, stablecoins, wallets, RWA platforms, and gaming applications. Thanks to low gas fees and direct Solidity compatibility, builders can deploy production-ready systems without changing their codebase, accelerating innovation across both consumer and institutional use cases.

Top 10 ZKsync Ecosystem Tokens to Watch in 2025

From decentralized liquidity to cross-chain routing and RWA tokenization, these projects represent the most influential pillars of the ZKsync network.

1. 1inch (1INCH)

1inch is the largest

DEX aggregator live on ZKsync, routing trades across multiple decentralized exchanges to secure the best execution price with minimal slippage. With fees on ZKsync falling to as low as ~$0.0001 per transaction and real-time settlement powered by Airbender proofs, users can swap assets faster and cheaper than on most L1 networks. As of November 2025, 1inch has processed more than $767 billion in total swap volume, 225 million+ swaps, and supports cross-chain trading across 13+ networks, including ZKsync Era. This deep liquidity, combined with limit orders, MEV protection, and risk screening, has made ZKsync one of the most efficient environments for DeFi swaps using the 1inch router.

2. Securitize

Securitize is one of the largest real-world asset tokenization platforms in the world, with more than $4 billion in tokenized assets and over 550,000 investor accounts. Powered by the ZK Stack and Prividium, Securitize enables institutions to issue tokenized treasuries, private credit, and public equities with on-chain KYC/AML, privacy-preserving settlement, and instant redemptions.

Major financial firms, including BlackRock, Hamilton Lane, and VanEck, have launched tokenized funds through Securitize, while partners like BNY Mellon and Morgan Stanley support custody and administration. As global RWA tokenization surpasses $20 billion in 2025, Securitize has become a core gateway bringing institutional capital and regulated securities into the ZKsync ecosystem.

3. Aave (AAVE)

Aave brings the world’s largest decentralized lending protocol to the ZKsync ecosystem, enabling users to supply or borrow ETH, stablecoins, and liquid staking tokens at a fraction of Ethereum’s gas cost. With over $56 billion in total deposits across 12+ networks and a proven security track record, Aave offers yield generation, over-collateralized borrowing, and instant settlement backed by zero-knowledge proofs. On ZKsync, lending actions execute in seconds with fees dropping to near-$0.0001, making it attractive for retail users seeking cheap borrowing and institutions deploying capital-efficient strategies. As ZKsync’s DeFi liquidity grows, Aave serves as a critical liquidity backbone for yields, stablecoin demand, and RWA collateralization.

4. LayerZero (ZRO)

LayerZero is an interoperability protocol that lets ZKsync apps send data and assets to dozens of other blockchains without using wrapped tokens or centralized bridges. For developers, it’s a practical way to transfer liquidity, build cross-chain money markets, issue omnichain NFTs/RWAs, or deploy dApps that work seamlessly across multiple chains. As more ZKsync Layer 2s and rollups appear, LayerZero’s messaging layer helps them share liquidity and users instead of operating in isolation, making it a core piece of infrastructure for ZKsync-based DeFi,

gaming, and real-world asset settlement.

5. Particle Network (PARTI)

Particle Network powers Web3 onboarding with smart contract wallets, passkey logins, gasless transactions, and full account abstraction, eliminating seed phrases and approval pop-ups. On ZKsync, this lets users sign in with Google, Apple, email, or social accounts and make on-chain transactions without paying gas directly, ideal for gaming, mobile apps, and fintech experiences that need frictionless sign-ups. With chain-agnostic “Universal Accounts,” users can access assets across chains without bridging, helping ZKsync dApps reach mainstream audiences instead of crypto-native only.

6. Ethena

Ethena supplies ZKsync with scalable, yield-bearing dollar liquidity through

USDe and sUSDe, which have become two of the network’s most-used stable assets. As of November 2025, USDe’s circulating supply has surpassed $8 billion, while sUSDe has grown beyond $4.5 billion in staked value, making them among the largest synthetic dollar instruments in crypto. On ZKsync, these assets are integrated into lending markets,

AMM liquidity pools, yield protocols, and even real-world asset settlement, strengthening DeFi stability and enabling users to hold or deploy a high-liquidity synthetic dollar with transparent backing and on-chain yields.

7. Solv Protocol

Solv Protocol brings institutional-scale, yield-bearing

Bitcoin and Ethereum to ZKsync through products like SolvBTC, tokenized BTC collateral, and SolvETH, income-generating ETH. With over $2 billion in total value locked and SolvBTC’s market cap surpassing $1 billion as of November 2025, it is one of the largest on-chain Bitcoin liquidity sources in crypto. Users can borrow, lend, and earn yield on BTC through structured vaults, AMMs, and lending platforms, while institutions tap into transparent reserves, real-time backing, and regulatory-aligned settlement. By offering deep, liquid

BTC and

ETH assets on ZKsync, Solv strengthens DeFi markets and enables Bitcoin to function as productive capital across the ecosystem.

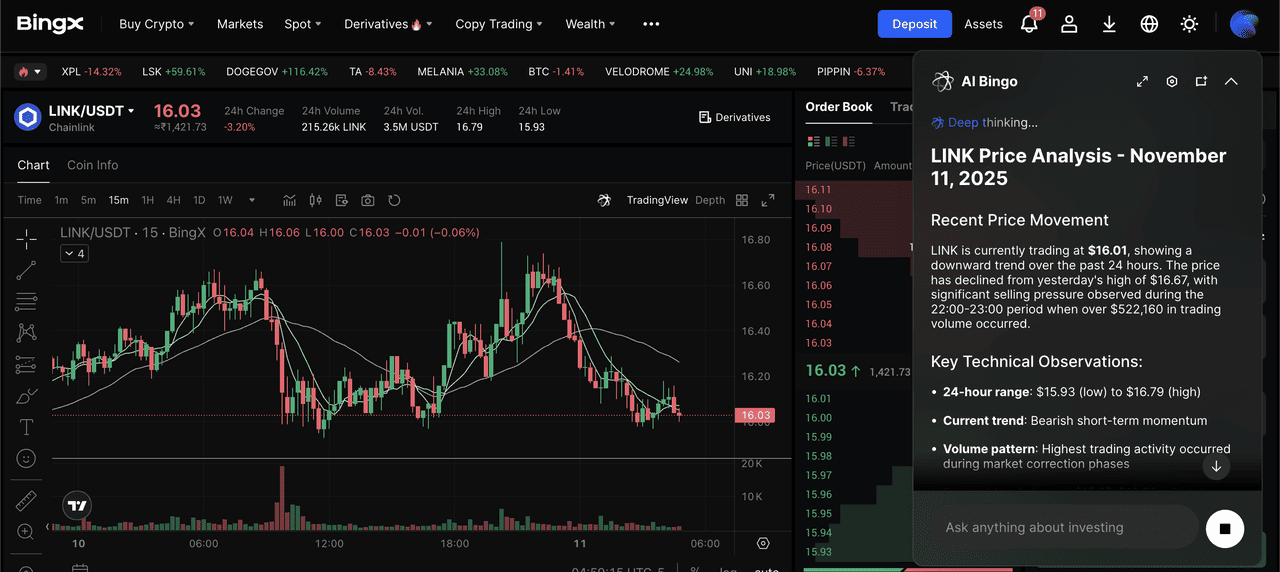

8. Chainlink (LINK)

Chainlink provides ZKsync with the real-time price feeds and off-chain proofs that DeFi apps and RWA platforms need to function safely. Its oracles secure billions of dollars in lending, AMM swaps, options, and leverage markets, while CCIP enables cross-chain messaging and asset transfers across major chains. Institutions and protocols, including Aave,

GMX,

Circle, Mastercard, and J.P. Morgan pilots, use Chainlink to automate settlements, verify reserves, and stream data on-chain. Because liquidation engines and collateral ratios depend on accurate pricing, LINK has become a critical infrastructure token securing the ZKsync DeFi ecosystem.

9. Maverick Protocol (MAV)

Maverick is one of ZKsync’s highest-efficiency DEXs, using dynamic, programmable liquidity that moves with price action to reduce slippage and increase LP earnings. With swap gas below 100,000, millions in daily volume, and over $6 million in TVL, the protocol helps traders get tighter pricing on majors and stablecoins while giving LPs higher fee capture for the same capital. Liquidity providers can choose different modes to concentrate liquidity in active price ranges, improving returns compared to passive AMMs. As liquidity deepens and incentive programs expand, Maverick is quickly becoming a core trading venue for ZKsync assets.

10. WOO (WOO)

WOO brings centralized-exchange–grade liquidity to ZKsync through tight bid-ask spreads, deep market-maker pools, and low-fee swaps across major tokens. With over $15 million in TVL and daily trading activity driven by institutional liquidity partners, traders benefit from lower slippage on large orders and better execution than typical AMM DEXes. WOO also supports cross-chain routing, letting users swap assets from other networks directly into ZKsync. This makes it a strong hub for high-volume traders, quants, market makers, and users who want CEX-level execution while staying fully on-chain.

How to Buy and Trade ZKsync Ecosystem Tokens on BingX

Whether you’re investing long-term, trading volatility, or exploring ZKsync DeFi, BingX supports both Spot and Futures markets, and with BingX AI insights for a more comprehensive trading experience.

Spot Market to Buy and Sell ZKsync Coins

LINK/USDT trading pair on the spot market powered by BingX AI insights

2. Enable BingX AI on the chart to analyze support, resistance and trend signals

3. Execute a

Market Order for instant or Limit Order for custom price

Futures Market – Trade ZKsync Projects with Leverage

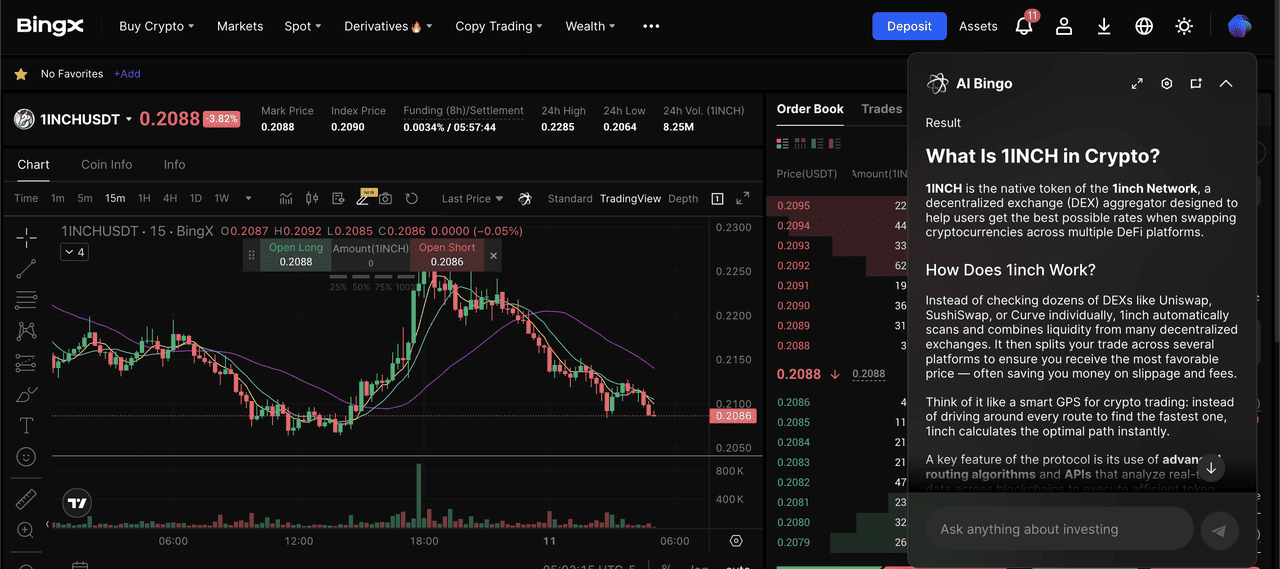

1INCH/USDT perpetual contract on the futures market powered by BingX AI

For experienced traders, BingX Futures enables long or short positions on major ZKsync ecosystem tokens.

2. Activate BingX AI to detect momentum & volatility

3. Set leverage and place Long (Buy) or Short (Sell) orders

Final Thoughts

ZKsync’s growth in 2025 shows how Layer-2 ecosystems are expanding beyond simple scaling into institutional finance, RWAs, gaming, and cross-chain liquidity. From stablecoin infrastructure like Ethena, lending markets like Aave, and efficient DEXs like Maverick and WOO, to enterprise-grade tokenization like Securitize, the ZKsync ecosystem now spans some of the strongest names in crypto and traditional finance.

For traders and builders, following these projects provides a glimpse into the future: programmable capital markets, private settlement, and real-world assets moving on-chain at scale. With BingX, investors can easily buy, trade, or analyze ZKsync ecosystem tokens across Spot and Futures markets, supported by

AI tools that enhance decision-making in real time.

Related Reading