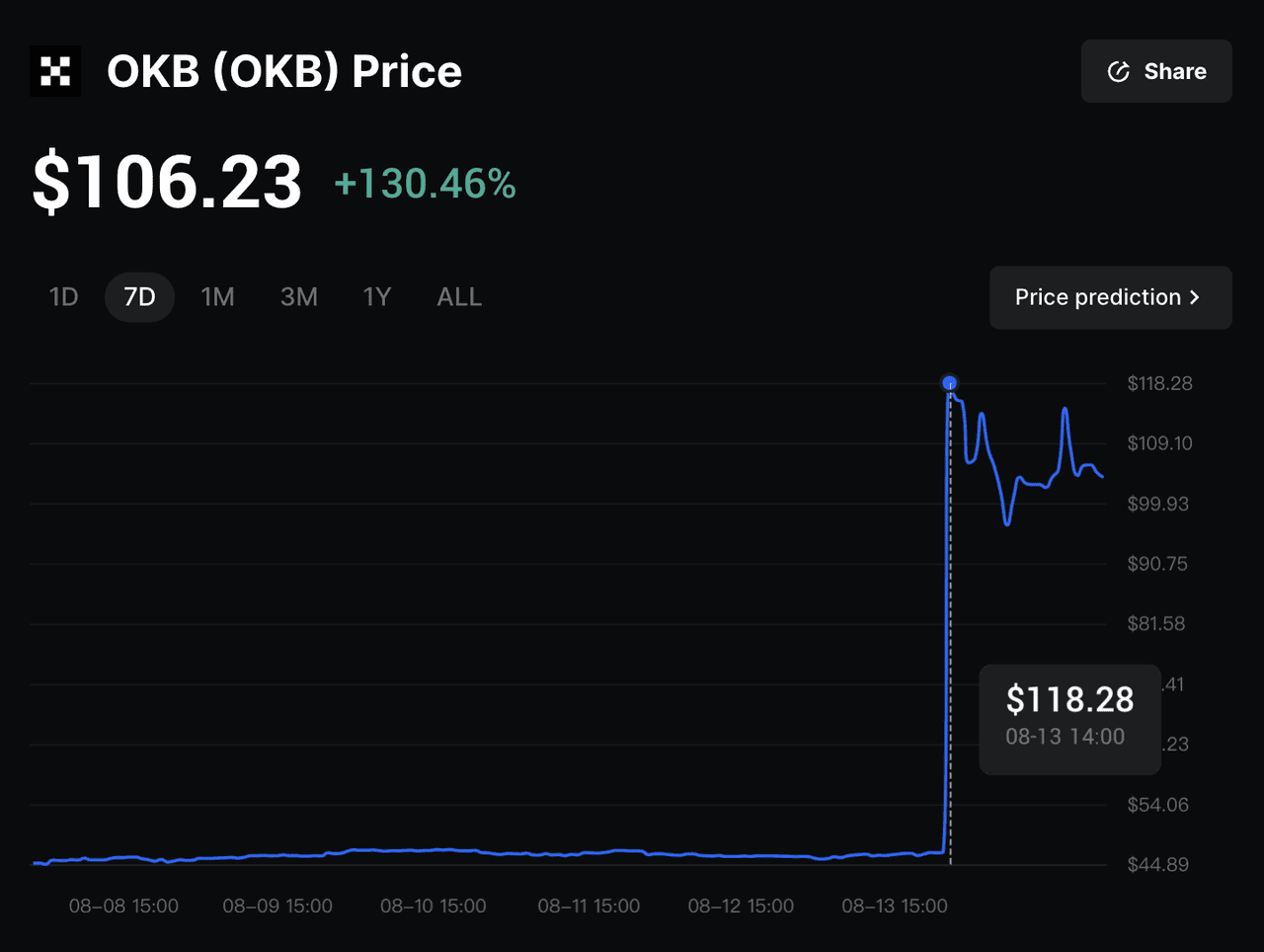

OKB, the native token of cryptocurrency exchange OKX, experienced an extraordinary 200% price surge on August 13, 2025, reaching a new all-time high of $142 after the company announced a historic $7.6 billion token burn. The surge came as OKX executed a one-time burn of 65.26 million OKB, cutting the circulating supply by more than 50% and permanently capping the total supply at 21 million tokens.

The explosive rally saw OKB jump from $46 to over $104, briefly touching $142 before settling in the $102–$104 range and closing the day at $118.28. Trading volume skyrocketed over 21,000% to $1.25 billion as traders rushed to capitalize on the unprecedented supply shock, marking one of the largest deflationary events in exchange token history.

What is OKB and Its New Tokenomics?

OKB is the utility and gas token of the OKX ecosystem, powering transactions on its Layer 2 blockchain, X Layer, and providing benefits within the OKX Exchange. It connects the exchange’s trading platform, Web3 services, and

decentralized applications.

Previously, OKB followed a buyback-and-burn model with periodic token burns. This changed on August 13, 2025, when OKX executed a one-time burn of 65,256,712 OKB worth about $7.6 billion, cutting supply by over 50% and fixing the total supply at 21 million tokens.

The OKB smart contract was also upgraded to remove minting and burning capabilities, making the token fully deflationary. From now on, supply is permanently fixed, shifting OKB’s model to

Bitcoin-like scarcity.

Key Features and Use Cases

• Gas Token for X Layer: Required for all transactions.

• Trading Fee Discounts: Lower fees for spot, futures, and perpetual markets.

• Exclusive Access: Entry to OKX Jumpstart token launches.

• Ecosystem Integration: Works across OKX Wallet, OKX Pay, and partner apps.

What Drives the OKB Surge?

On August 13, 2025, OKX unveiled a milestone update, combining a historic token burn with major blockchain enhancements and network transitions.

1. Historic $7.6B Token Burn and Supply Cap

• Burned 65,256,712 OKB worth about $7.6 billion, cutting the

circulating supply by over 50%.

• Permanently fixed the total supply at 21 million tokens.

• Upgraded the OKB

smart contract to remove minting and burning capabilities, locking supply indefinitely.

2. X Layer PP Upgrade and Ecosystem Integration

• Integrated the latest

Polygon CDK technology into X Layer through the PP upgrade.

• Increased throughput to 5,000 transactions per second, introduced near-zero

gas fees, and improved scalability.

• Delivered better

Ethereum compatibility for a smoother developer experience.

• Fully integrated X Layer with OKX Wallet, OKX Exchange, and OKX Pay.

• Made X Layer the default settlement network for OKX Pay, enabling faster and cheaper global transactions.

3. Network Transition and Token Migration

• Began phasing out the OKTChain and Ethereum L1 version of OKB.

• Ended OKT trading on August 13, 2025, with remaining OKT to be periodically converted into OKB until January 1, 2026.

• Advised Ethereum-based OKB holders to migrate to X Layer using the Withdraw to X Layer feature for a one-click swap.

This announcement not only cements OKB’s scarcity but also strengthens its role as the sole gas and utility token in a faster, more cost-efficient, and more integrated blockchain ecosystem.

OKB Upgrade Key Dates

• August 5, 2025: X Layer PP upgrade completed, boosting TPS to 5,000, introducing near-zero gas fees, and improving Ethereum compatibility.

• August 15, 2025: One-time burn of 65.26 million OKB executed, permanently capping supply at 21 million.

• January 1, 2026: OKTChain officially decommissioned; final deadline for OKT-to-OKB conversion.

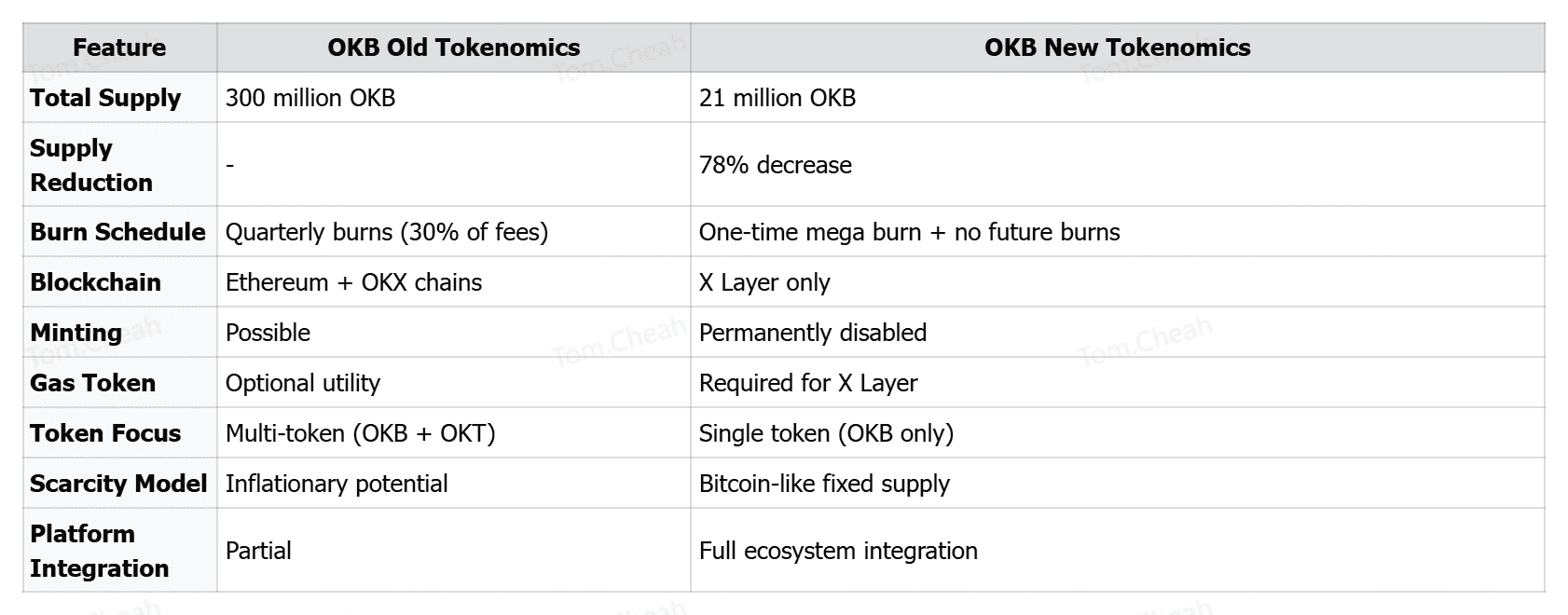

How OKB Tokenomics Have Evolved

The August 2025 update brought the most significant change to OKB’s economic model since its launch. Below is a side-by-side look at the old vs new tokenomics, highlighting how the one-time $7.6 billion burn and ecosystem shift to X Layer have reshaped OKB’s supply, utility, and integration.

What Does the Tokenomics Overhaul Mean for OKB Holders?

The August 13, 2025 announcement represents a major shift in OKB’s role and value proposition. Here are the key takeaways for holders:

1. Permanent Scarcity: A one-time burn of 65.26 million OKB reduced total supply by over 50% and locked it at 21 million tokens. The removal of minting capabilities eliminates inflation risk, creating a Bitcoin-like scarcity model.

2. Central Role in the OKX Ecosystem: OKB is now the sole gas token for all transactions on X Layer, including activity across

DeFi protocols, payment services, and

real-world asset (RWA) applications.

3. Increased Utility from Product Integration: Full integration with OKX Wallet, OKX Exchange, and OKX Pay ensures OKB is used across multiple user touchpoints. Migration from Ethereum L1 and the phase-out of OKT remove token competition within the ecosystem.

4. Value Linked to X Layer Growth: As X Layer adoption expands, transaction demand could increase OKB usage and on-chain circulation. OKB’s long-term performance will be closely tied to the network’s success and developer adoption.

These changes make OKB more scarce, more essential, and more directly connected to the growth of OKX’s blockchain ecosystem.

OKB Price Prediction: Can a 200% Weekly Surge Push Toward $170?

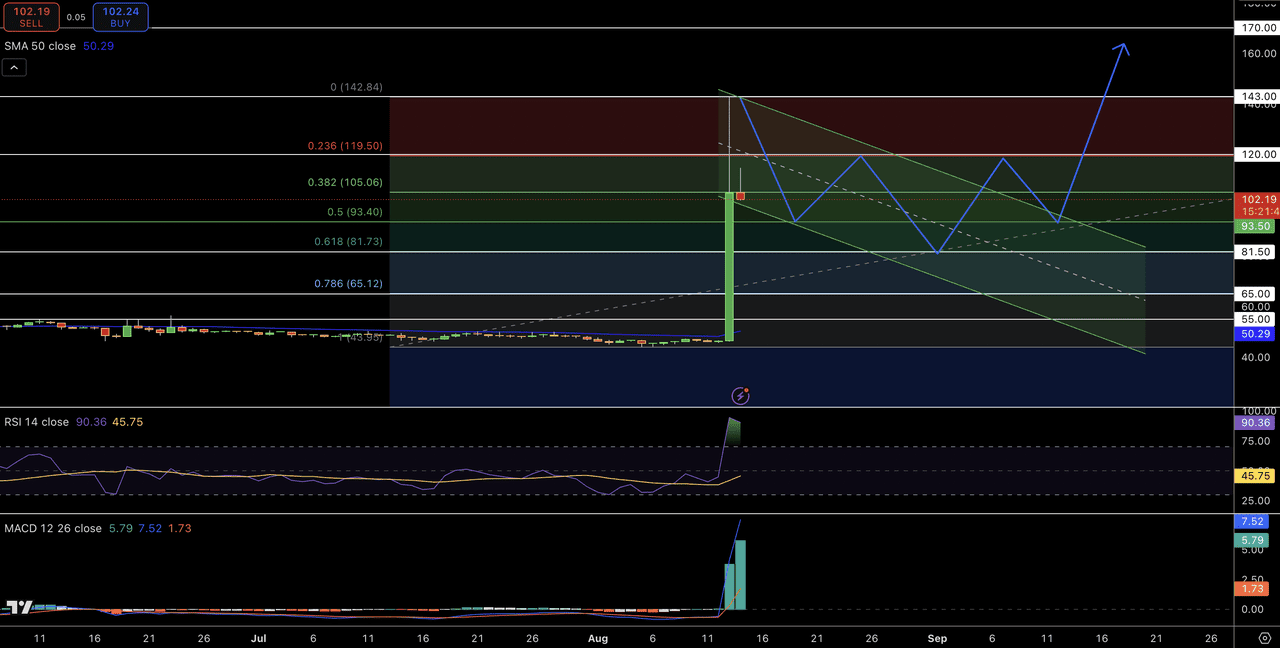

OKB’s explosive 200% weekly surge has shifted its technical outlook from long-term consolidation into full-blown breakout territory.

On the daily chart, price action has rocketed from $44 to $114, slicing through multiple

Fibonacci levels before pausing just under the 0.382 retracement at $105. The vertical nature of this rally, combined with an

RSI at 91, signals extreme overbought conditions, making a cooling-off phase likely. A retracement toward the 0.5 level at $93 or the 0.618 zone near $81 could provide the first meaningful support.

Structurally, this move resembles a vertical flagpole in a potential

bull flag pattern. If price consolidates between $81 and $120 in a tightening range, the stage could be set for another leg higher toward $143 and, ultimately, the $170 psychological level as projected by the drawn path. Should the price break above $170 USD, the next target would be the $200 mark.

MACD remains in bullish territory with strong histogram momentum, though a flattening of shorter-term moving averages could signal the onset of consolidation.

OKB Key Price Levels to Watch

A plausible trade setup for aggressive bulls would involve scaling in on dips toward $93 and $82 with stops below $65, targeting $143 in the medium term and $170 on a confirmed breakout. If OKB holds above $105 after its cooldown, momentum traders may re-enter early, anticipating a push into the $120–$143

resistance zone.

While the immediate pace may slow, the broader chart now favors a long-term bullish structure, positioning OKB for further upside if volume supports the next breakout leg.

Risk Reminder: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice. Cryptocurrency markets are highly volatile, and prices can change rapidly. Please conduct your own independent research, consider your personal risk tolerance, and consult with a licensed financial advisor before making any investment decisions. Never invest money you cannot afford to lose.

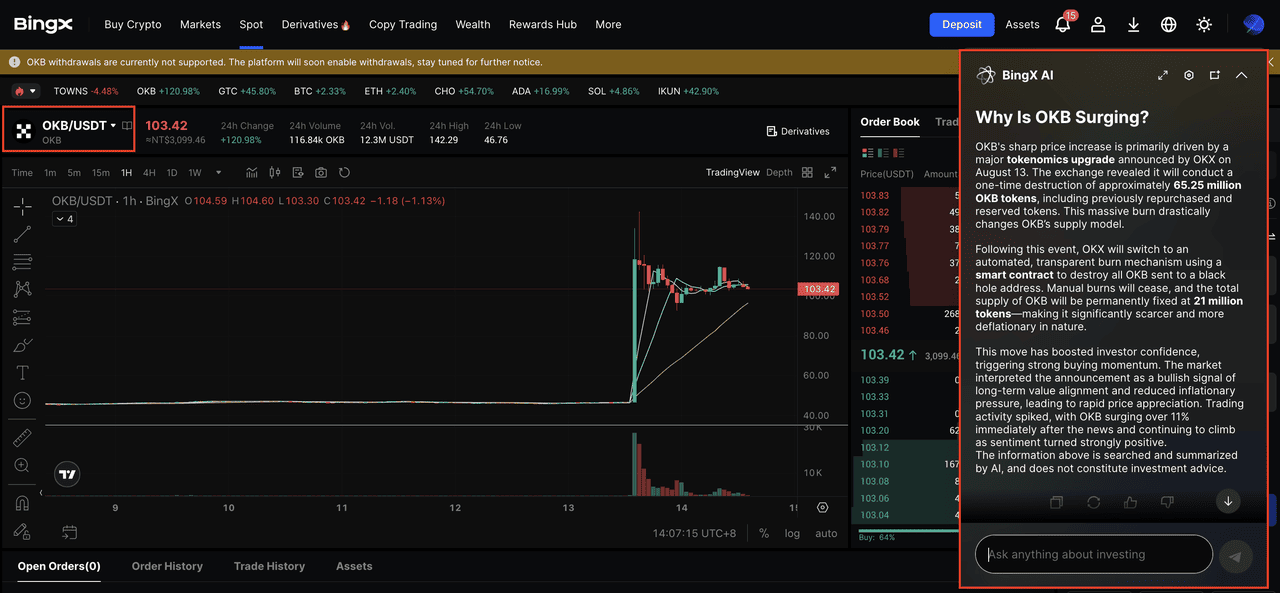

How to Trade OKB Tokens on BingX

OKB is the utility and gas token of the

X Layer blockchain, offering trading fee discounts, token launch access, and broad ecosystem use. It is listed on both the BingX Spot Market and Perpetual Futures Market, giving traders flexibility for long-term holding or short-term trading.

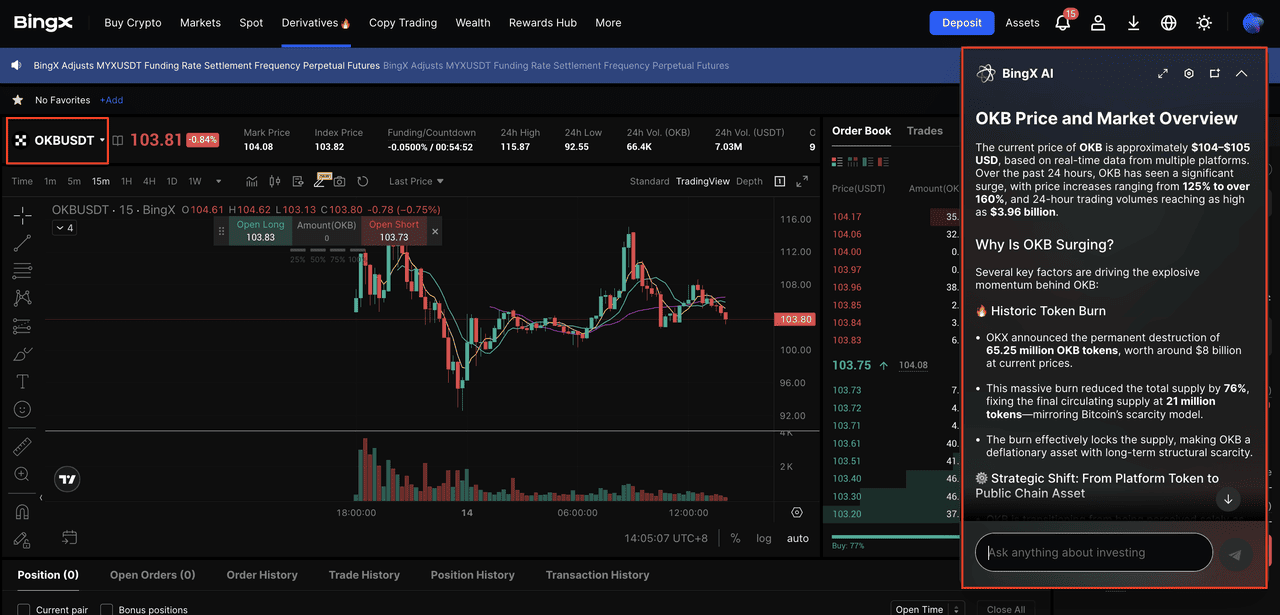

BingX AI provides real-time market analysis to support better decisions.

Step 1: Search for OKB/USDT on Spot or Perpetual Futures

For Spot Trading

Go to the

Spot Market on BingX and search for

OKB/USDT. Place a market order to buy instantly or set a limit order for your preferred entry price. Spot trading is ideal for those holding long term or using OKB in the ecosystem.

For Perpetual Futures

Search

OKB/USDT in the

Perpetual Futures Market to go long or short without an expiration date. This setup works for both bullish and bearish views. Leverage can magnify gains but also increases risk, so use it cautiously, , and always set a stop-loss to protect your capital.

Step 2: Use BingX AI for Real-Time Market Insights

Click the AI icon on the chart to activate BingX AI, which highlights key support and resistance zones, trend direction, and recent market events. These insights can help with timing and decision-making.

Step 3: Execute and Monitor Your Trade

Choose a market order for instant execution or a limit order for a targeted entry price. Continue monitoring BingX AI and market conditions to adjust your position as needed.

Final Thoughts

The August 2025 update marks a defining moment for OKB, combining a historic $7.6 billion token burn with a complete ecosystem shift to X Layer. With supply permanently capped at 21 million and OKB now serving as the sole gas and utility token, its value is more directly tied to the growth and adoption of the network than ever before.

For holders, this means a more predictable scarcity model, deeper integration across products, and increased utility as X Layer expands in DeFi, payments, and real-world asset applications. While future performance will depend on network adoption and market conditions, the changes have positioned OKB at the center of a streamlined, high-performance blockchain ecosystem.

Related Reading

Frequently Asked Questions (FAQs) on OKB

1. Which chain does OKB run on?

OKB now runs exclusively on X Layer, a Layer 2 blockchain built with Polygon CDK. The Ethereum L1 version is being phased out.

2. Which wallets support OKB?

OKB on X Layer is not an ERC-20 token. It is supported by

Web3 wallets that allow custom network configuration, such as

MetaMask and other wallets compatible with X Layer’s network settings. After the upgrade, Ethereum L1 OKB does not automatically migrate. You must manually bridge it to X Layer using the official bridge feature.

3. Can I use my ERC-20 wallet to store OKB?

ERC-20 wallets can only be used for the Ethereum L1 version, which is being phased out. To use OKB in the current ecosystem on X Layer, you should deposit your ERC-20 OKB to the exchange and withdraw it to X Layer. This ensures full compatibility and access to ecosystem features.

4. What Is OKB’s burn rate?

On August 15, 2025, OKX burned approximately 50.2% of the total supply. Under the new tokenomics, there is no ongoing burn rate, and the previous quarterly burn schedule has been permanently discontinued.

5. When will OKT and OKTChain be retired?

OKT trading ended on August 13, 2025, and OKTChain will be fully decommissioned on January 1, 2026.

6. Should I migrate my OKT to OKB?

Yes. All remaining OKT will be periodically converted into OKB until January 1, 2026. Migrating early ensures you receive your OKB without delays.