As

Ethereum’s leading Layer‑2 powerhouse,

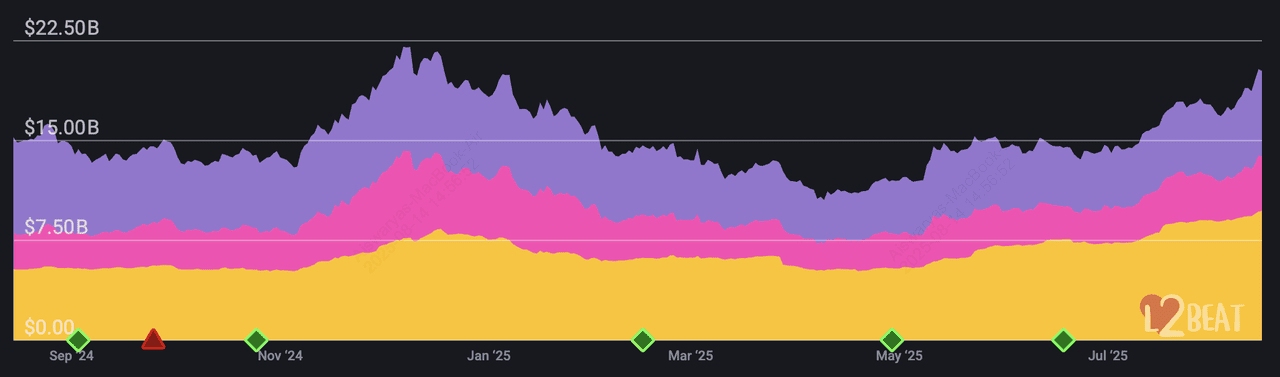

Arbitrum continues scaling with industry‑leading features, offering ultra‑low fees, rapid finality, and the largest total value locked (TVL) among L2s. By August 2025, Arbitrum One’s TVL ticked up to $8.6 billion, marking its highest ever and reinforcing its top‑tier status in

Ethereum scaling.

Arbitrum One TVL | Source: L2Beat

In this breakdown, we spotlight the ten most compelling projects shaping Arbitrum’s narrative in 2025, complete with usage metrics, economic insights, and growth stories.

What Is Arbitrum, and Why Is It Ethereum’s Largest Layer-2?

Arbitrum is a Layer-2 (L2) scaling solution for Ethereum, built by Offchain Labs in 2018. It uses a technology called Optimistic Rollups, which processes transactions off Ethereum’s mainnet (Layer-1) while still inheriting Ethereum’s security. This means users get the same trust and decentralization as Ethereum, but with much lower fees and faster speeds.

Instead of every Ethereum validator executing every transaction, Arbitrum batches thousands of transactions together and posts them as compressed data to Ethereum. Disputes are resolved only if fraud is suspected, keeping the system efficient and cost-effective. For everyday users, this translates to transaction costs up to 20–50x lower than mainnet Ethereum, with average fees often under a few cents.

Arbitrum is also known for its modularity and developer-friendly environment. Builders can deploy dApps directly on Arbitrum One (the main chain) or launch customized chains via Arbitrum Orbit. This flexibility has attracted major projects such as

Uniswap,

Aave,

GMX,

Magic Eden, and Robinhood, creating one of the most diverse ecosystems in Web3.

Put simply, Arbitrum combines Ethereum’s security with layer-2 efficiency, making it the go-to choice for both DeFi protocols and mainstream companies. That’s why it consistently ranks as Ethereum’s largest and most widely used L2.

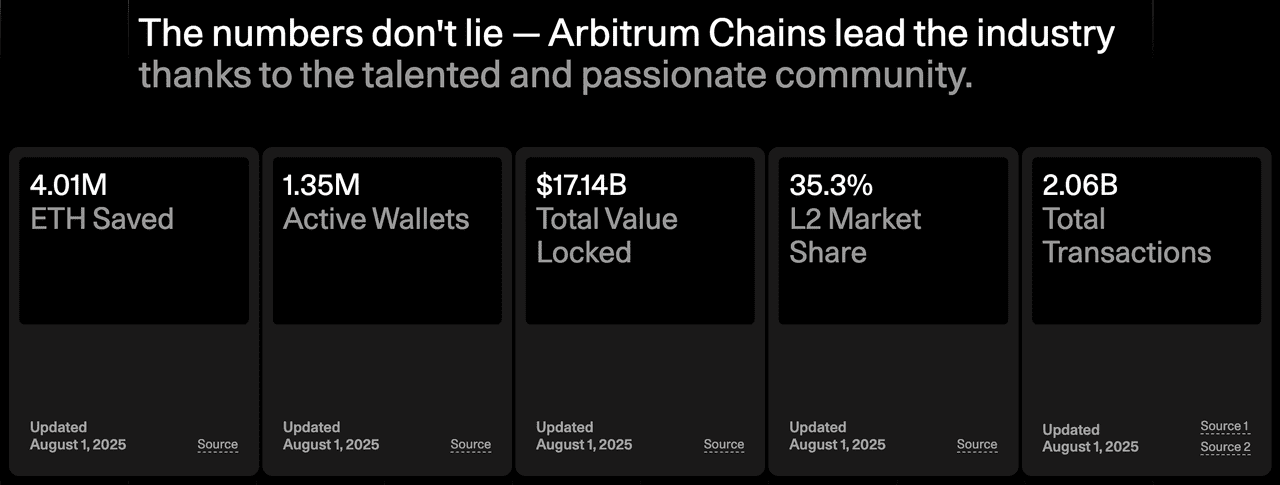

Arbitrum Commands Over 35% of Ethereum L2 with $17B+ TVL

As of August 2025, Arbitrum continues to dominate the Layer-2 landscape with a total value locked (TVL) of $17.14 billion, the highest among all Ethereum scaling solutions. It holds a commanding 35.3% share of the L2 market, cementing its position as the single largest rollup by adoption. The network boasts over 1.35 million active wallets, reflecting consistent daily engagement across DeFi, gaming, and NFT platforms. Cumulatively, Arbitrum has processed more than 2.06 billion transactions, demonstrating both scalability and reliability at scale.

Beyond these headline metrics, Arbitrum’s ecosystem has grown remarkably diverse. Arbiscan, the network’s official blockchain explorer, tracks nearly 600,000 ERC-20 tokens deployed on Arbitrum One, underscoring the breadth of activity taking place. Since launch, users have collectively saved an estimated 4.01 million ETH in gas fees compared to executing the same activity directly on Ethereum Layer-1. This combination of cost efficiency, developer adoption, and high throughput explains why major players like GMX, Magic Eden, Robinhood, and BlackRock’s BUIDL have chosen Arbitrum as their preferred scaling platform.

What Are the 10 Biggest Arbitrum Projects to Watch?

Arbitrum’s thriving ecosystem is home to hundreds of applications, but a few standout projects are driving its growth in 2025 and shaping the future of Ethereum scaling and web3 adoption.

1. GMX: The Leading On-Chain Perpetual DEX

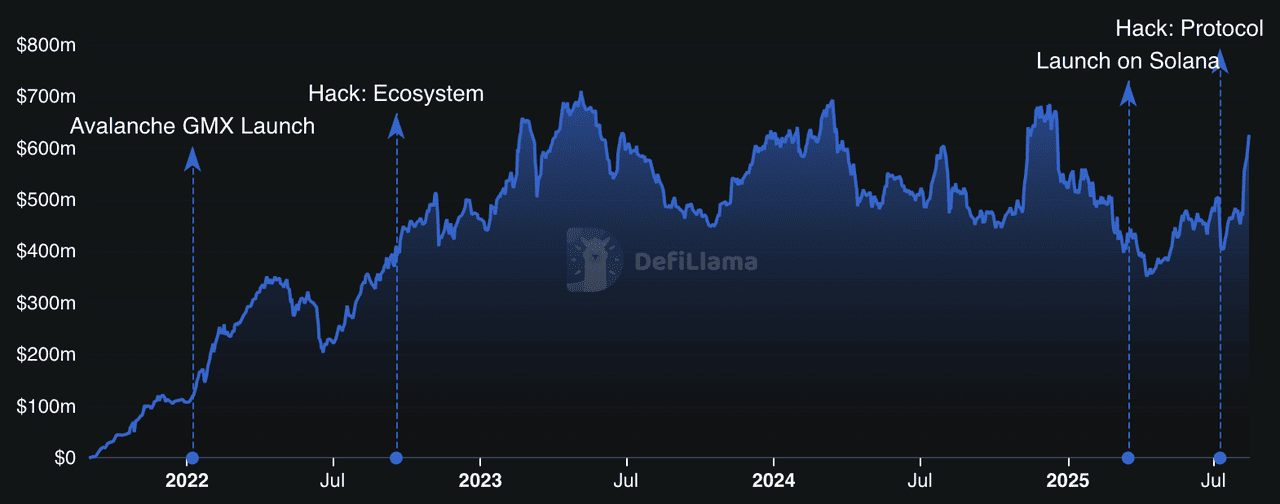

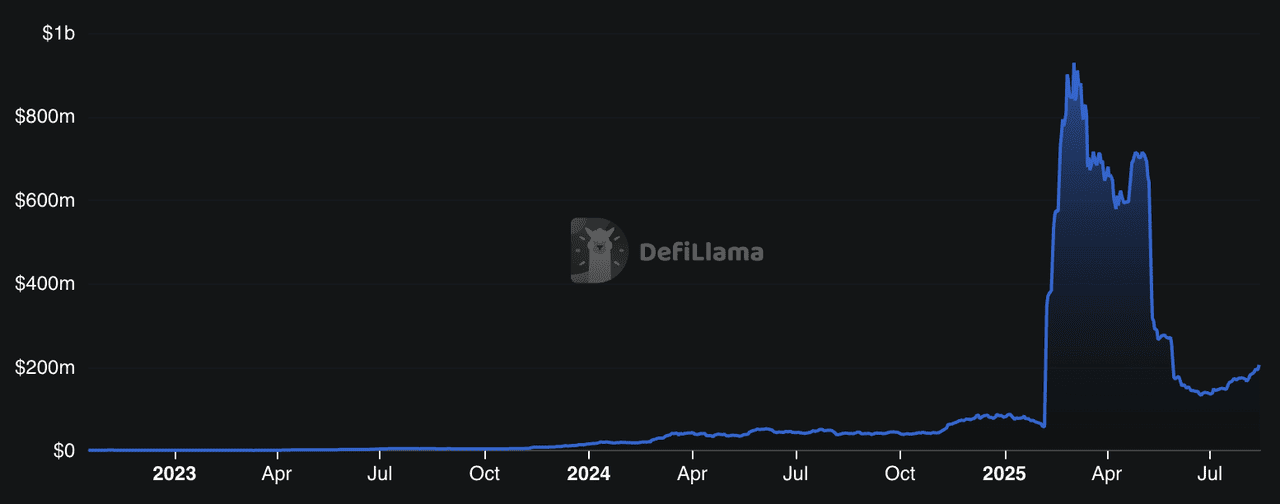

GMX TVL | Source: DefiLlama

GMX is Arbitrum’s flagship decentralized exchange (DEX), offering both perpetual swaps and spot trading for over 70 cryptocurrencies, including

BTC,

ETH, and

SOL. Unlike centralized platforms, GMX is fully non-custodial, meaning users retain control of their assets at all times. Built to take advantage of Arbitrum’s low fees and high throughput, GMX delivers deep liquidity, minimal slippage, and a transparent on-chain trading experience. Its architecture relies on GM liquidity pools and GLV vaults, which provide capital efficiency for traders while generating rewards for liquidity providers and stakers.

The exchange has grown into one of the most active DeFi platforms, with cumulative DEX volumes exceeding $22.3 billion and perpetual swap volumes topping $278.4 billion. GMX processes around $1.1 billion in weekly volume across Arbitrum and Avalanche, with daily perp volumes averaging more than $330 million. Its governance token, GMX, maintains a market cap of about $179.8 million, with nearly 60% of supply staked to earn a share of protocol fees. By combining high-speed execution, fee-sharing incentives, and robust liquidity, GMX has positioned itself as a cornerstone of the Arbitrum ecosystem and a model for sustainable DeFi growth.

2. ApeChain: Arbitrum-Powered Layer-3 for the ApeCoin Universe

ApeChain is a dedicated Layer-3 blockchain built on Arbitrum Orbit, designed specifically for the ApeCoin ecosystem. It integrates $APE as its native gas token and supports advanced developer tools through Stylus, enabling coding in languages like Rust and C++. This customization makes ApeChain ideal for NFTs, gaming, and high-performance consumer applications that require speed, scalability, and seamless user experiences.

Since its launch in October 2024, ApeChain has quickly gained momentum, debuting with 60+ applications across DeFi, NFTs, and gaming. Its infrastructure achieves block speeds under 100 milliseconds, providing near-instant responsiveness for interactive platforms. By tailoring blockchain performance to the ApeCoin community, ApeChain highlights Arbitrum’s modular vision, offering domain-specific chains that can scale ecosystems while remaining aligned with Ethereum’s security.

3. Robinhood on Arbitrum — Fintech’s On-Chain Leap

Robinhood on Arbitrum represents one of the most significant steps in bridging traditional finance with blockchain infrastructure. Instead of treating crypto purely as a tradable asset, Robinhood is leveraging Arbitrum’s Layer-2 technology to power its trading infrastructure in Europe. By building directly on-chain, the fintech giant can offer faster settlement, lower costs, and improved transparency while still delivering the smooth, familiar experience its users expect. This approach abstracts away blockchain complexity, allowing millions of retail users to benefit from crypto’s efficiency without needing to manage wallets, RPCs, or explorers themselves.

The integration signals a major milestone: a mainstream fintech company fully embracing crypto as the underlying technology stack of its services. It aligns Robinhood with Ethereum’s scaling roadmap and places Arbitrum at the center of a new financial era, where blockchain quietly powers everyday applications. For the broader ecosystem, this partnership validates Layer-2 networks as enterprise-ready infrastructure and sets the stage for further adoption of Arbitrum across global markets.

4. BlackRock’s BUIDL Fund — RWAs Going On-Chain

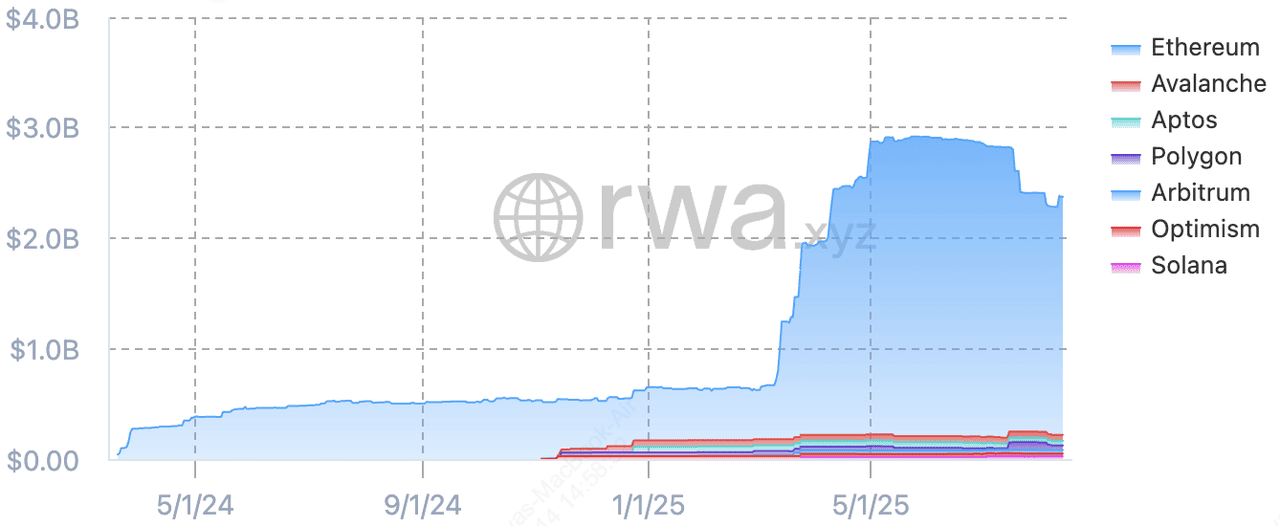

BlackRock's BUIDL fund total asset value | Source: RWA.xyz

BlackRock’s BUIDL Fund is the largest and most influential tokenized treasury product to date, bringing U.S. government securities directly on-chain. Launched in March 2024 in partnership with Securitize, the USD Institutional Digital Liquidity Fund (BUIDL) converts short-term U.S. Treasuries, cash, and repurchase agreements into digital tokens that maintain a stable $1.00 value. Investors earn around 4.5% annual yield, distributed monthly as new tokens in their wallets, making it a blockchain-native version of a money market fund. With traditional custody provided by BNY Mellon and digital custody handled by firms like Anchorage, Fireblocks, and BitGo, BUIDL combines Wall Street-grade security with blockchain efficiency. By August 2025, it has amassed roughly $2.9 billion in AUM, holding a commanding 39% market share in the tokenized treasury sector.

The fund has expanded beyond Ethereum to seven chains, including Arbitrum, where it benefits from low fees, deep DeFi liquidity, and seamless interoperability. BUIDL’s integration with protocols like

Ethena Labs’ USDtb

stablecoin, which allocates over 90% of its reserves to BUIDL, has further entrenched it as critical DeFi infrastructure. For institutions, BUIDL represents a secure, regulated gateway into tokenized finance, while for DeFi, it unlocks new collateral and liquidity opportunities. Its growth reflects a broader trend in tokenization, with projections estimating a $2–16 trillion market by 2030. By merging traditional finance scale with blockchain innovation, BlackRock’s BUIDL Fund positions Arbitrum as a leading hub for

real-world asset (RWA) adoption.

5. Pirate Nation — Orbit-Powered Web3 Strategy Game

Pirate Nation is a fully on-chain strategy game developed by Proof of Play and deployed on an Arbitrum Orbit chain, purpose-built for high-performance

Web3 gaming. Unlike traditional blockchain games that only tokenize assets, Pirate Nation runs its entire game logic on-chain, from player actions to crafting systems. Players collect and send pirates on adventures, gather resources, earn treasure, and level up their characters, all secured by smart contracts. This design makes Pirate Nation a “forever game,” as its mechanics remain functional as long as the blockchain exists. With block times as fast as 250 milliseconds and throughput up to 70 million gas per second, the game delivers smooth, real-time experiences that rival traditional online games.

Since its rise in 2024, Pirate Nation has attracted more than 2.5 million players, achieving the highest daily active user count in Web3 gaming. Its success demonstrates how Orbit chains can scale interactive applications that demand both speed and transparency. Beyond gameplay, Pirate Nation embodies key Web3 principles: players truly own their characters and assets, creators are empowered to remix or extend the game, and communities form around shared ownership. By combining fun, culture, and decentralization, Pirate Nation proves that Arbitrum Orbit isn’t just a scaling solution but also a platform for mainstream-quality, on-chain gaming.

6. Magic Eden — Multichain NFT Marketplace Embracing Arbitrum

Magic Eden is one of the world’s leading multichain NFT marketplaces, and its integration with Arbitrum has opened new opportunities for creators and collectors seeking low fees, fast transactions, and deep liquidity. Originally launched on

Solana, Magic Eden has since expanded to support Ethereum,

Polygon,

Bitcoin Ordinals, and now Arbitrum, giving users a unified hub to mint, buy, and sell NFTs across multiple blockchains. The platform also offers powerful features such as NFT aggregation, advanced analytics, and unified liquidity, allowing users to seamlessly purchase NFTs even if their funds are on another chain. This interoperability, paired with Arbitrum’s efficiency, makes it easier than ever to trade digital collectibles in a cost-effective and accessible way.

By the numbers, Magic Eden has become a powerhouse in the NFT space, hosting over 4,000 unique collections and attracting roughly 10 million monthly visits. Its platform valuation is around $1.6 billion, reflecting its position as one of the most trusted NFT marketplaces globally. The ecosystem also extends into its governance token, $ME, which as of August 2025 carries a market cap of $736 million and sees around $525,000 in daily trading volume. By embracing Arbitrum, Magic Eden enhances liquidity and visibility for creators while giving collectors faster, cheaper access to NFT markets, cementing its role as a cornerstone of the multichain Web3 economy.

7. GAM3S.GG — Gaming Hub & Arbitrum Ecosystem Curator

GAM3S.GG is a leading Web3 gaming hub that curates discovery, reviews, news, and quests for blockchain gamers, while also hosting the annual GAM3 Awards, now fully integrated with the Arbitrum ecosystem. Positioned as the cultural backbone of Web3 gaming, the platform connects players to projects like Pirate Nation and highlights the best games across chains through curated content and community-driven recognition. Beyond discovery, GAM3S.GG integrates quests, reward systems, and analytics that keep users engaged while giving developers a spotlight to scale their communities. Its close alignment with Arbitrum Gaming Ventures’ $10M investment program reinforces its role as both a gateway for players and a distribution channel for next-gen gaming projects.

By the numbers, the project has raised $4.5 million through token sales and IDO rounds, with its G3 token maintaining a market cap of around $2 million, a fully diluted valuation (FDV) of $3.75 million, and roughly $300,000 in daily trading volume. This economic foundation supports GAM3S.GG’s expansion as it scales content, partnerships, and player rewards. As the Web3 gaming market is forecasted to grow from $37.5 billion in 2025 to $183 billion by 2034, GAM3S.GG is positioned to be a key player in Arbitrum’s gaming narrative, fueling discovery, community culture, and long-term adoption of on-chain games.

8. Dolomite (DOLO) — Comprehensive Lending and Margin Hub on Arbitrum

Dolomite TVL | Source: DefiLlama

Dolomite is a decentralized trading and lending protocol that supports more than 1,000 assets across Arbitrum,

Mantle, Polygon zkEVM, and

X Layer, making it one of the most comprehensive DeFi platforms available. It allows users to lend, borrow, margin trade, and earn on a wide range of tokens, from yield-bearing assets to governance tokens, without losing their DeFi-native rights such as staking rewards or governance access. By preserving the utility of collateral, Dolomite ensures users can maximize both liquidity and ecosystem benefits.

As of August 2025, Dolomite manages over $332 million in liquidity, with $123 million borrowed and more than $1.13 billion in trading volume. The platform offers advanced tools like isolated and cross-margin borrowing to minimize liquidation risks while supporting assets such as MAGIC, ETH, GMX,

ARB, and WBTC. With yields reaching 80%+ on staked assets and seamless mobile trading features, Dolomite has become a core liquidity and margin hub on Arbitrum. Backed by multiple audits and powered by the DOLO token for governance and incentives, it stands out as one of DeFi’s most innovative and secure financial primitives.

9. Ethena USDe (USDe) — Synthetic Dollar with On-Chain Yield

Ethena brings its

synthetic stablecoin USDe to Arbitrum with a unique design backed by delta-hedged ETH and BTC derivatives. Unlike fiat-backed stablecoins, USDe is fully on-chain and generates a native yield through its Internet Bond, which passes derivative funding rates to holders. This gives users access to a stable, yield-bearing asset that is independent of centralized reserves, while expanding Arbitrum’s stablecoin landscape with a more decentralized alternative.

By August 2025, USDe has surpassed $3 billion in supply across Ethereum and Arbitrum, becoming one of the fastest-growing stablecoins. Its integration into Arbitrum-native protocols powers new yield strategies, lending markets, and collateral options, with sUSDe offering APYs around 19%. Ethena’s model strengthens Arbitrum as a hub for synthetic stablecoin adoption, while giving users an alternative to

USDT and USDC that combines stability, decentralization, and passive income.

10. Pepe (PEPE) — Memecoin Culture on Arbitrum

Pepe (PEPE), one of the most recognizable

memecoins in crypto, has carved out a strong cultural and trading presence on Arbitrum. First launched on Ethereum in April 2023, PEPE skyrocketed into popularity with its viral community push, hitting a multibillion-dollar market cap within its first year. On Arbitrum, its low fees and faster transaction speeds have made trading and holding PEPE more accessible to global retail participants. This has helped cement PEPE as both a cultural touchstone and a driver of user activity within Arbitrum’s growing ecosystem.

As of August 2025, PEPE holds the position of the third-largest memecoin, boasting a market cap of over $5 billion and ranking within the top 30 cryptocurrencies overall. Daily trading volumes often exceed $500 million across exchanges like BingX and

Uniswap. On Arbitrum, liquidity pools on DEXs such as Uniswap and

Camelot provide deep liquidity with minimal slippage, while NFT collaborations and gaming integrations extend PEPE’s cultural relevance. Beyond its speculative appeal, PEPE demonstrates how memecoins can broaden adoption on Layer-2 networks, blending meme-driven enthusiasm with accessible DeFi infrastructure.

Final Thoughts

Arbitrum in 2025 brings together a diverse mix of innovation, from advanced DeFi platforms like GMX, to institutional-grade tokenization with BlackRock’s BUIDL, and cultural touchpoints in gaming and NFTs through Pirate Nation, ApeChain, Magic Eden, and GAM3S.GG. With Robinhood’s integration, the network also signals how mainstream fintech is beginning to embrace blockchain as a foundational layer. Collectively, these projects demonstrate how Arbitrum has evolved into a well-rounded ecosystem spanning finance, entertainment, and infrastructure.

That said, it’s important to remember that every opportunity in crypto carries risks. Token prices can be volatile, protocols may face technical or regulatory challenges, and new ecosystems can take time to mature. Always do your own research (DYOR), start small when exploring new platforms, and use audited, reputable projects to minimize exposure.

Related Reading