Bitcoin’s Layer‑1 remains unmatched in security with minimal throughput (~7 TPS), limiting its utility for smart contracts, DeFi, and NFTs. In 2025, some of the most popular Bitcoin Layer‑2 networks, including Lightning Network, Stacks, Rootstock (RIF), Merlin, and Hemi, are unlocking scalability, programmability, liquidity, and Bitcoin-native DeFi (BTCFi), signaling a new era of innovation.

Discover the top five Bitcoin Layer‑2 networks of 2025, their technology, TVL, token data, protocols, and where to trade them on BingX.

What Is a Bitcoin Layer-2 and How Does It Work?

A Bitcoin Layer-2 (L2) is like an extra “fast lane” built on top of the main Bitcoin blockchain. Instead of processing every transaction directly on Layer-1, which can only handle about seven transactions per second, L2s handle most of the activity off-chain. Transactions are bundled, processed, or exchanged on these secondary layers at much higher speeds and lower costs, and only the final results are anchored back to the main Bitcoin network for settlement. This design keeps Bitcoin secure while making it more practical for everyday use like micropayments, trading, or smart contracts.

Different types of Bitcoin L2s use different methods.

1. State channels (e.g., Lightning Network) let two users lock up Bitcoin and exchange as many transactions as they want instantly, with only the final balance recorded on-chain.

2. Sidechains (e.g., Stacks and Rootstock) act as independent blockchains pegged to Bitcoin, often adding smart contract support.

3. Rollups (e.g., Merlin) gather thousands of transactions, generate cryptographic proofs, and submit a single summary back to Bitcoin, making the process faster, cheaper, and more scalable.

Together, these approaches expand Bitcoin’s functionality without changing its core protocol.

Bitcoin L2s vs. Ethereum L2s: How Bitcoin Layer-2s Differ from Ethereum Layer-2 Networks

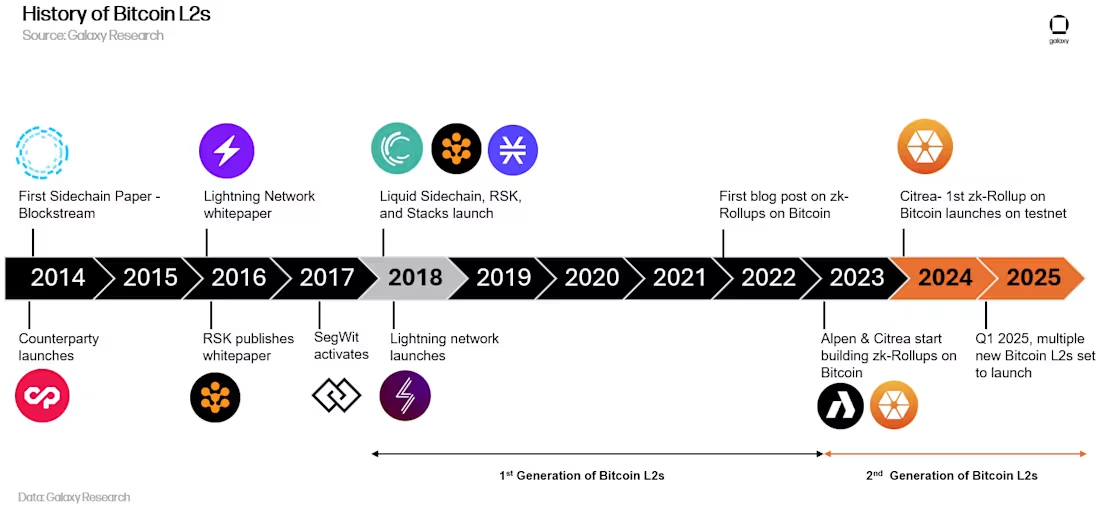

A history of Bitcoin layer-2 networks | Source: Galaxy

Bitcoin Layer-2s exist because Bitcoin’s base chain is highly secure but limited in functionality. Since Bitcoin’s Layer-1 wasn’t built for smart contracts or complex apps, L2s add those features on top. They anchor back to Bitcoin’s Proof-of-Work security through methods like payment channels, sidechains, or rollups. This makes them ideal for expanding Bitcoin’s use cases, such as enabling DeFi with BTC, adding liquidity tools, and supporting fast, low-fee payment networks like Lightning.

Ethereum, on the other hand, already supports smart contracts at its base layer. Its Layer-2s, like

Arbitrum and

zkSync, are designed mainly to scale what Ethereum already does well, such as DeFi, NFTs, and

Web3 gaming, by making it faster and cheaper. These L2s inherit Ethereum’s Proof-of-Stake security and work seamlessly with its dApp ecosystem. In short, Bitcoin L2s are about unlocking new possibilities for Bitcoin, while Ethereum L2s are about making existing apps run better at scale.

Why Bitcoin Layer-2 Networks Matter in 2025

Bitcoin Layer-2s are more than just scaling fixes but are the foundation of

Bitcoin DeFi (BTCFi). By moving transactions off-chain and adding programmability, these networks make it possible to lend, borrow, and swap directly in BTC rather than relying on wrapped tokens on Ethereum. They also expand Bitcoin’s reach into NFTs, DAOs, and smart contracts, while enabling micropayments and contract execution at a fraction of the cost. Cross-chain bridges further connect Bitcoin to ecosystems like Ethereum and

Sui, making BTC a more liquid and usable asset across Web3.

The numbers show how fast this sector is growing.

Merlin Chain has surpassed $1.7 billion in TVL as of August 2025. Hemi (HEMI), a newer entrant, has quickly grown into a major Bitcoin L2 with over $1.2 billion in TVL, more than 90 protocols, and a community of 100,000+ users. Alongside Lightning Network,

Stacks, and Rootstock, these L2s dominate in 2025 thanks to their mix of speed, programmability, BTC-anchored security, and thriving ecosystems, transforming Bitcoin from

digital gold into a programmable financial layer.

The Top 5 Bitcoin Layer-2 Projects of 2025

Here are the leading Bitcoin Layer-2 networks in 2025, each enhancing Bitcoin’s usability by making it faster, more programmable, and more secure.

1. Lightning Network

The

Lightning Network is Bitcoin’s most established Layer-2 solution, designed to make payments fast, cheap, and scalable. Instead of recording every single transaction on Bitcoin’s base layer, Lightning allows users to open payment channels between two parties. Once open, these channels let users send Bitcoin back and forth instantly and at almost no cost, with only the opening and closing balances eventually settled on the main blockchain. This makes Lightning ideal for micropayments, remittances, and merchant transactions, where speed and low fees matter most.

What makes Lightning powerful is its scalability and flexibility. The network is capable of handling millions of transactions per second, far beyond Bitcoin Layer-1, while maintaining decentralization and security through Bitcoin’s smart-contract scripting. Payments can be routed across a network of channels, similar to how data packets move across the internet, ensuring that users don’t need direct channels with everyone they transact with. Features like atomic swaps also allow cross-chain transactions between compatible blockchains, expanding Bitcoin’s interoperability. In practice, Lightning is already integrated into major wallets, exchanges, and point-of-sale systems, making it the most widely adopted Bitcoin L2 today.

2. Stacks (STX)

Stacks is a Bitcoin Layer-2 that uses the Proof-of-Transfer (PoX) consensus and the Clarity programming language to bring smart contracts and decentralized applications (dApps) to Bitcoin without altering its base layer. Every Stacks transaction anchors back to Bitcoin, ensuring finality and security are tied to the most decentralized blockchain. Developers use Stacks to build applications ranging from DeFi protocols and lending platforms to NFT marketplaces and DAOs, all while tapping into Bitcoin’s security and liquidity. The introduction of sBTC, a 1:1 Bitcoin-backed asset, has unlocked BTC’s capital for productive use across the Stacks ecosystem, enabling lending, trading, and yield strategies.

The network’s ecosystem has grown rapidly, with projects such as Arkadiko (decentralized stablecoin protocol), Gamma (NFT marketplace), Velar (Bitcoin DeFi platform), BitFlow (DEX), and Zest Protocol (BTC lending) attracting developers and users. Wallets like Xverse, Ryder, and Leather integrate seamlessly with Stacks apps, making it accessible for retail adoption. As of 2025, Stacks secures over $208 million in TVL, with the STX token trading around $0.63 and a market cap above $1.1 billion. With continuous upgrades like self-custodial on-ramps and new DeFi features, Stacks positions itself as a leading Bitcoin Layer-2, bridging Bitcoin’s security with Web3 functionality.

3. Rootstock Infrastructure Framework (RIF)

Rootstock is an EVM-compatible sidechain that runs alongside Bitcoin and is secured through merged mining, allowing Bitcoin miners to validate both Bitcoin and Rootstock blocks with the same hashing power. This design extends Bitcoin’s security model to smart contracts and dApps built on Rootstock, while maintaining compatibility with the Ethereum ecosystem through Solidity support. The RIF token powers this ecosystem, providing access to identity solutions, oracles, decentralized storage, and payment services. With these tools, Rootstock enables a broad range of DeFi and Web3 applications anchored in Bitcoin’s security.

The Rootstock ecosystem has been expanding steadily, especially across Latin America, where it is used in real-world payments and decentralized finance solutions. RIF serves multiple roles: it can be staked in the RootstockCollective DAO to fund Bitcoin-based projects, used for governance votes, and spent on services like RIF Relay (gas fee payments in any ERC-20), RIF Flyover (fast Bitcoin transfers in and out of Rootstock), and RIF Rollup (zk-rollup scaling for cheaper transactions). As of 2025, RIF trades at around $0.056 with a market cap of $55 million and over $1.2 million in daily trading volume, underscoring its position as one of the longest-running and most reliable Bitcoin Layer-2 networks.

4. Merlin Chain (MERL)

Merlin Chain is a Bitcoin-native ZK-Rollup Layer-2 that combines scalability, security, and programmability. It supports a wide range of Bitcoin protocols, including BRC-20, BRC-420, Bitmap, and Atomicals, making it a versatile hub for Bitcoin assets and dApps. By using zero-knowledge proofs and decentralized oracles, Merlin achieves low fees, high throughput, and transparent validation, while fraud-proof systems ensure network security. Its EVM compatibility allows developers to easily port existing Ethereum applications to Bitcoin’s ecosystem.

In just six months, Merlin has grown into one of the largest Bitcoin L2s with over $1.7 billion TVL, more than 150 dApps, and $16 billion in bridge volume. The MERL token powers staking, governance, and transaction fees, and it trades around $0.115 with an active daily volume of about $105 million. The roadmap for 2025–26 includes BTC staking yields up to 21% APR, cross-chain integrations with networks like Sui, ecosystem grant programs, and AI-driven features. With its rapid adoption and strong developer traction, Merlin is positioning itself as a leading force in Bitcoin’s emerging DeFi and Web3 economy.

5. Hemi (HEMI)

Hemi is a modular Bitcoin Layer-2 that merges Bitcoin’s security with Ethereum’s programmability, creating what it calls a “supernetwork.” Its key innovation is the Hemi Virtual Machine (hVM), which embeds a full Bitcoin node inside an Ethereum-compatible EVM. This allows developers to build smart contracts and dApps that interact directly with Bitcoin data, enabling lending, staking, cross-chain exchanges, and other DeFi functions using real BTC rather than wrapped tokens. The network runs on a Proof-of-Proof (PoP) consensus and a Bitcoin-Secure Sequencer design, ensuring that all transactions benefit from Bitcoin-grade security while maintaining Layer-2 speed and efficiency.

Backed by Bitcoin OG Jeff Garzik and supported by $15 million in funding, Hemi has quickly grown into one of the most ambitious BTCFi platforms. It supports over 90 protocols, secures more than $1.2 billion in TVL, and has attracted over 100,000 users to its ecosystem. The HEMI token is listed on exchanges like MEXC, often paired with zero-fee trading promotions to drive adoption. With features such as non-custodial Bitcoin services, trustless restaking with native BTC, and interoperability tunnels between Bitcoin and Ethereum, Hemi is positioning itself as a cornerstone of Bitcoin’s programmable finance future.

How to Trade Bitcoin Layer-2 Projects on BingX

BingX makes it simple to access and trade leading Bitcoin Layer-2 tokens, whether you’re a beginner or an advanced trader.

1. Spot Trading

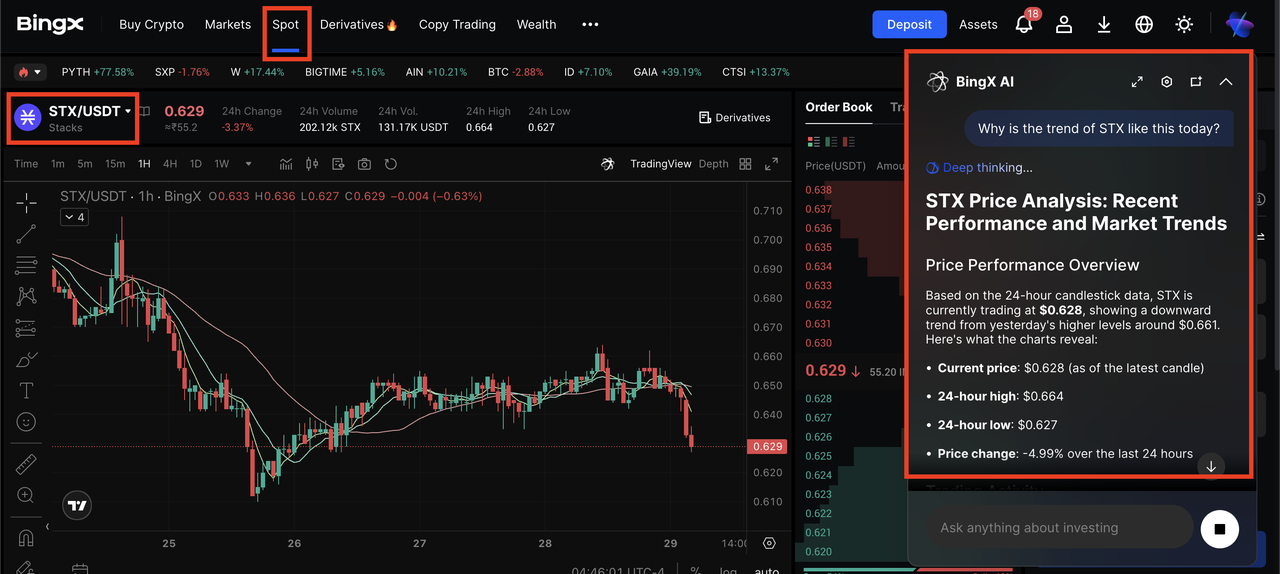

STX/USDT trading pair on the spot market, powered by BingX AI insights

You can buy and sell Bitcoin Layer-2 tokens such as MERL, STX, and

HEMI directly on the

BingX Spot Market. Orders are executed quickly, with fees often under 0.1%, making spot trading ideal if you want to accumulate tokens for the long term, swap between pairs like

STX/USDT or

MERL/USDT, or enter and exit positions without leverage.

2. Futures/Perps Market

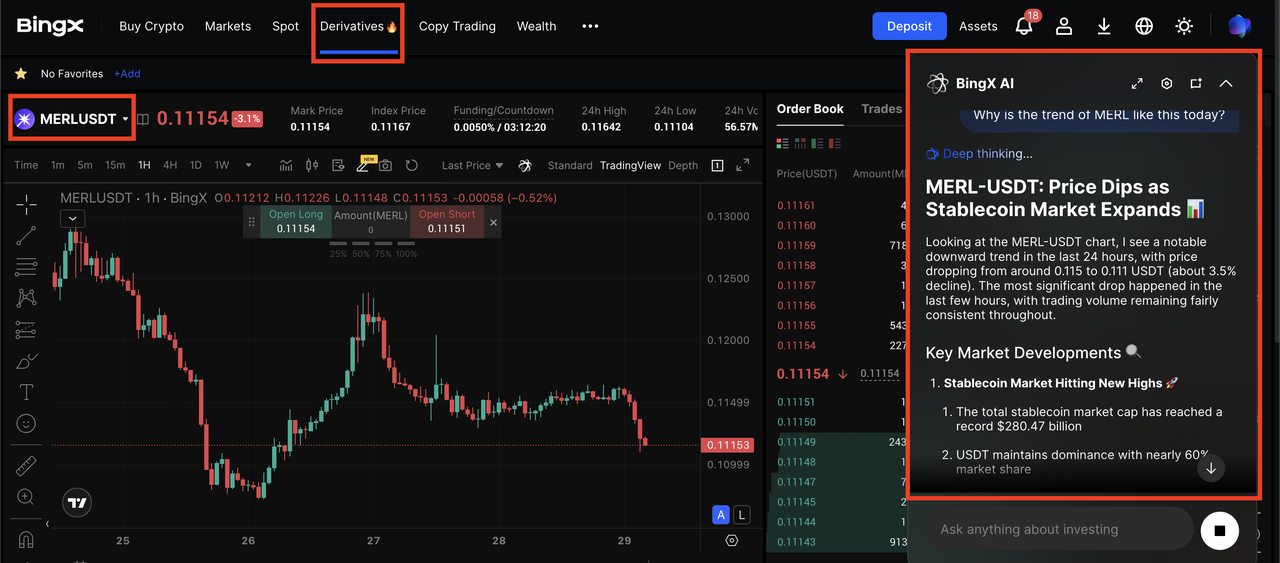

MERL/USDT perpetual contract on the futures market powered by BingX AI

BingX also offers

perpetual futures contracts on selected L2 tokens, allowing you to go long or short with leverage. This is useful if you want to hedge spot holdings, speculate on short-term price swings (e.g., MERL during ecosystem updates), or manage risk exposure during volatile markets. Unlike dated contracts, perps never expire, so you can keep positions open as long as margin requirements are met.

3. Copy Trading

With

BingX Copy Trading, you can automatically follow and replicate trades made by experienced traders who specialize in L2 tokens. For example, if a top trader builds positions in STX before a major upgrade, your account mirrors those moves in real time. It’s a practical way to learn strategies, diversify your portfolio, and participate in Bitcoin L2 opportunities without actively trading every market move yourself.

BingX also provides AI-powered tools and alerts via

BingX AI to help you track emerging L2 projects like Hemi and Merlin. By monitoring charts, liquidity, and trading pairs, you can stay updated on new trends and tokens gaining traction.

Conclusion

Bitcoin Layer-2 networks are evolving BTC beyond its reputation as “digital gold,” turning it into a programmable and liquid financial layer. Projects like Lightning, Stacks, Rootstock, Merlin, and Hemi are at the forefront, each addressing Bitcoin’s limitations in different ways. Lightning enables instant, low-fee payments, while Stacks and Rootstock expand programmability with DeFi and smart contracts. Merlin uses zk-Rollups to achieve high throughput and interoperability, and Hemi introduces logic-driven finality by embedding Bitcoin’s state into an EVM environment. Together, they showcase the diverse paths Layer-2s are taking to strengthen Bitcoin’s role in the broader crypto economy.

What sets these networks apart in 2025 is a combination of speed, programmability, security, and adoption. They inherit Bitcoin’s security while introducing new architectures for scaling and functionality. Ecosystem growth, measured by TVL, developer activity, and transaction volumes, highlights their traction and long-term potential. Still, risks remain, from bridge vulnerabilities to liquidity fluctuations, so users should approach carefully and stay informed. As these networks mature, they are likely to play an essential role in Bitcoin’s transformation into a more versatile financial platform.

Related Reading