Borrowing and lending have always been part of finance, but in crypto they operate in a completely different way.

Aave is one of the protocols redefining this process, allowing anyone to earn interest or take out loans without the need for a bank account, credit score, or intermediary.

In 2025, institutional interest in building an

Ethereum treasury is growing, driven by the additional yield opportunities it offers through DeFi, including lending,

liquid staking, and other on-chain strategies. Aave sits at the center of this shift, providing deep liquidity, multi-chain access, and transparent on-chain markets that appeal to both retail and institutional participants. This combination has made it a cornerstone of the DeFi ecosystem today.

What Is Aave and How Does it Work?

Aave is an open-source, non-custodial decentralized lending protocol that enables users to lend, borrow, and earn interest on cryptocurrencies without traditional intermediaries. The name “Aave” comes from the Finnish word for “ghost,” symbolizing the protocol’s mission to build a transparent, borderless financial system.

Originally launched in 2017 as

ETHLend before rebranding to Aave in 2018, the platform has grown into one of the largest and most trusted DeFi protocols, with a

total value locked (TVL) of $40.177 billion across multiple blockchain networks as of 2025. It operates through

smart contracts on

Ethereum,

Polygon,

Arbitrum,

Optimism,

Avalanche, and other chains, ensuring transparency, security, and permissionless access to its markets.

Core Features of the Aave Protocol

• aTokens for Earners: Depositors receive interest-bearing tokens (e.g., aUSDC, aETH) that accrue interest in real time.

• Flexible Interest Rates: Borrowers can choose between stable rates (e.g., 5–15%) or variable rates (e.g., 2–8%) depending on market conditions.

• Flash Loans: Pioneered by Aave, these allow instant, collateral-free loans repaid within a single blockchain transaction.

• Wide Asset Support: Beyond ETH and stablecoins, Aave supports 50+ tokens across multiple chains, each with tailored risk parameters.

By combining deep liquidity, innovative features, and a strong security record, Aave has become a core infrastructure layer in the

decentralized finance (DeFi) ecosystem.

What Makes Aave at the Center of the 2025 DeFi Boom?

Aave is attracting unprecedented attention in 2025, setting new records in deposits, market dominance, and institutional adoption. It has become the leading venue for both retail and institutional players to generate yield, manage liquidity, and deploy Ethereum treasuries efficiently. With its ability to integrate new DeFi products, scale across multiple chains, and maintain strong security standards, Aave has evolved into a core pillar of on-chain finance.

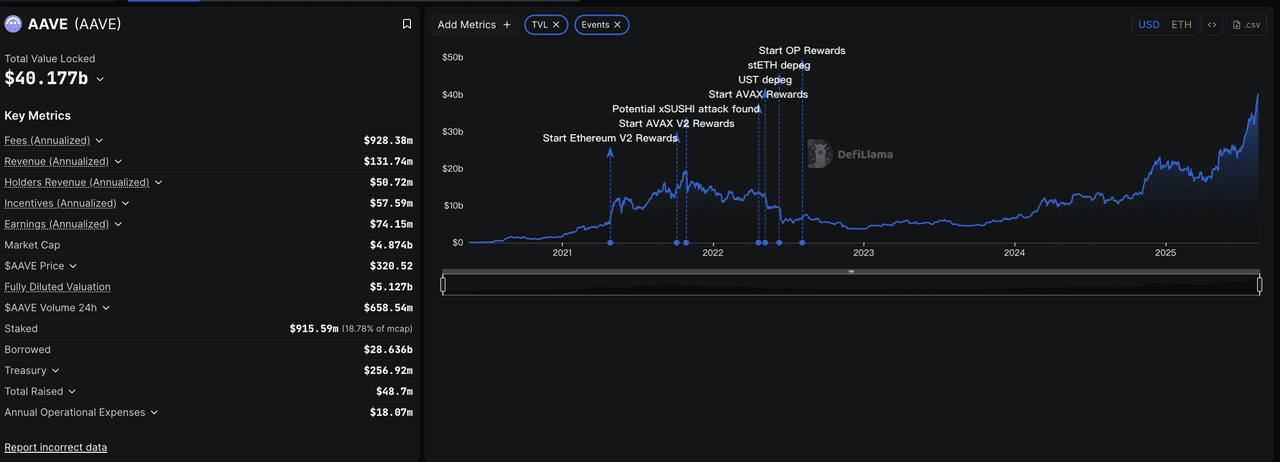

1. Aave’s $40B TVL, 66% Lending Market Share, and Rapid Growth

Aave commands a 66.7% share of the $91.7 billion DeFi lending market and controls about 80% of outstanding debt on Ethereum. Its total value locked currently stands at $40.177 billion, rising 35.07% in the past month and 16.47% in the past week, making it one of the fastest-growing major DeFi protocols in 2025. Founder Stani Kulechov projects that deposits could surpass $100 billion by year-end, a target made more plausible by its accelerating inflows.

This scale places Aave’s deposit base ahead of Barclays and within reach of Deutsche Bank’s size, underscoring DeFi’s ability to rival traditional banking. For institutions building Ethereum treasuries, Aave offers additional yield through lending, staking, and other DeFi strategies. Fintech and traditional finance firms, including Nasdaq-listed Blockchain Technology Consensus Solutions (BTCS), are actively deploying assets on Aave as part of their treasury operations, cementing its status as a preferred institutional infrastructure.

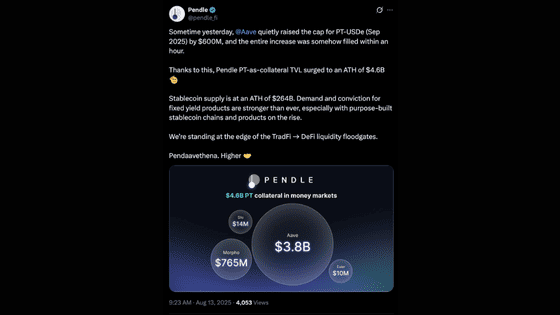

2. "Pendaavethena" Leads Growth in the 2025 DeFi Space: Pendle, Aave, Ethena

A key driver of Aave’s 2025 growth is the rise of "Pendaavethena", the powerful yield loop created by combining

Pendle’s fixed-yield markets,

Ethena’s USDe stablecoin, and Aave’s deep lending pools.

Ethena’s deposits on Aave climbed from $4.6 billion to $6.4 billion in just ten days, fueled by the Ethena Liquid Leverage Effect. This includes $4 billion in Pendle PT, $1.4 billion in USDe, and $1 billion in sUSDe. On August 13, Aave raised the cap for PT-USDe by $600 million, which filled in under an hour, pushing Pendle PT-as-collateral TVL to a record $4.6 billion.

USDe supply has crossed $10 billion, making it the third-largest

stablecoin by

market cap, while the overall stablecoin market reached $264 billion. The surge in demand for fixed-yield products has positioned Aave as the top deployment venue for these assets, solidifying its role as the primary yield engine in this cycle’s DeFi landscape.

Read More:

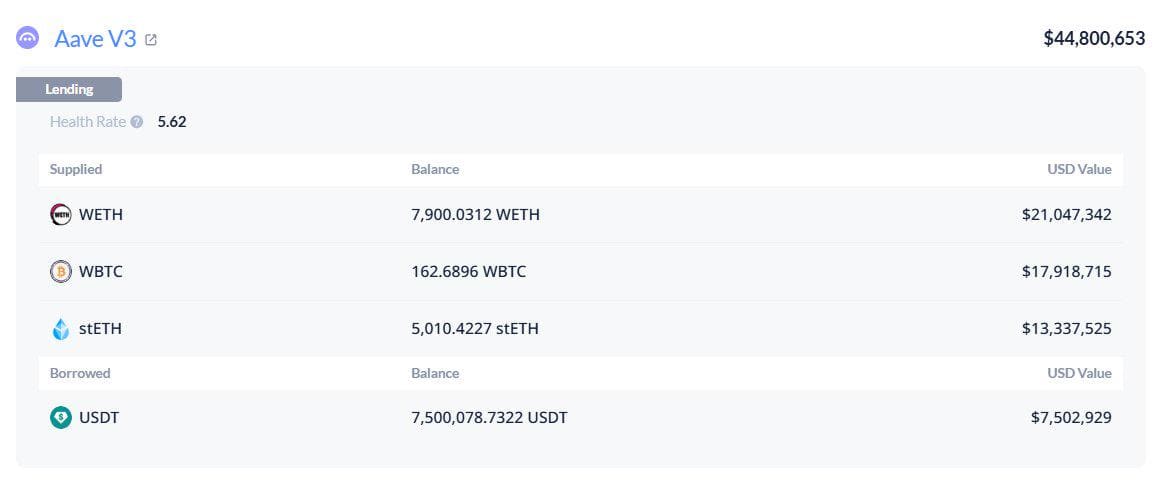

3. WLFI Integrates Aave Into Its Institutional Treasury Strategy

Borrowed funds are converted into

WLFI’s USD1 stablecoin, demonstrating sophisticated treasury management and active platform utilization. The fact that 16% of WLFI’s treasury is deployed on Aave for borrowing and lending, rather than simply holding AAVE tokens, marks a strong vote of confidence in Aave’s infrastructure from a high-profile institutional player.

How Users Generate Passive Income from Aave

Aave operates on blockchain-based smart contracts that automate lending, borrowing, and interest payments without intermediaries. Users deposit assets into liquidity pools, which other users can borrow from, and the protocol runs 24/7 with full transparency and security.

The interest earned by depositors comes directly from borrowers. Each loan carries an interest rate determined by supply and demand in the specific asset’s liquidity pool. Most of this interest is paid out to liquidity providers, while a smaller portion goes to Aave’s reserve for risk management. When borrowing demand rises, yields for depositors increase, making returns closely tied to market activity on the platform.

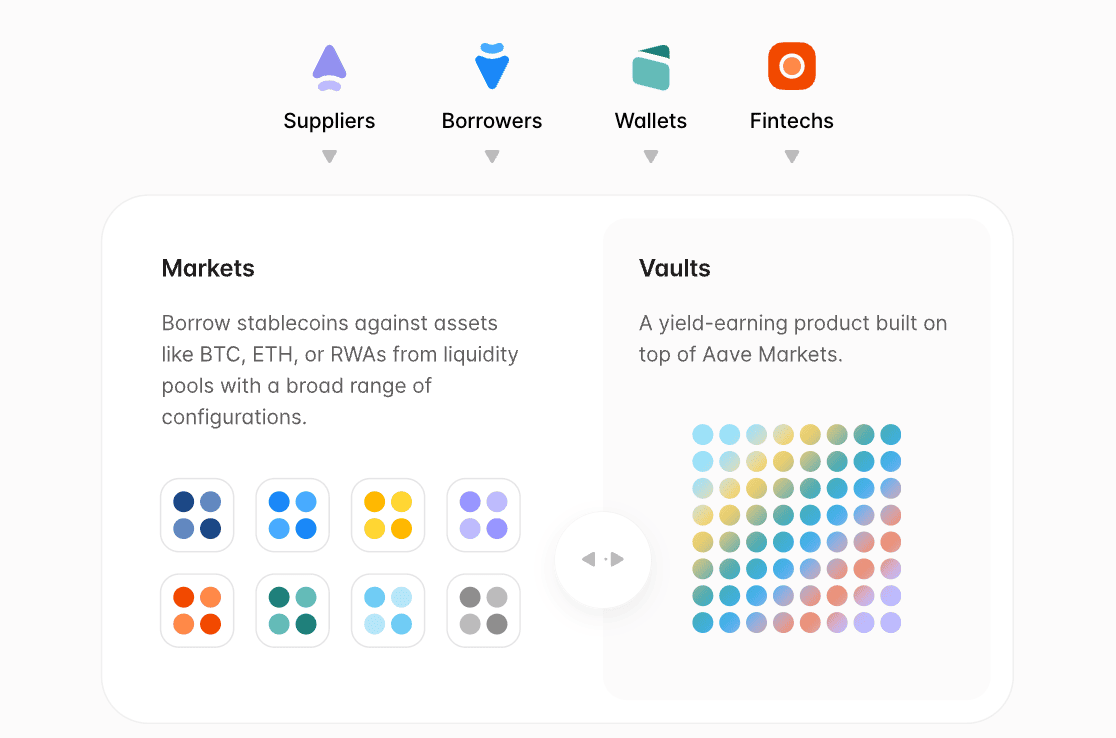

What You Can Do on Aave: Lending, Borrowing, Flash Loan, and More

Aave offers a broad set of tools that let users earn yield, access liquidity, and manage assets without leaving the blockchain. Available across Ethereum mainnet,

Layer 2 networks like Arbitrum, Optimism, and Polygon, as well as other chains such as Avalanche, Aave gives users the flexibility to choose faster, cheaper environments for their transactions. Whether you are an individual looking to grow your holdings or an institution managing an Ethereum treasury, Aave’s services are designed to work seamlessly across chains.

1. Lending: Supply Liquidity and Earn Passive Interest

Deposit supported cryptocurrencies into Aave’s liquidity pools and receive

aTokens (such as aUSDC or aETH) in return. These tokens automatically grow in balance as interest accrues, so your

Web3 wallet reflects earnings in real time. Interest rates are determined algorithmically based on supply and demand for each asset, offering a transparent and predictable way to earn yield.

2. Borrowing: Unlock Liquidity Without Selling Assets

Deposit crypto such as ETH, USDC, or other supported tokens as collateral to borrow other cryptocurrencies. Loan-to-Value (LTV) ratios determine your borrowing limit, and you can choose between stable interest rates for predictability or variable rates that move with market conditions. If the value of your collateral drops below the liquidation threshold, a portion will be automatically sold to repay your loan.

3. Flash Loans: Instant, Collateral-Free Borrowing

Users can use flash loans to borrow assets instantly without posting upfront collateral such as ETH, stablecoins, or other tokens, provided the full amount is repaid within the same blockchain transaction. Popular for arbitrage, debt restructuring, and collateral swaps, flash loans are a flexible tool for advanced DeFi strategies. With Aave’s multi-chain support and Layer 2 integrations, these transactions can be executed faster and at lower cost.

4. GHO Stablecoin: Borrow a Stable Asset While Keeping Collateral Active

Aave has launched GHO, its own overcollateralized, governance-controlled stablecoin. You can mint GHO by depositing collateral into the protocol, giving you a stable on-chain currency while keeping your collateralized assets working in the background. GHO is designed for payments, DeFi strategies, and earning opportunities, making it an additional way to unlock liquidity without selling your holdings.

What Is AAVE Token?

AAVE is the native governance and utility token of the Aave protocol, with a fixed supply of 16 million and no future issuance. About 15.2 million are in circulation as of August 2025, most distributed during the 2020 migration from LEND, with the rest held in the Aave Ecosystem Reserve to fund development and incentives.

AAVE has one of the most decentralized and well-structured tokenomics models in DeFi. There is no founding team or investor concentration, and governance was officially handed to the community in 2020. Voting power is capped to prevent dominance, ensuring a truly democratic governance process. Holders use AAVE to propose and vote on protocol changes, asset listings, and risk parameters, making it the central coordination tool for the ecosystem.

The token also secures the platform through the Safety Module, where stakers provide an insurance reserve against shortfalls and earn rewards in return. Currently, around 2.9 million AAVE, or 19.12% of supply, are staked at a 4.63% APY. With clear utility, deflationary pressure through potential buybacks and burns, and alignment between governance, security, and growth, AAVE remains a cornerstone of the protocol’s long-term sustainability.

Is Aave Safe to Use?

Aave has been operating since January 2020, after first launching as ETHLend in 2017, and now secures over $11B in total value locked. The core protocol has never suffered a major loss, though there have been minor incidents in peripheral systems. In June 2025, a reward exploit let an attacker claim 48.9 AAVE through zero-token deposits, and in August 2024, $56K was taken from a non-core adapter contract.

Security is reinforced by multiple layers of protection:

• $382M Safety Module in AAVE, GHO, and ABPT, which can be slashed to cover deficits.

• Umbrella system (2025) enabling instant on-chain slashing during bad debt events.

• Proactive risk controls, including audits, bug bounties, Chainlink oracles, and Aave V3 features like supply caps, borrow caps, and isolated collateral.

With its long operational history, decentralized governance, and strong insurance reserves, Aave is regarded as one of the most secure DeFi lending protocols—though, like all DeFi, it is not entirely risk-free.

How to Trade Aave (AAVE) Tokens on BingX

Aave (AAVE) is the governance and utility token of the Aave protocol, one of the largest DeFi lending platforms, known for its multi-chain lending markets, flash loan innovation, and GHO stablecoin. AAVE is available on both the BingX Spot Market and Perpetual Futures Market, giving traders flexibility to build a long-term position or capture short-term market moves. BingX also offers real-time analysis through

BingX AI to help identify better trade setups.

Step 1: Search for AAVE/USDT on Spot or Perpetual Futures

AAVE Spot Trading

Go to the

Spot Market on BingX and search for

AAVE/USDT. Place a market order to buy instantly or set a limit order for your preferred entry price. Spot trading is ideal for those looking to hold AAVE long term, participate in governance, or gain exposure to DeFi growth.

AAVE Perpetual Futures

Search

AAVE/USDT in the

Perpetual Futures Market to go long or short without an expiration date. This allows strategies for both bullish and bearish markets. Using leverage can increase potential returns but also raises risk, so manage it carefully.

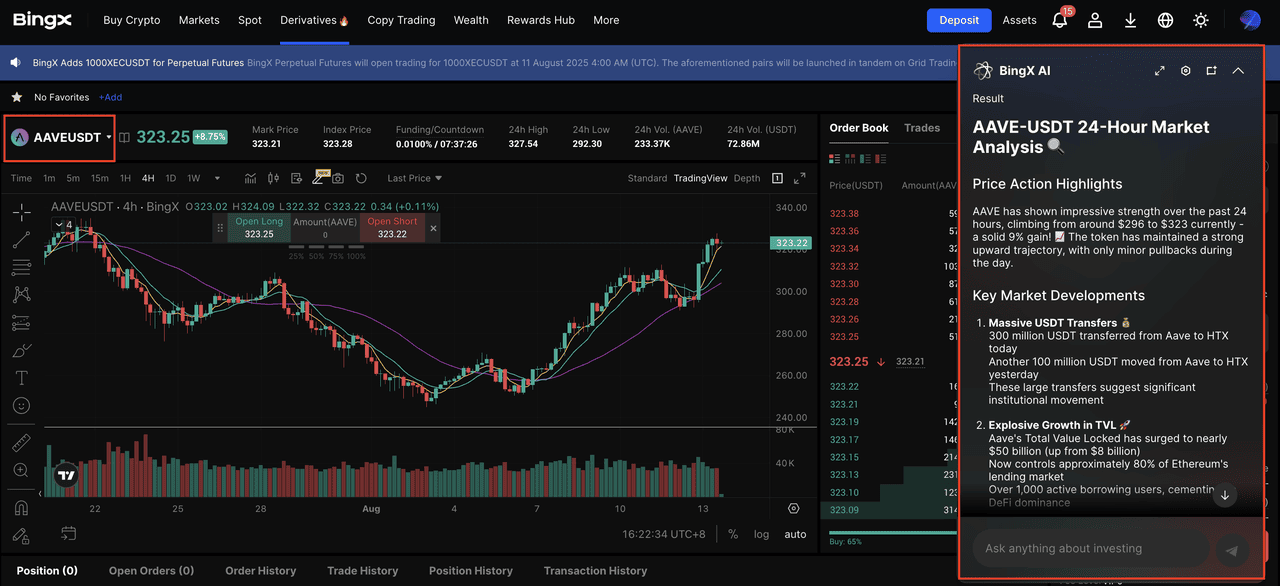

Source: BingX AAVE/USDT Perpetual Futures

Step 2: Use BingX AI for Real-Time Market Insights

Click the AI icon on the trading chart to launch

BingX AI. This tool highlights key support and resistance levels, identifies trend direction, and surfaces recent market-moving events such as Aave’s TVL growth and major partnerships. These insights can help refine your strategy and timing.

Step 3: Execute and Monitor Your Trade

Use a market order for immediate execution or a limit order to target your ideal entry price. Continue monitoring BingX AI to adapt your position and strategy based on market conditions.

Final Thoughts

Aave has secured its place as one of the most influential protocols in DeFi, combining deep liquidity, innovative features, and strong community governance. Its growing institutional adoption, integrations with emerging DeFi trends like Pendaavethena, and well-designed tokenomics give it a unique position in the 2025 crypto landscape.

Whether you are supplying liquidity, borrowing against collateral, exploring flash loans, or trading AAVE itself, the protocol offers a versatile set of tools for both individual and institutional users. With continued expansion across chains and products like the GHO stablecoin, Aave is well positioned to remain a core pillar of on-chain finance for years to come.

Related Reading