On July 14, 2025,

Bitcoin reached a new all-time high above $123,000. That same day,

HYPE, the native token of

Hyperliquid, also set its own all-time high at $49.75. The parallel rally reflects a broader return of confidence across crypto markets, but in HYPE’s case, the momentum is also being driven by strong fundamentals.

Hyperliquid’s ecosystem has expanded significantly in recent months. Its

Layer 1 blockchain has grown to nearly $2 billion in

total value locked(TVL), and the protocol now ranks among the top performers in daily revenue, consistently outpacing Ethereum and Solana. A growing number of

DeFi applications are launching on the network, and speculation around a second

airdrop continues to attract attention. Hyperliquid also executed a record-breaking $3.97 million HYPE token buyback, signaling strong confidence in its token economy and reinforcing its position in the decentralized finance space. As HYPE hovers near its peak, many are watching closely to see whether it can break through the $50 mark and sustain new highs. As HYPE hovers near its peak, many are watching closely to see whether it can break through the $50 mark and sustain new highs.

This article breaks down the main factors driving HYPE’s recent price movement, including market momentum, protocol growth, and token supply dynamics. With HYPE trading just below its peak, the real question is whether it’s building toward a breakout or about to run out of steam.

What Is Hyperliquid DEX and How Does It Work?

Source: Hyperliquid Foundation

Hyperliquid is a decentralized exchange (

DEX) purpose-built for

perpetual futures trading. Unlike most DEXs that run on Ethereum or

Layer 2 networks, it operates on its own Layer 1 blockchain, designed from the ground up to prioritize speed, user experience, and transparency.

What sets Hyperliquid apart is that it feels more like a centralized exchange, but with fully non-custodial infrastructure. Users maintain full control of their assets, and there are no

KYC requirements. All trades are transparent and verifiable on-chain.

Key Features of Hyperliquid

• Custom Layer 1 Blockchain: Built from scratch using the HyperBFT consensus, tailored for high-speed, on-chain trading

• Gas-Free Trading: No

gas fees on trades. Only low

maker (0.01%) and

taker (0.035%) fees apply.

• One-Click Execution: Trades settle instantly without repeated wallet approvals.

• High Leverage Options: Up to 50x leverage across over 130 supported markets.

• Fully On-Chain Order Book: Transparent matching with one-block finality.

• Non-Custodial by Design: Users retain full control of their assets. No centralized custody or KYC.

• Built for Traders: Optimized UI, advanced order types, and smooth performance even during high volatility.

Hyperliquid’s performance-first design has helped it stand out in a crowded market, making it one of the fastest-growing platforms in on-chain derivatives.

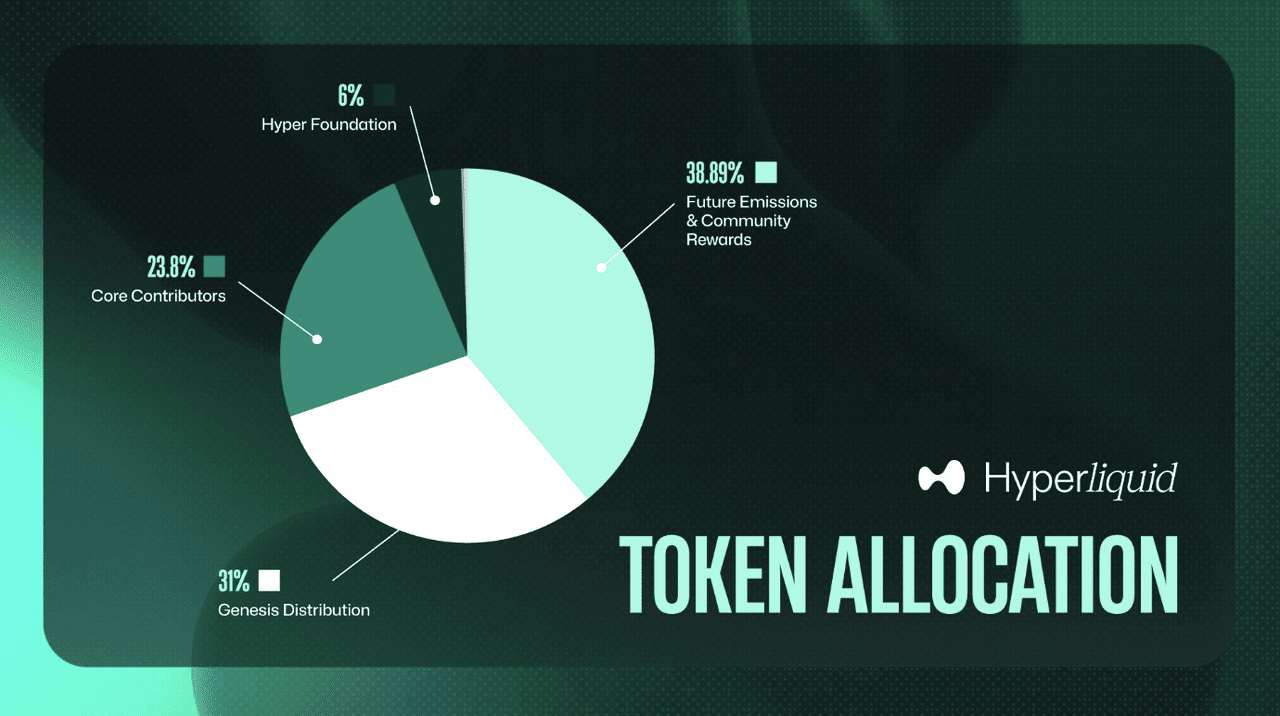

What Is the HYPE Tokenomics?

HYPE has a fixed total supply of 1 billion tokens, with a distribution model focused on long-term participation and protocol growth. There is no allocation to venture capital or private investors.

$HYPE Token Allocation

• 38.89% reserved for future emissions and community rewards

• 31.00% distributed at genesis (November 29, 2024)

• 23.80% allocated to current and future core contributors

• 6.00% assigned to the Hyper Foundation budget

• 0.30% set aside for community grants

• 0.012% allocated via HIP-2 governance proposal

Hyperliquid uses 97% of trading fees to buy back, redistribute, or burn HYPE. Over 110,000 tokens have already been burned. The tokenomics prioritize utility, transparency, and long-term alignment with platform users.

What Is the HYPE Token Utility?

HYPE is the native token of the Hyperliquid ecosystem, built to reward users, support platform activity, and align long-term participation with network growth.

Key use cases for HYPE

• Fee rewards: 97% of trading fees are used to buy back or redistribute HYPE, linking token demand directly to platform usage.

• Staking: Users can stake HYPE to earn rewards, with yields up to 55% annually and reduced token supply over time.

• Trading benefits: Active traders may receive lower fees or added incentives for holding and using HYPE.

• Governance: HYPE holders can vote on decisions related to protocol changes, rewards, and upgrades.

• No VC allocation: All tokens were distributed to users, not investors, reinforcing utility-driven value.

HYPE is more than a governance token. It plays an active role in how value flows through the Hyperliquid platform.

What Makes HYPE Price Surge in 2025?

Hyperliquid’s rise in 2025 is more than just market momentum. It reflects growing adoption, strong fundamentals, and platform usage that directly ties back to HYPE’s value. Here are the key developments driving both platform traction and token demand:

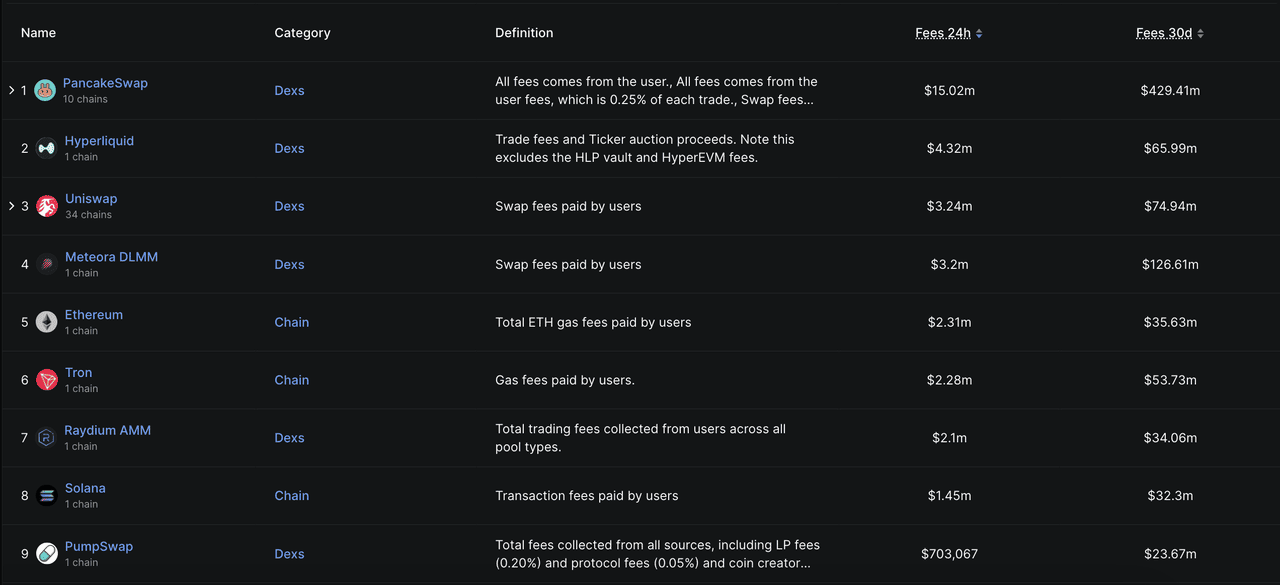

1. Strong revenue and token demand: Hyperliquid has consistently outperformed Ethereum and

Solana in daily trading revenue. On July 14, it recorded $1.7 million in fees in a single day. Since 97% of fees are used to buy or redistribute HYPE, volume directly supports price. Staking yields of up to 55% and ongoing token burns also reduce circulating supply, adding steady buy-side pressure.

Hyperliquid Generated More Fees than Ethereum and Solana | Source: DefiLlama

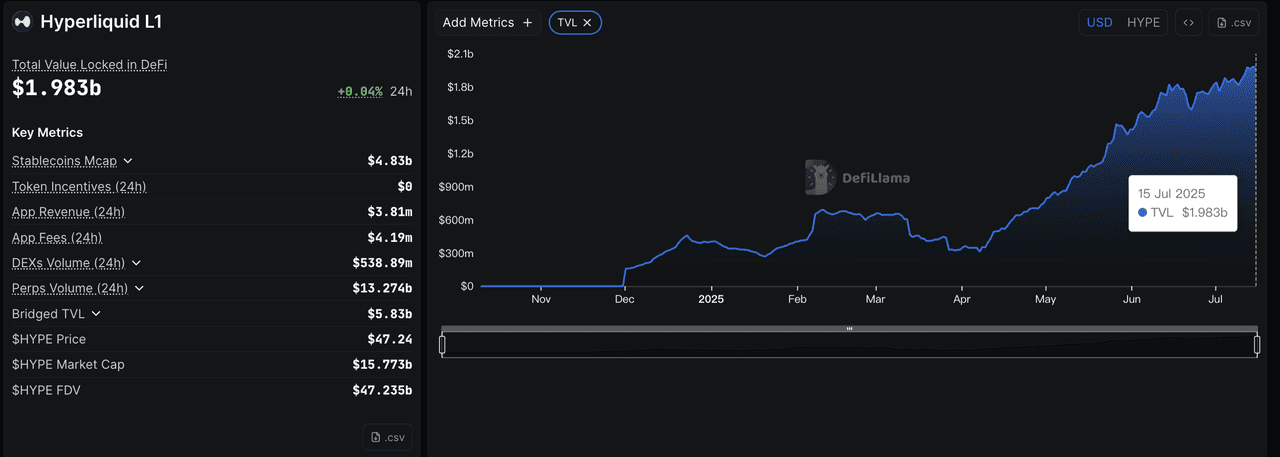

2. Layer 1 growth: HyperEVM, Hyperliquid’s custom Layer 1 chain, has reached nearly $2 billion in total value locked and now ranks among the top 10 blockchains. A growing user base and deeper on-chain activity increase the relevance of HYPE within the ecosystem.

Hyperliquid L1 TVL Reached Nearly $2B | Source: DefiLlama

3. Ecosystem expansion: Over 175 teams are building on HyperEVM as of July 2025. The recent CoreWriter upgrade has enabled tighter integration between DeFi apps and the trading engine, increasing utility for both developers and users. As more activity moves on-chain, HYPE plays a larger role in value flow.

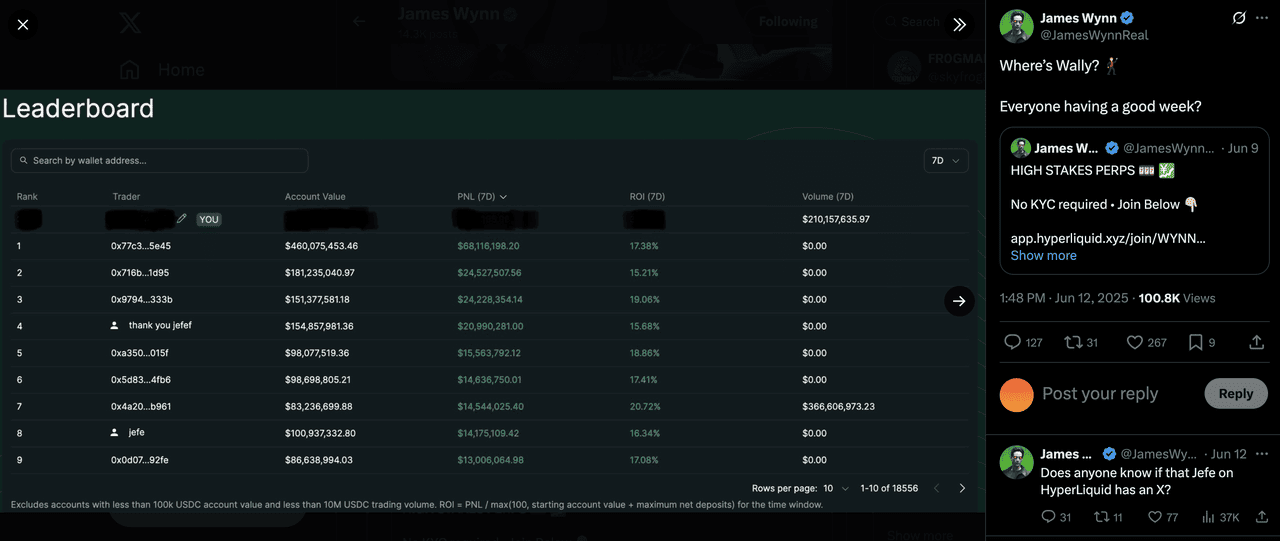

4. Whale visibility:

Crypto whales like James Wynn and Qwatio have helped bring public attention to the platform through high-profile leveraged trades. Their activity has drawn in new users and helped showcase the platform’s execution speed and scalability.

James Wynn High-Leveraged Trades on Hyperliquid Made the Platform Went Viral | Source: James Wynn X (Twitter)

5. Token buybacks strengthen price: Hyperliquid’s record-breaking $3.97 million HYPE token buyback in July 2025 reduced circulating supply and sent a strong signal of confidence to the market. This strategic move aligns with rising platform revenues and reinforces bullish sentiment around the token.

6. $HYPE Airdrop expectations: After a major airdrop in 2024, nearly 39% of the total supply remains reserved for future emissions. Continued speculation around a second airdrop is keeping engagement high and driving on-chain activity.

7. Market sentiment: Like most tokens, HYPE remains sensitive to broader market trends. Bitcoin’s recent

all-time high has improved overall crypto sentiment, which may continue to benefit tokens with strong fundamentals.

Hyperliquid’s protocol-level growth isn’t just good for the platform. It creates real demand drivers for HYPE, making it one of the few tokens in DeFi today whose price outlook is tied closely to actual usage.

Beyond an optimistic market sentiment, HYPE’s price momentum in 2025 is being driven by real activity on the Hyperliquid platform, where trading volume, user engagement, and developer traction are all picking up.

What Is the HYPE Price Prediction (2025)?

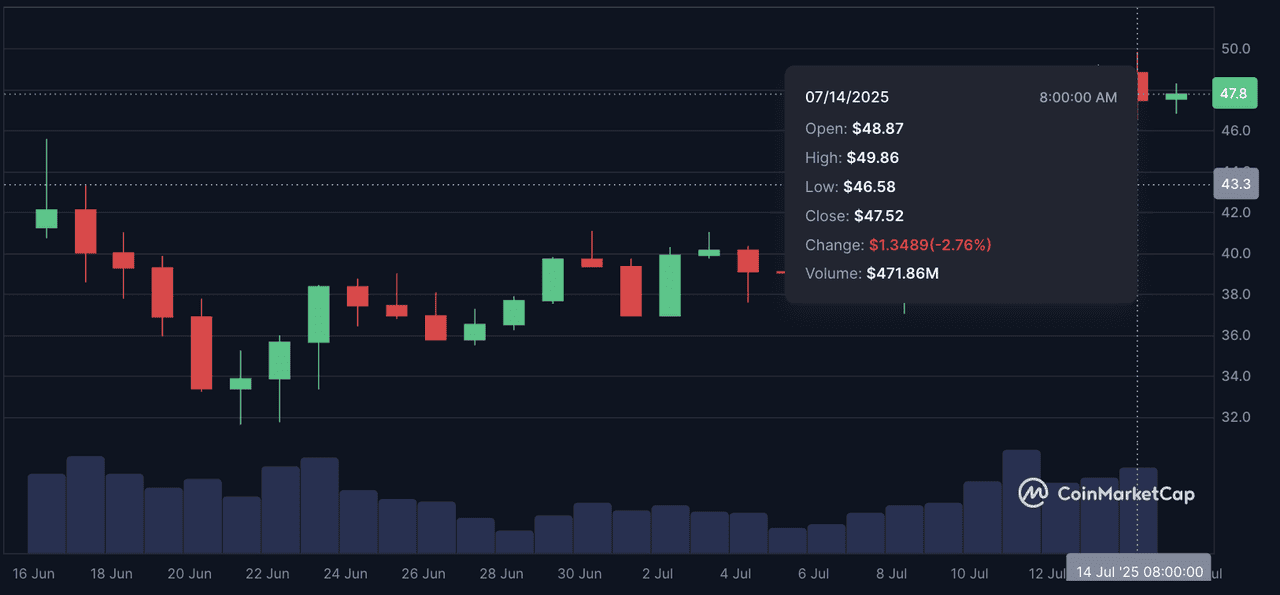

After hitting a record high of $49.75 on July 14, 2025, HYPE has stayed near its peak as market optimism continues. With strong fundamentals and growing interest in the broader crypto space, many are now asking how far HYPE could go by the end of the year.

Will HYPE Hit $50 in 2025?

HYPE’s all-time high of $49.75 came on July 14, the same day Bitcoin crossed $123,000. It was just 0.5% short of breaking the $50 mark.

Whether it gets there may depend on how strong the current

bull run becomes. Total crypto

market cap recently climbed past $3.2 trillion, and HYPE saw over $450 million in daily volume during its peak. With Hyperliquid generating $1.7 million in daily fees and 97% used for HYPE buybacks or redistribution, any uptick in trading could push it over the line.

If Bitcoin continues to lead and

altcoins follow, HYPE hitting $50 seems more like a matter of timing than possibility.

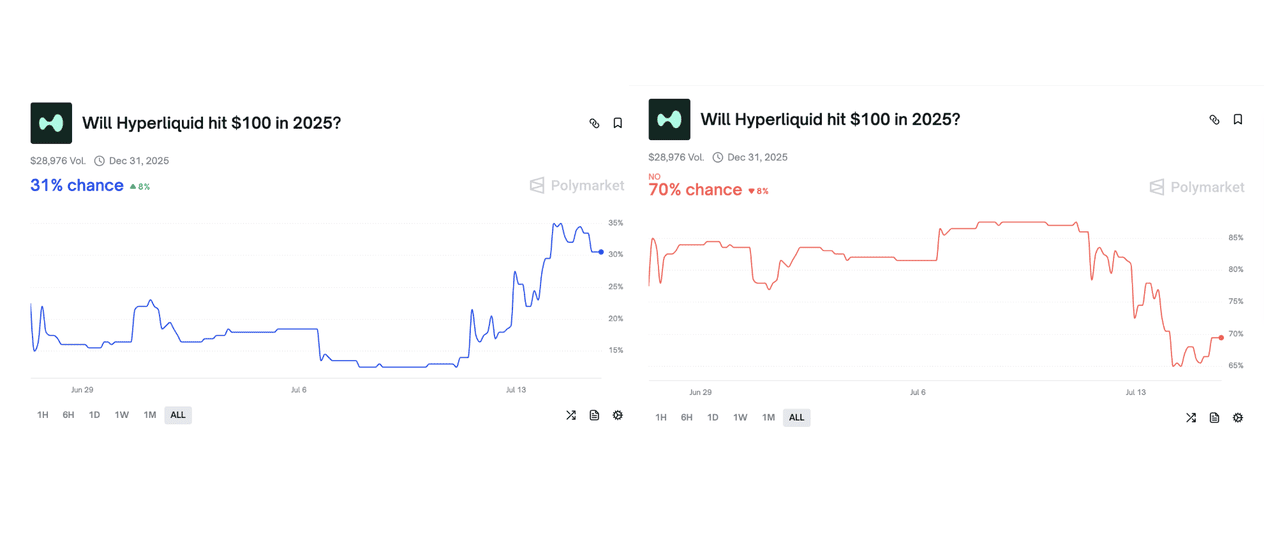

Will HYPE Hit $100 in 2025?

According to prediction market data from Polymarket, traders currently give HYPE a 31% chance of reaching $100 by December 31, 2025. This probability has climbed in recent days, reflecting increased optimism following the token’s strong July performance.

At the same time, the market still leans cautious, with a 69% chance priced on the "No" side. These forecasts help frame expectations around HYPE’s performance, highlighting both the excitement around its momentum and the perceived limits of its upside in the near term. Reaching $100 would likely require a combination of sustained DeFi expansion, strong token demand, and supportive market conditions through the second half of the year.

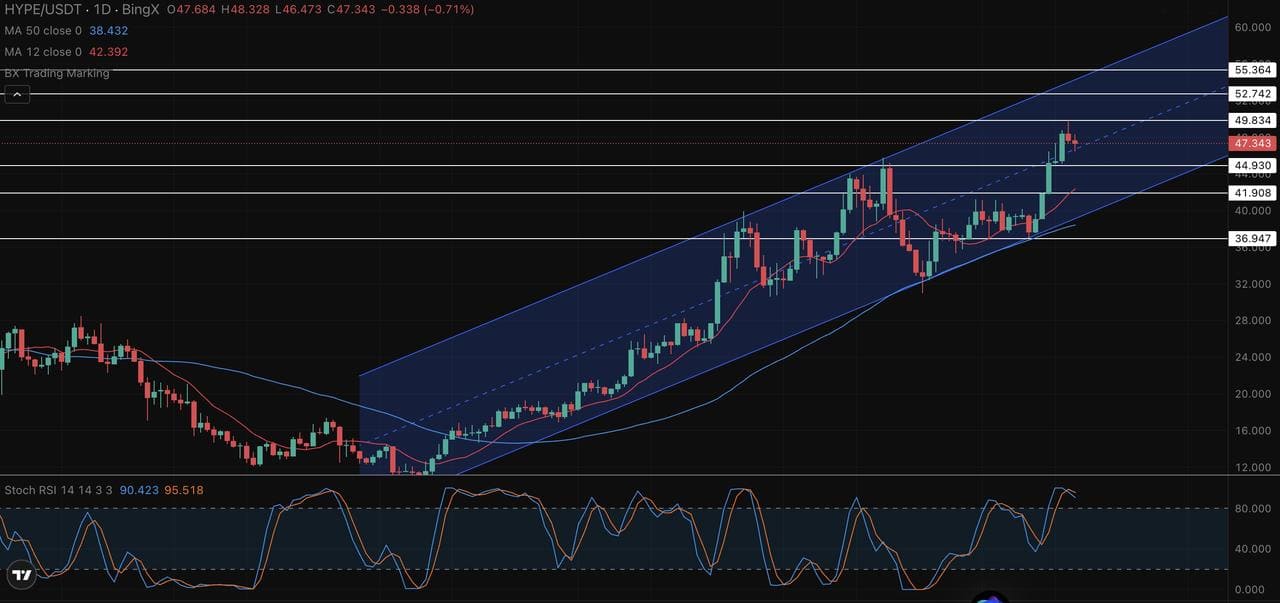

HYPE/USDT Technical Outlook: Channel Strength Holds, Momentum Faces Short-Term Test

HYPE/USDT continues to ride a well-structured ascending channel, a classic sign of a healthy uptrend characterized by consistent higher highs and higher lows. Price remains above both the 12-day and 50-day moving averages, currently at $42.38 and $38.43 respectively, suggesting medium- and long-term bullish momentum is intact.

These moving averages often act as dynamic support in trending markets and reinforce the underlying strength when they slope upward, as they do here.

Recent candles show strong bullish intent, with multiple higher closes and a clean breakout above horizontal resistance at $44.93.

The surge was accompanied by three consecutive green candles, an emerging “three white soldiers” pattern, which typically suggests sustained buying pressure and the potential for continued upside.

However, these signals often perform best when they appear after a downtrend or near

support zones. In this case, the pattern emerged mid-channel, so its strength may be more moderate.

On the momentum front, the Stochastic RSI has moved into overbought territory, printing 90.1 and 95.4. While this signals strong bullish momentum, it can also hint at near-term exhaustion. It’s important to remember that in strong uptrends,

RSI and Stoch RSI can stay overbought for extended periods, so overbought doesn't always mean a reversal is near.

The chart remains constructive, but traders should watch for signs of weakening momentum or bearish reversal candles like a spinning top or shooting star near resistance. Such patterns, especially at key levels like $49.83 or $52.74, may flag short-term pauses or consolidation.

Final Thoughts

HYPE’s performance in 2025 reflects more than just short-term hype. With a well-designed token model, consistent platform usage, and growing ecosystem momentum, its price action has remained closely tied to real on-chain activity. From outperforming Ethereum and Solana in daily revenue to sitting just below the $50 mark at its recent peak, HYPE has shown both resilience and relevance in the current market cycle.

That said, the path forward depends on multiple factors such as sustained protocol growth, broader market conditions, and how the team handles future token emissions. While the $100 milestone remains uncertain, the near-term outlook is supported by strong fundamentals, active user participation, and rising trader interest.

Whether HYPE continues higher or enters a consolidation phase, it has already positioned itself as one of the more credible DeFi tokens of 2025 and one worth watching as the cycle unfolds.

Related Reading