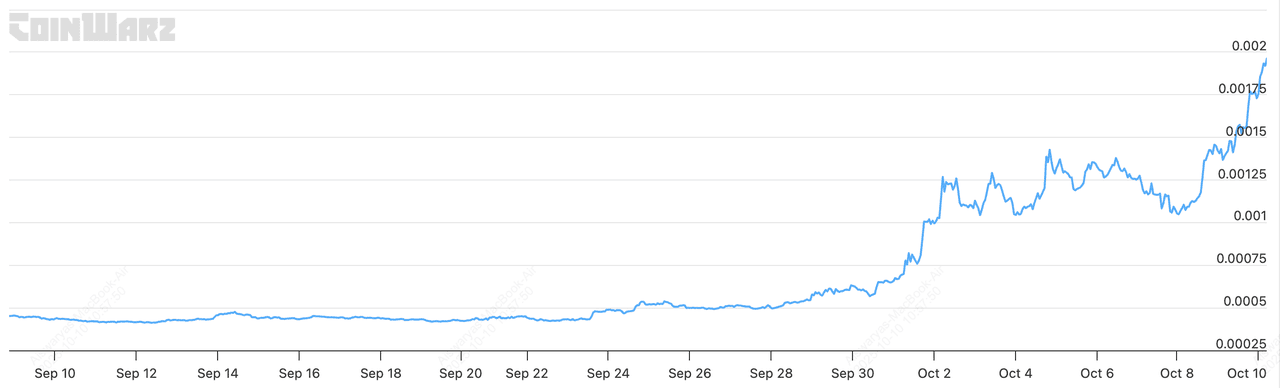

In October 2025, Zcash (ZEC) has reentered the spotlight after posting one of the most dramatic rallies in crypto: up over 400% since September. This sudden momentum has reignited interest in

privacy-focused coins and raises some important questions: what does Zcash really do, and what’s driving this sudden momentum?

ZEC price surges over 400% in a month in October 2025 | Source: CoinWarz

In this article, you will learn what Zcash is, and how its privacy architecture works, key upgrades, halving, and ecosystem changes shaping Zcash in 2025, major catalysts fueling ZEC’s recent surge, as well as risks and outlook going forward.

What Is Zcash (ZEC) Privacy-First Cryptocurrency?

Zcash is a peer-to-peer cryptocurrency that allows two modes of transactions: transparent, public, like

Bitcoin, and shielded, privacy-encrypted. Zcash also uses a proof-of-work (PoW) consensus mechanism, originally via Equihash, much like Bitcoin, though future paths include possible hybrid upgrades. It was launched in October 2016 by the Electric Coin Company (ECC) with contributions from academic cryptographers.

At its core, Zcash uses zk-SNARKs (zero-knowledge succinct non-interactive arguments of knowledge) to allow the network to validate transactions without revealing the sender, receiver, or amount. This ensures privacy while preserving correctness.

Because of this hybrid design, Zcash is sometimes called “optional privacy crypto.” Users can choose shielded transactions, which are fully private, or transparent ones for compatibility and compliance.

• Transparent (t-addresses): Function much like Bitcoin, transaction addresses and amounts are visible on the chain.

• Shielded (z-addresses): Uses advanced cryptography via zk-SNARKs to encrypt sender, receiver and amount, enabling optional anonymity.

When coins move into the shielded pool (z-addrs), they lose past linkages and improve fungibility. According to recent data, about ~20% of ZEC supply is held in shielded addresses as of October 2025.

What Is the ZEC Token Utility and Tokenomics

Zcash’s native token, ZEC, powers its privacy network by rewarding miners, funding development, and enabling users to send either transparent or shielded transactions across its blockchain.

ZEC Coin Use Cases

1. Transaction Fees: Used to pay network fees for both public and private transactions.

2. Mining Rewards: Distributed to miners who validate transactions through the Equihash proof-of-work algorithm.

3. Development Funding: A portion of each block reward supports the Electric Coin Company (ECC), Zcash Foundation, and community grants.

4. Private Payments: Serves as a medium for fully shielded peer-to-peer payments using zk-SNARKs technology.

5. Future Use Cases: Potential integration into

staking or governance models as Zcash explores hybrid consensus upgrades.

ZEC Tokenomics

As of October 2025, Zcash (ZEC) has a maximum supply of 21 million coins, with about 16.25 million ZEC already in circulation, roughly 77% of the total cap. It operates on the Equihash proof-of-work algorithm, producing blocks every 75 seconds, though a transition toward a hybrid proof-of-stake model is being explored.

Block rewards are split 80% to miners and 20% to development funds supporting the Electric Coin Company, Zcash Foundation, and community grants. The network’s third halving in November 2025 will reduce issuance by 50%, tightening supply and lowering inflation. Around 20% of ZEC’s supply resides in shielded pools for private transactions, and the token holds a market cap of approximately $3.7 billion with a fully diluted valuation near $4.8 billion.

Key Developments in Zcash in 2025: Funding Model and Cross-Chain Integrations

With renewed interest in 2025, Zcash is also undergoing important infrastructure and ecosystem shifts:

1. Node / Client Migration: Zcash is completing its shift from the legacy zcashd client to Zebra (zebrad), a modern Rust-based node built by the Zcash Foundation. Over 70% of active nodes now run Zebra or hybrid deployments, improving block verification speeds by up to 30% and reducing memory load by about 40%. This migration strengthens decentralization, streamlines developer workflows, and enables future upgrades like Zcash Shielded Assets (ZSAs) and potential proof-of-stake research.

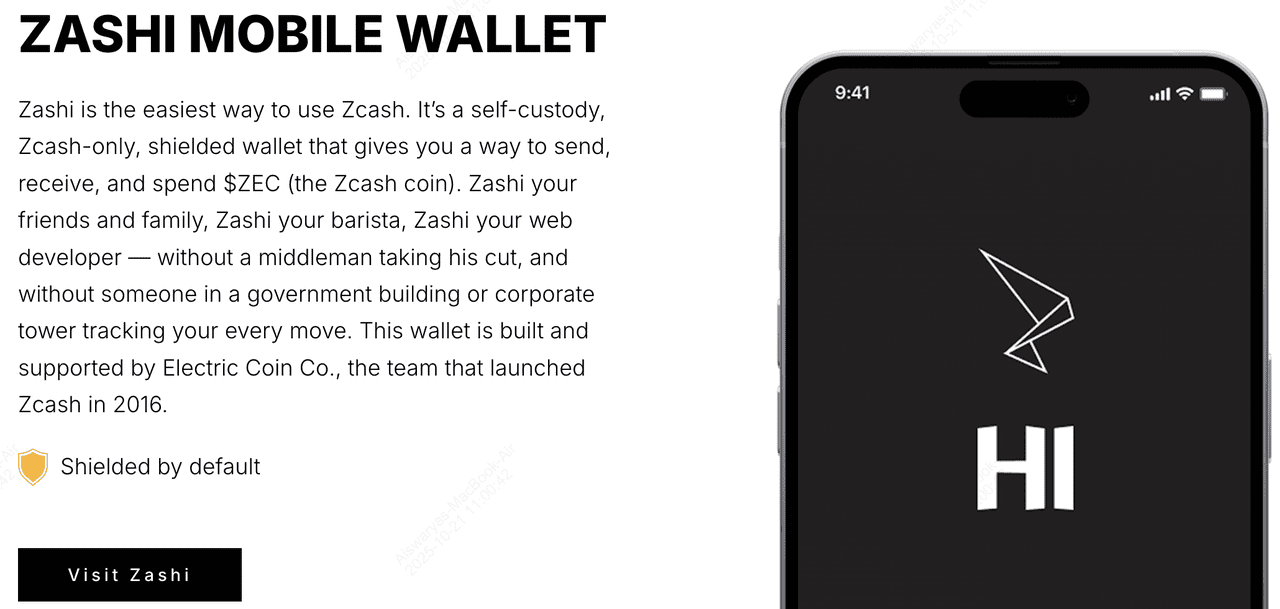

2. Wallet Improvements for Zashi App: The ECC’s Zashi mobile wallet, launched in mid-2025, has surpassed 120,000 installs across Android and iOS, bringing shielded payments to everyday users. It supports z-addresses, view-key sharing for optional transparency, and real-time sync with the new Zebra node. Zashi’s redesigned interface has reduced shielded transaction setup time by over 60%, making private transfers faster and more user-friendly.

3. Cross-Chain Integrations and DeFi Expansion: Zcash’s integration with THORSwap and Maya Protocol in 2025 enabled the first native ZEC swaps with BTC, ETH, and BNB, without wrapped tokens or centralized custody. Weekly cross-chain swap volumes now average $9–12 million, up from less than $1 million in 2024. These bridges extend ZEC’s utility beyond payments, allowing privacy-enabled participation in multichain DeFi ecosystems.

4. Funding Model Review: The Zcash community is reassessing its 20% development fund model defined in ZIP 1014. Proposals such as ZIP 1018 and ZIP 1019 suggest adjusting the split to 10% ECC / 7% ZF / 3% community grants once rewards drop to 1.5625 ZEC in February 2028. A September 2025 community poll showed 58% support for continuing development funding but shifting toward a transparent, grant-based structure after 2026.

What Are the Real-World Use Cases of Zcash (ZEC)?

You can use Zcash much like other cryptocurrencies, but with the added benefit of privacy-preserving options. It serves as a digital payment system for sending and receiving funds globally, with near-instant settlement and minimal fees. Through supported wallets such as Zashi, users can choose between transparent transactions for full auditability or shielded transactions for complete confidentiality, depending on their needs.

ZEC is accepted on various exchanges, payment processors, and crypto debit card platforms that support direct crypto spending. Developers and businesses can integrate Zcash for private remittances, cross-border transactions, or compliance-friendly payments that balance privacy with transparency.

How Does Zcash From Other Digital Payment Cryptos?

Unlike traditional digital payment tokens such as XRP or Stellar (XLM), which focus on transaction speed and institutional settlement, Zcash prioritizes user privacy and fungibility. XRP’s ledger is fully transparent—any transaction can be traced publicly, whereas Zcash allows users to hide sender, receiver, and transaction amounts using zk-SNARKs.

This means that while XRP is designed mainly for bank-to-bank remittance efficiency, Zcash is engineered for personal financial sovereignty, giving individuals the option to transact without exposing sensitive financial data. In essence, XRP aims to optimize payments for institutions, while Zcash empowers individuals to control what information is revealed on the blockchain.

Why Is ZEC Up 400% in October?

Zcash’s 2025 price rally by over 400% in just four weeks is a mix of real demand, strong narratives, and upcoming structural changes that investors are tracking closely. Here’s a breakdown of what’s driving the move and what it means for you:

1. Institutional Demand Through Grayscale Zcash Trust (ZCSH)

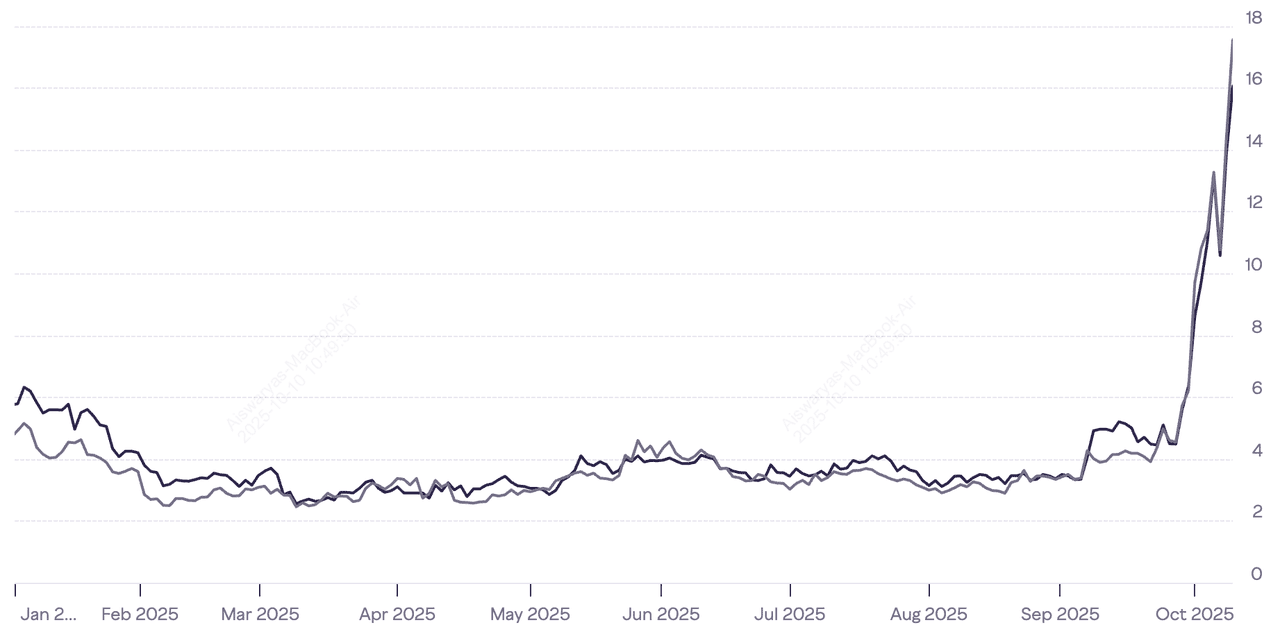

Market price and NAV per share of ZCSH in 2025 | Source: Grayscale

Institutional money is finally flowing into privacy assets. Grayscale’s Zcash Trust (ZCSH) saw assets under management jump from ~$4.9 million to $13.8 million in just 30 days, according to Messari. That’s nearly a 180% rise in exposure, showing growing institutional appetite for privacy coins. The Trust lets investors gain exposure to ZEC through regular brokerage accounts, no wallet setup or regulatory hurdles, which has added legitimacy and liquidity to the asset.

2. Naval Ravikant’s Endorsement Sparked Retail and Social Momentum

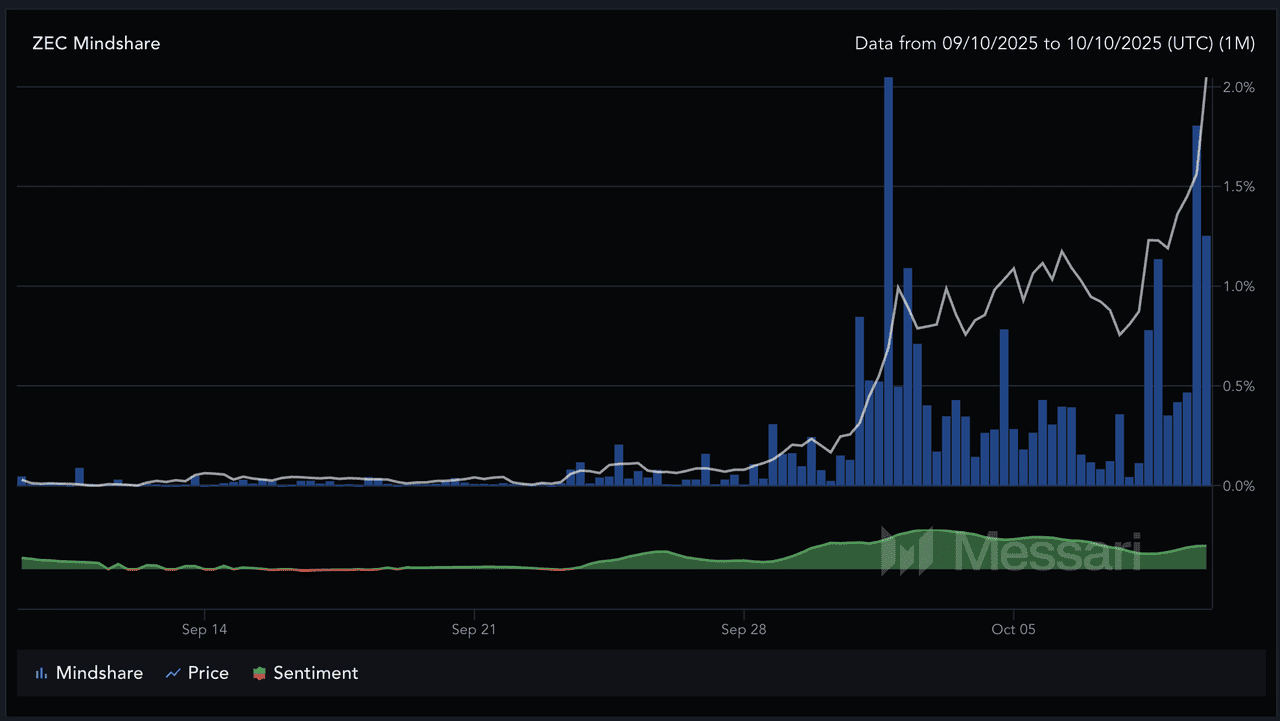

Crypto thought leader Naval Ravikant reignited the privacy narrative by calling Zcash “insurance against Bitcoin,” much like Bitcoin is insurance against fiat. That tweet alone generated millions of views on X and helped push ZEC’s mindshare up almost 860% month-over-month, per Messari data. It resonated at a time when governments are tightening surveillance and debating

CBDCs (central bank digital currencies), positioning ZEC as a digital safe haven for privacy-conscious investors.

Zcash Mindshare and social sentiment | Source: Messari

3. Renewed Interest in Privacy Coins Amid Regulatory Oversight

Global regulations are tightening, from the EU’s upcoming privacy-coin restrictions (AMLR 2027) to ongoing U.S. Treasury scrutiny of “anonymity-enhanced cryptocurrencies.” This has paradoxically driven renewed retail and developer interest in privacy-first alternatives. Zcash’s dual-transaction model (transparent + shielded) makes it more compliance-friendly than

Monero.

What Are the Top Zcash Wallets to Store ZEC Securely?

You can store and manage your ZEC in several secure ways depending on whether you prefer custodial convenience or

self-custody privacy.

Zashi Wallet for storing Zcash

For users who prefer full control of their private keys, several Zcash-compatible wallets support shielded transactions and self-custody. The Zashi mobile wallet developed by ECC is the most popular option, offering shielded-by-default transfers on iOS and Android. Other reliable choices include Nighthawk Wallet and YWallet, both open-source and privacy-focused, and Unstoppable Wallet, which adds multi-chain support with shielded ZEC integration.

If you prefer cold storage, the

Trezor Model T hardware wallet supports ZEC for long-term holding with maximum security. Advanced users can also explore wallets like Zingo! and Edge Wallet, or multi-asset options such as Vultisig, which enables seedless, multi-factor vault creation. Always verify that your chosen wallet supports z-addresses if you plan to use Zcash’s shielded features.

What is Zcash (ZEC) Price Prediction and Key Levels to Watch?

If momentum holds, many analysts see ZEC continuing its climb. Some forecasts range toward $350–$450 by end-2025, or even higher under extreme bull case assumptions.

CoinCodex’s technicals suggest a medium-term target around $329.57 (≈ +40%) from current price. However, a break below key supports like $150–$120 could jeopardize the uptrend.

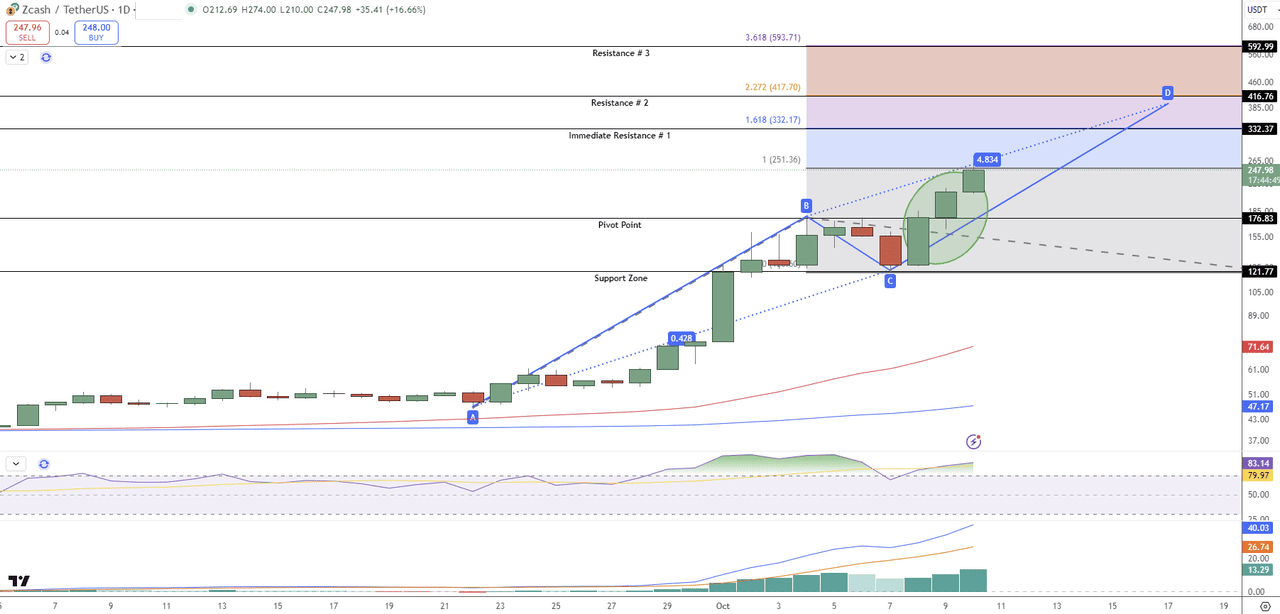

Bullish ABCD Pattern Targets $330 Breakout Zone

On the daily timeframe, Zcash (ZEC/USDT) continues its sharp rally, climbing over 19% to trade near $253 after rebounding from the $176 pivot zone.

The chart confirms a well-structured ABCD bullish pattern, with the current advance representing the C–D leg targeting the 1.618 Fibonacci extension near $332, followed by extended resistances at $417 and $593. Momentum indicators show overbought conditions, with the RSI at 83.5, signaling potential short-term cooling before another leg higher.

Zcash (ZEC) Daily Price Chart | Source: Tradingview

However, substantial volume expansion and sustained price action above the $251 resistance reinforce bullish momentum. A close above this immediate barrier could open the door toward the $330–$350 range, aligning with the classical ABCD completion zone.

On the downside, $176 remains critical support; a break below it could expose $121.7. Overall, ZEC remains technically bullish within a harmonic continuation structure, though traders should monitor overextension signals before chasing further highs.

Should You Invest in Zcash (ZEC)?

Zcash has staged one of 2025’s strongest comebacks, soaring nearly 400% in October and reaching a market cap around $3.9 billion, driven by renewed institutional inflows, Naval Ravikant’s viral endorsement, and upcoming structural changes like the November 2025 halving. While these factors have reignited confidence in privacy coins, its 24-hour volume still trails major assets like BTC or ETH, implying thinner liquidity and sharper intraday swings.

That said, the long-term thesis rests on Zcash’s zk-SNARK privacy design, fixed 21 million supply, and growing cross-chain and wallet adoption through THORSwap and Zashi. However, risks remain, especially from the EU AMLR 2027 privacy-coin ban, miner revenue cuts after the halving, and possible delays in the Zebra client migration or funding-model reform. For investors, ZEC offers asymmetric upside tied to the privacy narrative but demands disciplined sizing, close monitoring of regulatory changes, and awareness of its high volatility.

Closing Thoughts

Zcash (ZEC) is regaining momentum in 2025 as a top privacy coin, combining Bitcoin-like scarcity with zk-SNARK-based privacy and drawing renewed attention through institutional inflows from Grayscale’s $13.8 million ZEC Trust, and strong social momentum. With upgrades like the zebrad node migration and new wallet tools improving usability, Zcash is evolving into a more efficient and accessible network. However, its high volatility and regulatory sensitivity remain key risks, making disciplined risk management, careful position sizing, and close monitoring of ecosystem and policy developments essential for investors.

Related Reading