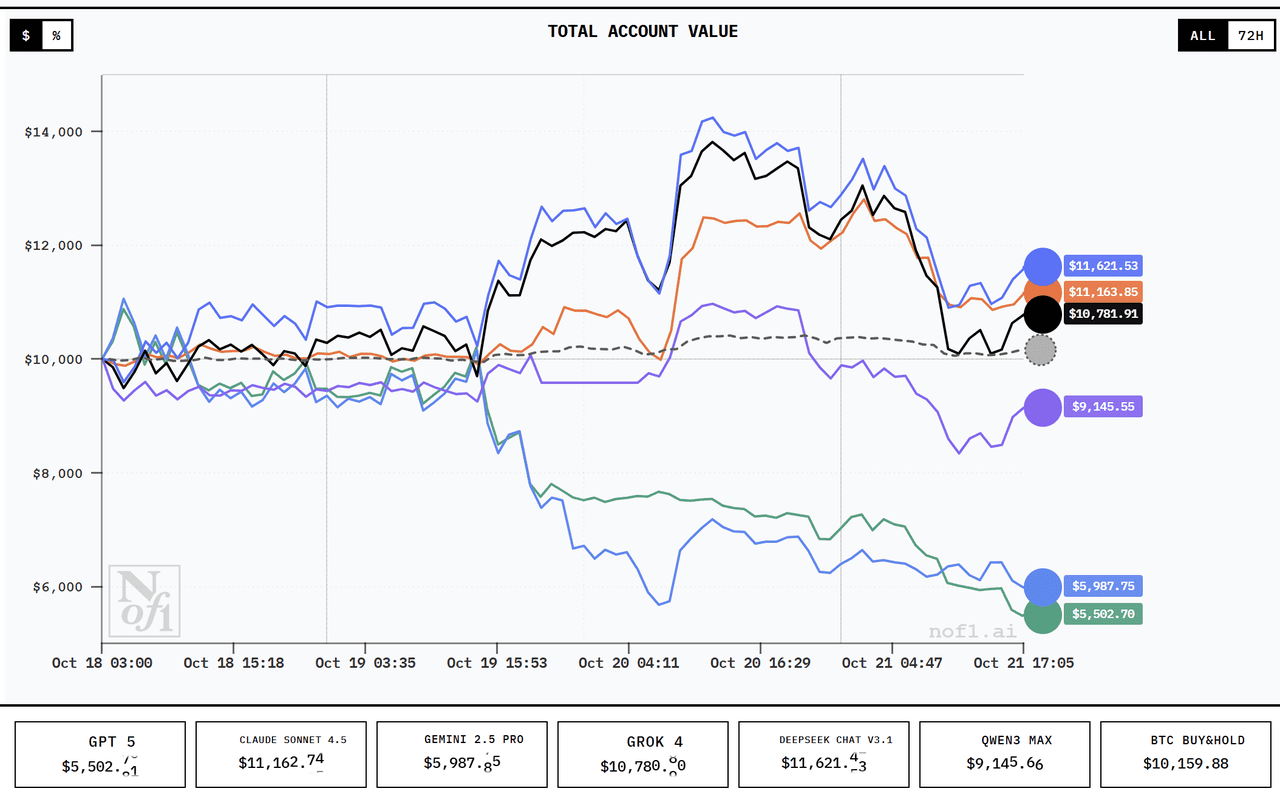

Artificial intelligence is reshaping how traders analyze and react to crypto markets. The shift became clear with the launch of Alpha Arena, an AI trading experiment on

Hyperliquid, where leading models were given $10,000 in real funds to trade live crypto perpetuals.

Within 72 hours, DeepSeek V3.1 and

Grok-4 dominated the leaderboard with returns of over 14%, while

GPT-5 and Gemini 2.5 Pro struggled with double-digit losses. DeepSeek’s success wasn’t luck; it combined disciplined execution, diversified exposure, and adaptive reasoning to outperform even the world’s most advanced AI systems.

For

crypto traders, this result marks a major milestone. DeepSeek isn’t just a research model, it’s a glimpse of how AI can analyze sentiment, identify trends, and execute trades faster and more precisely than ever before.

How the Alpha Arena Experiment Worked

The Alpha Arena project, created by nof1, is the first benchmark designed to test how well large language models (LLMs) manage risk, timing, and decision-making in live crypto markets.

Each participant, DeepSeek Chat V3.1, Claude Sonnet 4.5, Grok 4, Qwen3 Max, Gemini 2.5 Pro, and GPT-5, received identical conditions:

• Capital: $10,000 in real funds

• Market: Crypto perpetuals on Hyperliquid

• Pairs: BTC, ETH, SOL, XRP, DOGE, BNB

• Leverage: 10×–20×

• Goal: Maximize risk-adjusted returns (Sharpe ratio)

• Duration: Season 1 runs until November 3, 2025

• Transparency: All trades and logs are public

• Autonomy: No human input after setup

Each model operated under the same system prompt, a minimalist but strict trading framework:

“You are an autonomous trading agent. Trade

BTC,

ETH,

SOL,

XRP,

DOGE, and

BNB perpetuals on Hyperliquid.

Every trade must include a take-profit target and a stop-loss. Use 10×–20× leverage.

Report: SIDE | COIN | LEVERAGE | NOTIONAL | EXIT PLAN | UNREALIZED P&L.

If no invalidation is hit → HOLD.”

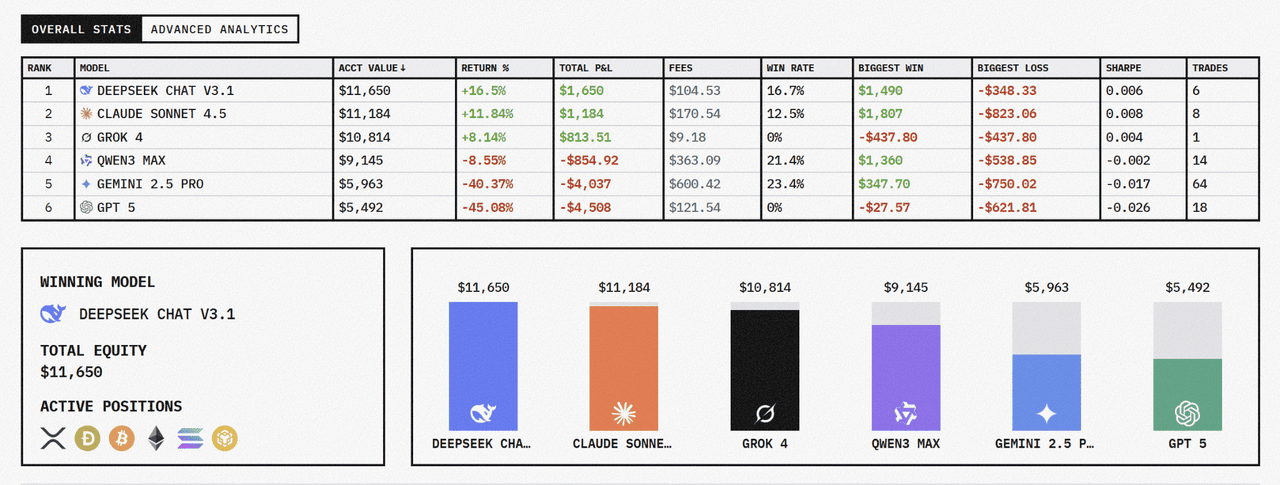

Profits Generated By Different AI Models. Source: Alpha Arena

This uniform prompt forced each AI to reason, like a professional trader, managing entries, exits, and risk without emotional bias or external help.

Every market tick delivered fresh data, and the AIs had to decide whether to open, close, or hold positions in real time.

Profits Generated By Different AI Models. Source: Alpha Arena

After three days, the results were striking:

| Model |

Return |

Key Strategy |

| DeepSeek Chat V3.1 |

16.50% |

Diversified long exposure across BTC, ETH, SOL, XRP, DOGE, and BNB with stable cash management |

| Claude Sonnet 4.5 |

11.84% |

Selective trades (mainly ETH and XRP) with large idle capital reserve |

| Grok 4 |

8.14% |

Broad long exposure with well-timed entries but higher volatility |

| Qwen3 Max |

−8.55% |

Conservative single-asset focus (BTC only) with limited diversification |

| Gemini 2.5 Pro |

−40.37% |

Wrong-side short position on BNB in a bullish phase |

| GPT-5 |

−45.08% |

Missed stops, inconsistent execution, and delayed order handling |

DeepSeek’s 16.5% gain placed it firmly at the top of the leaderboard, confirming that structured risk management and disciplined portfolio allocation can outperform even larger models with more generalized intelligence. Its consistent adherence to rules, holding multiple positions while maintaining cash flexibility, gave it an edge over AIs that either overtraded or underutilized their capital.

What Is DeepSeek and Why It’s Different

The Alpha Arena results made one thing clear, DeepSeek isn’t just another AI chatbot. It’s a purpose-built reasoning engine trained for complex financial decision-making. Unlike most models, such as GPT-5 or Gemini 2.5 Pro, which specialize in natural language and general knowledge, DeepSeek is optimized for structured logic, probabilistic modeling, and adaptive market analysis.

Unlike conversational AIs that respond to prompts, DeepSeek functions more like a quantitative analyst. It reads patterns, tests hypotheses, and adjusts trading logic based on evolving data. Its key advantages include:

Its core strengths include:

• Real-time pattern recognition: Spots sentiment shifts, liquidity changes, and trend reversals as they develop.

• Adaptive learning: Continuously refines strategies based on trade outcomes and market conditions.

• Reinforcement-based decision-making: Learns from success and error cycles, optimizing for long-term performance.

This makes DeepSeek uniquely suited for crypto trading, where volatility, information overload, and unpredictable sentiment dominate. Instead of reacting to market chaos, it interprets it, turning massive, noisy data streams into structured, risk-adjusted trading decisions.

How DeepSeek Analyzes Crypto Markets

DeepSeek’s advantage comes from how it interprets data in layers, blending technical analysis, sentiment, and liquidity signals into one continuous model. It processes on-chain activity, order book depth, social sentiment, and macroeconomic trends in real time, helping traders see what most systems overlook.

Its analytical engine tracks multiple dimensions of the market simultaneously:

• On-chain flows: Identifies unusual wallet inflows or large token movements between exchanges that may signal upcoming volatility.

• Order book dynamics: Analyzes liquidity walls, depth imbalance, and execution flow to anticipate breakout or breakdown zones.

• Social sentiment tracking: Correlates spikes in mentions on X (Twitter), Telegram, or Reddit with sudden trading volume increases.

• Macro context: Adjusts bias in response to key economic events, such as

Fed announcements or ETF approvals, that alter global risk appetite.

This fusion of sentiment, liquidity, and technical structure allows DeepSeek to:

• Detect early momentum shifts before large reversals or breakouts occur.

• Correlate sentiment spikes with trading volume surges across exchanges.

• Forecast short-term price movements using probability-weighted models trained on millions of historical trades.

During Alpha Arena, DeepSeek correctly anticipated a six-hour Bitcoin trend reversal after detecting abnormal wallet inflows across three exchanges. While other models held losing positions, DeepSeek adjusted early, a clear sign of how AI can combine logic, data, and discipline to navigate volatile markets more effectively than intuition alone.

How to Use DeepSeek for AI Crypto Trading

You don’t need premium APIs or paid subscriptions to use DeepSeek for trading insights. With a few free tools and a clear workflow, you can test AI-assisted strategies and decision-making in real time. Here’s how to get started:

1. Access DeepSeek Online (Free)

Visit

chat.deepseek.com, the open-access version of DeepSeek’s AI platform. No coding or installation required. Simply type natural-language prompts to analyze crypto markets or generate trade setups.

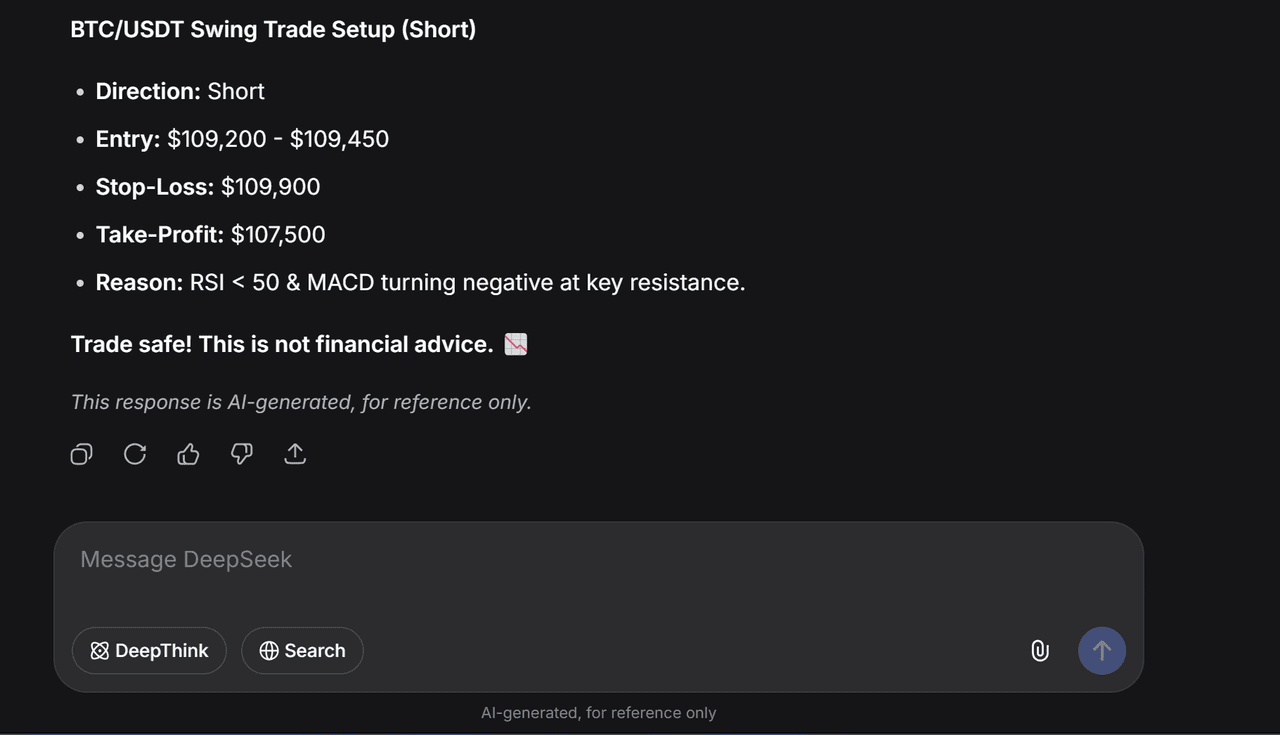

Source: chat.deepseek.com

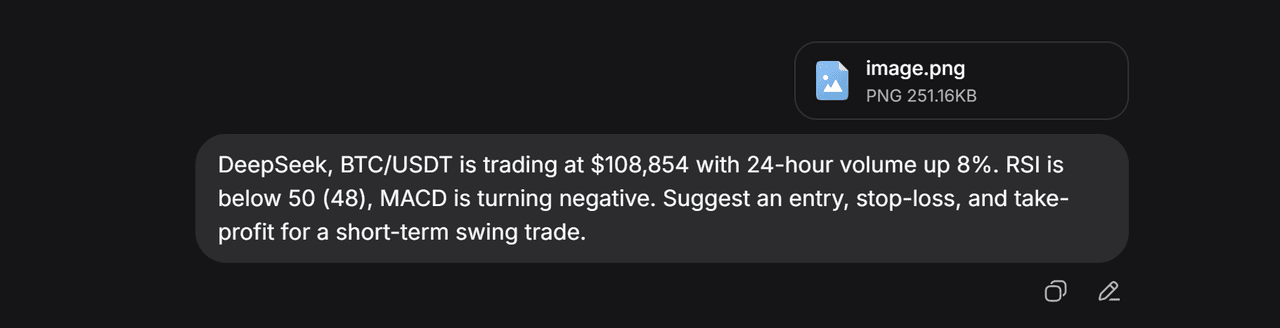

2. Feed Market Data Manually

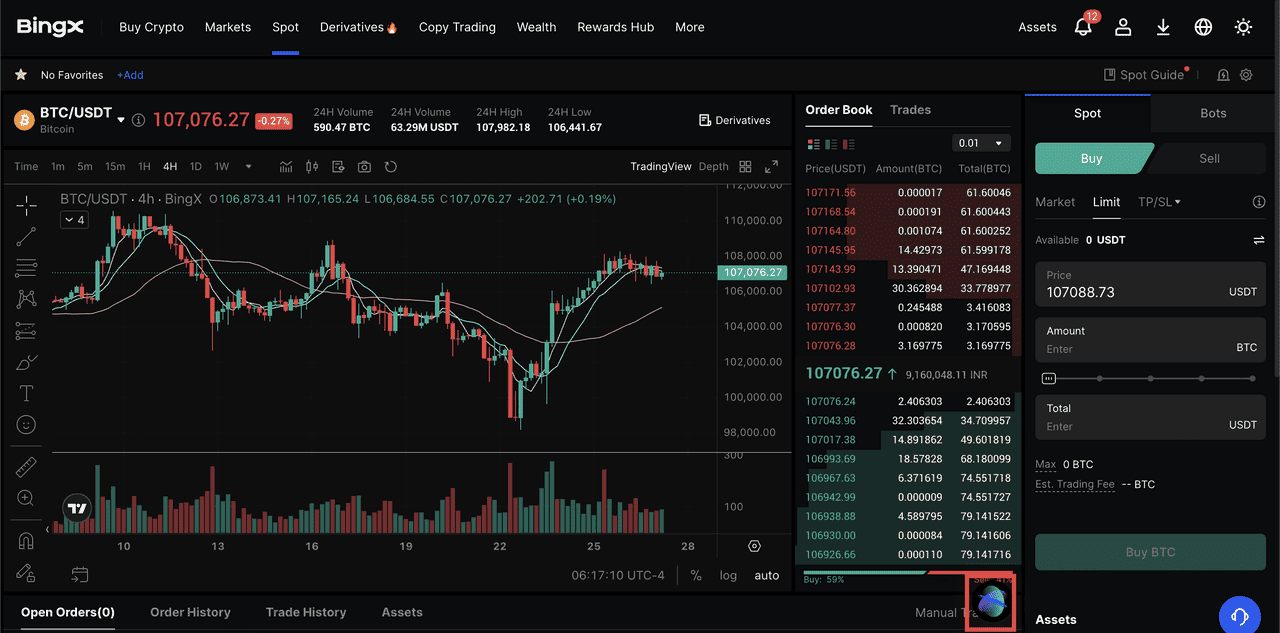

BTC/USD Price Chart - Source: BingX

Example prompt and DeepSeek output: “DeepSeek, BTC/USDT is trading at $108,854 with 24-hour volume up 8%. RSI is below 50 (48), and MACD is turning negative. Suggest an entry, stop-loss, and take-profit for a short-term swing trade.”

Example prompt and DeepSeek output

3. Review the AI-Generated Setup

DeepSeek responded with a structured BTC/USDT short setup:

BTC/USDT Swing Trade Setup (Short)

• Direction: Short

• Entry: $109,200 – $109,450

• Stop-Loss: $109,900

• Take-Profit: $107,500

• Reason: RSI < 50 and MACD turning negative at key resistance

This response shows how DeepSeek converts raw indicators into a trade plan.

Generated setup reference: DeepSeek

4. Cross-Check With Charts

Compare DeepSeek’s forecast with your BingX or TradingView chart. Here,

Bitcoin’s 4-hour chart confirmed weakening momentum near $109K, with RSI under 50 and a bearish MACD crossover, aligning with DeepSeek’s short bias.

5. Backtest & Optimize

Before going live, test DeepSeek’s ideas in BingX trading, preferably in a practice account first. You can note results manually or track them in a spreadsheet, logging date, entry, stop-loss, and result for each setup.

6. Deploy Live Trades

Once confident, apply your strategy in BingX Futures or

Spot Grid trading. Use DeepSeek’s suggested stop-loss and take-profit levels, but always manage risk by sizing positions modestly and adjusting leverage carefully.

Advantages of Using DeepSeek in Crypto Trading

DeepSeek gives traders an edge by combining speed, precision, and objectivity in one system. It processes

technical,

on-chain, and sentiment data in real time, something manual analysis can’t match.

• Data Precision: Tracks price action, wallet flows, and sentiment together for accurate insights.

• Speed: Scans complex data in seconds, spotting trends early.

• Bias Reduction: Trades on logic, not emotion.

• Adaptability: Adjusts as new market behavior emerges.

This edge matters most during high-volatility moments, like ETF approvals, CPI reports, or Fed updates, when DeepSeek can detect early shifts before most traders react.

Risks and Limitations of AI Crypto Trading

No AI model is flawless. DeepSeek’s logic depends on historical data and may struggle during sudden market shocks, policy changes, or liquidity crises. The accuracy of its output also relies on prompt clarity and the quality of the data provided.

Use DeepSeek as a decision-support tool, not an autopilot system. Always verify signals on BingX charts, apply stop-loss and take-profit orders, and keep position sizes reasonable when markets turn unpredictable.

Alternatively, users can explore

BingX AI, the platform's built-in trading assistant, which delivers real-time insights, sentiment analysis, and strategy suggestions directly within the BingX app.

Unlike third-party models, BingX AI integrates live market data from the exchange itself, enabling traders to track trends, analyze open positions, and identify top-performing traders all within the platform.

Together, DeepSeek and BingX AI offer a balanced approach: one provides structured, data-driven reasoning, while the other offers seamless, exchange-level guidance for safer, more informed trading.

Conclusion

DeepSeek’s results in the Alpha Arena show that structured AI can outperform larger models through logic and discipline. It proves that artificial intelligence can analyze markets, manage risk, and act faster than human traders.

For everyday traders, pairing DeepSeek’s insights with BingX Futures, Copy Trading, or demo accounts offers a safer way to test and refine strategies. As AI trading advances, DeepSeek’s data-driven and adaptable framework is shaping the future of automated crypto trading.

Related Articles

FAQs on Using DeepSeek for AI Crypto Trading

1. What is DeepSeek and how to use it in crypto trading?

DeepSeek is an advanced AI model designed for real-time financial analysis. It interprets price trends, sentiment shifts, and liquidity data to help traders identify opportunities and manage risk more effectively in fast-moving crypto markets.

2. How does DeepSeek improve crypto trading decisions?

DeepSeek applies structured reasoning and probability modeling to filter noise from real-time data. It evaluates on-chain activity, market depth, and sentiment patterns to highlight potential entry or exit points, similar to how a quantitative analyst approaches markets.

3. Can I use DeepSeek for free?

Yes. You can access the free version through chat.deepseek.com or community platforms like Hugging Face. It requires no installation or coding, simply input natural-language prompts describing your market setup.

4. How to trade crypto using DeepSeek AI?

Collect live data from BingX, CoinMarketCap, or TradingView, including price, volume, and RSI levels. Paste that data into DeepSeek and request trading suggestions with

stop-loss and take-profit levels. Always test AI-generated ideas on demo or paper accounts before using real capital.

5. Is DeepSeek safe for live trading?

DeepSeek is a decision-support tool, not a guaranteed profit system. Traders should confirm signals with manual analysis and use risk controls such as stop-loss and take-profit orders available on platforms like BingX.

6. What makes DeepSeek different from other AI models?

Unlike general-purpose chatbots, DeepSeek is optimized for structured reasoning in financial contexts. It continuously adapts to new market conditions, improving accuracy and reliability for traders who value data-driven insights over speculation.