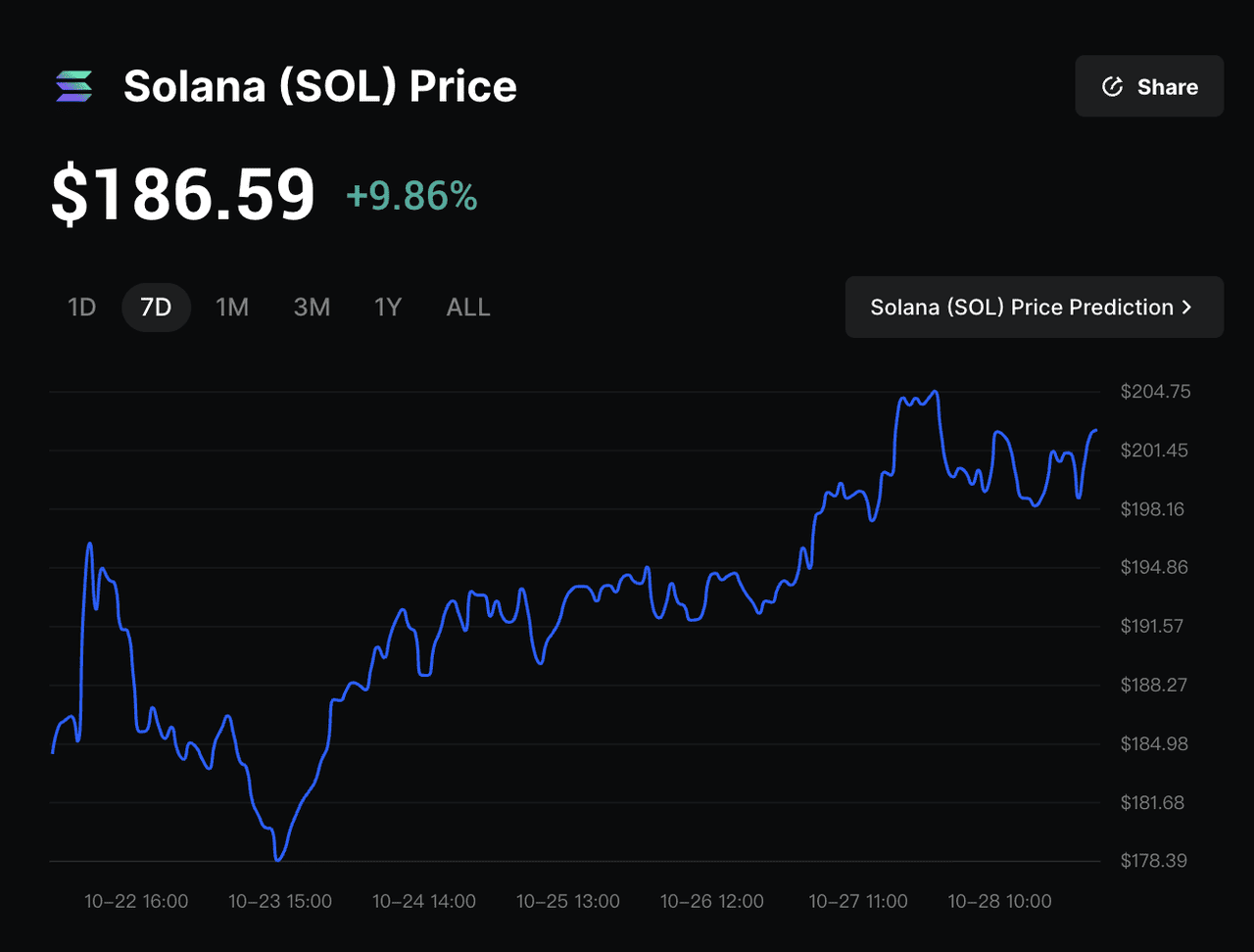

The NYSE listing of Bitwise’s Solana ETF (BSOL) on October 28, 2025 marks a major milestone for the crypto market. Joining it are Grayscale’s Solana ETF (GSOL), converting from its trust later this week, and Canary Capital’s new spot

Litecoin (LTC) and

Hedera (HBAR) ETFs, signaling the next wave of regulated altcoin investment products in the United States.

A Solana ETF tracks the price of

Solana (SOL), giving investors exposure to the cryptocurrency without directly holding it. Following the SEC’s approval of

spot Bitcoin and

Ethereum ETFs in 2024, Solana becomes the 3rd cryptocurrency to have a U.S.-listed spot ETF, further bridging traditional finance and the blockchain market.

While two Solana ETFs debut this week, others from Fidelity, Franklin Templeton and VanEck remain under SEC review, reflecting growing institutional demand for regulated altcoin exposure.

What Is Solana (SOL)?

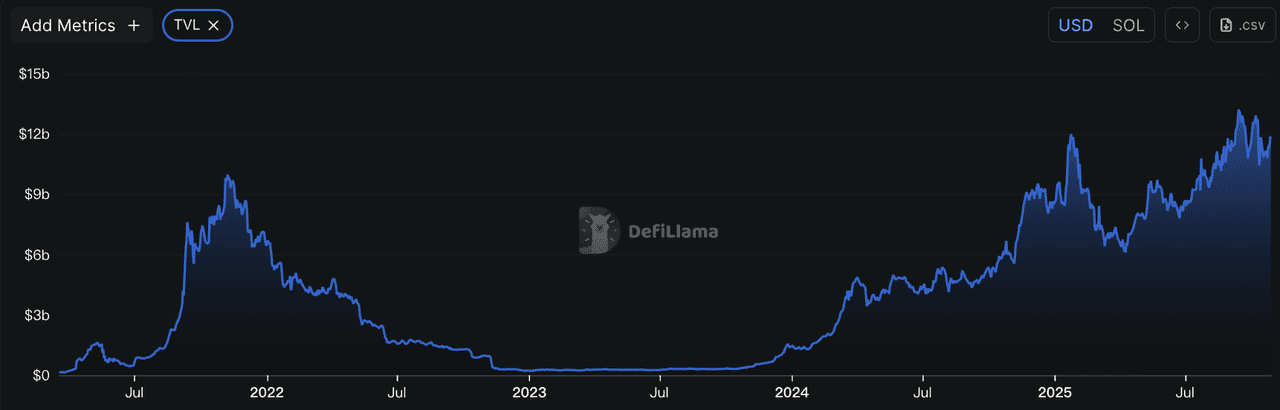

Solana is a high-speed, low-cost blockchain often called an “Ethereum killer” for its ability to process thousands of transactions per second at a fraction of

Ethereum’s cost. In 2025, Solana remains one of the top-performing Layer 1 networks, with a total value locked (TVL) of about $11.78 billion and expanding activity across decentralized finance (DeFi), NFTs, memecoins, and gaming.

Solana uses a hybrid Proof of History (PoH) and Proof of Stake (PoS) system that enables fast transaction speeds, low fees, and strong scalability.

In 2025, Solana is introducing two key upgrades to boost speed and reliability. Firedancer, developed by Jump Crypto, increases network performance and scalability, while Alpenglow improves transaction finality and overall stability. Together, they make Solana faster, more secure, and better suited for large-scale applications.

The Solana ecosystem is one of the most active in crypto. In

DeFi, platforms like

Raydium and

Jupiter lead decentralized trading and liquidity aggregation. In the booming

memecoin launchpad sector, platforms such as

Pump.fun and

LetsBonk.fun drive new token creation, community engagement, and on-chain activity. Beyond DeFi, Solana continues to expand into consumer technology with the launch of the

Solana Seeker smartphone, which integrates Web3 features and on-chain identity directly into mobile hardware. Combined with rising

institutional adoption, these developments reinforce Solana’s position as a leading blockchain for innovation and scalability in 2025.

What Is a Solana ETF?

A Solana ETF, or exchange-traded fund, is a regulated investment product that tracks the price of Solana (SOL), allowing investors to gain exposure to the cryptocurrency without directly holding it or managing

wallets and

private keys. Instead of using a crypto exchange or

self-custody setup, investors can buy and sell ETF shares through traditional brokerage accounts, just like stocks.

The launch of Solana ETFs marks the 3rd category of spot crypto ETFs approved in the United States, following

Bitcoin and Ethereum. This gives both retail and institutional investors a simpler and compliant way to participate in Solana’s growth while minimizing custody risks and technical complexity.

Some Solana ETFs, such as Bitwise’s Solana ETF (BSOL) and Grayscale’s Solana ETF (GSOL), also include a staking feature. These funds not only track SOL’s market price but also stake their holdings on the Solana network to earn on-chain rewards, which are reinvested to enhance overall returns for investors.

How Does a Solana ETF Work?

A Solana ETF offers regulated exposure to Solana (SOL) without requiring investors to buy or store tokens directly. It functions similarly to existing Bitcoin and Ethereum ETFs.

• Asset backing: The ETF is managed by a financial institution that holds SOL tokens or related instruments. Each share represents a portion of the fund’s total assets.

• Fund structure: The ETF’s value tracks Solana’s market price, and its Net Asset Value (NAV) equals the total SOL held divided by outstanding shares.

• Exchange trading: Shares trade on major stock exchanges like the NYSE, allowing investors to buy and sell during market hours.

• Staking rewards: Some ETFs, including BSOL and GSOL, stake their holdings to earn 5–7% on-chain rewards, which are reinvested into the fund.

• Management and fees: The fund charges a small annual management fee, typically around 0.2–0.3%.

This structure provides regulated, liquid, and accessible exposure to Solana’s growth without the complexity of managing wallets or private keys.

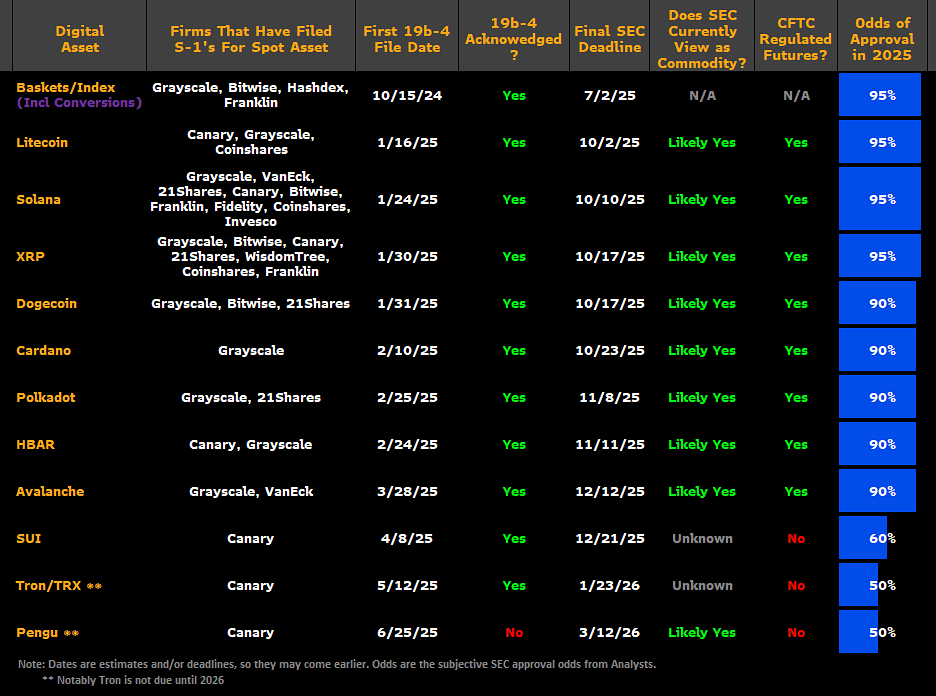

Altcoin ETFs Move Forward Amid U.S Shutdown Under “Generic Listing Standards”

October 2025 was expected to be “ETF Month,” with up to 16 altcoin ETF applications, including Solana, Litecoin, and Hedera, reaching final SEC review deadlines. However, the ongoing U.S. government shutdown suspended most SEC activity and delayed key decisions. Even so, the market reached a milestone as several altcoin ETFs launched in the United States, marking the first wave of regulated crypto investment products.

This progress was made possible by the SEC’s newly adopted “generic listing standards,” which allow qualified crypto ETFs to list automatically if they meet predefined requirements. Approved earlier in 2025, this framework enabled issuers to move forward despite the shutdown, bypassing the usual approval bottlenecks and signaling a turning point for digital asset regulation.

The Bitwise Solana ETF (BSOL) and Grayscale Solana ETF (GSOL) are now trading on the New York Stock Exchange (NYSE) and NYSE Arca, alongside Canary’s Litecoin (LTC) and Hedera (HBAR) ETFs. Their listings mark a breakthrough for digital assets entering traditional markets. According to Bloomberg analysts Eric Balchunas and James Seyffart, this wave of altcoin ETFs could pave the way for broader crypto adoption, while

Polymarket traders assign a 99% probability that more crypto ETFs will gain approval by the end of 2025, reflecting rising institutional confidence across the sector.

U.S. Solana ETFs Updates 2025: New Launches and Pending SEC Review Timeline

The race to launch spot Solana ETFs in the United States has accelerated through 2024 and 2025 as major asset managers seek regulated exposure to Solana (SOL) without requiring investors to manage wallets or private keys.

Solana ETFs Launched in the U.S. in October 2025

1. Bitwise Solana ETF (BSOL) officially listed on the New York Stock Exchange (NYSE) on October 28, 2025, becoming the first U.S. spot Solana ETF. Managed by Bitwise Asset Management, the fund directly holds SOL and includes on-chain staking through Helius Technologies, targeting around 5–7% annual rewards.

Solana ETF Filings Still under SEC Review

1. Grayscale Solana ETF (GSOL) currently operates as a publicly traded trust with over 130 million dollars in assets under management and includes staking functionality. Grayscale has filed to convert the trust into a spot Solana ETF, with the official listing on NYSE Arca expected in early November 2025, following Bitwise’s launch. The conversion aims to provide greater liquidity and accessibility for institutional investors once approved.

2. VanEck Solana Trust filed in June 2024 and was the first firm to submit an S-1 registration with the SEC for a U.S. spot Solana ETF. The proposal aims to track SOL’s price directly and highlights its scalability and low fees. The expected SEC review window is Q4 2025.

3. 21Shares Core Solana ETF filed in June 2024 for listing on the Cboe BZX Exchange. The application emphasizes Solana’s decentralized design and argues that SOL should be classified as a commodity under U.S. law. The next SEC review deadline is November 2025.

4. Canary Solana ETF filed between late 2024 and early 2025 as part of Canary Capital’s broader altcoin ETF lineup, which also includes Litecoin (LTC) and Hedera (HBAR). The review is expected in December 2025.

5. Franklin Templeton Solana ETF filed in March 2025 with both S-1 and 19b-4 forms to list on the Cboe BZX Exchange. It remains under SEC review, with an anticipated decision in early 2026.

Global Spot Solana ETFs: Canada, Europe, and Hong Kong Lead the Way

While the United States only recently approved spot Solana ETFs, several global markets had already introduced Solana-based investment products, paving the way for broader institutional adoption.

1. Canada: 3iQ, Purpose, Evolve, and CI Solana ETFs

On April 16, 2025, the Toronto Stock Exchange (TSX) became the first in the world to list four spot Solana ETFs, approved by the Ontario Securities Commission (OSC). Issuers including 3iQ, Purpose Investments, Evolve, and CI Financial hold actual SOL tokens with institutional-grade custody and offer staking rewards to investors. Each ETF tracks a unique Solana index, providing regulated exposure to Solana’s expanding role in DeFi, NFTs, and Web3. This established Canada as a pioneer in Solana-based ETF innovation.

2. Europe: VanEck Solana ETN, a Non-ETF Investment Product

The VanEck Solana ETN gives European investors exposure to the price of SOL through a listed exchange-traded note available on major European exchanges. Unlike an ETF, the ETN is not an exchange-traded fund but an unsecured debt instrument, meaning investors do not directly own the underlying SOL and instead rely on VanEck’s creditworthiness. Despite this structural difference, it remains one of the most popular Solana investment vehicles in Europe, offering a regulated alternative to direct token ownership.

3. Hong Kong: ChinaAMC Solana ETF

On October 22, 2025, the Securities and Futures Commission (SFC) approved ChinaAMC’s Solana ETF, the first in Hong Kong to provide direct exposure to SOL. Trading began on October 27 on the Hong Kong Stock Exchange (HKEX) under tickers 3460 (HKD), 83460 (RMB), and 9460 (USD). The ETF fully invests in SOL and tracks the CME CF Solana-USD Index, though it does not include staking. The launch highlights Hong Kong’s ambition to become Asia’s leading regulated crypto hub, even as mainland China tightens oversight of digital assets.

Together, these international products show how Canada, Europe, and Hong Kong have taken the lead in developing regulated Solana investment options, setting the foundation for global institutional participation in the Solana ecosystem.

Spot Solana ETFs vs. Solana Staking ETFs: Where the Line Begins to Blur

Canada was the first country to approve spot Solana ETFs with staking rewards, launching four funds from Purpose, 3iQ, Evolve, and CI/Galaxy on the Toronto Stock Exchange (TSX) in April 2025. These ETFs directly hold SOL and integrate

SOL staking, offering 2–3.5% annual yields, setting the standard for combining price exposure with on-chain income in regulated markets.

In the United States, the REX-Osprey Solana Staking ETF, launched in July 2025, became the first American product to combine SOL price exposure and staking rewards, supported by Anchorage Digital as its staking partner. The model was later expanded with the Bitwise Solana ETF (BSOL), which began trading on October 28, 2025, as the first U.S. spot Solana ETF to include on-chain staking. Managed by Helius Technologies, BSOL stakes its SOL holdings to earn about 7% annual yield, providing investors with both market performance and network-generated income.

With these developments, the line between staking ETFs and spot ETFs has nearly vanished. Both now deliver a mix of capital appreciation and staking rewards, reflecting a broader evolution in ETF design that merges traditional finance structures with on-chain yield generation.

| Feature |

REX-Osprey Solana Staking ETF |

Bitwise Solana ETF (BSOL) |

| Launch Date |

July 2025 |

October 28, 2025 |

| Exposure Type |

SOL price + staking rewards |

Spot SOL + staking rewards |

| Staking Partner |

Anchorage Digital |

Helius Technologies |

| Estimated Annual Yield |

5–7% |

Around 7% |

| Management Fee |

Standard ETF rate |

0.20% (waived initially) |

| Focus |

First U.S. staking ETF |

First U.S. spot Solana ETF with staking |

Should You Invest in a Solana ETF?

A Solana ETF provides a convenient, regulated way to gain exposure to Solana (SOL) without managing wallets, private keys, or crypto exchanges. It suits investors who want the security and accessibility of traditional finance while participating in the growth of the Solana ecosystem. Since ETFs trade on public exchanges and follow regulatory standards, they offer transparent pricing, better liquidity, and in some cases, staking rewards that generate additional yield.

However, Solana ETFs still face the same market volatility as SOL itself. Price swings can be influenced by crypto sentiment, regulatory shifts, or global macro trends. Certain products, such as ETNs or closed-end funds, may also carry added complexities like credit risk or trading at a premium or discount to their net asset value (NAV).

• If you’re a traditional investor: A Solana ETF is an ideal entry point. It lets you gain crypto exposure through familiar stock market platforms with built-in investor protections and easy liquidity.

• If you’re a crypto-native investor: You may prefer to buy SOL directly on BingX, transfer it to your personal wallet, and stake it on-chain to earn higher yields and retain full control of your assets.

Conclusion

The approval and launch of spot Solana ETFs mark a new era where blockchain technology meets regulated markets. From Canada’s early adoption to the recent U.S. listings of Bitwise’s BSOL and Grayscale’s GSOL, Solana has become a symbol of how crypto assets are entering mainstream portfolios. With built-in staking rewards, these ETFs go beyond simple price tracking—they blend yield generation, liquidity, and accessibility in a format both traditional and crypto investors can understand.

Whether through a brokerage account or direct staking on-chain, Solana’s growing integration into traditional finance is reshaping how investors participate in the next wave of digital asset innovation.

Related Reading