Spot Ethereum ETFs have unlocked over $7.9 billion in assets as of July 2025 since their U.S. debut in 2024, giving investors a regulated way to gain exposure to ETH without the hassle of wallets or

private keys. With the 2025

altcoin season in full swing and

corporate adoption of Ethereum accelerating across DeFi, NFTs, and

tokenized assets, interest in ETH staking products has surged. Now, a new wave of staking-enabled ETFs is raising the stakes, literally.

In July 2025, BlackRock submitted an amended 19b-4 filing via Nasdaq to allow staking in its iShares Ethereum Trust (ETHA). If approved, ETHA would become the first U.S. Ethereum ETF to stake assets through custodians like Coinbase, enabling the fund to generate staking rewards on top of ETH price exposure. The filing proposes staking “all or a portion” of the trust’s ETH while carefully managing liquidity and slashing risks.

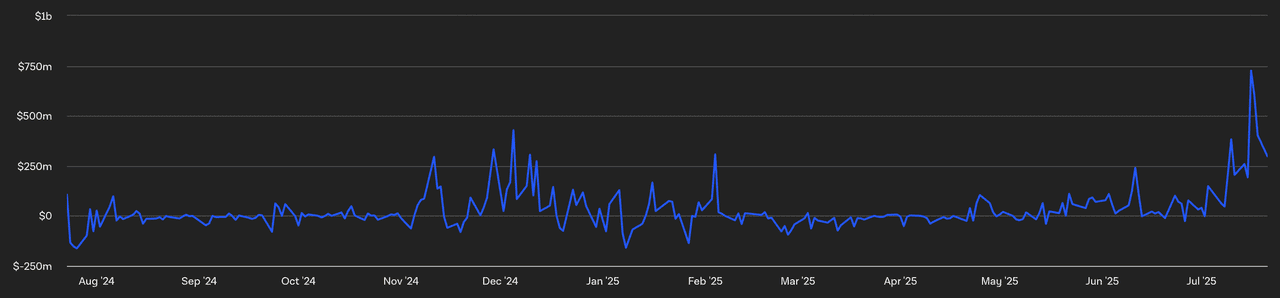

Spot Ethereum ETF inflows | Source: TheBlock

These products don’t just track ETH’s price; they also generate yield by participating in Ethereum’s proof-of-stake system. The excitement is already palpable, with the first U.S.

Solana staking ETF (SSK) surpassing $100 million in AUM (assets under management) within its first 12 trading days.

In this guide, you will learn how Ethereum staking ETFs combine

ETH price exposure with staking rewards, offering a regulated way to earn passive income from Ethereum’s proof-of-stake (

PoS) system. You can also explore what exactly an Ethereum staking ETF is, and when it could launch in the U.S. market.

Rising Demand for Staking-Enabled ETFs in 2025

The launch of U.S. spot Bitcoin and Ethereum ETFs in early 2024 paved the way for broader adoption of crypto-backed funds. In 2025, the market’s attention shifted to staking-enabled ETFs, with asset managers like BlackRock, Grayscale, and Franklin Templeton proposing Ethereum ETFs that stake a portion of their holdings.

Staking ETFs combine traditional ETF structure with Ethereum’s PoS consensus mechanism, allowing investors to earn

staking rewards while enjoying regulated market access. The 21Shares Ethereum Staking ETP (AETH), launched in 2019 in Europe, pioneered this approach, while U.S. investors are now eyeing BlackRock’s proposed staking feature for its iShares Ethereum Trust (ETHA).

What Is Ethereum (ETH)?

Ethereum is a decentralized blockchain platform that enables smart contracts, decentralized applications (

dApps), and

tokenized RWAs (real-world assets). Since transitioning to a proof-of-stake (PoS) consensus in September 2022 (the Merge), Ethereum allows holders to stake their ETH to help secure the network and earn rewards.

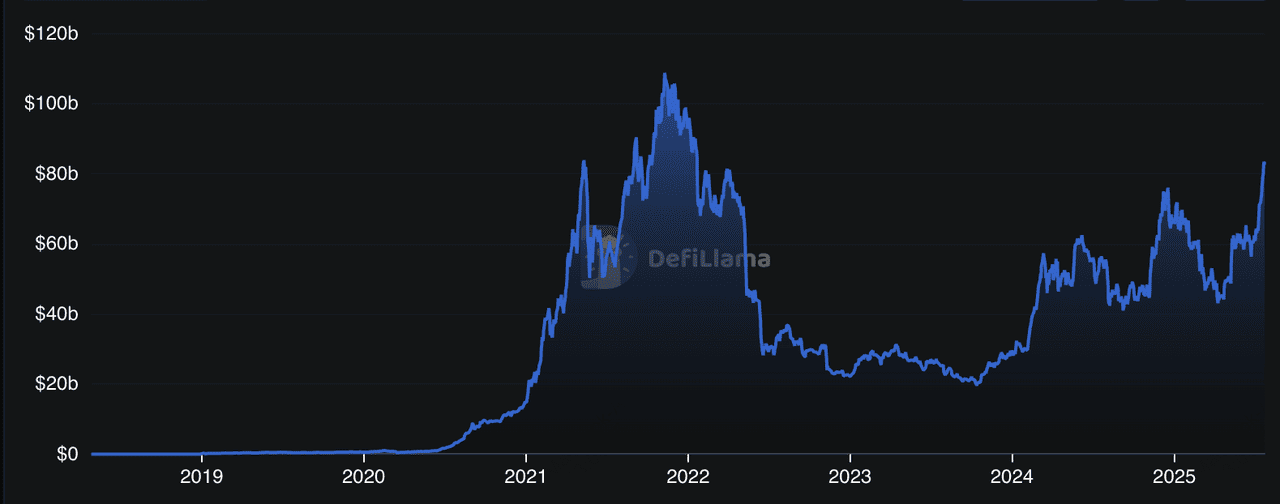

Ethereum TVL | Source: DefiLlama

As of August 2025, Ethereum remains the leading

smart contract platform, with over $82 billion in total value locked (TVL) across DeFi protocols, NFTs, and tokenized RWAs. This growing ecosystem makes Ethereum an attractive asset for both capital appreciation and passive yield through staking.

What Is an Ethereum Staking ETF?

An Ethereum staking ETF is an exchange-traded fund that holds physical ETH and stakes it on the Ethereum network to earn rewards. This approach offers investors exposure to ETH price movements and the additional benefit of staking yield, all within a familiar ETF wrapper.

For example, the 21Shares Ethereum Staking ETP (AETH) in Europe reinvests staking rewards back into the fund, enhancing its net asset value (NAV). In the U.S., BlackRock’s proposed ETHA staking feature would allow the fund to delegate ETH to validators via trusted custodians like Coinbase Custody, generating staking income for investors.

This structure eliminates the need for investors to manage crypto wallets or set up

validators themselves.

Instead of buying an Ethereum Staking ETF, you can also

buy spot ETH directly on centralized exchanges like BingX. This gives you full ownership of your ETH tokens and the flexibility to stake them yourself or trade them anytime, potentially earning higher yields by choosing your own validators and staking strategies.

How Does an Ethereum Staking ETF Work?

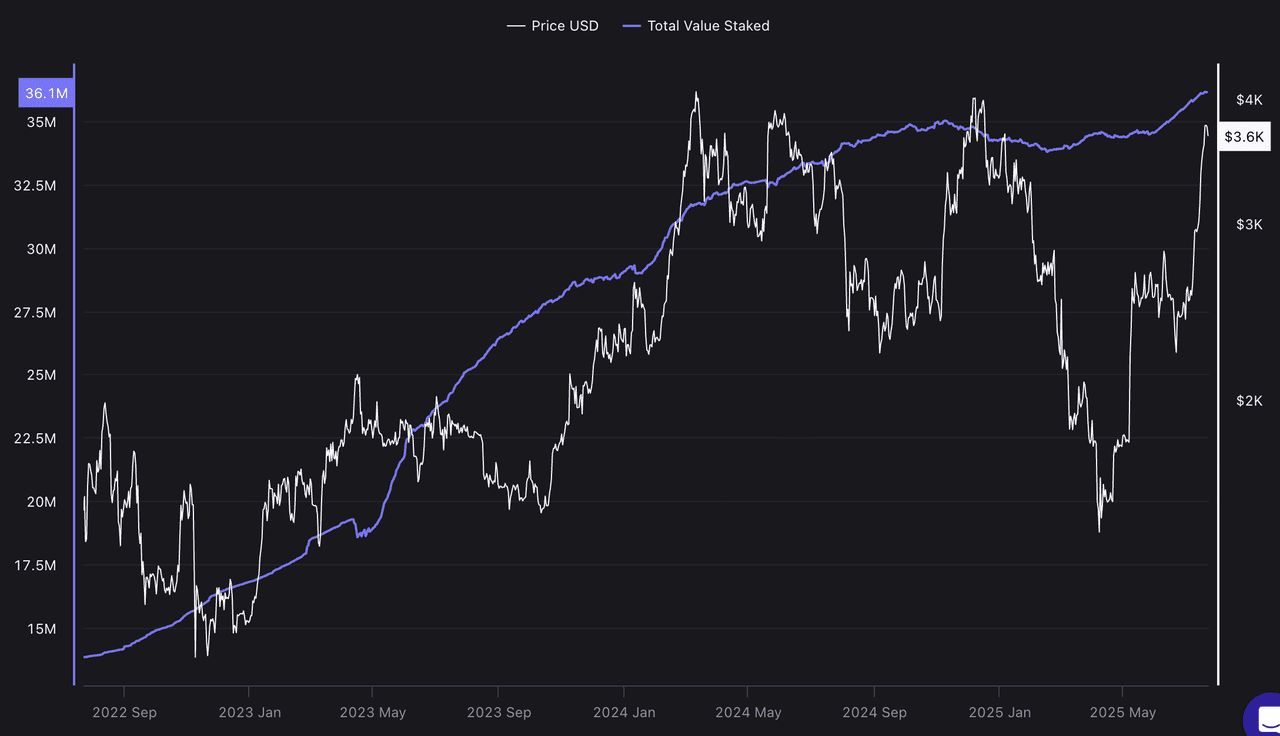

Ethereum total value staked vs. price | Source: CryptoQuant

An Ethereum staking ETF simplifies access to staking by integrating it directly into the fund. Here’s how it works:

1. Fund Composition – The ETF holds actual ETH tokens, which form its core assets. For example, ETHA is 100% physically backed by ETH kept in cold storage.

2. Staking Process – The fund stakes a portion of its ETH holdings through regulated custodians and validator operators like Coinbase Custody, Figment, or Anchorage Digital.

3. Earning Rewards – Staked ETH earns rewards from network participation (currently yielding 1.7% to 2.2% annually after fees for most ETFs).

4. Reward Distribution – These rewards are either reinvested into the ETF (accretive to NAV) or distributed as dividends, depending on the fund’s structure.

5. Investor Access – Investors buy shares of the ETF via traditional brokerage accounts, gaining ETH price exposure and staking yield without handling crypto directly.

This setup is designed to comply with securities laws, with U.S. products like ETHA operating under SEC Rule 19b-4 and leveraging the Investment Company Act of 1940 for staking compliance.

Why Is an ETH Staking ETF Important for Investors?

An Ethereum staking ETF offers a unique combination of capital growth and passive income. By staking ETH, the ETF earns rewards that enhance investor returns even during periods of price stability. This dual-income model sets it apart from spot ETFs that only track ETH price.

For retail investors, it removes the technical barriers of setting up validators or managing wallets. For institutions, the regulated framework and professional custody services provide a secure entry point into Ethereum’s staking economy.

With U.S. regulatory approval potentially arriving in late 2025, Ethereum staking ETFs could soon join the ranks of yield-bearing crypto funds like the REX-Osprey Solana Staking ETF (SSK), which attracted over $100 million AUM within weeks of launch.

Ethereum Staking ETF vs. Spot Ethereum ETF: Key Differences

| Feature |

Spot Ethereum ETF |

Ethereum Staking ETF |

| Exposure |

Tracks ETH price |

Tracks ETH price + staking |

| Staking Rewards |

No |

Yes (1.7% - 2.2% net yield) |

| Complexity for Investor |

Minimal |

Minimal |

| Custody |

Institutional-grade |

Institutional-grade |

| Liquidity Considerations |

High |

Slightly lower (due to staking lock-ups) |

A Spot Ethereum ETF gives investors exposure to ETH’s price movements by holding physical ETH in custody. It tracks the market price of Ethereum, allowing investors to buy and sell shares just like a stock without managing private keys or wallets. Since their U.S. launch in 2024, spot ETH ETFs have grown rapidly, with BlackRock’s ETHA alone attracting over $7.9 billion in assets under management (AUM). However, they do not generate any additional income beyond price appreciation.

In contrast, an Ethereum staking ETF adds a yield component by staking a portion of the ETH it holds on the network. For example, European products like the 21Shares Ethereum Staking ETP (AETH) offer net yields of around 1.7%–2.2% annually after fees. This setup means investors earn both from ETH price gains and staking rewards. However, staking introduces slight liquidity trade-offs because of unbonding periods on the Ethereum network (ranging from 9 to 50 days) and potential slashing risks, though these are rare and managed by professional custodians.

Top Ethereum Staking ETFs Available Outside the U.S.

For investors seeking Ethereum staking exposure as of July 2025, several established staking ETFs/ETPs are already live in Europe and Canada, offering yield, convenience, and regulatory clarity well before U.S. staking ETFs are approved. Here are some standout options:

1. 21Shares Ethereum Staking ETP (AETH) – Europe

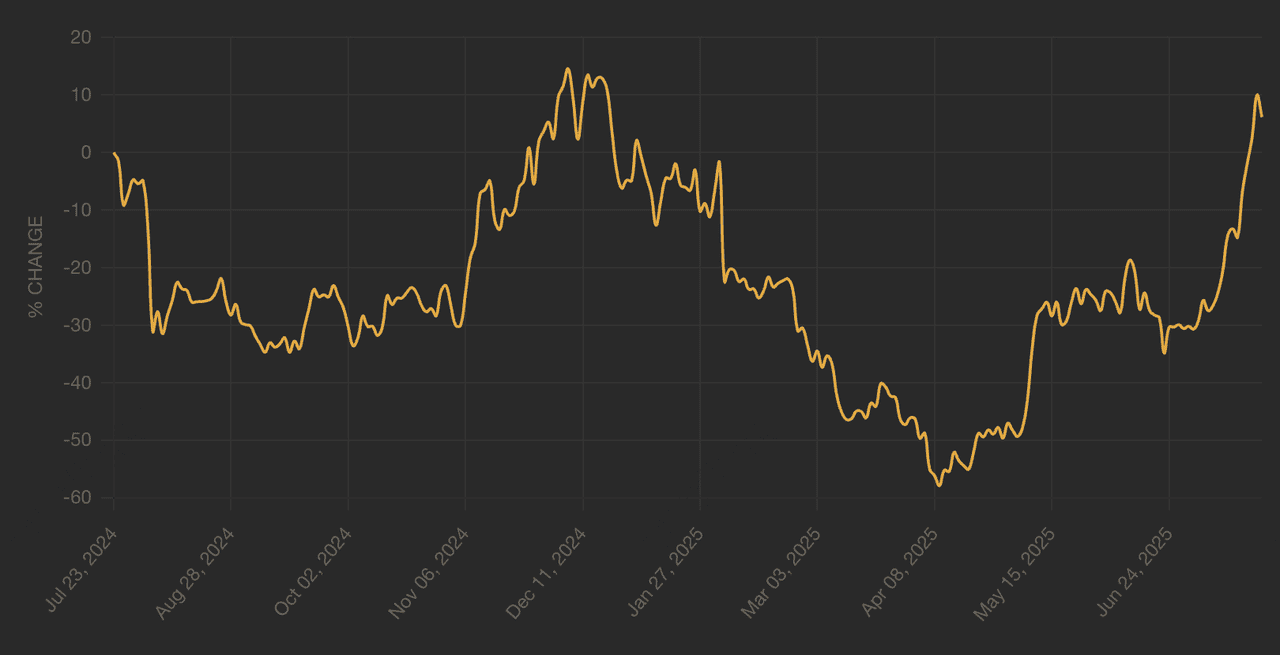

21Shares' AETH performance | Source: 21Shares

The 21Shares Ethereum Staking ETP (AETH) is Europe’s longest-running Ethereum staking product, launched in 2019. It is 100% physically backed by ETH, offers a net yield of around 1.7% annually after fees, and reinvests staking rewards into the fund for enhanced performance. With over €483 million in AUM, it provides exposure to ETH and staking income through a simple brokerage account.

2. 3iQ Ether Staking ETF (ETHQ) – Canada

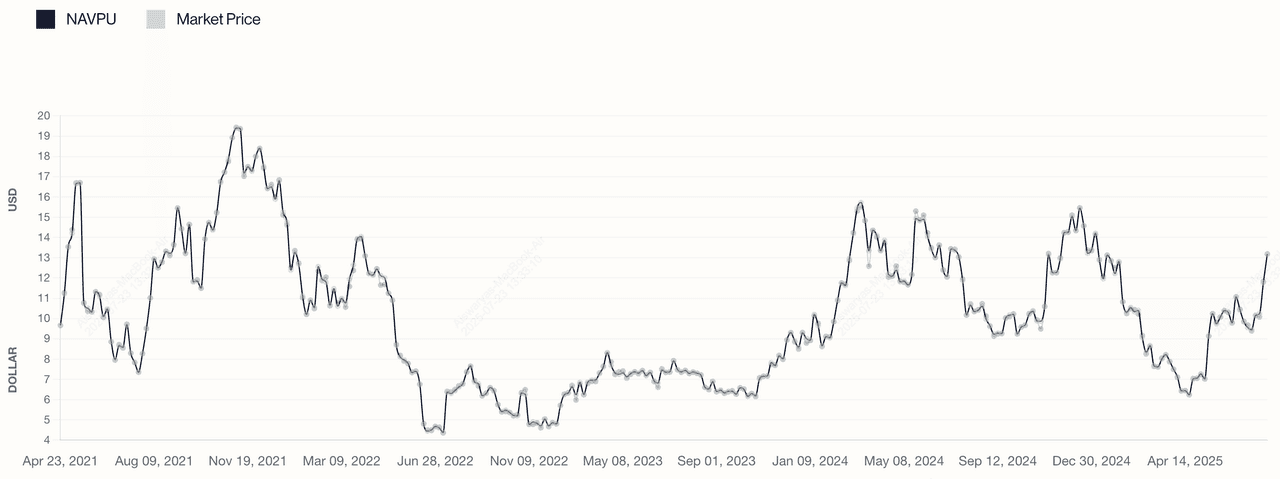

ETHQ net asset value (NAV) per unit & market price | Source: 3iq

The 3iQ Ether Staking ETF (ETHQ) in Canada combines ETH price exposure with daily accrual of staking rewards, currently yielding about 1.81%. With assets around CA$130 million, it uses segregated cold storage and is eligible for registered accounts like TFSA and RRSP, appealing to Canadian investors seeking regulated staking income.

3. Purpose Ether Staking Corp. ETF – Canada

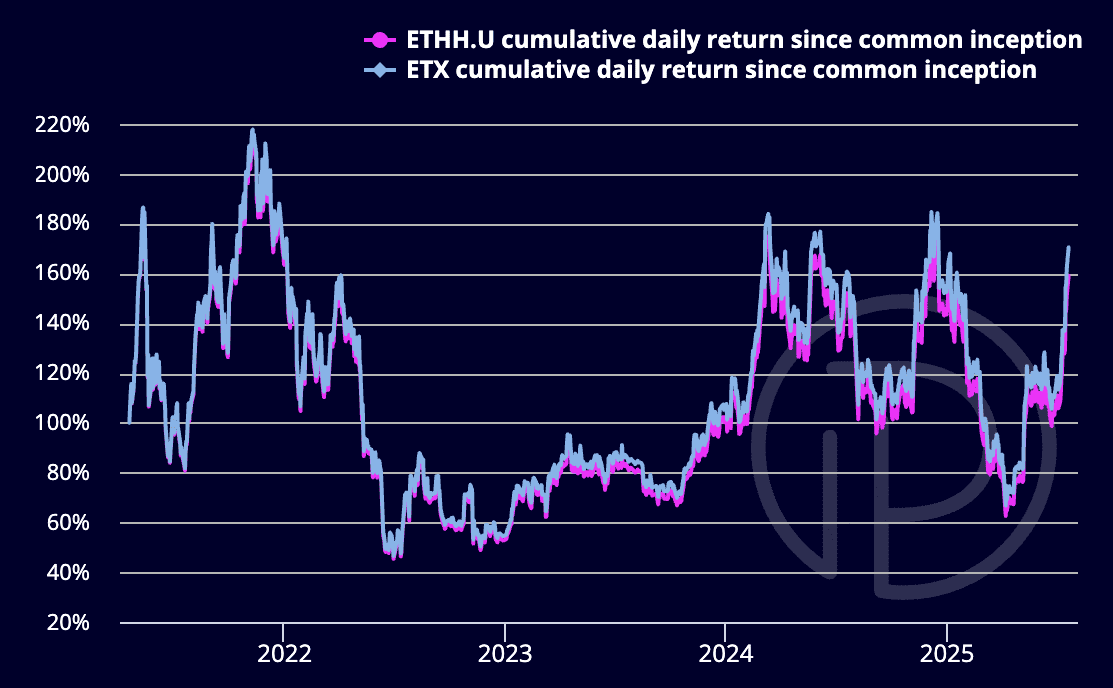

Purpose Ethereum staking ETF NAV per unit vs ETH return | Source: Purpose

The Purpose Ether Staking Corp. ETF, also based in Canada, gives investors access to ETH staking rewards without meeting the 32 ETH threshold. It holds physically settled ETH in cold storage and is TFSA/RRSP eligible, making it a low-barrier, tax-efficient option for passive ETH income.

These products illustrate real-world demand for staking-enabled ETFs. With yields between ~1.7% and ~1.8%, they offer a tangible lift over spot ETH price exposure, while eliminating technical hassle for most investors. They also set benchmarks for when U.S. staking ETFs like BlackRock’s ETHA receive approval: expect similar structures, yields, and operational safeguards.

Should You Invest in an Ethereum Staking ETF?

While staking-enabled ETFs offer higher return potential, they come with additional considerations. Staking rewards are not guaranteed and depend on validator performance and network conditions. Unstaking periods (ranging from 9 to 50 days) may also affect fund liquidity.

Management fees and validator service charges can reduce net yield. However, for many investors, the benefits of regulated access, simplified staking participation, and dual-income potential outweigh these risks.

As Ethereum’s staking adoption grows and regulatory clarity improves, staking ETFs could become a key component in

diversified crypto portfolios.

Final Thoughts

Ethereum staking ETFs represent an important step in the evolution of crypto investment products, blending the simplicity of traditional ETFs with Ethereum’s staking rewards. As major players like BlackRock work toward approval, investors may soon access ETH’s price growth and passive income in a regulated structure.

However, staking involves risks such as validator penalties, unbonding periods, and potential regulatory shifts that could impact yields. For those seeking direct exposure today, buying and staking ETH on platforms like BingX offers full control and the possibility of higher returns, though it also requires more active management and risk awareness.

Related Reading