A spot Zcash ETF is a proposed exchange-traded fund that would hold actual

Zcash (ZEC) as its underlying asset and trade on a traditional stock exchange, just like a stock or gold ETF. Its goal is simple: let you get regulated exposure to ZEC’s price without needing a

crypto wallet or managing private keys.

Grayscale submits application for Zcash spot ETF | Source: SEC

On November 26, 2025, Grayscale Investments filed a Form S-3 with the U.S. Securities and Exchange Commission (SEC) to convert the existing Grayscale Zcash Trust into a spot Zcash ETF, planned to trade on NYSE Arca under the ticker ZCSH.

If approved, this would be the first U.S. ETF focused exclusively on Zcash, giving both retail and institutional investors a mainstream way to access a leading privacy coin through a brokerage account. It comes right as Zcash (ZEC) has surged over 1,000% in 2025, overtaken

Monero (XMR) to become the largest

privacy coin by market cap, and seen record demand for shielded transactions.

Why Did Grayscale File for a Zcash ETF?

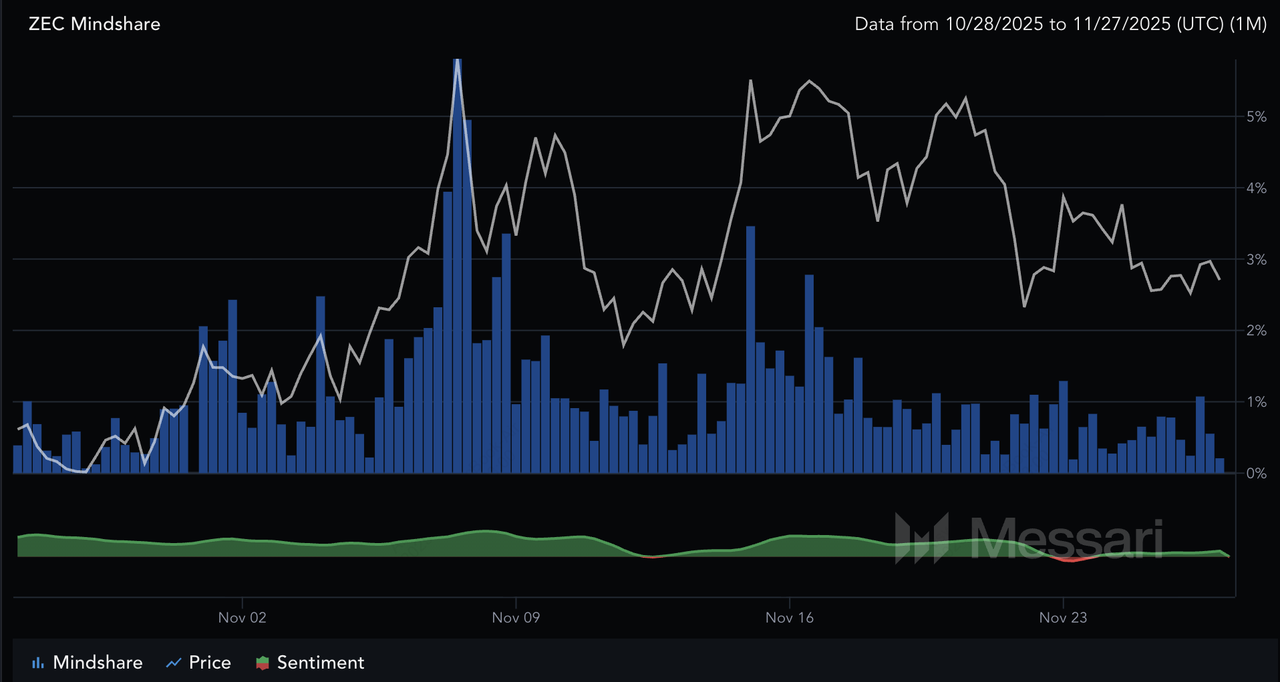

Zcash's Mindshare on the rise | Source: Messari

Zcash is gaining ETF attention from Grayscale because it has rapidly shifted from a niche privacy coin to a mainstream crypto asset in 2025. ZEC has surged roughly 1,000% in 2025, with sustained trading above $500–$600, and has overtaken Monero to become the largest privacy coin by market cap. Adoption of its core feature, zk-SNARK–powered shielded transactions, is also rising, with an estimated 25–30% of all ZEC now held in shielded addresses and a growing share of transactions occurring privately. This combination of price momentum, liquidity, and real usage has pushed Zcash into the spotlight for issuers seeking the next ETF-ready crypto asset.

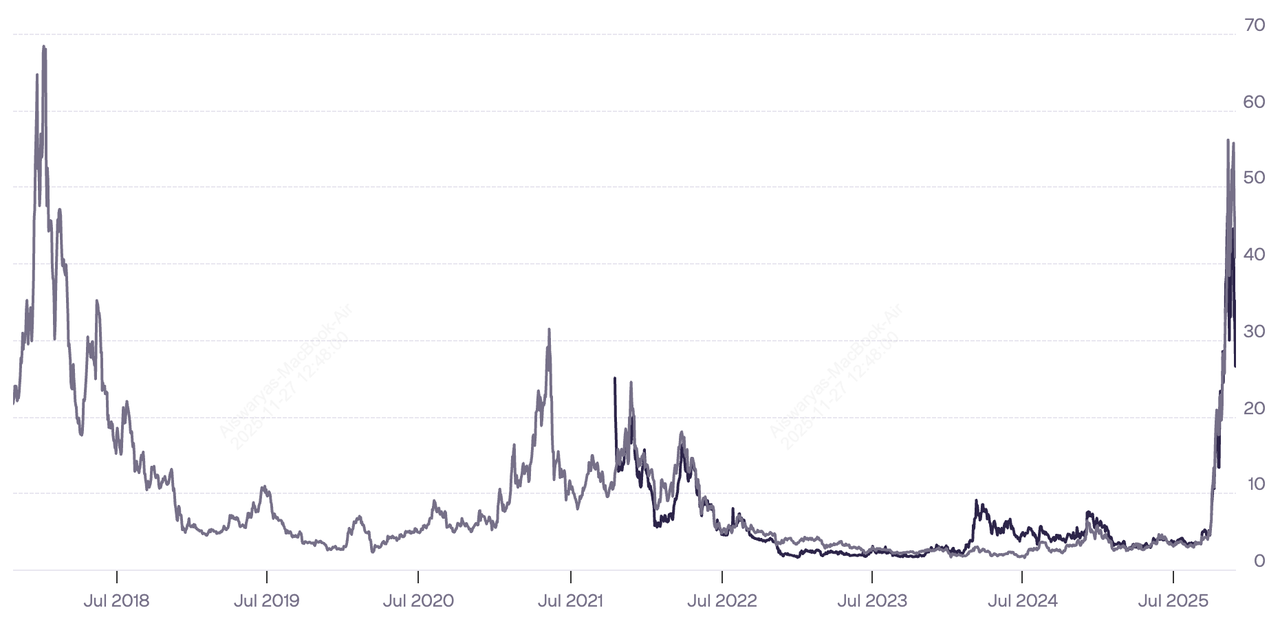

Grayscale Zcash Trust (ZCSH) market price and NAV per share | Source: Grayscale

Grayscale’s move toward a Zcash ETF is a continuation of a proven strategy: convert long-running single-asset trusts into fully regulated spot ETFs once market conditions and liquidity justify it. Its Zcash Trust (ZCSH), launched in 2017, already holds roughly 394,000 ZEC as of November 2025, valued near $190–$200 million at recent prices, giving Grayscale a sizable, seasoned product to transition. The firm has executed this model repeatedly, converting its Bitcoin (GBTC) and Ethereum (ETHE) trusts into spot ETFs in early 2024, followed by successful ETF launches for

Solana (SOL),

XRP, and

Dogecoin (DOGE). With ZCSH trading publicly and demonstrating sufficient volume, assets, and price discovery, Zcash became the next logical candidate in the pipeline.

What Is a Spot Zcash (ZEC) ETF?

A spot Zcash ETF is a traditional stock-market product that holds actual Zcash (ZEC) in reserve and lets you buy exposure to its price through a normal brokerage account. Instead of dealing with crypto wallets, exchanges, or private keys, you simply trade ETF shares the same way you would trade a stock. Because the fund holds real ZEC, not futures or derivatives, it aims to follow Zcash’s spot market price as closely as possible. This makes it a beginner-friendly way to gain ZEC exposure without touching on-chain tools.

In Grayscale’s proposal, the ETF would trade on NYSE Arca under the ticker ZCSH and use the CoinDesk Zcash Price Index (ZCX) to calculate its net asset value. All underlying ZEC would be stored by Coinbase Custody, with Coinbase, Inc. acting as prime broker and BNY Mellon managing administrative and transfer-agent duties. In simple terms, institutional partners handle the technical side like secure storage, trade execution, and compliance, while the ETF structure mirrors the value of the ZEC it holds, minus fees. This setup offers a regulated, easy-access alternative to buying and managing ZEC directly.

How Would the Grayscale Spot Zcash ETF Work?

Here’s a simple, beginner-friendly breakdown of how a spot Zcash ETF would work behind the scenes.

1. Underlying ZEC holdings: The fund holds a pool of ~394,400 ZEC, valued at around $200 million as of November 2025. Each ETF share represents a fractional claim on that ZEC pool.

2. How NAV (net asset value) is calculated: The ETF uses the CoinDesk Zcash Price Index (ZCX) to determine the value of its ZEC holdings.

• NAV = (Total ZEC held × ZCX price) − fund expenses.

• NAV updates daily to show the “true” value of each share.

3. Share creation and redemption process: Shares are created or redeemed in 10,000-share baskets. At launch, Grayscale proposes cash-only transactions for these baskets:

• Authorized participants send cash to the trust.

• The trust uses that cash to buy or sell ZEC through a liquidity provider.

• In-kind ZEC transfers (directly depositing or withdrawing ZEC) may be added later if regulators approve.

4. Trading on NYSE Arca: Once listed under ticker ZCSH, the ETF trades intraday like any stock. The market price can differ slightly from NAV based on:

• Real-time ZEC spot movements

• Investor demand for ETF shares

• Premium/discount effects, generally smaller than in trust structures.

5. Fees to consider: The existing Grayscale Zcash Trust currently charges a 2.5% annual management fee, and the ETF is expected to charge a similar rate unless reduced at launch.

For investors, a spot Zcash ETF like ZCSH offers a simple, regulated way to gain exposure to ZEC without managing wallets or private keys; you just buy and sell shares through a standard brokerage account. All underlying ZEC is stored by Coinbase Custody, while BNY Mellon oversees administrative and transfer-agent duties, giving the product institutional-grade security, audited oversight, and clear regulatory safeguards.

Read more:

How Does the Zcash ETF Differ From Grayscale's Zcash Trust?

The proposed Zcash ETF would differ from Grayscale’s existing Zcash Trust by offering daily creations and redemptions, tighter tracking to ZEC’s spot price, and intraday trading on NYSE Arca, reducing the large premiums and discounts the trust has historically experienced.

While the trust trades over-the-counter and can deviate significantly from its underlying ZEC value, the ETF structure is designed to keep prices closer to NAV through market makers and basket transactions. The ETF would also provide greater liquidity, clearer regulatory oversight, and a more transparent pricing benchmark, the ZCX index, making it a more efficient and accessible vehicle for mainstream investors than the legacy trust model.

What Does a Spot Zcash ETF Mean for ZEC Investors?

Here’s why a spot Zcash ETF would be a big deal for ZEC investors and the broader privacy-coin market.

• First regulated gateway to a privacy coin: This would be the first U.S. ETF focused on a privacy-preserving cryptocurrency, signaling growing regulatory acceptance of zk-based assets. It gives ZEC mainstream visibility similar to

BTC and

ETH once their ETFs launched.

• Unlocks institutional demand: Many funds, retirement accounts, and advisers cannot hold raw crypto, but can buy SEC-regulated ETFs. A ZEC ETF could attract the first wave of institutional inflows into privacy assets, especially with ZEC now a $8 billion+ market-cap asset.

• Better liquidity and tighter spreads: ETF shares trade intraday on NYSE Arca, improving liquidity and narrowing spreads compared to OTC trust trading. This structure could reduce the large 20–40% premiums/discounts that the current ZCSH trust has shown in volatile markets.

• Improved price discovery and transparency: NAV is calculated using the ZCX spot index, giving investors a clearer, more reliable benchmark. Market makers and authorized participants help keep the ETF price aligned with ZEC’s real value.

When Could a Spot Zcash ETF Launch?

A spot Zcash ETF does not have a confirmed launch date yet, but the process is officially underway. Grayscale has already submitted a Form S-3 to the SEC to convert its Zcash Trust into an ETF, and NYSE Arca has signaled it will list the product under the ticker ZCSH once the filing becomes effective.

Looking at Grayscale’s past conversions provides a rough benchmark: simpler single-asset products, like its Solana or Dogecoin ETFs, moved from filing to trading in roughly 3–4 months, while more complex or heavily scrutinized products have taken 9–12 months. Because ZEC is a privacy coin, the SEC is likely to apply closer AML and market-surveillance scrutiny than it applied to transparent-chain assets like BTC, ETH, or

SOL.

Key Factors That Could Affect the SEC's Zcash ETF Gets Approval

Whether ZCSH is approved quickly or slowly will depend on several regulatory variables. The SEC will evaluate market manipulation risk in ZEC trading, the strength of Grayscale’s custody and compliance setup with Coinbase Custody and BNY Mellon, and broader policy debates around privacy coins, especially as the U.S. coordinates with stricter EU AML rules that already limit trading of privacy-enhanced assets.

If the SEC applies the same standards it used for other altcoin ETFs and sees no major compliance gaps, a late-2026 approval is a realistic best-case scenario based on historical ETF timelines. But if regulators determine that privacy-coin ETFs require additional rulemaking or safeguards, approval could be significantly delayed, or denied altogether. For now, ZCSH remains proposed, not approved, and any timeline should be treated with caution.

What Are the Pros and Cons of Spot Zcash ETF vs. Buying ZEC Directly?

Here’s how a spot Zcash ETF compares with holding ZEC yourself (for example, on an exchange or in a self-custody wallet):

Pros and Cons of Proposed Spot Zcash ETF (ZCSH)

Pros

• Easy to buy in a brokerage account, with no wallet setup.

• Fits into traditional portfolios alongside stocks and bonds.

• Uses institutional custody via Coinbase Custody and BNY Mellon.

Cons

• You don’t control private keys, so you can’t use ZEC on-chain for shielded payments.

• You pay management fees and rely on the fund’s operations.

• Trading hours are limited to stock market hours, not 24/7.

Buying ZEC on a Crypto Exchange like BingX: Pros and Cons

Pros

• You can trade 24/7, access spot and derivatives markets, and move ZEC to self-custody if you want on-chain privacy.

• You have the option to use ZEC for payments, DeFi, or shielded transfers, depending on your wallet setup.

Cons

• You must manage wallets, withdrawals, and security if you self-custody.

• Regulatory treatment, delistings, or regional restrictions may affect where and how you can trade ZEC.

In short, the ETF is about regulated price exposure, while direct ZEC is about full crypto functionality and 24/7 market access.

How to Trade Zcash (ZEC) on BingX Futures

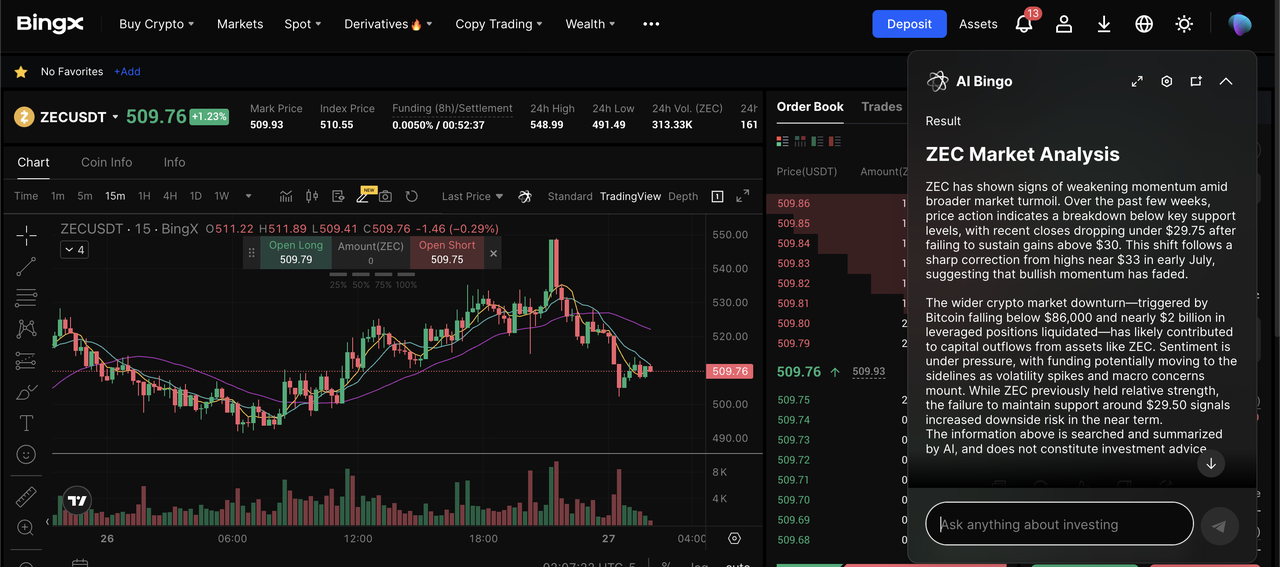

ZEC/USDT perpetual contract on the futures market powered by BingX AI

BingX Futures lets you trade ZEC with leverage and 24/7 market access, giving you more flexibility than a traditional ETF. Go long if you expect ZEC to rise. Go short to profit from drops or hedge your spot holdings.

1. Create or Log In to Your BingX Account: Go to bingx.com or open the BingX app. Sign up with your email/phone number and complete any required verification for your region.

3. Transfer Funds to Your Futures Wallet: Open Assets → Transfer. Move USDT from your Spot Wallet to Futures Wallet so it’s available for trading.

5. Choose Your Leverage: Select your preferred leverage level, e.g., 2x, 5x, 10x. Beginners should start with low leverage to reduce risk.

6. Decide Whether to Go Long or Short: Tap Buy/Long if you think ZEC will go up. Tap Sell/Short if you expect the price to fall or want to hedge.

7. Set Your Order Type

• Market Order: Opens instantly at the current price (easiest for beginners).

• Limit Order: Opens only at the price you choose.

Enter the amount of USDT or ZEC you want to trade.

8. Add Risk Controls: Set a

Stop-Loss to limit your downside. Add a Take-Profit level to lock in gains automatically. Keep position sizes small while you learn.

9. Monitor Your Position: Track your open position under Positions. Watch PnL, margin usage, and

funding rates. BingX also offers AI trading insights to help you understand market trends and volatility.

10. Close Your Trade: When you're ready, tap Close to exit your long or short position. Your PnL (profit or loss) will go straight into your Futures Wallet.

Important risk reminder: Futures carry high risk. Use low leverage, set stop-losses, and manage your position size carefully.

What Are the Key Risks of Investing in a Spot Zcash ETF?

Before you get too excited about a Zcash ETF ticker, it’s worth understanding the main risks highlighted in filings and analyst commentary:

• Market volatility: ZEC has seen 1,000%+ rallies and sharp 50–60% drawdowns within weeks. Price swings will directly impact ETF shares.

• Regulatory risk: Future rules could restrict trading or custody of privacy coins in some jurisdictions, which might affect ETF operations.

• Liquidity risk: If ZEC liquidity dries up or spreads widen, tracking the ZCX index accurately could become harder.

• Tracking and fee drag: Management fees and operational costs mean ETF performance can lag spot ZEC over time.

Final Thoughts

A proposed spot Zcash ETF like Grayscale’s ZCSH aims to give investors simple, brokerage-based access to ZEC while relying on institutional partners such as Coinbase Custody and BNY Mellon for secure storage and administration. Even without a confirmed launch date, the filing highlights how much the privacy-coin landscape has evolved in 2025, with Zcash transitioning from a niche cryptography project to a high-profile asset drawing institutional interest and mainstream market attention.

Until regulators reach a decision, investors can either trade ZEC directly on exchanges like BingX for full on-chain functionality or wait to see whether ZCSH becomes the first approved U.S. privacy-coin ETF. Regardless of the route you choose, remember that ZEC is a highly volatile asset and privacy coins face ongoing regulatory scrutiny. Always consider these risks, along with liquidity, custody, and compliance factors, before allocating capital to ZEC or any ETF built around it.

Related Reading