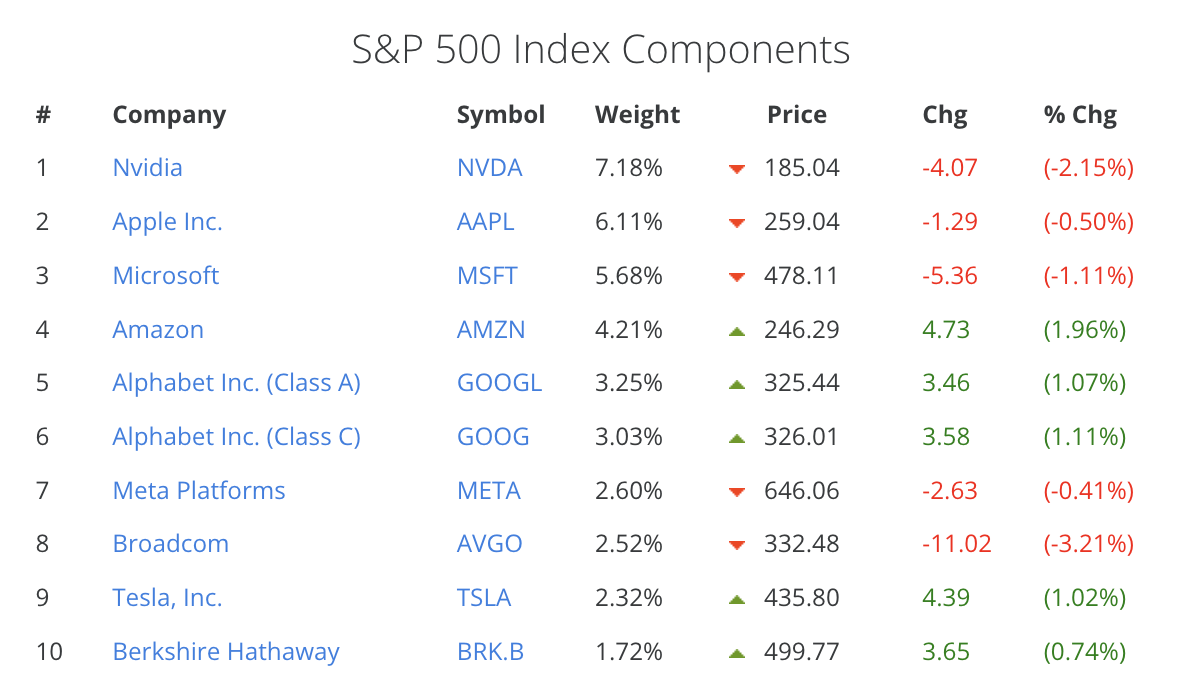

Over the past decade, US technology stocks have evolved from a high-growth equity segment into the structural core of global capital markets. By the end of 2025, US tech companies accounted for more than 36% of the total market capitalization of the

S&P 500, with mega-cap leaders consistently ranking among the world’s largest publicly listed companies by value. Entering 2026, technology continues to anchor global productivity, capital expenditure cycles, and digital infrastructure investment across

AI, cloud computing, semiconductors, software, and platform ecosystems.

At the same time, access to these market leaders is no longer limited to traditional brokerage accounts. Today, investors can gain price exposure to leading US tech stocks using crypto through

tokenized stocks on BingX, trading directly with

stablecoins in a crypto-native environment. The top US technology companies you can invest in with crypto in 2026 include

NVIDIA,

Alphabet (Google),

Apple,

Microsoft,

Amazon,

Meta Platforms, Broadcom,

Tesla, and

Palantir, each representing a different layer of the modern tech stack, from AI hardware and cloud infrastructure to platforms, software, and data-driven applications.

Momentum from 2025 has carried into 2026, but with a clear shift in market tone. After a year dominated by AI-driven multiple expansion, investors are increasingly focused on earnings durability, capital efficiency, and real-world monetization of AI and cloud investments. Rather than treating technology as a single macro trade, markets are now differentiating between infrastructure providers, platform owners, and application-layer beneficiaries, making selectivity and structural understanding more important than ever.

US Tech Stocks Market Performance in 2025 and Outlook for 2026

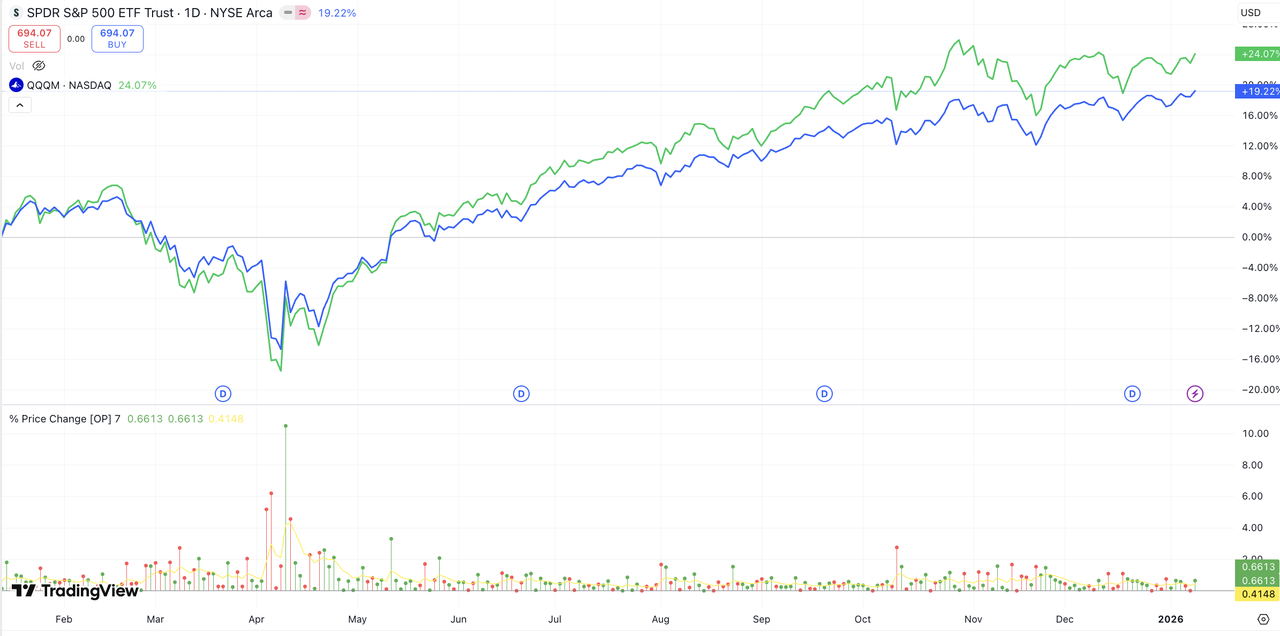

By the end of 2025, US technology stocks had firmly established themselves as the primary driver of equity market performance, though returns varied significantly across subsectors and individual companies. The Nasdaq Composite and

Nasdaq-100, both heavily weighted toward technology, software, semiconductors, and internet platforms, finished the year up roughly 24%, while the more diversified S&P 500, which represents a wider range of sectors across the US economy, gained around 19%. Market leadership remained highly concentrated, with AI- and cloud-exposed mega-cap stocks accounting for a disproportionate share of index-level gains.

Performance dispersion widened beneath the surface. Infrastructure and

AI-linked companies such as NVIDIA and Broadcom continued to benefit from sustained data-center investment, while platform companies including Alphabet, Microsoft, and Meta Platforms saw renewed confidence tied to AI monetization and operating leverage. In contrast, more mature consumer-facing tech names such as Apple and Amazon delivered steadier but more moderate returns, reflecting margin normalization and already elevated valuations. Entering 2026, US tech stocks remained market leaders, but no longer moved in lockstep.

What Are the Key Drivers Shaping US Tech Stocks in 2026?

Following strong but uneven gains in 2025, US tech stocks enter 2026 in a more selective phase. Performance is increasingly driven by execution quality and outcomes across the technology and digital infrastructure stack.

1. AI spending shifted toward monetization: After heavy AI investment in 2025, focus has moved to converting AI spending into revenue and margins across semiconductors, cloud services, and AI-enabled platforms.

2. Software, cloud, and semiconductor margins came under scrutiny: Investors are paying closer attention to margin sustainability across core tech segments. Software and platform companies are evaluated on operating leverage and pricing power, while semiconductor and infrastructure players face scrutiny around capital intensity, utilization, and return on investment.

3. Storage, data-center, and energy efficiency reshaped the tech stack: Performance is no longer driven by “tech” as a single category. Infrastructure providers, platform owners, and application-layer companies are increasingly differentiated by their exposure to data-center buildouts,

storage and networking demand,

energy consumption efficiency, and capital requirements within AI and cloud value chains.

4. Tech stocks became more macro-sensitive: Large US tech companies are increasingly influenced by interest rates, enterprise IT budgets, and global investment cycles, reinforcing their role as core portfolio holdings rather than pure growth trades.

What Are the 9 Best Tokenized US Tech Stocks to Watch in 2026?

As US tech stocks enter a more selective phase in 2026, leadership is increasingly concentrated among companies positioned at the center of AI, cloud, and digital infrastructure spending cycles. Here are the top tokenized tech stocks to watch this year:

| Company |

Ticker |

Market Cap (Jan 12, 2026) |

Rank (US) |

Core Focus (2026) |

| NVIDIA |

NVDA |

~$4.50T |

#1 |

AI data-center GPUs, accelerated compute, energy-efficient AI infrastructure |

| Alphabet |

GOOGL |

~$3.97T |

#2 |

Search and YouTube advertising, AI monetization, Google Cloud AI services |

| Apple |

AAPL |

~$3.83T |

#3 |

Consumer ecosystem, services monetization, on-device and privacy-focused AI |

| Microsoft |

MSFT |

~$3.56T |

#4 |

Enterprise software, Azure cloud, AI across productivity and infrastructure |

| Amazon |

AMZN |

~$2.64T |

#5 |

AWS cloud infrastructure, enterprise AI workloads, logistics efficiency |

| Meta Platforms |

META |

~$1.75T |

#6 |

Digital advertising platforms, AI-driven ad optimization, social graphs |

| Broadcom |

AVGO |

~$1.30T |

#7 |

Networking silicon, custom chips, data-center connectivity, infrastructure software |

| Tesla |

TSLA |

~$1.20T |

#8 |

EVs, autonomy software, AI training systems, energy storage |

| Palantir |

PLTR |

~$0.65T |

#18 |

Enterprise and government AI analytics, application-layer AI deployment |

1. NVIDIA (NASDAQ: NVDA)

Market Cap: ~$4.50T (as of Jan 12, 2026)

Rank: #1 among publicly listed US companies

NVIDIA remained one of the most influential US tech stocks in 2025, driven by strong demand for its data-center GPUs, the core hardware behind AI infrastructure. In fiscal 2026, ending January 2026, NVIDIA reported $57 billion in revenue, with data-center sales up 66% year over year, reflecting continued hyperscaler and enterprise investment.

Entering 2026, focus has shifted to scalability and energy efficiency. NVIDIA’s next-generation Vera Rubin platform, unveiled at CES 2026, targets up to five times higher performance with improved energy efficiency and is expected in the second half of the year. As data-center buildouts expand, power and energy constraints further position NVIDIA as a bellwether for AI GPU demand.

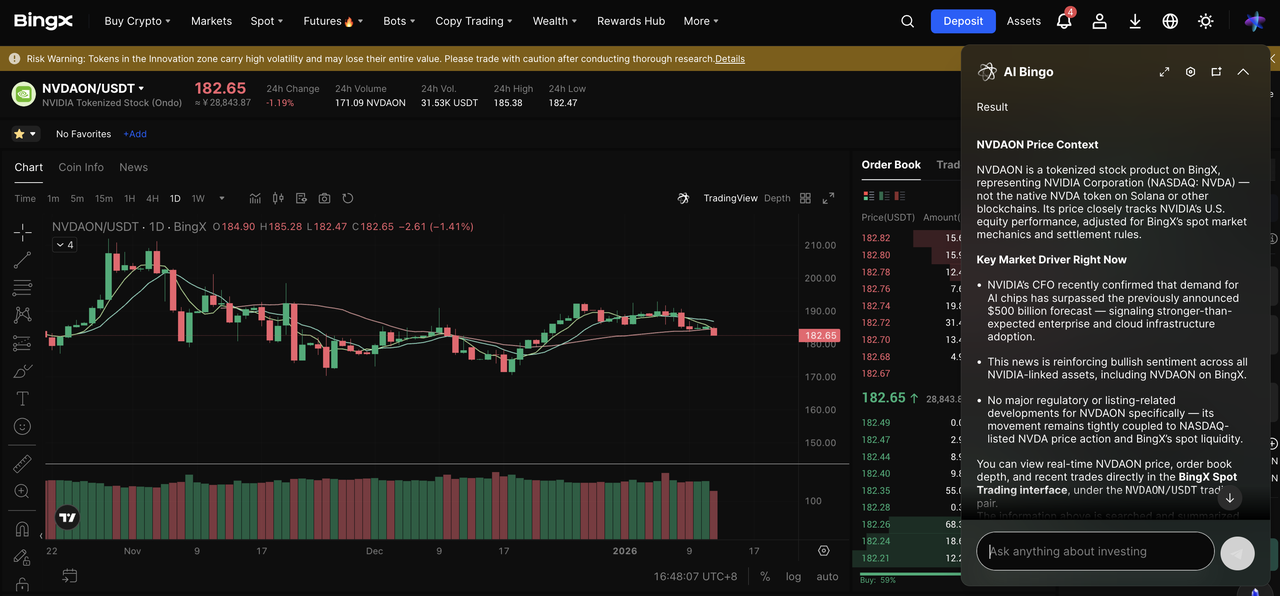

Alternative: Nvidia Tokenized Stocks (NVDAX, NVDAON)

For crypto-native investors, NVIDIA exposure is also available through tokenized stock products such as

NVDAX and

NVDAON, which track NVDA’s price performance on-chain. These instruments allow trading with stablecoins and integration into a broader crypto portfolio, but they do not provide shareholder rights and rely on issuer and platform structures rather than direct equity ownership.

2. Alphabet Google (NASDAQ: GOOGL)

Market Cap: ~$3.97T (as of Jan 12, 2026)

Rank: #2 among publicly listed US companies

Alphabet remained a core US tech leader in 2025, supported by resilient Search and YouTube advertising, which continue to account for the majority of its revenue. While advertising growth remained steady, investor focus increasingly shifted toward how AI integration could enhance search experiences, ad formats, and long-term platform defensibility.

Entering 2026, Alphabet’s outlook is defined by AI monetization at scale. The company is embedding generative AI directly into Search, including AI-powered summaries and shopping features, while Google Cloud continues to expand its enterprise AI offerings. Markets are closely watching whether Alphabet can sustain advertising economics while accelerating cloud growth and margin expansion, positioning it as a platform-level AI beneficiary rather than a pure infrastructure play.

Alternative: Google Tokenized Stocks (GOOGLX, GOOGLON)

Alphabet is also available through tokenized stock products such as

GOOGLX and

GOOGLON, which provide blockchain-based price exposure to GOOGL shares. These instruments do not confer shareholder rights and carry issuer, platform, and regulatory risks, making them a complementary option rather than a substitute for direct equity ownership.

3. Apple (NASDAQ: AAPL)

Market Cap: ~$3.83T (as of Jan 12, 2026)

Rank: #3 among publicly listed US companies

Apple remained one of the most resilient US tech leaders in 2025, supported by its massive installed device base and steadily growing services revenue. While iPhone growth was more mature compared with earlier cycles, high-margin businesses such as the App Store, subscriptions, and payments continued to provide stable cash flow, reinforcing Apple’s position as a platform-driven ecosystem rather than a pure growth stock.

Entering 2026, Apple is focusing on AI-enabled ecosystem upgrades rather than cloud infrastructure. Its Apple Intelligence features emphasize on-device processing, privacy, and system-level integration, aiming to support user engagement, services monetization, and incremental upgrade cycles. This positions Apple as a consumer-facing AI platform rather than an infrastructure or cloud-first player.

Alternative: Apple Tokenized Stocks (AAPLX, AAPLON)

Apple tokenized stocks such as

AAPLX and

APPLON, provide a crypto-based way to gain exposure to AAPL’s market performance. These instruments are commonly used by investors seeking fractional exposure or stablecoin-based settlement, but they remain structurally different from owning Apple shares through regulated equity markets.

4. Microsoft (NASDAQ: MSFT)

Market Cap: ~$3.56T (as of Jan 12, 2026)

Rank: #4 among publicly listed US companies

Microsoft remained one of the most strategically positioned US tech companies in 2025, supported by recurring revenue across enterprise software, cloud services, and productivity platforms. Azure continued to grow strongly into late 2025, while Microsoft’s dominance in enterprise licensing and subscriptions provided stable cash flow and operating leverage, reinforcing its role as a core institutional holding.

Entering 2026, Microsoft’s outlook is increasingly shaped by AI integration across the enterprise stack. The company is embedding generative AI into Office, Windows, GitHub, and Azure, positioning AI as a usage-driven revenue accelerator rather than a standalone product. At the same time, heavy investment in AI data centers, networking, and energy infrastructure has drawn closer scrutiny of margins and capital efficiency, making Microsoft a bellwether for how large-scale AI deployment translates into sustainable enterprise monetization.

Alternative: Microsoft Tokenized Stocks (MSFTON)

Microsoft is available via tokenized stock products like

MSFTON, enabling price exposure to MSFT within a crypto trading environment. While these instruments offer accessibility and trading flexibility, they do not represent direct ownership in Microsoft and are subject to platform, issuer, and regulatory considerations.

5. Amazon (NASDAQ: AMZN)

Market Cap: ~$2.64T (as of Jan 12, 2026)

Rank: #5 among publicly listed US companies

Amazon remained a core US tech heavyweight in 2025, supported by steady improvement in retail margins and continued strength in AWS. Cost discipline across fulfillment and logistics helped stabilize profitability, while advertising services within Amazon’s commerce ecosystem continued to grow, reinforcing diversification beyond core retail operations.

Entering 2026, Amazon’s outlook is increasingly driven by cloud, AI, and infrastructure efficiency. AWS remains central to the company’s long-term valuation, with investor focus on enterprise AI workloads, data storage, and compute demand tied to generative AI adoption. At the same time, markets are watching how rising capital expenditure on data centers, networking, and energy consumption impacts margins, positioning Amazon as both a cloud infrastructure leader and a bellwether for AI-related capex cycles.

Alternative: Amazon Tokenized Stocks (AMZNON)

Tokenized Amazon stocks such as

AMZNON allow investors to track AMZN’s price movements using crypto pairs. These products are often used for tactical positioning or diversification within digital asset portfolios, rather than long-term ownership or participation in Amazon’s corporate actions.

6. Meta Platforms (NASDAQ: META)

Market Cap: ~$1.75T (as of Jan 12, 2026)

Rank: #6 among publicly listed US companies

Meta remained one of the strongest-performing large-cap US tech stocks in 2025, driven by a rebound in digital advertising efficiency and disciplined cost control. Engagement across Facebook, Instagram, and WhatsApp stayed resilient, while improved ad targeting and pricing supported margin recovery, reinforcing Meta’s position as a core platform in global digital advertising.

Entering 2026, Meta’s outlook centers on AI-driven ad optimization and platform monetization. The company continues to deploy AI across content ranking, recommendation systems, and ad delivery, positioning AI as a direct driver of revenue efficiency rather than a standalone product. At the same time, ongoing investment in AI infrastructure and Reality Labs remains under scrutiny, making Meta a bellwether for balancing AI-led growth with capital discipline.

Alternative: Meta Tokenized Stocks (METAX, METAON)

Meta exposure is also available through tokenized stocks like

METAX and

METAON, which mirror META’s price performance on-chain. These instruments appeal to traders and crypto-native investors but do not convey shareholder benefits and may experience different liquidity conditions than traditional markets.

7. Broadcom (NASDAQ: AVGO)

Market Cap: ~$1.30T (as of Jan 12, 2026)

Rank: #7 among publicly listed US companies

Broadcom became a key US tech beneficiary in 2025 as demand rose for networking silicon, custom chips, and data-center connectivity tied to AI expansion. Its semiconductor business benefited from hyperscaler investment in AI data centers, while its infrastructure software segment contributed stable, high-margin recurring revenue, supporting earnings resilience.

Entering 2026, Broadcom’s outlook is anchored in AI-driven data-center infrastructure, particularly high-speed interconnects, switches, storage connectivity, and custom silicon. As AI workloads scale, demand for data movement and networking has become as critical as compute itself, positioning Broadcom as a picks-and-shovels supplier alongside GPU-focused players.

Alternative: Broadcom Tokenized Stocks (AVGOON)

Broadcom tokenized stocks such as

AVGOON provide crypto-based access to AVGO’s market performance, particularly appealing to investors seeking exposure to AI infrastructure suppliers without using equity brokers. As with all tokenized equities, they remain derivative instruments rather than direct share ownership.

8. Tesla (NASDAQ: TSLA)

Market Cap: ~$1.20T (as of Jan 12, 2026)

Rank: #8 among publicly listed US companies

Tesla remained one of the most debated US tech stocks in 2025, as the company navigated slowing EV price growth alongside continued expansion in energy storage and software-related revenue. While vehicle margins faced pressure from pricing competition, Tesla’s scale, vertical integration, and global manufacturing footprint continued to differentiate it from traditional automakers.

Entering 2026, Tesla’s outlook increasingly centers on software, autonomy, and energy infrastructure rather than vehicle volumes alone. Progress in Full Self-Driving deployment, AI-driven training infrastructure, and large-scale energy storage projects has shifted investor focus toward Tesla’s long-term platform potential. As AI, robotics, and energy systems converge, markets continue to view Tesla as a hybrid between an automaker and an AI-enabled infrastructure company, with execution remaining the key variable.

Alternative: Tesla Tokenized Stocks (TSLAX, TSLAON)

Tesla tokenized stocks including

TSLAX and

TSLAON offer a way to gain TSLA price exposure within crypto markets, where Tesla is often treated as a high-volatility, narrative-driven asset. These products are frequently used for active trading rather than long-term equity-style holding.

9. Palantir (NYSE: PLTR)

Market Cap: ~$0.65T (as of Jan 12, 2026)

Rank: Among the top publicly listed US software companies

Palantir emerged as one of the strongest-performing US software stocks in 2025, driven by accelerating demand for its AI-driven data analytics platforms across government and commercial customers. The company’s Artificial Intelligence Platform (AIP) gained traction among enterprises seeking to operationalize large language models on proprietary data, helping Palantir transition from a government-centric contractor to a broader enterprise software provider.

Entering 2026, Palantir’s outlook centers on enterprise AI deployment and operating leverage. Unlike infrastructure-focused AI plays, Palantir sits at the application layer, enabling organizations to integrate AI into real-world decision-making, logistics, and operations. Markets are watching whether continued AIP adoption can sustain revenue growth while expanding margins, positioning Palantir as a software-native beneficiary of the AI cycle rather than a hardware or cloud infrastructure proxy.

Alternative: Palantir Tokenized Stocks (PLTRON)

Palantir is available through tokenized stock products such as

PLTRON, enabling exposure to PLTR’s price movements on-chain. Given Palantir’s positioning as an enterprise AI software company, these instruments are often used by investors looking to express thematic AI views within crypto portfolios rather than hold traditional software equities.

How to Invest in US Tech Stocks: A Step-by-Step Guide

Investors today have multiple ways to gain exposure to leading US technology companies, ranging from traditional equity ownership to crypto-native trading instruments. Each approach offers a different balance between ownership rights, accessibility, flexibility, and risk, making it important to choose the method that best fits your investment goals and experience level.

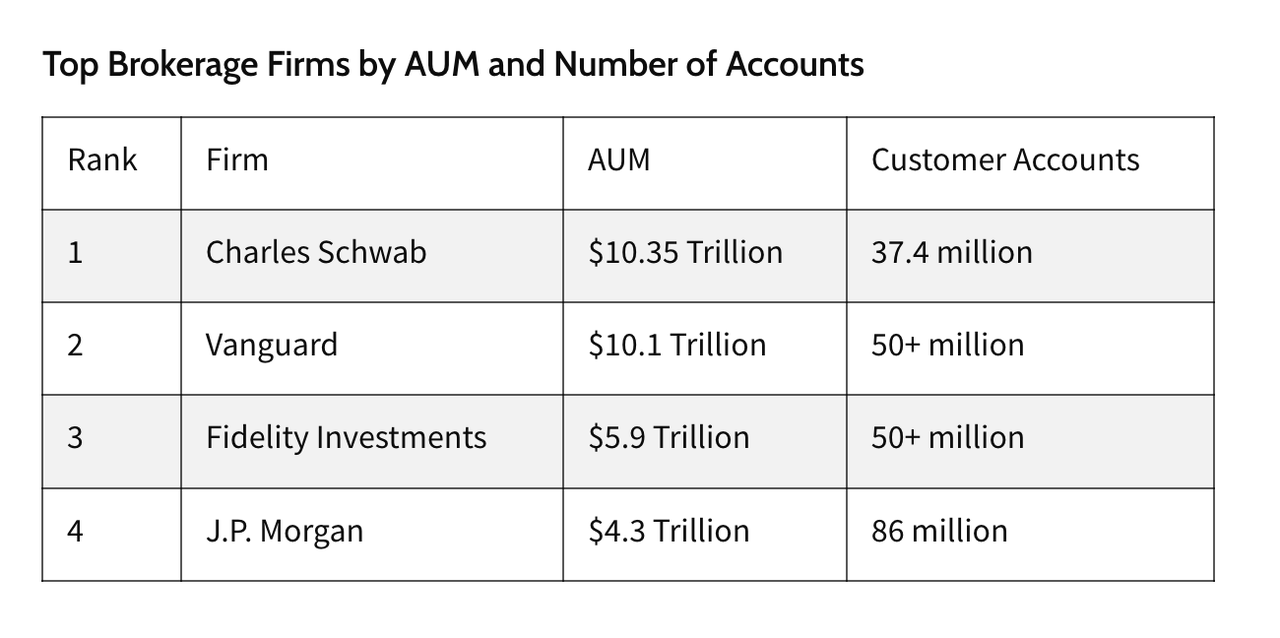

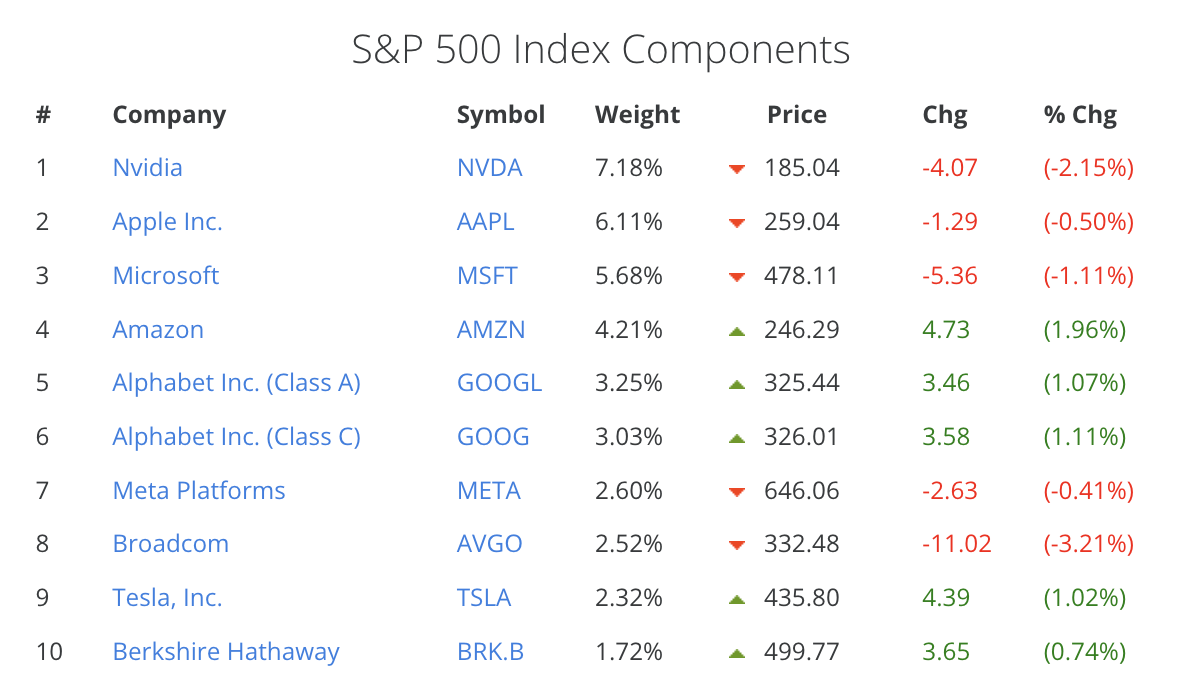

1. Buy US Tech Stocks Through a Traditional Brokerage

Purchasing US tech stocks through a regulated brokerage is the most established approach and closely mirrors how investors buy conventional equities. This method is typically preferred by long-term investors who want direct ownership of shares, voting rights where applicable, and exposure to dividends or stock buybacks.

Major US tech stocks such as NVIDIA, Alphabet, Apple, Microsoft, Amazon, Meta, Broadcom, and Tesla are all listed on US exchanges and can be accessed through mainstream brokerage platforms.

Source: Investopedia

Step 1: Open an account with a regulated brokerage such as Fidelity, Charles Schwab, Robinhood, eToro, or Webull.

Step 2: Complete identity verification, fund your account, and submit any required tax documentation.

Step 3: Search for the stock ticker and purchase full or fractional shares based on your budget.

Step 4: Consider factors such as taxes, currency conversion costs, and cross-border investment rules.

This route offers the highest level of ownership and regulatory clarity, but may involve higher friction for non-US investors and limited trading hours.

2. Buy US Tech Tokenized Stocks on BingX

Tokenized US tech stocks provide a blockchain-based way to access equity price exposure without relying on a traditional brokerage account. These assets are designed to track the economic performance of publicly listed US companies while being traded and held on crypto-native platforms.

For investors already active in crypto markets, BingX tokenized stocks allow exposure to major US tech companies to be managed alongside digital assets using stablecoins. With support from

BingX AI, users can monitor market trends, volatility, and price dynamics within a single trading interface.

Step 2: Deposit USDT into your Spot wallet using a supported network.

Tokenized stocks do not confer shareholder rights and carry issuer, platform, and regulatory risks, but they offer greater accessibility, fractional exposure, and crypto-native settlement.

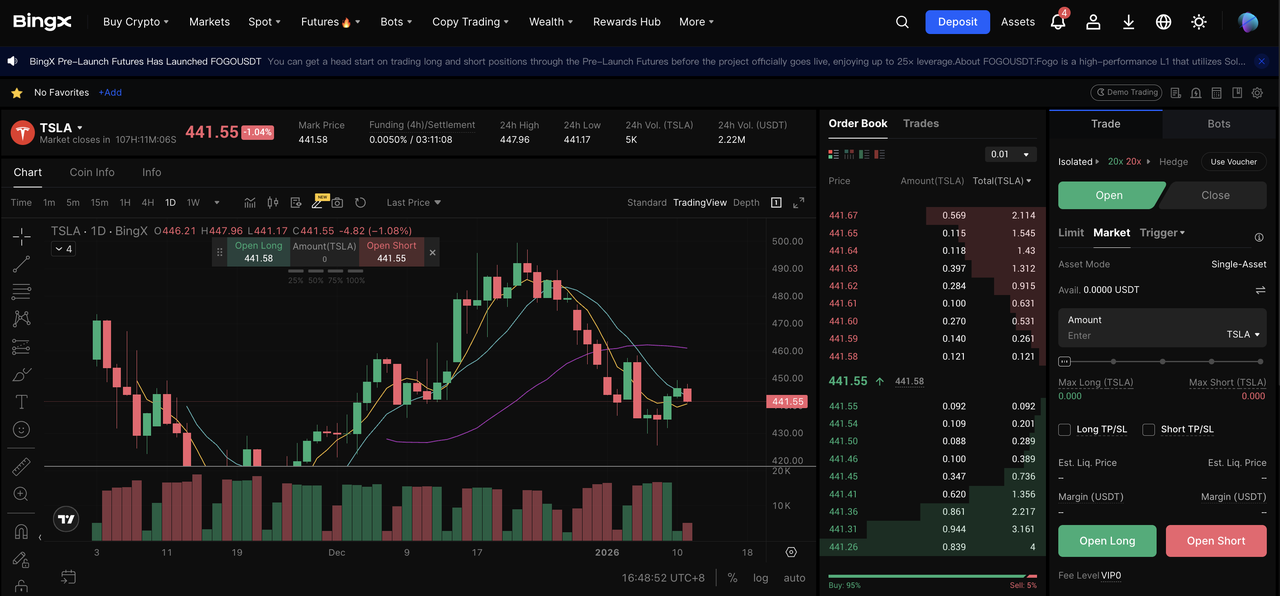

3. Trade US Tech Stock Price-Linked Futures on BingX TradFi

Stock price-linked futures are derivative contracts that allow traders to speculate on the price movements of US tech stocks without holding shares or tokenized assets. On

BingX TradFi, these products support both long and short positions and are commonly used for short-term trading, hedging, or tactical positioning.

Because futures involve leverage and liquidation mechanics, they are generally more suitable for experienced traders with active risk management strategies.

Step 3: Choose a long or short position and set leverage according to your risk tolerance.

Step 4: Monitor margin requirements, liquidation levels, and market movements in real time.

This approach offers maximum flexibility and capital efficiency but also carries higher risk due to leverage.

Risks and Considerations Before Investing in Tokenized US Tech Stocks

While US tech tokenized stocks expand access to equity price exposure, they also introduce risks that differ from traditional stock ownership. Understanding these factors is essential before investing.

1. No direct share ownership: Tokenized stocks typically provide economic price exposure only and do not include shareholder rights such as voting, dividends, or participation in corporate actions.

2. Issuer and structural risk: These instruments rely on issuing structures, custodians, and counterparties to accurately track the underlying US-listed stock, introducing dependencies beyond the public market itself.

3. Liquidity and pricing differences: On-chain liquidity may differ from traditional exchanges, which can result in wider spreads, lower depth, or temporary price deviations during periods of high volatility.

4. Regulatory uncertainty: Tokenized equities operate at the intersection of securities regulation and crypto markets, where rules continue to evolve across jurisdictions and may affect availability or trading conditions.

5. Crypto market volatility: Because tokenized stocks trade within crypto-native environments, broader crypto market movements can amplify short-term price fluctuations independent of company fundamentals.

Taken together, US tech tokenized stocks are best viewed as a complementary investment format, rather than a replacement for traditional equity ownership. Investors should consider their risk tolerance, investment horizon, and familiarity with tokenized structures before allocating capital.

Final Thoughts

US technology stocks remain central to global markets in 2026, but leadership is increasingly selective. Performance now depends less on broad tech momentum and more on each company’s position within the AI, cloud, and digital infrastructure stack, with greater emphasis on fundamentals, capital efficiency, and sustainable monetization.

At the same time, investors have more ways to gain exposure. Alongside traditional equity ownership, tokenized stocks and stock-linked futures offer additional flexibility and accessibility, especially for crypto-native participants. Each approach carries different trade-offs, making it essential for investors to align their strategy with their risk tolerance, investment horizon, and understanding of the instruments involved.

Related Reading