Bitcoin remains one of the most talked-about assets in finance, bridging traditional markets and crypto. While owning Bitcoin directly through exchanges and wallets is common, not every investor wants to handle custody, private keys, or exchanges themselves. That’s where spot Bitcoin ETFs come in, as regulated financial products that track Bitcoin’s price by holding the asset itself and trade like stocks on major exchanges.

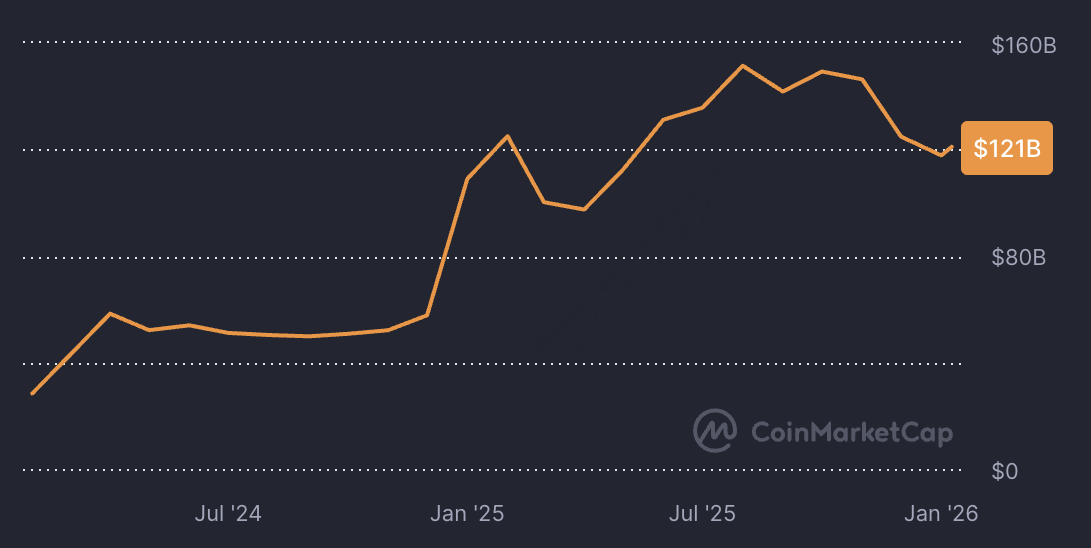

Total AUM of spot Bitcoin ETFs | Source: Coinmarketcap

Spot Bitcoin ETFs first launched in the United States in January 2024 and have since become one of the fastest-growing ETF categories in history. From launch through early 2026, U.S. spot Bitcoin ETFs have attracted over $110 billion in cumulative net inflows, with total assets under management peaking above $150 billion during the 2025 Bitcoin rally and holding above $121 billion as of January 2026. This rapid capital adoption reflects strong institutional demand, deep liquidity, and the credibility of issuers such as BlackRock, Fidelity, and Grayscale, positioning spot Bitcoin ETFs as a core gateway for traditional investors seeking regulated Bitcoin exposure.

This guide walks you through the top spot Bitcoin ETFs to watch in 2026, including how they work, what to consider when choosing one, and which funds stand out this year.

What Is a Spot Bitcoin ETF (Exchange Traded Fund) and How Does It Work?

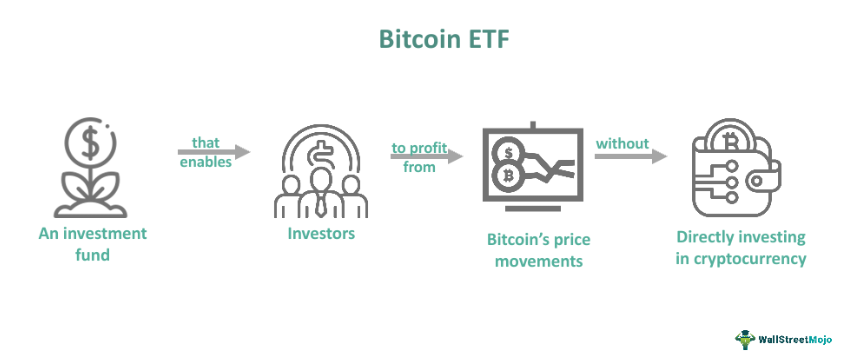

How Bitcoin ETFs work | Source: WallStreetMojo

A spot Bitcoin ETF is a regulated investment fund that lets you gain exposure to Bitcoin’s real-time market price without buying or

storing Bitcoin yourself. Instead of holding shares in a company, the ETF directly holds physical Bitcoin in secure custody on behalf of investors.

When you buy shares of a spot Bitcoin ETF through a stock brokerage account, you effectively own a proportional claim on the Bitcoin held by the fund. For example, if Bitcoin rises by 1%, the ETF’s share price is designed to rise by roughly the same amount, minus a small annual management fee, typically 0.15%–0.25% per year.

Spot Bitcoin ETFs trade on major U.S. exchanges like NASDAQ and NYSE, meaning you can buy or sell them during regular market hours just like stocks or traditional ETFs. The fund issuer, such as BlackRock or Fidelity, handles Bitcoin custody, security, and compliance, removing the need for crypto wallets, private keys, or blockchain transactions.

What Are the Best Spot Bitcoin ETFs to Buy in 2026?

1. BlackRock's iShares Bitcoin Trust (IBIT)

• Ticker: IBIT

• Issuer: BlackRock (iShares)

• Launch: January 2024

• Structure: Physically backed spot Bitcoin ETF

The iShares Bitcoin Trust (IBIT) is the largest and most liquid spot Bitcoin ETF globally, and it has effectively become the benchmark product for institutional Bitcoin exposure. Since its launch in January 2024, IBIT has accumulated over $70 billion in assets under management, accounting for more than half of all U.S. spot Bitcoin ETF assets as of early 2026.

IBIT has also been the most actively traded Bitcoin ETF since launch, regularly posting daily trading volumes in the billions of dollars. This depth of liquidity translates into consistently tight bid–ask spreads, which helps reduce implicit trading costs, an important advantage for both institutional desks and active traders.

From an infrastructure standpoint, IBIT is managed by BlackRock, the world’s largest asset manager, and uses Coinbase Prime as its institutional custodian. This setup combines BlackRock’s ETF and

risk-management expertise via its Aladdin platform with

Coinbase’s large-scale crypto custody operations, addressing two of the biggest concerns for traditional investors: security and operational reliability.

IBIT is designed to remove the tax, custody, and operational complexity of holding Bitcoin directly. Investors gain price exposure through a familiar exchange-traded product without managing wallets, private keys, or

on-chain transactions.

Investor Profile

IBIT is best suited for:

• Institutional investors seeking large-scale Bitcoin exposure

• Active traders who benefit from high liquidity and low spreads

• Long-term allocators prioritizing fund stability and issuer credibility

Pros

• Largest AUM among spot Bitcoin ETFs

• Deepest liquidity and highest trading volume

• Backed by BlackRock with institutional-grade custody via Coinbase Prime

Cons

• Expense ratio is slightly higher than some smaller or “mini” Bitcoin ETFs, which may matter for long-term buy-and-hold investors focused purely on fee minimization

2. Fidelity Wise Origin Bitcoin Fund (FBTC)

• Ticker: FBTC

• Issuer: Fidelity Investments

• Launch: January 2024

• Structure: Physically backed spot Bitcoin fund

The Fidelity Wise Origin Bitcoin Fund (FBTC) is one of the most widely held and institutionally trusted spot Bitcoin ETFs in the U.S. market. Since launch, FBTC has attracted over $18 billion in assets under management, placing it consistently among the top three spot Bitcoin ETFs by AUM, behind only BlackRock’s IBIT and Grayscale’s products.

FBTC’s key differentiator is vertical integration. Unlike most spot Bitcoin ETFs that rely on third-party custodians, FBTC uses Fidelity Digital Assets®, Fidelity’s in-house, regulated crypto custody platform, to store its Bitcoin. This reduces counterparty complexity and appeals to investors who prioritize custody transparency, operational control, and long-term institutional reliability.

From a trading perspective, FBTC offers intraday liquidity with no lockups, trading on major U.S. exchanges with healthy daily volumes and competitive bid–ask spreads. While it does not match IBIT’s sheer trading depth, FBTC remains sufficiently liquid for most retail and professional investors, including those allocating via retirement accounts.

Fidelity’s early and sustained involvement in digital assets also strengthens FBTC’s positioning. The firm has been researching Bitcoin since 2014, launched institutional crypto custody services in 2018, and expanded into digital asset asset management well before spot ETFs were approved. This decade-long track record gives FBTC credibility with advisors and conservative allocators entering crypto for the first time.

Investor Profile

FBTC is best suited for:

• Long-term investors seeking Bitcoin exposure through a trusted traditional financial institution

• Advisors allocating Bitcoin within retirement accounts like IRAs and 401(k)s

• Investors who value in-house custody and operational conservatism over ultra-low fees

Pros

• Backed by Fidelity, a global asset manager with 70+ years of market experience

• Bitcoin custody handled internally via Fidelity Digital Assets®

• Strong AUM and reliable liquidity for long-term allocation

Cons

• Expense ratio is slightly higher than ultra-low-fee alternatives like Grayscale’s Bitcoin Mini Trust, which may matter for fee-sensitive buy-and-hold investors

3. Bitwise Bitcoin ETF (BITB)

• Ticker: BITB

• Issuer: Bitwise Investment Advisers

• Launch: January 10, 2024

• Structure: Physically backed spot Bitcoin ETF

The Bitwise Bitcoin ETF (BITB) stands out as one of the most cost-efficient and transparent spot Bitcoin ETFs in the U.S. market. As of January 2026, BITB manages approximately $3.53 billion in assets under management, holding around 38,900 BTC directly in trust and offering 1:1 spot Bitcoin exposure.

BITB charges a 0.20% sponsor fee, placing it below the category average and making it particularly attractive for investors who plan to hold Bitcoin exposure over multiple years, where fee drag becomes more meaningful. For comparison, a 0.05%–0.10% annual fee difference can compound into a noticeable return gap over long time horizons.

From a trading perspective, BITB offers solid liquidity despite its smaller size. The fund averages over 3.3 million shares in daily trading volume, with a 30-day median bid–ask spread of just 0.02%, indicating efficient price discovery and low transaction friction for both retail and professional investors.

BITB is also notable for its proof-of-reserves transparency. The fund publishes daily independent examinations confirming that Bitcoin reserves exceed trust net assets, helping reduce concerns around custody and backing. Bitcoin is held with Coinbase Custody, while Bank of New York Mellon serves as the trust custodian, combining crypto-native custody with traditional financial infrastructure.

Performance tracking has been tight since inception. As of year-end 2025, BITB delivered a since-inception return of around 38%, with minimal divergence between NAV (net asset value) and market price, reinforcing its effectiveness as a true spot Bitcoin vehicle rather than a proxy with structural drag.

Investor Profile

BITB is best suited for:

• Long-term Bitcoin investors focused on lower fees and accurate price tracking

• Portfolio builders allocating Bitcoin alongside other ETFs

• Investors who value transparency and proof-of-reserves disclosures

Pros

• Lower-than-average expense ratio of 0.20%

• Tight bid–ask spreads and efficient tracking

• Daily proof-of-reserves and institutional-grade custody

Cons

• Smaller AUM and lower liquidity than mega-funds like IBIT or FBTC, which may matter for very large institutional trades

4. ARK 21Shares Bitcoin ETF (ARKB)

• Ticker: ARKB

• Issuer: ARK Invest & 21Shares

• Launch: January 10, 2024

• Structure: Physically backed spot Bitcoin ETF

The ARK 21Shares Bitcoin ETF (ARKB) represents a hybrid approach to spot Bitcoin exposure, combining ARK Invest’s innovation-driven investment philosophy with 21Shares’ crypto-native ETF expertise. As of early January 2026, ARKB manages approximately $3.6 billion in assets under management, placing it firmly in the mid-tier of U.S. spot Bitcoin ETFs, below mega-funds like IBIT and FBTC, but comparable to Bitwise’s BITB.

ARKB tracks the CME CF Bitcoin Reference Rate – New York Variant, a widely used institutional benchmark, and holds 100% of assets in Bitcoin stored in cold storage with a qualified custodian. This structure delivers direct spot price exposure while removing the operational burden of wallet management, private keys, and on-chain security for investors.

A key catalyst for ARKB’s retail adoption was its 3-for-1 share split in 2025, which lowered the per-share trading price and made the ETF more accessible to smaller investors without changing the fund’s underlying economics. Since the split, ARKB has maintained tight price alignment, trading within ±0.5% of NAV on 100% of recent trading days, and posting a 30-day median bid-ask spread of around 0.03%, indicating efficient market-maker participation despite its smaller size.

From a performance standpoint, ARKB closely mirrors Bitcoin’s spot price movements. As of September 2025, the ETF posted a 79% one-year return and a 69% return since inception, with minimal tracking divergence between NAV and market price, confirming its effectiveness as a pure spot Bitcoin vehicle rather than a thematic proxy.

ARKB’s appeal also lies in brand positioning. For investors already familiar with ARK’s innovation-focused ETFs (such as ARKK or ARKW), ARKB serves as a complementary Bitcoin allocation within a broader “disruptive innovation” portfolio framework, rather than a purely fee- or liquidity-optimized product.

Investor Profile

ARKB is best suited for:

• Investors seeking innovation-oriented Bitcoin exposure aligned with ARK’s long-term thesis

• Retail investors who benefited from improved affordability after the share split

• Portfolios where Bitcoin is treated as a strategic diversifier, not a trading instrument

Pros

• Competitive expense ratio at 0.21%

• Improved accessibility following the 3-for-1 share split

• Strong NAV tracking and low bid-ask spreads for its size

Cons

• Mid-tier AUM and trading volume compared with dominant funds like IBIT and FBTC, which may matter for very large or high-frequency trades

5. VanEck Bitcoin ETF (HODL)

• Ticker: HODL

• Issuer: VanEck

• Launch: January 4, 2024

• Structure: Physically backed spot Bitcoin ETF

The VanEck Bitcoin ETF (HODL) is designed for investors seeking simple, institutionally backed Bitcoin exposure with an emphasis on cost efficiency. As of January 8, 2026, HODL manages approximately $1.42 billion in total net assets, positioning it as a smaller but established player within the U.S. spot Bitcoin ETF landscape.

A key differentiator for HODL in 2026 is its temporary fee waiver structure. From November 25, 2025 through July 31, 2026, VanEck has waived the entire sponsor fee on the first $2.5 billion of assets. If assets exceed that threshold during the waiver period, only the portion above $2.5 billion is charged a 0.20% fee, with all investors paying a weighted-average effective fee. After July 31, 2026, the sponsor fee standardizes at 0.20%, placing HODL competitively among mid-fee spot Bitcoin ETFs.

Structurally, HODL is a pure passive vehicle. It seeks only to track the spot price of Bitcoin minus expenses, without leverage, derivatives, or active strategies. The fund holds 100% physical Bitcoin in cold storage with a qualified custodian, removing custody and security complexity for investors while preserving direct price linkage.

From a performance standpoint, HODL delivered a YTD return of around 3.8% as of early January 2026, closely tracking Bitcoin’s spot market movements. While its trading volume and liquidity are lower than dominant funds like IBIT or FBTC, HODL remains sufficiently liquid for long-term allocators who prioritize holding over frequent trading.

VanEck’s long-standing presence in the ETF industry, particularly in commodities,

gold ETFs, and alternative assets, adds an additional layer of issuer credibility, appealing to investors who prefer experienced ETF sponsors with crypto-adjacent expertise.

Investor Profile

HODL is best suited for:

• Cost-sensitive investors seeking temporary zero-fee exposure

• Long-term Bitcoin holders prioritizing simplicity and issuer credibility

• Portfolios using Bitcoin as a strategic alternative asset, not a trading instrument

Pros

• Sponsor fee waived on first $2.5B of assets through July 2026

• Simple, passive spot Bitcoin tracking with physical backing

• Issued by VanEck, a seasoned ETF provider

Cons

• Smaller AUM and lower trading volume than top-tier funds

• Less attractive for high-frequency traders who rely on ultra-deep liquidity

Spot Bitcoin ETFs vs. Futures Bitcoin ETFs: What’s the Difference in 2026?

The key difference between spot Bitcoin ETFs and futures-based Bitcoin ETFs lies in how they gain exposure to Bitcoin’s price. Spot Bitcoin ETFs hold actual Bitcoin in custody, while

futures Bitcoin ETFs track Bitcoin indirectly using cash-settled futures contracts that must be rolled over regularly.

Because spot ETFs own Bitcoin outright, they tend to track Bitcoin’s market price more accurately over time. Futures ETFs, by contrast, often experience tracking slippage due to contract roll costs, contango, and periodic rebalancing, especially during volatile or sideways markets.

From a performance perspective, this structural gap has been measurable. Since spot Bitcoin ETFs launched in January 2024, they have consistently shown tighter tracking and lower long-term drag compared with futures-based products. For example, in 2025, leading spot ETFs closely mirrored Bitcoin’s annual return, while the largest futures-based ETF lagged by several percentage points due to rollover costs.

In 2026, spot Bitcoin ETFs are widely viewed as the preferred vehicle for investors seeking:

• Direct, long-term exposure to Bitcoin’s price

• Lower structural costs over multi-year holding periods

• Simpler portfolio integration without derivatives risk

Futures Bitcoin ETFs may still appeal to short-term traders or tactical strategies, but for most investors aiming to hold Bitcoin as a strategic allocation, spot ETFs offer a more efficient and transparent structure.

As always, your choice should align with your investment horizon, risk tolerance, and overall portfolio strategy. If you’re uncertain, consider seeking guidance from a qualified financial advisor before allocating capital.

How to Choose the Best Spot Bitcoin ETF: An Investor Checklist

When evaluating spot Bitcoin ETFs, focus on these core factors that directly affect cost, liquidity, and risk:

1. Expense Ratio: This is the annual management fee charged by the fund, and lower expense ratios generally improve long-term returns by reducing ongoing cost drag.

2. Assets Under Management (AUM): Larger funds typically attract more institutional participation, resulting in stronger liquidity and more efficient price discovery.

3. Liquidity and Trading Volume: Higher daily trading volume usually leads to tighter bid–ask spreads and lower transaction costs when buying or selling shares.

4. Issuer Reputation: ETFs issued by established financial institutions tend to benefit from more robust operational infrastructure, regulatory experience, and risk management systems.

5. Custody and Security: The quality of the ETF’s Bitcoin custodian is critical, as it determines how securely the underlying assets are stored and safeguarded against operational or cyber risks.

How to Buy Spot Bitcoin ETFs

Buying a spot Bitcoin ETF follows the same process as investing in traditional stock or index ETFs, making it accessible even for first-time investors:

1. Open a brokerage account that supports U.S.-listed ETFs, such as accounts offered by major online brokers.

2. Deposit funds into your account using cash or bank transfer before placing any trades.

3. Search for the ETF by its ticker symbol (for example, IBIT, FBTC, or BITB) to review pricing, fees, and liquidity.

4. Place a buy order during market hours, choosing between a market order for instant execution or a limit order to control your entry price.

Before investing, confirm that your broker offers the specific ETF you want, as not all platforms support every spot Bitcoin ETF.

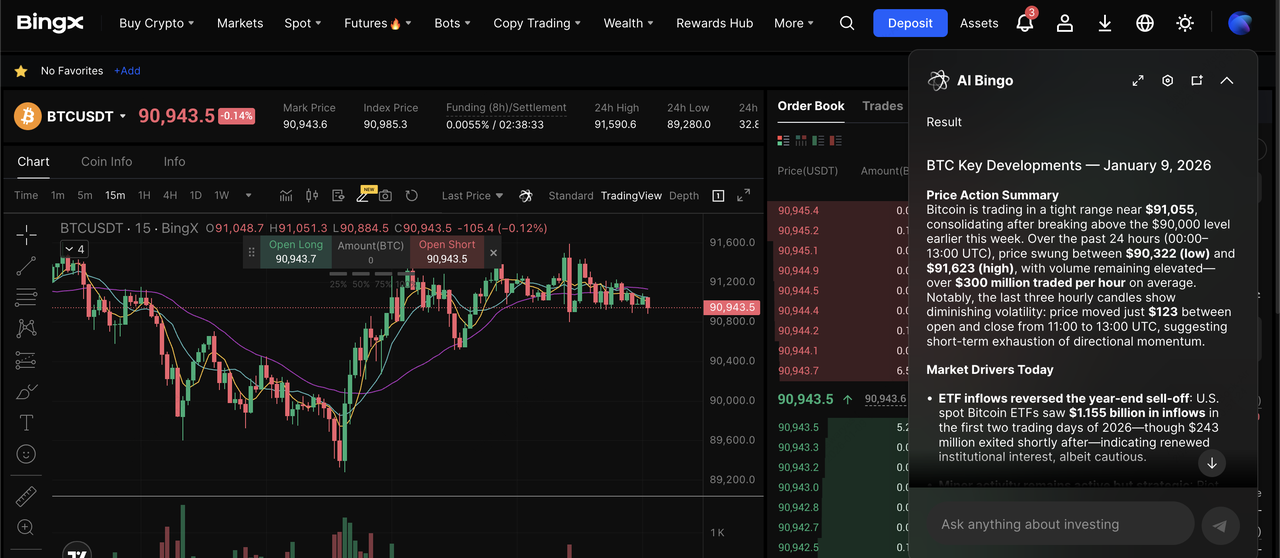

Other Ways to Invest in Bitcoin: Trade BTC on BingX

While spot Bitcoin ETFs offer regulated exposure through traditional brokers, trading Bitcoin (BTC) directly on BingX provides greater flexibility, deeper market access, and more active control over your strategy. Unlike ETFs, limited to market hours, fixed fees, and passive price tracking, BingX lets you trade BTC 24/7, access real-time global liquidity, and use advanced tools such as

BingX AI insights to analyze trends, manage risk, and identify opportunities across spot and derivatives markets.

BingX also removes ETF-related constraints like annual expense ratios, NAV premiums/discounts, and custody layers. Instead, you get direct exposure to BTC, faster execution, and multiple ways to tailor risk, from simple spot buying to futures and automated DCA strategies, supported by AI-driven market signals, risk alerts, and strategy optimization.

Buy, Sell, or Hold BTC on the Spot Market

BTC/USDT trading pair on the spot market powered by BingX AI insights

Spot trading is best for beginners and long-term investors who want direct BTC ownership without leverage, making it suitable for holding through multiple market cycles.

1. Create and verify your BingX account.

2. Deposit funds like

USDT or supported fiat methods.

4. Place a market order for instant buy or limit order to set your price.

Long or Short BTC Futures with Leverage

BTC/USDT perpetual contract on the futures market powered by BingX AI

Futures trading is best for experienced traders seeking short-term opportunities or portfolio hedging, allowing you to profit in both rising and falling markets with precise risk controls and AI-assisted insights.

1. Enable Futures Trading in your account.

2. Transfer funds to your futures wallet.

4. Set leverage, stop-loss, and take-profit, guided by BingX AI risk tools.

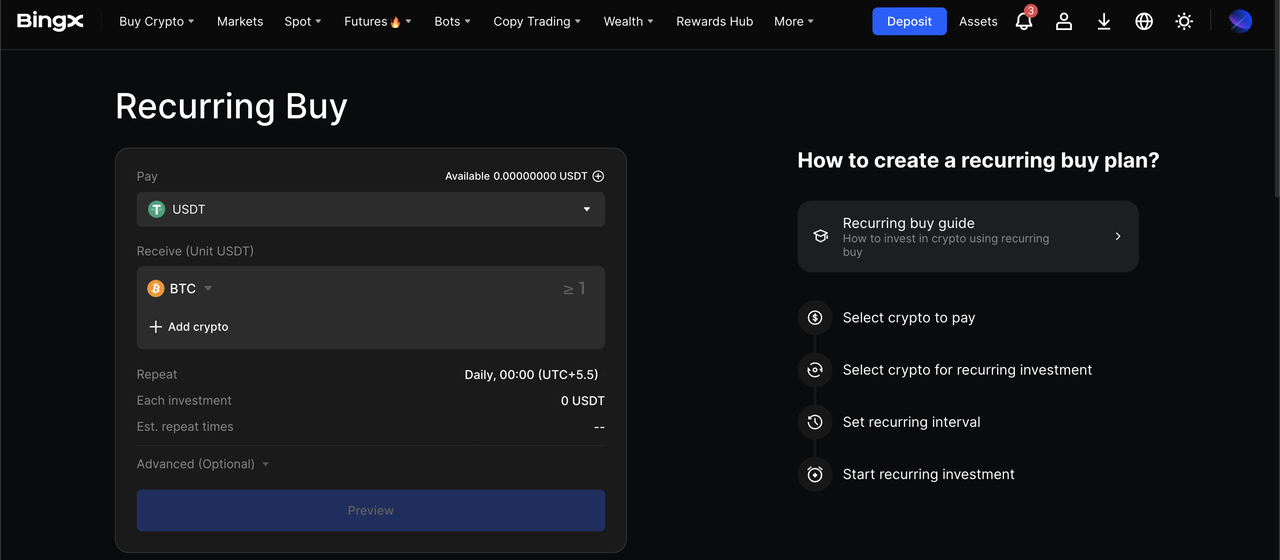

Automate BTC Accumulation with DCA on BingX

How to DCA Bitcoin with BingX Recurring Buy

Dollar-cost averaging (DCA) Bitcoin is best for investors focused on steadily building BTC exposure over time, as it reduces timing risk and helps smooth volatility through automated, disciplined investing.

2. Select BTC and choose your investment amount and frequency like daily/weekly.

3. Activate the plan and let automation handle execution.

If you want 24/7 access, lower structural costs, AI-powered insights, and flexible strategies, trading BTC directly on BingX offers advantages that Bitcoin ETFs can’t match, especially for active traders and long-term accumulators alike.

Conclusion: Should You Invest in Spot Bitcoin ETFs in 2026?

Spot Bitcoin ETFs have significantly lowered the barrier for mainstream investors to gain regulated exposure to Bitcoin, and in 2026 they remain one of the most accessible entry points into the asset class. Leading options such as iShares Bitcoin Trust (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC), and Grayscale Bitcoin Mini Trust (BTC) stand out for their liquidity, cost efficiency, and institutional backing, making them well-suited for traditional portfolios seeking Bitcoin exposure without direct custody.

That said, spot Bitcoin ETFs remain fully exposed to Bitcoin’s inherent price volatility, and their performance will continue to rise and fall with broader crypto market cycles. Before investing, carefully assess your risk tolerance, time horizon, and portfolio allocation, as crypto-related assets may not be suitable for every investor.

For those who want greater flexibility, 24/7 market access, and more active control, trading BTC directly on BingX can be a compelling alternative to ETFs. BingX allows you to trade Bitcoin on the spot and futures markets, automate long-term accumulation through DCA strategies, and leverage BingX AI-powered insights to support data-driven decision-making, without ETF expense ratios or trading-hour limitations. As always, conduct independent research or consult a financial advisor to ensure your chosen approach aligns with your financial goals in 2026.

Related Reading