A

stablecoin “depeg” is when a $1-pegged coin trades meaningfully away from $1. It happens due to liquidity shocks, reserve/counterparty issues, oracle/exchange quirks, code/mechanism failures, or a loss of confidence. Depegs can be brief (cents off $1) or catastrophic (pennies on the dollar). To reduce risk: diversify across stablecoins/issuers, favor transparent reserves and deep liquidity, cap allocation, know your redemption routes, and set pre-planned exit rules.

When “stable” coins lose their stability, the entire crypto market feels it. Stablecoins are meant to be safe havens, digital dollars for traders, DeFi users, and investors. Yet history shows that even the most trusted ones can break their peg. During the October 2025 flash crash, over $3.8 billion in stablecoin value briefly swung off parity across major exchanges, underscoring how quickly confidence can fracture under stress.

In this guide, we explain why a stablecoin depegs, examples of famous incidents, how it affects crypto portfolios, and what you can do to stay protected during stablecoin depegging events.

What Is a Stablecoin Depeg?

A stablecoin depeg happens when a coin designed to stay at $1 trades meaningfully away from that price, for example, $0.90 or $1.10, and fails to recover quickly. When a depeg lasts for hours or days, it can ripple across DeFi, trading, and lending markets, undermining confidence in the broader crypto ecosystem.

Minor fluctuations of less than 1% are common, but prolonged gaps or sharp drops signal real stress. According to Moody’s, more than 1,900 depeg events occurred between early 2020 and mid-2023, with 609 coming from large-cap stablecoins.

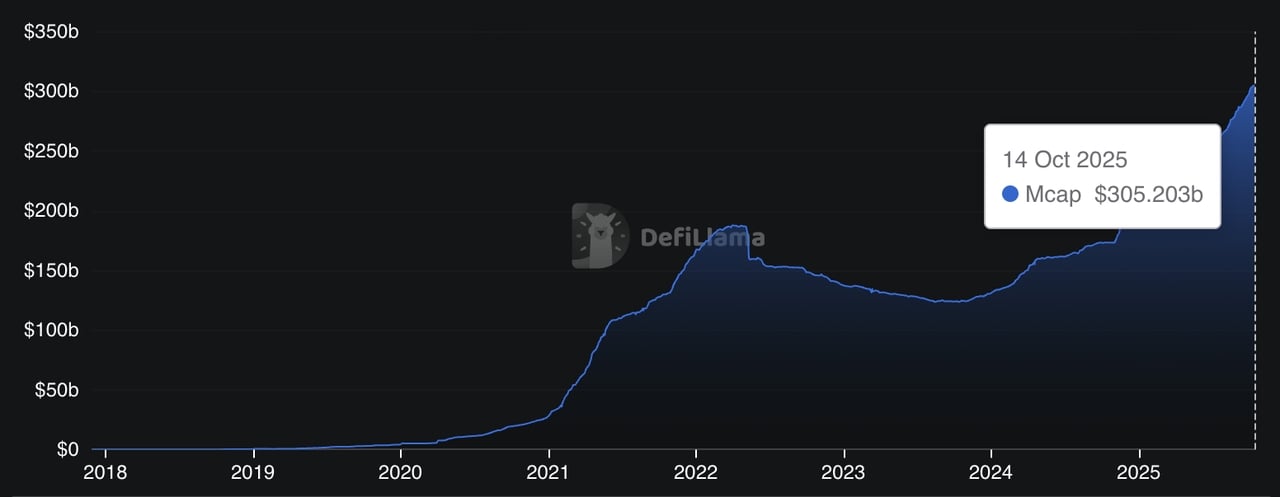

Total market cap of stablecoins | Source: DefiLlama

As of October 2025, the stablecoin market has grown to over $305 billion, largely dominated by fiat-backed issuers like

Tether (USDT) and

USD Coin (USDC), according to OCBC. Yet stability isn’t guaranteed; Moody’s recorded 1,914 depeg events through mid-2023, with 609 involving major stablecoins, most brief but a few catastrophic such as UST and USDR. Notably, USDC’s Silicon Valley Bank scare in March 2023 sent its price down to $0.8789 before rebounding after deposit assurances, while the Terra UST/LUNA collapse in 2022 erased tens of billions and permanently damaged confidence in algorithmic models.

How Stablecoins Maintain Their Peg

To understand why depegs happen, it helps to know how pegs are maintained.

1. Fiat-Backed Stablecoins

These hold traditional assets like U.S. dollars, Treasury bills, or cash equivalents in reserve. Each coin is ideally redeemable 1:1. Examples include

USDT and USDC. Arbitrageurs buy when price < $1 and redeem, or sell/mint when price > $1, keeping the peg tight.

2. Crypto-Collateralized Stablecoins

Protocols like

DAI use over-collateralized crypto assets. For every $1 DAI minted, there might be $1.50+ in

ETH or staked assets locked. If collateral value drops, automated liquidations maintain solvency.

3. Algorithmic or Synthetic Stablecoins

Algorithmic stablecoins rely on smart-contract rules and secondary tokens to balance supply and demand. They can scale fast but depend on market confidence; if that breaks, the peg collapses.

4. Hybrid or RWA-Backed Stablecoins

Some newer stablecoins hold

tokenized real-world assets like real estate or short-term bonds. While transparent, their liquidity can vanish during redemption waves, exposing holders to depeg risk.

Why Stablecoins Depeg: 6 Common Triggers

Stablecoins can lose their peg for many reasons, often triggered by a mix of liquidity stress, technical flaws, or market panic. Here are six of the most common causes behind stablecoin depegs:

1. Liquidity shock: This occurs when a surge in redemptions drains a stablecoin’s reserves or on-chain liquidity pools, temporarily pushing its price below $1. For example, USDR fell to around $0.51 in October 2023 after its liquid DAI buffer was depleted during mass withdrawals.

2. Reserve or counterparty risk: When stablecoin reserves are held in banks or custodians that face insolvency or regulatory freezes, user confidence collapses. A notable case was USDC in March 2023, which plunged to $0.8789 after $3.3 billion of its backing was trapped in Silicon Valley Bank.

3. Mechanism failure: Algorithmic stablecoins depend on internal mint-and-burn mechanisms that can fail when redemptions accelerate, causing the system to spiral downward. The best-known example is Terra UST, which collapsed in May 2022, wiping out tens of billions as its peg mechanism broke.

4. Oracle or exchange glitch: Faulty data feeds or thin exchange orderbooks can misprice stablecoins, making them appear depegged even if collateral remains intact. In October 2025, Ethena’s USDe briefly dropped to $0.65 on Binance due to a local pricing glitch, though it quickly recovered elsewhere.

5. New-coin liquidity gap: Newly launched stablecoins often lack deep liquidity and redemption pathways, making them unstable during initial trading. For instance, USST slipped to $0.96 within hours of its launch as thin liquidity and speculative selling overwhelmed early markets.

6. Market panic or macro stress: Broader sell-offs or global uncertainty can trigger simultaneous redemptions across multiple stablecoins, deepening market instability. During the October 2025 downturn, several leading stablecoins briefly deviated from their peg as investors rushed to liquidate positions.

Even the most robust stablecoins can depeg if several of these factors hit at once.

Real-World Examples of Stablecoin Depegs

Let’s look at some notable cases and what they teach investors.

1. Ethena USDe: October 2025

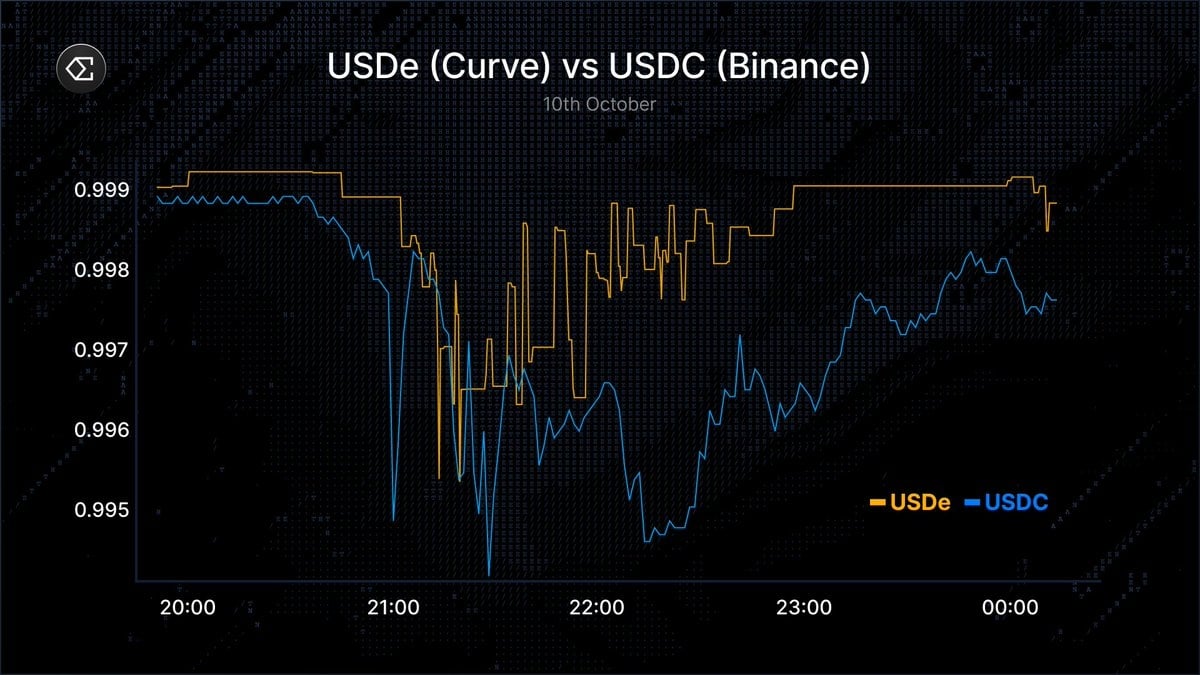

USDe on Curve and Binance | Source:

X

During a sharp market downturn in October 2025,

Ethena’s synthetic stablecoin USDe briefly fell to $0.65 on Binance, even as it traded near parity on other platforms. The issue stemmed from Binance’s internal pricing oracle, which relied on thin orderbook data rather than deeper liquidity indices. Despite the dramatic chart,

Ethena confirmed that its delta-hedged reserves remained fully collateralized and redemptions were unaffected. The peg recovered within an hour, highlighting how exchange-specific oracle errors can trigger false depegs in volatile markets.

2. STBL USST: October 2025

USST depeg | Source: TradingView

Shortly after launch, the USST stablecoin from the STBL protocol slipped to about $0.96, driven by thin liquidity and early speculative selling. The lack of deep market-making support made the new token vulnerable to slippage and arbitrage delays. In response, STBL partnered with Ondo Finance to back USST with up to $50 million worth of USDY, a tokenized U.S. Treasury yield asset, improving collateral transparency and redemption credibility. This episode showed how early-stage stablecoins often face depth and trust gaps before stabilizing.

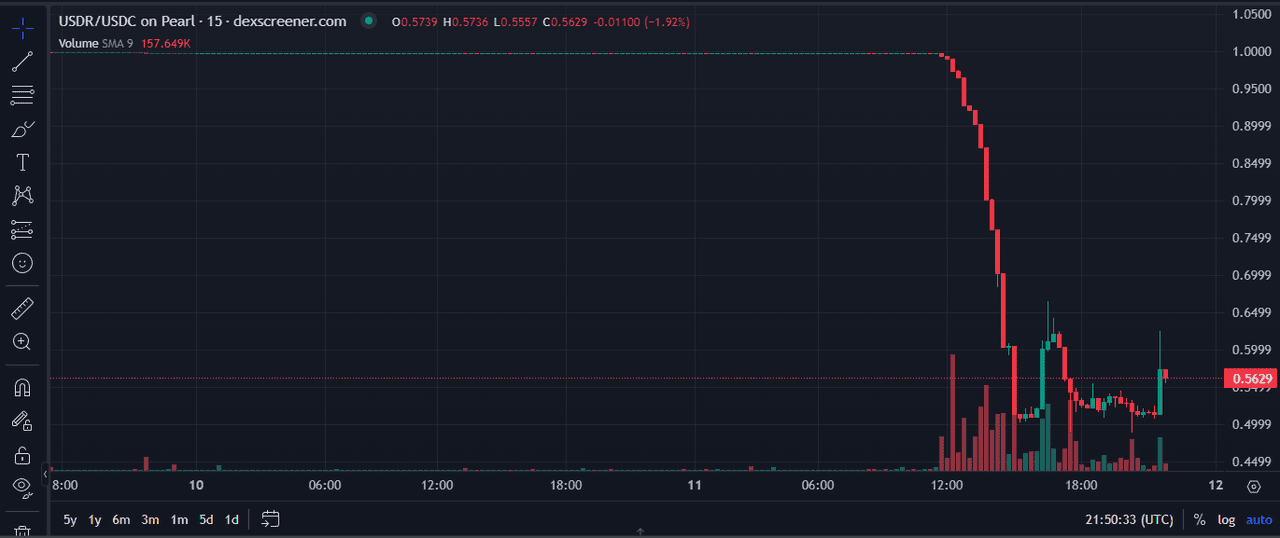

3. Real USD (USDR), Tangible Protocol: October 2023

USDR depeg | Source: Cointelegraph

In October 2023, USDR, a stablecoin backed by tokenized real estate and DAI, fell to around $0.51 after mass redemptions exhausted its DAI buffer. The remaining collateral, mostly illiquid real estate tokens, could not be sold quickly enough to honor withdrawals, trapping value on-chain. Despite being overcollateralized on paper, the peg collapsed due to a mismatch between asset liquidity and redemption speed. The case highlighted that “backed” doesn’t always mean “liquid,” and stablecoins tied to real-world assets can still fail under redemption stress.

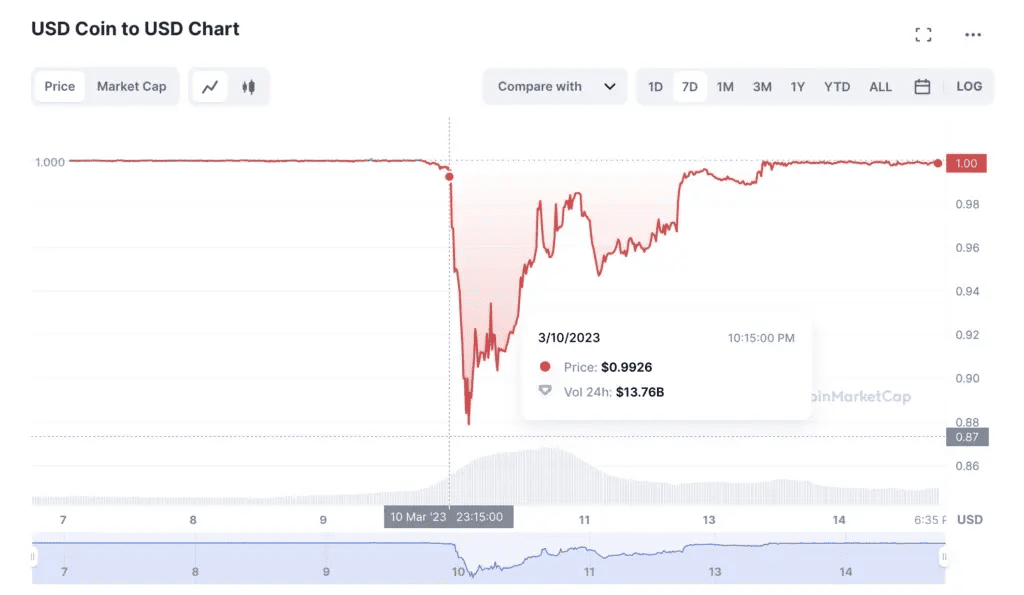

4. USD Coin (USDC): March 2023

USDC depeg | Source: Cybrid

In March 2023, $3.3 billion of USDC’s $40+ billion reserves were temporarily trapped at Silicon Valley Bank following its sudden collapse. Panic selling sent USDC’s price to $0.8789, wiping billions in market value within hours. Once regulators guaranteed SVB deposits, USDC swiftly regained its peg, though its supply shrank by around $1.9 billion overnight as redemptions surged. The incident underscored how even fiat-backed stablecoins face counterparty and banking concentration risk, emphasizing the need for diversified custodial relationships.

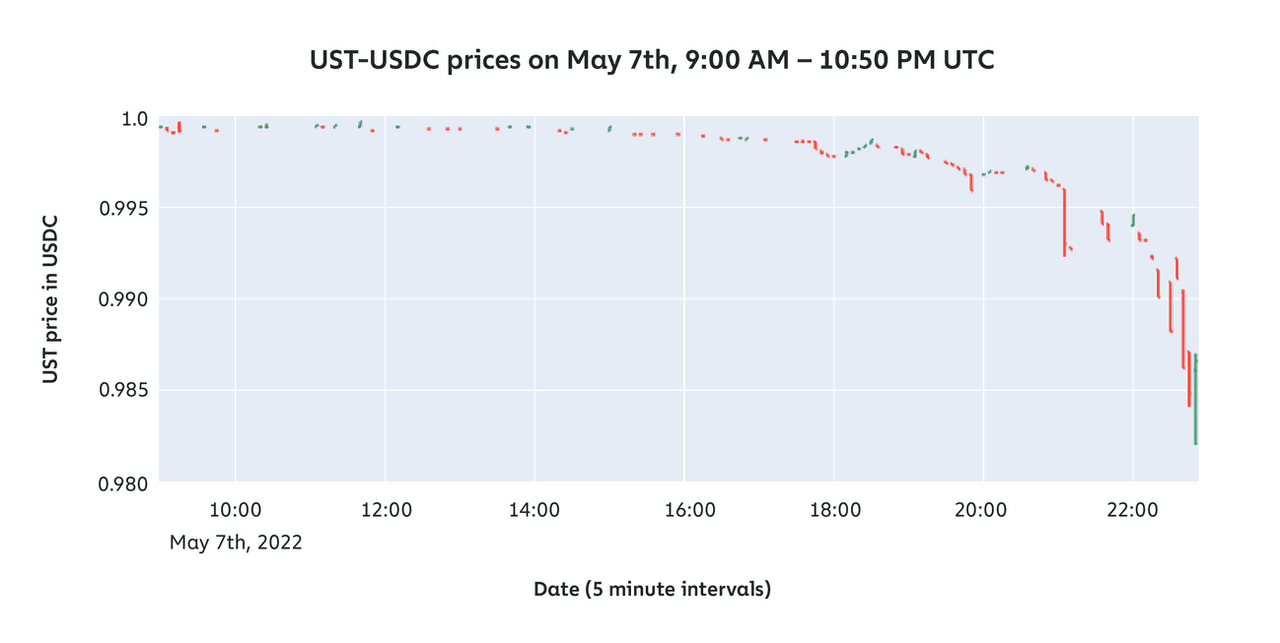

5. Terra UST / LUNA: May 2022

UST depeg | Source: Chainalysis

The collapse of Terra’s algorithmic UST remains the most destructive stablecoin failure to date. When confidence faltered, holders redeemed UST for LUNA en masse, triggering a hyperinflationary feedback loop that crashed both tokens. Within days, UST plunged from $1 to below $0.10, erasing over $40 billion in market capitalization and destabilizing the broader crypto market. The event demonstrated the fatal flaw of purely algorithmic models: when redemptions mint more of a collapsing asset, recovery becomes mathematically impossible.

How Depegging of Stablecoins Impact Crypto Investors

Stablecoin depegs can ripple across the entire crypto ecosystem, affecting not just token holders but also DeFi protocols, exchanges, and market confidence. Here are the main ways they impact investors:

• Capital loss and volatility: When a supposedly stable asset trades below $1, investors face instant losses; for example, a $10,000 position drops by $1,000 if the price falls to $0.90.

• DeFi liquidation chains: Stablecoins serve as key collateral in lending and derivatives markets; even small depegs can trigger cascading liquidations across multiple protocols.

• Liquidity freeze: As market makers pull out during stress, trading spreads widen and redemptions slow, making it expensive or impossible to convert stablecoins back to cash.

• Confidence erosion: Each depeg weakens trust in the system, pushing traders toward “safer” assets and causing temporary liquidity drains in DeFi pools and exchanges.

• Regulatory backlash: High-profile depegs invite scrutiny from regulators, often resulting in stricter compliance rules that can limit trading pairs or DeFi participation.

How to Protect Your Portfolio from Stablecoin Depegs

Stablecoin depegs are unpredictable, but you can reduce their impact by managing risk and diversifying wisely. Here are ten practical steps every trader and DeFi user can take to safeguard their portfolio:

1. Diversify Across Stablecoins: Avoid concentrating all your funds in one asset. Combine a fiat-backed stablecoin like USDC or USDT, a decentralized one like DAI or sDAI, and a small exposure to yield-bearing options such as USDe.

2. Favor Transparency and Depth: Choose stablecoins that offer audited reserves, public collateral data, and deep on-chain liquidity through platforms like

Curve,

Uniswap, or

PancakeSwap.

3. Monitor Reserve and Banking Risks: Stay informed about where reserves are held, whether in banks, Treasuries, or money market funds, and watch for any signs of counterparty stress or regulatory intervention.

4. Set Portfolio Caps: Treat stablecoins as short-term credit instruments, not insured cash. Keep their share within 10–30% of your total holdings depending on your risk appetite.

5. Track Market Depth in Real Time: Watch liquidity metrics on DeFiLlama or Curve; when a pool becomes over 60% weighted to one coin, it signals imbalance and potential depeg pressure.

6. Establish Exit Alerts: Use price alerts for early action; a dip below $0.995 is a warning, and below $0.98 may justify swapping into another stablecoin or major crypto.

7. Verify Redemption Channels: Ensure you can directly redeem stablecoins yourself, not just through institutional partners, since redemption access is often the last safeguard of a peg.

8. Avoid Leverage Using Stablecoins: Leveraged positions or

yield-farming with stables can amplify depeg losses; maintain conservative margin levels and monitor liquidation points closely.

9. Use Hedging Tools Where Available: Experienced users can protect themselves through shorts, options, or delta-neutral positions that offset depeg exposure.

10. Follow Official Announcements: In market turbulence, rely on issuer updates, exchange dashboards, or on-chain data instead of unverified social media claims that can spread panic.

Final Thoughts

Stablecoins are essential for the crypto economy, powering trading pairs, DeFi lending, and on-chain settlements. Yet they are not risk-free. Even top-tier coins can wobble under stress from banking issues, thin liquidity, or oracle malfunctions.

For investors, treating stablecoins as “digital dollars” without risk management is a mistake. The best defense is diversification, transparency, and vigilance; monitor liquidity, track issuer updates, and pre-plan your exit strategy.

In crypto, stability is earned, not assumed.

FAQs on Stablecoin Depegs

1. What does “stablecoin depeg” mean in crypto?

It means a stablecoin’s market price has moved significantly away from its intended value; for example, a $1 coin trading at $0.90.

2. Are all depegs dangerous?

Not necessarily. Small or brief deviations often self-correct through arbitrage. But large, sustained depegs like UST or USDR can destroy value permanently.

3. Which stablecoins depegged recently?

Recent cases include USDe, USST, USDC, UST, and USDR, each caused by different factors such as liquidity gaps, oracle errors, or reserve stress.

4. How can I check if a stablecoin is safe from depegging?

Look for real-time reserve data, third-party attestations, and deep on-chain liquidity. Avoid tokens with unclear backing or untested algorithms.

5. What’s the safest stablecoin type?

Historically, fully fiat-backed stablecoins with audited reserves and robust redemption, such as USDT and USDC, have shown the fastest recovery times after shocks.

Related Reading