This launch couldn't come at a better time for stablecoins, where the total market cap surpassed $300 billion for the first time on October 3, 2025, propelled by advanced regulatory frameworks in the United States and Europe. For

Solana, JupUSD signals a push toward greater self-sufficiency, diminishing dependence on cross-chain bridges and externally issued stablecoins.

What Is JupUSD Stablecoin on Solana?

Launching between mid-October and December 2025, JupUSD will initially draw full collateralization from USDtb, guaranteeing a 1:1 peg to short-term U.S. Treasury instruments for unwavering stability. Later on, JupUSD will mix in USDe to add yield-boosting features through their smart hedging strategy. This setup could let holders earn solid returns without skimping on security.

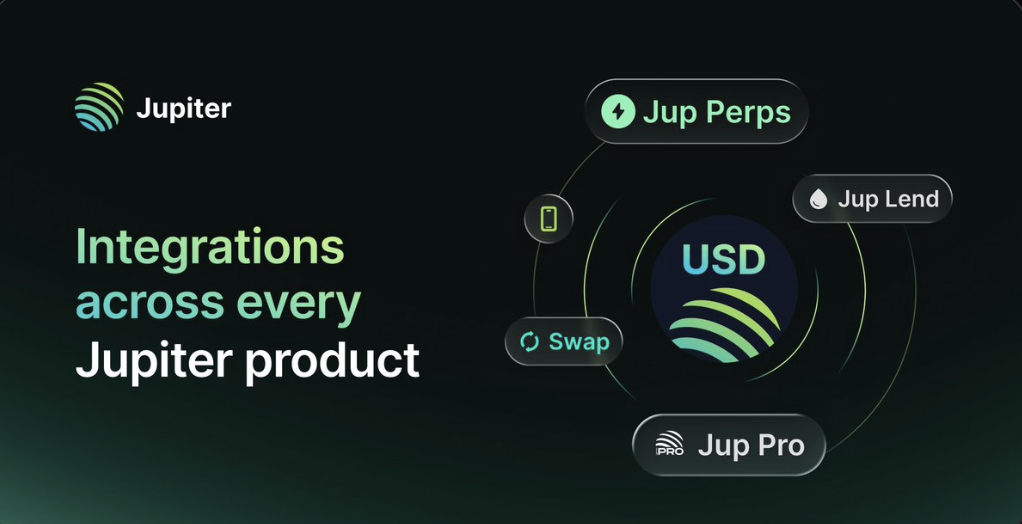

What sets JupUSD apart is its deep integration across Jupiter’s suite of products. On Jupiter Perps, it will function as the primary collateral asset, gradually replacing the existing $750 million in stablecoin liquidity within Jupiter’s pools to enhance efficiency and reduce liquidity fragmentation. Within Jupiter Lend, JupUSD will serve as the core liquidity reserve, supporting the platform’s lending and borrowing operations.

Across the broader trading ecosystem, including Jupiter Swap, Pro, and the mobile app, JupUSD will enable fluid swaps and pair directly with other assets. Looking ahead, integrations with Jupiter features are on the horizon, complete with perks tailored for $JUP token holders. Development of Solana-specific minting and redemption smart contracts is progressing steadily, bolstered by ongoing multi-firm audits to ensure improved reliability as announced on Jupiter's X on October 8th.

The Powerhouses Behind the Partnership: Jupiter and Ethena

As a premier decentralized exchange (DEX) aggregator on the Solana blockchain, Jupiter Exchange has become a major liquidity hub on Solana, managing billions in monthly trading volume through its swap interface, the Jupiter Perps perpetuals platform, and the Jupiter Lend borrowing protocol. As of October 8, 2025, it holds approximately $750 million in stablecoin liquidity across its pools, a portion of which is planned for gradual migration into JupUSD to simplify operations and improve user experience.

Ethena Labs, a leading DeFi protocol built on Ethereum, leverages its experience in the stablecoin sector to drive innovation in decentralized finance. since launch, USDe has facilitated over $16 billion in minting (as of October 8), and by October 9, 2025, it has a market capitalization nearing $15 billion, placing it among the more prominent stablecoins. Its companion token, USDtb, maintains roughly $1.8 billion in value. Ethena employs a delta-neutral hedging strategy to help maintain peg stability while also generating yield, making it a suitable partner for large-scale stablecoin deployments.

This partnership leverages Ethena’s “Stablecoin-as-a-Service” framework, a customizable solution allowing platforms like Jupiter to issue and manage their own branded stablecoins without building every component themselves. Ethena handles critical functions such as backing asset management, redemption processing, and compliance, enabling Jupiter to concentrate on growth and adoption.

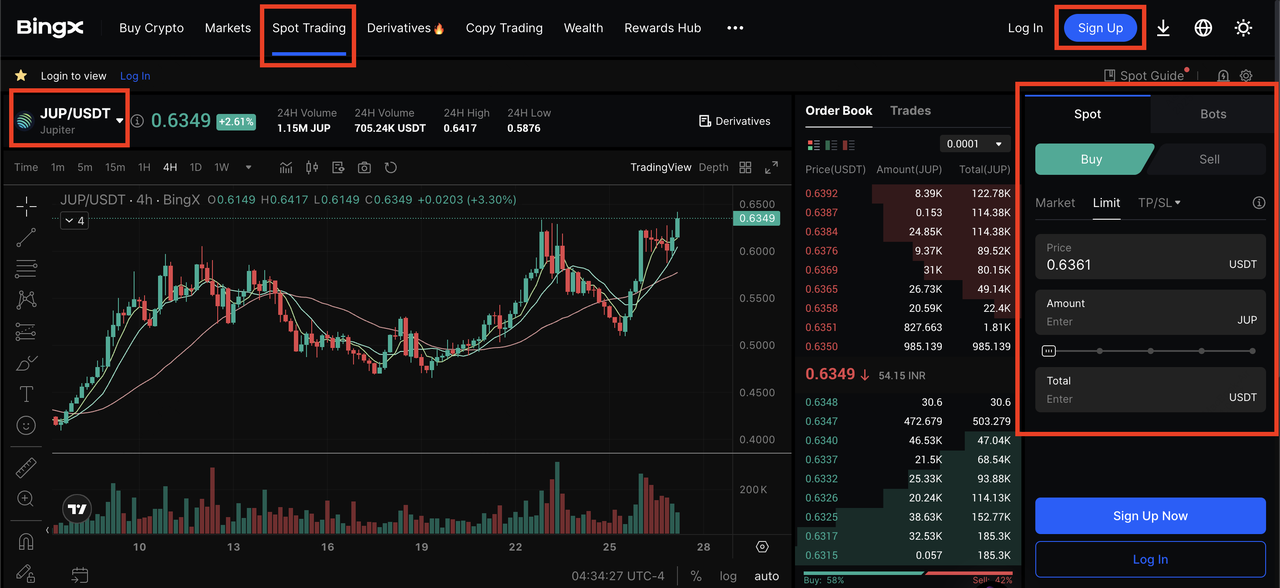

How to Buy Jupiter (JUP) on BingX

Follow these simple steps to buy $JUP on BingX quickly and get ahead of the curve for the impending JupUSD launch:

1. Create a BingX Account: Visit the BingX website or

download the app, register with your email, and set a strong password.

2. Complete Security Settings: verify your email and phone, enable two-factor authentication, and complete

KYC if required.

3. Deposit Funds: Transfer

USDT,

SOL, or another supported asset to your BingX wallet. On-chain deposits are generally more cost-effective than direct credit card purchases.

4. Buy JUP: You can purchase JUP directly on the BingX spot market. Here's our guide to help you

buy JUP tokens on BingX. For

derivatives trading, BingX offers USDT-M and Coin-M futures markets, allowing you to speculate on JUP price movements without holding the token itself.

Storing JUP on BingX

After buying JUP tokens on BingX, store your tokens directly on the BingX platform for convenience and instant access to a wide variety of trading tools. BingX provides institutional-grade security, including cold and hot wallet separation, regular audits, and a 100% Proof of Reserve system to ensure your assets are fully backed.

Conclusion

JupUSD marks a strategic milestone for both Jupiter and the Solana ecosystem, signaling a move toward native, self-sustaining liquidity and stablecoin independence. By leveraging Ethena’s proven “Stablecoin-as-a-Service” framework, Jupiter aims to create a transparent, yield-enabled stablecoin that strengthens trading, lending, and collateral utility across its growing DeFi network. If successful, JupUSD could become a cornerstone for liquidity on Solana, bridging efficiency with institutional-grade stability.

However, as with any emerging stablecoin, users should remain mindful of potential risks, including smart contract vulnerabilities, peg maintenance challenges, and evolving regulatory conditions. Before engaging with JupUSD or related yield programs, it’s important to review official audits, monitor liquidity conditions, and adopt sound risk management practices.

Related Reading