Falcon Finance (FF) is building a universal collateralization infrastructure that lets you post a wide range of liquid assets as collateral to mint a USD-pegged synthetic dollar called USDf, and then convert that liquidity into diversified, risk-managed yield via sUSDf. In practice, you bring assets like

BTC,

ETH,

stablecoins, or select

tokenized RWAs, mint USDf against them, and choose to earn yield by staking into sUSDf. With a current

TVL (total value locked) of around $1.9 billion, the platform demonstrates the substantial amount of collateral already in use within the system.

The design pairs transparent on-chain accounting with institutional execution so collateral stays visible while strategies run where liquidity is deepest. In other words, your BTC, ETH, stablecoins, and approved

RWAs can be mobilized into on-chain dollars and put to work across different market conditions rather than relying on a single spread or venue.

Falcon Finance (FF) | Source: FF Website

What Is Falcon Finance (FF) and How Does It Work?

Falcon Finance is a DeFi protocol that provides a unified collateralization layer. Users can deposit supported assets like stablecoins (USDC, USDT) or crypto tokens (BTC, ETH, SOL) as collateral to mint USDf, a synthetic dollar stablecoin. USDf can then be staked into sUSDf to earn yield. The system uses over-collateralization, minting and redemption mechanisms, and risk controls to keep USDf stable and secure.

• Mechanism: Deposit

supported assets → mint USDf → stake to sUSDf to earn diversified yield.

• Collateral rules: Stablecoins mint 1:1; non-stable assets like BTC/ETH require overcollateralization.

• Architecture: On-chain tracking of collateral and liabilities; execution and hedging on centralized venues via institutional custodians.

• Intent: Keep risk visible on-chain and execution efficient off-exchange; diversify yield sources beyond one trade.

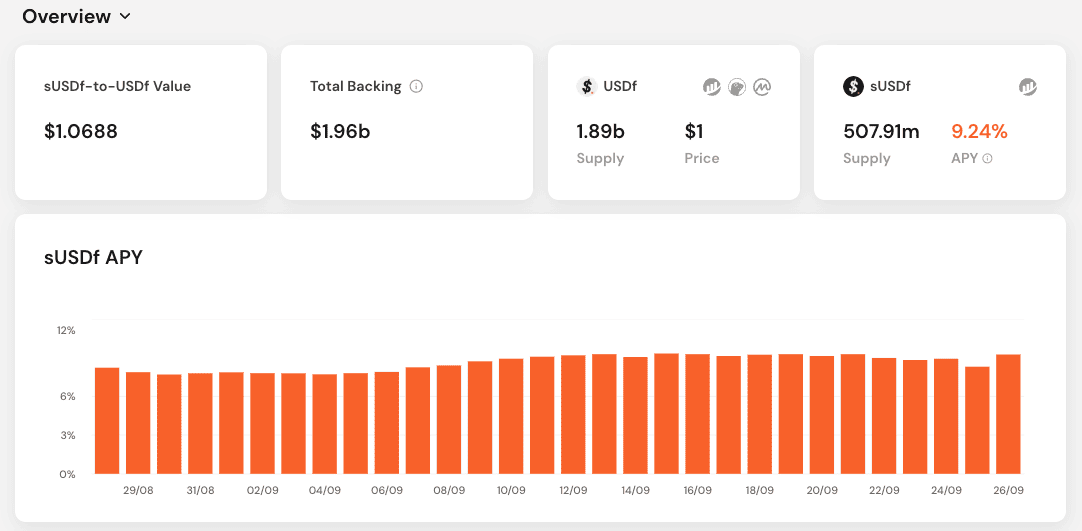

• Live stats: USDf supply is about USD 1.89 billion and holding the $1 peg, backed by roughly USD 1.96 billion in collateral. sUSDf stands near USD 507.91 million, earning around 9.24%

APY. The sUSDf:USDf value is 1.0688, reflecting accrued yield.

• APY trend (Aug 29 to Sep 26): roughly 7 to 8% rising to just over 9%, matching a stable peg, growing sUSDf balances, and a strengthening yield curve.

Falcon Finance Overview | Source: FF Website

Key pieces in one place

• USDf is the overcollateralized dollar you mint against eligible collateral.

• sUSDf is the yield-bearing version of USDf.

• FF is the governance and utility token for the protocol.

How Is Falcon Finance’s Yield Different From Other Yield Coins?

A lot of

DeFi yield products hang on a single opportunity. When

perpetual funding rates are positive, they earn. When funding flips, the engine stalls or worse. Falcon’s pitch is diversification and rotation. The sUSDf strategy set includes positive funding carry, negative funding carry when the sign flips, cross-venue arbitrage, native staking on assets that provide it, and on-chain liquidity provisioning in tier-one pools.

The point is to rely less on one spread and more on a basket that can be dialed up or down as markets change. That will not remove risk, but it should make the source of return less brittle than a one-trade model.

The project describes itself as a universal collateralization layer, which matters for yield because the collateral base is not limited to one coin class. Stablecoins, blue-chip tokens, and approved RWAs can all feed the USDf mint. A broader collateral base and a broader strategy menu can help the yield engine adapt across cycles instead of living and dying with a single exchange or product. Recent coverage cites fast growth in USDf supply and TVL, although those numbers will rise and fall as conditions shift. The bigger takeaway is that Falcon is not trying to win only when one market regime is in play.

Note: Diversifying yield sources can smooth returns, but it does not remove risk. Sharp market moves, execution slippage, liquidity gaps, or counterparty and custody failures can still lead to losses.

What Is Falcon Finance (FF) Utility and Tokenomics?

FF lets holders help govern risk and incentives, offers staking-based boosts and access to new vaults with usage-linked rewards, and is stewarded by the FF Foundation, which manages distributions, listings, audits, and clear unlock schedules.

• Governance: FF holders help set collateral eligibility, minting thresholds, risk caps, and incentive design.

• Utility: Staking/holding FF can boost USDf/sUSDf economics, give access to new vaults or structured mint paths, and earn usage-based rewards (minting,

staking, DeFi integrations).

• Goal: Align user behavior with protocol growth so FF carries real function, not just a label.

• FF Foundation: Manages token distributions, listing support, audits, and ecosystem grants; provides clear unlock schedules while ops teams handle custody, execution, and risk.

Falcon Finance Tokenomics

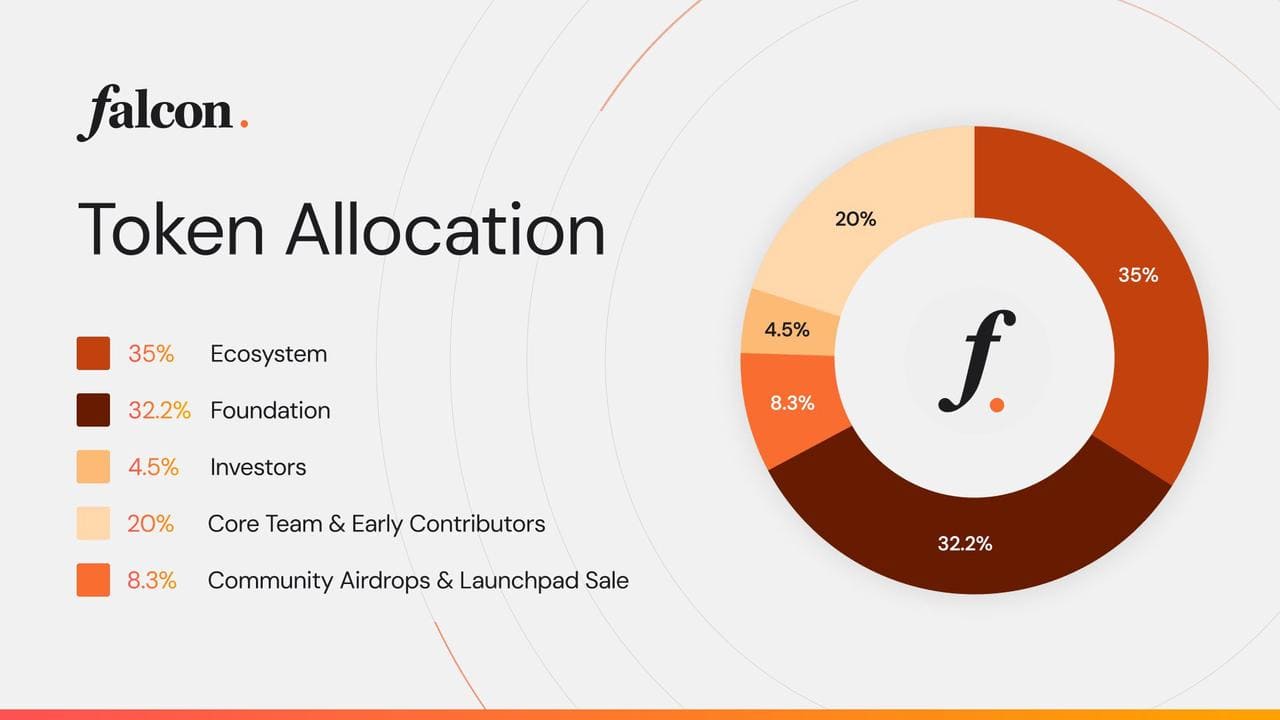

FF Token Allocation | Source: Falcon X

Falcon Finance discloses a maximum supply of 10,000,000,000 FF. Allocation is tilted to the ecosystem and the foundation, with additional slices for the core team and contributors, community programs and launchpads, and a smaller investors’ bucket. Falcon’s materials outline the split along these lines:

• Ecosystem roughly 35%

• Foundation a little over 30%

• Core team and contributors around 20%

• Community airdrops and launchpads a bit over 8%

• Investors around 4 to 5%

Has Falcon Finance Been Audited?

Independent audits by Zellic and Pashov report no critical or high-severity issues in the published summaries. Audits are a strong starting point, but they do not remove market, execution, liquidity, counterparty, or custody risk.

What’s Next for Falcon Finance: Future Roadmap

Falcon Finance Roadmap | Source: FF Website

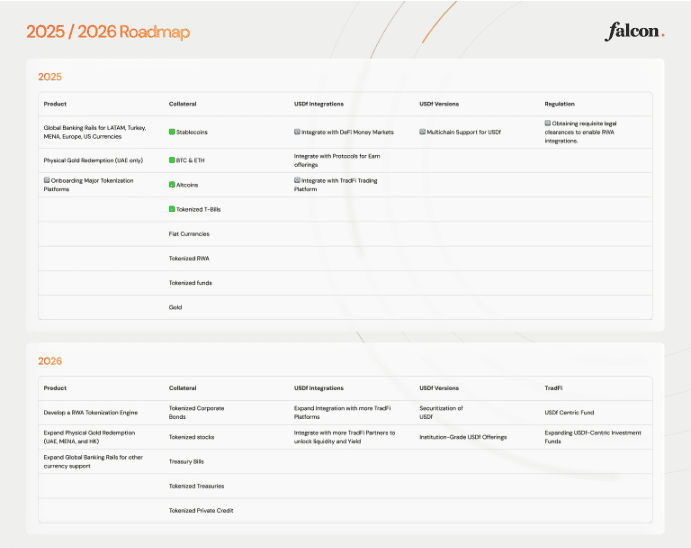

Falcon Finance’s next phase is about making USDf and sUSDf useful at scale without losing sight of risk. The team plans a measured expansion of supported collateral, deeper USDf integrations across DeFi and institutional venues, and multi-chain rollouts as audits and partner reviews clear. In parallel, they’re building the banking and compliance rails that let USDf touch real-world flows, plus an on-chain Insurance Fund designed to backstop markets in stress.

Looking into 2026, Falcon wants to move beyond pure crypto collateral by launching a modular RWA engine that can onboard assets like corporate bonds and private credit, while expanding redemption options such as physical gold in key hubs. The common thread is prioritising utility over speed. Carefully grow the surface area, keep reporting and audits transparent, and allow FF governance to steer the parameters as the system scales.

Conclusion

Falcon Finance aims to turn many types of collateral into a stable USD unit and route that liquidity into diversified, risk-managed yield. The model stands or falls on execution: keeping USDf’s peg steady, keeping sUSDf’s returns genuinely diversified, and scaling integrations without loosening risk controls. With a clear listing plan, published audits, and a foundation that oversees unlocks and incentives, the setup looks deliberate rather than hype driven. If those pieces hold after launch, FF can move from a new listing story to a useful piece of DeFi infrastructure.

Related Reading

FAQs on Falcon Finance (FF)

1. How do I mint or redeem USDf on Falcon Finance?

To mint USDf, deposit approved collateral into Falcon Finance. Stablecoins mint 1:1, while volatile assets like BTC or ETH require over-collateralization. Once confirmed, USDf is issued to your wallet. To redeem, first unstake sUSDf back into USDf, then redeem it for stablecoins or your collateral asset. Redemptions include a 7-day cooldown period before assets are released.

2. What is sUSDf and how do I stake or restake it?

sUSDf is the staked version of USDf. When you stake USDf, you receive sUSDf, which automatically grows in value as protocol yield accrues. You can also restake sUSDf into longer-term positions (e.g., 3 or 6 months) to receive boosted rewards. Unstaking converts sUSDf back into USDf, which can then be redeemed.

3. What are the supported collateral assets for USDf minting?

Falcon Finance accepts stablecoins like USDC and USDT and major cryptocurrencies such as BTC, ETH, and SOL as collateral to mint USDf. Stablecoins mint 1:1, while volatile assets require higher collateral ratios. The platform also plans to add select altcoins and tokenized real-world assets in the future.

4. Does Falcon Finance require KYC/KYB verification?

Falcon Finance requires KYC (Know Your Customer) for individuals and KYB (Know Your Business) for institutions. Verification involves submitting identity documents and proof of address before using core functions like minting, redeeming, and collateral management. This ensures regulatory compliance and security. Some regions may have additional restrictions depending on local laws.

5. How to register your wallet for $FF token claims?

To register your wallet for $FF token claims, connect your wallet on the Falcon Finance claim portal and complete the registration process. If you have already completed KYC/KYB verification, simply link your verified wallet address. If you hold multiple wallets, each wallet must be registered individually. Once registered, your wallet becomes eligible to claim $FF tokens during the distribution period.