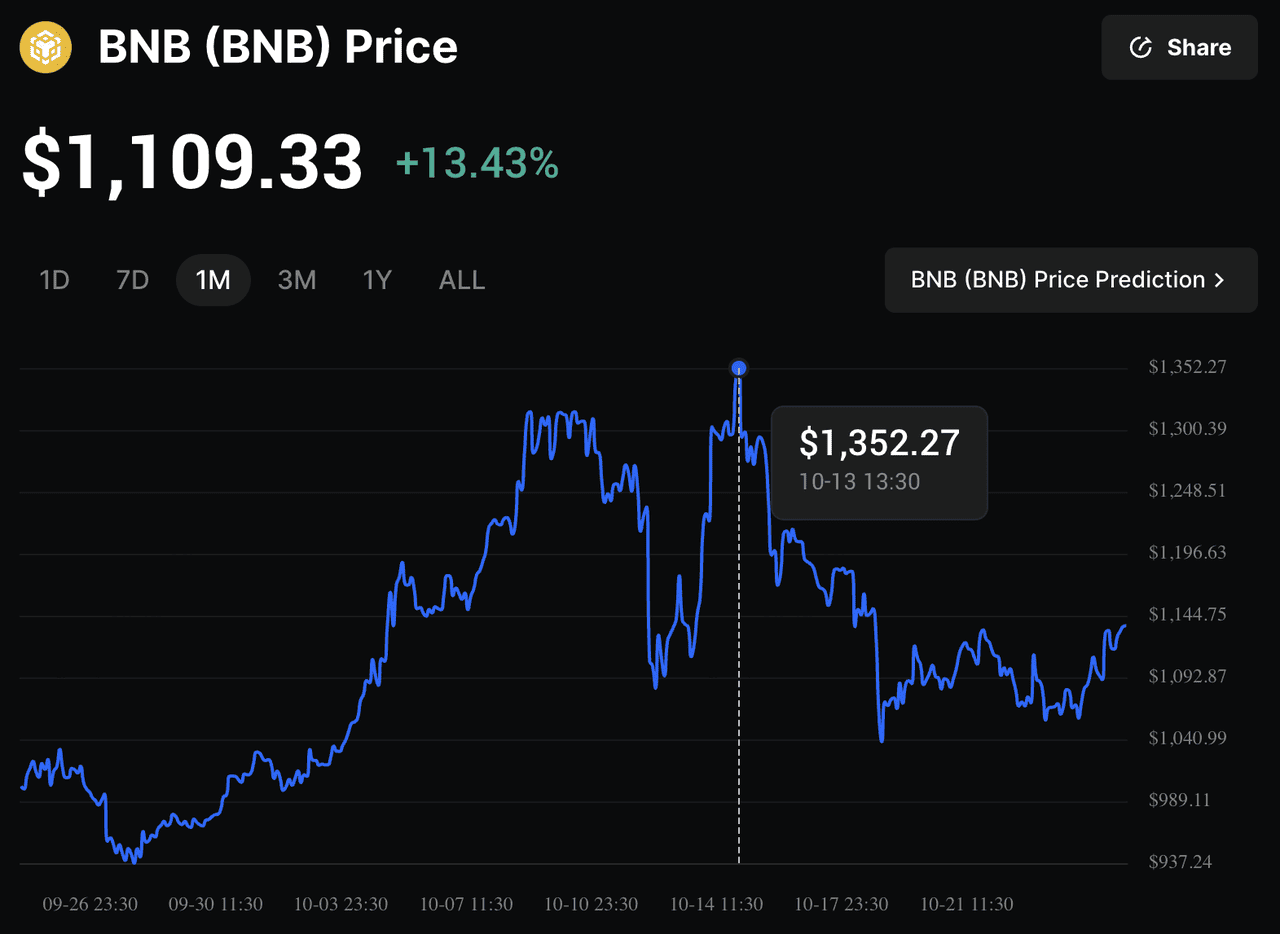

BNB Chain (BNB) reached a historic milestone on October 13, 2025, soaring to a new all-time high of $1,370.55, according to BingX data. The token is up over 13% in the past month, with daily trading volume topping $5.6 billion and market capitalization surpassing $158 billion as of writing.

BNB price surged over 13% in October 2025 | Source: BingX

BNB Price

This rally marks BNB’s strongest performance since 2021, driven by renewed on-chain activity, consistent token burns, rising institutional demand, and a surge in market optimism following U.S. President Donald Trump’s pardon of Binance founder Changpeng “CZ” Zhao, which many traders view as a major sentiment boost for the broader Binance ecosystem. As momentum builds, traders are now asking the big question: can BNB extend its rally and break above $2,000 in this cycle?

What Is BNB Chain and Its Native Token BNB Tokenomics?

BNB Chain is a high-performance blockchain developed by Binance to power decentralized applications and Web3 innovation. Built for speed and scalability, it integrates BNB Smart Chain (BSC) for smart contracts, BNB Beacon Chain for governance, and BNB Greenfield for decentralized data storage. Using a Proof-of-Staked Authority (PoSA) consensus model, it finalizes blocks in about three seconds with low transaction fees, while remaining fully EVM-compatible for seamless deployment of Ethereum-based DApps.

Its native token, BNB (Build and Build), serves as both the network’s utility and governance asset. BNB has a total supply of 200 million tokens, with a long-term target to reduce supply to 100 million through quarterly burn events that permanently remove tokens from circulation. This deflationary tokenomics model helps support scarcity and long-term value growth.

BNB Token Utility: Key Use Cases

• Paying gas fees on the BNB Smart Chain

• Staking to secure the network and earn rewards

• Participating in governance and on-chain voting

• Accessing DeFi, NFT, and gaming applications within the

BNB ecosystem

What’s Driving BNB to Its All-Time High in October 2025?

BNB token has surged to a new all-time high past $1,370 on October 13, 2025, driven by rising on-chain activity, growing institutional demand, expanding ecosystem partnerships, and renewed market confidence.

1. BNB Price Makes Gains After U.S. President Trump Pardons CZ

BNB’s sharp price rally gained an extra push from a major political event,

U.S. President Donald Trump’s pardon of Binance founder Changpeng “CZ” Zhao on October 23, 2025. The news triggered immediate bullish sentiment across the market, with BNB spiking over 3.6% within hours of the announcement, reaching an intraday high above $1,120. Traders on X described the event as the start of an “up-only” phase for BNB, interpreting the pardon as a symbolic green light for the exchange’s renewed legitimacy in the United States.

The development also reignited broader optimism around altcoins. Tokens tied to the BNB ecosystem and politically connected projects like

World Liberty Financial (WLFI), associated with Trump’s son’s crypto venture, saw notable gains, suggesting that market sentiment could be shifting toward an early-stage altcoin season.

2. Rising On-Chain Activity Fuels Record BNB Token Burns

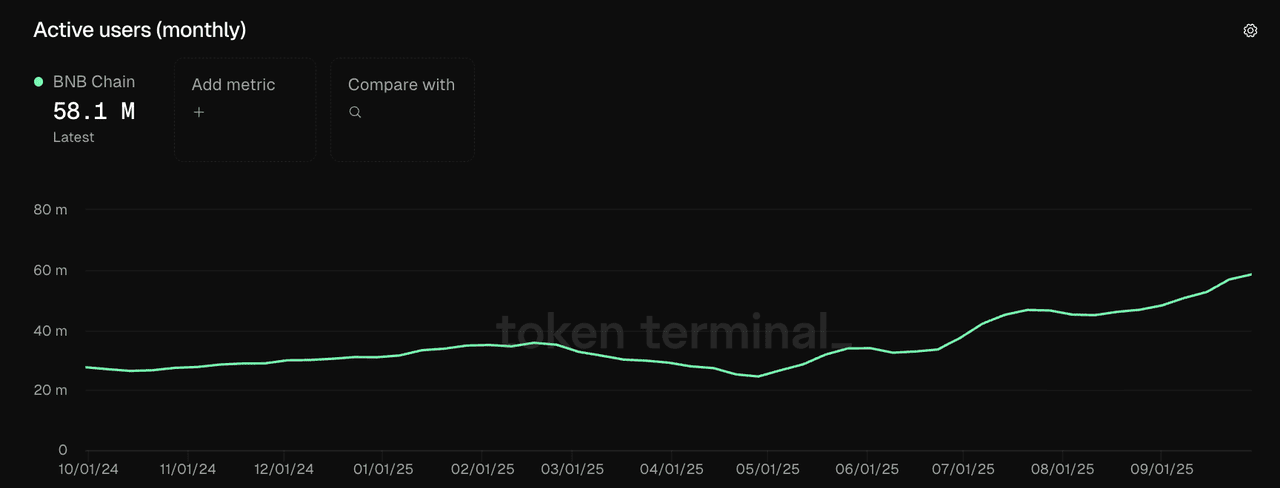

BNB Chain’s ecosystem has expanded rapidly throughout 2025, supported by strong user growth and on-chain activity. According to

Token Terminal, monthly active users increased from about 36 million in January 2025 to 58.1 million by October 2025, marking a 61% jump in just nine months. This surge in usage has driven higher transaction volume and gas consumption in BNB, directly powering the network’s auto-burn mechanism, which permanently removes tokens from circulation each quarter.

In July 2025, Binance completed its 32nd quarterly burn, destroying 1,595,599 BNB valued at about $1.02 billion. It ranks as the third-largest burn since 2023, following the 25th burn in October 2023 of 2.14 million BNB and the 26th burn in January 2024 of around 2.14 million BNB tokens. 2024 recorded the highest annual burn total at around 6.99 million BNB, while 2025 has already removed 3.17 million in two quarters, showing strong momentum and sustained network activity.

2. Institutional Adoption Establishes BNB as a Corporate Reserve Asset

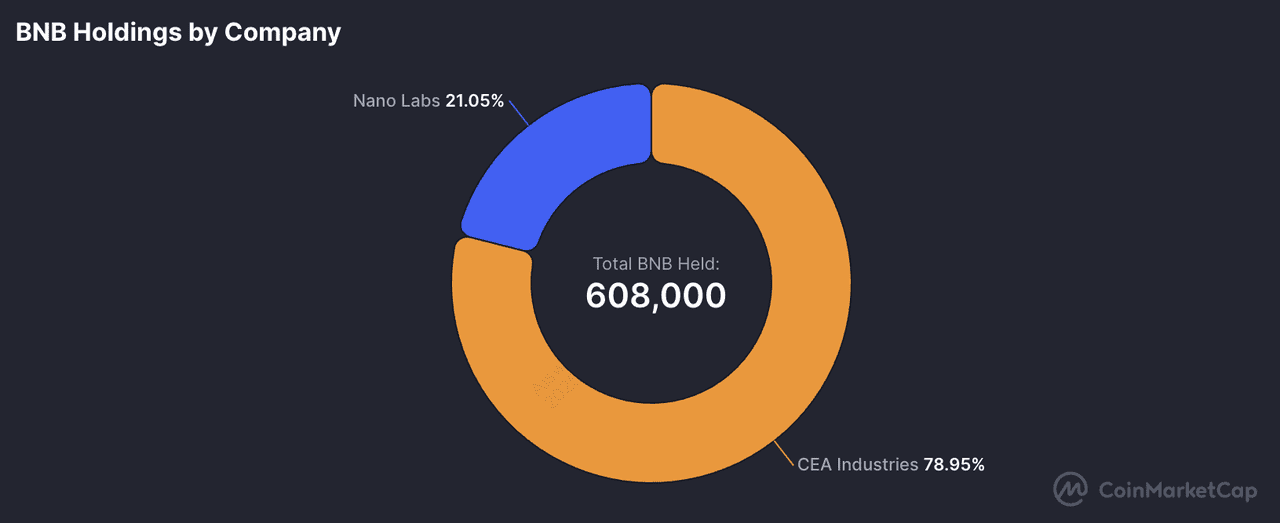

BNB corporate treasury holdings | Source: Coinmarketcap

In 2025, BNB witnessed a sharp rise in institutional adoption as more public companies and financial firms began adding it to their treasuries, signaling growing confidence in Binance’s ecosystem. BNB’s mix of liquidity, deflationary supply, and utility-driven value has made it an attractive alternative to

Bitcoin and

Ethereum for treasury diversification. Recent data shows two major public companies, CEA Industries (Nasdaq: BNC) and Nano Labs (Nasdaq: NA), collectively holding over 608,000 BNB worth around $691 million, accounting for 0.44% of total supply.

New entrants like Applied DNA Sciences (Nasdaq: APDN) have further accelerated the “BNB treasury movement” by adopting yield-focused digital asset strategies, including a $27 million private placement and additional BNB-linked warrants worth up to $31 million. Meanwhile, China Renaissance Holdings is reportedly raising $600 million for a digital-asset treasury fund to accumulate BNB, marking one of the first such efforts from a traditional investment bank. Together, these moves highlight BNB’s growing appeal as a corporate reserve asset and its expanding role in bridging traditional finance with decentralized markets.

3. BNB Chain Ecosystem Growth Strengthens Long-Term Foundation

BNB Chain’s ecosystem has expanded significantly in 2025, driven by the success of its leading DeFi protocols and new infrastructure partnerships. According to Messari,

PancakeSwap remains the dominant DEX with around $1.3 billion TVL, handling over 90% of the network’s DEX volume, while

Aster Perp DEX, a cross-chain derivatives platform that originated on BNB Chain, has surpassed 2 million users and about $2 billion in combined TVL. This continued expansion reinforces BNB Chain’s position as one of the most active Layer-1 ecosystems in decentralized finance.

Alongside this growth, BNB Chain’s recent collaboration with

Chainlink integrates Cross-Chain Interoperability Protocol (CCIP) and Data Streams, giving developers access to secure cross-chain communication and reliable real-world data. Together, these advancements highlight how ecosystem growth and infrastructure innovation are working in tandem to strengthen BNB’s utility, network activity, and long-term value.

4. Market Momentum and Renewed Confidence Back BNB's Surge

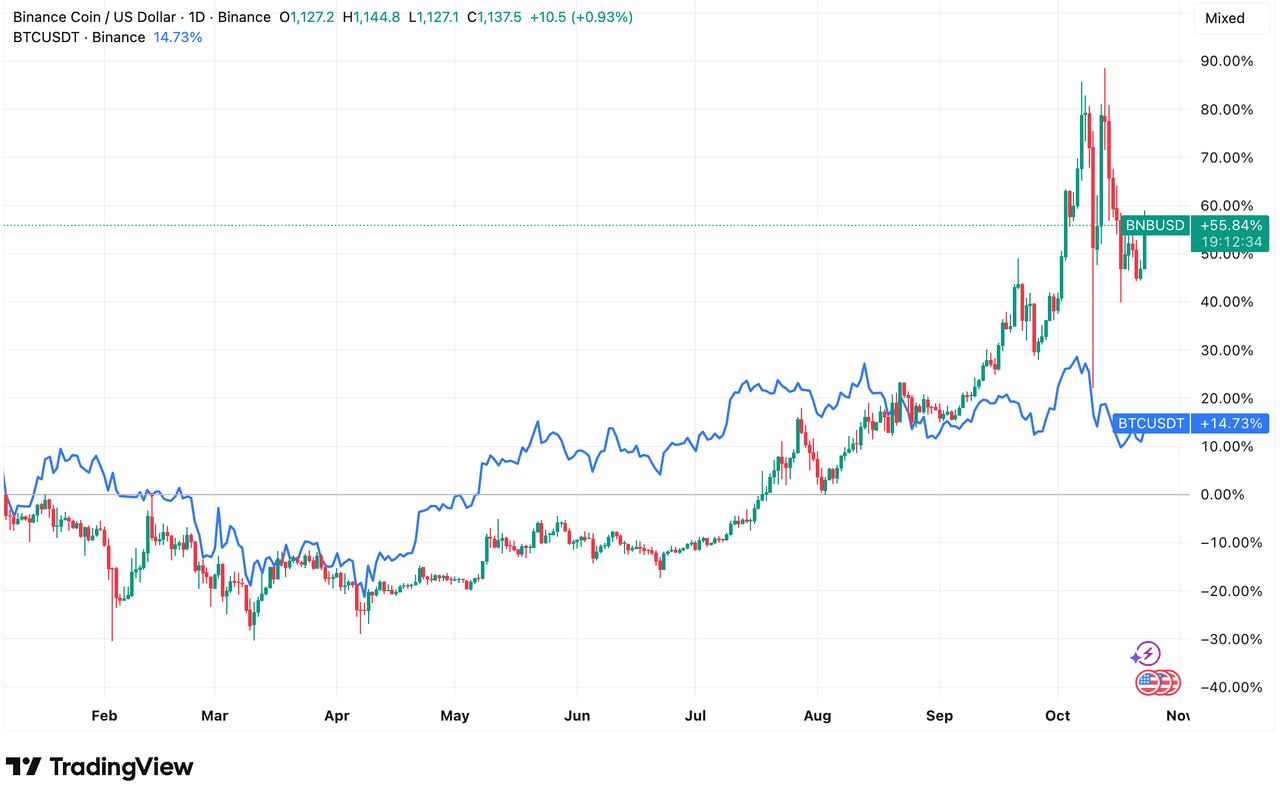

BNB vs. BTC YTD performance | Source: TradingView

BNB’s 2025 rally is supported by the broader strength of the crypto market, led by Bitcoin’s resurgence. On October 5, 2025,

Bitcoin reached a new all-time high of about $125,600, breaking past its

previous August peak. This milestone reignited market confidence and triggered fresh capital inflows across major Layer-1 ecosystems, with BNB among the main beneficiaries. As of late October, BNB has registered over 55% gains in 2025, bitoutperforming Bitcoin's YTD gains of around 14.7%.

BNB also achieved a record high of $1,370.55 in mid-October 2025, driven by increasing on-chain activity, expanding DeFi participation, and sustained quarterly burns. Supported by strong liquidity, an active user base, and growing institutional interest, BNB has reinforced its position as one of the most resilient and fundamentally sound assets in the current bull cycle.

BNB Price Prediction: Will It Reach $2,000 in the 2025 Bull Run?

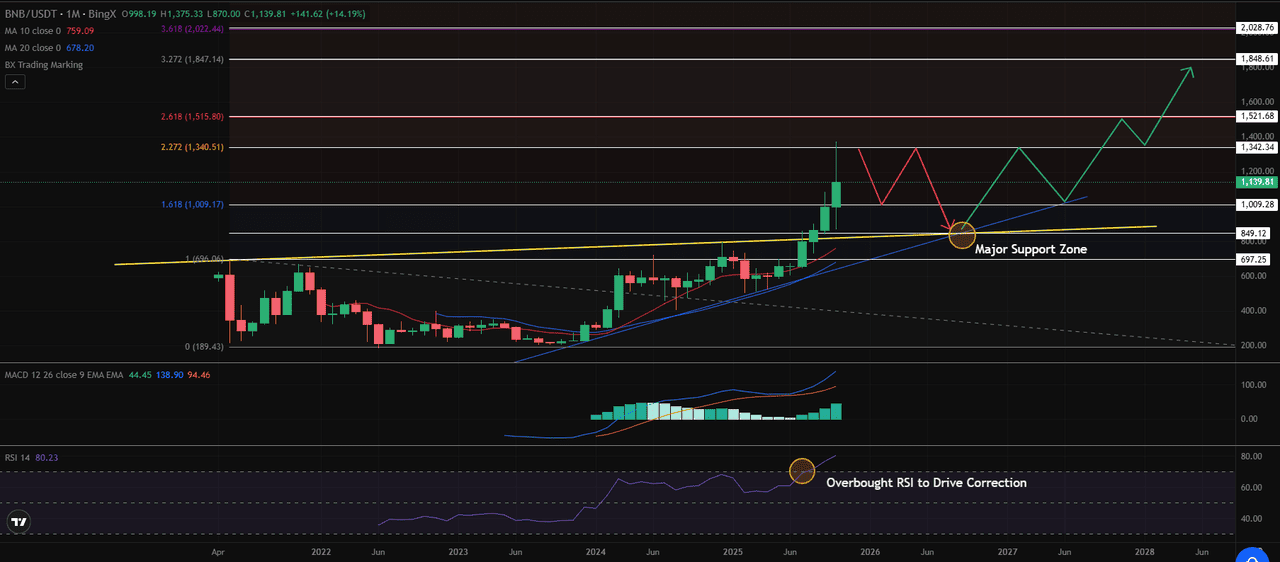

BNB (BNB/USDT) is trading near $1,140, up roughly 14% this month, as the token sustains its breakout above long-term resistance at $700. The monthly chart shows a decisive shift from consolidation to expansion, with price action following an

ascending channel supported by rising 10- and 20-month EMAs, a hallmark of a maturing bullish trend.

1. Overbought RSI Signals Near-Term Cooling

Momentum indicators hint at a short-term pause before the next leg higher. The

Relative Strength Index (RSI) at 80 remains firmly in overbought territory, typically preceding mild corrections during extended rallies. Historically, these phases serve as natural resets that strengthen the underlying trend. A retest of the $850–$1,000 support zone, aligned with the long-term trendline and the 1.618 Fibonacci extension, could provide an attractive accumulation opportunity for long-term investors.

2. Key Resistance Levels Ahead

BNB faces immediate resistance near $1,340 and $1,515, where profit-taking may emerge. The

Moving Average Convergence Divergence (MACD) histogram continues expanding in positive territory, reflecting sustained bullish momentum across higher timeframes. Should bulls maintain control above the $1,000 pivot, Fibonacci projections highlight potential upside targets at $1,848 and $2,028, key zones that align with the next impulse wave in the ongoing uptrend.

BNB/USD Monthly Price Chart | Source:

BingX3. Long-Term BNB Price Outlook: $2,000 Remains Within Reach

Candlestick analysis reveals a long-bodied bullish candle, confirming dominant buyer sentiment. However, a brief consolidation phase between $1,000 and $1,400 would help stabilize momentum before a breakout attempt.

Technically, BNB’s structure remains constructive: rising EMAs, a steady MACD slope, and a consistent series of higher lows all signal underlying strength. As long as the token holds above $1,000, the 2025 bull cycle could drive prices toward $2,000, reinforcing BNB’s position as one of the market’s most resilient large-cap assets.

With rising on-chain activity and a technically confirmed breakout, BNB appears poised to join the next wave of market leaders as crypto sentiment turns decisively bullish.

On-Chain Sentiment Shows BNB’s Rally Remains Fundamentally Healthy

On-chain and market sentiment indicators provide a deeper look into the health of BNB’s latest rally. While price action alone shows strength, these data-driven metrics help determine whether the token is fundamentally supported or overbought.

• The MVRV Z-Score compares BNB’s market value to its realized value, which represents the average price at which all tokens last moved. Higher readings indicate investors are sitting on larger unrealized profits, often signaling overheated conditions.

• RSI (Relative Strength Index) measures the speed and magnitude of recent price changes to gauge momentum and potential overbought or oversold levels.

• Funding Rates on perpetual futures reflect the balance between long and short traders. Neutral rates suggest a stable market, while spikes can indicate excessive leverage on one side.

As of October 6, 2025, BNB’s key metrics show a healthy and fundamentally supported uptrend rather than speculative excess:

| Metric |

Latest Value (Oct 6, 2025) |

Interpretation |

| MVRV Z-Score |

32.4 (TradingView data) |

Well below the overheated zone (>56), indicating sustainable network-driven growth. |

| RSI (14-day) |

≈ 72 (Investing.com) |

Strong bullish momentum, approaching but not exceeding typical overbought levels. |

| Funding Rate |

+0.0000% (Coinalyze) |

Neutral sentiment showing balanced positioning between longs and shorts. |

How to Trade BNB Tokens on BingX

BNB (Build and Build) is the native utility token of the BNB Chain ecosystem, used for transaction fees, staking, and access to token launches and ecosystem rewards. It is available on both the BingX Spot Market and Perpetual Futures Market, giving traders flexibility for long-term holding or short-term trading.

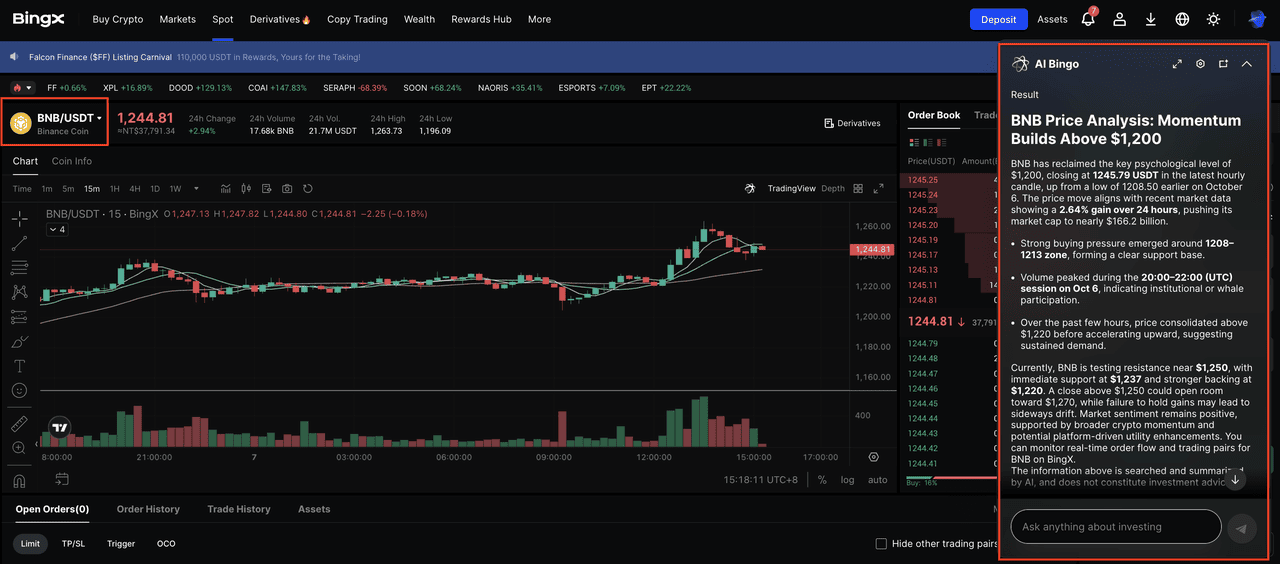

BingX AI also provides real-time market analysis to support smarter decisions.

Step 1: Search for BNB/USDT on Spot or Perpetual Futures

For Spot Trading

Go to the

Spot Market on BingX and search for

BNB/USDT. Place a

market order to buy instantly or set a limit order at your preferred price. Spot trading is ideal for users who plan to hold BNB long term or use it for ecosystem activities such as staking or transaction fees.

Source: BingX BNB/USDT Spot Market

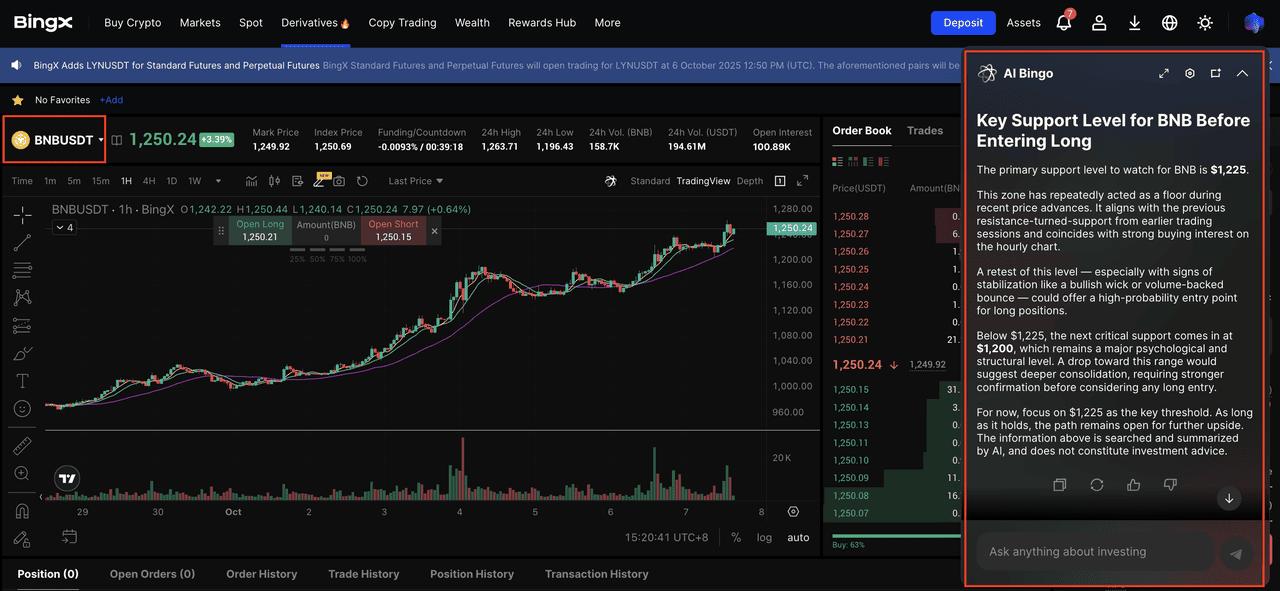

For Perpetual Futures

Search for

BNB/USDT perpetual contract in the

Perpetual Futures Market to go long or short without an expiration date. This setup suits traders with bullish or bearish views. Leverage can amplify potential returns but also increases risk, so always use it cautiously and set a

stop-loss to protect your capital.

Source: BingX BNB/USDT Perpetual Futures

Step 2: Use BingX AI for Real-Time Market Insights

Click the AI icon on the chart to activate BingX AI, which identifies key support and resistance levels, trend direction, and major market events. These insights can help refine your timing and decision-making process.

Step 3: Execute and Monitor Your Trade

Choose a market order for instant execution or a limit order to enter at a specific price. Monitor your trade using BingX AI and market indicators to adjust your position when necessary.

Final Thoughts

BNB’s surge to a new all-time high in October 2025 reflects more than a short-term rally. It highlights the growing maturity of its ecosystem and the confidence investors have in its fundamentals. Strong on-chain activity, expanding institutional adoption, and a robust DeFi network continue to drive both token demand and long-term value.

As the broader crypto market enters a renewed growth phase, BNB stands out for combining real utility with sustained ecosystem development. While market cycles will continue to fluctuate, the structural drivers behind BNB’s rise, including consistent burns, strategic partnerships, and deep liquidity, position it as one of the most resilient assets in the 2025 bull run and beyond.

Related Reading