Circle, the company behind the

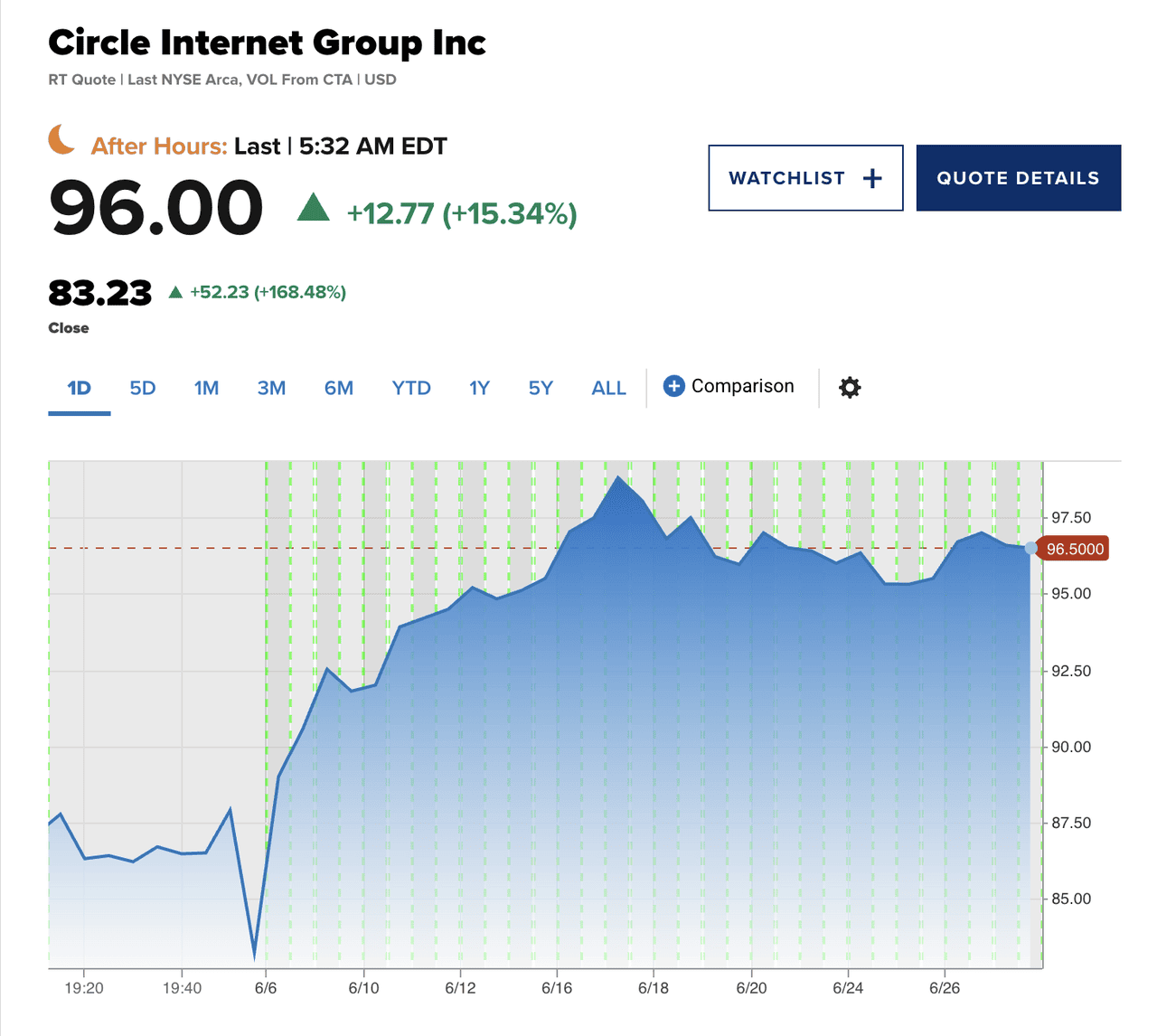

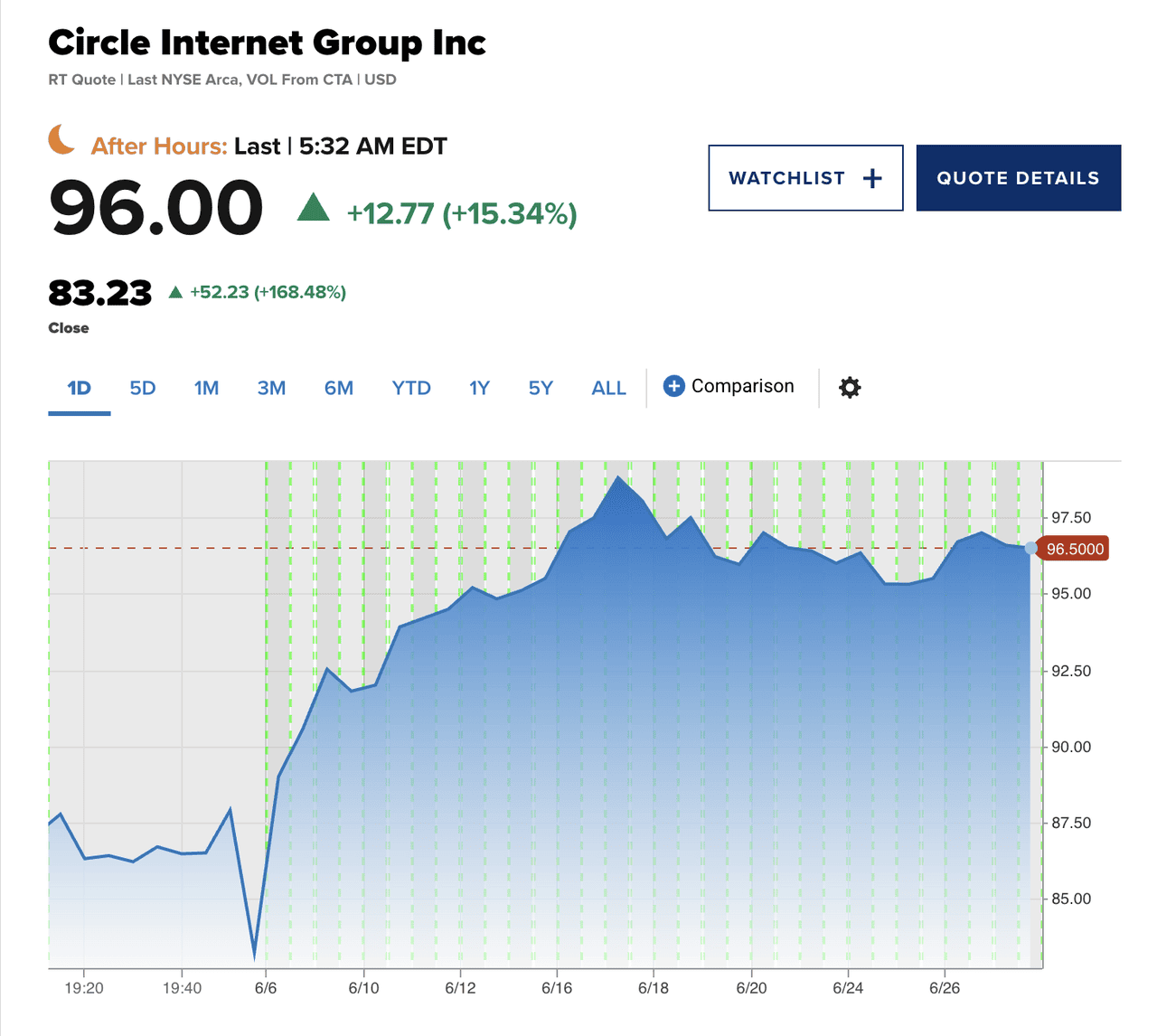

USDC stablecoin, went public on June 5, 2025, listing on the New York Stock Exchange under the ticker CRCL. Shares surged 168% on day one, closing at $83.23 after pricing at $31, in one of the year’s strongest IPO performances. The offering raised over $1.1 billion, pushing Circle’s valuation past $16 billion.

The IPO arrives as

stablecoins gain traction in both the crypto sector and traditional finance. As the issuer of USDC, one of the world’s largest dollar-backed stablecoins, Circle is emerging as a key player in the push to build regulated financial infrastructure for the digital economy. Investor enthusiasm reflects growing confidence in the stablecoin model, especially as regulatory clarity advances.

With strong momentum, clearer policy support, and increasing adoption of USDC worldwide, Circle is positioned to reshape how digital dollars move across borders and industries. This article explores what Circle does, why its IPO matters, and what the rise of CRCL could mean for the future of stablecoins and the broader crypto industry.

What Is Circle? The Company Behind Stablecoin USD

Source: Circle Official Site

Founded in 2013 by Jeremy Allaire and Sean Neville, Circle started as a crypto wallet and payments platform before evolving into one of the most important financial infrastructure companies in the blockchain space. Its mission is to enable open, global, and programmable money by building tools that bridge traditional finance and the internet economy.

Circle is best known as the issuer of

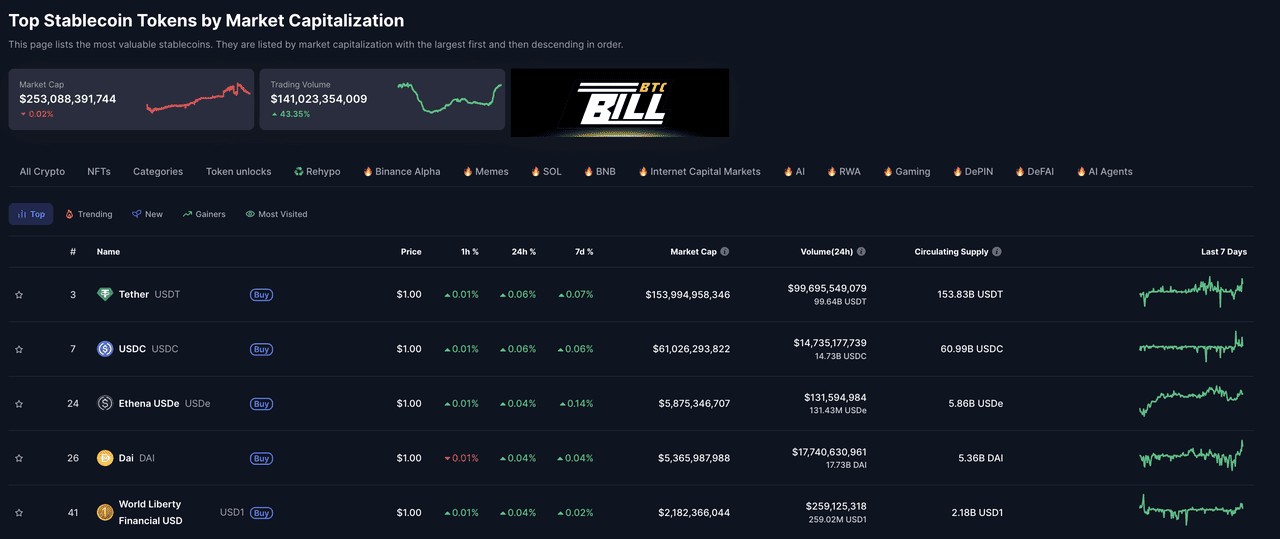

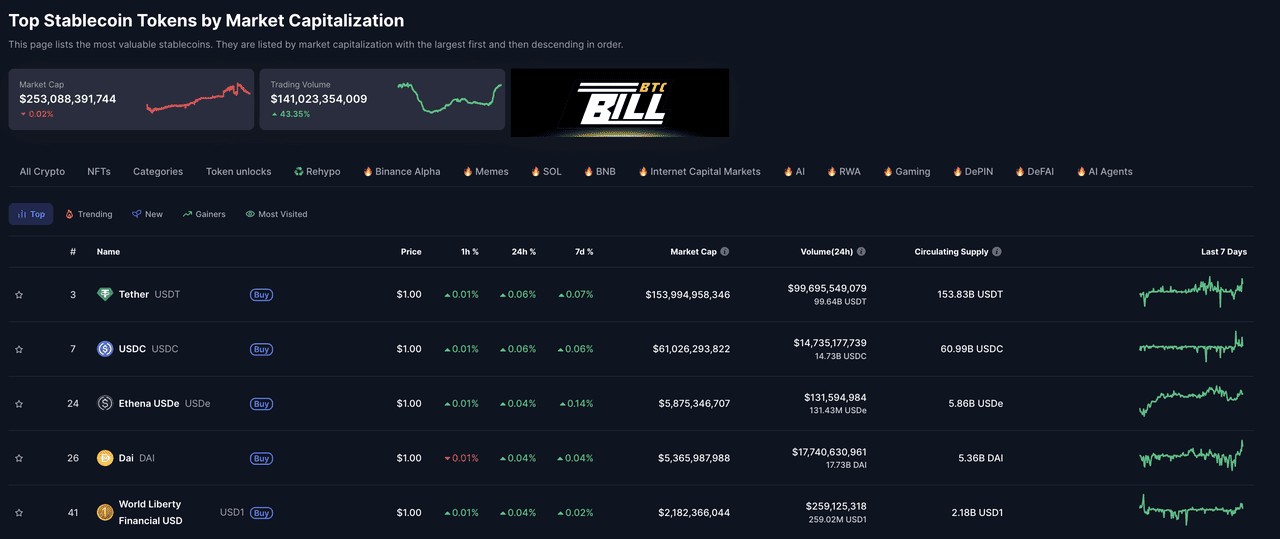

USD Coin (USDC), a dollar-pegged stablecoin used across exchanges, payment platforms, and decentralized finance (DeFi) applications. USDC is fully backed by cash and short-term U.S. Treasuries, with regular attestations provided to ensure transparency. As of early June 2025, there is over

$60 billion worth of USDC in circulation, making it the

second-largest stablecoin globally after

Tether (USDT).

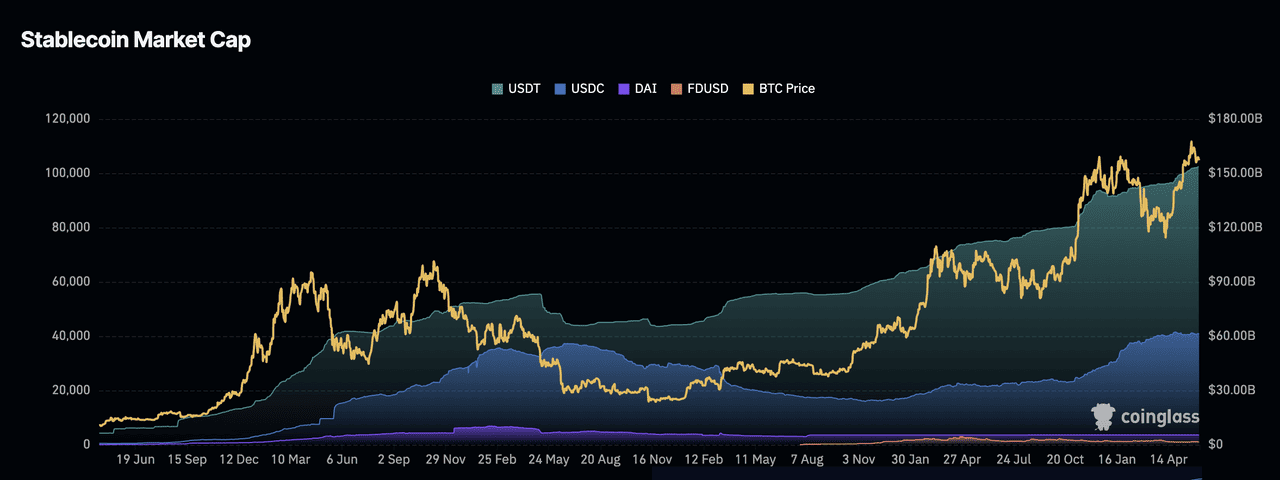

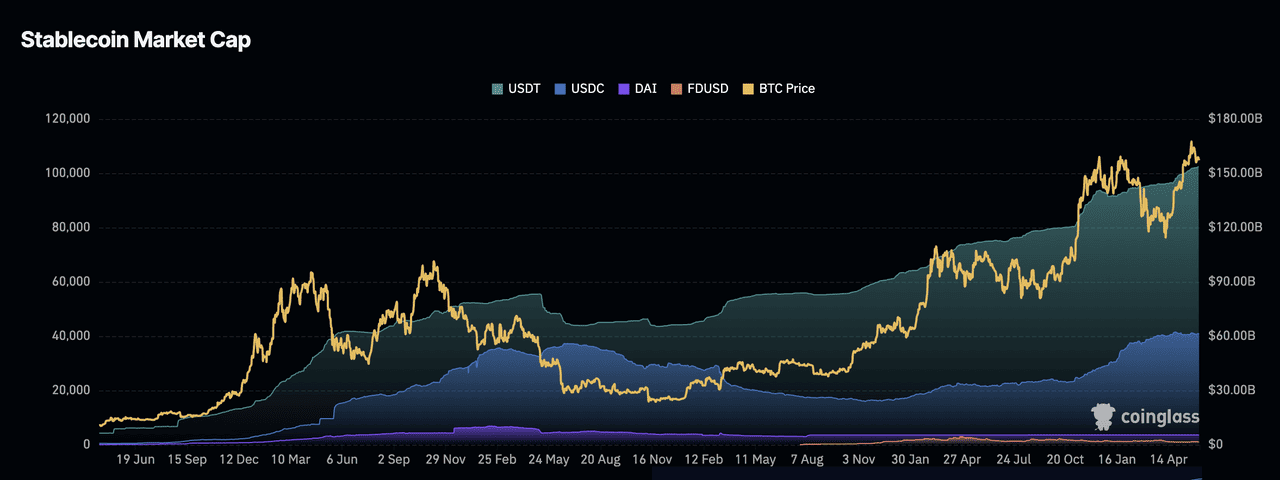

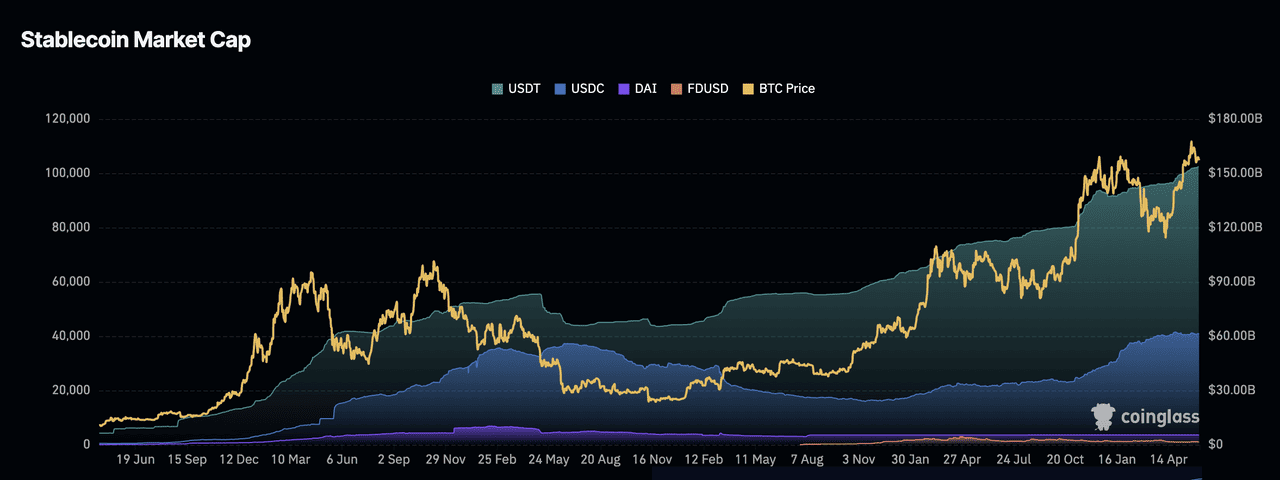

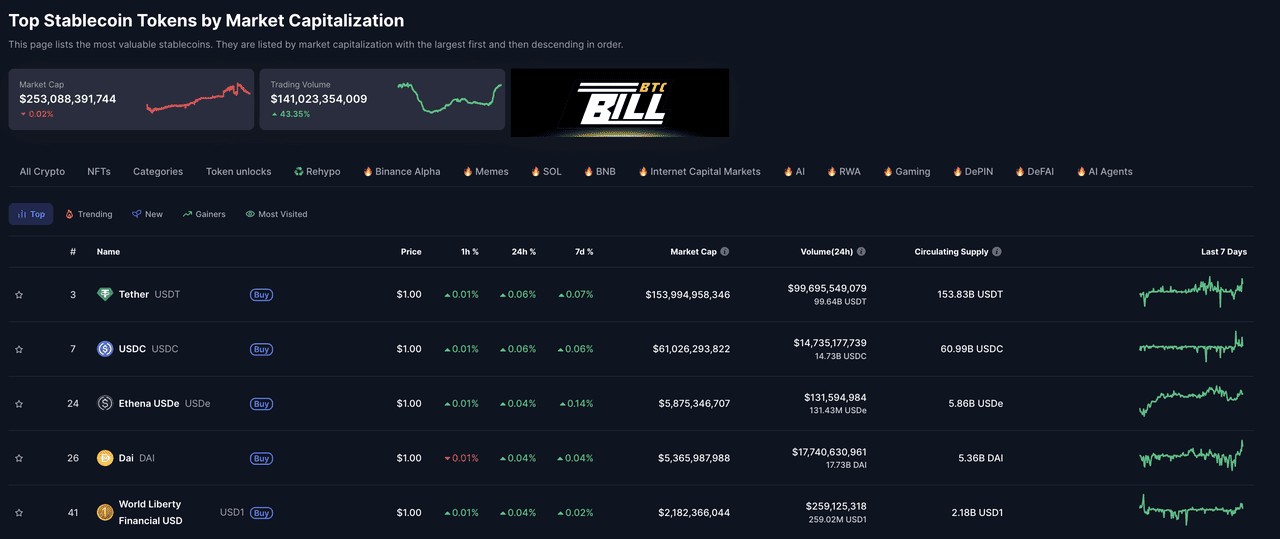

Source: Coinglass

Key Milestones and Products

• Stablecoins: Circle issues both USDC (

USD-pegged) and

EURC (

euro-pegged), designed for global digital payments and financial settlement.

• Licensing: Circle was the first recipient of New York’s BitLicense in 2015 and now holds regulatory approvals in the European Union and Singapore.

• Circle Payments Network (CPN): A blockchain-based system that facilitates cross-border payments, B2B settlements, and treasury operations using stablecoins.

• Infrastructure Services: Circle also offers developer APIs, fiat on/off ramps through Circle Mint, and cross-chain capabilities via its Cross-Chain Transfer Protocol (CCTP).

With this foundation, Circle aims to serve as a core layer of the internet’s financial system, bringing stablecoins into mainstream financial infrastructure across borders and sectors.

Circle IPO (CRCL) Highlights and Valuation

The IPO of Circle Internet Group marked a major milestone in the evolution of crypto finance. As the issuer of USDC, Circle’s debut on the New York Stock Exchange (NYSE) on June 5, 2025 drew strong investor interest, signaling Wall Street’s growing appetite for stablecoin infrastructure. The offering is priced at $31 per share, well above the expected range of $27 to $28 and significantly higher than the initial estimate of $24 to $26. The final pricing reflected extraordinary institutional demand.

IPO Highlights

• IPO Time: June 5, 2025

• Ticker: CRCL

• Performance: The IPO was priced at $31 per share, opened at $69, peaked at $103.75, and closed the day at $83.23, exceeding both the revised pricing range and the initial target, marking a 168% gain from the IPO price.

• Valuation: The offering raised approximately $1.1 billion, giving Circle a market capitalization of $16.7 billion at close. This more than doubled its pre-IPO valuation of $6.8 billion.

Institutional interest was strong. Ark Invest expressed intent to purchase up to $150 million in shares, and BlackRock aimed to acquire 10% of the offering.

Circle (CRCL) Price Marked a 168% Gain from the IPO Price | Source: CNBC

From a Failed SPAC to a Market Breakout

This was not Circle’s first attempt to go public. In 2021, the company announced plans to merge with a SPAC in a deal valuing it at 9 billion dollars, but that effort was scrapped in 2022 amid rising regulatory pressure and broader market fallout following the collapse of platforms like FTX.

Rather than push forward too early, Circle spent the next three years strengthening its position. It expanded globally, launched key infrastructure such as the Circle Payments Network, and secured licenses across the United States, European Union, and Asia. By 2025, with bipartisan support for stablecoins growing and macro conditions improving, Circle re-entered the market with momentum. Its IPO was not just a rebound. It was a strategic reintroduction to the public markets.

Global Stablecoin Markets Overview

Circle’s IPO arrives at a time when stablecoins are being redefined. No longer limited to crypto trading, they are increasingly viewed as essential infrastructure for payments, settlements, and digital commerce. This shift helps explain the timing of Circle’s public debut, and why stablecoin issuers are now attracting institutional attention.

To understand the full context, it is important to examine where the global stablecoin market stands today.

The Evolving Role of Stablecoins

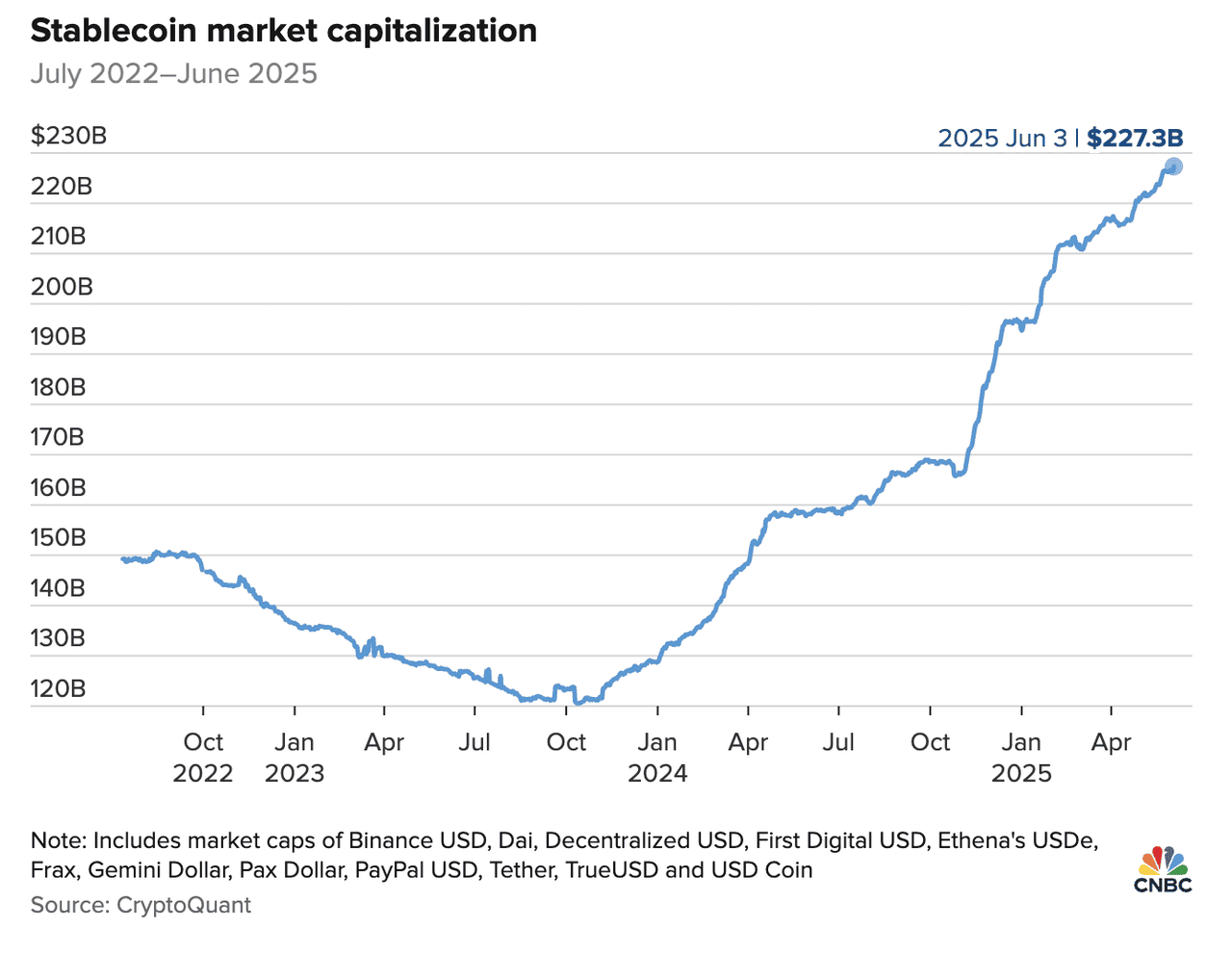

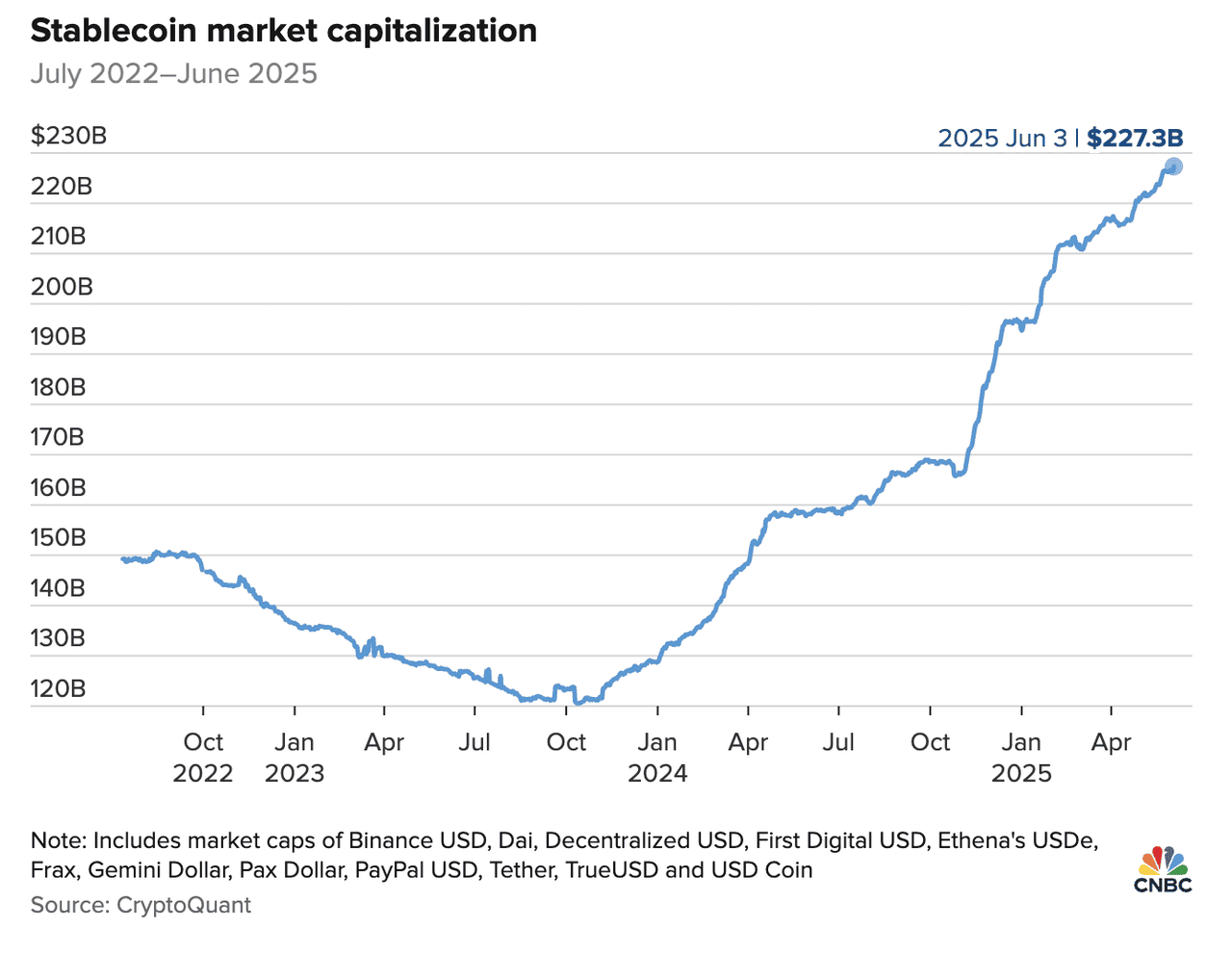

As of mid-2025, the total market capitalization of stablecoins exceeds 200 billion dollars | Source: CNBC

Stablecoins are digital assets pegged to the value of fiat currencies, most commonly the U.S. dollar. Originally used to move

liquidity between exchanges, they have become critical components of on-chain finance. Today, stablecoins are used in

decentralized finance (DeFi), cross-border remittances, B2B payments, and tokenized settlement systems.

Total Market Cap of Stablecoins Exceeds 200 Billion Dollars | Source: CoinMarketCap

As of mid-2025, the total market capitalization of stablecoins exceeds 200 billion dollars. Tether (USDT) leads with around 150 billion in circulation, followed by USDC at roughly 60 billion. While Tether dominates by volume, it continues to face scrutiny around transparency and reserves. Circle, in contrast, emphasizes full-reserve backing, public attestations, and regulatory compliance, making USDC the preferred choice for institutions and developers operating in regulated environments.

Momentum Toward Regulation and Utility

Stablecoin adoption is now intersecting with political and regulatory momentum. In the United States, both Congress and federal agencies are advancing legislation to provide a clear framework for fiat-backed stablecoins. Globally, countries like Singapore, the United Kingdom, and the European Union are proposing or implementing licensing regimes that treat stablecoins as financial infrastructure.

Analysts expect the stablecoin market to grow significantly by 2030, driven by applications in payments, tokenized treasuries, savings products, and programmable money. Initiatives like

PayPal USD (PYUSD), JP Morgan’s Onyx,

USD1, and various government-backed digital currencies reflect growing institutional validation of the stablecoin model.

With USDC and its newly launched Circle Payments Network (CPN), Circle is positioning itself at the center of this evolution. It aims to become not just a token issuer but a trusted layer for moving digital dollars across global markets.

Why Investors Are Excited and What Risks Remain about Circle IPO

Circle’s blockbuster IPO was driven by more than short-term hype. For many investors, CRCL represents a high-conviction bet on the expanding role of stablecoins in global finance. Circle is not presenting itself as a speculative crypto play, but as a regulated infrastructure company with real revenue, long-term utility, and clear policy alignment. The level of institutional participation in the offering reflects this shift in perception.

Why Investors Are Bullish on Circle

Circle stands out with a straightforward revenue model. Most of its income comes from interest earned on USDC reserves, which are held in cash and short-term U.S. Treasuries. In Q1 2025, the company reported 578.6 million dollars in revenue and 122.4 million dollars in adjusted EBITDA, making it one of the rare profitable firms in crypto.

Investors are also betting on regulatory momentum. As governments move toward formalizing stablecoin rules, Circle’s compliance-first approach and global licenses give it an edge over less regulated competitors.

Finally, Circle’s infrastructure strategy adds long-term value. The Circle Payments Network (CPN) aims to modernize cross-border payments and treasury operations, positioning the company as a foundational player in institutional digital finance.

Potential Challenges facing Circle's IPO

Circle’s revenue is highly sensitive to interest rates. If the U.S. begins cutting rates, returns from USDC reserves could shrink, reducing profitability.

Competition is also heating up. Companies like PayPal, Stripe, and the politically linked

USD1 initiative are entering the stablecoin arena, especially in consumer-facing and payment-focused areas.

Regulatory clarity, while promising, carries risk. Supportive legislation could accelerate Circle’s growth, but overly restrictive or expensive requirements may limit its expansion or raise operating costs.

Finally, Circle’s public performance may invite comparisons to earlier crypto listings like Coinbase. After a strong debut in 2021, Coinbase (COIN) saw its share price decline sharply. Investors will be watching to see whether CRCL can maintain its momentum or face similar volatility.

What Does Circle IPO Mean for Crypto Market

It has been over four years since Coinbase went public in 2021, marking the first major crypto company to list on a U.S. exchange. Since then, the industry has weathered multiple boom-and-bust cycles, regulatory uncertainty, and high-profile collapses. Yet in 2025, the tide is turning. The approval of multiple

spot Bitcoin ETFs, bipartisan discussions around

Strategic Bitcoin Reserves in the U.S. treasury, and a renewed

crypto market bull run have all contributed to a resurgence in institutional interest.

Circle’s IPO arrives at the center of that momentum. It is more than a company milestone. It represents a new phase in how crypto firms are perceived by public markets, policymakers, and investors. By choosing a traditional listing, Circle signals that crypto infrastructure companies can meet mainstream financial standards while continuing to innovate.

Here are four key ways Circle’s public debut could shape the broader crypto landscape:

1. Legitimizing Crypto Infrastructure: Circle's success validates the idea that crypto companies can be profitable, compliant, and long-term focused. It sets a new standard for what sustainable growth looks like in Web3 and encourages investors to look beyond speculative tokens toward foundational infrastructure.

2. Opening the Door for More IPOs: Circle’s listing could inspire a new wave of public offerings from other crypto-native firms, especially those focused on stablecoins, payments, custody, or compliance. If CRCL performs well after its IPO, it will reinforce investor confidence in crypto as an investable sector with maturing business mod

3. Influencing Regulation: With Circle now in the public spotlight, policymakers have a real-world example of a stablecoin issuer operating transparently under financial oversight. This could help accelerate the development of regulatory frameworks in the U.S. and internationally, benefiting the entire ecosystem.

4. Shifting Market Sentiment: Circle’s IPO comes during a broader

crypto bull run, adding fuel to already rising momentum. Its strong public debut may help reinforce optimism across the market, signaling that infrastructure-focused crypto companies are gaining mainstream recognition. The timing also echoes Coinbase’s recent inclusion in the S&P 500 index, suggesting that traditional financial markets are increasingly open to credible, revenue-generating players from the blockchain sector.

As traditional finance and crypto continue to converge, Circle’s listing marks a clear turning point. It reflects the growing maturity of the industry and sets the tone for what a post-hype, infrastructure-driven crypto market could look like.

Final Thoughts

Circle’s IPO is a landmark moment in the current crypto market bull run. It shows that regulated, revenue-generating blockchain firms can successfully enter public markets and be taken seriously by institutional investors. With a business model built on stablecoins, Circle is helping redefine how digital dollars move through the global economy.

At the same time, the path forward is not without uncertainty. Regulatory shifts, interest rate changes, and new competition will all test Circle’s ability to maintain its early lead. But the company’s strong start on the public stage sends a clear message: infrastructure-driven crypto is entering a new era.

As more capital flows into the space and new players emerge, Circle's performance will likely serve as a bellwether for how traditional markets price the future of blockchain finance.

Related Readings