Forex (foreign exchange) is the largest and most liquid financial market in the world, with over $7 trillion in average daily trading volume as of 2026, according to global central-bank surveys, more than

equities, bonds, and

commodities combined. Price action is driven by central-bank interest rates, inflation data, capital flows, and geopolitical risk, making FX one of the fastest-reacting macro markets.

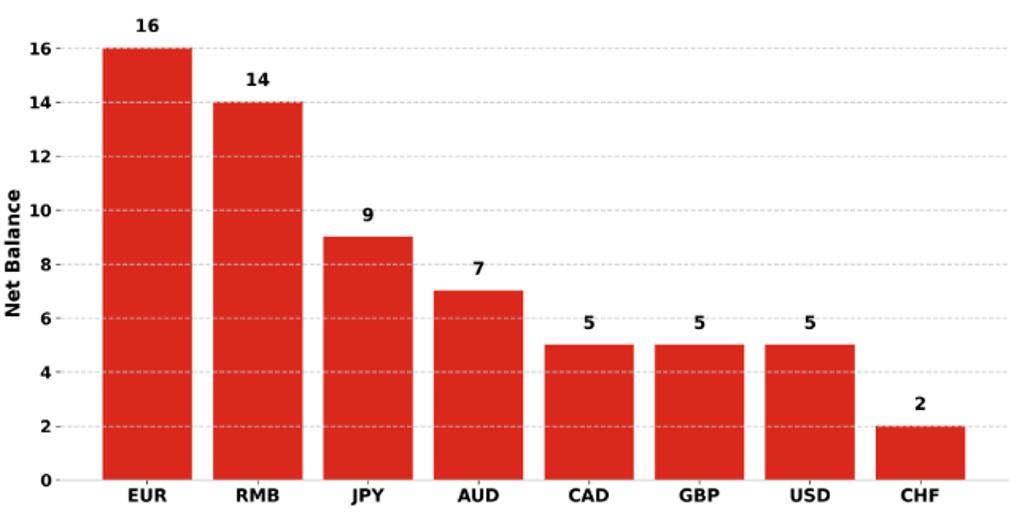

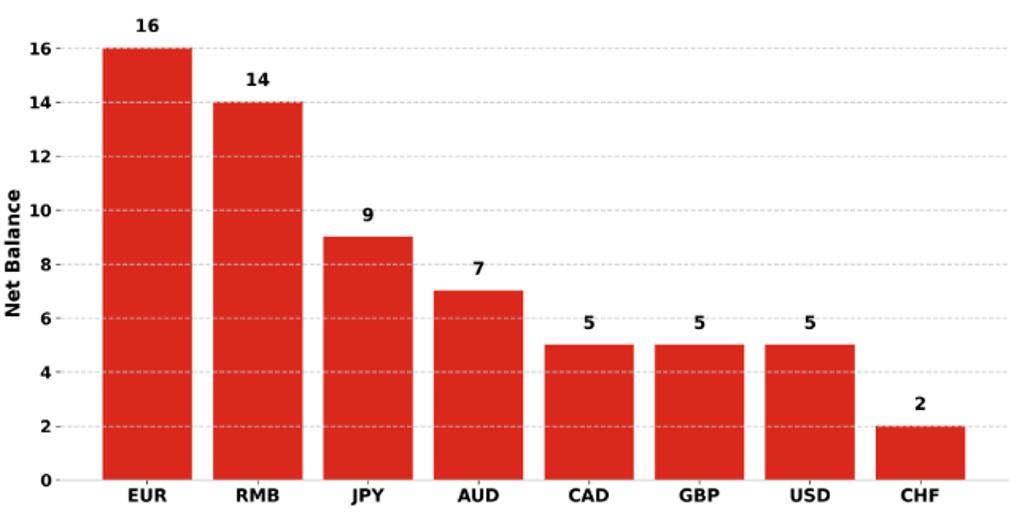

Net change in FX reserve expectations by currency | Source: MUFG Research

This shift toward on-chain TradFi is not limited to crypto-native platforms. In January 2026, the New York Stock Exchange, part of Intercontinental Exchange (ICE), announced it is developing a tokenised, blockchain-based trading platform designed to support 24/7 trading and near-instant settlement, pending regulatory approval. The proposed system combines NYSE’s Pillar matching engine with on-chain post-trade infrastructure, stablecoin funding, and

tokenised securities that retain traditional shareholder rights, highlighting how even legacy institutions are converging toward the same always-on, on-chain market model that crypto traders already use for forex, indices, and other TradFi instruments in 2026.

At the same time, macro drivers like a moderating U.S. dollar, potential Fed rate cuts, and shifting FX risk sentiment are creating broad volatility across major pairs such as

EUR/USD,

USD/JPY,

GBP/USD, and emerging markets.

This beginner-friendly guide explains what forex trading is, how forex perpetual futures work with crypto, and how to trade forex markets on BingX TradFi.

What Is Forex Trading?

Foreign exchange or forex trading involves buying one currency and selling another to profit from changes in exchange rates. It is the largest and most liquid financial market in the world, with daily trading volumes exceeding $7 trillion, far surpassing equities, bonds, and commodities. This scale allows traders to enter and exit positions efficiently across major pairs such as EUR/USD, USD/JPY, and GBP/USD, as well as select emerging-market currencies.

Forex remains popular in 2026 because it sits at the center of the global macro system. Currency prices react directly to central-bank interest-rate decisions, inflation data, employment reports, capital flows, and geopolitical developments, often moving immediately when new information hits the market. With trading activity spanning Asia, Europe, and North America, forex operates nearly 24 hours a day during the business week, creating frequent opportunities across different time zones.

In recent years, forex access has expanded beyond traditional brokers. Crypto-native platforms like

BingX TradFi now offer USDT-margined forex perpetual futures, allowing traders to go long or short currency pairs using a familiar futures interface. This structure combines the depth and macro relevance of forex markets with the speed, leverage, and risk controls that crypto traders already use, making FX one of the most actively traded

TradFi markets on-chain in 2026.

Why Trade Forex in 2026: Top 7 Key Advantages

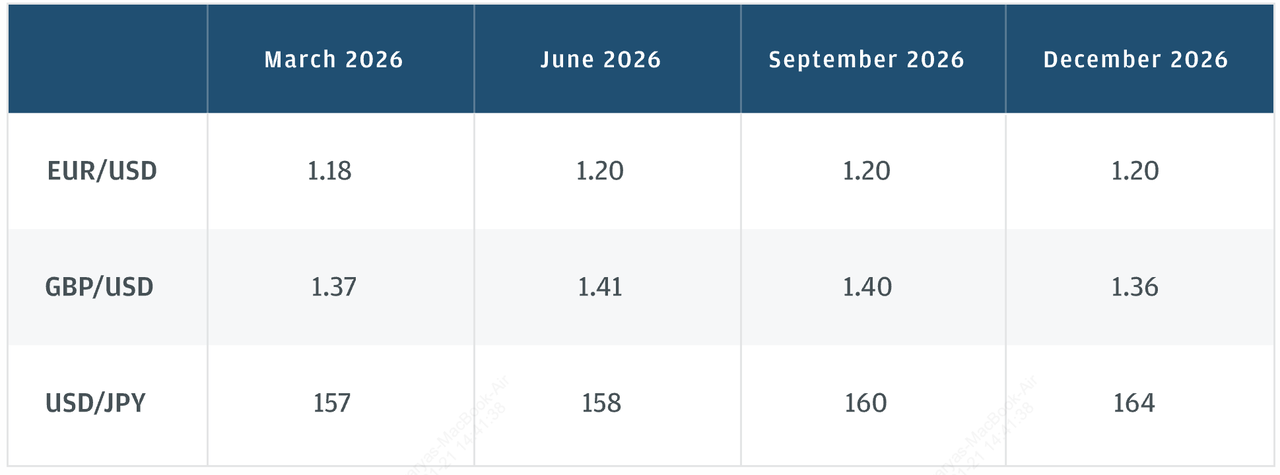

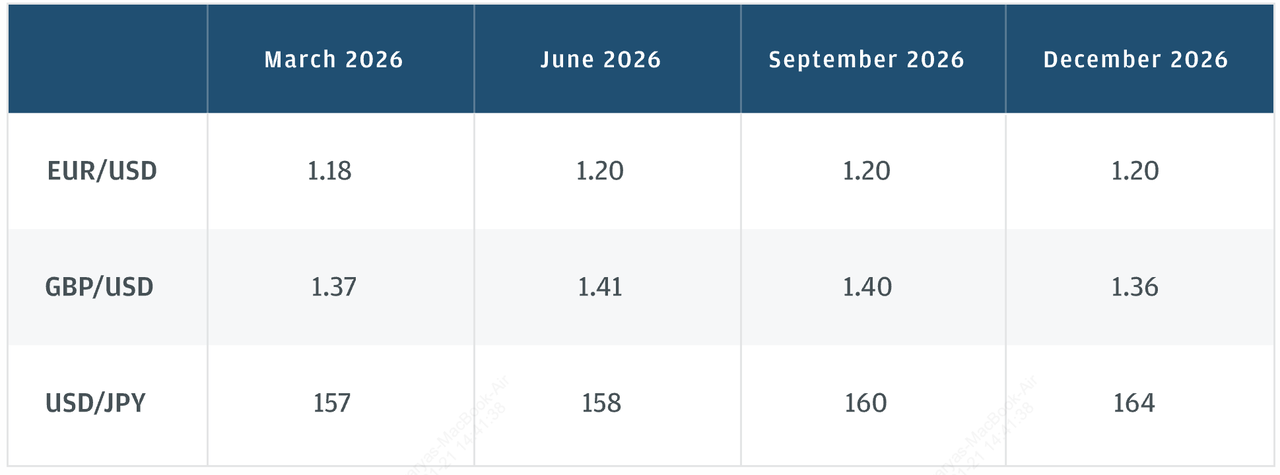

Forecasts for major forex pairs | Source: JP Morgan Research

In 2026, macroeconomic forces, including monetary policy divergence, dollar dynamics, and global risk sentiment, are expected to keep forex markets among the most active and tradable asset classes, creating specific opportunities for crypto-native traders.

1. Dollar weakness and volatility: Analysts expect the U.S. dollar to remain broadly soft through much of 2026, driven by anticipated Fed accommodation and moderating U.S. growth. This environment not only supports upside in pairs like EUR/USD and

AUD/USD, but also creates

arbitrage and relative-value opportunities as pricing temporarily diverges across FX spot markets, futures, and crypto-based perpetual contracts, especially around major data releases and central-bank decisions.

2. EUR/USD potential upside: Forecasts project EUR/USD to advance toward the 1.20–1.25 range as dollar pressures persist and eurozone fundamentals strengthen, offering a clear trend play for traders.

3. Two-way volatility in major crosses: The dollar’s expected “choppy path” through 2026, with weakening early and potential rebounds later, suggests sequential trend opportunities and mean-reversion setups in USD pairs.

4. Emerging market currency activity: BIS data shows emerging-market FX trading expanding faster than developed market currencies, highlighting growing liquidity and volatility in pairs beyond the G7, such as CNH and

BRL crosses.

5. Macroeconomic catalysts: Central bank divergence, inflation differentials, and labour market signals (e.g., softer U.S. jobs data) are likely to trigger sharper, data-driven moves in FX prices, which forex perpetual futures can efficiently capture.

6. Geopolitical risk and currency reactions: Real-time geopolitical developments, such as intervention threats to ease JPY weakness, create tactical trade triggers and range breaks in major pairs.

7. Unprecedented market size and liquidity: Forex remains the world’s largest financial market, with average daily turnover approaching $10 trillion as of 2025, up roughly 28% from pre-pandemic levels, translating to deep liquidity and narrow spreads ideal for active traders.

How to Trade Forex Pairs With Crypto

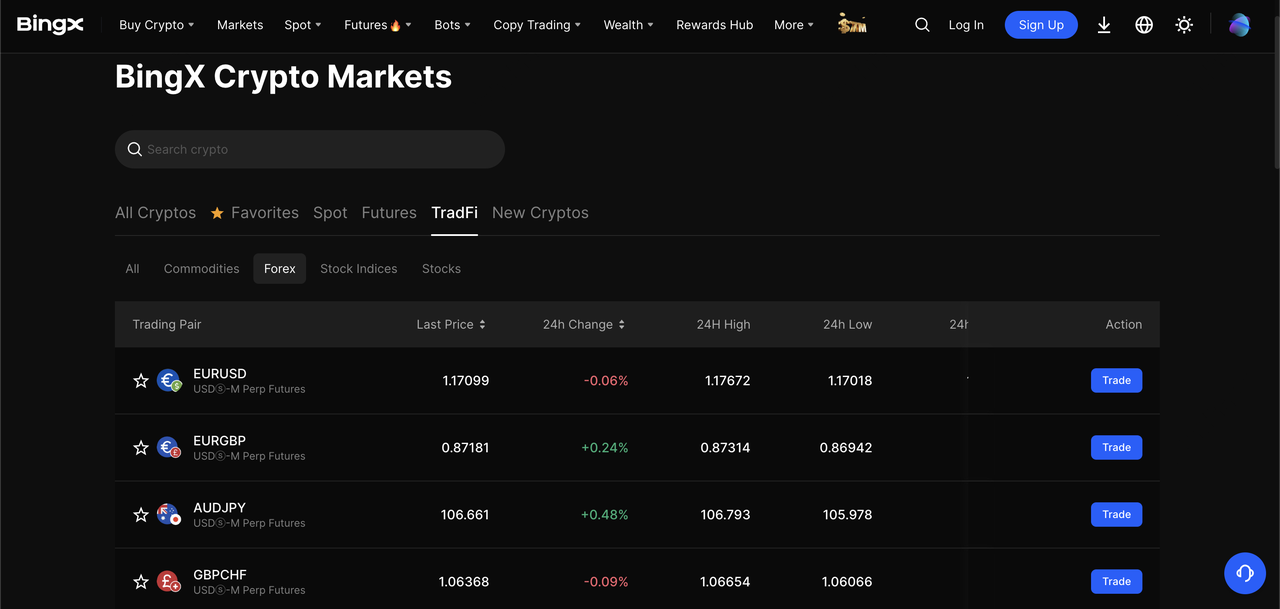

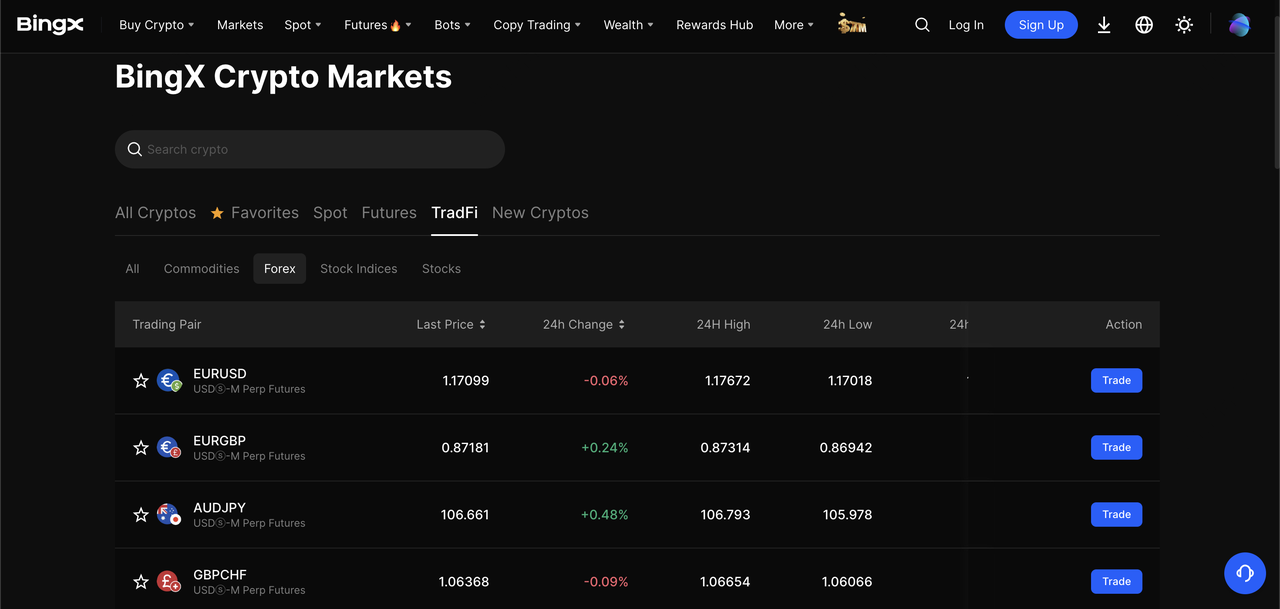

Trade popular forex pairs with crypto on BingX TradFi

Trading forex with crypto in 2026 is done primarily through USDT-margined perpetual futures, which track real-time currency prices while using crypto-native execution and risk controls. This allows traders to access the world’s most liquid market, where daily turnover exceeds $7 trillion, without traditional FX brokers, fiat funding, or spot currency settlement.

Here's an overview of how to trade forex markets with cryptocurrency:

1. Choose a forex pair based on macro drivers. Major pairs like EUR/USD, USD/JPY, and GBP/USD account for the bulk of global FX volume and are most sensitive to interest-rate differentials, inflation data, and central-bank guidance. For example, EUR/USD often reacts sharply to Fed vs. ECB policy divergence, while USD/JPY is closely tied to Fed–BoJ rate spreads.

2. Trade price movements via perpetual futures. Instead of exchanging physical currencies, you trade whether the exchange rate will rise or fall. If you expect the euro to strengthen against the dollar, you go long EUR/USD; if you expect dollar strength, you go short. PnL is calculated purely on price changes, not currency delivery.

3. Use USDT as margin and settlement. All collateral, profits, and losses are settled in

USDT, eliminating FX conversion costs and bank transfers. This is especially practical given that stablecoins now exceed $300 billion in total supply, making USDT a standard trading currency across crypto and

TradFi markets.

4. Apply leverage cautiously. Forex is typically low-volatility compared to crypto, which is why leverage is commonly used. A 0.5%–1% move in a major FX pair is meaningful; at 10× leverage, a 1% price move equals a 10% PnL change. Conservative leverage and position sizing are critical around high-impact events like CPI releases or rate decisions.

5. Manage risk with futures tools. Stop-loss and take-profit orders, real-time liquidation levels, and margin monitoring allow traders to control downside. This is particularly important because forex markets can gap during session transitions or after unexpected macro headlines.

On platforms like BingX TradFi, forex pairs are traded alongside indices, commodities, and stocks within the same USDT-based futures account. This enables data-driven macro strategies, such as pairing a short USD position with long gold or equity index exposure, without switching platforms or managing multiple accounts, making forex trading with crypto both efficient and scalable in 2026.

How to Trade Forex With Crypto on BingX TradFi: A Step-by-Step Guide

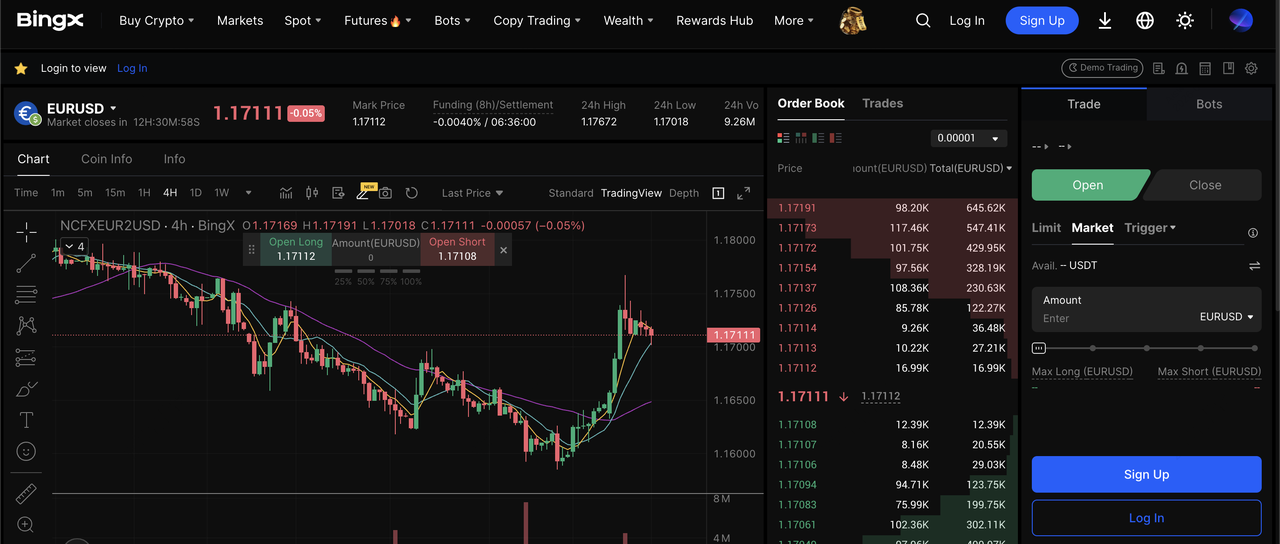

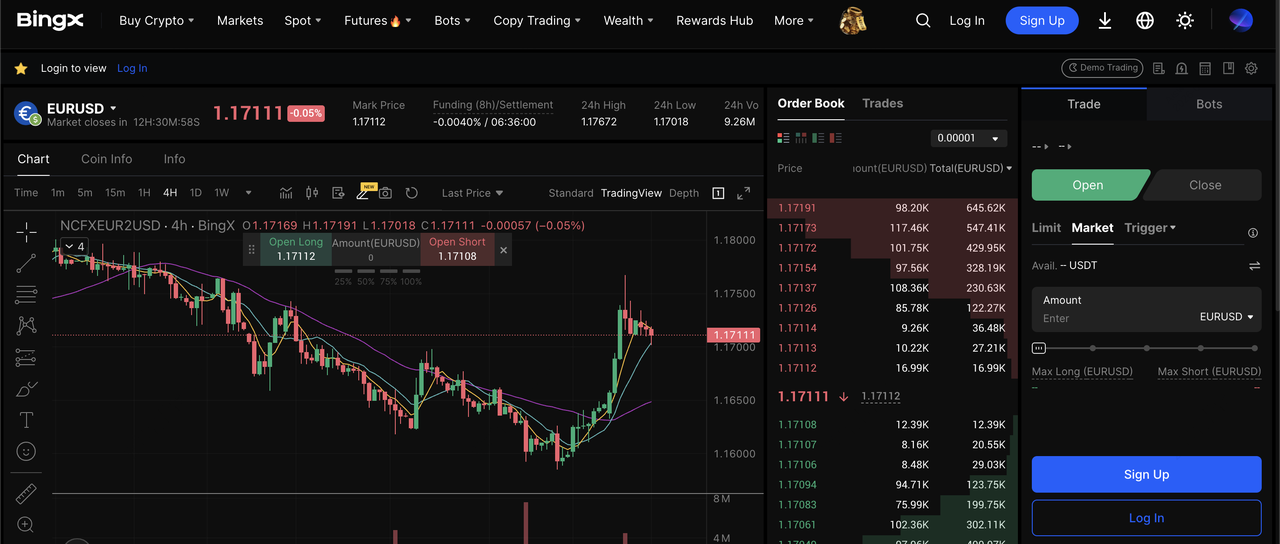

EURUSD-USDT perpetual contract on the BingX futures market

Forex perpetuals on BingX TradFi leverage the same USDT-margin system used for indices and commodities, making them intuitive for existing futures traders.

Step 1: Set Up Your BingX Account

Step 2: Select a Forex Pair

Go to Markets, select

TradFi and Forex and choose a forex perp such as EUR/USD, USD/JPY or other supported pairs.

Step 3: Choose Leverage

Select leverage based on your strategy and risk tolerance. Higher leverage boosts potential returns but also increases

liquidation risk.

• Limit order: Executes at your chosen price

Step 5: Manage Your Position

Open Long if you expect the base currency to strengthen, or Short if you expect it to weaken. Monitor real-time PnL, and adjust

stops and take-profits to

manage risk.

Why Trade Forex With Crypto on BingX TradFi: 5 Key Benefits

BingX TradFi lets you trade forex alongside indices, commodities, and stocks from a single USDT-based account, eliminating fiat rails and multiple broker accounts.

Practical advantages include:

1. Unified USDT settlement: No need for bank wires or fiat wallets.

2. Adjustable leverage: Custom leverage up to platform limits.

3. Two-way trading: Go long or short based on macro views.

4. Cross-market strategies: Combine FX positions with indices or commodities.

5. Familiar crypto controls: Real-time risk management tools akin to crypto perp trading.

This unified setup lets traders respond efficiently to macro catalysts, such as rate decisions, inflation releases, and geopolitical shifts, without the complexity of traditional forex infrastructure.

3 Key Things to Know Before Trading Forex Perpetual Futures

Before trading forex perpetual futures, it’s important to understand how FX market mechanics, funding costs, and leverage interact with crypto-style futures, since these factors can materially impact risk and performance in 2026’s macro-driven environment.

1. Trading Hours & Market Sessions: Unlike 24/7 crypto, forex perp markets follow global FX session hours. You may not be able to open/close positions when major FX sessions temporarily pause, although funding and overnight pricing can still affect your margin.

2. Funding Rates Are a Cost: Forex perps use funding to keep prices aligned with spot rates, and these payments, exchanged between longs and shorts at intervals, can add up over multi-day holds.

3. Leverage Amplifies Risks: Leverage increases both potential gains and losses. A sharp macro surprise, such as a Fed pivot or geopolitical escalation, can move forex pairs quickly, potentially triggering stop-outs or liquidations if positions are oversized.

Final Thoughts: Should You Trade Forex With Crypto in 2026?

Trading forex with crypto in 2026 offers a flexible, USDT-based way to access the world’s largest financial market, blending macro opportunity with crypto-native execution. BingX TradFi makes this possible through USDT-margined perpetual futures, giving traders a unified interface to manage FX, indices, commodities, and more.

That said, forex markets remain volatile and macro-driven, and leveraged trading carries significant risk. Use conservative leverage, define risk boundaries, and stay informed on major economic drivers ahead of data releases and policy decisions.

Risk reminder: Forex perp trading involves significant risk and may not be suitable for all traders. This article is for educational purposes only and does not constitute financial or investment advice.

Related Reading