In crypto, speed isn’t just an advantage, it’s survival. On July 14, 2025,

Bitcoin shattered records, hitting an all-time high above $123,000, and within days, the market saw the onset of an

altcoin season, with several tokens rallying 30–50% in a week. But here’s the catch: by the time technical indicators like

Relative Strength Index (RSI) or

Moving Average Convergence Divergence (MACD) react, the whales are already out.

This is where AI flips the script. Popular AI tools like

Grok AI and ChatGPT help you spot market signals as they emerge, and not after. From tracking

whale wallets to catching early altcoin buzz,

AI lets you decode on-chain data and position yourself ahead of the curve.

Why Track Whale Moves and On-Chain Data With AI?

Every blockchain transaction is public. You can see when wallets move millions in Bitcoin or when altcoins flow into decentralized exchanges. But there’s a problem: blockchains process millions of transactions daily, and making sense of that raw data requires time, tools, and expertise. That’s where AI steps in.

1. Whale Tracking: Follow the Smart Money: Whales, wallets holding large amounts of crypto, often signal major market shifts. Their moves can trigger fear or

FOMO across the market. For example:

i. BTC Inflows to Exchanges (CEX): When whales transfer Bitcoin to major centralized exchanges, it often means they’re preparing to sell. A surge in

BTC inflows in April 2024 preceded a 12% price drop within 48 hours.

ii. Outflows to Cold Wallets or DeFi: Conversely, when whales withdraw Bitcoin from exchanges to

hardware wallets or deposit into DeFi protocols, it usually signals long-term holding or

staking intentions. In July 2025, large ETH outflows coincided with a 20% price rally over two weeks.

Tracking these patterns manually is tough. AI tools can help you monitor them in real time and alert you as soon as significant whale activity is detected.

2. Spot Altcoin Trends Before They Explode: Altcoins are even more volatile than Bitcoin, with small market caps making them sensitive to sudden interest. AI can detect early:

• Spikes in decentralized exchange (DEX) trading volumes

• Rising token mentions across social platforms

• Increased unique wallet activity holding the token

3. Detect Network Health and Liquidity Shifts: AI can monitor blockchain metrics like active addresses, hash rates (for PoW chains), and total value locked (TVL) in DeFi protocols.

• A drop in active addresses might signal declining user engagement or a cooling market.

• A surge in TVL often precedes new bull runs, as seen on Solana in late 2024.

Example: In March 2025, a steady rise in Polygon’s TVL alongside active wallets hinted at ecosystem growth. Tokens like MATIC and associated DeFi coins surged 18% within a week.

4. Predict Market Sentiment With On-Chain Data: AI tools combine on-chain metrics with social

sentiment analysis to gauge investor mood.

• High exchange inflows + negative sentiment often predict sell-offs.

• Rising outflows + positive sentiment suggest accumulation phases.

This dual approach provides context for raw data, reducing false positives.

5. Spot Potential Risks and Unusual Activity: AI systems can flag anomalies like:

• Sudden large token transfers to unverified addresses (possible

rug pulls).

Example: In May 2025, AI tools flagged an unusual spike in

stablecoin swaps on a new DeFi protocol; hours later, the project suffered a $4M exploit.

6. Gain an Edge With Cross-Chain Analysis: Advanced AI can track token flows across multiple blockchains (

Ethereum →

BSC →

Solana), helping spot whale strategies using bridges or Layer-2s.

Example: Large USDT transfers from

Tron to Ethereum in July 2025 preceded a

USDT-backed altcoin rally.

How to Use Grok and ChatGPT for On-Chain Analysis

While on-chain data gives you real-time insights, pairing it with

AI tools can take your trading strategy to the next level. Two standout options are Grok AI and ChatGPT. Together, they help you move from raw data to fully formed trade plans.

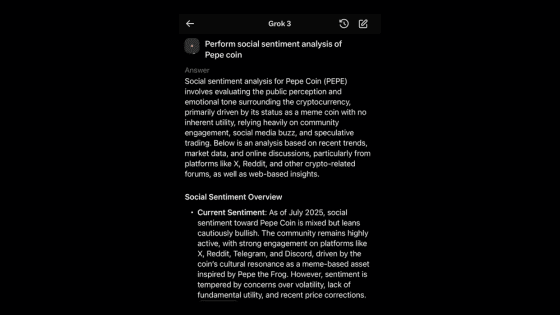

1. Begin with Grok 3: Real-Time Macro & Sentiment Scouting

Using Grok for sentiment analysis

Grok 3 is Elon Musk’s latest AI chatbot from xAI, deeply integrated on X with real-time access to social data. It surfaces early momentum shifts, like spikes in token mentions around news or whale activity, before traditional charts react.

How to Use Grok 3 for Macro and Sentiment Analysis

i. Monitor macro events: Ask Grok to summarize public sentiment after key economic events.

Example: “Grok, summarize the tone around ‘CPI surprise’ or ‘Bitcoin

whale movement’ in the past hour.” This helps you identify shifting narratives before price reacts.

ii. Track token buzz: Use this to discover early-stage 'hype' or sentiment surges.

Example: “Flag any >300% spike in mentions of

$SOL,

$DOT in 6 hours.”

iii. Use “Think” mode: With Grok 3’s advanced reasoning ability, activatable via “Think,” you can ask,

“Explain why mentions of ‘ETH whale’ surged after that news.”

Grok will walk through its logic step-by-step.

iv.. Get notified: Set alerts manually or integrate via unofficial APIs for fast action signals.

Grok sees narrative buildup on social media before prices adjust, giving you early tactical insight .

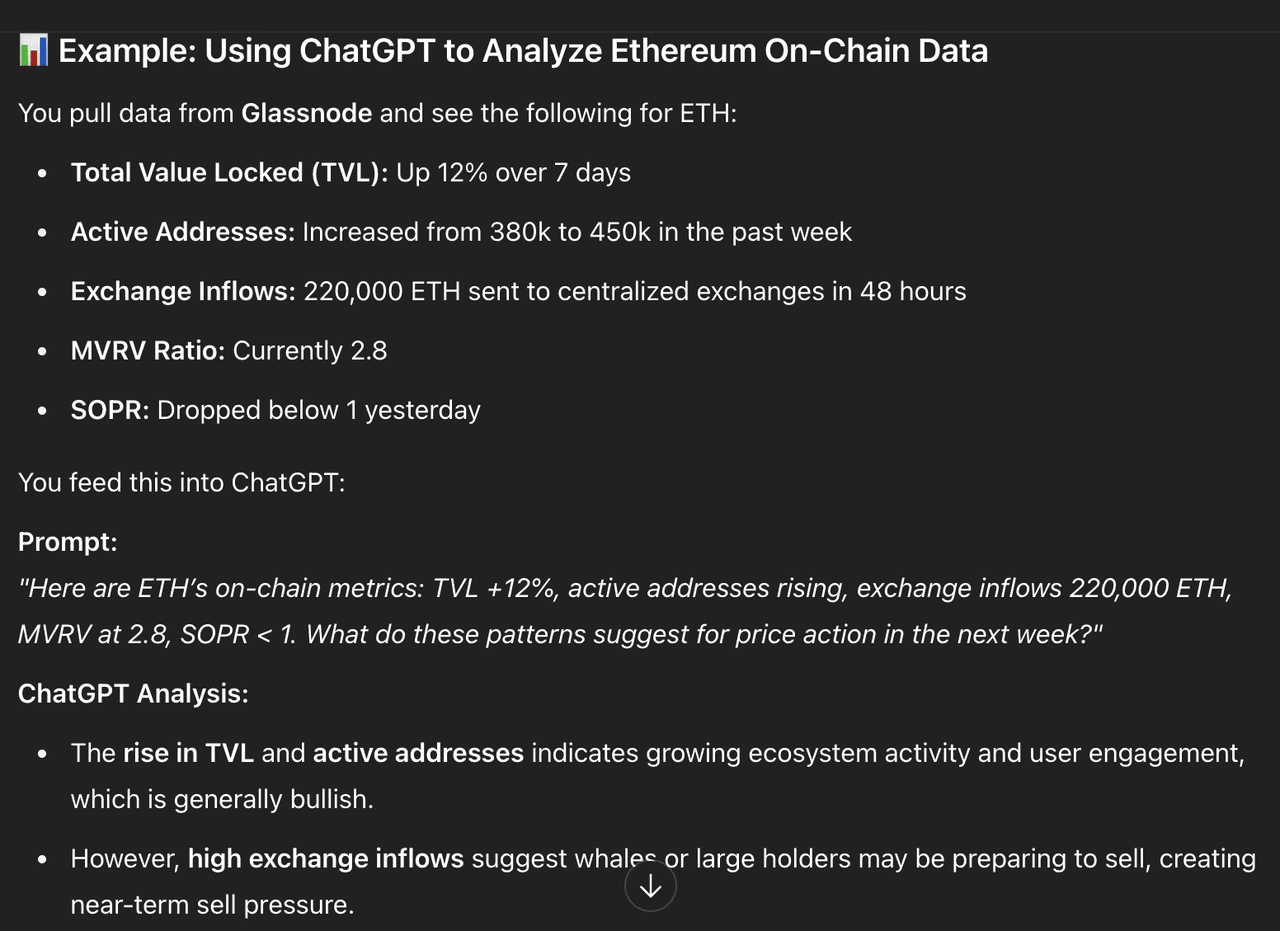

2. Dive Deep with ChatGPT: On-Chain Data Interpretation

On-chain analysis with ChatGPT

ChatGPT, especially GPT‑4, helps parse real on-chain metrics, like active addresses, MVRV, exchange flows, so you understand why the chain is moving.

How to Use ChatGPT to Interpret On-Chain Data

i. Collect the data: Use APIs like IntoTheBlock, Glassnode, CryptoQuant to pull relevant numbers.

ii. Feed it to ChatGPT: “Here are ETH’s daily TVL, active addresses, and exchange inflows over the past week. What do these patterns suggest?”

iii. Ask metric-specific questions:

• MVRV: “MVRV is at 2.5. What does that imply about market valuation?”

• SOPR: “SOPR dropping below 1 suggests what near-term behavior?”

• Exchange flows: “High inflows to exchanges. Should I expect sell pressure?”

iv. Combine metrics with narrative: “Add in X sentiment rising. Do these combined indicate a drawdown or breakout?”

ChatGPT will identify key signals, like Bitcoin dropping below realized value (MVRV < 1), and provide evidence-based insights related to price psychology and risk.

3. Integrate Sentiment + On-Chain for Stronger Signals

i. Start with Grok: If sentiment spikes around a token or event, Grok flags it with >200–300% mention growth.

ii. Move to ChatGPT: Pull data and ask ChatGPT to analyze whether on-chain behavior (like rising inflows, falling TVL) confirms the narrative shift.

iii. Create structured prompts: “Sentiment for $LINK spiked 350%. Exchange inflows doubled and SOPR dropped below 1. Summarize combined signals and suggest trade entry, stop-loss, and risk level.”

This dual-layered approach filters out false hype and helps distinguish sustainable trends from noise.

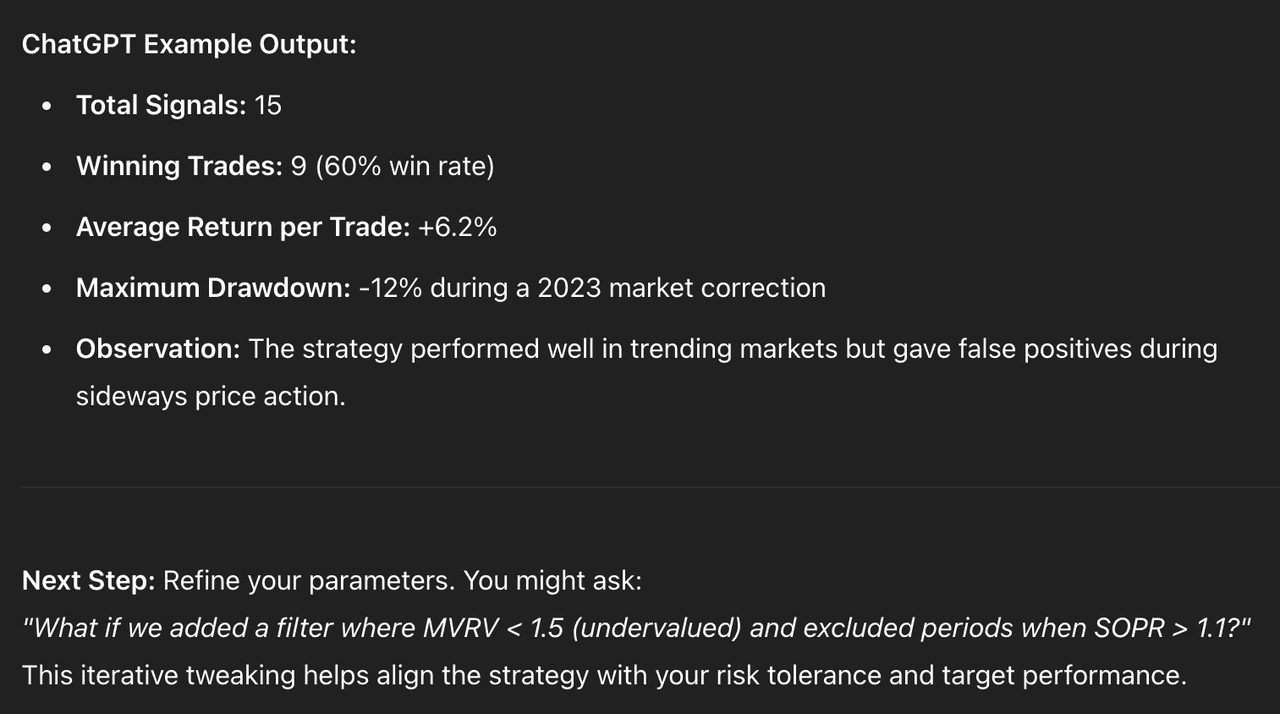

4. Backtest & Refine: Learn What Works

Backtesting helps measure whether sentiment + on-chain combinations historically would’ve worked, run tests over multiple market periods.

How to Backtest Your Strategy with ChatGPT: Sample Prompt

Backtest example | Source: ChatGPT

“Using historical data, what if we bought whenever sentiment spiked >200% and exchange inflows exceeded +100%? Show win rate, average return, and max drawdown.”

Then tweak thresholds, tokens, and duration until metrics align with your risk preferences.

5. Build Oversight Safeguards

i. Manual check as final filter: Always visually review trade signals.

ii. Use stop-loss: On-chain or sentiment-based breakouts can reverse quickly.

iii. Diversify your approach: Don’t trade a strategy blindly; portfolio-level risk matters.

iv. Be aware of AI quirks: Grok sometimes outputs misinformation or bias; double-check factually.

Convert Your AI-Powered On-Chain Analysis Into an Actionable Trading Strategy

Combining ChatGPT and Grok AI's analysis creates a powerful, all-in-one crypto trading system. Grok AI monitors real-time sentiment on X (Twitter) to spot hype cycles early, and ChatGPT synthesizes these insights to design strategies, simulate outcomes, and set risk management rules. Together, they form a seamless workflow that takes you from detecting market signals to executing trades in minutes, giving you a smarter and faster edge in volatile crypto markets. Here's how to get started:

Step 2: Assess Market Sentiment With Grok AI

Use Grok AI to analyze social media chatter and emotional language on X (Twitter). Ask for a summary of recent mentions of key terms like “$SOL,” “dump,” or “whale activity” within the past six hours. Pay attention to spikes in negative language (e.g., “fear,” “rug pull”) or bullish keywords (e.g., “moon,” “airdrop”).

Example: In April 2025, Grok flagged a surge in bearish sentiment related to US regulatory concerns. Within 48 hours, altcoins such as ADA and MATIC fell by 15–20%.

Step 2: Design a Trading Plan With ChatGPT

Input the on-chain and sentiment data into ChatGPT for strategy formulation. For instance, with a 20,000 BTC inflow to exchanges and Grok reporting a 300% increase in bearish chatter, ask ChatGPT:

“Based on similar past events, what is the likely BTC price reaction? Suggest entry, stop-loss, target, and position size for a short trade.”

ChatGPT can simulate historical outcomes, recommend technical levels based on support and resistance, and define risk parameters such as a 1.5% stop-loss and a 3% portfolio allocation.

Step 3: Check Whale Activity

Monitor significant BTC or ETH inflows and outflows. Outflows from exchanges often indicate that whales are accumulating assets, which can signal bullish sentiment. Inflows, on the other hand, may suggest whales are preparing to sell, creating potential downward pressure.

Step 4: Execute the Plan on Your Trading Platform

Use Spot or Futures markets to implement the strategy. Place limit or market orders and set stop-loss and take-profit levels for automated risk management. If you are a seasoned investor, you can apply moderate leverage (2–5x) for futures trades.

Risks and Limitations

While AI tools like ChatGPT and Grok AI offer valuable insights, they are not foolproof. False signals can arise from coordinated hype, spam campaigns, or sudden market anomalies. Additionally, low-volume tokens may not provide enough data for reliable analysis. It is important to remember that AI tools can deliver signals and insights but cannot execute trades on your behalf. To use AI effectively, always combine its outputs with technical analysis, sound risk management, and a clear trading plan.

Alternative Option: Use BingX to Spot Trading Signals

BingX AI is your smart crypto assistant built right into the BingX trading platform. It’s designed to simplify the complex world of crypto data and help you spot trading opportunities faster.

Instead of juggling multiple dashboards, news sites, and blockchain explorers,

BingX AI is fully integrated into the BingX trading platform, giving you an all-in-one solution to analyze, plan, and execute trades without switching between apps or tools. This seamless integration means you can monitor whale movements, track altcoin trends, and act on AI insights instantly, all within the same interface.

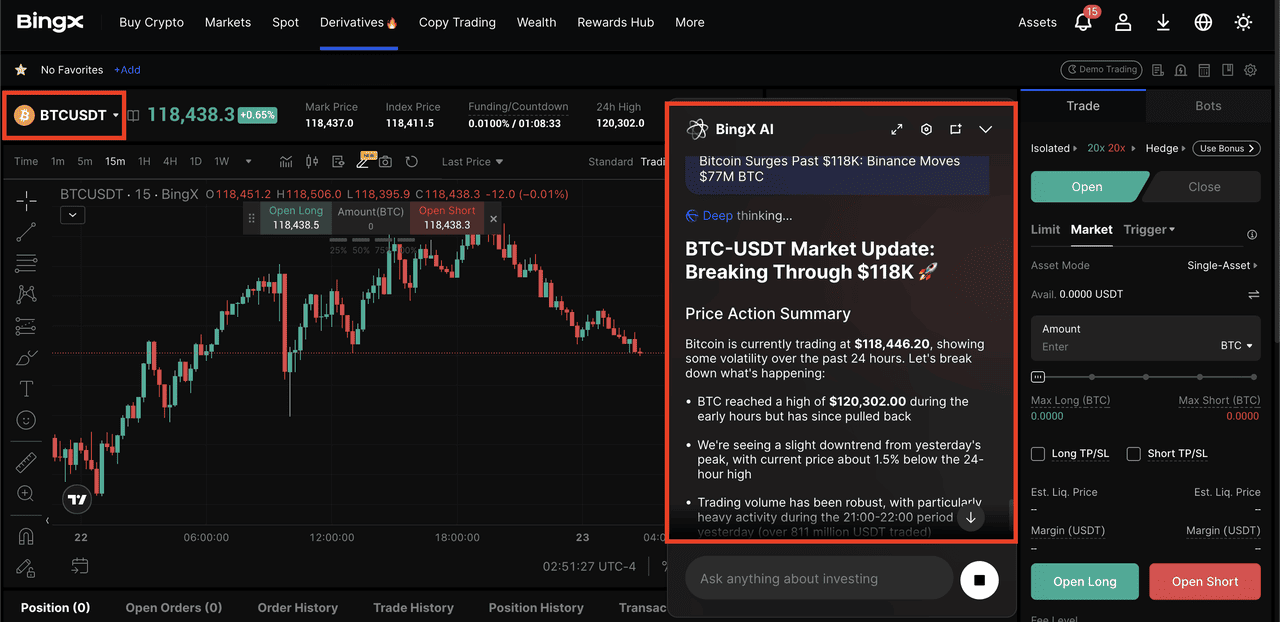

For example, as shown in the screenshot below, BingX AI flagged a surge in BTC’s breakout past $118,000, helping traders spot the trend early and capture gains before the broader market reacted.

BTC/USDT futures trading powered by BingX AI insights

Check out how BingX AI can work together with Grok AI and ChatGPT to identify a trading opportunity, design a strategy, and execute it effectively.

1. BingX AI detects heavy BTC inflows to leading exchanges (25,000 BTC total).

2. Grok AI flags a spike in bearish chatter (“rate hike fears,” “whale dumping”).

3. ChatGPT designs a trade:

• Entry: $122,800

• Stop-loss: $125,000 (1.8% risk)

• Target: $115,500 (5.9% reward)

• Position size: 2% of portfolio with 3x leverage

4.

Execution: Open

BTC/USDT short on BingX Futures with predefined levels

5. Result: Bitcoin drops 6%, and the trade hits the target for a net 17.7% ROI on allocated capital.

How BingX AI Can Analyze the Crypto Market

Here are some ways that BingX AI analyzes on-chain data, whale movements, and altcoin trends to deliver actionable insights for traders.

1. Real-Time Whale Tracking: BingX AI monitors large wallet movements across exchanges and flags significant transactions.

Example: In early 2024, ETH whales moved funds from Binance to DeFi, signaling accumulation. ETH rallied 15% days later, a move BingX AI could have identified early.

2. Spotting Altcoin Hype Early: It tracks token mentions on social media, DEX volume spikes, and smart contract activity to detect trending altcoins before breakouts.

Example: In May 2024,

FLOKI mentions jumped 300%, and early traders gained 20% before charts reacted.

3. Smarter Decisions With Combined Metrics: BingX AI evaluates multiple indicators, active addresses, TVL, MVRV ratios, to provide a holistic market view. It also compares projects within their sector for better context.

Conclusion: Can AI Boost On-Chain Analysis?

Grok and ChatGPT bring a powerful edge to on-chain analysis by turning raw blockchain data and social sentiment into actionable insights. Grok helps you monitor real-time market chatter and detect hype cycles, while ChatGPT could help you synthesize on-chain metrics to design strategies, simulate outcomes, and define risk rules. Together, they create a more informed and efficient workflow for navigating crypto’s fast-paced environment.

Still, it’s important to remember that AI is a tool, and not a crystal ball. Markets are inherently volatile, and no system can eliminate risk. Use AI insights as part of a broader strategy that includes technical analysis, disciplined risk management, and informed decision-making.

Related Reading