Crypto markets move fast, sometimes in ways that seem unpredictable. For traders, this creates both opportunity and risk. That’s why understanding chart patterns is essential. These formations, based on historical price behavior, offer visual clues about where the market might head next. Patterns like flags, wedges, and triangles help traders anticipate breakouts and identify more precise entry and exit points. Instead of relying on guesswork or emotion, traders can base decisions on repeatable logic, an advantage in a market defined by volatility.

Success in crypto trading often comes down to timing, structure, and discipline. Chart patterns, combined with support and resistance levels, defined price targets, and confirmation from indicators, form a structured trading framework. This toolkit empowers traders to navigate sharp swings with greater confidence and clarity.

In this article, we will explain key chart patterns and how to interpret them to make informed trading decisions in the crypto market.

What Are Crypto Chart Patterns?

Chart patterns are visual formations created by the price movements of cryptocurrencies on a trading chart. These patterns reflect market sentiment and trader psychology at work, essentially displaying the ongoing battle between buyers and sellers. When traders recognize these patterns, they can anticipate potential price movements with greater accuracy.

Support and resistance levels are key components of chart patterns. These levels mean that certain price points act as psychological barriers where traders tend to make significant decisions, often leading to peaks or troughs in the price.

Chart patterns fall into two main categories:

1. Continuation patterns - These suggest that the current market trend is likely to persist after a brief pause and can signal either bullish or bearish conditions. Examples include flags, pennants, and triangles.

2. Reversal patterns - These indicate that the current trend may be exhausting and price could move in the opposite direction, also signaling potential bullish or bearish reversals. Examples include head and shoulders, double tops, and wedges.

During consolidation periods, where price moves sideways within a range, these patterns help traders determine whether the market is simply taking a breather before continuing in the same direction, or preparing for a complete reversal. Often, chart patterns are still forming during these periods, so traders should be cautious until the pattern is fully developed.

Top Chart Patterns Every Crypto Trader Should Know

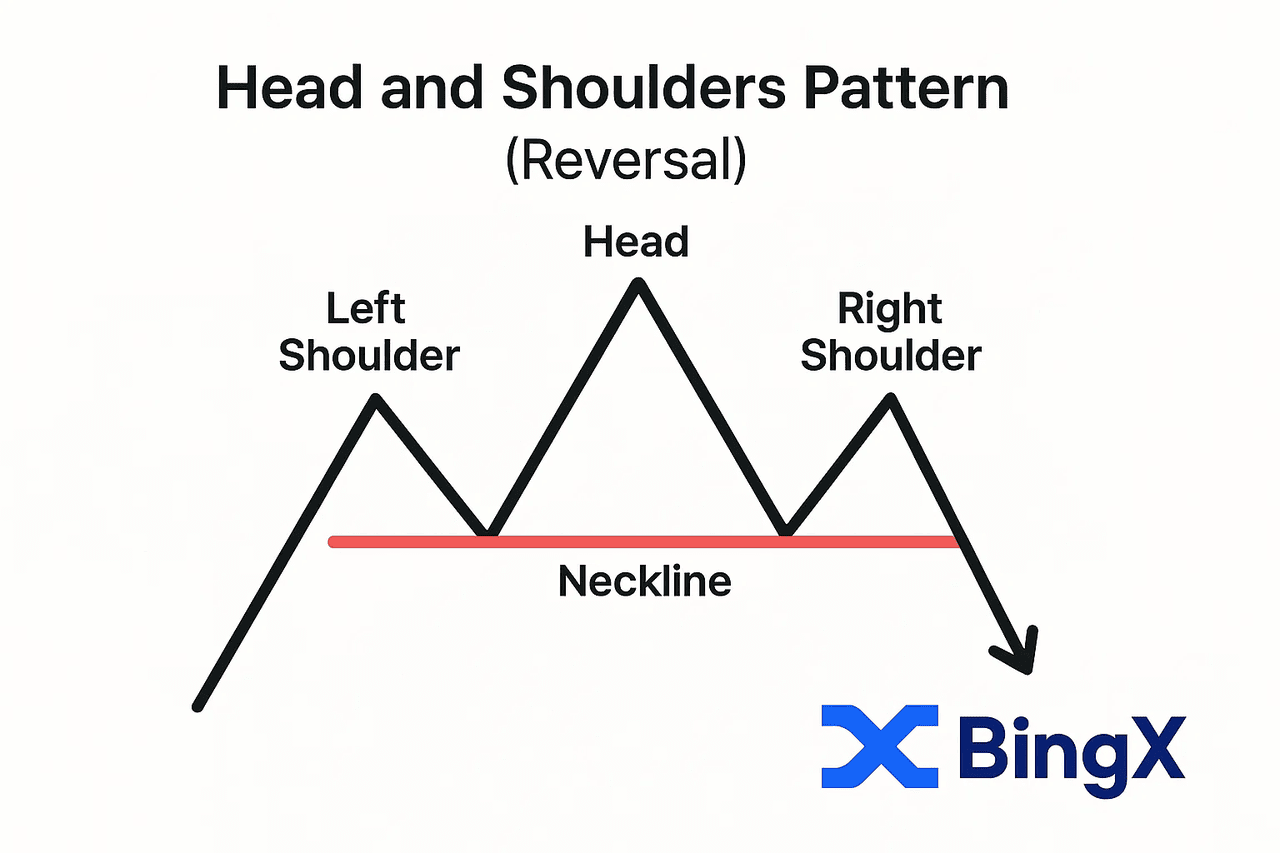

1. Head and Shoulders Pattern (Reversal)

The Head and Shoulders pattern is one of the most reliable reversal patterns, with an estimated success rate of 82% according to some analyses. This bearish formation consists of three successive peaks, with the middle peak, also known as the head, being the highest, and the two outside peaks, referred to as the shoulders, being lower and relatively equal in height.

Characteristics:

• Forms after an uptrend

• Features three peaks with the middle one being highest

• A horizontal "neckline" connects the lows between peaks

When the price breaks below the neckline after the right shoulder forms, it signals a potential trend change from bullish to bearish. This break is often followed by significant price falls, confirming the reversal. For price targets, traders typically measure the distance from the head to the neckline and project that distance downward from the breakout point.

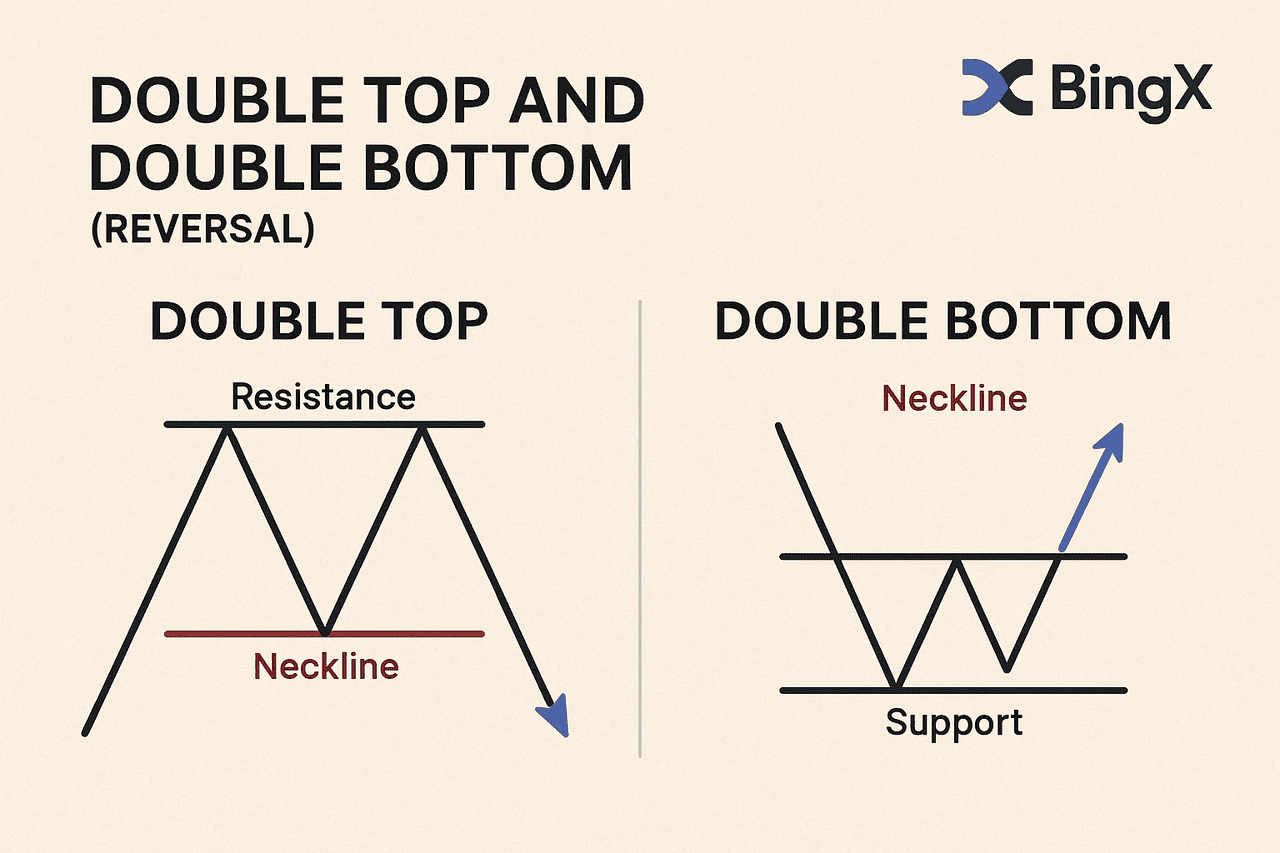

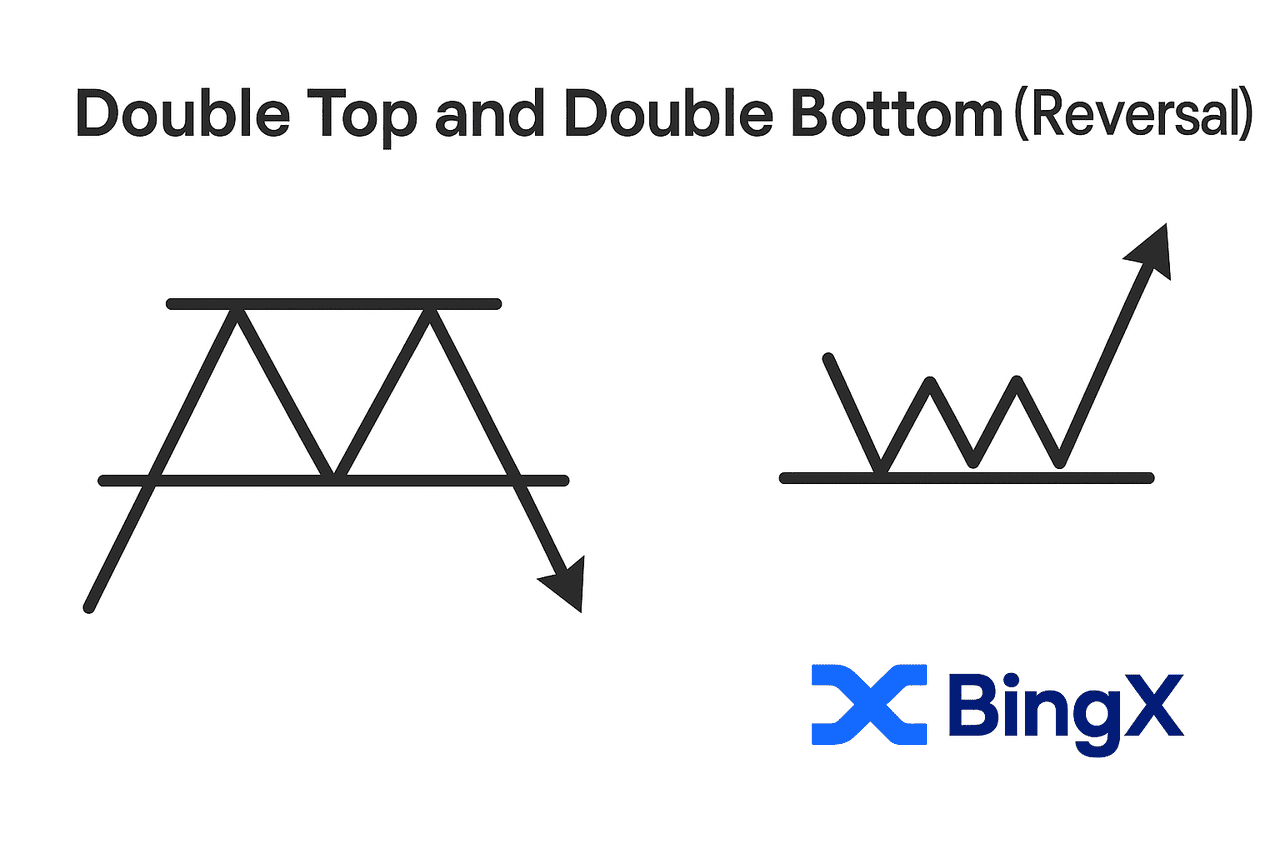

2. Double Top and Double Bottom (Reversal)

Double Top and Double Bottom patterns are among the most recognizable signals in technical analysis. Their distinctive M and W shapes help traders identify potential market reversals.

i. Double Top

A Double Top pattern resembles the letter "M" and forms when the price hits a resistance level twice but fails to break through. This failure often signals that buying pressure is weakening. Once the price breaks below the low between the two peaks, known as the neckline, it confirms a potential bearish reversal.

ii. Double Bottom

On the other hand, the Double Bottom pattern resembles a "W" and occurs when the price tests a support level twice but fails to push lower. This suggests that selling pressure is fading. A break above the peak between the two bottoms serves as confirmation of a bullish reversal.

Both patterns have an estimated reliability of about 82% for Double Bottoms , making them valuable tools for traders. The price target is typically calculated by measuring the height from the tops or bottoms to the neckline and projecting that distance from the breakout point.

Traders should wait until the pattern is completed, when the price breaks the neckline, before acting on the signal.

3. Triangle Patterns (Continuation & Reversal)

Triangle patterns form when price consolidates between converging trendlines, indicating a period of decreasing volatility before a potential breakout. After this consolidation, price will eventually break out in one direction.

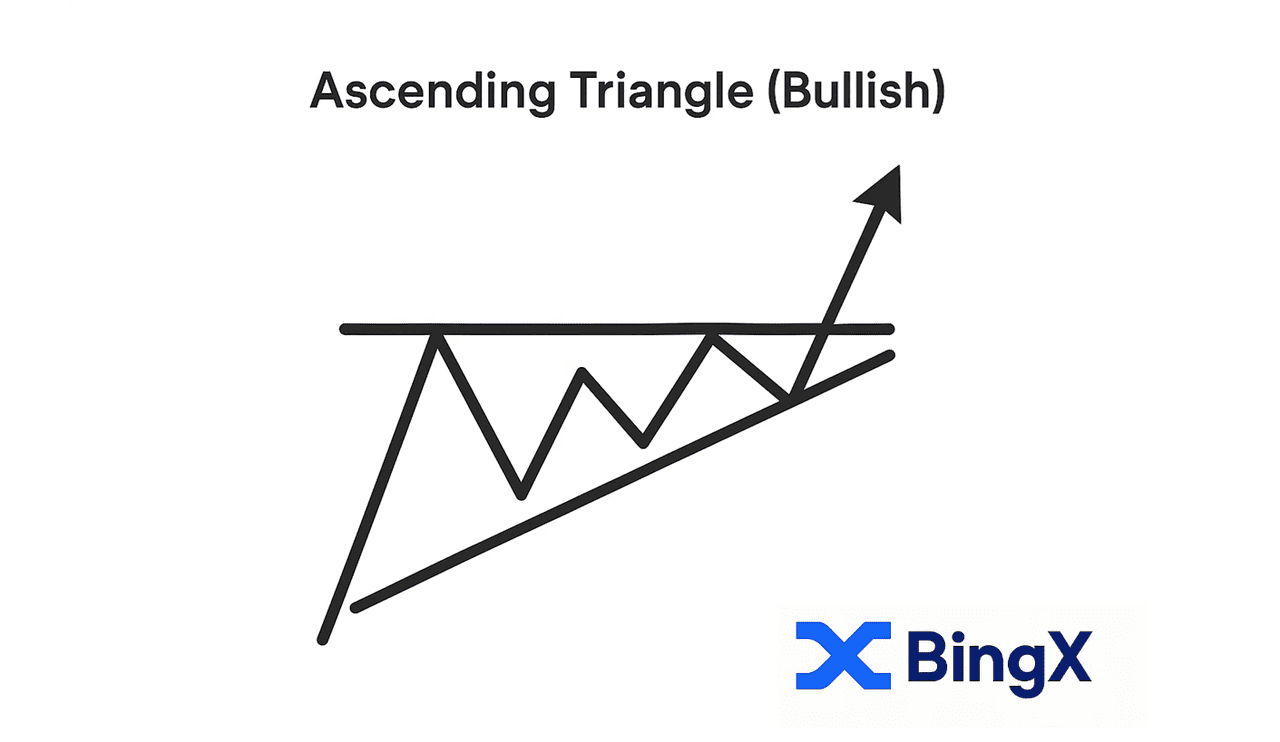

i. Ascending Triangle (Bullish)

An Ascending Triangle is characterized by a flat upper resistance line and a rising lower support line. This setup suggests growing bullish pressure, as buyers are increasingly willing to step in at higher prices.

When price eventually breaks above resistance, it often confirms a continuation of the uptrend.

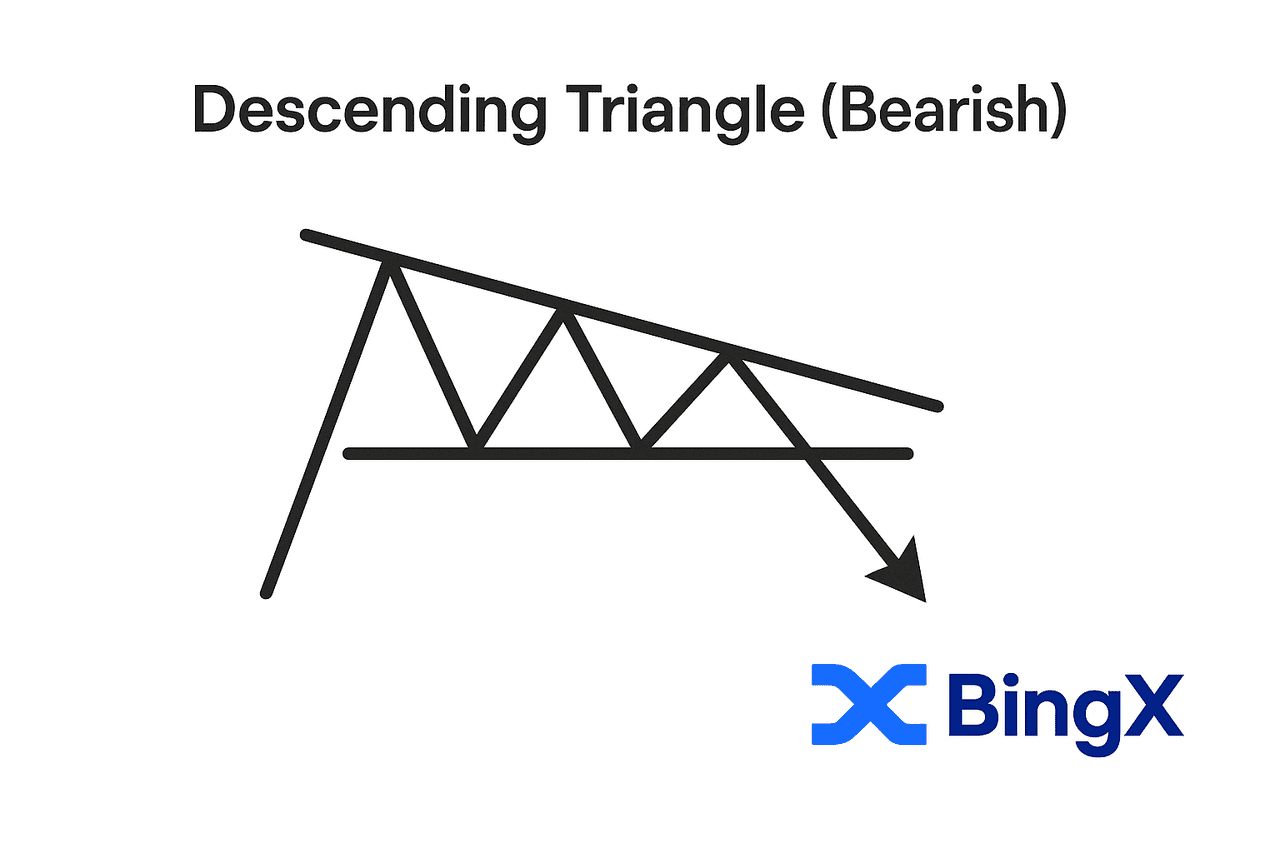

ii. Descending Triangle (Bearish)

In contrast, a Descending Triangle features a flat lower support line with a descending upper resistance line. This formation signals bearish sentiment, with sellers consistently pushing the price lower. A break below support typically indicates the continuation of a downtrend.

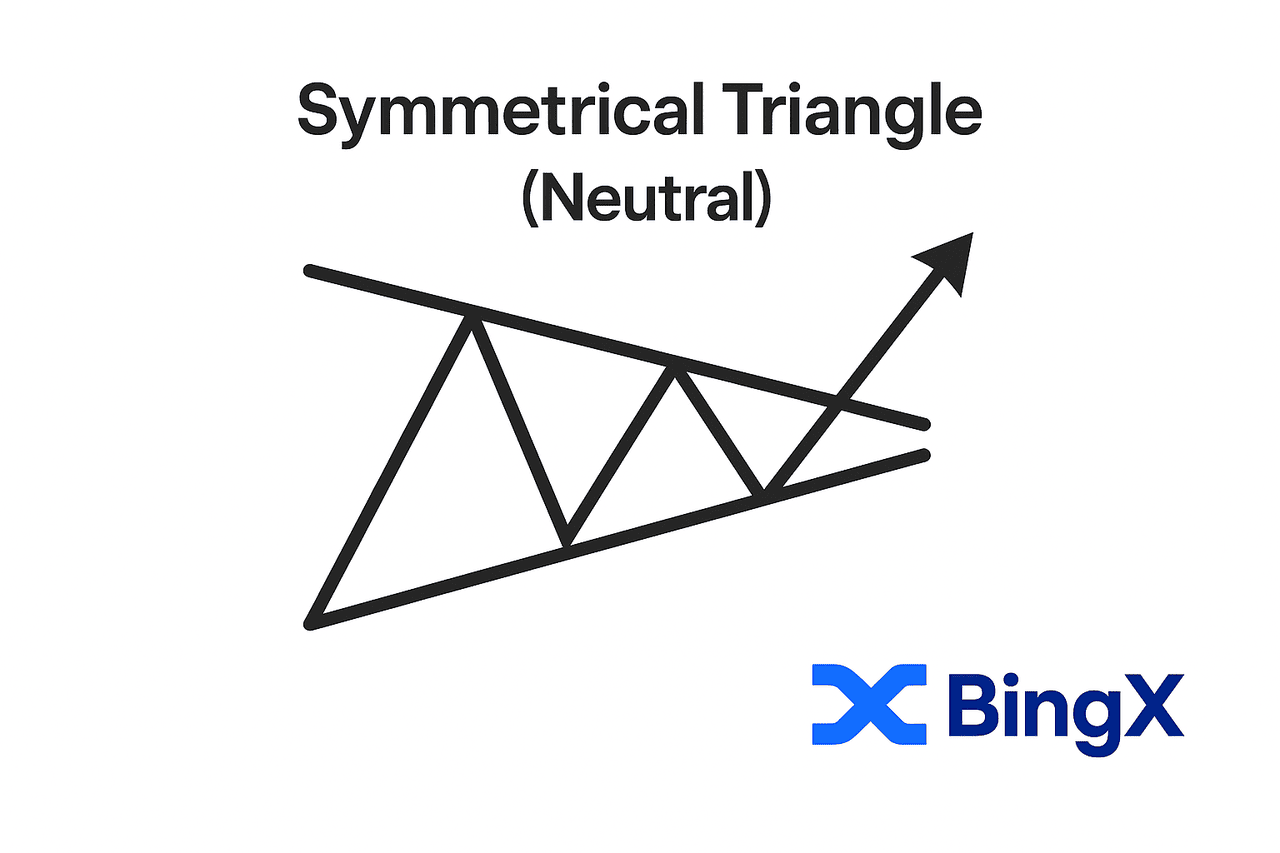

iii. Symmetrical Triangle

A Symmetrical Triangle occurs when both support and resistance lines slope toward each other, creating a converging shape. This pattern is directionally neutral, meaning the breakout can go either way. However, it often resolves in the direction of the prevailing trend.

Triangle patterns show approximately 62-73% reliability, depending on the specific formation. Price targets are estimated by measuring the widest part of the triangle and projecting that distance from the breakout point.

4. Flag and Pennant Patterns (Continuation)

Flag and Pennant patterns are short-term continuation setups that appear after a sharp price move, known as the flagpole. They signal brief pauses in strong trends, allowing traders to anticipate potential follow-through in the same direction. These patterns are important tools for traders to anticipate the continuation of the uptrend or downtrend.

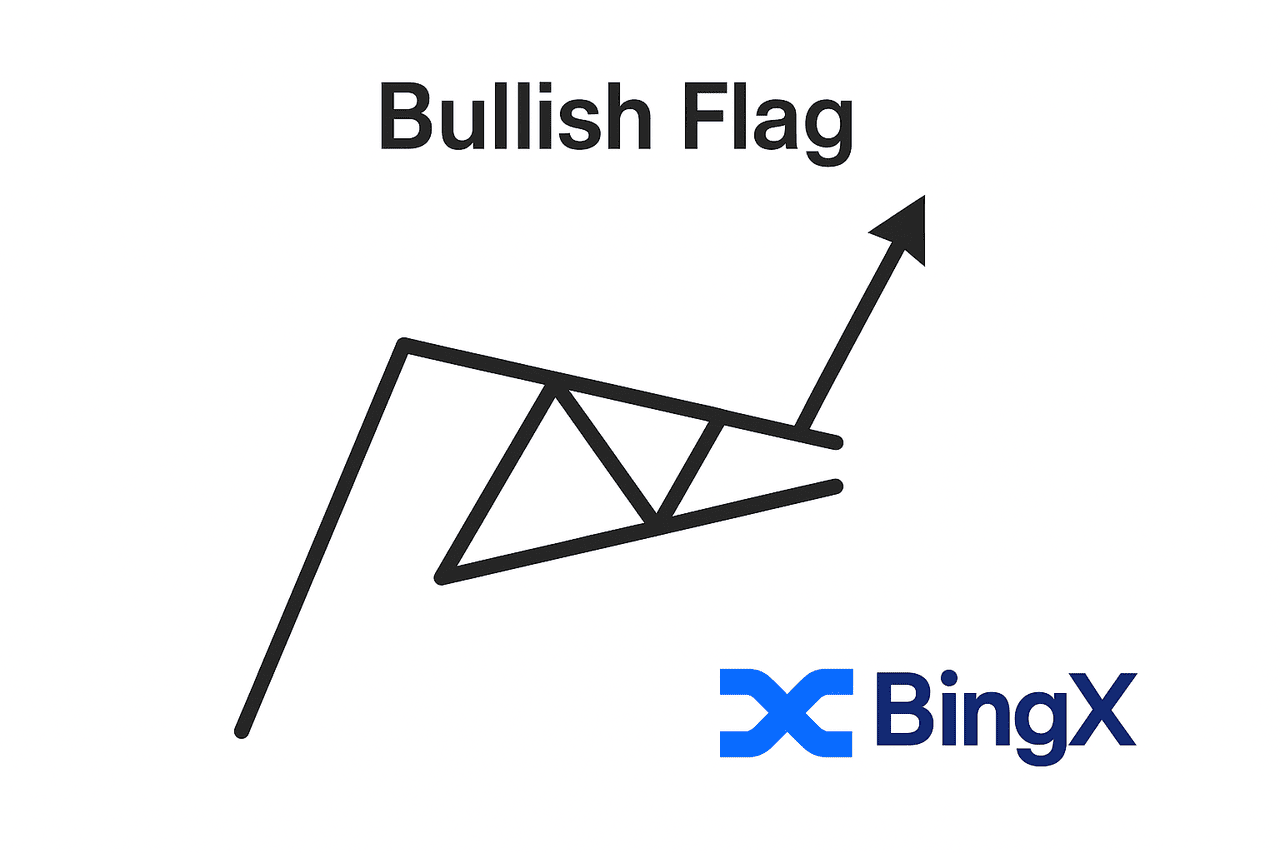

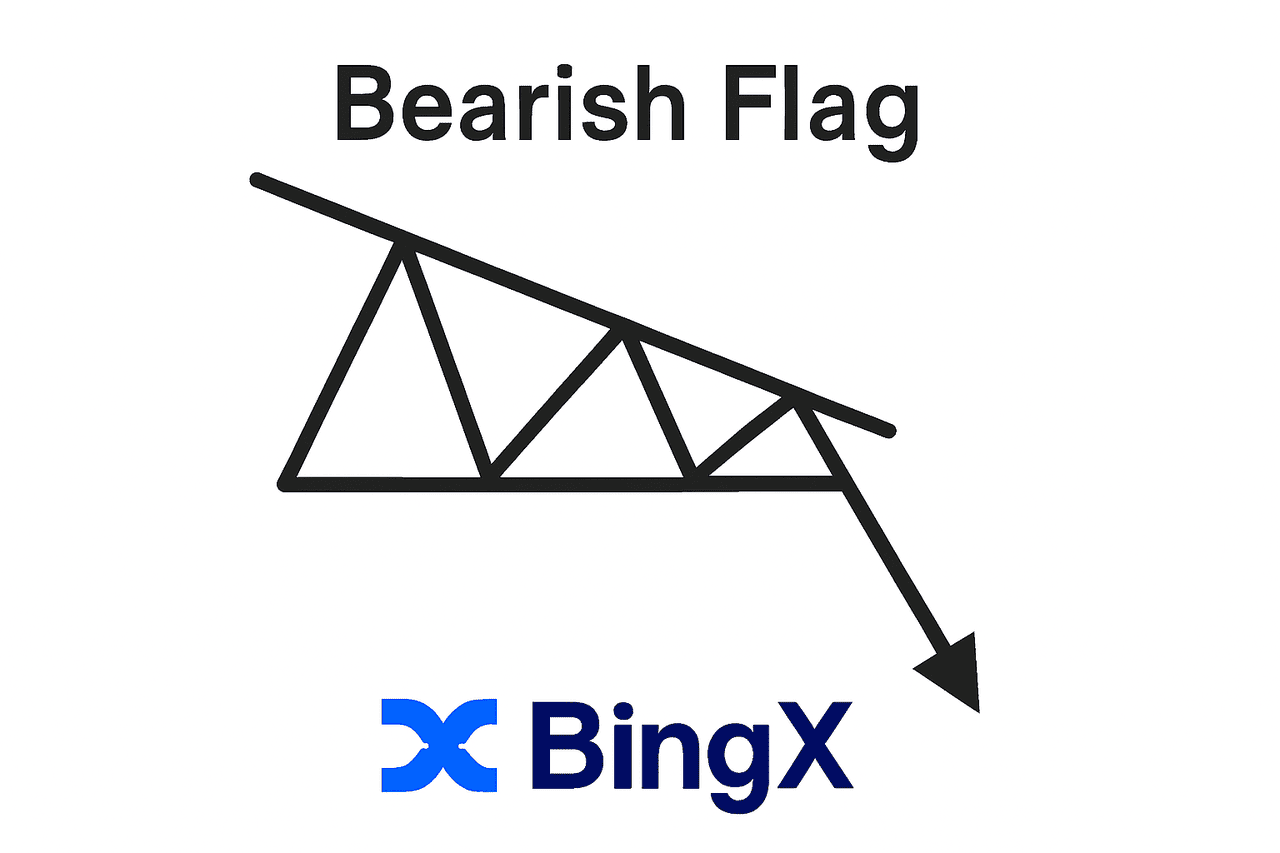

i. Bullish/Bearish Flag

A flag pattern resembles a small, sloping rectangle that forms after a sharp price movement, either upward or downward.

• Bullish Flag: A bull flag is a bullish pattern that appears after a sharp upward move, characterized by a rectangular consolidation phase that slopes slightly downward or sideways against the bullish trend. This pattern signals a potential breakout upwards, indicating a continuation of the uptrend and further bullish momentum.

• Bearish Flag: A bear flag, on the other hand, forms during a downward trend. It features a rectangular consolidation that slopes upward or sideways against the bearish trend, signaling a temporary retracement before the trend continues lower. Traders often look for increased trading volume when the bear flag breaks down, as this confirms the pattern's validity and may prompt them to enter a short position to capitalize on the continuation of the downtrend.

Both bull flags and bear flags resemble a flag on a pole, with the “flag” being the consolidation area. These flag patterns are considered high probability setups for traders, especially when confirmed by increased trading volume.

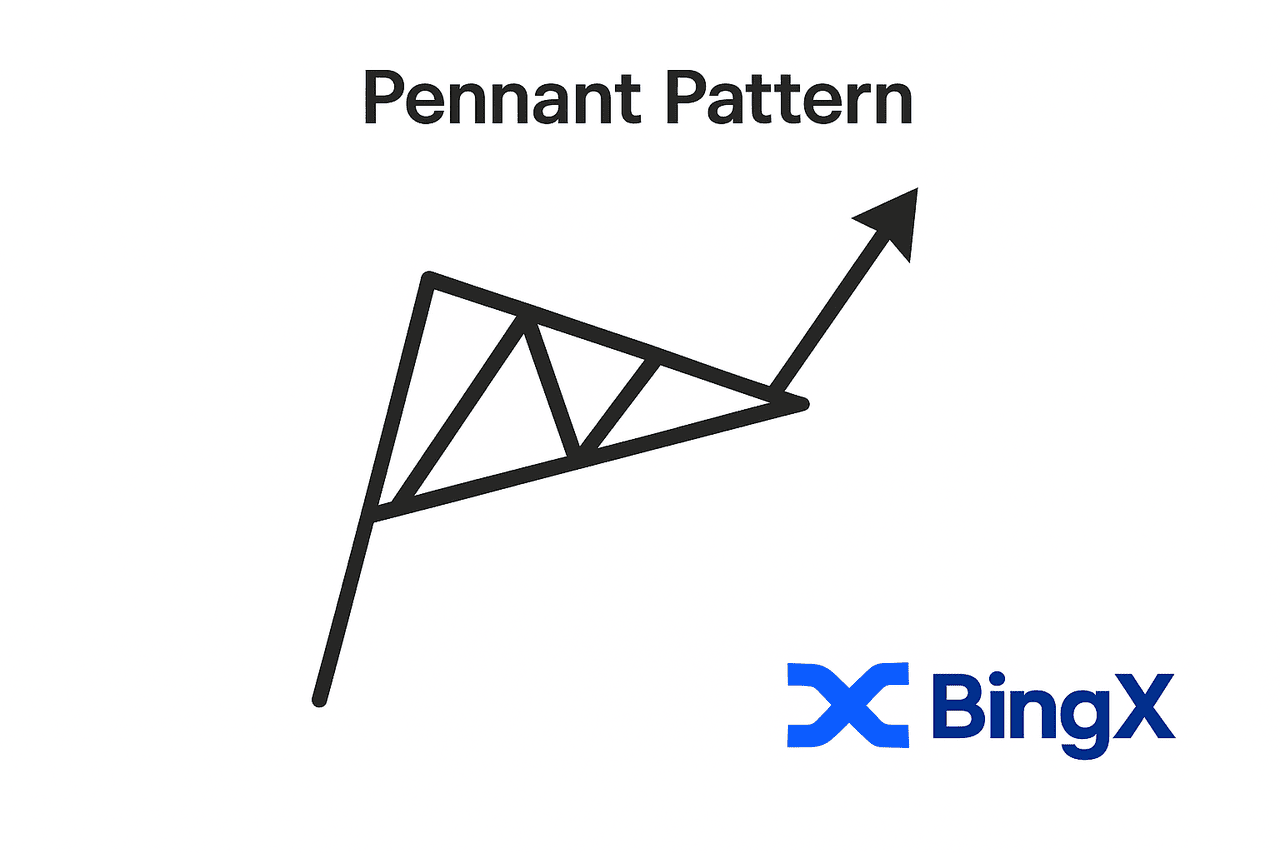

ii. Pennants

Pennants are similar to flags but form a small symmetrical triangle, known as a pennant formation, instead of a rectangle. A bullish pennant is a bullish pattern that forms after a strong upward price movement, followed by a brief consolidation with converging trendlines. The breakout from a bullish pennant, especially with increased trading volume, is important for confirming the continuation of the bullish trend.

Pennant patterns represent brief consolidation in a strong trend and usually result in continuation of the prevailing trend. However, pennant formation can sometimes fail if not confirmed by other technical indicators or if there is low trading volume during the pattern.

For both patterns, the price target is typically calculated by measuring the length of the flagpole and projecting it from the breakout point. Both bull flags and bullish pennants are used by traders to identify high probability trade setups and to anticipate further price movement in the direction of the trend.

5. Wedge Patterns (Reversal)

Wedge patterns form when price consolidates between two converging trendlines that are both pointing in the same direction.

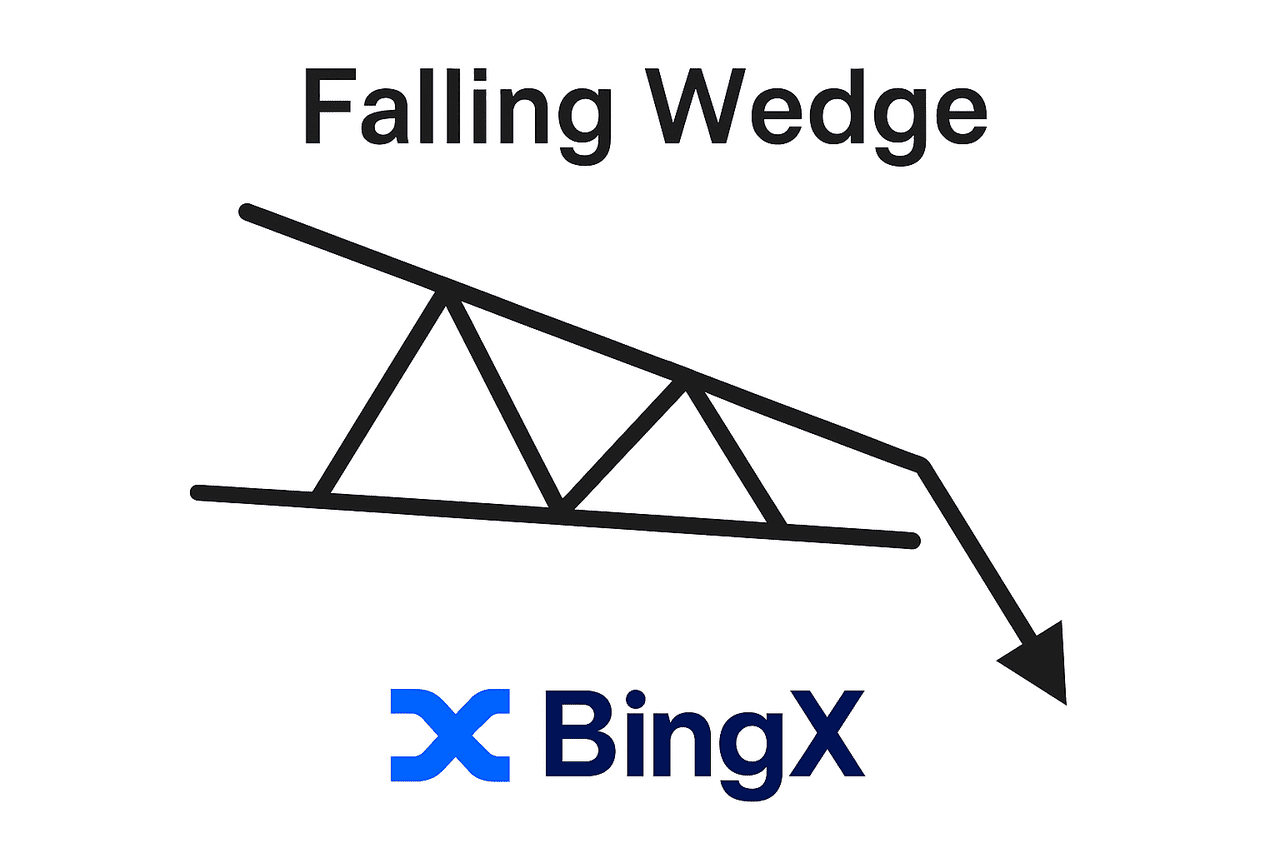

i. Falling Wedge

A falling wedge develops when both trendlines slope downward, with the upper line descending more sharply.

This pattern typically forms during a downtrend and suggests that selling pressure is losing steam. A breakout above the upper trendline often signals a bullish reversal and the beginning of an upward move.

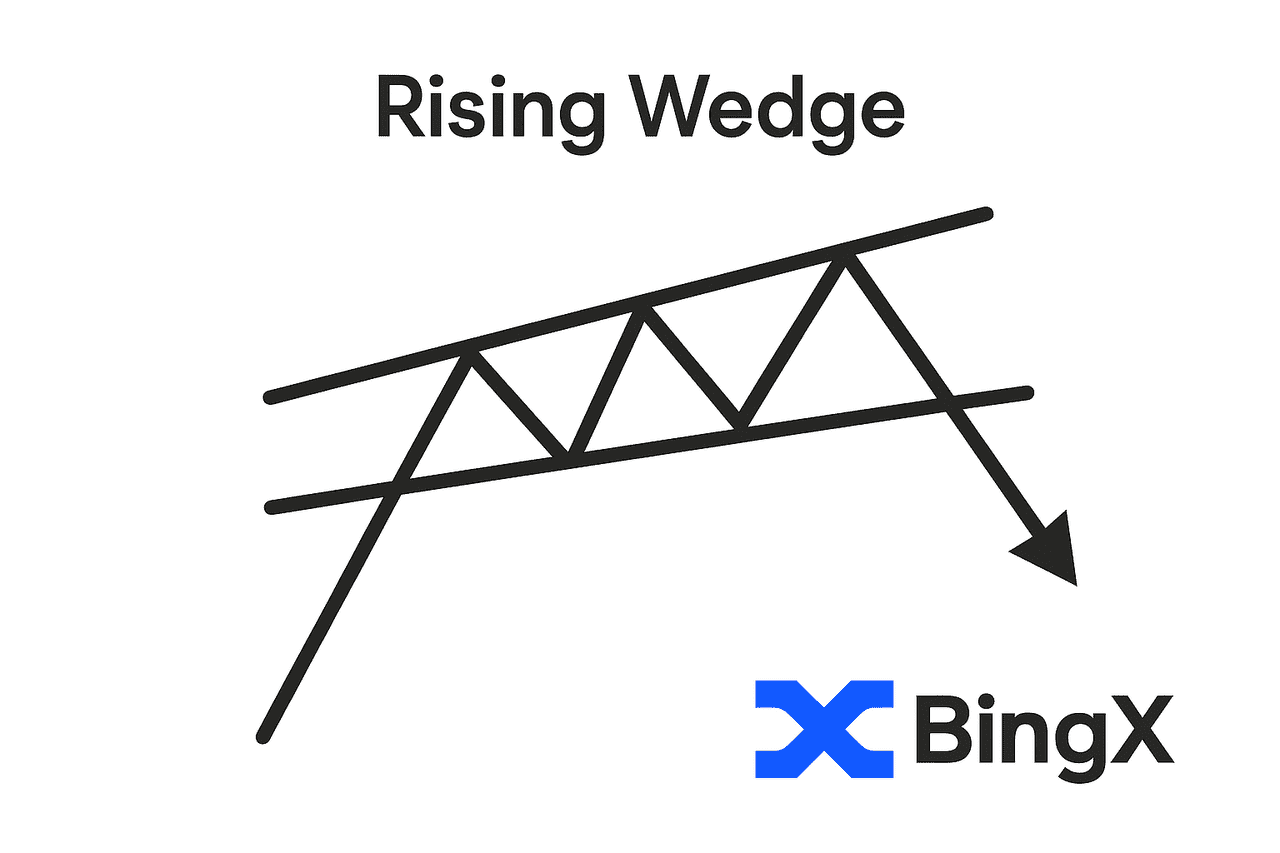

ii. Rising Wedge

In contrast, a rising wedge forms when both trendlines slope upward, with the lower trendline climbing at a steeper angle. This setup usually appears in uptrending markets and indicates that buying momentum is fading. When price breaks below the lower support line, it often confirms a bearish reversal.

Price targets for wedge breakouts are typically calculated by measuring the height of the widest part of the wedge and projecting that distance from the breakout point .

How to Set Accurate Price Targets Using Chart Patterns

1. Measuring the Move

The measuring technique is the primary method for establishing price targets from chart patterns. This approach involves:

1. For most patterns: Measure the height of the pattern from the highest to lowest point

2. Project that measurement: Apply this distance from the breakout point in the direction of the breakout

3. Flag and pennant patterns: Measure the flagpole's length and project it from the breakout point

This technique provides a reasonable estimate of how far the price might move after breaking out of a pattern. However, it should be used as a guideline rather than an exact science.

2. Using Support and Resistance as Target Zones

Support and resistance levels play a crucial role in refining price targets:

1. Previous support/resistance levels: These often act as magnets for price and can become targets

2. Zone approach: Consider targets as zones rather than exact price points

3. Multiple confirmations: When a measured move target coincides with a key support/resistance level, it strengthens the target's validity

Traders should be aware that price often reacts to these key levels, either pausing, reversing, or accelerating through them .

3. Accounting for Market Volatility

Cryptocurrency markets are notorious for their volatility, which affects how price targets should be approached:

1. Use buffer zones: Add some flexibility to targets rather than expecting exact hits

2. Adjust for volatility: Wider targets for more volatile assets and market conditions

3. Implement proper stop-losses: Protect against unexpected price movements that invalidate the pattern

4. Scale out of positions: Consider taking partial profits at different points

By accounting for crypto's inherent volatility, traders can set more realistic expectations and avoid the frustration of missed targets by narrow margins .

How to Use Chart Pattern Breakouts to Time Your Entry and Exit

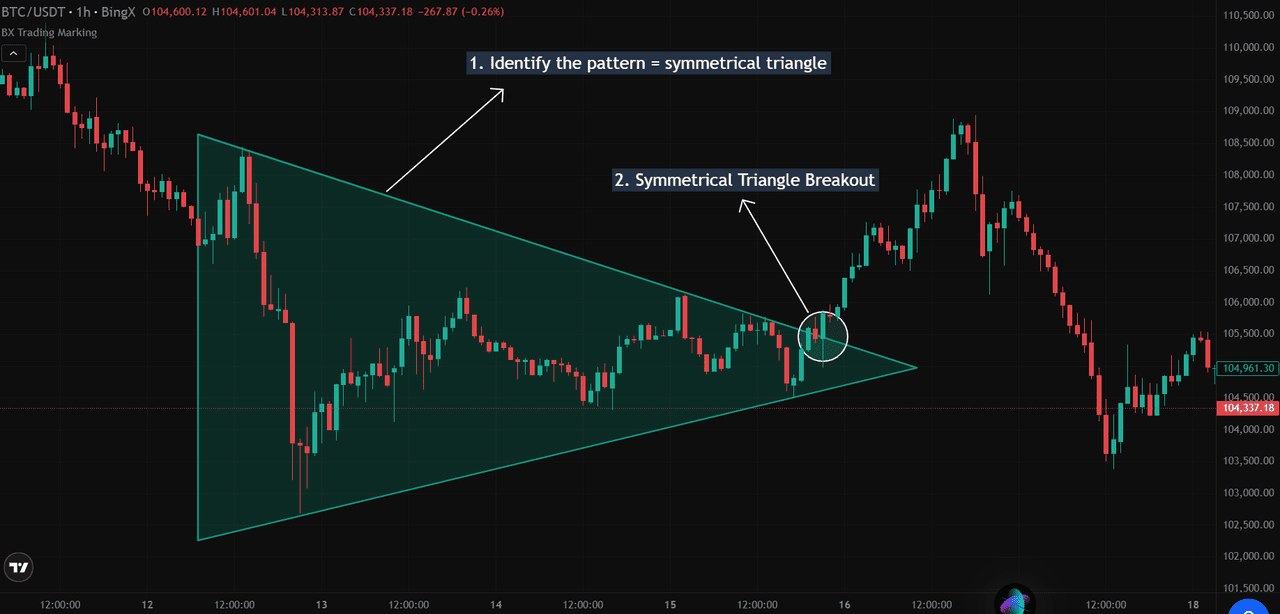

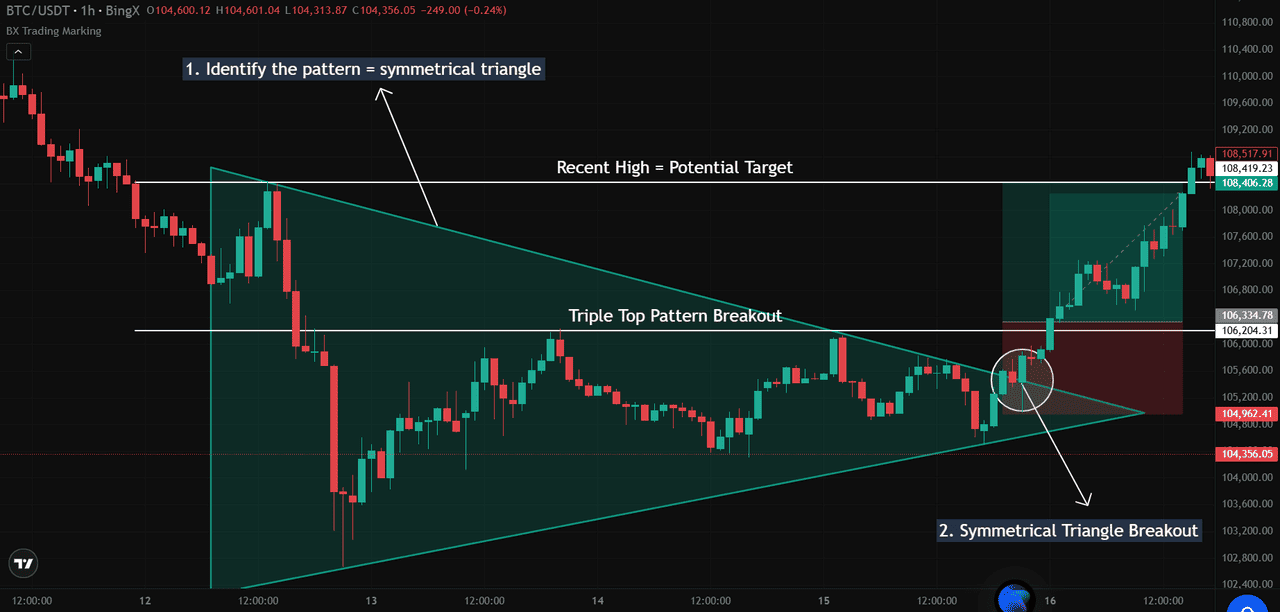

Let’s break down how to use a Symmetrical triangle

pattern to project price targets in crypto trading, using a real

BTC/USDT chart from BingX on the 1-hour timeframe.

After Bitcoin dropped from around $108,400 to $104,000, it entered a phase of consolidation where price action formed lower highs and higher lows. This created a symmetrical triangle, defined by two converging trendlines sloping toward each other, reflecting indecision in the market.

Volatility tapered off, volume decreased, and traders began anticipating a breakout.

1. Eventually, BTC broke above the upper trendline at around $105,800–$106,000, confirming a bullish breakout. This was validated by a strong candle close outside the triangle and an increase in volume, key elements traders look for to confirm the move is genuine. At this point, the triangle transforms from a neutral pattern into a bullish continuation setup.

To estimate the target, traders use the height of the triangle and project it from the breakout point. In this case:

• Triangle height = $108,400 − $104,000 = $4,400

• Breakout level = $105,800

• Projected target = $105,800 + $4,400 = $110,200

While Bitcoin didn’t quite reach the full projection, it rallied to $108,517, just shy of a previous high, before reversing.

This illustrates an important trading lesson: price targets are guidelines, not guarantees. Smart traders refine their targets by checking for nearby resistance levels or psychological zones like round numbers. In this setup, the $108,400–$108,500 zone acted as a ceiling for the move.

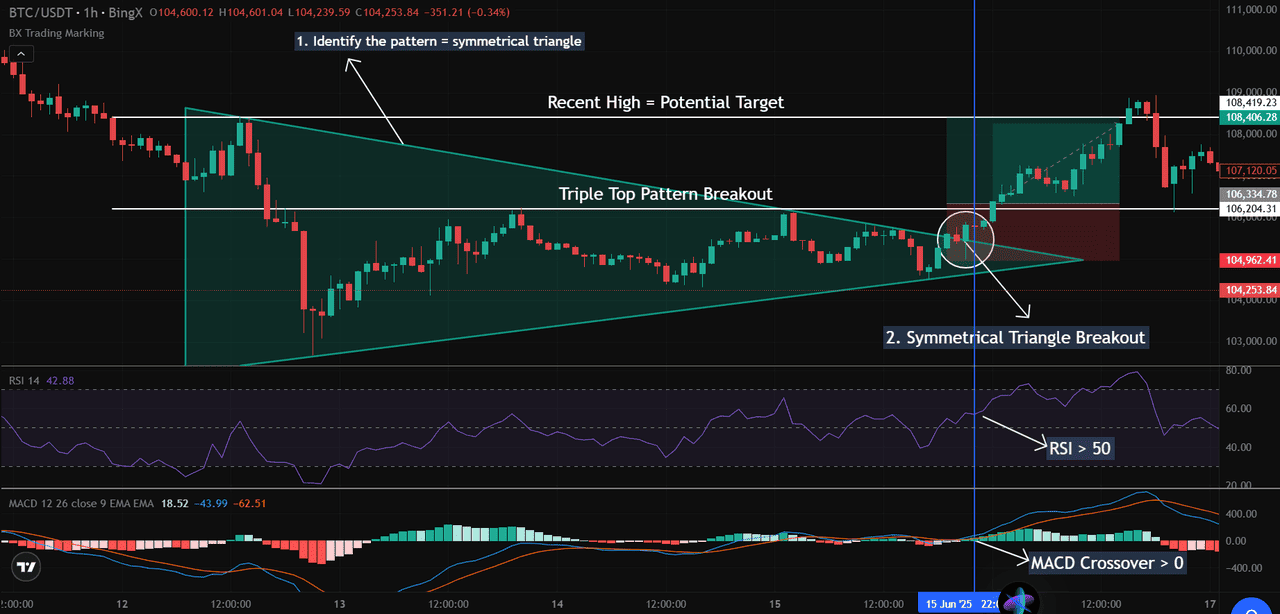

To manage risk and boost reliability, it’s always helpful to pair chart patterns with other technical tools like the

Relative Strength Index (RSI),

Moving Average Convergence Divergence (MACD), or volume analysis. These indicators can help confirm momentum and filter out false breakouts. Additionally, placing stop-loss orders just below the breakout point can help protect against potential reversals if the pattern fails.

What Are the Common Mistakes When Trading Chart Patterns?

Even experienced traders can fall into common traps when trading chart patterns. One frequent mistake is entering a trade before the pattern is complete, which can lead to losses if the anticipated move fails to materialize. Waiting for the pattern to be fully formed and confirmed by other indicators is essential for increasing success rates.

Another pitfall is relying solely on chart patterns without considering additional technical indicators or the broader market context. This approach can result in missed opportunities or unexpected losses, especially if false signals occur. The difference between a profitable trade and a loss often comes down to using a combination of chart patterns, technical indicators, and sound risk management.

Traders should also be cautious of false signals, instances where a breakout appears to occur but is not confirmed by other indicators such as volume or RSI. By ensuring that patterns are confirmed and by integrating other indicators into their analysis, traders can improve their potential for profits and reduce the likelihood of losses.

Top Tips for Using Chart Patterns Effectively

Chart patterns are valuable tools in crypto trading, but they work best when paired with confirmation, context, and risk management. Below is a structured guide to applying patterns, like the symmetrical triangle on the BTC/USDT 1-hour chart, more effectively in live market conditions.

1. Seek confirmation with RSI and MACD indicators:

A chart pattern is only as reliable as the confirmation behind it. In the BTC breakout example, we saw volume rise alongside price as Bitcoin moved above the triangle’s upper boundary a classic sign of genuine interest from buyers.

Two key momentum indicators provided confirmation:

• Relative Strength Index (RSI) crossed above 50, showing growing bullish momentum.

• Moving Average Convergence Divergence (MACD) printed a bullish crossover above the zero line, strengthening the case for a sustained breakout.

These signals help filter out false patterns that often occur in low-volume environments.

2. Be aware of invalidation levels:

Traders should always set clear criteria for when a pattern is no longer valid. For symmetrical triangles, invalidation often occurs when price falls below the last higher low or breaches the triangle’s lower support.

Setting stop-loss orders just outside these zones helps limit downside if the trade fails. In the BTC chart, a reasonable stop-loss could be placed just below $104,800, which would invalidate the breakout structure if breached.

Key risk control actions:

• Identify invalidation zones beneath structural support

• Set stop-loss accordingly

• Use breakout confirmation candles before entry

3. Consider market context:

Chart patterns do not exist in a vacuum. For the best results, ensure the setup aligns with broader market sentiment and the dominant trend. In this example, Bitcoin’s breakout aligned with a temporary recovery bounce after a strong downtrend, adding context to the pattern.

Also, be mindful of the timeframe:

• Higher timeframe patterns (4H, daily) are generally more reliable

• Shorter timeframes (15M, 1H) are more prone to false signals

• Always zoom out to assess macro direction

4. Practice proper risk management:

Even with confirmation and context, no pattern guarantees success. That’s why disciplined

risk management is essential. Traders should avoid over-leveraging and size positions based on their risk tolerance and capital exposure.

A smart exit plan can also include:

• Scaling out: Taking partial profits near key resistance levels (like $108,400 in this chart)

• Trailing stops: To lock in gains if the price continues in your favor

• Break-even protection: Moving stops to entry after the first target is hit

Conclusion: Build Confidence Through Pattern Mastery

Mastering chart patterns provides a structured approach to navigating the volatile cryptocurrency markets. While no pattern or analysis method is perfect, understanding these formations gives traders a significant advantage by helping identify potential price movements before they occur.

The key to success lies not in treating chart patterns as guaranteed predictions, but as probability-based tools that provide an edge when combined with proper risk management and a broader understanding of market conditions.

By continually studying how these patterns play out in real market conditions, traders can build confidence in their analysis and develop a disciplined approach to trading that survives the inevitable ups and downs of crypto markets.

Remember that pattern analysis is just one component of a comprehensive trading strategy. The most successful traders combine technical analysis with fundamental research, risk management, and emotional discipline to achieve consistent results in the challenging world of cryptocurrency trading.

Related Reading

FAQs on Crypto Chart Patterns

1. What are crypto chart patterns and why are they important?

Crypto chart patterns are visual formations on price charts that reflect market psychology and supply-demand dynamics. They help traders identify potential breakout or reversal points, allowing for more strategic entry and exit decisions in volatile crypto markets.

2. Are chart patterns reliable in crypto trading?

While no chart pattern guarantees a specific outcome, many like head and shoulders, triangles, and flags, have historically shown consistent performance when combined with confirmation indicators (e.g., RSI, MACD) and strong risk management.

3. Can I use chart patterns on lower timeframes like 15-minute or 1-hour charts?

Yes, but with caution. Patterns on shorter timeframes are more prone to false breakouts due to noise and volatility. Higher timeframes (4H, daily) generally produce more reliable signals, especially in trend-based strategies.

4. How do I calculate price targets from chart patterns?

Most patterns use a measuring technique: determine the height of the pattern (or flagpole), then project that distance from the breakout point. Always cross-check with nearby support/resistance zones for better accuracy.

5. What’s the best way to confirm a chart pattern breakout?

Confirmation comes through rising volume, a clean candle closes beyond the pattern boundary, and supporting signals from indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). Avoid trading patterns without at least one confirming factor.

Source: BTC/USDT Trading Chart on BingX

Source: BTC/USDT Trading Chart on BingX Source: BTC/USDT Trading Chart on BingX

Source: BTC/USDT Trading Chart on BingX Source: BTC/USDT Trading Chart on BingX

Source: BTC/USDT Trading Chart on BingX