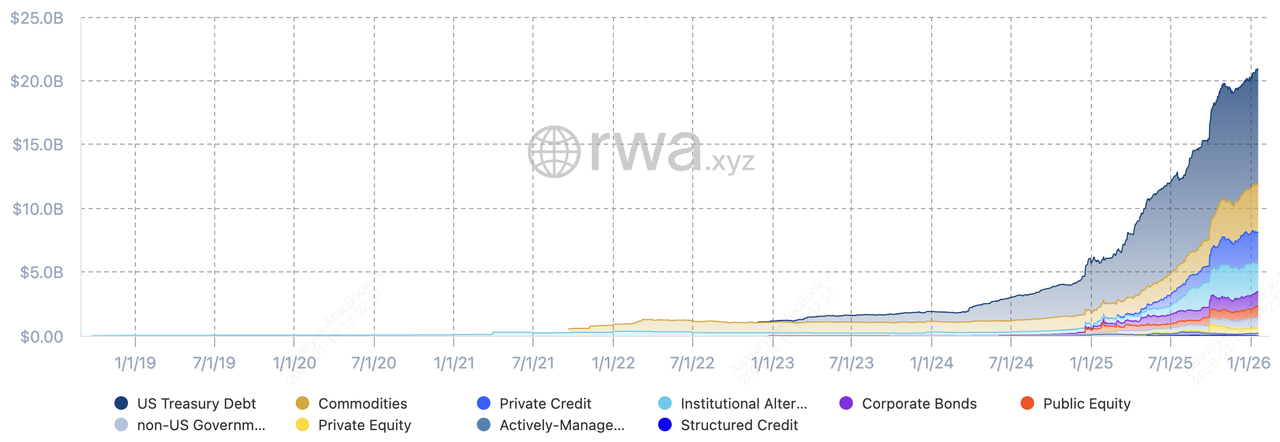

Total value of on-chain tokenized RWAs | Source: RWA.xyz

This guide explains the core shift behind that trend: trading price exposure vs. owning the underlying asset, and how crypto-native tools like tokenized RWAs and USDT-margined perpetuals are changing access, speed, and risk.

In this article, you will learn the difference between price exposure and ownership, when each approach makes sense, and how traders use tokenized RWAs and

USDT-margined TradFi perpetuals to access stocks, commodities, indices, and FX in 2026.

What Is TradFi, and How Does It Differ From Cryptocurrencies?

Traditional Finance (TradFi) refers to the legacy global financial system built around regulated intermediaries such as banks, brokers, exchanges, and clearinghouses. It includes asset classes like stocks, bonds, commodities, forex, and indices, with settlement cycles typically ranging from T+1 to T+2 and global market hours constrained by exchanges.

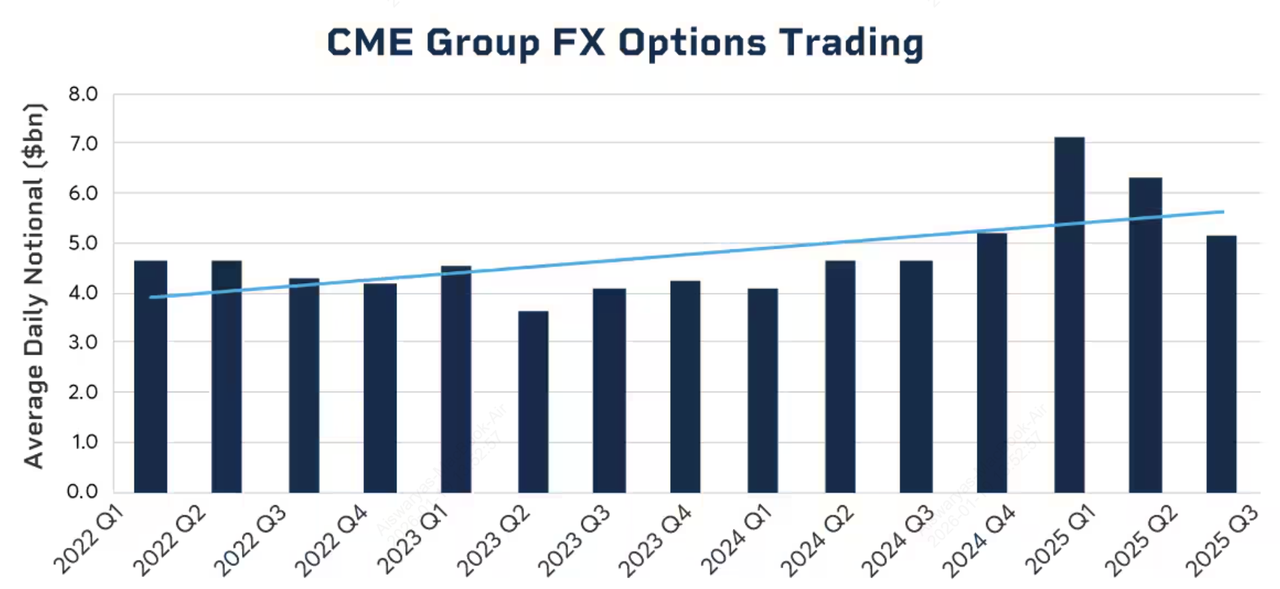

Forex options trading market size | Source: CME Group

As of January 2026, TradFi markets remain massive, global equities exceed $110 trillion in market cap, daily FX trading averages $7.5 trillion, and global commodities markets clear trillions of dollars annually, yet access is fragmented, capital-intensive, and jurisdiction-dependent.

Cryptocurrencies, by contrast, operate on blockchain networks with 24/7 trading, near-instant settlement, and no mandatory intermediaries. Crypto markets emphasize self-custody, on-chain transparency, and programmable financial instruments such as perpetual futures and tokenized RWAs. The key distinction is structural: TradFi prioritizes legal ownership and regulated custody, while crypto prioritizes price exposure, speed, and capital efficiency. In 2026, the convergence is accelerating as crypto platforms increasingly mirror TradFi assets via derivatives and tokenization, allowing traders to access traditional markets without brokers, fiat rails, or physical ownership.

TradFi Goes Crypto-Native in 2026 Even as RWA Market Grows Past $21B

Two concrete structural changes are redefining how traders access traditional markets, and both borrow directly from crypto’s playbook:

1. Stablecoins replace banks as the settlement layer: Stablecoins now act as the default collateral and settlement rail for cross-market trading. With stablecoin supply over $311 billion in 2026 and daily on-chain transfer volumes rivaling major payment networks, traders increasingly use

USDT and USDC to move capital between crypto and macro trades without bank wires, FX conversions, or T+2 delays. In practice, this means a trader can rotate from

Bitcoin to

gold, oil, or equity indices within seconds, using the same margin balance, something traditional brokerage accounts cannot match.

2. TradFi exposure is delivered via crypto-style instruments: Instead of owning stocks, commodities, or FX outright, traders increasingly access price exposure through USDT-margined perpetual futures and tokenized RWAs. These products mirror real-world prices but trade on exchange-style interfaces with:

• instant execution,

• deep order books,

• long/short access, and

• built-in leverage and risk controls.

Tokenized RWAs bring equities, commodities, and indices into wallets and on-chain venues, while perpetual futures let traders express macro views using the same mechanics they already use for

BTC and

ETH. The result: TradFi markets feel operationally like crypto, even though the underlying assets remain traditional.

In 2026, the competitive edge is not ownership but speed, capital efficiency, and unified exposure. TradFi isn’t replacing crypto, and crypto isn’t replacing TradFi. They’re converging into a single, crypto-native trading stack.

What Is “Ownership” in TradFi?

Ownership in TradFi means buying and holding the underlying asset, such as a stock or bond, typically through a broker or custodian. With equities, ownership can include shareholder rights like dividends and voting, while bonds provide coupon payments and principal repayment. The tradeoff is structural friction: custody requirements, market hours, regulatory overhead, and slower post-trade settlement. Even after the U.S. securities market moved to T+1 settlement, ownership still lacks the instant execution and capital mobility of crypto-native markets.

In the on-chain era, tokenized RWAs are emerging as a hybrid option for investors who want economic ownership with improved efficiency. Tokenized RWAs are on-chain tokens designed to track real-world assets like

tokenized gold, tokenized stocks, or

tokenized ETFs. Depending on structure, many tokens are designed to give you economic exposure or price tracking rather than full shareholder rights. This can lower barriers to entry and enable fractional sizing, while still behaving more like “spot” exposure with no funding rate, no liquidation from leverage unless you borrow elsewhere.

Ownership is best suited for: long-term investors, income-focused portfolios, and strategies that require holding the asset itself rather than trading short-term price movements.

What Is “Price Exposure” in TradFi?

An overview of how price exposure works | Source: TestBook

Price exposure means trading the direction and magnitude of an asset’s price movement without owning the underlying asset. This is typically achieved through derivatives such as futures, options, and CFDs, or through synthetic and tokenized instruments that closely track real-world markets.

In 2026, crypto-native platforms make this even more accessible. For example, USDT-margined perpetual futures on

BingX TradFi allow traders to gain on-chain price exposure to stocks, indices, commodities, and FX using the same mechanics as crypto perpetuals, without brokers, physical settlement, or fiat rails. BingX TradFi perpetuals are USDT-margined derivative contracts that track traditional markets like FX, commodities, stocks, and indices without owning the underlying asset. They have no expiry, and you can go long or short with adjustable leverage. They also follow market hours unlike 24/7 crypto, and may involve

funding fees, just like crypto perpetuals.

Price exposure is widely used because it is:

• Capital-efficient: Margin and leverage reduce upfront capital requirements

• Two-directional: Easily go long or short as macro conditions change

• Fast and flexible: Execution,

risk management, and PnL are trading-first, not custody-first

The tradeoff is clear: no ownership rights (no dividends, coupons, or voting), and leverage amplifies both gains and losses.

Price exposure is best suited for: short-term traders, hedgers, and macro-driven strategies that prioritize liquidity, speed, and capital efficiency over long-term asset ownership.

Price Exposure vs. Ownership: Key Differences and Which Option to Choose

In today’s on-chain, macro-driven markets, understanding the difference between price exposure and ownership helps traders choose the right tool for their goals, time horizon, and risk profile.

When to Choose Price Exposure for TradFi Instruments

Choose price exposure when speed, flexibility, and risk management matter more than holding the asset itself. In practice, this is how most active traders operate in 2026:

1. You are hedging portfolio risk: Macro hedges work best in deep, liquid markets. During 2024–2025 risk-off periods, gold and index futures absorbed the majority of hedge flow as altcoin correlations rose above 0.7–0.8, making diversification inside crypto ineffective.

2. You are trading macro catalysts: Events like CPI releases,

Fed rate decisions, OPEC meetings, or geopolitical shocks often move gold, FX, and indices 1–3% in minutes, moves that are cleaner and more tradable via futures than via high-beta altcoins.

3. You need capital efficiency: Futures and perpetuals let you control exposure with a fraction of the notional value, freeing capital for multiple strategies instead of tying it up in fully funded positions.

4. You need to short or switch bias quickly: Shorting equities, indices, or commodities is straightforward with derivatives, while shorting via ownership structures is often slow, restricted, or costly.

5. Execution quality matters: In stressed markets, major TradFi contracts retain tight spreads and deep order books, while many altcoins become thin and slippage-heavy.

When to Choose TradFi Ownership as Investment Strategy

Choose ownership when your objective is long-term asset accumulation rather than tactical trading. Ownership still makes sense when:

1. You are building multi-year exposure: Long-term equity and bond holders benefit from compounding, dividends, coupons, and corporate actions that derivatives do not provide.

2. Income matters: Dividends from equities and coupon payments from bonds remain exclusive to ownership-based strategies.

3. You want to avoid leverage and funding costs: Holding the asset outright removes

liquidation risk, margin calls, and ongoing funding payments.

4. You require legal title: Certain institutional mandates, tax structures, or operational needs require holding the underlying asset itself.

Bottom Line: Ownership or Price Exposure to Trade TradFi in 2026?

In 2026, price exposure dominates for traders and hedgers, while ownership remains relevant for investors and income-focused portfolios. Many sophisticated participants now combine both, using ownership for long-term allocation and price exposure for hedging, timing, and tactical macro trades.

How to Access TradFi Price Exposure with Crypto on BingX

GOLD/USDT perpetual contract on the futures market

BingX TradFi is built around USDT-margined perpetual futures for forex, commodities, stocks, and indices. The workflow is straightforward: fund with USDT, choose a market, set leverage, and trade long/short, without custody or delivery of the underlying asset.

1.

Sign up for a new BingX account or log into an existing one.

4. Set leverage carefully; lower levels reduce liquidation risk, while higher leverage amplifies both gains and losses.

Key Considerations When Trading TradFi Price Exposure

Trading TradFi price exposure via crypto-native instruments, such as USDT-margined perpetual futures, prioritizes speed and flexibility, but it also introduces derivative-specific risks that differ from spot ownership. Before trading, keep the following in mind:

1. Leverage amplifies outcomes: TradFi perps allow you to control large positions with relatively little capital, but even small moves in gold, indices, or FX can trigger liquidations if leverage is too high. Position size matters more than conviction.

2. Funding and carry costs: Perpetual futures use funding rates to stay aligned with spot prices. Holding positions through volatile or trending periods can accumulate costs or gains, which makes perps less suitable for passive, long-term exposure.

3. Macro-driven volatility: TradFi assets react sharply to scheduled events such as CPI releases, central-bank decisions, earnings, and geopolitical headlines. Price gaps and rapid repricing are common around these events, especially at market open.

4. Market hours and gaps: Unlike crypto, TradFi markets follow set trading sessions. When markets reopen, prices can gap past stop levels, increasing slippage and execution risk.

5. No ownership benefits: Price exposure does not include dividends, voting rights, or coupon payments. You are trading pure price movement, not holding the asset itself.

Bottom line: TradFi price exposure is best used for short-term trading, hedging, and macro positioning, with conservative leverage, defined risk limits, and awareness of funding costs and market hours.

How to Access TradFi Ownership With Crypto on BingX

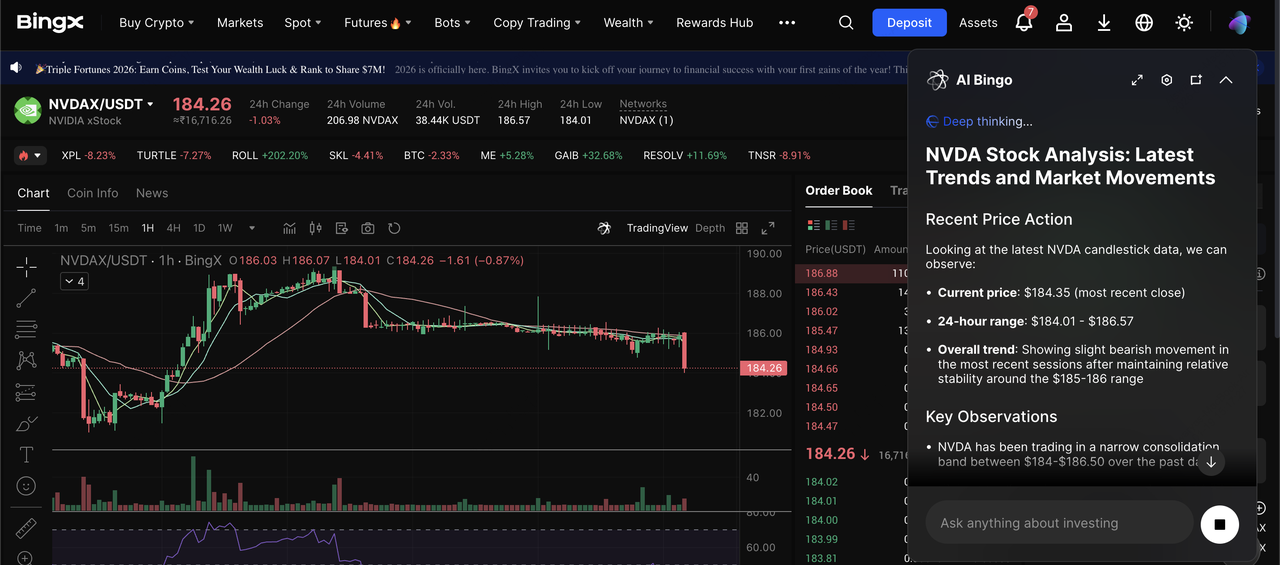

NVDAX/USDT tokenized stock on the spot market powered by BingX AI

BingX also offers ownership-style exposure to TradFi assets through tokenized spot markets, such as tokenized gold and tokenized stocks. Instead of trading leveraged price swings, you buy fully paid tokens that track the value of real-world assets and can be held like spot crypto.

1. Complete KYC and fund your account with USDT. Spot trading uses fully funded positions, with no leverage, no margin calls.

3. Select the asset and place a Spot order. Use a Market order for instant execution or a Limit order to buy at your preferred price.

4. Hold, transfer, or sell like any spot asset. There are no expiry dates, no funding fees, and no liquidation risk.

5. Use for longer-term allocation, not short-term leverage. Tokenized spot assets are best suited for inflation hedging, portfolio diversification, and lower-volatility exposure compared with perpetual futures.

Key Considerations When Trading TradFi With Ownership

Trading TradFi through ownership, whether via direct holdings or tokenized real-world assets (RWAs), prioritizes asset exposure and rights over speed and leverage, making it structurally different from derivatives-based trading. Before choosing ownership, consider the following:

1. Capital commitment is higher: Ownership typically requires paying the full value of the asset or a large portion of it, even with tokenized or fractional products. This limits position sizing flexibility compared to leveraged derivatives.

2. Returns come from price + income: Unlike price exposure, ownership may include dividends (stocks), coupon payments like bonds, or asset-linked value accrual like tokenized gold and

tokenized silver. These income streams matter over longer holding periods.

3. Lower liquidation risk, but higher opportunity cost: Owned assets are not subject to forced liquidation due to margin calls. However, capital is tied up and cannot be rapidly redeployed during fast-moving macro shifts.

4. Settlement and market hours still apply: Even when assets are tokenized, many follow traditional market calendars and settlement conventions, such as T+1 equities settlement in the U.S., which are slower than crypto-native execution.

5. Custody and counterparty considerations: Ownership, especially tokenized ownership, introduces custody, issuer, and legal-structure risk. Understanding how the asset is backed, redeemed, and regulated is critical.

Best suited for allocation, not trading: Ownership works best for long-term positioning, portfolio diversification, and income-focused strategies, rather than short-term hedging or tactical macro trades.

Bottom Line: Should You Trade TradFi via Ownership or Price Exposure in 2026?

In 2026, the choice between TradFi ownership and price exposure comes down to objectives, time horizon, and risk tolerance. Ownership, whether through traditional instruments or tokenized real-world assets, fits long-term allocation and income-focused strategies, while price exposure via derivatives and USDT-margined futures is better suited for short-term trading, hedging, and capital-efficient macro positioning. As TradFi continues moving on-chain, many traders will use both approaches in parallel, combining long-term holdings with tactical price exposure on the same crypto rails.

Risk reminder: Trading TradFi instruments, especially derivatives, carries significant risk due to leverage, volatility, and market gaps. Prices can move rapidly, and losses may exceed expectations if risk is not actively managed. This article is for educational purposes only and does not constitute financial or investment advice.

Related Reading