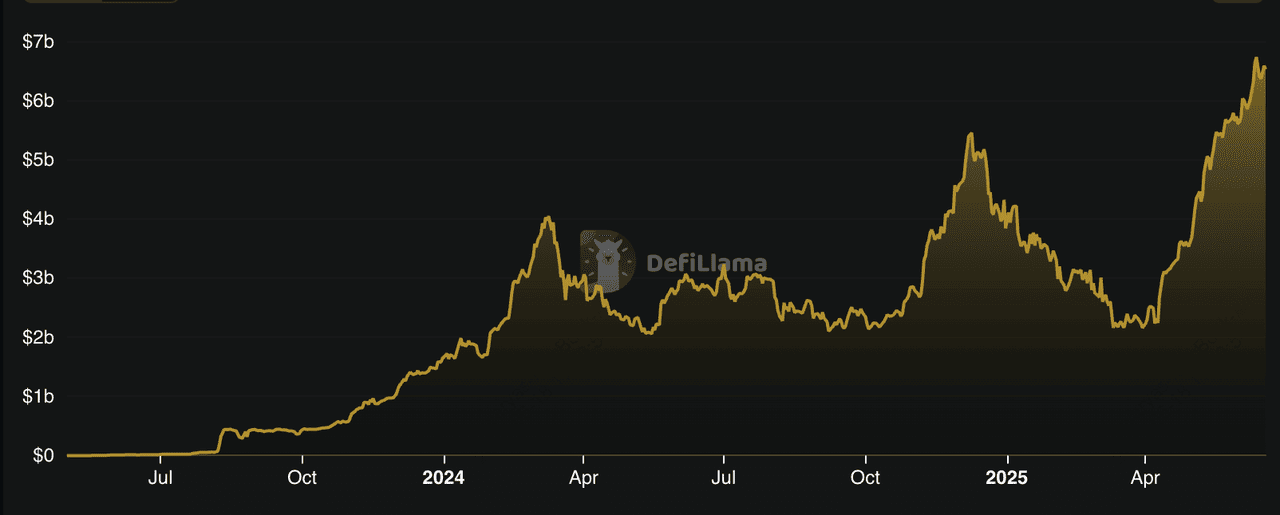

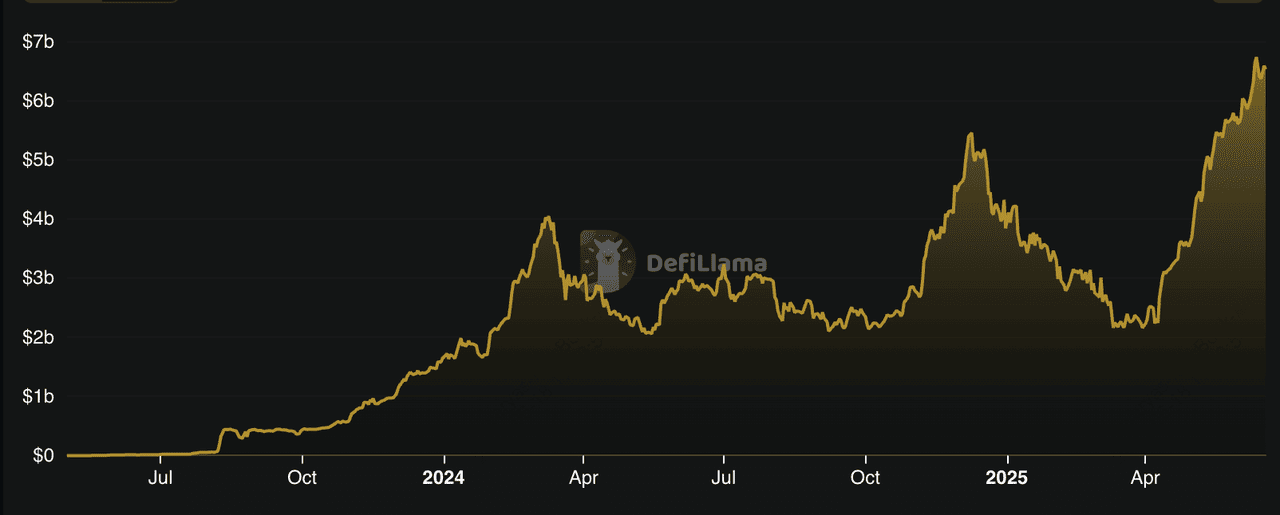

Spark Protocol is a next-generation

DeFi platform built to manage

liquidity, lending, and stablecoin yields across multiple blockchains. It currently handles over $3.5 billion in

stablecoin liquidity and generates more than $170 million in annualized revenue from protocols like SparkLend. As of June 2025, Spark Protocol has a total value locked (TVL) of over $6.5 billion.

Spark Protocol TVL | Source: DefiLlama

On June 17, Spark launched a major

airdrop of 300 million SPK tokens. If you interacted with Spark or partner platforms like Aave or Layer3, you may be eligible to claim SPK directly through the official Spark app.

Learn how to claim your SPK tokens from the Spark Protocol airdrop, explore eligibility criteria, key deadlines, and what to do with your tokens after claiming.

What Is Spark Protocol (SPK)?

Spark Protocol is a decentralized finance (DeFi) infrastructure platform designed to improve how stablecoins flow across the crypto ecosystem. It’s part of the broader Sky ecosystem, which includes the stablecoin USDS and

yield-bearing assets like sUSDS. With over $3.5 billion in liquidity and more than $172 million in real yield, Spark is quickly becoming one of the most important infrastructure layers in crypto.

At the core of Spark are three main products:

• Savings: Deposit stablecoins like

USDC,

DAI, or

USDS and earn yield automatically.

• SparkLend: A non-custodial lending market where you can borrow and lend assets such as

ETH, wstETH, and USDS.

• Spark Liquidity Layer: A cross-chain engine that moves capital between DeFi protocols and blockchains to optimize yield.

Spark is live on

Ethereum,

Arbitrum, Base,

Optimism, Unichain, and Gnosis Chain. It’s integrated with top protocols like

Aave and

Morpho and acts as a liquidity engine for the broader DeFi ecosystem, not just a competitor.

What Is SPK, Spark Protocol's Native Token?

SPK is the native token of Spark Protocol. It gives you a say in protocol decisions, lets you stake for rewards, and may be used to help secure Spark’s products in the future.

As a governance token, SPK allows you to vote on updates to the protocol. You can also stake SPK to earn Spark Points. These points could qualify you for future airdrops, reward boosts, or protocol incentives.

Over time, staked SPK will do more than just earn rewards. It may help validate Spark services, like securing bridges or verifying protocol activity. The longer you stake, the more rewards and influence you can gain. It's designed to keep the community engaged and aligned with Spark’s long-term goals.

SPK Tokenomics & Allocation

SPK token allocation | Source: Spark Protocol on X

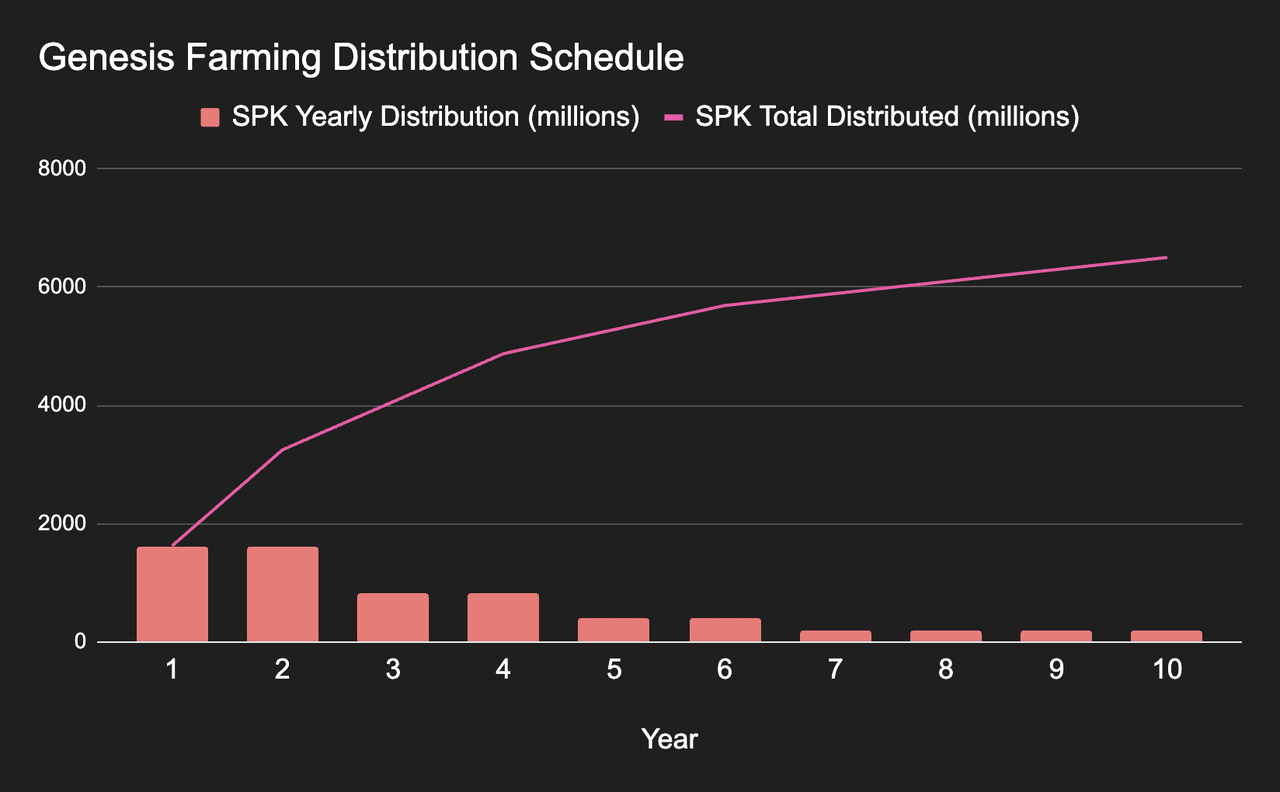

SPK has a fixed total supply of 10 billion tokens, carefully structured for long-term sustainability and growth. Here’s how it breaks down:

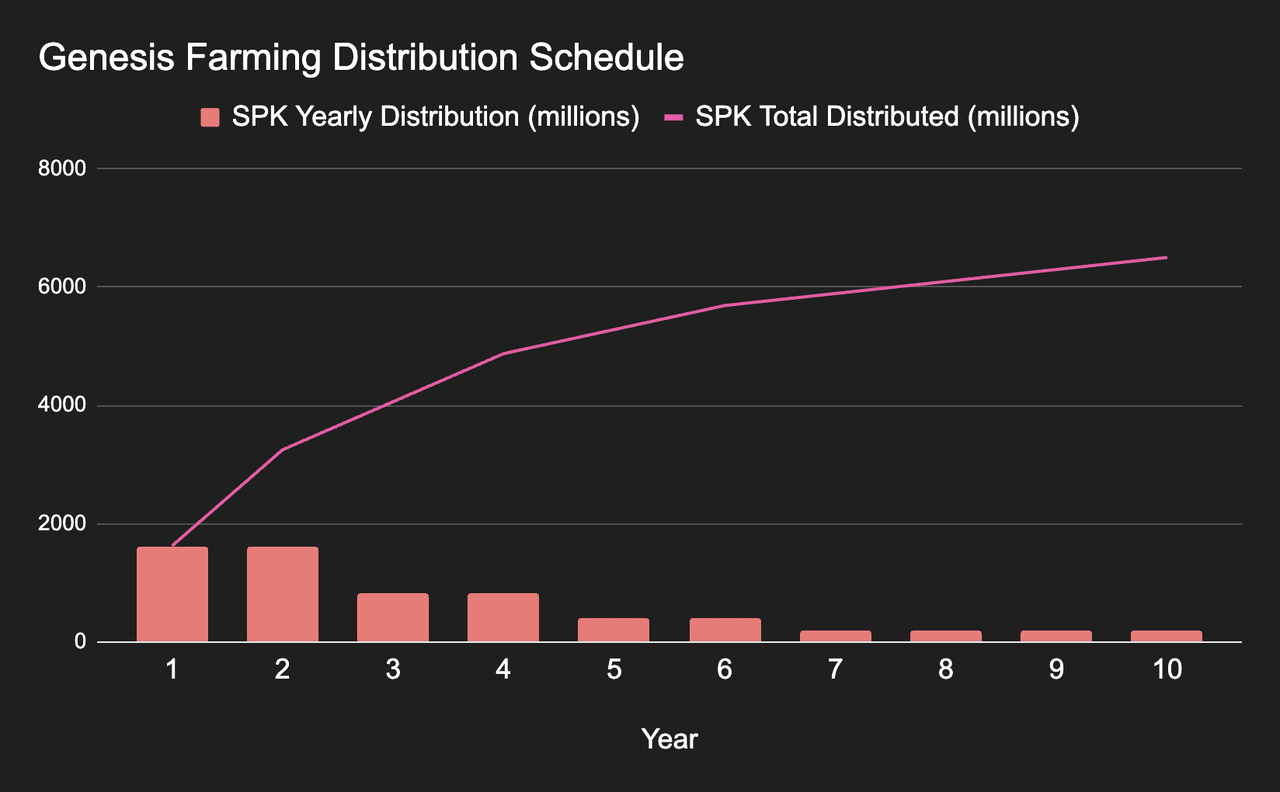

• 65% – Sky Farming (6.5B SPK): Earned by users over 10 years through USDS staking in Sky’s token farms. The annual distribution starts at 1.625 billion SPK and halves over time, similar to

Bitcoin’s model.

• 23% – Ecosystem Growth (2.3B SPK): Supports protocol development, grants, and airdrops. 17% was unlocked at the Token Generation Event (TGE), while the rest will be released gradually after one year.

• 12% – Team & Contributors (1.2B SPK): Reserved for Spark’s core builders. Tokens are locked for 12 months (25% cliff), then vested monthly over three years.

SPK token vesting schedule | Source: Spark docs

This tokenomics design ensures most SPK goes to users and the community, not insiders. It also reduces sell pressure by spreading distribution across a decade.

What Is the Spark Protocol Airdrop?

The Spark Protocol airdrop is a multi-phase token distribution event that rewards early users, lenders, and community participants with SPK tokens. The Ignition phase dropped 300 million SPK tokens on June 17, 2025. This milestone marked the beginning of on‑chain participation and set the stage for future boosts via Overdrive.

Spark has structured its airdrop into four main campaigns to reward early users and contributors:

• Pre‑Farming: Rewards based on lending or borrowing activity on SparkLend and Aave during the early period.

• Ignition: The initial launch-phase airdrop, designed for early protocol participants and Snapshot voters.

• Overdrive: A bonus round you can qualify for by staking your Ignition SPK and optionally boosting with Spark Savings.

• Layer3 Quests: Rewards for completing educational or task-oriented campaigns on Layer3.

Who Is Eligible for the SPK Token Airdrop?

To take part in Spark’s airdrop, you need to have performed at least one of the following on supported networks (Ethereum, Arbitrum, Base, Optimism, Gnosis,

Polygon):

• Pre-Farming: Lent or borrowed assets on SparkLend or Aave (Ethereum

mainnet) during the designated Pre‑Farming periods.

• Ignition:

- Held $1,000+ in stablecoins like USDS, sUSDS, sUSDC, sDAI, SAI (or $5,000+ in DAI) on April 15 for 2023–2025.

- Deposited ≥ $100 in a single SparkLend transaction by April 15, 2025.

- Lent ≥ $5,000 across Aave, Morpho, or Fluid by March 15, 2025.

- Participated in other DeFi activities like

Pendle,

Ethena, or

Curve 3‑pool by March 15, 2025.

• Layer3 Quests: Completed all four Spark quests on Layer3 during the qualification period

If you've met both the general and at least one activity requirement, you're eligible to claim SPK tokens. In addition, you must be at least 18 years old and not listed on any international sanctions lists, including those from the US, EU, UK, or UN, to be eligible for the $SPK airdrop.

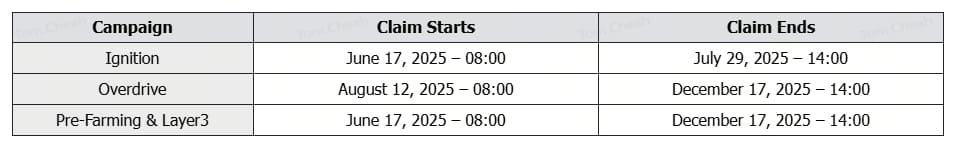

When to Claim the $SPK Airdrop: Key Dates to Know

Here are the key claiming windows (all times in UTC):

Missing a deadline means forfeiting that campaign’s reward. So, connect your

wallet and act before time runs out!

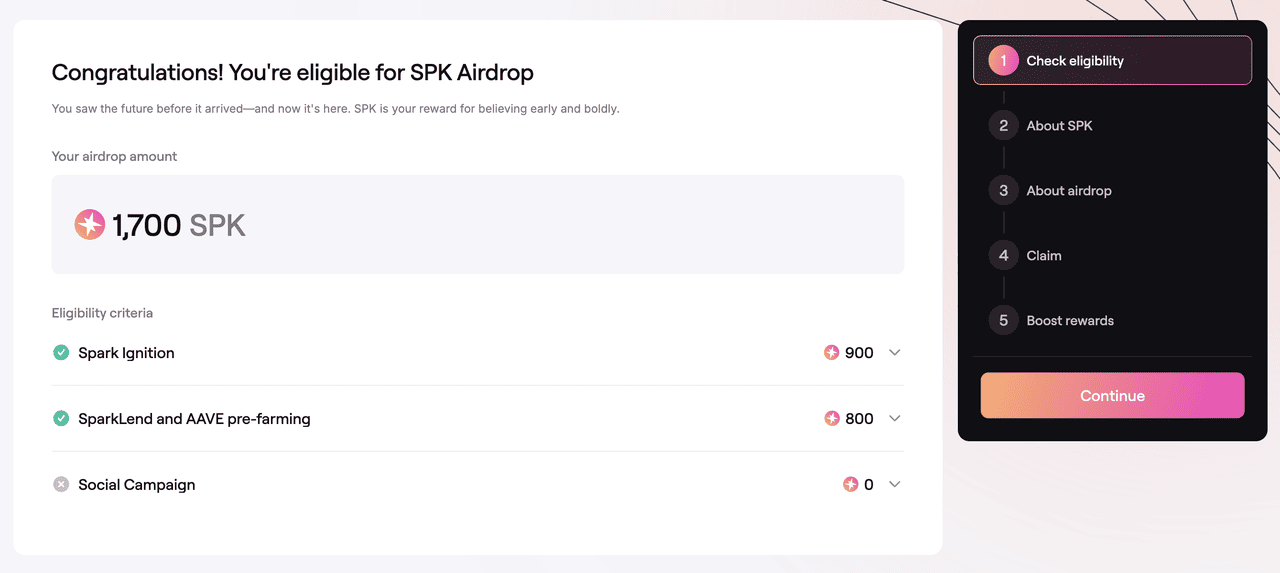

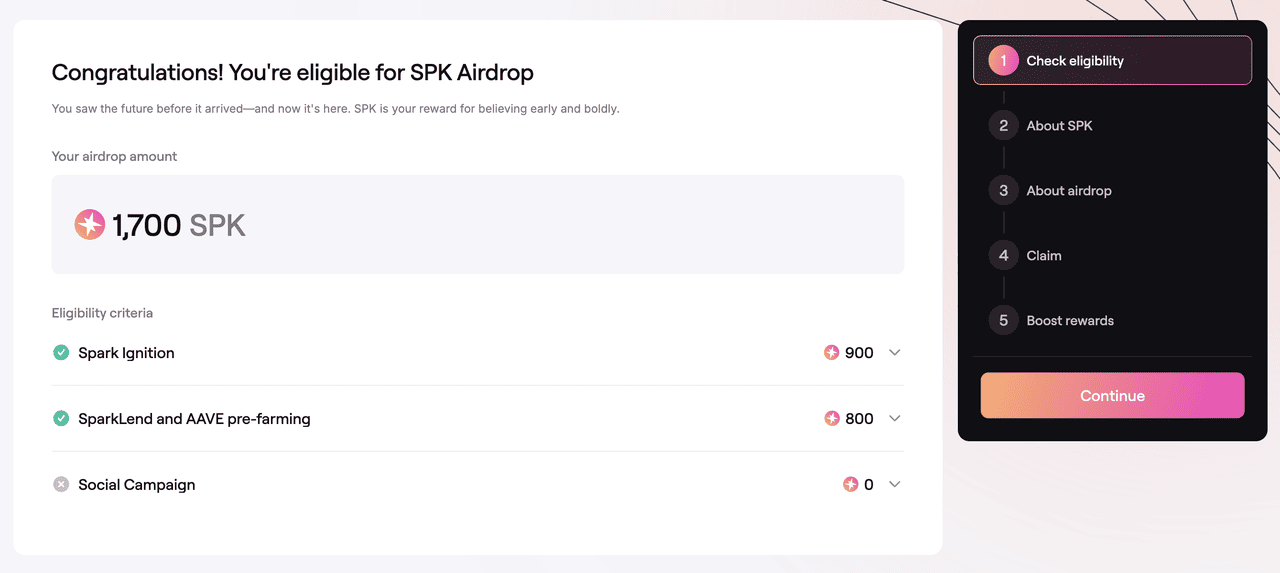

How to Claim $SPK Tokens After Spark Airdrop: A Step-by-Step Guide

Claiming your SPK tokens is easy, but make sure you use the official site to stay safe. Follow these steps to claim your Spark airdrop tokens:

1. Visit the

official Spark airdrop page. Never use third-party links as there are fake claim sites targeting users.

Spark airdrop eligibility checker | Source: Spark docs

2. Connect the same wallet you used to interact with Spark, Aave, or Layer3.

3. Check your eligibility. If you qualify, your SPK allocation will appear on-screen.

Spark airdrop eligibility checker | Source: Spark docs

4. Choose your action:

• Claim only: Receive SPK directly

• Stake in Overdrive: Lock your SPK for bonus rewards

5. Approve the transaction in your wallet. You’ll need ETH for gas fees.

6. (Optional) For Overdrive boosts, stake your SPK by July 29, 2025 and deposit at least 1,000 USDS or USDC to activate a higher point multiplier.

Once confirmed, your tokens will appear in your wallet. No cooldown. No delay.

Safety Tip: Be cautious when claiming your SPK, only use the official site to avoid scams and phishing links. Like most newly launched tokens, SPK saw price volatility after its airdrop, with a drop of over 23% in the first few days. More tokens will unlock gradually due to the vesting schedule, which could impact short-term price movements.

What Can You Do with SPK Tokens After Claiming?

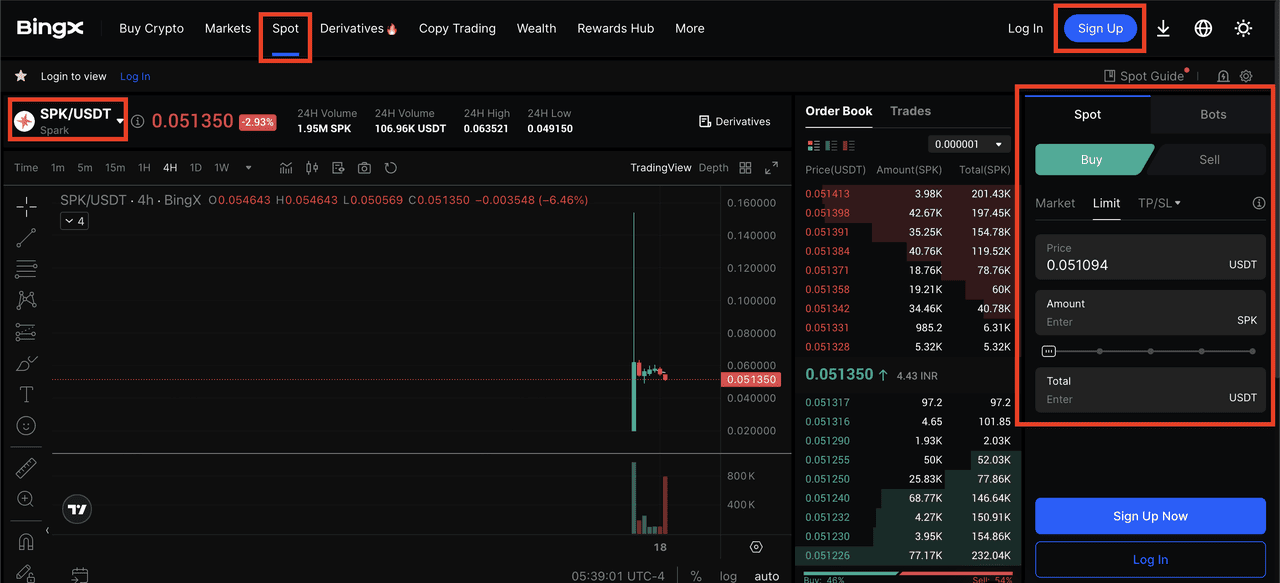

Once you’ve claimed your SPK tokens, they’re immediately available in your wallet, with no cooldown, no waiting. You can hold them, sell them, or stake them based on your goals.

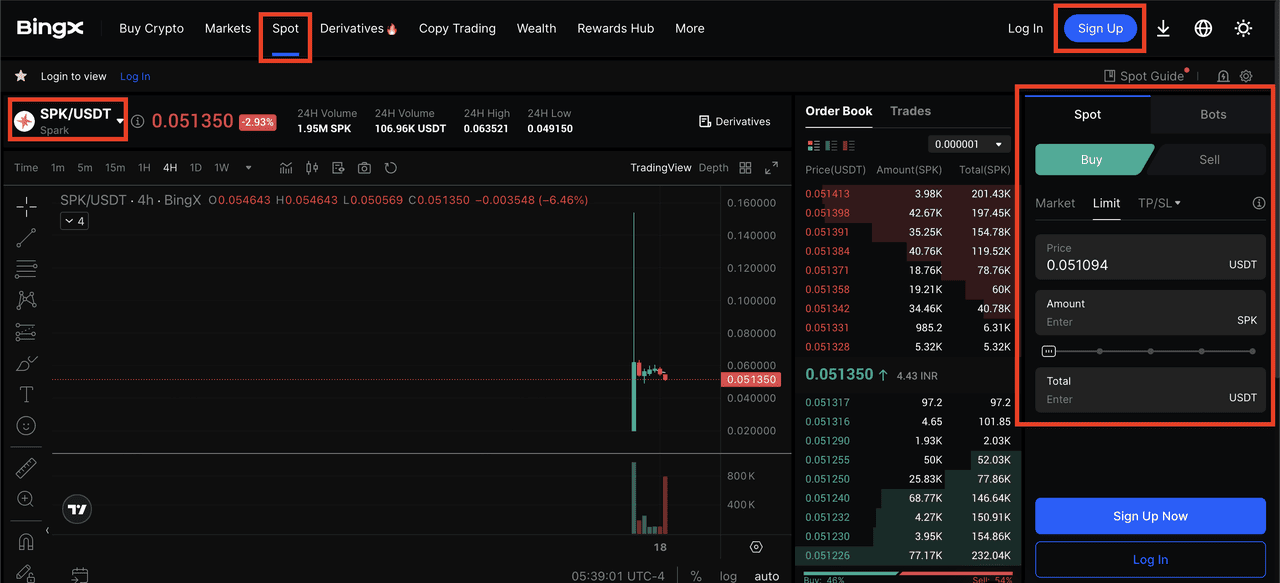

If you want to trade, SPK is already listed on top centralized exchanges like BingX. Simply search for the

SPK/USDT pair on the spot market to get started.

SPK/USDT trading on BingX spot market

Prefer to earn instead? You can stake SPK within the Spark ecosystem to receive Spark Points, which boost your airdrop rewards and increase your influence in future governance decisions. Joining the Overdrive phase before the July 29 deadline also gives you bonus multipliers if you stake and deposit USDS or USDC.

In the long run, staked SPK may play a role in securing Spark’s infrastructure, like bridges or liquidity tools, offering even more utility. Whether you’re here to trade or commit long-term, SPK gives you flexibility and opportunities across both DeFi and CeFi.

Conclusion

Spark is developing a robust DeFi infrastructure platform with deep liquidity, cross-chain automation, and yield-generation tools for stablecoins. It supports users and protocols across six blockchain networks, aiming to improve capital efficiency and access to on-chain finance.

The SPK token is central to this ecosystem. It enables governance, staking, and long-term rewards for active participants. If you’re eligible for the airdrop, this is your opportunity to join early and contribute to the protocol’s growth.

However, like any crypto project, SPK comes with risks, including market volatility and token unlocks. Always do your own research, manage your exposure, and follow official channels to stay informed.

Related Reading

FAQs on Spark Protocol Airdrop

1. What is the Spark (SPK) airdrop claim deadline?

Each airdrop campaign has a different claim window. The Ignition phase ends on July 29, 2025, while Pre-Farming, Layer3, and Overdrive claims remain open until December 17, 2025.

2. Can I stake SPK immediately after claiming the Spark Protocol airdrop?

Yes. After claiming, your SPK tokens are liquid and ready to stake. There’s no cooldown or lock-up period unless you join Overdrive for bonus rewards.

3. Can I still claim $SPK airdrop if I miss the Ignition window?

Yes. Even if you missed Ignition, you can still claim tokens from other campaigns like Pre-Farming, Layer3, or Overdrive, if you’re eligible. Staking SPK now may also help you earn points for future airdrops.

Spark Protocol TVL | Source: DefiLlama

Spark Protocol TVL | Source: DefiLlama SPK token allocation | Source: Spark Protocol on X

SPK token allocation | Source: Spark Protocol on X SPK token vesting schedule | Source: Spark docs

SPK token vesting schedule | Source: Spark docs

Spark airdrop eligibility checker | Source: Spark docs

Spark airdrop eligibility checker | Source: Spark docs Spark airdrop eligibility checker | Source: Spark docs

Spark airdrop eligibility checker | Source: Spark docs SPK/USDT trading on BingX spot market

SPK/USDT trading on BingX spot market