As global markets face persistent inflation risks, geopolitical uncertainty, and currency debasement concerns, gold has once again emerged as a preferred safe-haven asset. In 2025, spot gold surged above $4,525 per ounce in late December, pushing total above-ground gold market value beyond $30 trillion.

At the same time, a new class of digital assets called

tokenized gold has gained traction. These blockchain-based assets allow investors to own physical gold while benefiting from instant settlement, global accessibility, and fractional ownership.

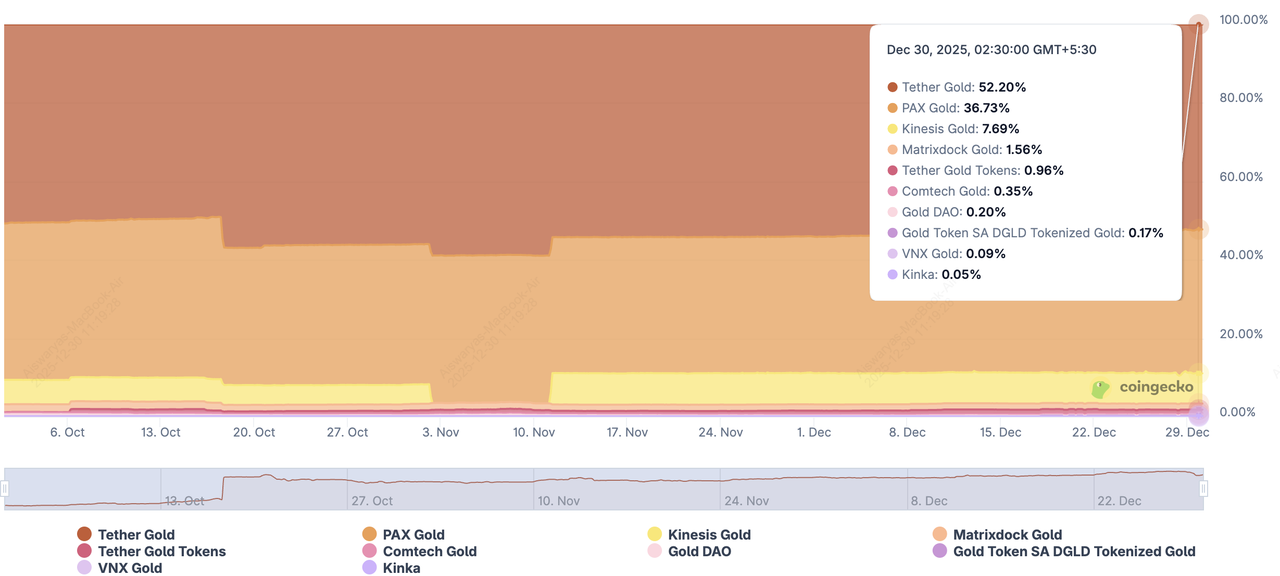

XAUT and PAXG dominate the tokenized gold market | Source: CoinGecko

Two projects dominate this sector:

Tether Gold (XAUT) and

Pax Gold (PAXG). Together, they represent around 90% of the tokenized gold market, valued at over $4.3 billion as of December 2025.

This guide breaks down XAUT vs. PAXG across structure, regulation, liquidity, transparency, and long-term investment suitability to help you decide which gold-backed crypto is better for your portfolio in 2026.

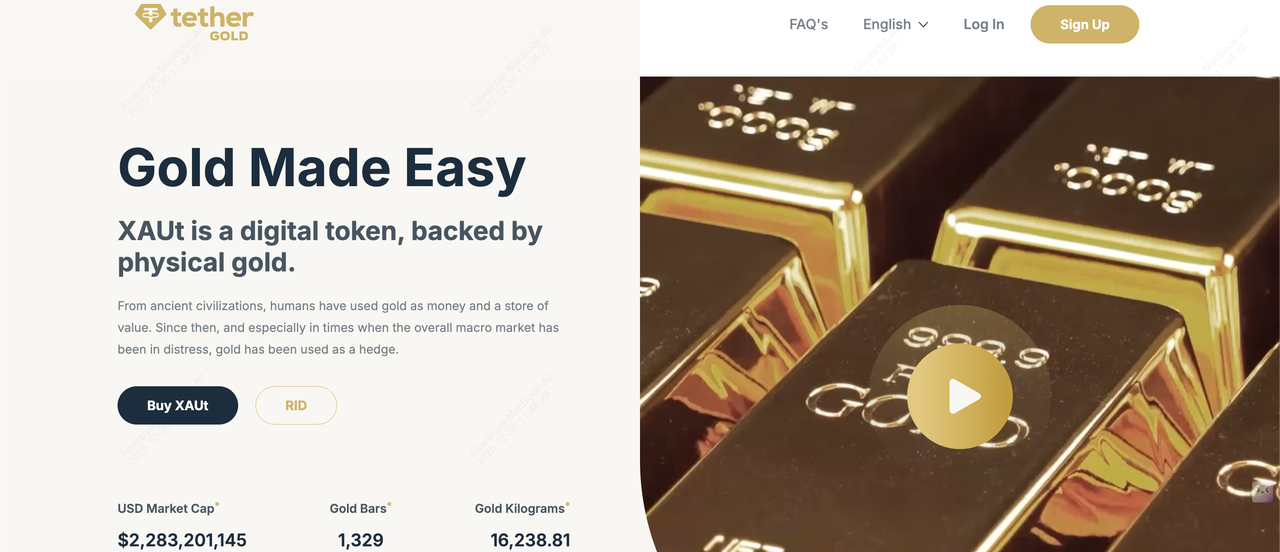

What Is Tether Gold (XAUT)?

Tether Gold (XAUT) is a digital asset issued by TG Commodities, a subsidiary of Tether. Each XAUT token represents one fine troy ounce of physical gold, securely stored in LBMA-accredited vaults in Switzerland.

Unlike gold ETFs or paper derivatives,

XAUT gives token holders direct ownership rights to allocated physical gold. Each token is linked to a specific gold bar with a serial number that can be verified on-chain.

As of end-2025, Tether Gold (XAUT) has a circulating supply of approximately 409,000 tokens, each backed 1:1 by physical gold, representing over 12.7 metric tons of vaulted gold. With gold prices trading above $4,300 per ounce, XAUT’s total market capitalization exceeds $2.2 billion as of December 2025, making it the largest tokenized gold asset in the crypto market. The token regularly records hundreds of millions of dollars in monthly trading volume, reflecting strong demand from both retail and institutional investors seeking on-chain exposure to gold. XAUT is divisible down to 0.000001 troy ounces, allowing precise position sizing while maintaining full backing by allocated bullion.

Key Features of XAUT Tokenized Gold

• 1:1 backed by LBMA gold bars

• Fractional ownership (down to 0.000001 oz)

• No recurring custody or management fees

• Redeemable for physical gold (subject to minimums)

XAUT is widely used by crypto-native investors who want gold exposure without leaving the blockchain ecosystem. Its deep liquidity and integration with centralized and decentralized exchanges make it especially attractive for active traders.

What Is Pax Gold (PAXG)?

Pax Gold (PAXG) is a regulated gold-backed digital asset issued by Paxos Trust Company, a New York–chartered financial institution overseen by the New York State Department of Financial Services (NYDFS). Each

PAXG token represents one fine troy ounce of LBMA-accredited gold, stored in professional vaults operated by approved custodians such as Brink’s. Token holders can verify bar serial numbers through Paxos’ public lookup tools.

As of end-2025, Pax Gold (PAXG) has a circulating supply of approximately 365,000 tokens, each backed 1:1 by one fine troy ounce of physical gold held in LBMA-approved vaults. With gold trading above $4,300 per ounce, PAXG’s total market capitalization stands near $1.6 billion as of late December 2025. The token maintains steady on-chain activity, supported by institutional demand and regular monthly attestations conducted by independent auditors. PAXG is fully redeemable for physical gold or cash, and its supply expands or contracts dynamically based on issuance and redemption activity, ensuring full backing at all times.

Key Features of PAXG Gold Token

• 1:1 backed by allocated physical gold

• Issued by a U.S.-regulated trust company

• Monthly third-party attestations

• Redeemable for physical gold or cash

• Strong institutional adoption

PAXG is often favored by institutional investors, funds, and compliance-focused entities due to its regulatory clarity and transparent audit structure.

XAUT vs. PAXG Tokenized Gold: Key Differences at a Glance

Below is a high-level comparison of the core metrics and characteristics that differentiate XAUT and PAXG as tokenized gold assets in the crypto market.

| Feature |

Tether Gold (XAUT) |

Pax Gold (PAXG) |

| Issuer |

TG Commodities (Tether) |

Paxos Trust Company |

| Regulation |

Offshore structure |

NYDFS-regulated |

| Gold Backing |

1 oz LBMA gold |

1 oz LBMA gold |

| Audits |

Attestations |

Monthly independent audits |

| Custody |

Swiss vaults |

London LBMA vaults |

| Redemption |

Physical gold (min ~430 oz) |

Physical gold or cash |

| Typical Users |

Crypto-native traders |

Institutions, funds |

| Market Cap (Dec 2025) |

Around $2.2 billion |

Around $1.6 billion |

1. Liquidity, Trading, and Market Adoption: XAUT's $2.2B vs. PAXG'x $1.6B M-Cap

XAUT currently holds the largest share of the tokenized gold market, with a market capitalization near $2.2 billion and consistently higher daily trading volumes. Its integration across major crypto exchanges and trading pairs, particularly against USDT, makes it more accessible for active traders and crypto-native users. XAUT is often used as a volatility hedge during market downturns, benefiting from deep liquidity and near-continuous trading activity.

PAXG, with a market cap of approximately $1.6 billion, attracts a different segment of the market. While trading volumes are typically lower than XAUT’s, PAXG sees stronger participation from institutions, asset managers, and compliance-focused investors. Its regulated status and transparent reporting framework make it easier to integrate into traditional investment portfolios, even if liquidity is slightly lower on retail exchanges.

2. Custody, Transparency: XAUT's Direct Ownership vs. PAXG's Regulatory Structure

XAUT represents direct ownership of physical gold stored in Swiss vaults, with each token linked to a specific LBMA-accredited bar that can be verified on-chain. The model prioritizes flexibility and capital efficiency: there are no recurring storage fees, and tokens can be transferred freely at any time. However, transparency and oversight rely primarily on issuer disclosures rather than regulatory supervision, meaning trust in Tether’s custody and reporting framework plays a central role.

PAXG, by contrast, operates under a more formal regulatory structure. Issued by Paxos Trust Company and overseen by the New York State Department of Financial Services (NYDFS), PAXG benefits from monthly third-party attestations and clearly defined custody rules. Each token corresponds to an allocated gold bar held in LBMA-approved vaults, providing a higher level of institutional assurance at the cost of reduced flexibility and potentially higher compliance overhead.

3. Risk Profile and Practical Considerations

Both XAUT and PAXG expose holders to gold price movements, but they also carry risks unique to tokenized assets. Investors must account for issuer and custody risk, potential regulatory changes, and operational dependencies such as smart contract security and exchange availability. XAUT may appeal to users prioritizing liquidity, portability, and ease of trading within crypto markets, while PAXG is better suited for investors who prioritize regulatory clarity, audited reserves, and long-term capital preservation.

Which Is Better in 2026: XAUT or PAXG?

There is no universal “winner” between Tether Gold (XAUT) and Pax Gold (PAXG); the better choice depends on how you intend to use tokenized gold within your portfolio. Both assets track the same underlying commodity, but their structure, liquidity profile, and regulatory positioning create meaningful differences in real-world use.

When to Choose Tether Gold (XAUT)

XAUT is better suited for active crypto users and traders who prioritize liquidity, speed, and ecosystem compatibility. With a market capitalization exceeding $2.2 billion and consistently higher daily trading volumes than PAXG, XAUT offers tighter spreads and easier entry and exit on major exchanges, including BingX. It integrates seamlessly with the broader Tether ecosystem, making it practical for portfolio hedging, short-term positioning, and capital rotation during periods of market volatility.

Because XAUT trades 24/7 and settles instantly on-chain, it functions more like a digital commodity than a traditional gold product. However, investors should recognize that XAUT relies on issuer transparency rather than formal regulatory oversight, meaning counterparty risk is higher than with regulated gold products.

Tether Gold (XAUT) is best suited for:

1. Active traders and crypto-native investors

2. Portfolio hedging during market volatility

3. Users prioritizing liquidity and on-chain flexibility

When to Choose Pax Gold (PAXG)

PAXG is better aligned with long-term, compliance-focused investors seeking gold exposure with institutional-grade safeguards. Issued by Paxos Trust Company and overseen by the New York State Department of Financial Services, PAXG benefits from strict regulatory oversight, monthly third-party audits, and fully allocated gold reserves held in LBMA-approved vaults.

While PAXG may trade at slightly lower volumes than XAUT, it offers greater transparency and regulatory certainty, features that appeal to asset managers, family offices, and risk-averse investors. Its structure makes it suitable for long-term wealth preservation rather than frequent trading or short-term speculation.

PAX Gold (PAXG) is best suited for:

1. Investors prioritizing regulatory clarity and audited reserves

2. Long-term holders seeking gold exposure with institutional safeguards

3. Portfolios focused on capital preservation over liquidity

Bottom Line: Complementary, Not Competing

XAUT and PAXG are best viewed as complementary tools rather than direct substitutes. XAUT functions like a liquid, crypto-native gold instrument, ideal for trading and tactical positioning. PAXG operates more like a digital gold bar, designed for stability, compliance, and long-term holding.

For many investors, a blended approach makes sense:

•

Buy PAXG as a long-term store of value anchored in regulatory certainty.

•

Buy XAUT for liquidity management, hedging, or tactical exposure within crypto markets.

Together, they represent two sides of the same thesis, bringing physical gold into the digital economy while serving different risk profiles and investment objectives.

How to Buy Tether Gold (XAUT) and Pax Gold (PAXG) on BingX

BingX makes it easy to trade both Tether Gold (XAUT) and Pax Gold (PAXG) using its spot and derivatives markets, supported by

BingX AI, which provides real-time market insights, trend analysis, and risk signals to help traders make more informed decisions.

Spot Trading: Buy, Sell, and Hold XAUT or PAXG

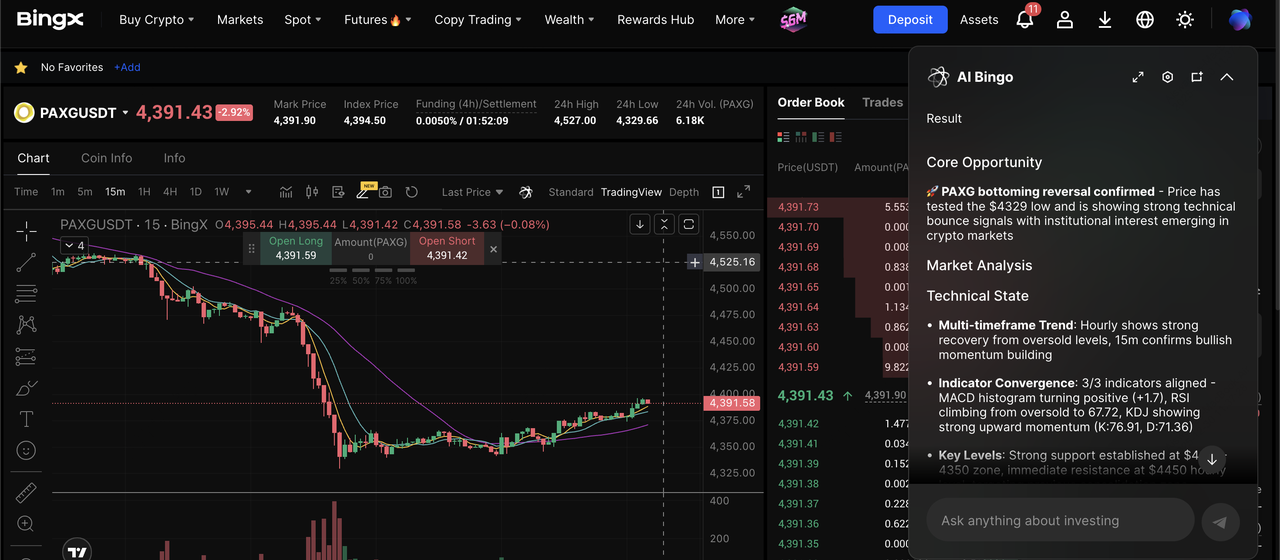

XAUT/USDT trading pair on the spot market powered by BingX AI insights

Spot trading is ideal for investors who want direct exposure to gold-backed tokens without leverage. On BingX, users can buy and sell XAUT/USDT or PAXG/USDT pairs with real-time pricing and deep liquidity.

3. Execute the trade and hold the tokens in your spot wallet.

4. Use BingX’s built-in AI tools to monitor price trends, support levels, and market momentum.

This approach suits long-term holders looking to use XAUT or PAXG as a digital store of value or portfolio hedge.

Futures Trading: Trade Gold Price Movements with Leverage

PAXG/USDT perpetual contract on the futures market powered by BingX AI

For more advanced users, BingX also offers XAUT and PAXG perpetual futures, allowing traders to speculate on gold price movements without holding the underlying asset.

2. Choose your position type (Long or Short) and set leverage based on your risk tolerance.

4. Monitor

funding rates, liquidation prices, and AI-generated market signals in real time.

Futures trading allows traders to capitalize on both rising and falling gold prices, making it suitable for hedging strategies and short-term opportunities, provided proper risk management is in place.

Final Thoughts: PAXG or XAUT, Which Tokenized Gold Coin to Buy in 2026?

Both Tether Gold (XAUT) and Pax Gold (PAXG) provide credible, on-chain exposure to physical gold, but they serve slightly different investor profiles. XAUT currently leads in market capitalization and trading volume, making it more liquid and better suited for active crypto participants who value flexibility, 24/7 trading, and integration with DeFi and centralized exchanges.

On the other hand, PAXG appeals to institutions and long-term holders due to its NYDFS regulation, monthly third-party audits, and clearly defined custody framework. In practice, XAUT behaves more like a crypto-native asset, while PAXG aligns more closely with traditional financial standards.

From a risk perspective, neither option is risk-free. Both rely on custodians, issuers, and off-chain gold storage, meaning counterparty and operational risks remain. XAUT carries higher reliance on issuer transparency, while PAXG faces stricter compliance obligations that may limit flexibility or availability in certain regions. For investors seeking balance, holding both can offer diversification across regulatory models, liquidity profiles, and operational frameworks, making tokenized gold a practical bridge between traditional safe-haven assets and modern digital finance in 2026.

Related Reading