DePIN is a blockchain-based model for building and coordinating physical infrastructure. Instead of depending on centralized corporations to deploy and manage systems, DePIN allows individuals and communities to contribute resources like bandwidth, compute power, and geolocation data in exchange for token rewards.

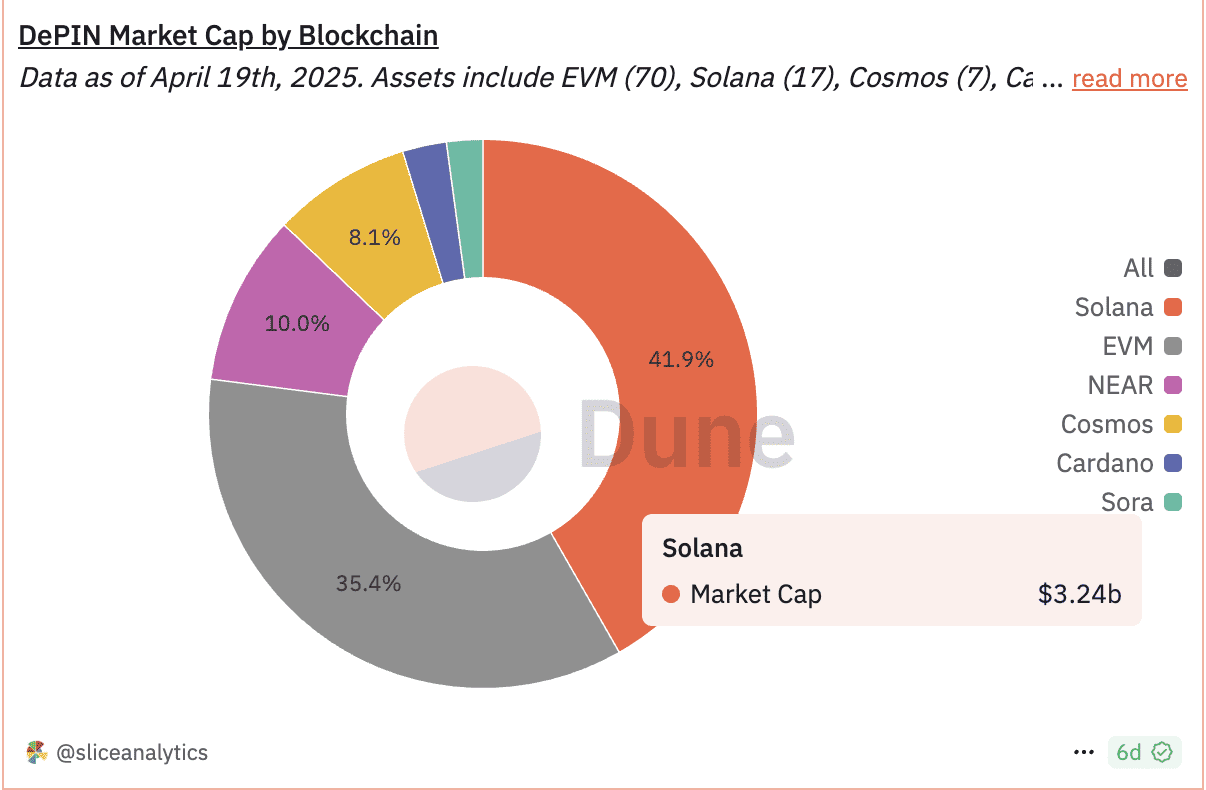

Solana has emerged as the preferred blockchain for DePIN projects due to its unique combination of high-throughput speed, exceptional scalability, and remarkably low transaction costs. The network's architecture enables the frequent microtransactions necessary for rewarding infrastructure providers in real-time, while its existing ecosystem provides the composability that DePIN projects need to integrate with other decentralized applications.

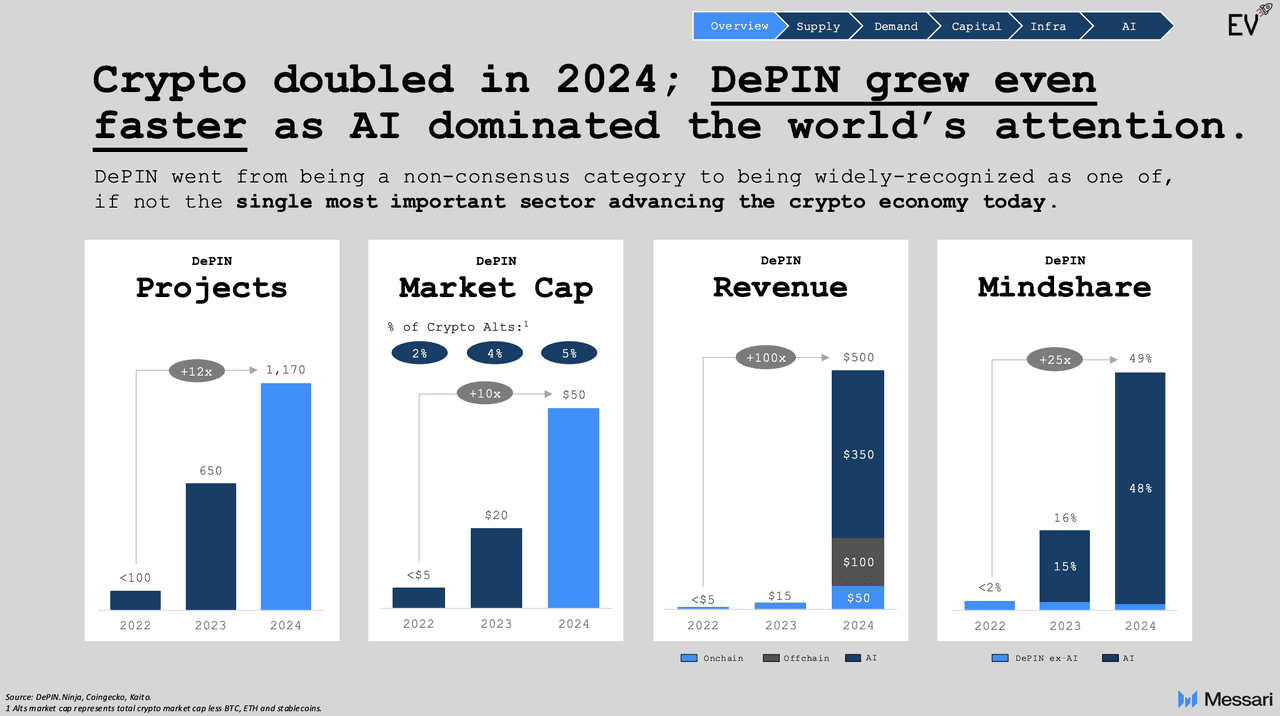

The numbers speak for themselves: Messari projects that the DePIN market cap could reach an astounding $3.5 trillion by 2028, and Solana is positioned at the forefront of this growth.

As of June 2025, the total market value of DePIN projects on Solana reached $3.24 billion, significantly surpassing other blockchain platforms and demonstrating the network's strong position in this emerging sector.

As DePIN evolves from concept to proven business models, certain projects have distinguished themselves through strong fundamentals, impressive growth metrics, and celebrity backing. These five Solana-based networks are leading the charge in bringing decentralized infrastructure to mainstream adoption.

1. Helium - Decentralized Wireless Networks

Helium Network stands as the undisputed pioneer of the DePIN movement, having successfully migrated to Solana on April 18, 2023. This strategic transition enabled Helium to leverage Solana's superior scalability while focusing on building decentralized wireless infrastructure.

Scale That Matters: The network operates IoT and mobile systems with nearly one million hotspots deployed across 192 countries, creating the world's largest decentralized wireless network. To put this in perspective, only 50-100 Helium hotspots are needed to provide coverage for an entire city, compared to traditional cell towers that cost up to $150,000 each to install. Helium's annual IoT connectivity costs just $1.75 per device versus $18-30 per device on traditional cellular networks (up to 17x cheaper).

In 2025, Helium continues expanding with its $20 unlimited 5G cellular plan, major carrier partnerships including AT&T WiFi integration and Telefónica's Mexico expansion, plus Google Pixel 8 integration. HNT maintains a strong market presence with $8.79 million in daily trading volume.

2. Render Network - GPU Computing Powerhouse

Source: Render Network

Render Network leads decentralized GPU computing with a star-studded advisory board including Hollywood legends J.J. Abrams (Star Wars, Star Trek), Ari Emanuel (CEO of Endeavor), digital artist Beeple (creator of the $69M

NFT), Brendan Eich (inventor of JavaScript), and Emad Mostaque (founder of Stability AI). This celebrity backing bridges cryptocurrency with Hollywood studio production pipelines.

Hollywood-Grade Impact: The platform demonstrates strong success with peak revenues of $300,000 per week and over 121 million RNDR tokens burned. RENDER commands significant market attention with $62.98 million in 24-hour volume and a $2.1 billion market cap. The network operates simply: individuals with idle GPU capacity contribute resources and earn tokens, while creators access distributed computing power at lower costs.

Render's 2024 transition from

Ethereum to Solana reflects superior capabilities for compute marketplaces. The platform integrates seamlessly with industry tools like Blender and Arnold.

3. Grass - AI Data Infrastructure

Source: Grass Network

Grass Network represents an innovative approach to data collection and AI model training, experiencing explosive growth from 200,000 to over 3 million users between Q4 2024 and early 2025. The platform allows users to share excess internet bandwidth to help train AI models while earning proportional rewards.

Rivaling Tech Giants: Currently processing around 759,000 TB of data daily, Grass is building the first open internet-scale web crawl to compete with trillion-dollar companies. The recent Sion Upgrade enhanced capabilities for processing multimodal web content with daily data collection rates rivaling major tech companies. Trading activity shows robust engagement with $44.51 million in daily volume.

Despite fluctuations, Grass remains the second-largest DePIN project on Solana after Helium. Market analysts predict significant growth potential for this AI infrastructure token.

4. io.net - Decentralized GPU Networks

Source: io.net

io.net positions itself as crucial AI infrastructure by aggregating global GPU supply and making it accessible to machine learning teams at significantly lower costs than centralized alternatives. The platform offers comprehensive products enabling permissionless access to global cloud clusters.

Solving AI's Biggest Challenge: The network requires node operators to stake minimum IO tokens as collateral before receiving rewards, ensuring network integrity. Users can deploy clusters using various payment methods including fiat and

USDC, though backend settlements occur in IO tokens.

In 2025, io.net continues expanding through partnerships with Alpha Network and Mira Network. The platform supports wide-ranging machine learning frameworks, ensuring flexibility despite recent supply-side challenges.

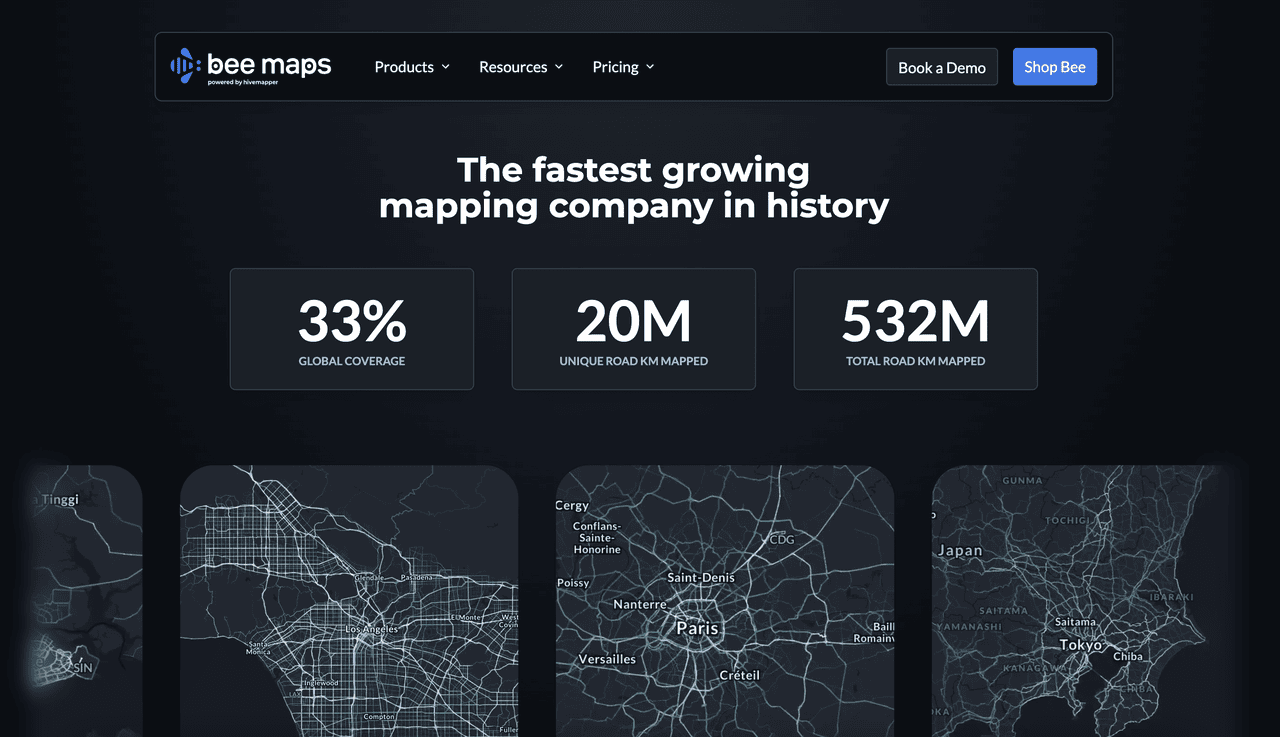

5. Hivemapper - Decentralized Mapping

Source: Bee Maps - Powered by Hivemapper

Hivemapper revolutionizes geospatial data by creating a decentralized Google Maps alternative through community-powered data collection. The project uses dashcam-equipped vehicles to generate comprehensive, up-to-date mapping data while rewarding contributors.

Breaking Google's Monopoly: The platform demonstrates DePIN composability by using Helium hotspots to verify driver locations without storing personal information. Hivemapper is one of only two companies capable of crawling the entire web for mapping data, directly challenging Google's multi-trillion dollar mapping infrastructure.

Hivemapper addresses traditional mapping pain points, including outdated information and limited coverage. By incentivizing drivers to contribute fresh data, the network maintains more current geographic information than centralized alternatives.

How to Evaluate Solana DePIN Projects Before Investing

With the rapid expansion of DePIN, not all projects will deliver lasting value. For investors, analysts, and contributors, evaluating these networks requires more than surface-level indicators. Here are five key areas to examine when assessing the strength and long-term viability of a DePIN project.

1. Check Real Infrastructure Growth: Look for evidence of physical deployment. This includes active nodes, connected devices, or contributors providing bandwidth, compute, or sensor data. A growing network usually signals real demand.

2. Link Token Utility to Network Usage: The token should play an active role in the network. It should be needed to access services, reward contributors, or pay for usage. If token demand doesn't grow with network usage, that’s a red flag.

3. Assess Scalability and Architecture: Can the project scale across geographies or use cases? Modular design, developer tools, and support for integration make it easier to expand as adoption increases.

4. Look for Real-World Integration: Projects that form partnerships with enterprises, cities, or platforms are more likely to succeed. Integration with existing systems shows product relevance and stronger go-to-market potential.

5. Consider Regulatory Sensitivity: DePIN projects vary in legal exposure depending on what they decentralize. Data-heavy networks face different challenges than compute-focused ones. Projects that address compliance early are better prepared for long-term growth.

Challenges and Opportunities for DePIN on Solana

Technical and Operational Challenges

DePIN projects on Solana face key issues around data integrity and infrastructure logistics. Verifying off-chain data like geolocation, bandwidth, or compute availability remains complex, with trustless verification still evolving. Maintaining decentralized hardware at scale also brings challenges in uptime, contributor reliability, and token-driven incentives.

Opportunities Through Latest Aplenglow and Firedancer Upgrade

Solana’s recent and upcoming upgrades offer critical improvements.

Alpenglow enhances fee stability, helping DePIN apps deliver predictable pricing for uploads, registrations, and rewards.

Firedancer significantly boosts throughput and resilience, making it easier to support real-time data from thousands of devices without network slowdowns. Together, these upgrades create a stronger foundation for scaling DePIN infrastructure.

Conclusion

As we move through 2025, the convergence of advanced computing, AI deployment, and IoT expansion is creating unprecedented demand for infrastructure that is faster, more local, and less reliant on centralized control. Solana’s DePIN ecosystem is emerging at the center of this shift, powered by ongoing technical improvements, growing investment, and real-world use. The projects building on Solana today reflect a broader movement toward decentralized infrastructure models that can scale flexibly, serve global demand, and operate with greater transparency and efficiency than traditional systems.

Related Reading