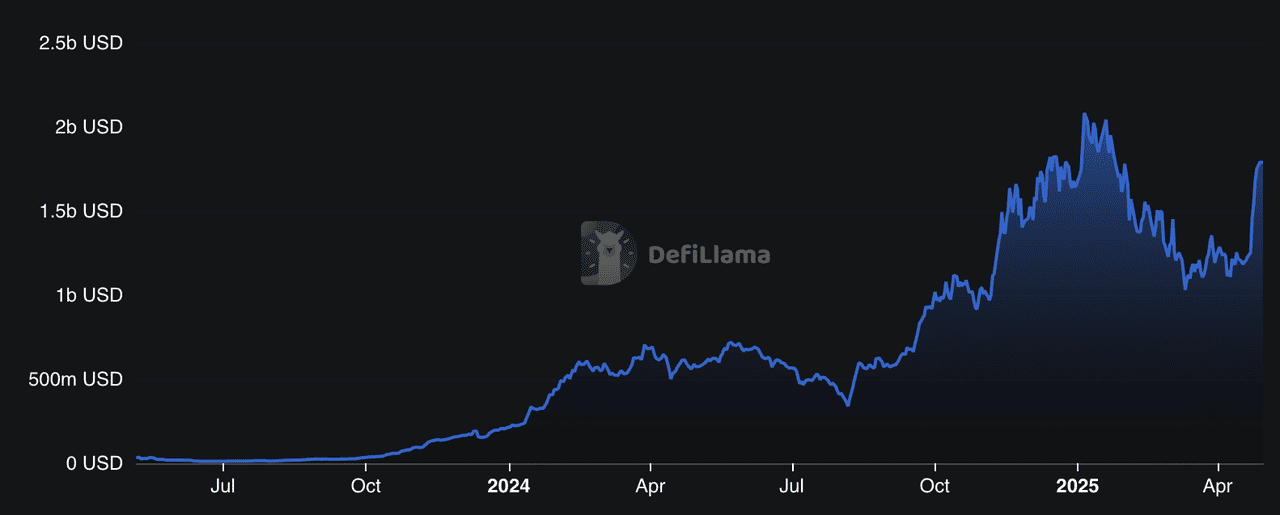

Sui Network is a leading

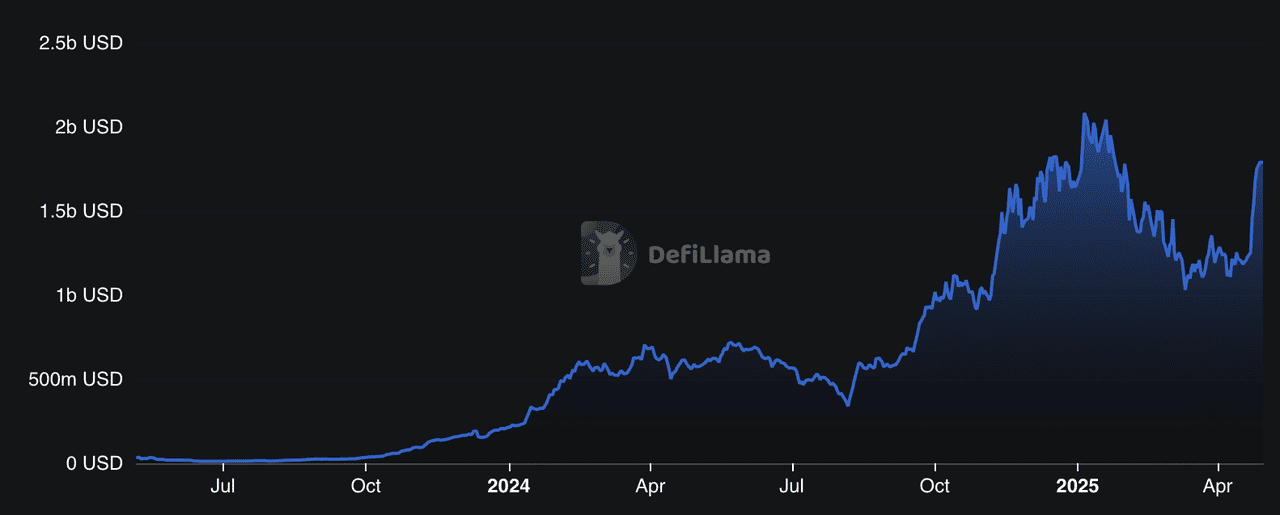

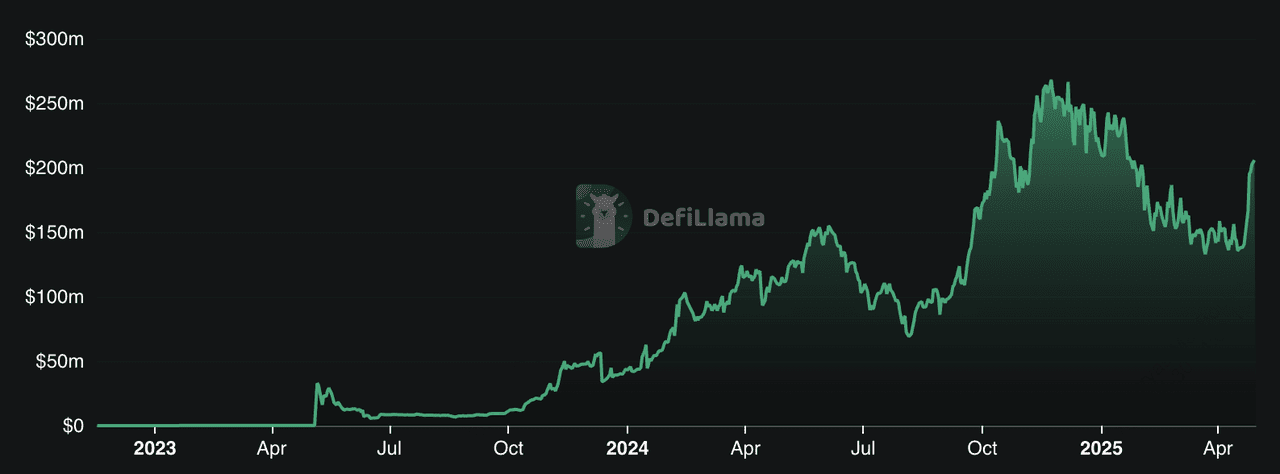

Layer-1 blockchain that combines high speed, low costs, and strong security. In 2025, it has seen explosive growth, attracting developers and users alike. As per data on DefiLlama, the Sui network's total value locked (TVL) in

DeFi has surged to $1.78 billion as of April 2025, with its nearly 50

DEXs registering a 24h trading volume of over $400 million as of writing. The increased activity is a strong indicator of heightened interest in Sui ecosystem tokens as the wider crypto market sentiment improves.

Sui DeFi TVL | Source: DefiLlama

In this article, you’ll find clear overviews of five

top Sui projects. You’ll learn each project’s core features, token use cases, and key strengths. This guide will help you navigate the Sui ecosystem with confidence.

Why Is the Sui Ecosystem Gaining Popularity in 2025?

Sui was founded in 2021 by former Meta Novi engineers, Evan Cheng, Adeniyi Abiodun, Sam Blackshear, George Danezis, and Kostas Chalkias, and its mainnet went live in May 2023. Since launch, Sui has rapidly evolved into a high-performance Layer-1 blockchain. The following data underscores why developers, traders, and institutions are increasingly drawn to the Sui ecosystem:

1. High Throughput: Sui processes up to 297,000 TPS with an average finality of about 400 ms, supporting real-time gaming, DeFi, and NFT applications without major delays.

2. Growing TVL: Total value locked increased from under $500 million in early 2024 to approximately $2.06 billion by January 2025.

3. Increased Trading Activity: Weekly DEX volume rose 45% to $3.6 billion, stablecoin supply on Sui exceeds $885 million, and

memecoin trading adds around $2.1 billion in volume.

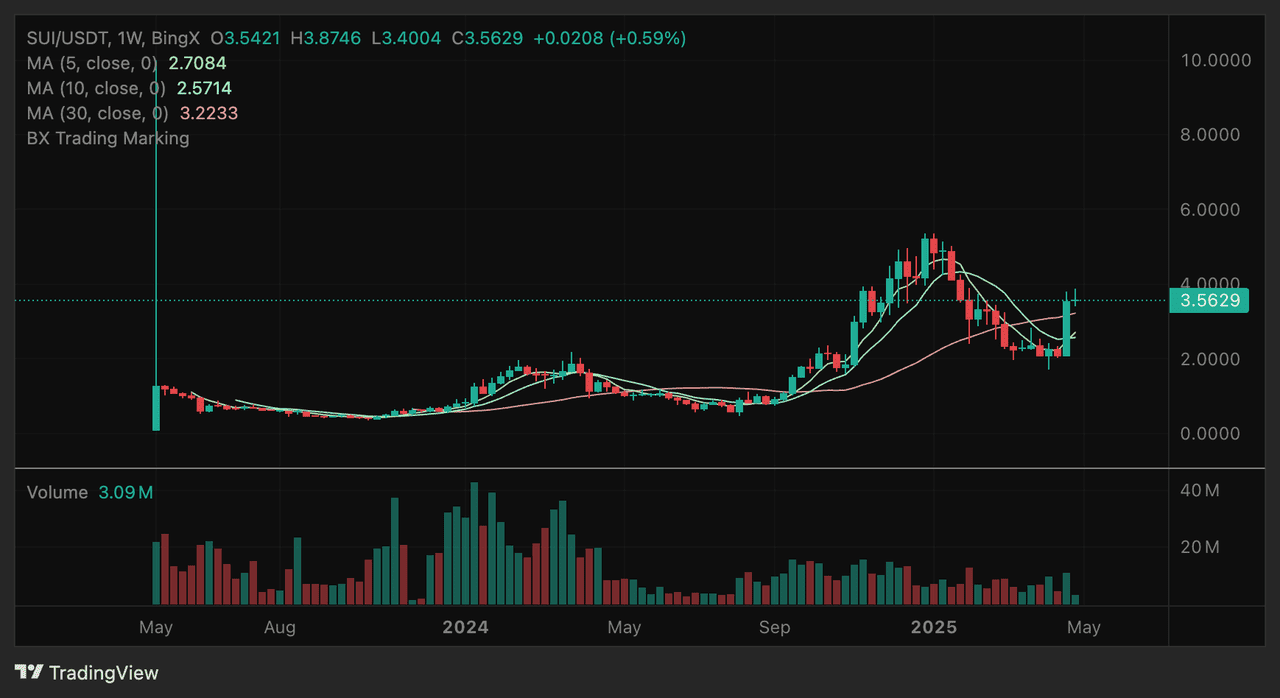

4. User and Price Growth: Active addresses have surpassed 168 million wallets, and the native SUI token has gained over 200%, reaching an all-time high of $5.35 in January 2025.

5. Rising Institutional Engagement: Two US-based SUI ETF applications, Cboe BZX’s Canary SUI ETF and 21Shares’ Delaware-registered trust, have been filed, indicating growing institutional interest.

Best Crypto Projects in the Sui Ecosystem to Know

Here's a list of some of the most popular Sui ecosystem crypto projects to keep an eye on or consider including in your portfolio. We selected these top Sui projects using a data-driven approach. Each project was evaluated on metrics like TVL, on-chain activity, and developer engagement. We also considered token utility,

liquidity on major exchanges, and security audits to ensure a well-rounded list.

DeepBook Protocol (DEEP)

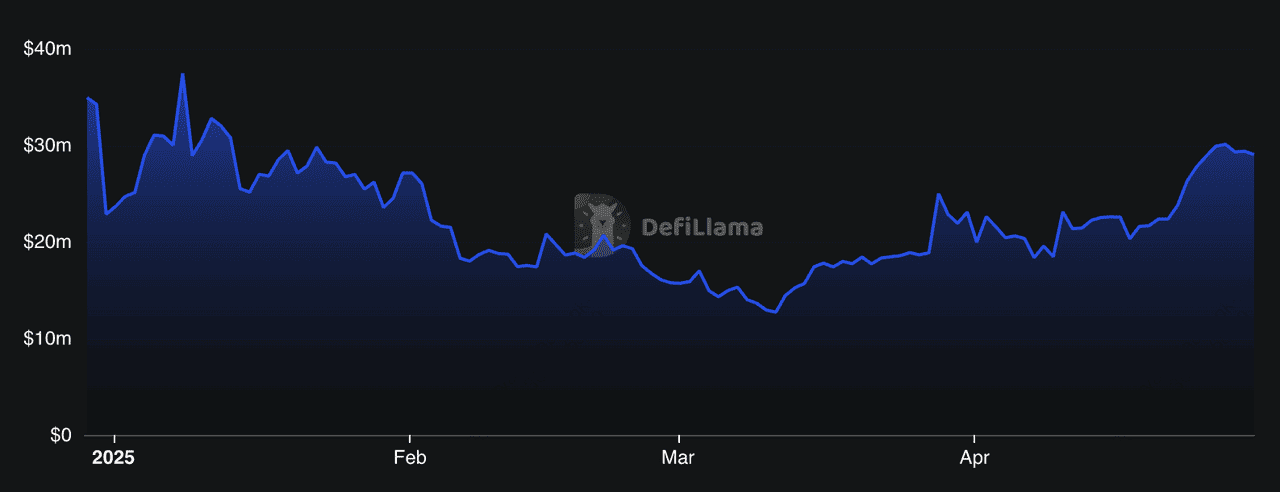

DeepBook has a TVL of nearly $500 million as of April 2025 | Source: DefiLlama

DeepBook Protocol is the premier on-chain order-book DEX built for the Sui Network. It offers a central limit order book (CLOB) architecture that delivers deep liquidity and smooth trades with minimal slippage. Since launching, DeepBook has processed over $8.7 billion in total volume and served more than 10 million users, burning over 13.8 million DEEP tokens from trading fees in the process. As of April 2024, DeepBook Protocol has a market cap of over $488 million.

The protocol powers ultra-low latency trading with settlement times around 390 ms and predictable, low fees. All order flow, book depth, and matching processes are fully on-chain for maximum transparency. The native

DEEP token aligns incentives across the ecosystem: holders use it for governance votes, trading fee payments, and liquidity rebates during low-volume periods. Through fee discounts and pool-creation incentives, DEEP helps ensure a robust, professional-grade trading environment on Sui.

Haedal (HAEDAL)

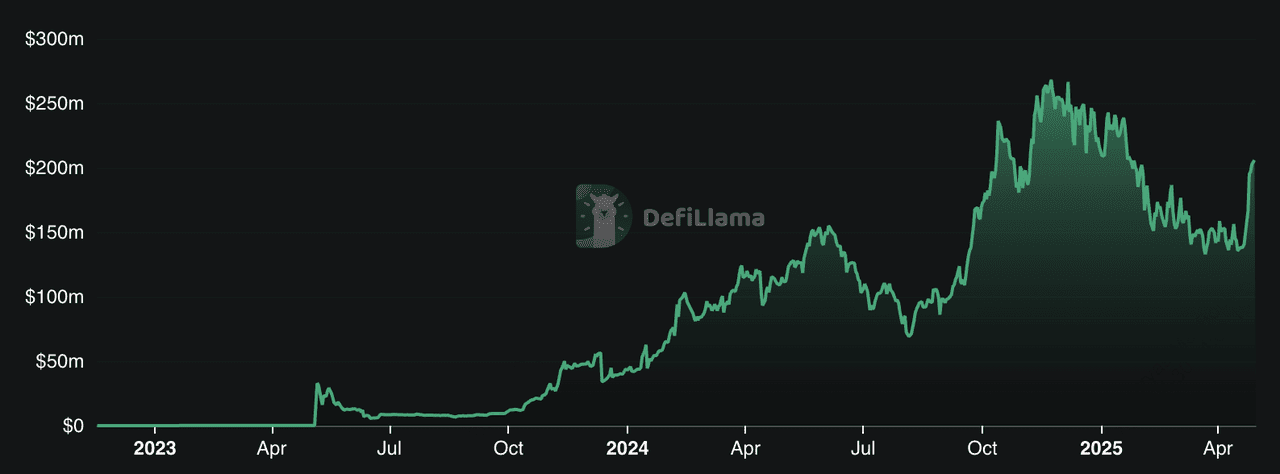

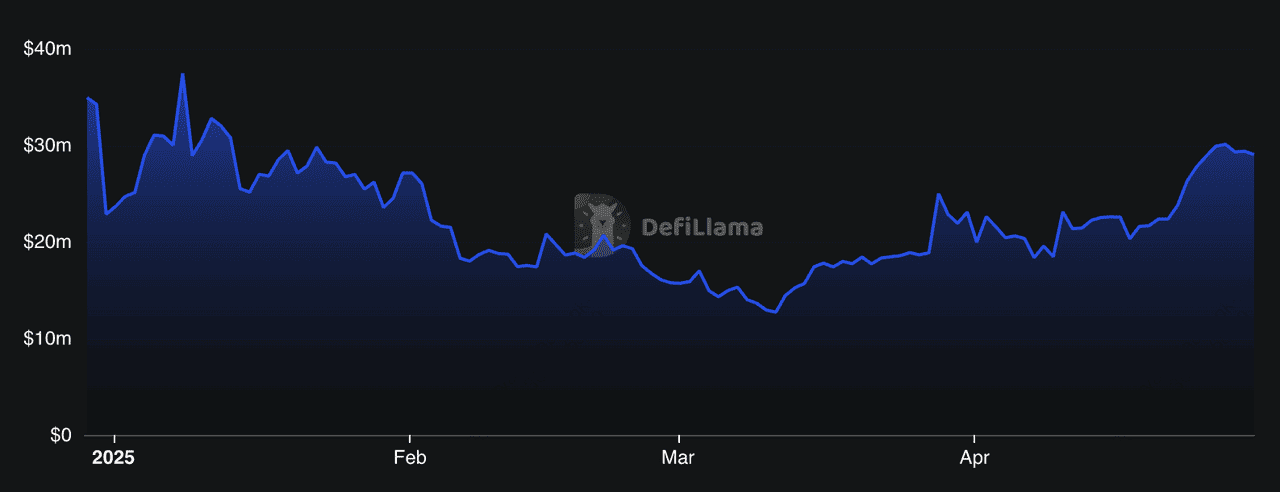

Haedel's TVL is over $195 million as of April 2025 | Source: DefiLlama

Haedal is a leading

liquid-staking protocol on the Sui Network. As of April 28, 2025, users have staked over $190 million worth of SUI across 865,835 accounts, making Haedal the fourth-largest DeFi protocol by TVL on Sui. The protocol automatically allocates stake to top

validators and issues haSUI at a 1 SUI ≈ 1.054 haSUI exchange rate. You continue earning the base SUI staking yield (around 2.5% APY) while using haSUI in DeFi to boost returns. Haedal has a market cap of over $16 million as of April 2025.

The native

HAEDAL token powers governance and rewards. Holders stake HAEDAL into veHAEDAL to vote on protocol upgrades and earn extra yield—recently boosting average APYs to over 3.2% during Q1 2025 through dynamic validator selection and revenue-sharing mechanisms. Haedal also ran a community airdrop allocating 5% of its 1 billion-token supply to early supporters. Regular security audits, a bug-bounty program, and over 44,000 daily active wallets underscore strong community engagement and protocol safety.

Cetus Protocol (CETUS)

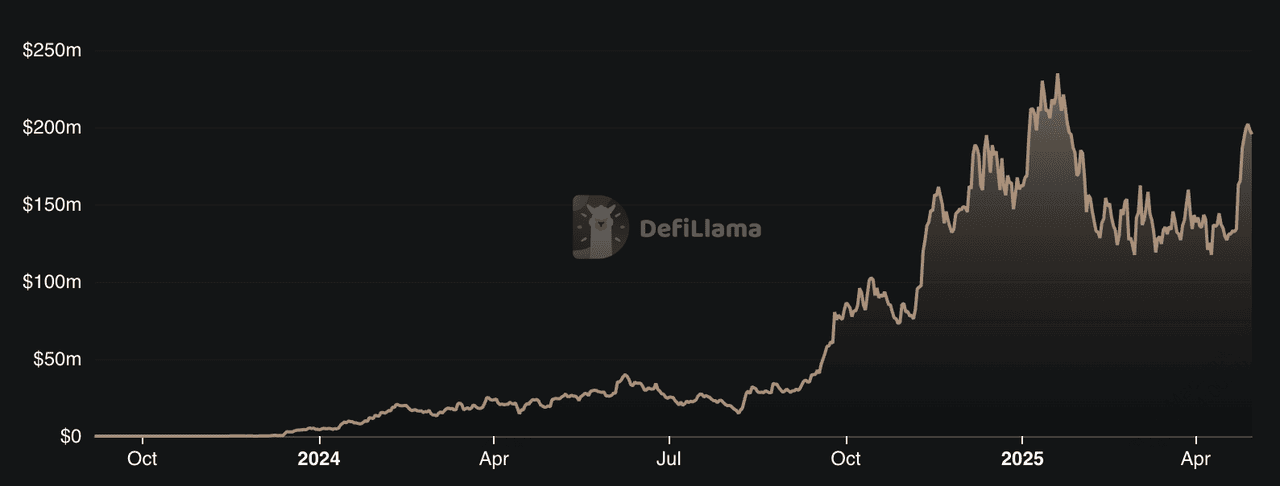

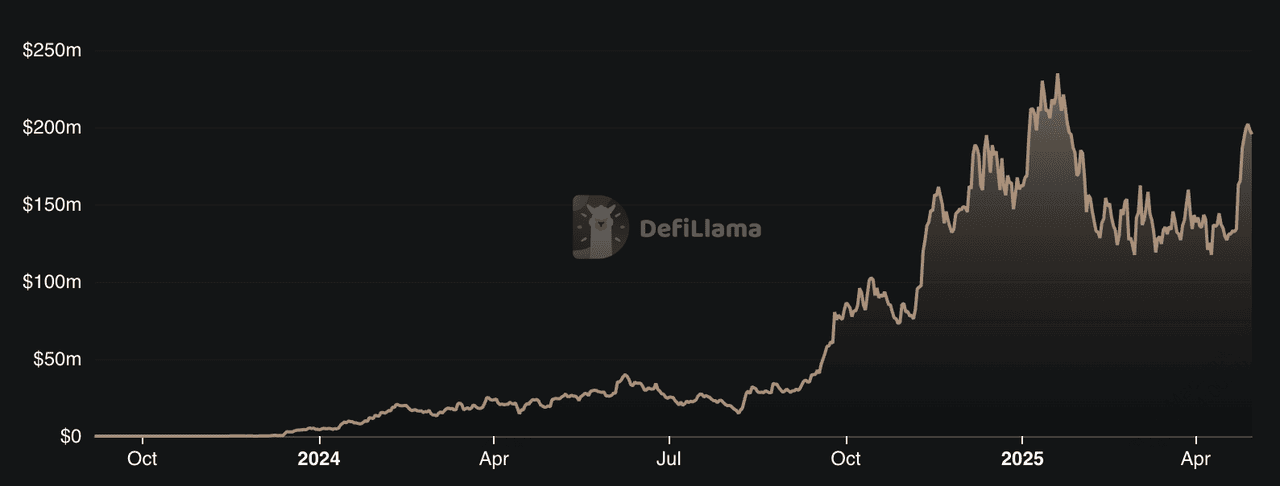

Cetus Protocol's TVL exceeds $200 million as of April 2025 | Source: DefiLlama

Cetus Protocol is a leading

AMM DEX built for Sui’s unique object model. It has surpassed $50 billion in total trading volume, accounting for over 65 % of Sui’s DEX activity, and supports 13 million on-chain accounts with 129 million all-time trades. The protocol uses concentrated liquidity pools to boost capital efficiency, offers impermanent-loss protection, and enables single-asset pools for flexible participation.

The native CETUS token fuels the ecosystem. Holders earn farming rewards by providing liquidity across Cetus pools. They also stake CETUS (or xCETUS) for yield and governance voting rights. With a max supply of 1 billion CETUS, of which 714 million are circulating, Cetus balances sustainable incentives (50% to liquidity mining) with long-term growth (15% to treasury, 20% to team, 15% to investors). This token model ensures that active contributors and liquidity providers share in the protocol’s success.

Walrus (WAL)

Source: Walrus

Walrus is a decentralized storage and data availability protocol built on the Sui Network. It specializes in handling large “blob” files, video, image, or dataset, using advanced erasure coding that breaks data into slivers across multiple nodes. This method ensures high availability even if some nodes fail, while keeping storage costs to around five times the blob size, far more efficient than full replication. As of April 2025, the global decentralized storage sector has a market cap of $4.64 billion, and Walrus ranks as one of the largest protocols in this sector with a market cap of over $700 million.

The native WAL token powers Walrus’s delegated proof-of-stake network. Storage nodes stake WAL (and its subdivision FROST) to join epoch committees responsible for storing and serving blobs. Token holders also use WAL to pay for storage services. At each epoch’s end, rewards are distributed to nodes and their delegators based on uptime and service quality, ensuring robust network operation. WAL has a circulating supply of 1.25 billion (out of 5 billion max), a market cap of roughly $706 million, and daily trading volumes above $73 million as of late April 2025.

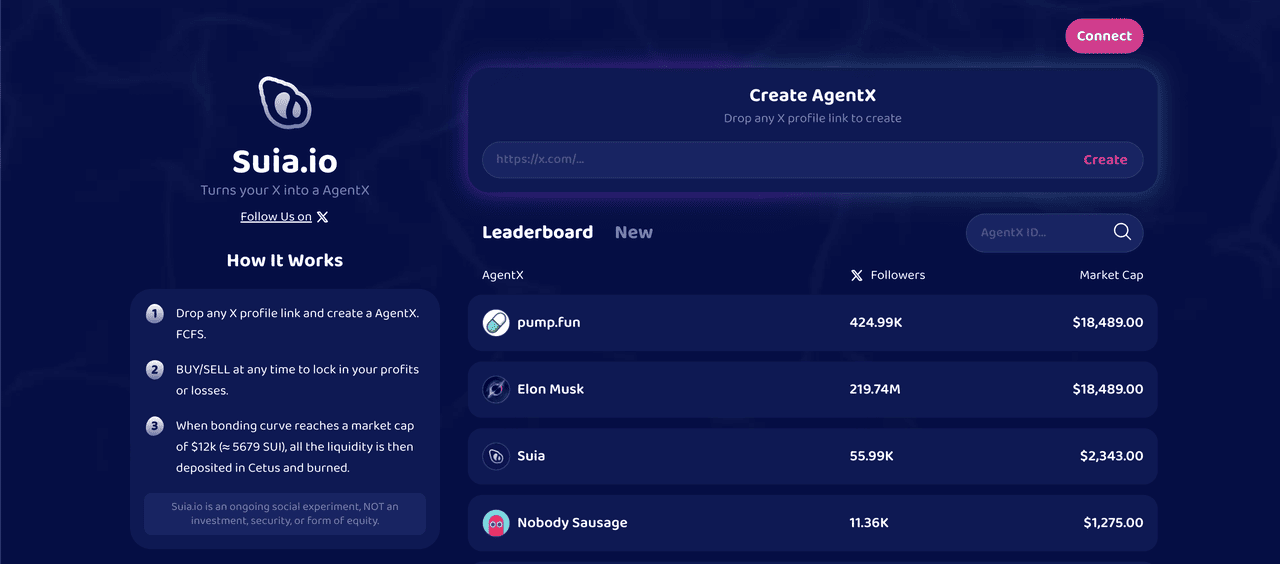

SUIA (SUIA)

Source: Suia.io

SUIA is the native governance and utility token of Suia.io, a

SocialFi DApp on the Sui Network that won Sui Foundation’s Builder Heroes award and MoveCTF and Demo Day championships. Backed by Sui Foundation, HashKey, SevenX, EVG, BingX, and Y2Z, Suia has connected over 80 projects in APAC and even launched an NFT coffee exchange with the Foundation.

Holders stake SUIA to participate in

DAO voting on grant allocations, developer bounties, and ecosystem incentives. A 2% fee on each transaction, 1% burned to reduce supply and 1% rewarded to Social Coin creators, powers a deflationary model and funds ongoing community rewards based strictly on usage and participation.

The SUIA token also implements a deflationary model: a 2% fee on transactions, 1% burns SUIA, and 1% rewards project creators, helps sustain long-term value. With a fixed supply of 100 million tokens and a fully diluted valuation of roughly $2.3 million, SUIA aligns community contributions with token economics to drive sustainable development in the Sui ecosystem.

How to Trade Sui Ecosystem Tokens on BingX

Trading Sui ecosystem tokens on BingX gives you access to deep liquidity, low fees, and a user-friendly interface. You can start trading Sui tokens with as little as $10 and leverage AI-powered tools for flexible spot, convert, and launchpad options, all in one place.

1. Create and Fund Your Account: Sign up on BingX and complete identity verification. Deposit assets via credit/debit card, P2P transfers, or crypto wallet. You can fund with

USDT, SUI, or other major tokens.

2. Spot Trading: Navigate to

Trade → Spot on BingX’s main menu. Search for your Sui-ecosystem pair, such as

DEEP/USDT or

HAEDAL/USDT.

Choose a Market Order for instant execution at current prices or a Limit Order to buy or sell at your target price. Enter the amount and confirm to place your order.

3. Launchpad for New Listings: Check Launchpad for early access sales of emerging Sui projects. You can stake designated tokens to participate in pre-sale rounds and claim allocations of new tokens like HAEDAL or SUIA.

Key Considerations When Investing in Sui Ecosystem Crypto Projects

Before you invest in Sui ecosystem tokens, take time to evaluate each project’s fundamentals and risks. A thorough review helps you make informed decisions in this fast-growing blockchain environment.

1. Project Maturity & Security: Prioritize battle-tested protocols with a proven track record and third-party audits. Check on-chain age, total transactions (nearly 10 billion on Sui mainnet), and audit reports from firms like CertiK or PeckShield.

2. Token Utility & Economics: Focus on tokens with clear, multipurpose use cases, such as DEEP for governance and fee rebates, or HAEDAL for liquid-staking rewards, to improve resilience during market stress.

3. Ecosystem Growth & Developer Support: Look for projects backed by active developer communities and frequent updates. Sui’s Move language and parallel-transaction model have already driven over 54 live DeFi protocols.

4. Liquidity & Trading Volume: Ensure high 24-hour volume and deep order books to minimize slippage. Verify liquidity metrics on BingX or CoinMarketCap before entering large positions.

5. Regulatory & Market Risks: Stay informed on local crypto regulations and prepare for volatility, especially when trading meme coins. Diversify across multiple projects, use stop-loss orders, and invest only what you can afford to lose.

Conclusion

The Sui ecosystem in 2025 offers fast, scalable projects—from order-book DEXs like DeepBook to liquid staking with Haedal and DAO funding via SUIA. Each token brings unique utility and growth potential. However, the crypto market remains volatile. Always do your own research, check on-chain metrics and audits, and manage your risk carefully before investing.

Related Reading

Sui DeFi TVL | Source: DefiLlama

Sui DeFi TVL | Source: DefiLlama SUI/USDT price chart | Source: BingX

SUI/USDT price chart | Source: BingX DeepBook has a TVL of nearly $500 million as of April 2025 | Source: DefiLlama

DeepBook has a TVL of nearly $500 million as of April 2025 | Source: DefiLlama Haedel's TVL is over $195 million as of April 2025 | Source: DefiLlama

Haedel's TVL is over $195 million as of April 2025 | Source: DefiLlama Cetus Protocol's TVL exceeds $200 million as of April 2025 | Source: DefiLlama

Cetus Protocol's TVL exceeds $200 million as of April 2025 | Source: DefiLlama Source: Walrus

Source: Walrus Source: Suia.io

Source: Suia.io