Tokenized stocks are fundamentally transforming how investors access global equity markets, especially in the rapidly expanding digital asset landscape. These blockchain-based representations of publicly traded shares let crypto investors gain exposure to major U.S. companies like

NVIDIA,

Apple,

Circle,

Coinbase, and

Alibaba without traditional brokerage constraints. Platforms such as

Ondo Global Markets and Backed Finance are playing a central role in this shift by issuing asset-backed, compliant stock tokens that mirror real equities. By combining fractional ownership, extended trading access, near-instant settlement, and DeFi interoperability, tokenized stocks offer flexibility and global reach that conventional equity markets cannot easily match.

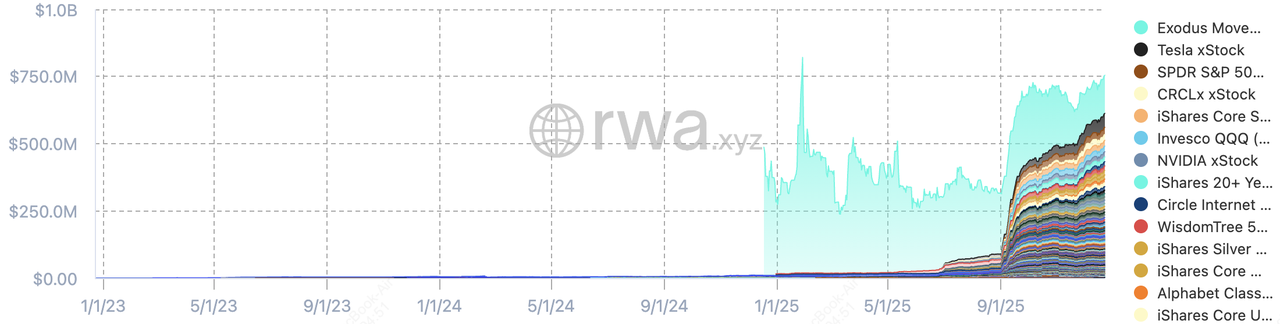

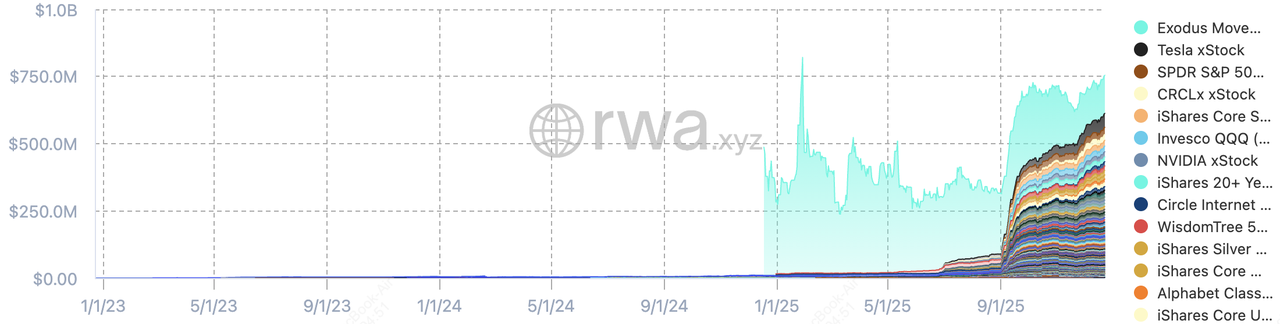

Total value of tokenized stocks | Source: RWA.xyz

Tokenized public stocks continue to see strong adoption and capital inflows, with total market value reaching approximately $755 million, up 16% month-over-month, according to RWA.xyz. Monthly

on-chain transfer volume has surged to around $2.14 billion, marking an 81% MoM increase and highlighting rising trading activity across platforms. At the same time, the number of active holders has climbed to roughly 140,100, up more than 22% MoM, signaling expanding global participation. While short-term active address counts can fluctuate with market conditions, the sustained growth in value, volume, and holders points to accelerating long-term demand for tokenized equities.

This article explores how tokenized stocks (xStocks) are reshaping equity investing in 2026, covering what they are, how they work, key platforms, top tokenized stocks to trade, and the benefits and risks for global crypto investors.

What Are Tokenized Stocks (xStocks)?

Tokenized stocks, also known as tokenized equities or tokenized shares, are blockchain-based digital tokens that represent ownership exposure to real publicly traded equities. Each token typically mirrors the price of a traditional share, enabling price tracking and tradability in digital markets.

Unlike traditional share ownership held through brokerages, tokenized stocks exist on public blockchains such as

Ethereum and

Solana, where they can be traded globally, often with minimal restrictions for eligible users.

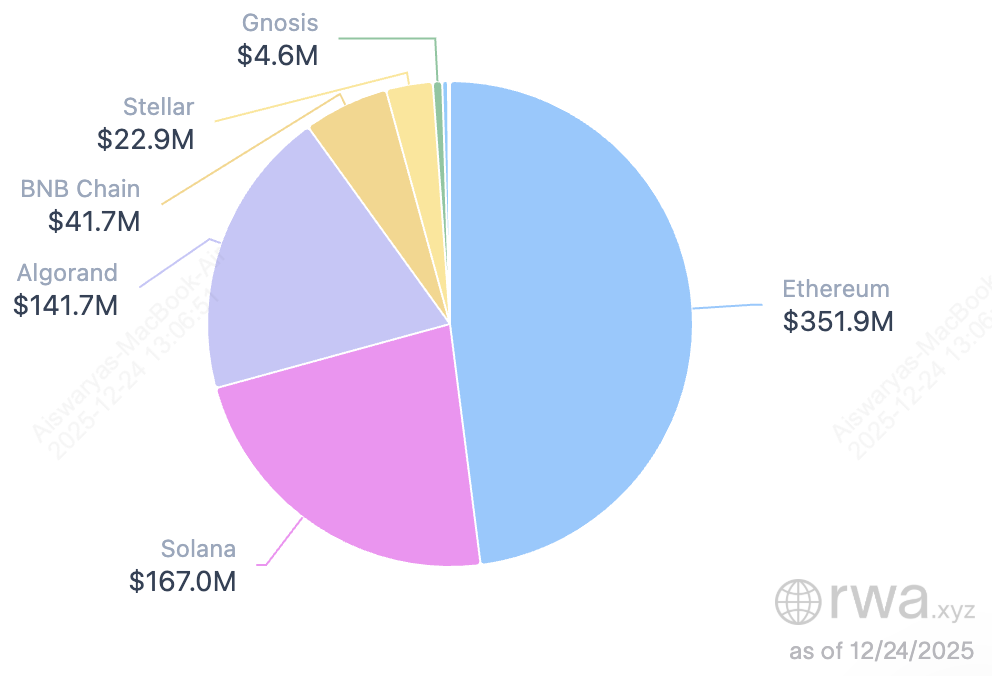

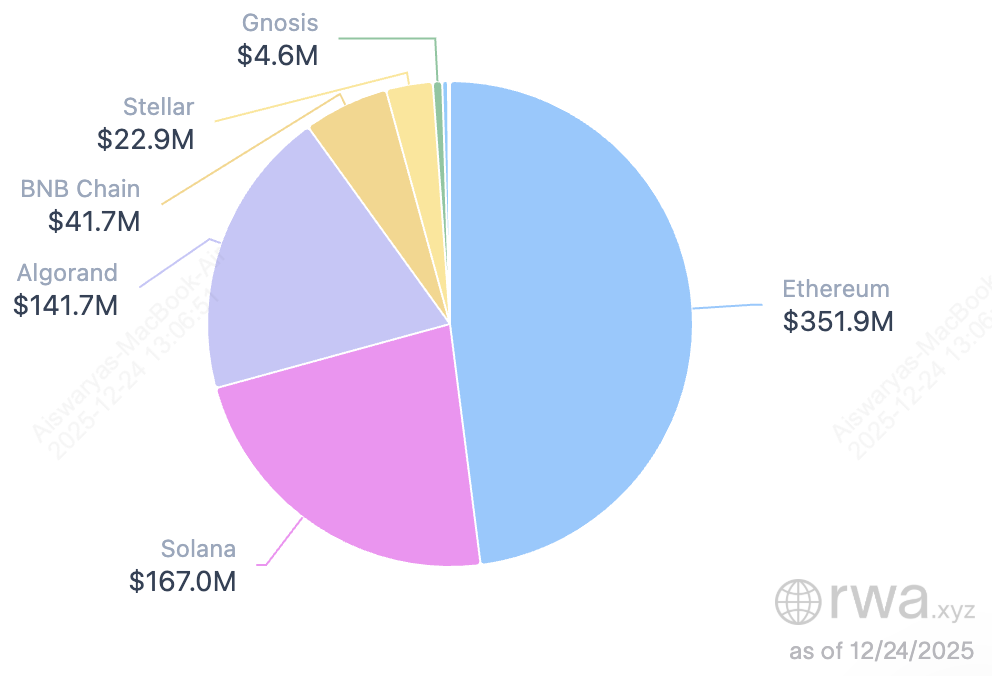

Tokenized stocks' breakdown by blockchain network | Source: RWA.xyz

Tokenized stocks have become a critical bridge between traditional equities and digital markets in 2025, driven by measurable adoption and institutional interest. According to RWA.xyz, tokenized public equities now account for about $755 million in on-chain value, led by Ethereum with $351 million, followed by Solana at $167 million,

Algorand at $141 million,

BNB Chain with $41.7 million,

Stellar at $22.9 million, and Gnosis with $4.6 million, while monthly transfer volumes exceed $2.1 billion, highlighting strong global demand for fractional, capital-efficient access to U.S. stocks without traditional brokerage barriers.Their permissionless, cross-border design enables global participation beyond legacy market infrastructure, a shift underscored by platforms like Backed Finance's xStocks, which have already processed over $10 billion in total transaction volume by December 2025.

At the same time, regulatory engagement is moving from theory to practice: Nasdaq is actively exploring tokenized trading infrastructure, and U.S. market plumbing providers such as DTCC have received no-action relief for tokenized RWAs, signaling cautious but meaningful regulatory openness. As major platforms, including BingX, expand tokenized stock offerings, competition is accelerating liquidity, product depth, and market efficiency, positioning tokenized equities as one of the most important

real-world asset (RWA) use cases in crypto for 2025 and beyond.

How Tokenized Stocks Work

Tokenized stocks are not just a niche crypto trend but are rapidly emerging as a bridge between traditional equities and decentralized markets. With robust trading volume milestones, expanding platform support, and increasing institutional interest, 2026 could be the year tokenized stocks move from early experiment to mainstream tradable assets.

1. Custodial Backing or Asset-Backed Model: A licensed custodian or regulated partner holds the underlying shares, e.g., Apple or

Tesla, in a secure account. For every physical share held, an equivalent number of tokenized shares is issued on-chain. This backing ensures token prices closely track the real stock price in traditional markets.

2. Fractional Ownership: Investors can purchase fractions of high-priced stocks, sometimes for as little as $1, lowering barriers to diversification and enabling broader participation.

3. 24/7 Global Trading: Tokenized stocks are tradable around the clock on compatible platforms and networks, providing liquidity and flexibility outside traditional exchange hours.

4. DeFi Integration: On some networks, these tokens can be used as collateral for

lending,

yield farming, or liquidity provision, unlocking advanced financial strategies within decentralized finance.

5. No Traditional Voting Rights: While economic exposure is linked to performance and dividends, token holders typically do not receive voting rights or corporate governance privileges associated with direct share ownership.

Why Trade Tokenized Stocks in 2026?

Tokenized stocks are rapidly gaining traction as a dynamic bridge between traditional equities and blockchain markets, offering distinct advantages that appeal to both retail and institutional traders. These digital equities allow you to buy and sell fractional shares of major companies like Apple, Tesla, and Nvidia using stablecoins such as

USDT or

USDC, without the need to convert into fiat currency, creating a seamless crypto-native trading experience.

Unlike conventional brokerage accounts, tokenized stock platforms often eliminate regional account requirements, broadening access for global investors where permitted. The fractional nature of these tokens enables diversified portfolios with low capital outlay, while 24/7 trading availability, far beyond traditional market hours, supports flexible strategy execution.

Additionally, some exchanges are expanding offerings to include derivatives and futures tied to tokenized equities, enhancing tactical opportunities for hedging and leveraged exposure. As tokenization infrastructure matures, with major players launching extensive xStocks services and expanding into stock and crypto hybrid markets, liquidity and ecosystem support are strengthening, underpinning the growing relevance of tokenized stocks as an innovative market alternative.

What Are the Top 10 Tokenized Stocks to Invest in 2026?

Below is a curated list of the top 10 tokenized stocks (xStocks) to trade in 2026, selected based on market demand, liquidity, global brand strength, and their growing adoption across leading tokenized equity platforms.

1. Tesla Tokenized Stock TSLAX and TSLAON

Tesla tokenized stock (TSLAX) is one of the most actively traded xStocks in the on-chain equities market, giving crypto investors round-the-clock exposure to Tesla, Inc., a global leader in electric vehicles, energy storage, and AI-driven autonomy. As of late 2025, TSLAX has grown into a sizeable on-chain asset with a total asset value of around $51.6 million, up 38% month-over-month, supported by over 20,500 holders and $134.8 million in monthly transfer volume, reflecting strong retail and trader demand. With Tesla’s equity valuation hovering around the $1 trillion mark, TSLAX allows you to track TSLA’s price movements 24/7, buy fractional exposure, and react to earnings, macro data, or EV-sector news without relying on traditional market hours.

Beyond TSLAX, Tesla exposure has also expanded through

TSLAon, the Ondo-issued tokenized version offered via Ondo Finance, which has seen even faster recent growth. TSLAon now holds ~$11.8 million in total asset value, up over 150% in 30 days, with monthly transfer volume exceeding $376 million, highlighting accelerating institutional and non-U.S. interest. Together, these Tesla xStock variants demonstrate why Tesla remains one of the most liquid and strategically important tokenized equities heading into 2026, well suited for long-term exposure, short-term trading, and portfolio diversification within a crypto-native environment.

2. NVIDIA Tokenized Stock NVDA and NVDAON

NVIDIA tokenized stock (NVDAX) gives crypto investors on-chain exposure to NVIDIA Corporation, the dominant force behind the global AI and data-center boom. By late 2025, NVIDIA had pushed past a $5 trillion market capitalization, driven by explosive demand for GPUs powering

AI models, cloud infrastructure, autonomous systems, and government supercomputing projects. This momentum is reflected on-chain as well:

NVDAX holds $17.1 million in total asset value as of December 2025, with over 14,400 holders and $41.5 million in monthly transfer volume, underscoring sustained retail and trader interest despite short-term volume fluctuations

Alongside NVDAX, demand has surged for

NVDAon, the Ondo-issued tokenized version aimed at non-U.S. users, which has seen total asset value jump over 238% month-over-month to ~$12.6 million, while monthly transfer volume exceeded $352 million, a nearly 4× increase. Together, these metrics highlight NVIDIA as one of the most actively traded and liquid tokenized equities going into 2026. For investors seeking exposure to high-growth themes such as AI, advanced computing, robotics, and data-center infrastructure, NVIDIA xStocks offer a practical way to trade NVDA’s price movements 24/7, with fractional sizing and crypto-native settlement—without relying on traditional brokerage access or market hours.

3. Apple Tokenized Stock AAPLX and AAPLON

Apple xStock (AAPLX) gives on-chain exposure to Apple Inc., one of the world’s most valuable and financially resilient Big Tech firms. As of late 2025, AAPLX tracks Apple shares trading around $271 per share, supported by Apple’s high-margin services business like App Store, iCloud, Apple Pay, and its tightly integrated hardware ecosystem. On-chain, AAPLX represents roughly $4.14 million in total asset value, held by over 9,100 wallets, with steady holder growth of ~20% month-over-month, indicating rising retail adoption despite a short-term pullback in transfer volume to $6.4 million.

In parallel,

AAPLon, the Ondo-issued tokenized version designed for non-U.S. users, has seen accelerating activity as institutional-style flows increase. AAPLon now accounts for about $3.03 million in total asset value, with nearly 1,900 holders and monthly transfer volume surging above $41.7 million, up 200% month-over-month, reflecting heavier trading and liquidity routing via traditional market rails. Together, AAPLX and AAPLon show how Apple’s blue-chip status is translating into meaningful on-chain demand in 2026, offering investors 24/7, fractional, and crypto-native access to Apple’s price movements without relying on traditional brokerage accounts.

4. Alphabet Google Tokenized Stock GOOGLX and GOOGLON

Alphabet tokenized stock (GOOGLX) provides on-chain exposure to Alphabet Inc., the parent company of Google and one of the most systemically important firms in the global digital economy. Alphabet continues to dominate core internet infrastructure across search, digital advertising, YouTube, Android, and cloud computing, while scaling long-term growth engines in artificial intelligence, data centers, and autonomous systems. As of December 2025, Alphabet’s Class A shares trade around $310, supported by a market capitalization above $3.5 trillion, and this demand is clearly reflected on-chain:

GOOGLX now represents $11.8 million in total asset value, held by over 11,000 wallets, with $35.6 million in monthly transfer volume, signaling broad retail and crypto-native participation despite modest short-term volume cooling.

At the same time, institutional-style flows are accelerating through

GOOGLon, the Ondo-issued tokenized version aimed at non-U.S. investors. GOOGLon has expanded to $13.8 million in total asset value, up over 210% month-over-month, while monthly transfer volume surged past $133 million, a 4× increase, despite a smaller holder base of just over 1,000 wallets. Together, these metrics position Alphabet as one of the most liquid and strategically important tokenized equities heading into 2026, offering investors 24/7, fractional, and borderless access to Google’s growth across AI, cloud, and digital services, without relying on traditional brokerage accounts or market hours.

5. Ondo Tokenized Invesco QQQ ETF QQQON

Invesco QQQ tokenized ETF (QQQon) gives on-chain exposure to the Invesco QQQ Trust, one of the most widely followed and actively traded ETFs globally. QQQ tracks the Nasdaq-100 Index, offering diversified exposure to leading technology and innovation-driven companies such as Apple, Microsoft, NVIDIA,

Amazon, Alphabet, and Meta, making it a core proxy for the AI, cloud computing, and semiconductor megatrends shaping markets into 2026. As of December 2025,

QQQon has grown to $20.9 million in total asset value, with its net asset value around $619, reflecting continued strength in U.S. large-cap tech equities.

On-chain activity also highlights rising adoption. QQQon now has over 820 holders, up more than 56% month-over-month, while monthly transfer volume exceeds $48.5 million, a 44% increase, indicating both growing participation and active trading. For non-U.S. retail and institutional investors, QQQon offers a practical way to access Nasdaq-100 performance 24/5, with fractional sizing,

stablecoin settlement, and the ability to move exposure on-chain without a traditional brokerage account. This makes tokenized QQQ particularly attractive for investors seeking broad tech diversification rather than single-stock risk, while staying fully within a crypto-native trading environment.

6. Ondo Palantir Tokenized Stock PLTRON

Palantir Technologies tokenized stock (PLTRon) gives on-chain exposure to Palantir Technologies, a key player in enterprise and government AI, data analytics, and operational decision software. Palantir has become one of the most closely watched AI stocks after its shares surged over 165% in 2025, driven by accelerating adoption of its AI Platform (AIP), expanding U.S. defense and government contracts, and deeper enterprise penetration. This momentum is clearly visible on-chain:

PLTRon now holds ~$1.04 million in total asset value, up 91% month-over-month, with monthly transfer volume jumping more than 700% to $4.8 million, signaling rapidly rising trader and investor interest.

PLTRon is issued by

Ondo Global Markets and provides 1:1 economic exposure to Palantir stock without shareholder rights, making it suitable for price exposure rather than governance participation. The token trades 24/7 using USDT settlement and is available to non-U.S. investors on platforms such as BingX, offering a crypto-native alternative to traditional brokerage access. With Palantir strengthening its strategic partnership with NVIDIA in late 2025 and positioning itself as a core software layer for large-scale AI deployment, PLTRon stands out as a high-growth, higher-volatility tokenized equity heading into 2026, well suited for investors seeking targeted exposure to the operational AI narrative within the tokenized stocks market.

7. Ondo Microsoft Tokenized Stock MSFTON

Microsoft tokenized stock (MSFTon) gives on-chain exposure to Microsoft Corporation, one of the world’s most valuable and strategically important technology firms, spanning cloud computing, AI infrastructure, enterprise software, and gaming. As of December 2025,

MSFTon trades around a net asset value of $485, reflecting Microsoft’s continued strength in Azure cloud growth and its deep integration of AI across products like Copilot, Office, and enterprise platforms. On-chain adoption is accelerating: total asset value stands at $2.58 million, while the number of holders has climbed over 61% month-over-month to 266, signaling growing global interest among non-U.S. Investors.

Trading activity highlights MSFTon’s rising relevance within the tokenized equities market. Monthly transfer volume has surged to nearly $42.9 million, up an exceptional 1,300%+ in 30 days, indicating heavier use for active trading, portfolio rebalancing, and institutional-style flows. Issued by Ondo Global Markets, MSFTon provides 1:1 economic exposure with reinvested dividends, trades 24/5 using USDT settlement, and removes the need for a traditional brokerage account. Heading into 2026, Microsoft’s combination of blue-chip stability and AI-driven growth makes MSFTon a core tokenized equity holding for investors seeking lower volatility than pure-play AI stocks, while still benefiting from the expanding on-chain RWA ecosystem.

Buy Microsoft Tokenized Stock (Ondo)(MSFTON) https://bingx.com/en/spot/MSFTONUSDT

8. Meta Platforms Tokenized Stock METAON and METAX

Meta tokenized stock (METAX / METAon) gives on-chain exposure to Meta Platforms, Inc., one of the world’s largest digital platforms spanning social media, AI-driven advertising, messaging, and immersive technologies. Meta continues to generate strong cash flows from Facebook, Instagram, WhatsApp, and Messenger while sharpening its strategic focus on AI infrastructure, recommendation systems, and AR glasses, alongside a more disciplined approach to metaverse spending. This shift has supported renewed investor interest heading into 2026, and it shows on-chain:

METAon now represents $5.7 million in total asset value, up 89% month-over-month, with monthly transfer volume near $82 million, a sharp 8× increase, signaling heavy trading and institutional-style flows.

At the same time,

METAX, the xStock version backed 1:1 by real Meta shares, has grown to $4.2 million in total asset value with over 3,300 holders, reflecting broader retail participation despite a recent dip in transfer volume. Issued by Ondo Global Markets (METAon) and xStocks providers (METAX), these tokens allow investors to trade Meta’s price movements 24/7, buy fractional exposure, and settle in USDT, without a traditional brokerage account. Together, METAX and METAon position Meta as one of the most actively traded and liquid tokenized Big Tech equities going into 2026, appealing to investors seeking exposure to digital advertising, AI-powered content, and the next phase of immersive computing within a crypto-native portfolio.

9. Ondo Amazon Tokenized Stock AMZNON

Amazon tokenized stock (AMZNon) gives on-chain exposure to Amazon.com, Inc., one of the most systemically important companies in global e-commerce, cloud computing, logistics, advertising, and AI infrastructure. Amazon’s long-term growth continues to be anchored by AWS cloud services, retail dominance, and AI-driven optimization across logistics and advertising, making it a core Big Tech holding heading into 2026. This strength is clearly reflected on-chain:

AMZNon now holds $4.38 million in total asset value, up 46% month-over-month, with over 600 holders and a monthly transfer volume exceeding $129 million, representing an explosive 1,650%+ increase in trading activity.

Issued by Ondo Global Markets, AMZNon provides 1:1 economic exposure to Amazon stock with dividends reinvested into the token’s value, while removing the need for a traditional brokerage account. The token trades 24/5 using USDT settlement and benefits from direct routing to traditional equity liquidity, helping keep prices closely aligned with AMZN shares. Going into 2026, Amazon’s combination of scale, cash-flow durability, and AI-driven growth makes AMZNon one of the most actively traded and liquid tokenized equities, well suited for investors seeking blue-chip exposure within a crypto-native portfolio.

10. Robinhood Tokenized Stock HOODX and HOODON

Robinhood tokenized stock (HOODX / HOODon) provides on-chain exposure to Robinhood Markets, Inc., a crypto-aligned fintech that has repositioned itself as a hybrid trading platform spanning equities, options, crypto, prediction markets, and tokenized assets. After a strong 200%+ rally in 2025, Robinhood entered 2026 with elevated visibility following its S&P 500 inclusion and growing revenues tied to retail trading activity and crypto market cycles. This momentum is reflected on-chain:

HOODX now holds $4.2 million in total asset value, up 63% month-over-month, with nearly 2,000 holders, while

HOODon, Ondo’s institutional-style version, has seen monthly transfer volume surge over 1,250% to $11.8 million, signaling rising trader and allocator interest.

Issued under both the xStocks framework (HOODX) and Ondo Global Markets (HOODon), these tokenized equities track HOOD’s market price while enabling USDT-based trading, fractional sizing, and 24/7 access without a traditional brokerage account. Neither token grants voting rights or dividends, making them best suited for investors focused on price exposure rather than ownership. Going into 2026, Robinhood’s role at the intersection of TradFi and crypto, combined with its own push into tokenized assets, makes HOODX and HOODon a thematic tokenized stock, appealing to traders betting on the continued convergence of equity markets and blockchain infrastructure.

How to Trade Tokenized Stocks on BingX

BingX combines tokenized equities with

BingX AI–powered tools to help you identify trends, manage risk, and execute trades efficiently. Whether you prefer owning spot exposure or trading price movements with leverage, BingX offers two flexible ways to trade xStocks using crypto.

Buy and Sell Tokenized Stocks on the Spot Market

Spot trading is ideal if you want direct price exposure to tokenized stocks without leverage.

1. Log in to your BingX account and fund it with USDT.

3. Use BingX AI indicators and charts to analyze price trends and liquidity.

4. Place a Market order for instant execution or a Limit order at your preferred price.

5. Hold the xStock for long-term exposure or sell anytime; spot markets allow straightforward buy-and-hold strategies.

Long or Short Tokenized Stocks on the Futures Market

Futures trading suits active traders who want leverage, hedging, or short-selling flexibility.

1. Transfer USDT to your

Futures Wallet on BingX.

2. Open Perpetual Futures and select the tokenized stock contract, where available.

3. Choose Cross or Isolated margin and set your leverage based on risk tolerance.

4. Use BingX AI insights,

funding rates, and order book depth to time entries.

Tip: Futures amplify gains and losses. Use conservative leverage and always apply TP/SL to protect capital.

Final Thoughts: Should You Trade Tokenized Stocks?

Tokenized stocks (xStocks) are emerging as a practical bridge between crypto markets and traditional equities, giving you on-chain, fractional, and near-24/7 access to globally recognized companies such as Tesla, Apple, NVIDIA, and major index products like QQQ, without opening a conventional brokerage account. For active traders, xStocks also unlock new strategies through spot and futures markets, enabling hedging, short-term speculation, and portfolio diversification using stablecoins within a crypto-native environment.

That said, tokenized stocks are not the same as owning traditional shares. They typically do not provide voting rights, and access may vary by jurisdiction as regulatory frameworks continue to evolve. Liquidity can be thinner for some tokens, increasing volatility and slippage, while futures trading introduces leverage risk that can amplify losses. Before trading xStocks, assess your risk tolerance, understand the product structure, and avoid overexposure. Used responsibly, tokenized equities can be a powerful addition to a modern trading strategy, but they should complement, not replace, sound risk management and independent research.

Related Reading