A

crypto bull market is characterized by consistent price surges driven by strong investor confidence and favorable market dynamics. These trends, which can last weeks or months, create significant opportunities for traders. However, volatility,

fear of missing out (FOMO), and sudden market corrections can disrupt even the best plans.

To be successful you need a strategy that incorporates proven methods like HODLing, momentum trading, dollar-cost averaging (

DCA) and sound risk management. This guide will show you how to capture gains while managing risk during a crypto bull run.

What Is a Crypto Bull Market?

A crypto bull market is a period of sustained price increases, rising investor confidence and high trading volume. These rallies often follow good news, institutional adoption or macroeconomic tailwinds and can last weeks or even months. The upside is significant, but so is volatility, so be prepared.

This guide will show you how to navigate a bull run. If you're new to the concept, read our beginner's guide,

10 Key Indicators to Signal a Crypto Bull Run, for deeper insight into market cycles and early signals of bullish momentum.

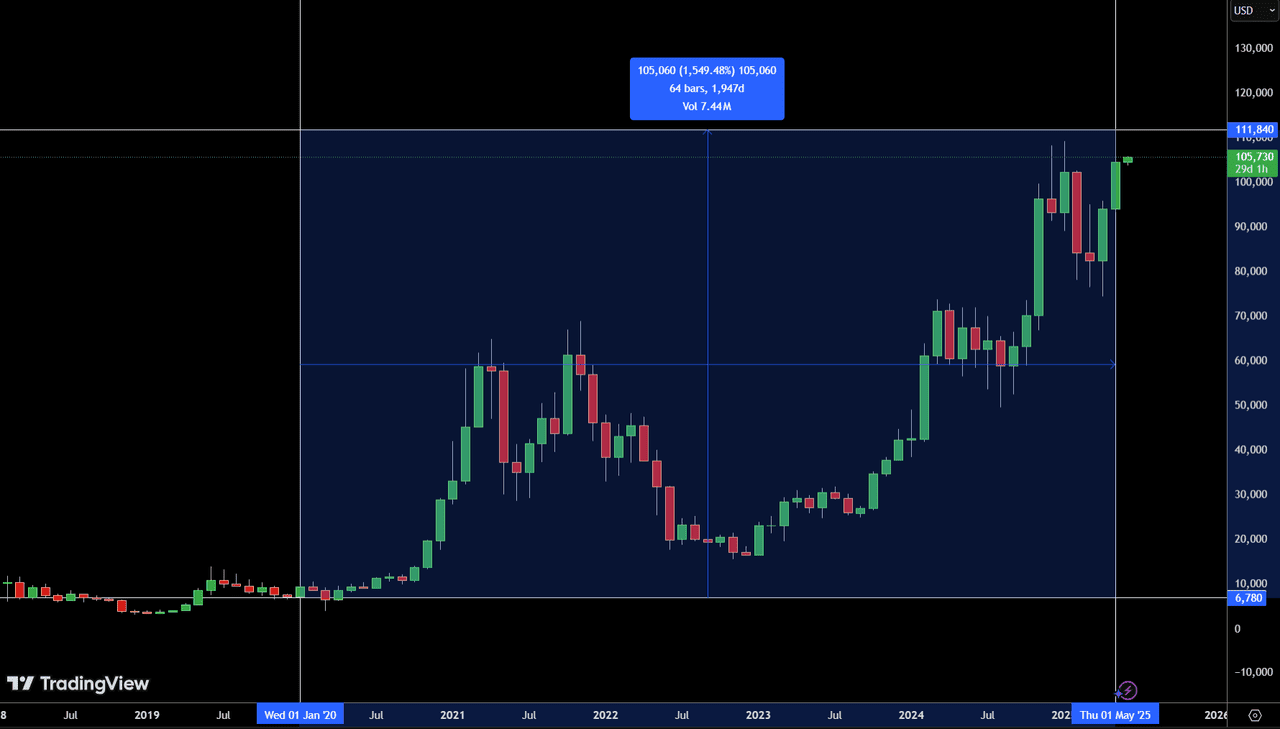

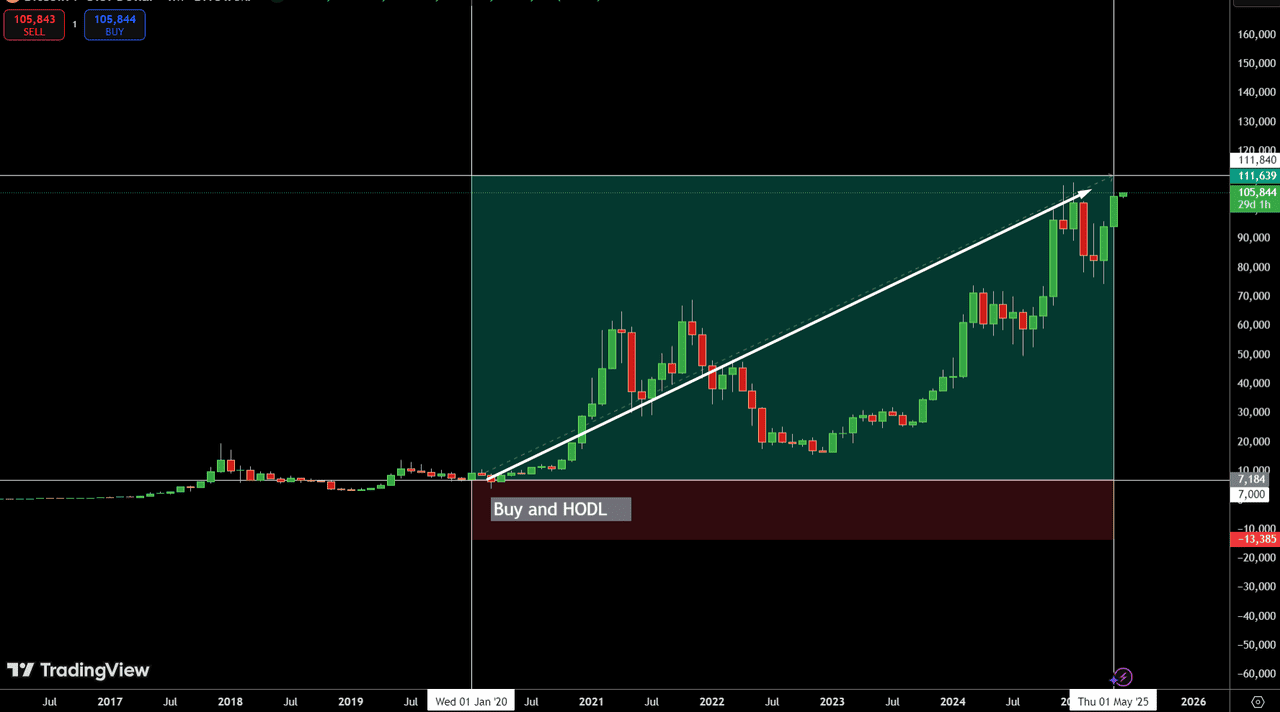

1. Buy and Hold (HODL) Strategy

The Origins of HODL

The world of cryptocurrency trading is full of unique terminology, but few are as iconic as “

HODL.” This term originated in December 2013 when a Bitcoin forum user posted a message titled “I AM HODLING,” a typo of “hold” that quickly became legendary. The phrase now encapsulates a philosophy of holding onto cryptocurrency investments for the long term, regardless of market fluctuations.

Why Buy and Hold HODL Bitcoin

HODLing is about riding out the volatility of crypto markets in anticipation of long-term gains. Instead of reacting to daily price swings, HODLers maintain their positions through both bull and bear markets, trusting the asset's long-term potential.

For instance, between January 2020 and May 2025, Bitcoin’s price surged from around $6,780 to over $111,800, delivering an astonishing 1,549% gain. Investors who maintained their positions through corrections and rallies were handsomely rewarded.

Key benefits of HODLing include:

• Simplicity: Requires minimal active management compared to frequent trading.

• Potential for long-term growth: Major coins like BTC and ETH have historically delivered strong returns.

• Lower transaction costs: Fewer trades mean reduced fees.

What Are the Risks of HODLing Cryptocurrency?

But HODLing isn’t risk free. The crypto market is volatile and will test even the most seasoned investors. 20% price swings in a day are common, and sudden corrections can cause panic selling.

Risks to consider:

Sudden price drops can cause emotional decisions, regulatory changes or security breaches can impact long term holdings. Long bear markets can temporarily erode gains and test your patience.

Best HODLing Strategy for Your Crypto

For a HODL strategy to be effective, it’s essential to focus on assets with strong fundamentals and large market capitalizations. Bitcoin (BTC) and Ethereum (ETH) remain top choices due to their resilience and widespread adoption. Setting clear exit plans, such as specific price targets or rebalancing thresholds, can help avoid knee-jerk decisions during market turbulence.

• Focus on major coins like BTC and ETH.

• Set predefined exit points to lock in gains.

• Stay informed about industry news and regulatory updates.

Imagine buying 1 BTC at $6,780 in January 2020. By May 2025, your investment could have grown to over $111,800, representing a staggering 1,549% return. This underscores the power of patience and the importance of trusting the broader upward trend, even in the face of market volatility.

In summary, HODLing aligns with long-term wealth building, embracing market fluctuations while maintaining a focus on growth potential.

2. Momentum Trading in Cryptocurrencies

What Is Momentum Trading?

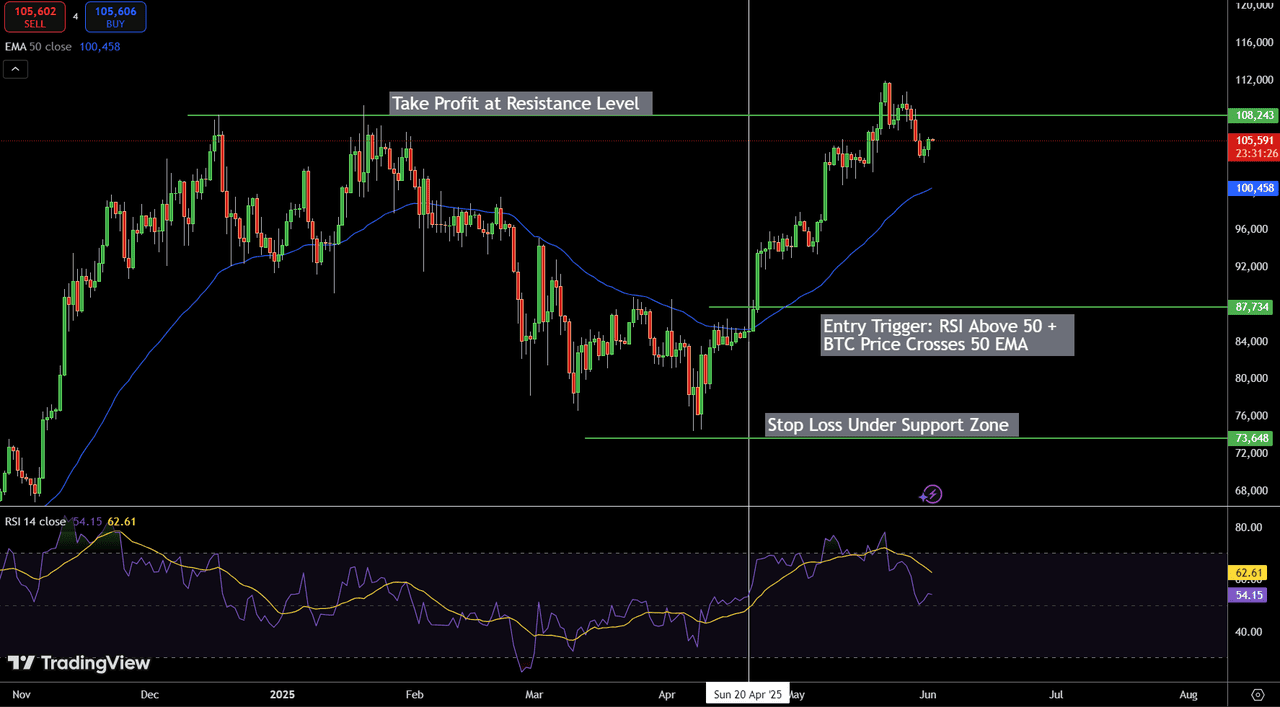

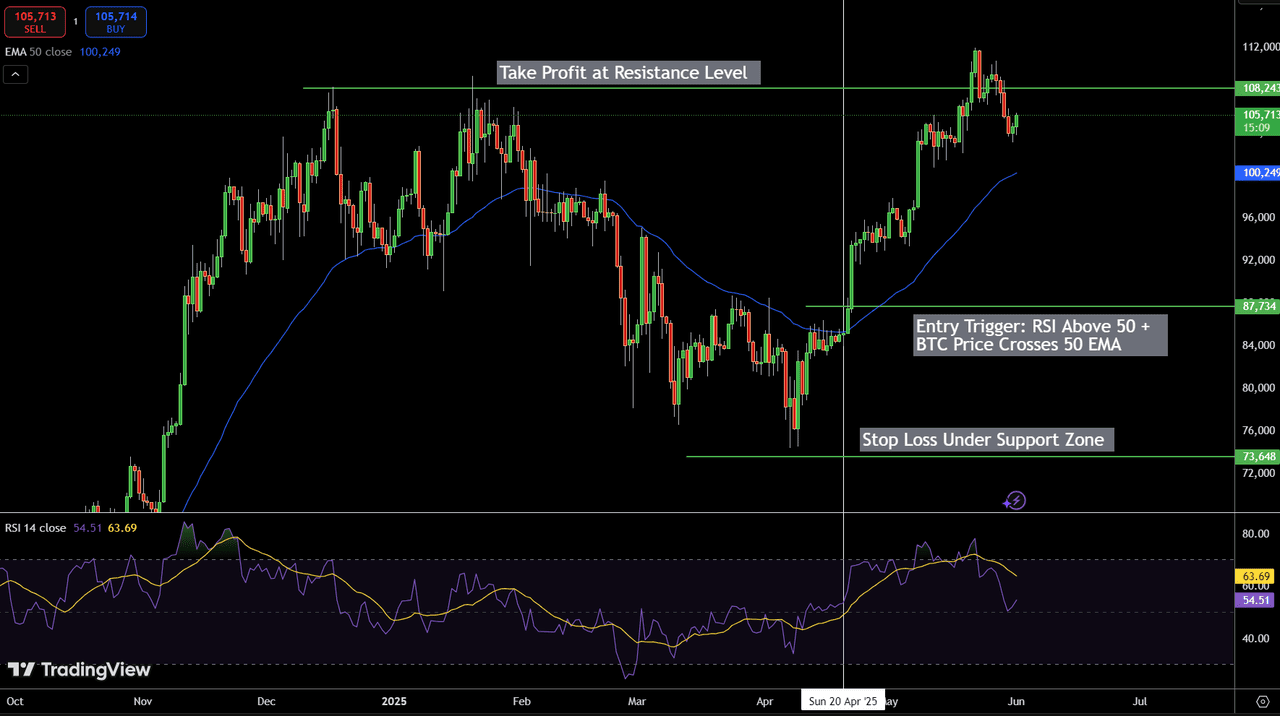

Momentum trading focuses on capturing short-term price movements by identifying and confirming market trends. In cryptocurrency, where price changes occur frequently, traders employ this approach to enter and exit trades based on technical indicators such as the 50-period Exponential Moving Average (EMA), the Relative Strength Index (RSI), and Bollinger Bands.

A Brief History of Momentum Trading

This strategy has been applied across markets for decades. Richard Driehaus (1942–2021) highlighted how following price trends can produce returns, emphasizing clear signals over speculation. Crypto’s continuous trading and rapid shifts make it a suitable environment for momentum-based strategies.

Key Technical Indicators for Momentum Trading

Momentum traders rely on several key tools to spot opportunities:

• 50-period Exponential Moving Average (EMA): A smoothed average that highlights trend direction. A price crossing above this level often signals upward momentum.

• Relative Strength Index (RSI): Measures the speed of price movements on a scale of 0 to 100. Readings above 50 indicate buying strength.

•

Bollinger Bands: Expand and contract in response to price volatility. A sharp breakout from the bands can signal a shift in momentum.

Why Use Momentum Trading?

This strategy enables traders to capitalize on rapid price movements, particularly in volatile markets such as cryptocurrency. However, it requires constant monitoring and quick decision-making, as reversals can happen suddenly.

Risk management is critical: Traders should define entry points using clear signals, such as a price crossing above the EMA and an RSI reading above 50, while placing stop-loss orders below key support levels to limit potential losses. Profits should be taken near resistance levels to lock in gains and minimize the risk of reversals.

In the chart, Bitcoin’s price crossed above the 50 EMA at $87,734 with an RSI of 54, indicating upward momentum. A take-profit at $108,243 and stop-loss at $73,648 created a controlled approach, offering a potential 23% gain.

Summary: Momentum trading involves using clear technical signals and a disciplined plan to respond to market movements. This approach helps traders navigate price shifts effectively while managing risks.

3. Dollar-Cost averaging (DCA)

What Is DCA?

Dollar-cost averaging (DCA) is a strategy where investors buy a fixed amount of cryptocurrency at regular intervals, regardless of its current price. Instead of investing a large sum all at once, DCA spreads out purchases over time.

Benefits of DCA

This approach helps reduce the impact of market volatility, as investors avoid buying at high prices altogether. By consistently investing over weeks or months, the average purchase price becomes smoother, especially in a market with sharp fluctuations, such as crypto. DCA also encourages discipline and avoids

emotional trading decisions.

Risks of DCA

DCA may result in slower gains compared to a lump-sum investment, particularly in a strong bull market where prices rise rapidly.

Best Practices for DCA

Best practices for dollar-cost averaging include automating your purchases through crypto exchanges or investment apps to maintain consistency, regularly reviewing your portfolio to ensure it aligns with your financial goals, and focusing on high-quality assets like Bitcoin or Ethereum that have demonstrated greater long-term potential.Additional best practices would include:

• Setting a fixed schedule (weekly, biweekly, or monthly) for your investments to avoid timing the market

• Maintaining discipline in your investment approach regardless of market conditions or price fluctuations Diversifying your investments across different cryptocurrencies for a balanced portfolio

Example of DCA

For example, imagine you invest $100 into Bitcoin every month for a year. In the first month, with Bitcoin priced at $20,000, you purchase 0.005 BTC. Next month, the price drops to $15,000, allowing you to buy 0.0067 BTC. In the third month, the price rises to $25,000, and you acquire 0.004 BTC.

Over the years, you invest a total of $1,200, gradually accumulating more Bitcoin when prices are lower. This steady approach lowers your average cost per BTC compared to investing the full amount at a single high point, making your investment less sensitive to market volatility and helping avoid emotionally timed purchases.

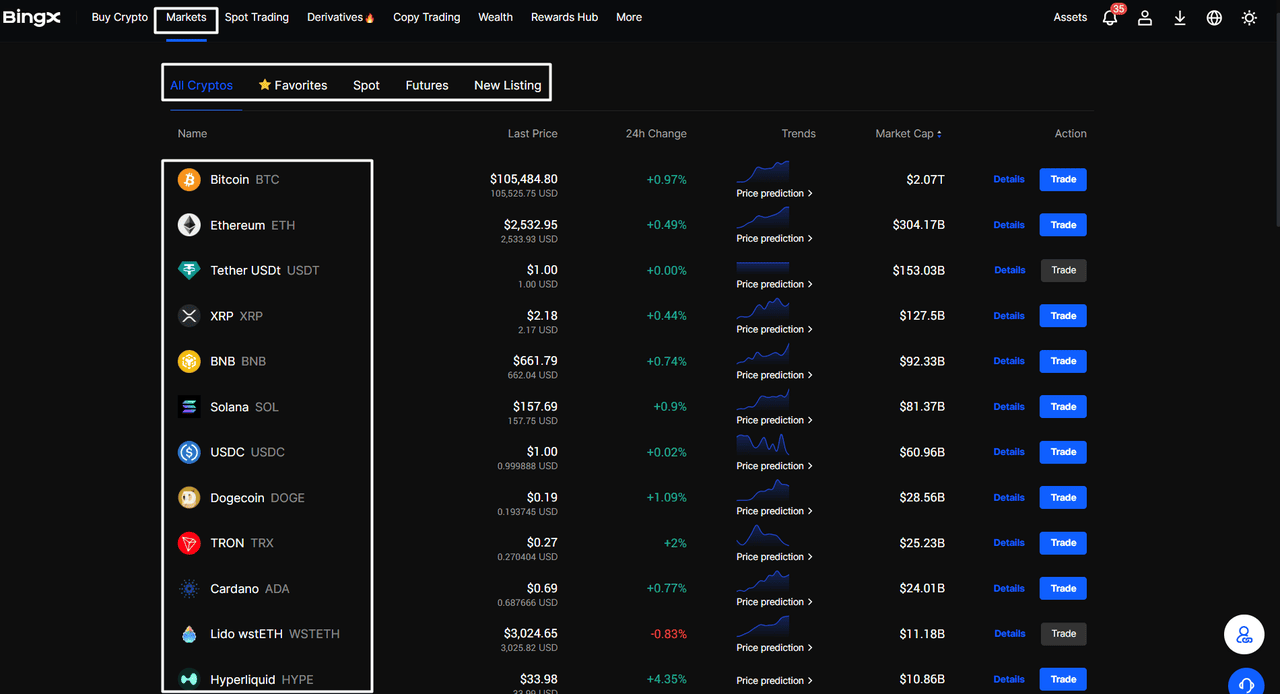

4. Portfolio Diversification

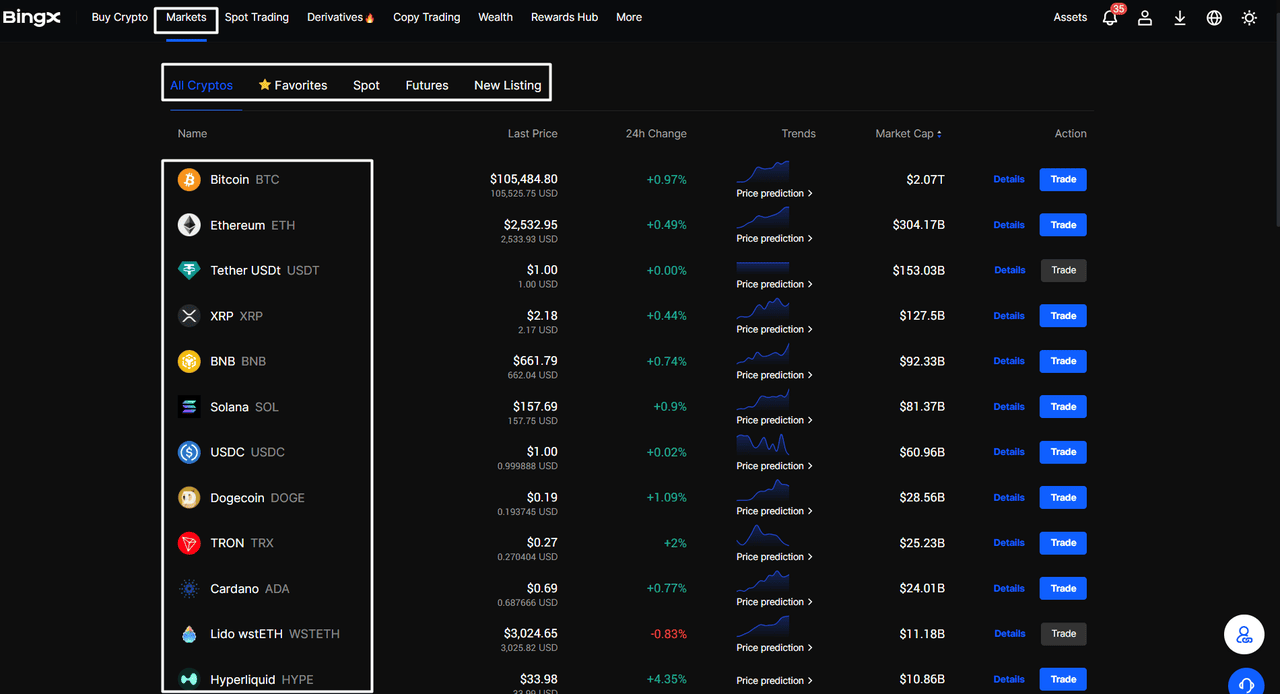

Diversification spreads investments across various digital

assets and strategies to manage risk and improve returns. In crypto markets, known for volatility, diversification helps balance potential gains with the risk of sharp price movements.

BingX offers a wide range of crypto assets, making it easy to diversify. Allocating funds across different coins and sectors can limit the impact of a single asset’s performance on the overall portfolio.

Source: BingX Market Page

Key Benefits: Why Diversify Your Crypto Portfolio?

• Risk Mitigation: Balancing Bitcoin with stablecoins or alternative cryptocurrencies (altcoins) helps smooth out volatility.

• Growth Exposure: Investing in sectors such as DeFi, Layer 2 solutions, and Web3 projects enables participation in multiple growth areas.

• Flexibility: BingX’s platform enables adjustments as new opportunities arise.

Risks and Challenges of Portfolio Diversification

Over-diversification can dilute returns and complicate portfolio management. Some assets require thorough research to understand their unique risks and potential.

Best Practices for Effective Diversification

• Balanced Allocation: Include large-cap coins, such as Bitcoin and Ethereum, complemented by mid-cap tokens and select high-risk, emerging assets.

• Periodic Rebalancing: Regularly review and adjust allocations to ensure they align with goals and effectively manage market shifts.

• Stay Informed: Use BingX’s resources to track performance, trends, and potential opportunities.

Diversification on BingX goes beyond protection. It’s a proactive strategy to enhance portfolio resilience and exposure to evolving market trends.

5. Utilizing Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are key tools in crypto trading. A stop-loss triggers an automatic sale if the price drops to a specific level, limiting potential losses. A take-profit does the opposite, selling when the price hits a target to secure gains.

These orders enable traders to manage their positions without requiring constant oversight. Instead of reacting to sudden price swings, traders set clear levels based on analysis and let the system handle execution.

However, there’s a trade-off. A stop-loss set too close to the current price may trigger minor dips, resulting in missed gains. A take-profit level set too low could cut off potential profits if the asset continues to climb.

For effective use, place stop-losses just below key support levels to protect against sharp declines, and set take-profit targets near logical resistance areas or at realistic gain levels. It's also important to review and adjust these levels regularly as market conditions change.

For example, Bitcoin’s price crossed above the 50-day EMA at $87,734, with the RSI above 50, signaling a bullish entry. A stop-loss was placed just below the support level at $73,648, minimizing downside risk. The take-profit was set at $108,243, near a resistance point, to lock in gains as price momentum continued.

This approach strikes a balance between potential profits and downside protection.

6. Staying Informed and Monitoring Market Trends

Staying updated with market developments is crucial for successful crypto trading. Prices move quickly, often in response to news, global events, or shifts in investor sentiment. Traders who stay informed can spot opportunities and manage risks more effectively.

Reliable sources, such as BingX and CoinMarketCap, provide real-time price updates and offer valuable insights into market movements. Additionally, community forums and social media platforms provide early signals of sentiment changes and potential catalysts.

Best practices include:

• Subscribing to market news through apps, websites, or newsletters.

• Joining online communities to engage with discussions and gauge broader sentiment.

• Tracking key indicators and trading volumes on platforms like BingX.

For example, a sudden increase in trading volume or a major regulatory announcement can significantly alter market trends. Being proactive about monitoring these changes helps traders stay ahead and make informed decisions.

7. Managing Emotions and Avoiding Impulsive Decisions

Trading isn’t just about numbers and charts; it’s a constant battle between logic and emotion. In crypto trading, where markets move quickly, emotions such as

fear, greed, and frustration can easily derail even the best trading plans.

Understanding the Impact of Emotional Trading

Fear often pushes traders to close positions too early or hold onto losses, hoping the market will turn. Greed tempts them to overtrade or ignore warning signs in pursuit of more gains. Both can lead to decisions that don’t align with a well-thought-out strategy.

For instance, imagine entering a trade on BingX at $87,734, with a stop-loss at $73,648 and a take-profit at $108,243. Without emotional control, a sharp market move might trigger panic, causing you to exit too early, or greed might prompt you to move your targets, risking larger losses.

How to Stay Disciplined and Prevent FOMO as a Trader

• Plan Ahead: Define clear entry, exit, and stop-loss levels before placing a trade.

• Stick to the Plan: Once your trade is live, trust your strategy and refrain from adjusting it based on short-term market fluctuations.

• Practice Patience: Resist the urge to check charts constantly. Instead, use BingX’s tools to monitor trends without overreacting.

• Learn from Experience: Accept that losses happen. Review trades, adjust plans, and improve discipline over time.

Trading success isn’t just about strategy; it’s about mastering your mindset. On BingX, cultivating strong habits of emotional control can help you navigate market fluctuations and make informed, data-driven decisions.

Conclusion

A crypto bull market presents opportunities for substantial profits, but success ultimately depends on a well-defined strategy, discipline, and emotional control. By combining approaches such as HODLing, momentum trading, dollar-cost averaging, and portfolio diversification, traders can maximize gains while effectively managing risks. Effective use of tools like stop-loss and take-profit orders further supports consistency.

Staying informed, monitoring trends, and maintaining a clear trading plan are essential for navigating crypto’s volatility. On BingX, a balanced approach that combines technical analysis and psychological discipline can position you to make informed, confident decisions in fast-moving markets.

Related Reading

Frequently Asked Questions (FAQ)

1. What is a crypto bull market?

A crypto bull market is a period of sustained price increases across cryptocurrencies, driven by strong investor confidence and favorable market conditions. These upward trends create opportunities for traders but also come with risks, such as market corrections and increased volatility.

2. Why is strategic planning essential during a bull market?

While price surges can present lucrative opportunities, the crypto market remains volatile. Without a clear plan, traders may fall prey to impulsive decisions, such as FOMO buying or panic selling. Combining strategies like HODLing, momentum trading, and dollar-cost averaging (DCA) helps manage risk and maintain discipline.

3. What does HODL mean?

HODL (Hold On for Dear Life) originated from a 2013 typo and has become a popular crypto strategy. It involves holding onto assets through market fluctuations, focusing on long-term potential rather than reacting to short-term volatility.

4. How does momentum trading work?

Momentum trading involves entering and exiting positions based on technical indicators that signal strong price trends. It relies on tools like the 50-period EMA, RSI, and Bollinger Bands to identify opportunities for short-term gains.

5. Why is portfolio diversification important?

Diversification spreads investments across different cryptocurrencies and sectors to balance potential gains with risk. It helps protect against sharp drops in individual assets and allows participation in multiple growth areas.

6. How do stop-loss and take-profit orders help manage risk?

Stop-loss orders limit potential losses by triggering a sale at a predefined price, while take-profit orders secure gains when a target is reached. These tools automate decisions, helping traders manage risk and avoid emotional reactions.

7. How can traders manage emotions during volatile markets?

Emotions like fear and greed can lead to impulsive decisions. Setting clear trading plans, trusting those plans during periods of volatility, and utilizing tools like BingX’s monitoring features can help traders maintain discipline.

8. Is BingX suitable for implementing bull market trading strategies?

Yes. BingX offers a range of trading tools, diverse assets, and resources to help traders apply strategies like HODLing, momentum trading, DCA, and diversification while managing risks effectively.

Source: BTC/USDT Trading Chart on BingX

Source: BTC/USDT Trading Chart on BingX Source: BTC/USDT Trading Chart on BingX

Source: BTC/USDT Trading Chart on BingX Source: BTC/USDT Trading Chart on BingX

Source: BTC/USDT Trading Chart on BingX Source: BingX Market Page

Source: BingX Market Page