Stablecoins are digital currencies designed to track the value of an underlying asset. USD-backed stablecoins aim to stay close to $1.00, making them useful as “crypto-native dollars” for trading, payments, and moving funds across blockchains. Other stablecoins can be pegged to different assets, such as gold or other real-world assets, so their price will move with the value of that underlying asset rather than staying near $1.

In 2026, Tether is effectively splitting its USD-stablecoin strategy into two lanes: USDT remains the global liquidity stablecoin used widely across offshore markets and crypto trading pairs, while

USAT (USA₮) is positioned as a U.S.-focused, GENIUS Act–aligned stablecoin designed for regulated rails and U.S. institutional use cases.

This guide breaks down USAT vs. USDT in plain terms, what they are, how they work, what’s the same, what’s different, and which one fits your use case.

What Are Tether's USD-Pegged Stablecoins, USAT and USDT?

Tether is the world’s largest stablecoin issuer and one of the most influential players in the digital asset economy. Best known for USDT, Tether provides on-chain dollars that power crypto trading, payments, and cross-border transfers at global scale, and also issues

Tether Gold (XAUT), a gold-backed token that tracks physical gold rather than the U.S. dollar. As of early 2026, Tether-issued tokens underpin tens of billions of dollars in daily trading volume, playing a central role in how liquidity moves across exchanges, blockchains, and regions.

In 2026, Tether operates two distinct USD-backed stablecoins with different regulatory and market objectives: USDT for global liquidity and USAT (USA₮) for U.S.-regulated rails.

What Is Tether (USDT) Stablecoin?

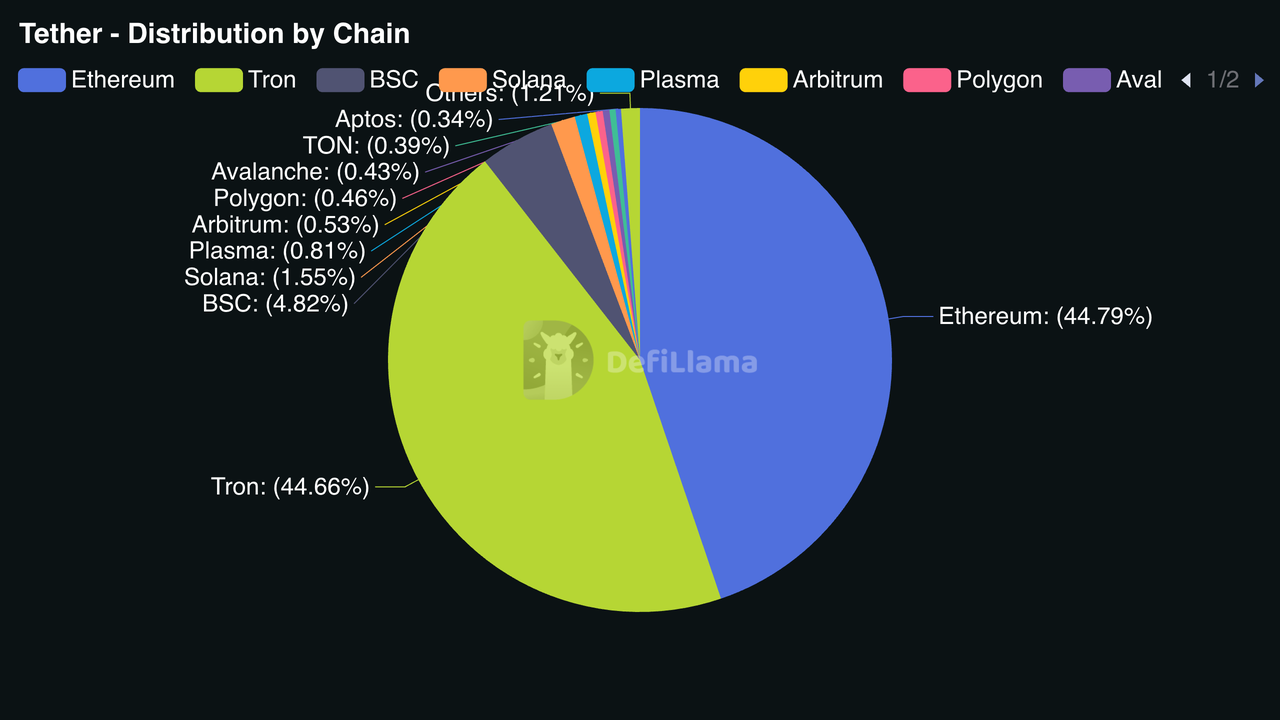

Tether market cap across leading blockchains | Source: DefiLlama

USDT is Tether’s flagship stablecoin and the most widely used “digital dollar” in crypto markets. With a market capitalization of roughly $186 billion and average daily trading volume exceeding $90 billion, USDT functions as the default settlement asset across centralized exchanges, derivatives platforms, and many DeFi markets. It is commonly used as a quote currency (for example, BTC/USDT), for exchange collateral, and for cross-border value transfers, especially in emerging markets where access to U.S. dollars is limited.

USDT’s dominance comes from scale and liquidity, not regulatory positioning. It operates globally across multiple blockchains and jurisdictions, making it highly efficient for trading and payments, but it is not structured as a U.S.-bank-issued stablecoin under a dedicated federal framework.

What Is Tether USAT (USA₮)?

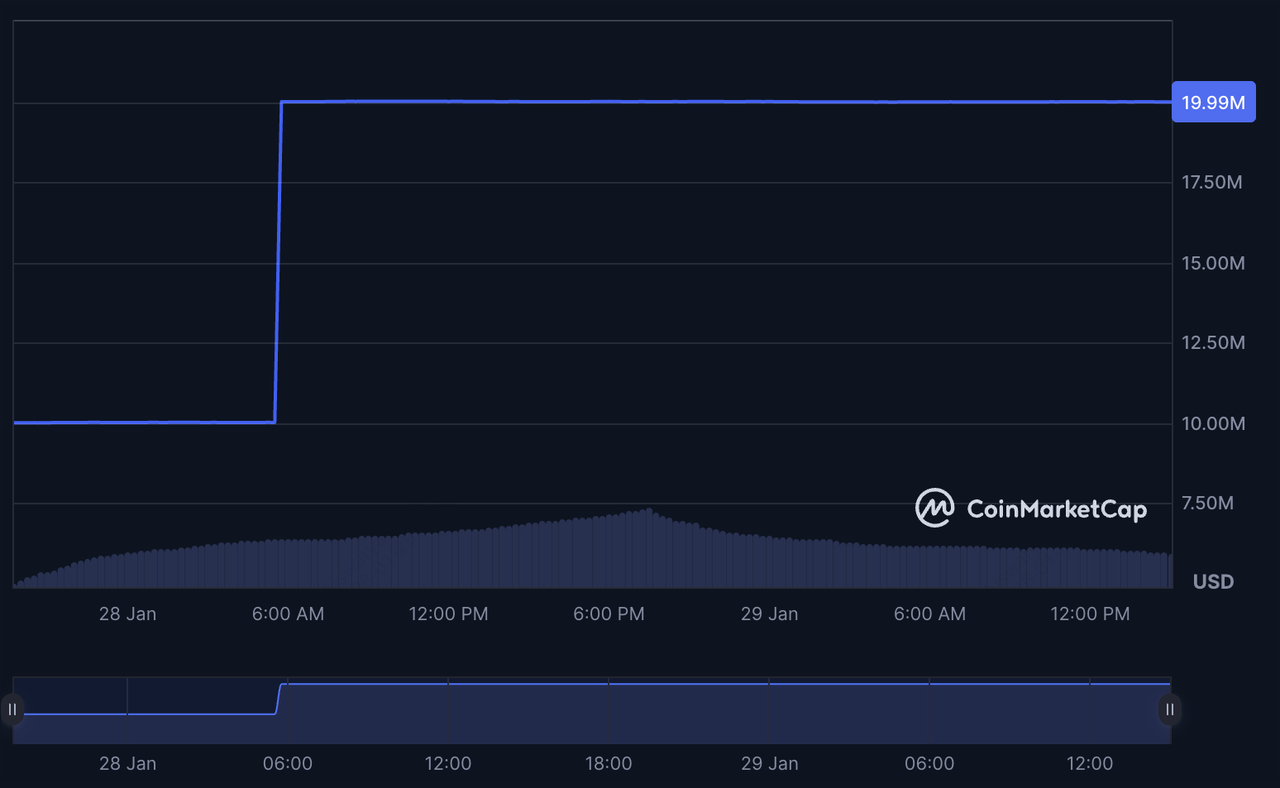

USAT market cap | Source: Coinmarketcap

USAT, also branded USA₮, is Tether’s U.S.-focused, dollar-backed stablecoin, officially launched on January 27, 2026. It is issued by Anchorage Digital Bank, a federally chartered digital asset bank regulated by the Office of the Comptroller of the Currency (OCC), and is designed to operate within the

GENIUS Act federal stablecoin framework. In its launch communications, Tether names Cantor Fitzgerald as reserve custodian and “preferred primary dealer,” signaling an institutional-grade reserve and oversight structure.

At launch, USAT entered circulation as an ERC-20 token on

Ethereum with a fully circulating supply of 20 million tokens, a market cap of roughly $20 million, and daily volume in the $15–16 million range, reflecting an early-stage rollout. Unlike USDT, USAT is explicitly positioned for U.S. institutions, regulated platforms, and compliant payment use cases, prioritizing regulatory eligibility over immediate global scale.

What Is the GENIUS Act, and Why Does It Matter for Tether?

The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), signed into law on July 18, 2025, establishes the first federal regulatory framework for U.S. payment stablecoins. The law limits issuance to permitted, regulated entities like federally chartered banks, requires 1:1 backing with high-quality liquid assets, mandates regular disclosures and attestations, and subjects issuers to bank-level AML, sanctions, and compliance oversight under U.S. regulators like the OCC.

This matters because it creates a clear regulatory divide within Tether’s stablecoin lineup. USAT is explicitly designed and marketed to operate inside the GENIUS Act perimeter, with issuance through a federally chartered U.S. bank and U.S.-based reserve oversight, making it usable by institutions and platforms that must stay within federal rules. USDT, meanwhile, remains Tether’s global liquidity stablecoin, optimized for scale and international markets rather than U.S. federal eligibility. In short, the GENIUS Act shifts competition from liquidity alone to regulatory qualification, and USAT exists to compete on that axis.

Similarities: What USAT and USDT Have in Common

Despite targeting different regulatory lanes, USAT and USDT share the same core economic function: they are USD-backed stablecoins designed to stay close to $1.00 and act as digital cash within crypto markets. In practice, both tokens are used as unit-of-account and settlement assets, allowing traders and users to move value without exposure to the price volatility seen in assets like Bitcoin or Ethereum.

Both stablecoins follow a centralized issuance and redemption model, meaning peg stability depends on the issuer’s reserve management, operational reliability, and redemption access rather than algorithmic mechanisms. Users rely on the issuer to mint and burn tokens, manage reserves, and maintain the $1 peg during normal market conditions. As a result, both USAT and USDT reduce price volatility, but not issuer, liquidity, or operational risk. Their usefulness ultimately depends on where they are supported, how easily they can be redeemed or transferred, and how they perform during periods of market stress.

USAT vs. USDT: What Are the Key Differences?

| Category |

USAT (USA₮) |

USDT (Tether) |

| Primary positioning |

U.S.-focused, GENIUS-aligned stablecoin |

Global liquidity stablecoin |

| Launch / history |

Public launch announced Jan 27, 2026 |

Launched 2014, longest-running major stablecoin |

| Issuer |

Anchorage Digital Bank, N.A. |

Tether (USDT) issuer entities follow a global model |

| Reserve custody (as stated) |

Cantor Fitzgerald named as reserve custodian and preferred primary dealer |

Broadly reserve-backed per Tether disclosures |

| Network (public tracker) |

Ethereum ERC-20 |

Nearly 90 blockchains |

| Market cap |

$20 million |

$190 billion |

| 24h volume |

$15–16 million |

$91 billion |

| Best for |

U.S.-regulated use cases (as designed) |

Trading liquidity + global transfers |

While both USAT and USDT aim to function as $1-pegged digital dollars, they are built for very different regulatory environments, users, and scales. The contrast between them is less about technology, and more about who can use them, where, and under what rules.

1. Regulatory Lane and Target Users: U.S. Vs. Global

USAT is built for the U.S. regulatory perimeter, targeting U.S.-based institutions, regulated exchanges, fintechs, and users that need a stablecoin issued under U.S. banking oversight and aligned with the GENIUS Act. Its appeal is eligibility and compliance, not maximum reach. USDT, by contrast, is optimized for global crypto liquidity, dominating offshore markets, international exchanges, derivatives platforms, and emerging-market payment flows where regulatory regimes are fragmented or lighter, prioritizing reach and depth over U.S. compliance.

2. Issuer Structure

USAT is issued by Anchorage Digital Bank, a federally chartered U.S. bank regulated by the Office of the Comptroller of the Currency (OCC), placing issuance squarely inside the U.S. banking system. USDT is issued by Tether–related entities under Tether’s long-standing global model; it is not framed as a U.S.-bank-issued stablecoin and does not operate under a U.S. federal banking charter.

3. Reserves and Custody Positioning

For USAT, Tether’s launch communications explicitly name Cantor Fitzgerald as reserve custodian and “preferred primary dealer,” underscoring institutional-grade custody and integration with U.S. financial markets. USDT is backed by a broad reserve portfolio with periodic attestations, but it is not positioned as a GENIUS Act–native, U.S.-bank-custodied product; the distinction is one of framing: USAT is “compliance-first,” while USDT is “liquidity-first.”

4. Supported Blockchains

USAT launched as an ERC-20 token on Ethereum, prioritizing compatibility with existing wallets, exchanges, and settlement rails; its on-chain presence is narrow by design at this stage. USDT is deeply multichain, spanning Ethereum,

Tron,

Solana,

Polygon,

TON,

Avalanche, and more, breadth that directly supports its role as the default settlement asset across global trading and payments.

5. Scale and Liquidity: USAT's $20M vs. USDT's $190B Market Cap

USDT operates at global scale, with roughly $186 billion in market cap, $90+ billion in daily volume and over 11.6 million holders on Ethereum alone, serving as core settlement fuel for traders and platforms worldwide. USAT is in early rollout, at about $20 million market cap, $15–16 million daily volume, a $20 million total and circulating supply, and over 220 holders, reflecting a compliance-led launch rather than a mature liquidity layer.

USAT or USDT, Which Tether Stablecoin Should You Use?

The choice between USDT and USAT is less about price stability, as both aim to stay near $1, and more about liquidity versus regulatory alignment.

• Choose USDT if you need maximum liquidity and flexibility. With a market cap of roughly $186 billion and $90+ billion in daily trading volume, USDT is the default settlement asset for global crypto markets. It dominates spot and derivatives pairs, offers deep order books, and is supported across dozens of blockchains and virtually every major exchange.

• Consider USAT if your priority is U.S. regulatory eligibility over scale. USAT is issued by a federally chartered U.S. bank and positioned to operate within the GENIUS Act framework, which matters for U.S. institutions, fintechs, and platforms that must stay inside federal compliance boundaries. With a current market cap of around $20 million, a fully circulating 20 million supply, and a few hundred holders, USAT is still in an early rollout phase, best suited for users who value compliance-first design and are comfortable with a smaller, developing liquidity footprint.

Bottom line: USDT is built for global trading and liquidity at scale. USAT is built for U.S.-regulated use cases, where who issues the stablecoin matters as much as how liquid it is.

Where to Buy USAT and USDT Stablecoins From Tether

Access to USAT and USDT reflects their different roles in Tether’s ecosystem: USAT is rolling out through select, compliance-oriented partners, while USDT is already the default settlement asset across global crypto markets.

How to Buy Tether USAT (USAT)

According to Tether’s launch and issuer communications, USAT is initially available through a limited set of platforms focused on regulated access and institutional readiness. Early partners include Kraken, OKX, Crypto.com, Bybit, and MoonPay. Availability can vary by jurisdiction, user type, and platform policy, and supported trading pairs or on-ramps may differ. Because USAT is still in an early rollout phase (≈$20M market cap, ~20M circulating supply), users should verify official listings, supported networks, and the correct contract address on each platform before purchasing or transferring.

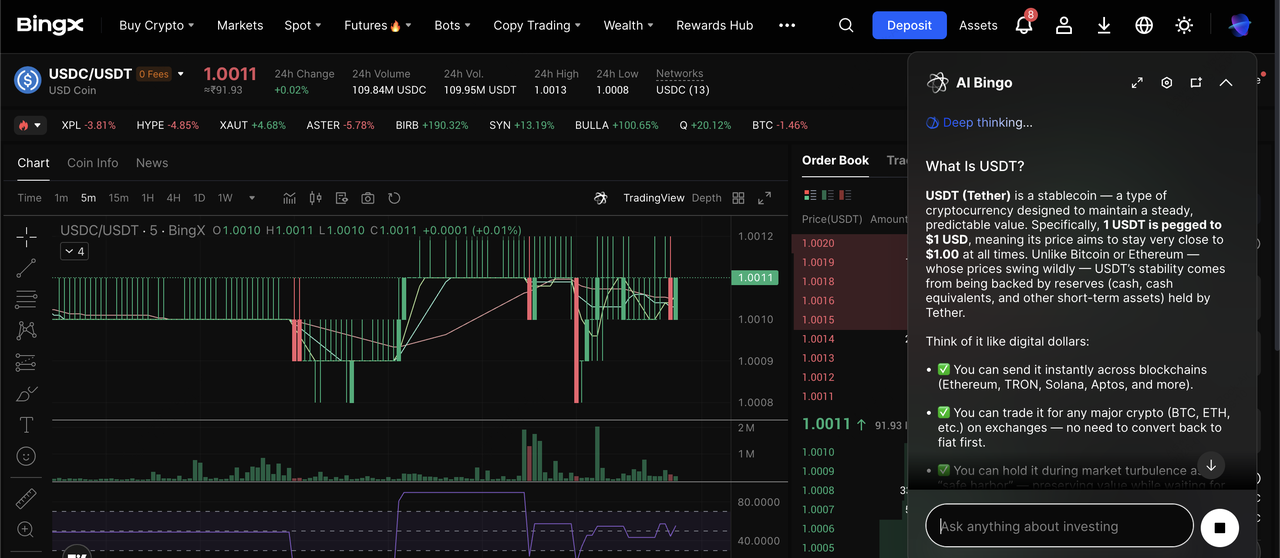

How to Buy USDT on BingX

USDC/USDT trading pair on the spot market powered by BingX AI insights

On BingX, USDT is the primary global-exposure stablecoin, widely used for spot and futures trading, hedging, and value transfer.

2. Fund your account – Add funds via fiat on-ramps (cards, bank transfers, local rails where supported) or deposit crypto from an external wallet.

4. Use USDT – Trade spot or futures pairs,

manage risk, or transfer USDT across supported networks for low-cost, 24/7 settlement.

In practice: USAT access is selective and compliance-first; USDT on BingX offers immediate, deep liquidity and broad utility across trading and transfers.

Key Risks Before You Use USAT and USDT Stablecoins

Stablecoins are designed to reduce price volatility, and not to eliminate financial, operational, or regulatory risk. Before using USAT or USDT, it’s important to understand where those risks actually sit.

1. Issuer and redemption risk: A $1 peg ultimately depends on who can redeem, how redemptions work, and how reserves are managed. Even with 1:1 backing claims, direct redemption is often limited to approved counterparties, not retail users. During periods of market stress, operational delays, platform bottlenecks, or tighter redemption conditions can affect liquidity and pricing. Always review the issuer’s redemption mechanics, reserve disclosures, and the role of custodians or banking partners.

2. Regulatory and platform risk: Regulatory alignment does not guarantee uninterrupted access. Laws, guidance, and enforcement priorities can change, and exchanges or payment platforms may add, limit, or remove support based on jurisdiction, user type, or internal compliance decisions. A stablecoin that is available today may be restricted tomorrow in certain regions, even if it is marketed as compliant.

3. On-chain, custody and transfer risk: When using stablecoins on-chain, verification is critical. Always confirm the official contract address, the correct blockchain network, and the receiving wallet compatibility before sending funds. Mistakes, such as using the wrong network, interacting with a fake token, or relying on insecure bridges, can lead to irreversible losses. For USAT, public trackers currently list an Ethereum ERC-20 contract, so you should double-check that any platform or wallet supports that specific contract before transacting.

Conclusion

USDT and USAT serve different purposes within Tether’s stablecoin ecosystem. USDT remains the global liquidity backbone of crypto markets, with massive scale, deep trading volume, and near-universal exchange support. USAT, launched in January 2026, represents Tether’s U.S.-focused stablecoin, issued through a federally chartered bank and designed to operate within the GENIUS Act regulatory framework.

When choosing between them, start with your objective. USDT is best suited for users who need maximum liquidity, broad market access, and global utility. USAT is better aligned with U.S.-regulated use cases, where issuer structure and regulatory eligibility matter more than scale. In both cases, remember that “stable” refers to price, not risk, due diligence around issuer structure, redemption access, platform support, and on-chain execution remains essential.

Related Reading

FAQs on Differences Between USAT and USDT

1. Is USAT the same as USDT?

No. USDT is Tether’s global stablecoin, while USAT (USA₮) is a U.S.-focused stablecoin issued by Anchorage Digital Bank, N.A. and designed for the GENIUS Act framework.

2. Which stablecoin is bigger: USAT or USDT?

USDT is vastly larger. As of January 2026, CoinMarketCap shows a near $190 billion market cap for USDT vs. $20 million for USAT.

3. Can USAT or USDT lose the $1 peg?

Yes. Both are designed to track $1, but market stress, redemption frictions, or platform constraints can cause temporary deviations. Always evaluate issuer, reserves, and how you access/redemption routes.